Does Walmart have good health insurance? This question is top of mind for many potential and current employees. The retail giant offers a range of health insurance plans, but how do they stack up against other major employers? This article dives into the details of Walmart’s health insurance offerings, exploring plan types, costs, benefits, and employee feedback. We’ll also examine the network of healthcare providers, wellness programs, and frequently asked questions.

Walmart’s health insurance plans are designed to cater to diverse employee needs and preferences. They offer a variety of options, including HMOs, PPOs, and high-deductible plans. The specific coverage and cost of each plan vary based on factors such as employee status, dependents, and location.

Walmart’s Health Insurance Plans

Walmart offers a variety of health insurance plans to its employees, including full-time, part-time, and seasonal workers. These plans are designed to meet the diverse needs of Walmart’s workforce, offering different levels of coverage and benefits.

Types of Health Insurance Plans

Walmart offers a range of health insurance plans, each with different coverage options and costs. Here’s a breakdown of the main types:

- PPO (Preferred Provider Organization): This plan offers a wide network of healthcare providers. You can choose to see any doctor or hospital within the network, but you’ll pay lower co-pays and deductibles. You can also see providers outside the network, but you’ll pay higher costs.

- HMO (Health Maintenance Organization): HMO plans require you to choose a primary care physician (PCP) within the network. You’ll need a referral from your PCP to see specialists. HMOs generally have lower premiums than PPOs but may have more restrictions on coverage.

- HDHP (High Deductible Health Plan): HDHPs have higher deductibles than other plans but lower premiums. They are often paired with a Health Savings Account (HSA), which allows you to save pre-tax dollars for healthcare expenses.

Coverage Options

Each Walmart health insurance plan offers various coverage options, including:

- Medical Coverage: This covers doctor visits, hospital stays, surgeries, and other medical services.

- Prescription Drug Coverage: This covers the cost of prescription medications.

- Dental Coverage: This covers dental cleanings, fillings, and other dental services.

- Vision Coverage: This covers eye exams, eyeglasses, and contact lenses.

Eligibility Criteria

Eligibility for Walmart’s health insurance plans depends on several factors, including:

- Employee Status: Full-time employees are typically eligible for health insurance. Part-time and seasonal employees may have different eligibility requirements.

- Dependents: You can usually add your spouse and children to your health insurance plan.

- Location: Some health insurance plans may not be available in all locations.

Plan Costs

The cost of Walmart’s health insurance plans varies depending on several factors, including:

- Plan Type: PPOs generally have higher premiums than HMOs.

- Coverage Level: Plans with more comprehensive coverage typically have higher premiums.

- Employee Status: Full-time employees may pay lower premiums than part-time employees.

- Location: The cost of healthcare varies by location, which can affect the cost of health insurance.

Health Savings Accounts (HSAs)

Walmart offers Health Savings Accounts (HSAs) to employees enrolled in high-deductible health plans. An HSA is a tax-advantaged savings account that you can use to pay for healthcare expenses. You can contribute pre-tax dollars to your HSA, and the money grows tax-free.

Note: HSAs are only available to employees enrolled in HDHPs.

Important Considerations

When choosing a Walmart health insurance plan, consider the following:

- Your Healthcare Needs: Consider your current and future healthcare needs. Do you need a plan with comprehensive coverage, or are you looking for a more affordable option?

- Your Budget: Compare the costs of different plans, including premiums, deductibles, and co-pays.

- Your Location: Make sure the plan you choose is available in your location.

- Your Healthcare Providers: Check to see if your preferred doctors and hospitals are in the plan’s network.

