- Introduction to Tax Credits for Health Insurance

- Types of Tax Credits

- Calculating Tax Credits

- Applying for Tax Credits

- Impact of Tax Credits on Health Insurance Costs

- Tax Credit Renewal and Changes

- Tax Credit Reporting and Filing

- Last Point

- Clarifying Questions: How Do Tax Credits Work For Health Insurance

How do tax credits work for health insurance? This question is on the minds of many Americans seeking affordable healthcare. The Affordable Care Act (ACA), also known as Obamacare, offers tax credits to help individuals and families offset the cost of health insurance premiums. These credits are designed to make coverage more accessible, especially for those with lower incomes.

Understanding the nuances of these tax credits can be confusing, but it’s crucial for maximizing your savings. This guide will break down the different types of tax credits, eligibility requirements, calculation methods, and how they can impact your health insurance costs.

Introduction to Tax Credits for Health Insurance

The Affordable Care Act (ACA), also known as Obamacare, aims to provide affordable health insurance to all Americans. One of the ways it does this is by offering tax credits to help individuals and families pay for their health insurance premiums. Tax credits are essentially a reduction in your tax liability, meaning you owe less in taxes.

Purpose of Tax Credits, How do tax credits work for health insurance

Tax credits for health insurance are designed to make coverage more affordable, especially for lower- and middle-income individuals and families. The amount of the tax credit is based on your income and the cost of health insurance plans in your area.

The Affordable Care Act and Tax Credits

The ACA created a marketplace where individuals and families can shop for and compare health insurance plans. This marketplace also determines your eligibility for tax credits, which are offered to help you pay for your health insurance premiums. The amount of the tax credit you receive depends on your income and the cost of health insurance in your area.

Eligibility Criteria for Tax Credits

To be eligible for tax credits, you must:

- Be a U.S. citizen or a lawful permanent resident.

- Not be incarcerated.

- Not be claimed as a dependent on someone else’s tax return.

- Have a household income that falls within certain limits.

- Be enrolled in a health insurance plan through the ACA marketplace.

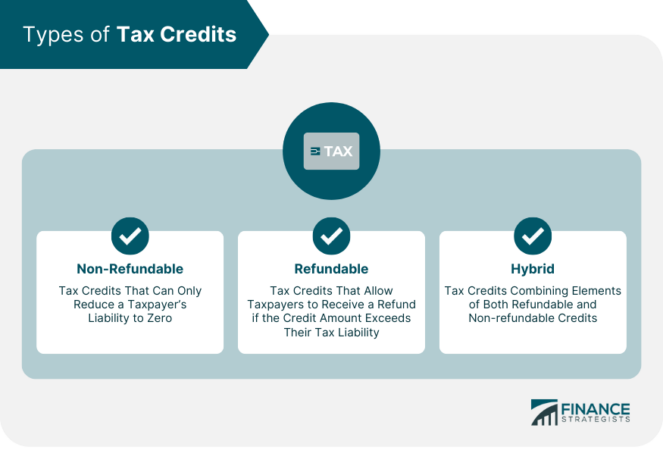

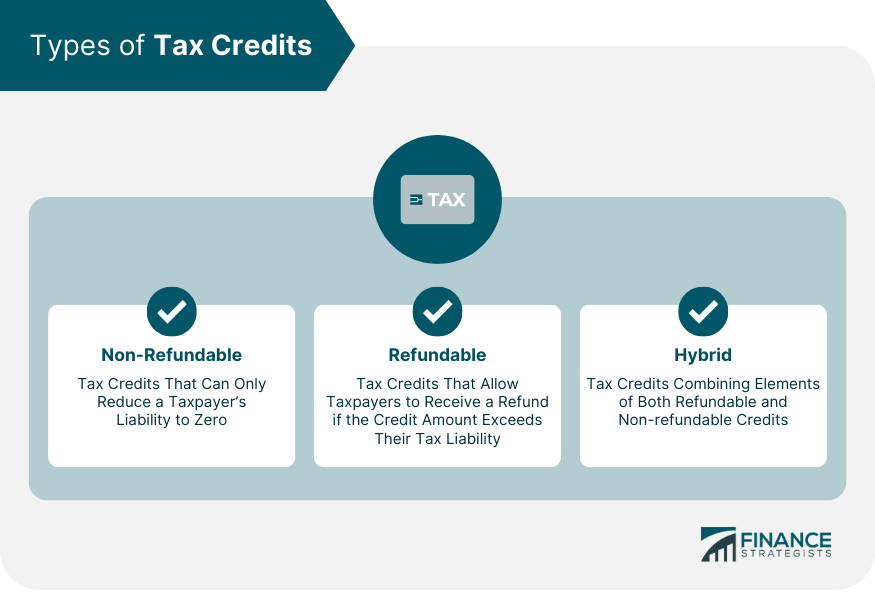

Types of Tax Credits

There are different types of tax credits available for health insurance, designed to help individuals and families afford coverage. These credits can significantly reduce the cost of health insurance premiums, making it more accessible for many.

