How much is health insurance per month for one person? This is a common question, and the answer is not simple. The cost of health insurance varies greatly depending on a number of factors, including your age, location, health status, and the type of coverage you choose.

Understanding these factors is crucial to finding affordable and comprehensive health insurance. This guide will explore the key aspects of health insurance costs, helping you make informed decisions about your coverage.

Factors Influencing Health Insurance Cost

Your health insurance premium, the monthly amount you pay for coverage, is determined by several factors. Understanding these factors can help you make informed decisions about your health insurance plan and potentially save money.

Age, How much is health insurance per month for one person

Your age is a significant factor in determining your health insurance premium. Generally, younger individuals tend to have lower premiums compared to older individuals. This is because younger people are statistically less likely to require extensive medical care. As you age, your risk of developing health issues increases, leading to higher premiums.

Location

The geographic location where you live can also influence your health insurance costs. Premiums vary based on the cost of healthcare services in your region. Areas with higher healthcare costs, such as major cities, tend to have higher insurance premiums.

Health Status

Your health status plays a crucial role in premium calculations. Individuals with pre-existing conditions, such as diabetes or heart disease, often face higher premiums. This is because insurers anticipate higher healthcare costs for individuals with pre-existing conditions. However, the Affordable Care Act (ACA) prohibits health insurers from denying coverage or charging higher premiums based solely on pre-existing conditions.

Coverage Options

The type of coverage you choose significantly affects your premium. Higher coverage levels, such as comprehensive plans with extensive benefits, typically come with higher premiums. Conversely, plans with limited benefits and higher deductibles generally have lower premiums.

Lifestyle Choices

Your lifestyle choices can influence your health insurance premiums. For example, individuals who engage in unhealthy habits, such as smoking or excessive alcohol consumption, may face higher premiums. This is because these habits increase the risk of developing health issues, leading to higher healthcare costs.

Health Insurance Subsidies and Assistance: How Much Is Health Insurance Per Month For One Person

The Affordable Care Act (ACA) introduced various programs and provisions to make health insurance more accessible and affordable for individuals and families. One of the key components of the ACA is the availability of government subsidies and tax credits, which can significantly reduce the cost of health insurance premiums.

Eligibility Requirements and Application Process

The eligibility requirements for health insurance subsidies vary depending on factors such as income level, household size, and state of residence. Individuals and families can apply for subsidies through the Health Insurance Marketplace, which is a platform where they can compare different health insurance plans and enroll in coverage. The application process involves providing information about income, household size, and other relevant details. The Marketplace then determines the amount of subsidy that the applicant is eligible for.

Impact of Income Level on Subsidy Amounts

The amount of subsidy an individual or family receives is directly tied to their income level. Generally, lower-income individuals and families are eligible for larger subsidies. The ACA establishes income thresholds for subsidy eligibility, and individuals exceeding these thresholds may not qualify for financial assistance.

Examples of Programs that Offer Financial Assistance

Several programs offer financial assistance for health insurance premiums. These programs include:

- Premium Tax Credits: These tax credits are available to individuals and families who purchase health insurance through the Marketplace. The amount of the tax credit depends on the individual’s income and the cost of the chosen health insurance plan. The tax credit is typically claimed when filing federal income taxes.

- Cost-Sharing Reductions: These reductions help lower the out-of-pocket costs associated with health insurance, such as deductibles, copayments, and coinsurance. Cost-sharing reductions are available to individuals and families with lower incomes who purchase health insurance through the Marketplace.

- Medicaid Expansion: Under the ACA, states have the option to expand Medicaid eligibility to individuals with incomes up to 138% of the federal poverty level. Medicaid provides comprehensive health coverage to low-income individuals and families, including coverage for preventive care, hospitalization, and prescription drugs.

Health Insurance Market Trends

The health insurance market is constantly evolving, driven by factors such as healthcare reform, technological advancements, and demographic shifts. Understanding these trends is crucial for individuals and families seeking affordable and comprehensive health coverage.