Cost and Premiums

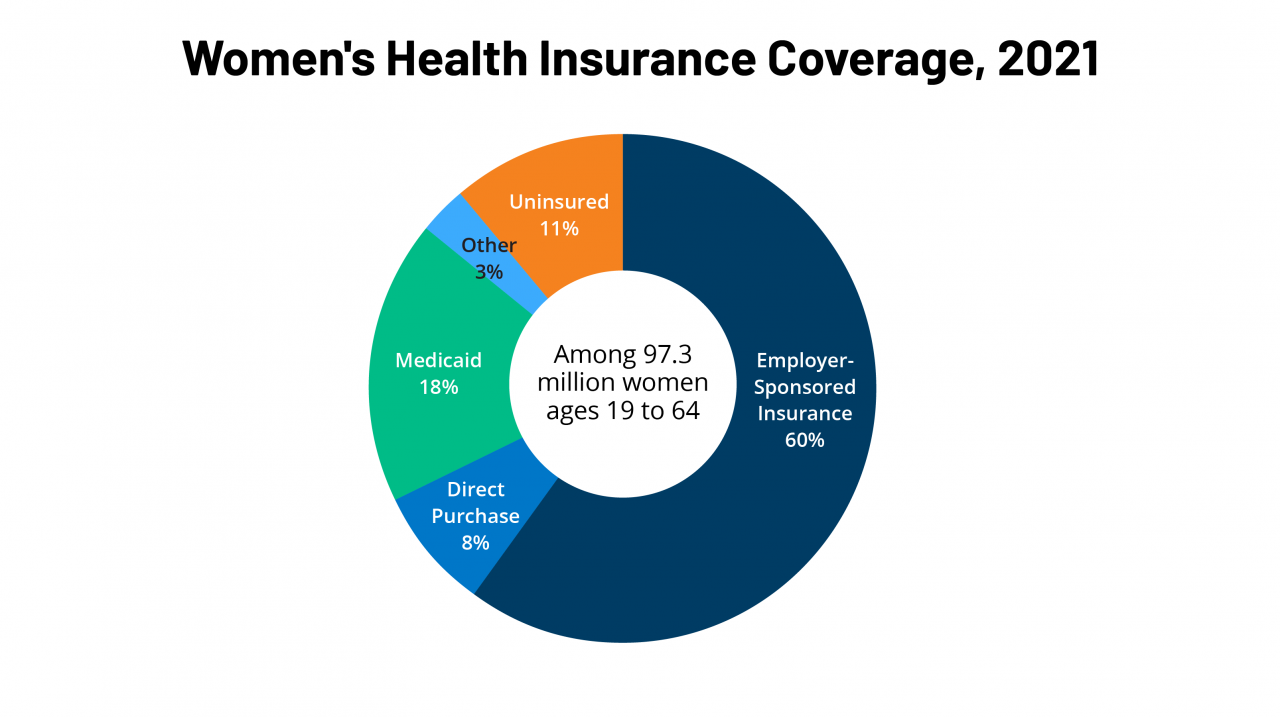

Walmart offers a variety of health insurance plans to its employees, and the cost of these plans can vary depending on several factors. Understanding these factors is essential for employees to make informed decisions about their health insurance coverage.

Comparison with Other Employers

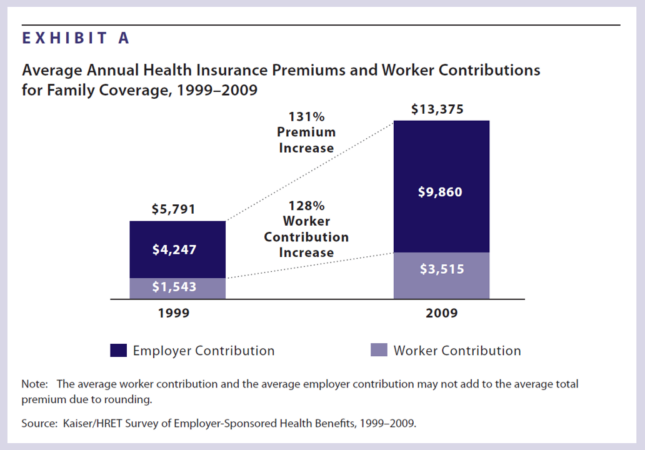

Walmart’s health insurance premiums are generally considered to be competitive with other major employers in the United States. However, it’s important to note that premium costs can fluctuate based on factors like location, plan type, and employee demographics. For instance, a Walmart employee in a state with a high cost of living might face higher premiums compared to an employee in a state with a lower cost of living.

Factors Influencing Premium Costs

Several factors influence the cost of health insurance premiums for Walmart employees. These factors include:

- Plan Type: Walmart offers a range of health insurance plans, from basic plans with limited coverage to comprehensive plans with extensive coverage. The more comprehensive the plan, the higher the premium cost.

- Coverage Level: Within each plan type, Walmart offers different coverage levels, such as individual, family, or single. Family coverage typically has a higher premium than individual coverage.

- Employee Demographics: Factors like age, location, and health status can influence premium costs. For example, older employees might face higher premiums than younger employees due to the potential for higher healthcare expenses.

Cost-Saving Options and Subsidies

Walmart offers various cost-saving options and subsidies to help employees manage their health insurance costs. These options may include:

- Health Savings Accounts (HSAs): Walmart employees can contribute to HSAs, which are tax-advantaged accounts that can be used to pay for healthcare expenses.

- Flexible Spending Accounts (FSAs): FSAs allow employees to set aside pre-tax dollars to pay for eligible healthcare expenses.

