How to get health insurance tax credit is a question many Americans ask, especially those struggling with the rising cost of healthcare. This guide will walk you through the process of qualifying for and receiving this valuable tax credit, which can significantly reduce your healthcare expenses.

The Affordable Care Act (ACA) established the Health Insurance Tax Credit to help individuals and families afford health insurance. This credit is available to those who meet certain income requirements and purchase their health insurance through the Marketplace. It’s important to note that the credit is not a direct payment but rather a reduction in your tax liability, either through advance payments or a refund at tax time.

Eligibility for the Health Insurance Tax Credit

The Health Insurance Tax Credit (HCTC) can help lower the cost of health insurance premiums for eligible individuals and families. This credit is available to people who purchase health insurance through the Health Insurance Marketplace (also known as the Affordable Care Act marketplace). To determine if you qualify for the HCTC, you need to understand the eligibility criteria, which are primarily based on your income and household size.

Income Requirements

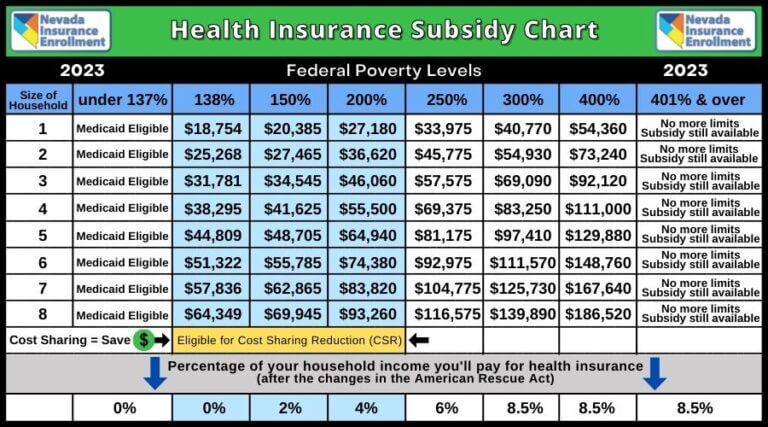

The HCTC is available to individuals and families who meet certain income requirements. These requirements are based on the federal poverty level (FPL), which is adjusted annually. The FPL is a measure of the minimum income needed to support a family.

- The amount of tax credit you receive depends on your income and household size. You may be eligible for the full credit, a partial credit, or no credit at all.

- For 2023, the income thresholds for the HCTC are as follows:

- For a single individual, the maximum income to qualify for the full credit is $51,520.

- For a family of four, the maximum income to qualify for the full credit is $107,000.

Household Size and Eligibility

The number of people in your household, including yourself, impacts your eligibility for the HCTC. Each additional member of your household increases the maximum income limit for qualifying for the full tax credit.

- Here’s an example: If you are a single individual, your maximum income to qualify for the full credit is $51,520. However, if you have a spouse and one child, your maximum income to qualify for the full credit increases to $107,000.

Types of Health Insurance Plans

The HCTC is available for individuals and families who purchase health insurance plans through the Health Insurance Marketplace. This includes plans offered by private insurance companies and plans offered through state-run marketplaces.

- You can use the Health Insurance Marketplace to compare plans and find the one that best meets your needs and budget.

Examples of Qualifying Individuals

Here are some examples of individuals who may qualify for the HCTC:

- A single individual who earns $45,000 per year and has no dependents.

- A family of four with an annual income of $90,000.

- A self-employed individual who earns $60,000 per year.

Calculating the Tax Credit Amount

The Health Insurance Tax Credit (HCTC) is calculated based on your income and the cost of your health insurance plan. The amount of the credit can significantly reduce your tax liability, making health insurance more affordable.

Factors Influencing the Credit Amount

The HCTC is designed to help individuals and families with moderate incomes afford health insurance. The amount of the credit is determined by several factors:

- Your Income: The credit amount is inversely proportional to your income. The lower your income, the higher the credit amount you can receive.

- Your Household Size: The credit amount is also influenced by the number of people in your household. Larger families generally receive a higher credit.

- The Cost of Your Health Insurance Plan: The credit amount is calculated based on the premium you pay for your health insurance plan. The higher the premium, the higher the potential credit amount.

Example Calculation

Let’s consider a hypothetical individual named Sarah. Sarah is single and earns an annual income of $30,000. She purchased a health insurance plan with a monthly premium of $300. Based on her income and the cost of her plan, Sarah is eligible for a monthly tax credit of $100. This means she will receive a total of $1,200 in tax credits throughout the year, significantly reducing her overall healthcare expenses.

Credit Amounts Based on Income

The following table shows the approximate credit amounts for different income levels, assuming a monthly health insurance premium of $300:

| Annual Income | Credit Amount (Monthly) |

|---|---|

| $20,000 | $150 |

| $25,000 | $125 |

| $30,000 | $100 |

| $35,000 | $75 |

| $40,000 | $50 |

Important Note: The actual credit amount may vary depending on individual circumstances and the specific health insurance plan chosen. It’s always best to consult with a tax professional or visit the official IRS website for the most up-to-date information and calculations.