Impact of Healthcare Reform and Government Regulations

Healthcare reform and government regulations have significantly impacted the health insurance market, influencing premium costs and coverage options. The Affordable Care Act (ACA) introduced several key provisions that have reshaped the landscape, such as the individual mandate, expanded Medicaid eligibility, and the creation of health insurance marketplaces.

- Premium Stabilization: The ACA’s individual mandate aimed to encourage healthy individuals to enroll in health insurance, thereby stabilizing the risk pool and preventing premium increases for those with pre-existing conditions.

- Subsidies and Tax Credits: The ACA provides subsidies and tax credits to eligible individuals and families to help them afford health insurance. These subsidies are based on income and are designed to make coverage more accessible.

- Essential Health Benefits: The ACA mandates that all health insurance plans offered in the marketplaces must cover essential health benefits, including preventive care, hospitalization, and prescription drugs.

Emerging Technologies and Their Impact

Technological advancements are playing a growing role in the health insurance industry, transforming how insurers operate and consumers access care.

- Telemedicine and Virtual Care: Telemedicine allows individuals to consult with healthcare providers remotely, reducing the need for in-person visits and potentially lowering costs.

- Wearable Technology and Health Data: Wearable devices, such as fitness trackers and smartwatches, can collect health data, enabling insurers to better assess individual risk and tailor premiums accordingly.

- Artificial Intelligence (AI) and Machine Learning: AI and machine learning algorithms are being used to analyze large datasets, identify patterns, and predict health outcomes, potentially leading to more personalized and cost-effective care.