Premium Tax Credit (PTC)

The Premium Tax Credit (PTC) is a refundable tax credit available to individuals and families who purchase health insurance through the Health Insurance Marketplace. This credit helps lower the cost of monthly premiums.

- The PTC is calculated based on household income, location, and the cost of health insurance plans in your area.

- The amount of the PTC is determined by a sliding scale, with larger credits available for lower-income households.

- The PTC can be claimed as a tax credit on your federal income tax return, reducing your tax liability.

The PTC is calculated based on the following formula:

PTC = (Cost of Coverage – Maximum Affordable Contribution) x Credit Percentage

The Maximum Affordable Contribution is a percentage of your household income, determined by the IRS. The Credit Percentage is also determined by your income level, with higher percentages available for lower-income households.

Advance Premium Tax Credit (APTC)

The Advance Premium Tax Credit (APTC) is a portion of the PTC that can be applied directly to your monthly health insurance premiums. This reduces the amount you pay out-of-pocket for coverage.

- The APTC is based on your estimated income for the year, and it’s adjusted throughout the year based on your actual income.

- If you overestimate your income, you may need to repay some of the APTC at the end of the year.

- If you underestimate your income, you may receive a larger tax credit when you file your federal income tax return.

Calculating Tax Credits

The amount of tax credit you receive depends on several factors, including your income, family size, and the cost of health insurance in your area.

The tax credit is designed to help people afford health insurance, and the amount you receive is based on a sliding scale.

Income Thresholds and Eligibility Guidelines

The amount of tax credit you receive depends on your income and family size. The tax credit is available to people with incomes up to 400% of the federal poverty level. The higher your income, the smaller the tax credit you will receive.

- For 2023, the federal poverty level is $13,590 for a single person, $18,310 for a family of two, and $27,470 for a family of four.

- The income thresholds for different tax credit levels are adjusted annually.

- You can find the most up-to-date income thresholds on the HealthCare.gov website.

Step-by-Step Guide to Calculate Tax Credit Amount

Here’s a step-by-step guide to calculate the amount of tax credit you may be eligible for:

- Determine your household income. This includes income from all sources, such as wages, salaries, self-employment income, and investments.

- Determine your family size. This includes yourself, your spouse, and any dependents.

- Find your income threshold. Use the federal poverty level guidelines and your family size to determine your income threshold.

- Compare your income to the income threshold. If your income is below the income threshold, you may be eligible for a tax credit.

- Determine the cost of health insurance in your area. This can be found on the HealthCare.gov website or through a health insurance broker.

- Calculate the amount of your tax credit. The amount of your tax credit will depend on your income, family size, and the cost of health insurance in your area.

The tax credit is calculated as a percentage of your health insurance premium. The percentage will vary depending on your income and family size.

Applying for Tax Credits

You can apply for tax credits when you enroll in a health insurance plan through the Health Insurance Marketplace. This is done through the same process as enrolling in a plan.

Applying Through the Marketplace

You can apply for tax credits through the Health Insurance Marketplace website or by phone.

- The Marketplace website is the easiest way to apply. You can create an account and fill out an application online.

- You can also apply by phone by calling the Marketplace at 1-800-318-2596.

Required Information

When you apply for tax credits, you will need to provide the following information:

- Your Social Security number

- Your income information, including your income from all sources

- Your household size

- Your citizenship status

- Your address

- Your contact information

Deadlines

The deadline to apply for tax credits is typically the same as the deadline to enroll in a health insurance plan. However, you can apply for tax credits at any time during the year if you experience a qualifying life event, such as getting married, having a baby, or losing your job.

Impact of Tax Credits on Health Insurance Costs

Tax credits are designed to make health insurance more affordable for individuals and families. They directly reduce the amount of money you have to pay for your health insurance premiums, making coverage more accessible.

Tax Credits and Premium Reduction

Tax credits can significantly reduce the cost of health insurance premiums. The amount of the tax credit you receive is based on your income and family size. For example, if you earn $30,000 a year and have a family of four, you might qualify for a tax credit that covers a large portion of your monthly premium. This can make the difference between being able to afford health insurance and going without coverage.

Impact of Tax Credits on Different Income Levels

The impact of tax credits varies depending on your income level. Lower-income individuals and families often receive the most significant tax credit benefits. For example, a family earning $25,000 per year might receive a tax credit that covers almost all of their health insurance premiums. Higher-income individuals and families might receive smaller tax credits, but they still benefit from the program.