Applying for the Tax Credit

You can apply for the Health Insurance Tax Credit through the Health Insurance Marketplace. The application process is straightforward and can be completed online, over the phone, or in person.

Applying Through the Marketplace

The Health Insurance Marketplace is the official platform for applying for health insurance and the tax credit. You can access the Marketplace website or use the Marketplace mobile app.

Required Documentation

To apply for the tax credit, you’ll need to provide some basic information about yourself and your household, including:

- Your Social Security number

- Your income and household income

- Your citizenship or immigration status

- Your address

- Information about any dependents

You may also need to provide documentation to verify your income, such as:

- Tax returns

- Pay stubs

- W-2 forms

Applying Online

The most convenient way to apply for the tax credit is online. You can create an account on the Marketplace website and complete your application in a few simple steps.

Applying Over the Phone

You can also apply for the tax credit by phone. Call the Marketplace at 1-800-318-2596 to speak with a representative.

Applying In Person

If you prefer to apply in person, you can visit a certified application assister (CAA) in your area. CAAs are trained professionals who can help you complete your application and answer any questions you may have.

Step-by-Step Guide

Here’s a step-by-step guide for completing your application for the Health Insurance Tax Credit through the Marketplace:

- Visit the Marketplace website or app. You can access the Marketplace website at healthcare.gov or use the Marketplace mobile app.

- Create an account. If you don’t already have an account, you’ll need to create one. This will allow you to save your application progress and access your account information.

- Complete the application. The application will ask for basic information about yourself and your household, including your income, citizenship status, and address.

- Provide documentation. You may need to provide documentation to verify your income, such as tax returns, pay stubs, or W-2 forms.

- Submit your application. Once you’ve completed the application and provided any required documentation, you can submit it.

- Review your application. The Marketplace will review your application and determine your eligibility for the tax credit.

- Enroll in a health insurance plan. If you’re eligible for the tax credit, you can enroll in a health insurance plan through the Marketplace.

Receiving the Tax Credit

The Health Insurance Tax Credit (HITC) is designed to make health insurance more affordable. It’s applied directly to your health insurance premiums, lowering your out-of-pocket costs. You can receive the credit in two ways: advance payments or a tax refund.

Advance Payments

Advance payments are made directly to your insurance company, reducing your monthly premium. You can receive advance payments throughout the year, which helps to make health insurance more manageable.

- To receive advance payments, you must apply for the HITC during open enrollment.

- The amount of the advance payment is based on your estimated income and family size.

- You’ll receive a monthly bill from your insurance company that reflects the reduced premium.

Tax Refund

If you don’t receive advance payments, you can claim the HITC as a tax credit when you file your federal income tax return. This means you’ll receive a refund for the amount of the credit you’re eligible for.

- You can claim the tax credit even if you didn’t receive advance payments.

- You’ll need to provide documentation of your health insurance premiums and income to claim the credit.

- The amount of the tax credit you receive will be based on your actual income for the year.

Examples of the Credit’s Impact

The HITC can significantly impact your health insurance costs. For example:

- A single individual with an annual income of $25,000 may be eligible for a tax credit of $2,000 per year. This would reduce their annual health insurance premium by $2,000.

- A family of four with an annual income of $50,000 may be eligible for a tax credit of $5,000 per year. This would reduce their annual health insurance premium by $5,000.

Comparing Credit Delivery Methods

| Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Advance Payments | Monthly payments made directly to your insurance company. | Reduces monthly premiums, making health insurance more affordable. | Requires accurate income estimates to avoid overpayments or underpayments. |

| Tax Refund | Credit claimed on your federal income tax return. | Provides a lump sum refund at tax time. | Requires documentation of premiums and income. |

Impact of the Tax Credit on Healthcare Access: How To Get Health Insurance Tax Credit

The Health Insurance Tax Credit has a significant positive impact on affordability and access to health insurance for many Americans. This tax credit is designed to help individuals and families who meet certain income requirements pay for health insurance premiums. By reducing the financial burden of healthcare, the tax credit empowers individuals to access necessary medical care and improve their overall well-being.

Increased Affordability and Access to Health Insurance

The tax credit plays a crucial role in making health insurance more affordable, particularly for low- and middle-income individuals and families. By providing financial assistance to offset the cost of premiums, the tax credit allows more people to obtain health insurance coverage, thereby reducing the number of uninsured Americans.

The tax credit can be used to purchase health insurance through the Health Insurance Marketplace, a platform where individuals can compare and select plans that meet their needs and budget.

Benefits for Qualifying Individuals and Families

The tax credit provides numerous benefits for those who qualify, including:

- Reduced Healthcare Costs: The tax credit directly reduces the amount individuals pay for health insurance premiums, making healthcare more affordable and accessible.

- Improved Access to Medical Care: With health insurance coverage, individuals can access preventive care, screenings, and necessary medical treatment without facing significant financial hardship.

