- Factors Influencing Health Insurance Costs in Arizona

- Types of Health Insurance Plans in Arizona

- Arizona Health Insurance Marketplace

- Employer-Sponsored Health Insurance in Arizona

- Affordable Care Act (ACA) in Arizona

- Resources for Finding Health Insurance in Arizona: How Much Is Health Insurance In Arizona

- Ending Remarks

- FAQ Overview

How much is health insurance in Arizona? This question is on the minds of many residents, as the cost of healthcare continues to rise. Understanding the factors that influence health insurance premiums in Arizona is crucial for making informed decisions about your coverage.

From individual health conditions and age to location and family size, numerous factors come into play when determining your health insurance costs. Arizona offers a variety of health insurance plans, including HMOs, PPOs, and POS plans, each with its own unique features and considerations. The Arizona Health Insurance Marketplace also plays a significant role in facilitating enrollment and providing subsidies for eligible individuals. Let’s explore these aspects in more detail to shed light on the complexities of health insurance in Arizona.

Factors Influencing Health Insurance Costs in Arizona

Health insurance premiums in Arizona, like elsewhere, are influenced by a variety of factors. Understanding these factors can help individuals make informed decisions about their coverage needs and find the most suitable and affordable plan.

Individual Health Conditions

Pre-existing health conditions significantly impact health insurance costs. Individuals with chronic conditions, such as diabetes, heart disease, or cancer, typically require more extensive medical care, leading to higher premiums. Insurance companies assess individual health risks and adjust premiums accordingly. For example, a person with diabetes may face higher premiums compared to someone with no pre-existing conditions.

Age and Location

Age is another key factor influencing health insurance costs. Generally, older individuals tend to have higher premiums because they are more likely to require medical care. Location also plays a role. Premiums can vary depending on the cost of living and the availability of healthcare providers in a particular region. For instance, premiums in urban areas with a higher concentration of specialists and hospitals may be higher than in rural areas.

Family Size and Coverage Needs, How much is health insurance in arizona

The size of a family and the coverage needs of its members significantly impact health insurance costs. Larger families typically require more extensive coverage, leading to higher premiums. Additionally, the specific needs of family members, such as the presence of children or elderly individuals, can influence the cost of coverage. For instance, a family with young children may require comprehensive coverage for well-child visits and immunizations, which can increase premiums.

Types of Health Insurance Plans in Arizona

Arizona offers a variety of health insurance plans, each with its own unique features and benefits. Choosing the right plan can be overwhelming, but understanding the differences between the most common plan types can help you make an informed decision.

Health Maintenance Organizations (HMOs)

HMOs are known for their affordability and emphasis on preventative care. They typically have lower premiums than other plan types, but you’ll need to choose a primary care physician (PCP) within the HMO’s network.

To access specialty care, you’ll generally need a referral from your PCP.

This can be beneficial in terms of cost-effectiveness and coordination of care, but it can also be restrictive if you prefer to choose your own specialists.

Preferred Provider Organizations (PPOs)

PPOs offer more flexibility than HMOs, allowing you to see specialists without a referral. They also have broader networks, giving you more choices for doctors and hospitals.

However, PPOs generally have higher premiums than HMOs.

You’ll also pay more for services outside of the PPO’s network.

Point of Service (POS) Plans

POS plans combine features of both HMOs and PPOs. Like HMOs, they require you to choose a PCP within the network.

However, you can also see specialists outside of the network, although you’ll pay higher out-of-pocket costs.

POS plans offer a balance between cost and flexibility, but they can be complex to understand.

Summary of Key Features

| Plan Type | Coverage | Cost | Network Restrictions |

|---|---|---|---|

| HMO | Limited network, requires referrals | Lower premiums | Highly restricted |

| PPO | Broader network, no referral required | Higher premiums | Less restricted |

| POS | Combines HMO and PPO features | Moderate premiums | Moderately restricted |

Arizona Health Insurance Marketplace

The Arizona Health Insurance Marketplace, also known as the Affordable Care Act (ACA) Marketplace, is a platform that allows individuals and families in Arizona to compare and purchase health insurance plans. The Marketplace is designed to simplify the process of finding affordable and comprehensive health coverage.

Role of the Marketplace

The Arizona Health Insurance Marketplace plays a crucial role in facilitating health insurance enrollment by offering a centralized platform for individuals to compare and purchase plans. The Marketplace provides a variety of options from different insurance companies, allowing consumers to choose a plan that meets their needs and budget.

Eligibility Criteria for Subsidies and Tax Credits

The Marketplace offers subsidies and tax credits to help eligible individuals and families afford health insurance. To qualify for these financial assistance programs, individuals must meet certain income and household size requirements.

