What is a good deductible health insurance – What is a good deductible for health insurance? It’s a question many people ask, and the answer isn’t always straightforward. Your health insurance deductible is the amount you pay out-of-pocket before your insurance kicks in to cover the rest of your medical expenses. Understanding deductibles is crucial, as they directly impact your healthcare costs. It’s like a gatekeeper, allowing you to access your insurance coverage once you’ve paid your portion.

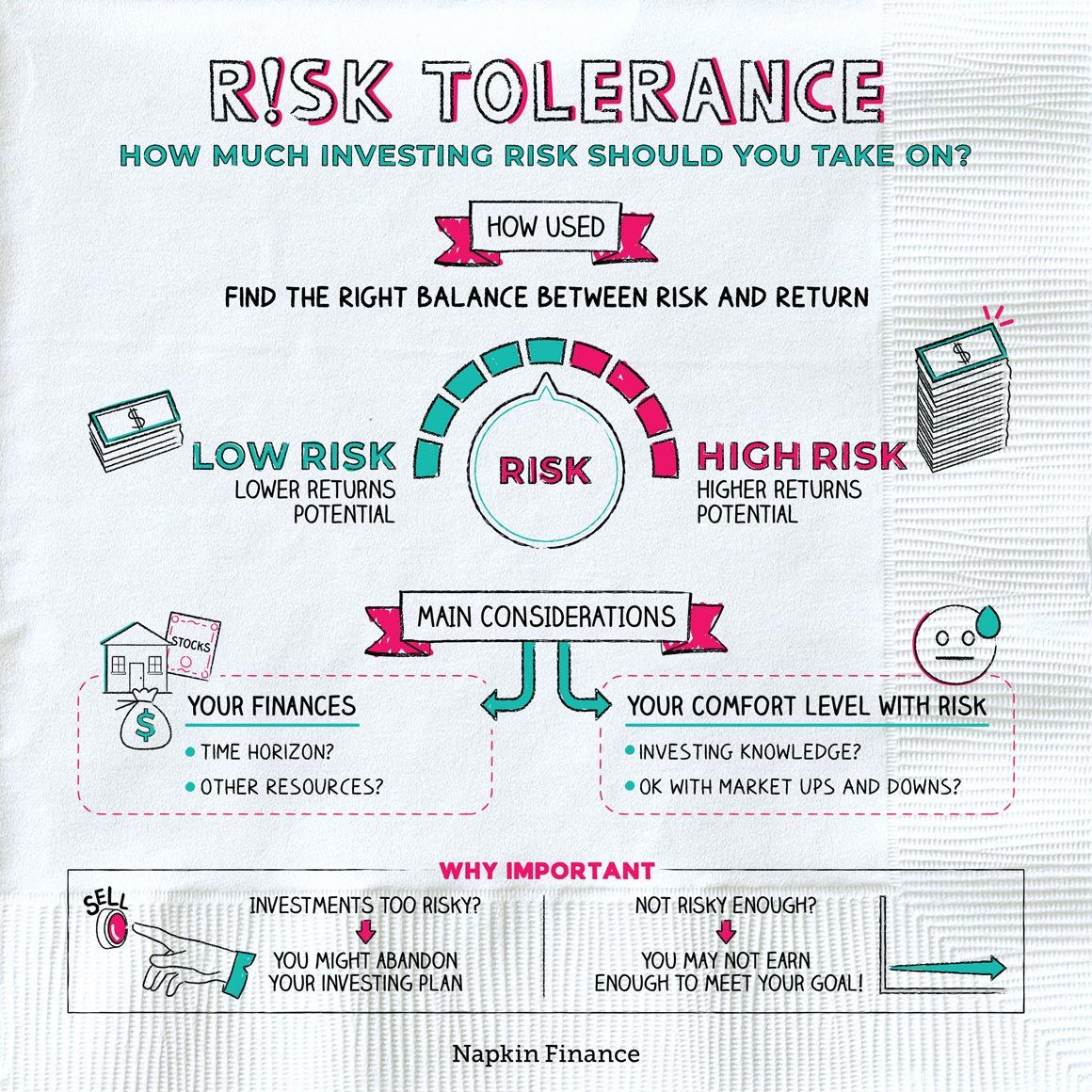

Choosing the right deductible involves considering various factors, including your health, financial stability, and risk tolerance. A higher deductible often means lower monthly premiums, but you’ll need to pay more out-of-pocket before your insurance starts covering your medical expenses. On the other hand, a lower deductible means you’ll pay less upfront, but your monthly premiums will be higher. Ultimately, the best deductible for you depends on your individual circumstances and priorities.