Potential Savings from Tax Credits

The following table illustrates the potential savings from tax credits based on income brackets:

| Income Bracket | Estimated Annual Savings |

|---|---|

| $25,000 – $35,000 | $1,500 – $2,500 |

| $35,000 – $45,000 | $1,000 – $1,500 |

| $45,000 – $55,000 | $500 – $1,000 |

It’s important to note that these savings are estimates and can vary based on individual circumstances.

Tax Credit Renewal and Changes

Tax credits for health insurance are typically renewed annually. The process for renewing tax credits and potential changes in eligibility and amounts are explained below.

Renewal Process

Tax credits are usually renewed automatically if your income and other eligibility factors haven’t changed. However, you’ll need to update your information if there have been any changes.

Changes in Eligibility and Amounts

Tax credit eligibility and amounts can change based on various factors, including:

- Income: If your income increases, your tax credit may decrease or even be eliminated. Conversely, if your income decreases, your tax credit may increase.

- Household Size: Changes in your household size, such as adding or removing dependents, can affect your eligibility and credit amount.

- Immigration Status: Changes in your immigration status can impact your eligibility for tax credits.

- State of Residence: Moving to a different state may affect your eligibility for certain tax credits.

Updating Personal Information and Income Changes

It’s crucial to update your information with the Marketplace if there are any changes in your income, household size, or other eligibility factors. You can update your information through the Marketplace website or by contacting customer service.

Updating your information ensures you receive the correct amount of tax credit and avoid potential penalties.

Tax Credit Reporting and Filing

When you file your taxes, you need to report any tax credits you received for your health insurance. This ensures that you’re not claiming the same credit twice and helps the IRS track the program’s effectiveness. Reporting your tax credits correctly is crucial to avoid potential penalties and ensure you receive the full benefit of the program.

Information Needed When Filing Taxes

To accurately report your tax credits, you’ll need to gather several key pieces of information. These documents will help you verify your eligibility and calculate the amount of the credit you’re entitled to.

- Form 1095-A, Health Insurance Marketplace Statement: This form provides details about your health insurance plan, including the coverage period, premiums paid, and the amount of tax credits you received.

- Social Security Numbers (SSNs): You’ll need the SSNs of yourself and any dependents you claimed on your tax return.

- Income Information: You’ll need your income information, including your W-2 forms and any other relevant income documentation.

- Other Relevant Documents: Depending on your specific situation, you may need additional documents like your immigration status or proof of citizenship.

Reporting Tax Credits on Tax Returns

You’ll report your tax credits on your federal income tax return. The specific form you use will depend on your filing status and the type of tax credit you’re claiming.

- Form 8962, Premium Tax Credit (PTC): This form is used to calculate and report the premium tax credit. It’s generally used by individuals who purchased health insurance through the Marketplace.

- Form 1040, U.S. Individual Income Tax Return: You’ll enter the amount of the premium tax credit you calculated on Form 8962 on your Form 1040.

Consequences of Incorrect Reporting or Failure to Report Tax Credits

It’s crucial to report your tax credits accurately. Failing to do so can result in several consequences, including:

- Overpayment of Taxes: If you don’t report your tax credits correctly, you might end up paying more taxes than you owe.

- Penalties: The IRS may impose penalties if you fail to report your tax credits or if you report them incorrectly.

- Recapture of Tax Credits: If your income exceeds certain thresholds, you might be required to repay some or all of the tax credits you received. This is known as “recapture.”

Last Point

Navigating the world of health insurance and tax credits can be overwhelming, but with the right information, you can make informed decisions. By understanding the types of tax credits available, your eligibility, and the application process, you can potentially save a significant amount of money on your health insurance premiums. Remember to review your income and eligibility annually, as changes may affect your tax credit amount. Stay informed, and take advantage of the resources available to ensure you receive the benefits you deserve.

Clarifying Questions: How Do Tax Credits Work For Health Insurance

What is the difference between the Premium Tax Credit (PTC) and the Advance Premium Tax Credit (APTC)?

The PTC is a tax credit you claim on your federal income tax return to reduce your tax liability. The APTC is a monthly tax credit that reduces the cost of your health insurance premiums directly.

If I’m eligible for tax credits, how do I apply for them?

You can apply for tax credits through the Health Insurance Marketplace (healthcare.gov). You can also apply through a certified broker or agent.

How do I know if I’m eligible for tax credits?

Your eligibility for tax credits is based on your income and family size. You can use the Marketplace’s eligibility tool to see if you qualify.

Can I lose my tax credits if my income changes?

Yes, your tax credit amount may change if your income changes. If your income increases, you may receive a smaller tax credit. If your income decreases, you may receive a larger tax credit.

What happens if I don’t report my tax credits correctly on my tax return?

If you don’t report your tax credits correctly, you may have to pay back some or all of the tax credit you received. You may also be subject to penalties.