- Income: The income threshold for eligibility varies depending on the number of people in the household. Individuals who earn less than 400% of the federal poverty level may qualify for subsidies. For example, in 2023, a single individual earning less than $51,520 per year would qualify for subsidies.

- Household Size: The number of people in a household also influences eligibility. Larger families may have higher income thresholds for qualifying for subsidies.

- Citizenship: Individuals must be U.S. citizens or lawful permanent residents to qualify for subsidies.

Steps Involved in Applying for Health Insurance

Applying for health insurance through the Arizona Health Insurance Marketplace is a straightforward process. Individuals can apply online, over the phone, or in person at a local enrollment center. The steps involved in applying include:

- Create an Account: Individuals first need to create an account on the Marketplace website. This involves providing basic personal information, such as name, address, and date of birth.

- Provide Income Information: Applicants must provide income information, including their annual income and household size. This information is used to determine eligibility for subsidies and tax credits.

- Compare Plans: Once eligibility is determined, individuals can browse and compare different health insurance plans from various insurance companies. The Marketplace website provides a user-friendly tool for comparing plans based on factors such as premium cost, coverage, and deductibles.

- Enroll in a Plan: After selecting a plan, individuals can enroll in it through the Marketplace. The enrollment process typically involves providing additional information, such as payment details and health history.

Employer-Sponsored Health Insurance in Arizona

Employer-sponsored health insurance is a common way for Arizonans to obtain health coverage. Many employers offer a variety of plans, allowing employees to choose the option that best suits their needs and budget. Understanding the different types of plans and their associated costs is crucial for making informed decisions.

Types of Employer-Sponsored Health Insurance Plans in Arizona

Employers in Arizona offer a range of health insurance plans to their employees, each with its own features and cost structure. Some of the most common types include:

- Health Maintenance Organizations (HMOs): HMOs provide comprehensive health coverage through a network of providers. They typically have lower monthly premiums but require you to choose a primary care physician (PCP) within the network. Referrals from your PCP are often needed to see specialists.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility than HMOs, allowing you to see providers both in and out of their network. However, you’ll generally pay higher premiums and copays for out-of-network services.

- Exclusive Provider Organizations (EPOs): EPOs resemble HMOs but typically have a broader network of providers. They often offer lower premiums than PPOs but require you to stay within the network for all services.

- Point-of-Service (POS) Plans: POS plans combine features of HMOs and PPOs, allowing you to choose in-network providers but offering some out-of-network coverage for a higher cost.

- High-Deductible Health Plans (HDHPs): HDHPs have lower monthly premiums but require you to pay a higher deductible before your insurance kicks in. They often pair with a Health Savings Account (HSA), allowing you to save pre-tax money for healthcare expenses.

Advantages and Disadvantages of Employer-Sponsored Plans

Employer-sponsored health insurance offers several advantages, but it also has some drawbacks:

Advantages:

- Cost Savings: Employers often contribute a significant portion of the premium, making coverage more affordable for employees.

- Tax Advantages: Premiums paid by employers are generally tax-deductible for both the employer and the employee.

- Group Rates: Employers negotiate group rates with insurance companies, which can be lower than individual rates.

- Access to a Wider Range of Plans: Employers typically offer a variety of plans to cater to the diverse needs of their workforce.

Disadvantages:

- Limited Choice: Employees may not have the same level of flexibility as individuals who purchase their own insurance.

- Potential for Higher Premiums: If an employer’s workforce is older or has higher healthcare needs, premiums may be higher.

- Loss of Coverage: If you lose your job, you may lose your health insurance coverage.

- Changes in Benefits: Employers can make changes to their health insurance plans, which may affect your coverage and costs.