- Peace of Mind: Knowing they have health insurance provides peace of mind and reduces the anxiety associated with unexpected medical expenses.

- Financial Stability: By reducing the financial burden of healthcare, the tax credit contributes to overall financial stability for individuals and families.

Role in Reducing Uninsured Rates

The tax credit has played a significant role in reducing uninsured rates in the United States. According to the U.S. Census Bureau, the uninsured rate among Americans has declined since the Affordable Care Act was implemented, and the tax credit is a key factor contributing to this trend.

The tax credit has been particularly effective in reducing uninsured rates among low- and middle-income individuals and families, who were previously more likely to be uninsured.

Real-World Examples

Numerous individuals and families have benefited from the tax credit, allowing them to obtain health insurance coverage and access necessary medical care. For example, a single mother with two children who works as a cashier at a local grocery store was able to obtain health insurance through the Marketplace thanks to the tax credit. This coverage allowed her to access preventive care for her children and receive treatment for her own health condition, which she had previously been unable to afford.

Future of the Health Insurance Tax Credit

The Health Insurance Tax Credit (HITC) has been a significant policy in expanding access to affordable health insurance. As the program continues to evolve, its future is a subject of ongoing debate and analysis. Understanding the current policy landscape, potential changes, and long-term implications is crucial for assessing its impact on healthcare affordability.

Current Policy Landscape, How to get health insurance tax credit

The HITC is currently part of the Affordable Care Act (ACA), offering financial assistance to individuals and families who meet certain income thresholds. The program’s eligibility criteria and the amount of the tax credit are based on factors such as income, household size, and geographic location. While the HITC has played a vital role in expanding access to health insurance, there are ongoing discussions about its future.

Potential Changes and Extensions

The HITC’s future is subject to various potential changes and extensions.

- One possibility is expanding the program’s eligibility criteria to include more individuals and families, particularly those with higher incomes. This would make the tax credit available to a broader segment of the population, potentially reducing the number of uninsured individuals.

- Another potential change is increasing the amount of the tax credit. This would make health insurance more affordable for those who already qualify for the program. Increasing the credit amount could significantly reduce the financial burden associated with health insurance premiums, allowing individuals to access quality healthcare services.

- The program’s structure could also be modified. One potential change is transitioning from a tax credit to a direct subsidy. This would streamline the process of receiving financial assistance and make it easier for individuals to understand how the program works. It could also help simplify the administration of the program.

- There is also discussion about extending the program’s duration. The current law does not specify an end date for the HITC, but its long-term future is uncertain. Extending the program would provide greater stability and predictability for individuals and families who rely on the tax credit for affordable healthcare.

Long-Term Implications on Healthcare Affordability

The HITC’s long-term implications on healthcare affordability are multifaceted.

- By reducing the cost of health insurance, the HITC can help improve access to healthcare services for low- and middle-income individuals and families. This can lead to better health outcomes and reduced healthcare costs in the long run.

- The HITC can also contribute to a more stable and sustainable healthcare system. By ensuring that more individuals have access to affordable health insurance, the program can help reduce the number of uninsured individuals, leading to lower healthcare costs and a more balanced healthcare system.

- However, the HITC’s long-term impact on healthcare affordability is also influenced by other factors, such as the cost of healthcare services, the availability of healthcare providers, and the overall health of the population.

Timeline of the Health Insurance Tax Credit

The HITC’s history and potential future can be visualized in a timeline:

| Year | Event |

|---|---|

| 2010 | The Affordable Care Act (ACA) is enacted, establishing the Health Insurance Tax Credit (HITC). |

| 2014 | The ACA’s health insurance marketplaces open, with the HITC playing a crucial role in making health insurance affordable for millions of Americans. |

| 2017 | The Trump administration attempts to repeal and replace the ACA, but these efforts fail. |

| 2021 | The Biden administration takes office and expresses support for the ACA, including the HITC. |

| 2022-Present | Ongoing discussions about the future of the HITC, including potential changes and extensions. |

| Future | The HITC’s long-term future remains uncertain, with potential for expansion, modification, or even elimination. |

Closing Notes

Navigating the world of healthcare can be daunting, but understanding how to get health insurance tax credit can ease the burden. By carefully considering your eligibility, understanding the application process, and exploring the various ways to receive the credit, you can potentially save a significant amount of money on your healthcare expenses. Remember, access to affordable healthcare is crucial, and this tax credit can play a vital role in making it a reality for many Americans.

Key Questions Answered

What if I am self-employed? Can I still get the tax credit?

Yes, you can still qualify for the tax credit if you are self-employed. You will need to file your taxes as self-employed and report your income accordingly.

If I receive the tax credit, will I have to pay it back later?

No, the tax credit is not a loan that you need to repay. It is a reduction in your tax liability, and you keep the money.

How often do I need to update my income information?

You should update your income information if there is a significant change, such as a job loss or a large change in income. This can affect the amount of tax credit you receive.