- Employer Contributions: Walmart may contribute a portion of the premium cost for certain plans, depending on the employee’s coverage level and plan type.

Benefits and Coverage

Walmart’s health insurance plans offer a range of benefits and coverage features designed to cater to the diverse needs of its employees and their families. The plans are designed to provide comprehensive healthcare coverage, ensuring access to essential medical services while promoting preventive care and overall well-being.

Preventive Care

Preventive care services are a cornerstone of Walmart’s health insurance plans, emphasizing early detection and disease prevention. The plans cover a wide range of preventive services, including:

- Annual physical exams

- Routine screenings for common conditions such as cancer, diabetes, and heart disease

- Immunizations and vaccinations

- Well-woman visits and Pap smears

These services are typically covered at 100% with no copayments or deductibles, encouraging employees to prioritize their health and well-being.

Prescription Drugs

Walmart’s health insurance plans include coverage for prescription drugs, ensuring access to necessary medications at affordable prices. The plans feature a formulary, a list of approved drugs covered by the plan. While most commonly prescribed medications are included, some may require prior authorization from the insurer.

Hospitalization

Hospitalization is a significant expense, and Walmart’s health insurance plans offer comprehensive coverage for inpatient care. The plans cover:

- Room and board

- Surgeries

- Physician services

- Diagnostic tests

- Medications

The plans may have specific coverage limits and deductibles for hospitalization, depending on the chosen plan.

Other Essential Healthcare Services

Beyond preventive care, prescription drugs, and hospitalization, Walmart’s health insurance plans cover a wide range of other essential healthcare services, including:

- Mental health and substance abuse treatment

- Vision care

- Dental care

- Rehabilitation services

- Home health care

These services are designed to address various health needs and ensure comprehensive coverage for employees and their families.

Coverage Levels

Walmart’s health insurance plans offer different coverage levels to meet the diverse needs of its employees. The plans are generally comparable to industry standards, with varying deductibles, copayments, and coinsurance rates. For example, a higher-deductible plan may offer lower premiums but require a larger out-of-pocket expense before insurance coverage kicks in. Conversely, a lower-deductible plan may have higher premiums but offer greater coverage for medical expenses.

Employee Feedback and Reviews

Employee feedback and reviews provide valuable insights into the real-world experience of Walmart’s health insurance plans. By examining these reviews, we can gain a deeper understanding of the plan’s strengths and weaknesses from the perspective of those who rely on them.

Pros and Cons Based on Employee Reviews

Employee reviews highlight both positive and negative aspects of Walmart’s health insurance plans. Here’s a table summarizing these pros and cons:

| Pros | Cons |

|---|---|

| Affordable premiums and deductibles for some plans. | Limited network of healthcare providers in some areas. |

| Comprehensive coverage for essential healthcare services. | Claims processing can be slow and cumbersome. |

| Access to telehealth services for convenient consultations. | High out-of-pocket costs for certain procedures and medications. |

| Employee assistance programs for mental health and wellness support. | Limited options for specialized care, such as mental health or dental. |

Ease of Access to Healthcare Providers

Employee reviews frequently mention the ease of access to healthcare providers as a significant factor in their satisfaction with Walmart’s health insurance plans. While some employees report having a wide network of providers to choose from, others express concerns about limited access to specialists or providers in their specific geographic locations. This highlights the importance of considering the plan’s network coverage in relation to individual needs and location.

Claims Processing

Claims processing is another area where employee reviews offer valuable insights. Some employees praise the efficiency and responsiveness of Walmart’s claims processing system, while others report delays, difficulties in obtaining approvals, and frustration with the process. These experiences underscore the need for clear communication and efficient procedures to ensure a smooth claims experience for employees.

Overall Customer Satisfaction

Overall customer satisfaction with Walmart’s health insurance plans varies based on individual experiences and plan specifics. Some employees express positive sentiments regarding the affordability, coverage, and support services offered by the plans. Others highlight challenges with network limitations, claims processing, and out-of-pocket costs. These diverse perspectives demonstrate the importance of carefully considering individual needs and circumstances when evaluating Walmart’s health insurance options.

Employee Testimonials, Does walmart have good health insurance

Employee testimonials offer a firsthand perspective on the impact of Walmart’s health insurance plans on their lives. For example, one employee shared their positive experience with the plan’s coverage for a recent medical procedure, emphasizing the affordability and ease of access to care. Another employee expressed concerns about the limited network of providers in their area, highlighting the need for more comprehensive coverage options. These testimonials illustrate the diverse range of experiences that employees have with Walmart’s health insurance plans.