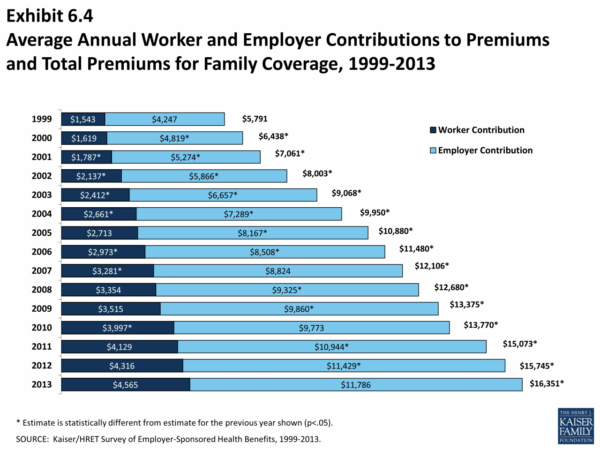

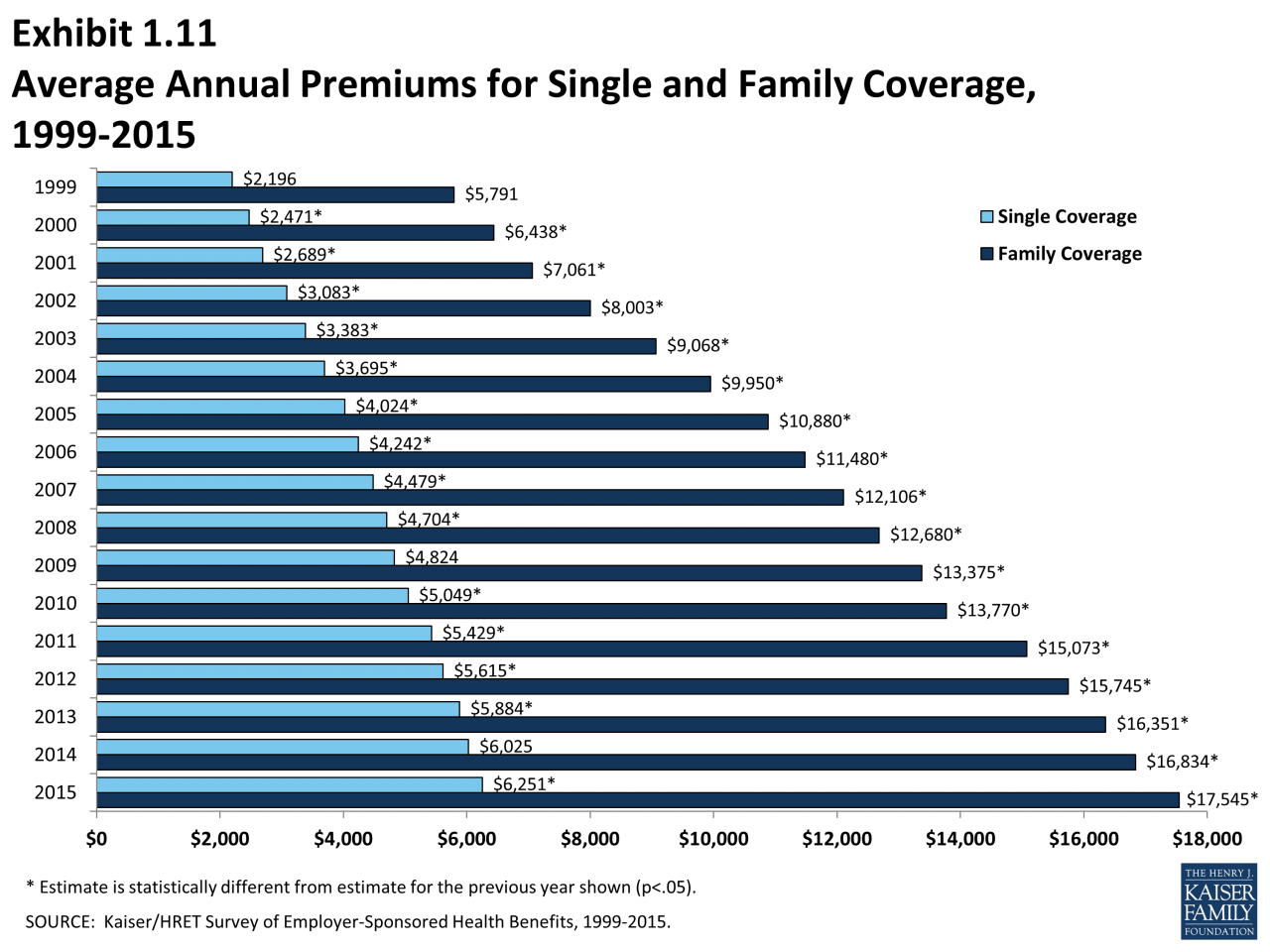

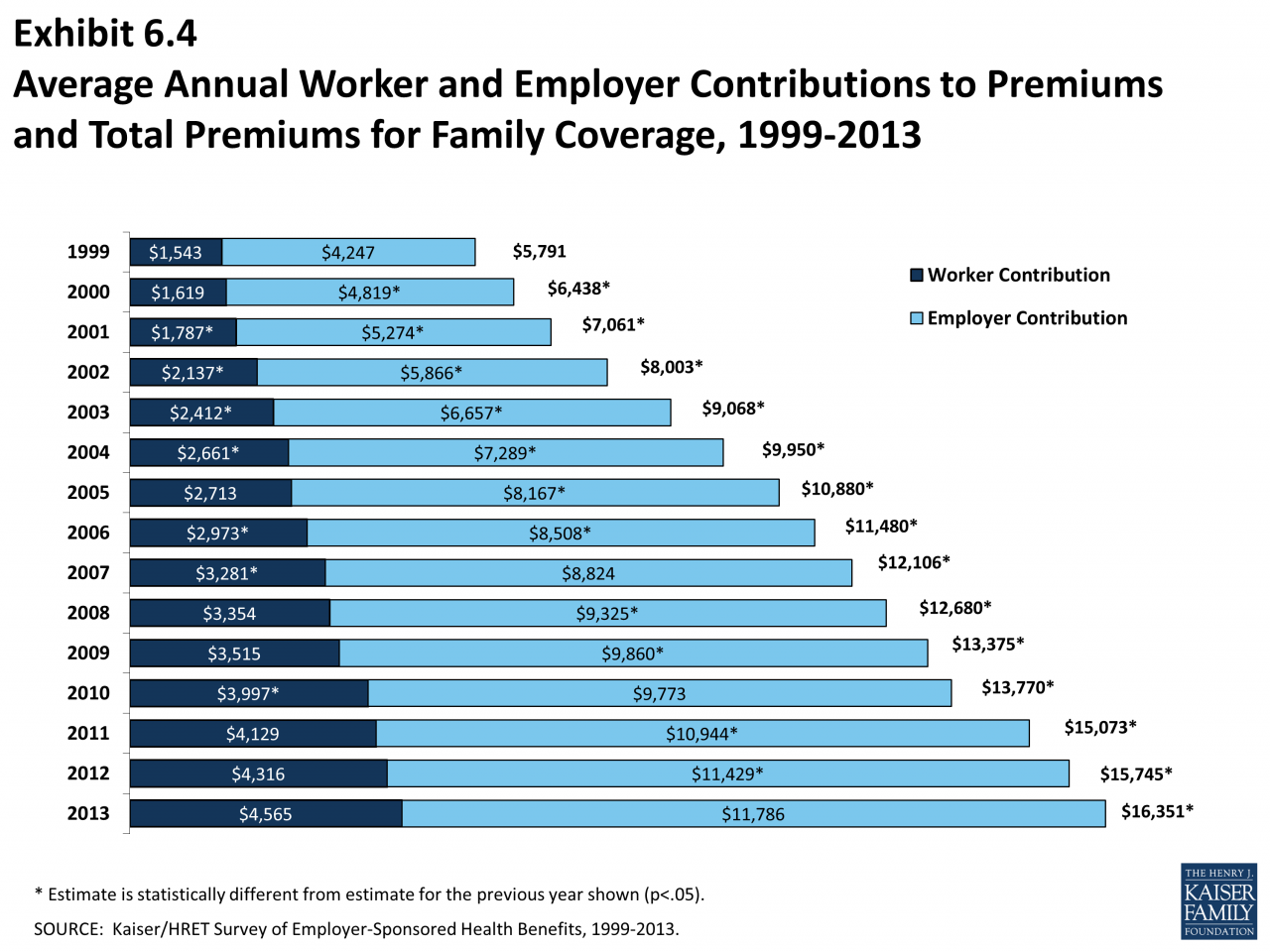

Examples of Employer-Sponsored Plans and Their Associated Costs

The specific costs of employer-sponsored health insurance plans vary widely based on factors such as:

- The employer’s size and industry: Larger employers with a more stable workforce may be able to negotiate lower premiums.

- The type of plan: HMOs generally have lower premiums than PPOs.

- The employee’s age and health status: Older employees or those with pre-existing conditions may pay higher premiums.

- The employee’s geographic location: Premiums can vary based on the cost of healthcare in a particular area.

Here are some examples of employer-sponsored plans and their associated costs:

- Example 1: A large technology company in Phoenix, Arizona, offers its employees a choice between an HMO, a PPO, and an HDHP. The monthly premium for the HMO is $200 per employee, while the PPO costs $350 and the HDHP is $150.

- Example 2: A small retail business in Tucson, Arizona, offers its employees a single PPO plan. The monthly premium for this plan is $250 per employee.

Affordable Care Act (ACA) in Arizona

The Affordable Care Act (ACA), also known as Obamacare, has significantly impacted health insurance in Arizona. The ACA aimed to expand health insurance coverage and make it more affordable for millions of Americans, including residents of Arizona.