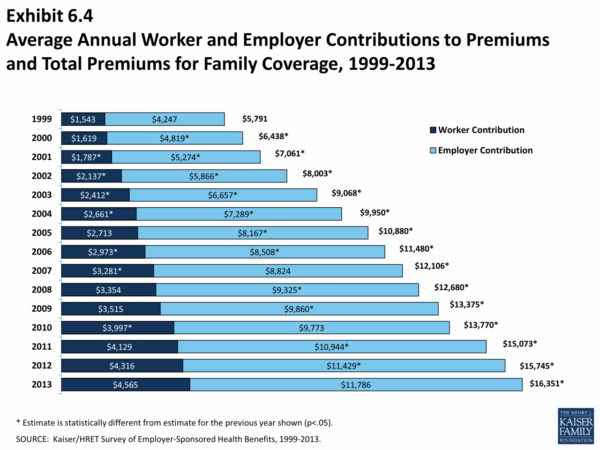

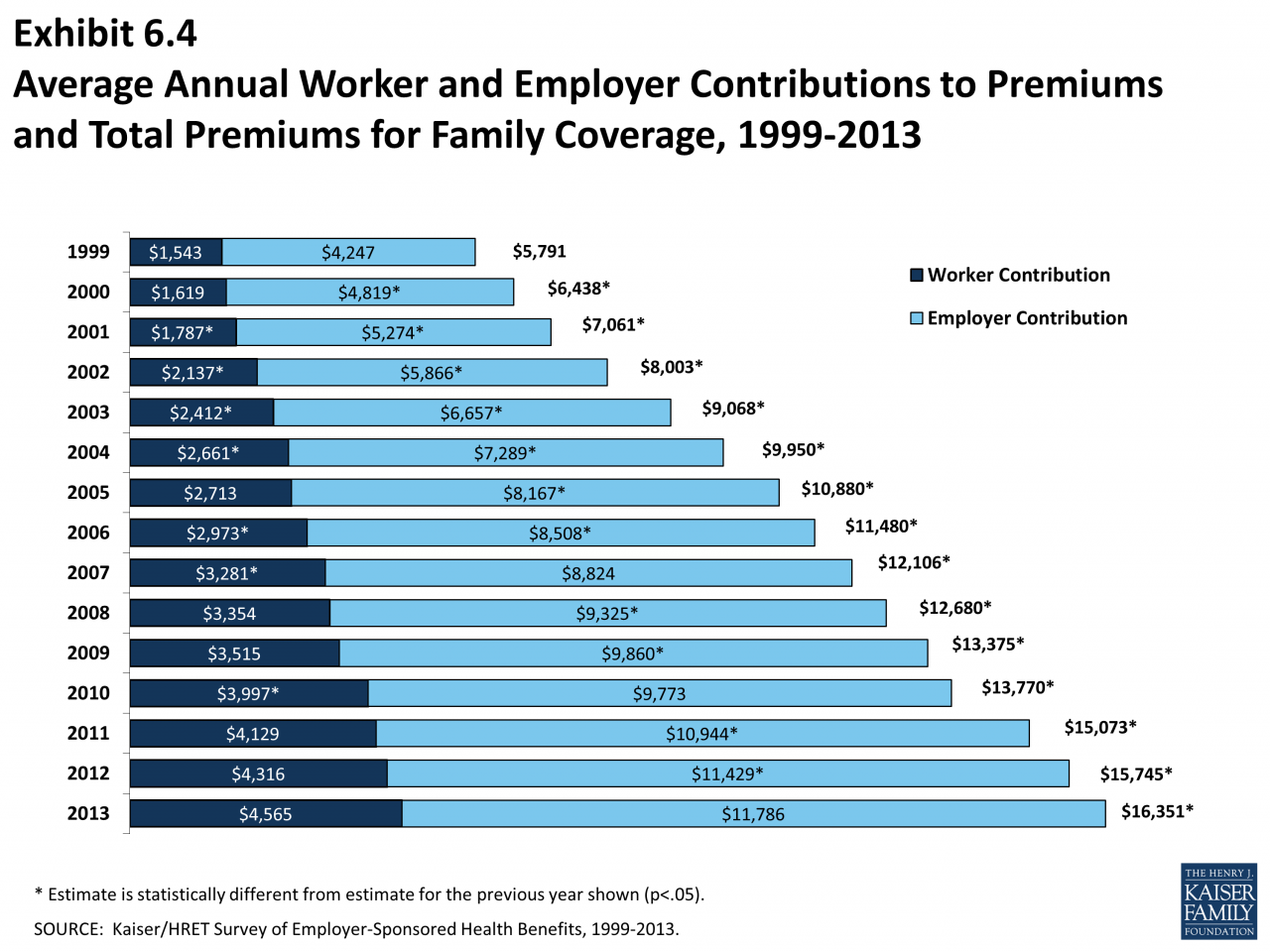

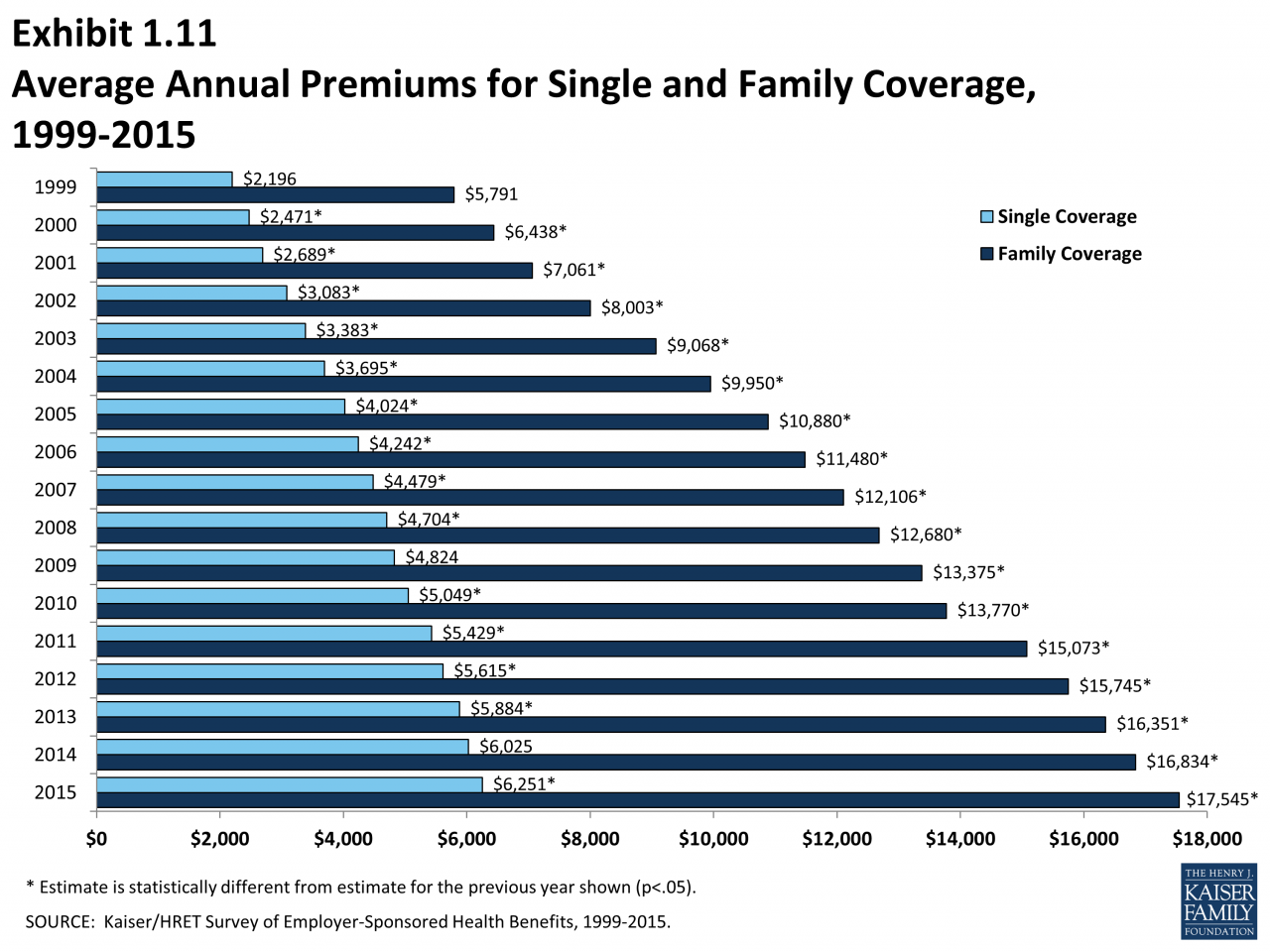

Key Factors Driving Changes in Health Insurance Costs

Several factors can influence future changes in health insurance costs.

- Healthcare Inflation: Rising healthcare costs, driven by factors such as technological advancements, pharmaceutical prices, and administrative expenses, can lead to higher premiums.

- Demographic Shifts: An aging population, with its associated increase in healthcare utilization, can contribute to rising insurance costs.

- Government Policies: Changes in government policies, such as modifications to the ACA or new regulations, can impact health insurance premiums and coverage options.

Outcome Summary

Finding the right health insurance plan is a crucial step in ensuring your well-being. By understanding the factors influencing costs, exploring different plan options, and utilizing available resources, you can navigate the health insurance market and secure affordable coverage that meets your needs. Remember to regularly review your plan and make adjustments as necessary to stay protected and financially secure.

Essential Questionnaire

What is the average cost of health insurance per month for one person?

The average cost of health insurance per month for one person varies significantly depending on factors like age, location, health status, and plan type. It’s best to get personalized quotes from different insurance providers to determine the actual cost for you.

What are some common medical expenses covered by health insurance?

Common medical expenses covered by health insurance include doctor visits, hospital stays, surgeries, prescription drugs, preventive care, and mental health services. However, specific coverage varies based on your plan type and provider.

Can I get health insurance if I have a pre-existing condition?

Yes, you can get health insurance even if you have a pre-existing condition. The Affordable Care Act prohibits insurers from denying coverage or charging higher premiums based solely on pre-existing conditions. However, your premiums might be higher than those of individuals without pre-existing conditions.

How do I compare different health insurance plans?

When comparing health insurance plans, consider factors like premiums, deductibles, copayments, coinsurance, coverage networks, and the types of medical services included. Utilize online comparison tools and consult with insurance agents to find the best plan for your needs and budget.