Network and Provider Access

Walmart’s health insurance plans offer access to a network of healthcare providers, including doctors, hospitals, and other healthcare facilities. The network’s size and scope can vary depending on the specific plan and location. It’s essential to understand the network’s reach and limitations to ensure you have access to the healthcare services you need.

Network Coverage and Provider Availability

The network of healthcare providers available through Walmart’s health insurance plans is designed to provide convenient access to quality care. It’s important to note that the network’s coverage may vary depending on the specific plan and location.

The network typically includes a wide range of healthcare providers, including:

- Primary care physicians (PCPs)

- Specialists, such as cardiologists, dermatologists, and oncologists

- Hospitals

- Urgent care centers

- Mental health professionals

- Pharmacies

To access the network, you can use the online provider directory or mobile app provided by the insurance company. This directory allows you to search for providers by specialty, location, and other criteria.

Potential Challenges of Accessing Healthcare Services

While Walmart’s health insurance plans offer access to a network of healthcare providers, there are potential challenges that you may encounter:

- Waiting Times: Depending on the provider’s availability and the demand for services, you may experience waiting times for appointments. This is particularly true for specialists, who may have limited availability.

- Geographic Limitations: The network may not include all providers in your area, especially if you live in a rural or underserved area. You may need to travel to access certain specialists or facilities.

- Out-of-Network Costs: If you choose to see a provider outside the network, you may be responsible for a higher out-of-pocket cost. It’s essential to check the plan’s out-of-network coverage and potential costs before seeking care.

It’s crucial to understand the network’s limitations and potential challenges before enrolling in a Walmart health insurance plan. Consider factors like your location, preferred providers, and potential out-of-network costs to ensure the plan meets your healthcare needs.

Health and Wellness Programs: Does Walmart Have Good Health Insurance

Walmart recognizes the importance of employee well-being and offers a comprehensive suite of health and wellness programs designed to support employees in leading healthier lives. These programs are designed to promote physical, mental, and financial well-being, contributing to a healthier and more engaged workforce.

Health Screenings

Walmart provides various health screenings to its employees, allowing them to assess their overall health and identify potential health risks early on. These screenings cover a range of health factors, including:

- Blood pressure: Regular blood pressure checks are crucial for detecting hypertension, a condition that can lead to heart disease and stroke.

- Cholesterol: High cholesterol levels can contribute to heart disease, and screenings help identify individuals at risk.

- Blood sugar: Monitoring blood sugar levels is essential for detecting diabetes, a chronic condition that affects millions.

- Body mass index (BMI): BMI screenings provide an indication of body fat percentage and can help identify potential weight-related health risks.

Fitness Initiatives

Walmart encourages its employees to adopt healthy lifestyle habits through various fitness initiatives, such as:

- On-site fitness centers: Many Walmart stores offer on-site fitness centers equipped with exercise equipment, allowing employees to conveniently work out during breaks or after work.

- Fitness challenges: Walmart often organizes fitness challenges, motivating employees to participate in physical activities and compete for prizes or recognition.

- Wellness programs: These programs provide employees with resources and guidance on healthy eating, exercise, and stress management, promoting overall well-being.

Mental Health Support

Walmart recognizes the importance of mental health and provides resources to support employees’ mental well-being:

- Employee Assistance Program (EAP): The EAP offers confidential counseling services for employees facing personal or work-related challenges, including stress, anxiety, and depression.

- Mental health awareness programs: Walmart conducts workshops and seminars to educate employees about mental health issues, reducing stigma and encouraging help-seeking behavior.

- Mental health resources: Employees have access to online resources and support groups, providing information and guidance on mental health conditions and treatment options.

Final Wrap-Up

Ultimately, the quality of Walmart’s health insurance depends on individual needs and priorities. While some employees may find the plans comprehensive and affordable, others might prefer different coverage options. It’s crucial to carefully evaluate the plans, compare costs and benefits, and consider your personal healthcare needs before making a decision.

FAQ Summary

How can I enroll in Walmart’s health insurance?

Enrollment typically occurs during open enrollment periods, which are announced annually. You can access enrollment materials and information through the Walmart employee portal or HR department.

What are the waiting periods for coverage?

Waiting periods for coverage can vary depending on the plan type. It’s best to consult the plan details or contact the HR department for specific information.

Does Walmart offer health insurance to part-time employees?

Walmart does offer health insurance to part-time employees, but eligibility requirements and coverage options may differ from full-time employees. Check with your local HR department for details.

Can I use my existing doctor with Walmart’s health insurance?

Whether you can use your current doctor depends on whether they are part of Walmart’s network. You can access a directory of providers through the health insurance portal or website.