Impact of the ACA on Health Insurance in Arizona

The ACA has led to several changes in the Arizona health insurance market. One of the most notable changes is the creation of the Arizona Health Insurance Marketplace, a platform where individuals and families can shop for and compare health insurance plans. The ACA also mandated that health insurance plans cover essential health benefits, which include preventive care, hospitalization, and prescription drugs.

Essential Health Benefits Mandated by the ACA

The ACA requires all health insurance plans to cover ten essential health benefits. These benefits are:

- Ambulatory patient services (outpatient care)

- Emergency services

- Hospitalization (including inpatient care)

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative services and devices

- Preventive and wellness services

- Laboratory services

- Pediatric services (including oral and vision care)

Subsidies and Cost-Sharing Reductions under the ACA

The ACA provides subsidies and cost-sharing reductions to help individuals and families afford health insurance. These subsidies are based on income and family size. The ACA also established a sliding scale for cost-sharing reductions, which reduce out-of-pocket expenses for individuals and families with lower incomes.

Resources for Finding Health Insurance in Arizona: How Much Is Health Insurance In Arizona

Finding the right health insurance plan in Arizona can be overwhelming, but it doesn’t have to be. Several resources are available to help you navigate the process and find the best plan for your needs and budget.

Reputable Websites and Organizations

Several reputable websites and organizations provide information about health insurance in Arizona. These resources can help you understand your options, compare plans, and find the best coverage for your specific needs.

- Arizona Department of Insurance: This website offers comprehensive information about health insurance in Arizona, including consumer guides, FAQs, and links to other relevant resources. It also allows you to file complaints against insurance companies.

- HealthCare.gov: This federal website is the official marketplace for health insurance plans offered through the Affordable Care Act (ACA). You can use this website to compare plans, apply for subsidies, and enroll in coverage.

- Arizona Health Care Cost Containment System (AHCCCS): This state agency provides health insurance to low-income individuals and families through the Arizona Medicaid program. It also offers programs to help people with disabilities and seniors access healthcare.

- Consumer Reports: This independent consumer organization provides unbiased reviews and ratings of health insurance plans. You can use their website to compare plans and find the best coverage based on your needs.

- National Association of Insurance Commissioners (NAIC): This organization provides information about insurance regulations and consumer protection laws. You can use their website to learn more about your rights as an insurance consumer.

Tips for Comparing Health Insurance Quotes

Comparing health insurance quotes is essential to finding the best plan for your needs and budget. Here are some tips to help you compare quotes effectively:

- Consider your healthcare needs: Think about your current health conditions, medications, and anticipated healthcare needs in the future. This will help you identify the coverage you need and prioritize it when comparing plans.

- Compare deductibles, copayments, and coinsurance: These are the out-of-pocket costs you will pay for healthcare services. Make sure to compare these costs across different plans to understand the total cost of coverage.

- Check the provider network: Ensure that your preferred doctors and hospitals are in the plan’s network. Out-of-network care can be significantly more expensive.

- Look for additional benefits: Some plans offer additional benefits, such as dental, vision, or prescription drug coverage. These benefits can add value to your plan and help you save money on healthcare costs.

- Read the fine print: Carefully review the plan’s terms and conditions to understand your coverage and any limitations. This will help you avoid surprises and ensure you are getting the coverage you need.

Finding the Best Plan

Finding the best health insurance plan involves considering your individual needs and budget. It’s essential to compare quotes from different insurance companies and understand the coverage and costs associated with each plan. Utilizing the resources mentioned above and following the tips for comparing quotes can help you make an informed decision and find the right plan for your situation.

Ending Remarks

Navigating the world of health insurance in Arizona can be a challenging but rewarding journey. By understanding the various factors influencing costs, exploring different plan types, and utilizing available resources, you can find a plan that meets your individual needs and budget. Remember to carefully consider your health conditions, location, and family size when making your decision, and don’t hesitate to reach out to reputable organizations for guidance and support.

FAQ Overview

What are the common types of health insurance plans available in Arizona?

Arizona offers a range of health insurance plans, including HMOs, PPOs, and POS plans. Each plan type differs in its coverage, costs, and network restrictions.

What are the eligibility criteria for subsidies and tax credits through the Arizona Health Insurance Marketplace?

Eligibility for subsidies and tax credits through the Arizona Health Insurance Marketplace is based on factors such as income, household size, and citizenship status.

What are the advantages and disadvantages of employer-sponsored health insurance plans?

Employer-sponsored health insurance plans offer advantages like group rates and potential tax benefits, but they can also have limitations in terms of plan options and coverage.