Understanding Deductibles

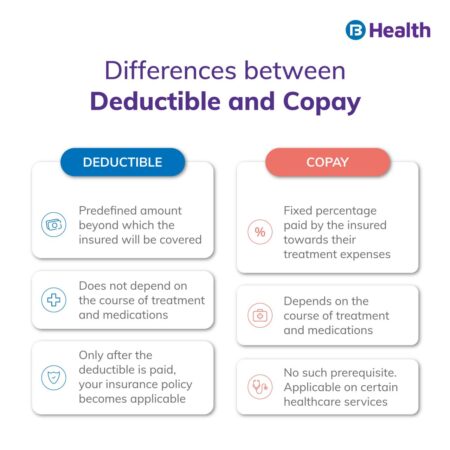

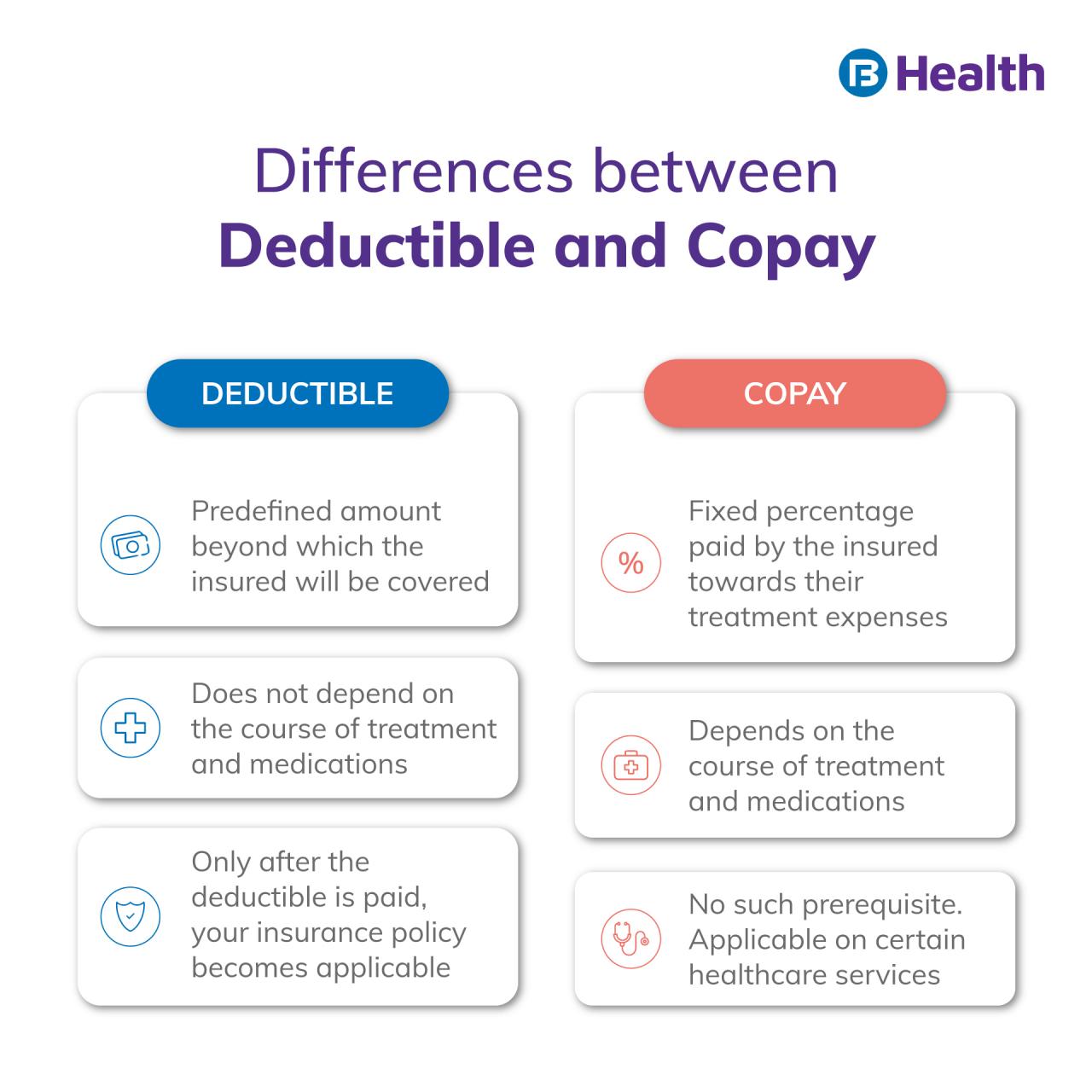

A deductible is a fixed amount you have to pay out-of-pocket before your health insurance plan starts covering your medical expenses. Think of it as a threshold you need to cross before your insurance kicks in.

Deductibles and Premiums

Deductibles are closely related to your health insurance premiums. Premiums are the monthly payments you make to keep your health insurance active.

The relationship between deductibles and premiums is often an inverse one. This means that:

- Higher Deductible: Usually leads to lower premiums. If you’re willing to pay more upfront, you can potentially save on your monthly payments.

- Lower Deductible: Generally results in higher premiums. If you want more protection and less out-of-pocket costs, you’ll likely pay more each month.

The key is to find a balance between the deductible and premium that fits your budget and risk tolerance.

Factors Influencing Deductible Choice

Choosing the right deductible for your health insurance plan is a crucial decision that impacts your out-of-pocket costs and overall financial well-being. Several factors come into play when determining the appropriate deductible level, and understanding these factors is essential to make an informed choice.

Health and Risk Factors

Your individual health and risk factors significantly influence the deductible you choose. Individuals with pre-existing conditions or a history of frequent medical needs may benefit from a lower deductible. This is because they are more likely to incur higher healthcare costs and a lower deductible can help mitigate these expenses. On the other hand, individuals who are generally healthy and have a lower risk of significant medical events may find a higher deductible more financially advantageous.

Financial Stability and Budgeting

Financial stability and budgeting are crucial considerations when choosing a deductible. Individuals with a stable financial situation and a robust emergency fund may be more comfortable with a higher deductible. This is because they have the financial resources to cover the deductible amount in case of a medical emergency. Conversely, individuals with limited financial resources or a lower emergency fund may prefer a lower deductible to minimize their out-of-pocket expenses in case of unexpected medical needs.

Pros and Cons of High vs. Low Deductibles

The choice between a high and low deductible involves weighing the pros and cons of each option.

High Deductibles

* Pros:

*

- Lower monthly premiums.

- Potential for significant savings over time if you rarely use healthcare services.

* Cons:

*

- Higher out-of-pocket costs if you need medical care.

- Can be financially challenging if you experience a major medical event.

Low Deductibles

* Pros:

*

- Lower out-of-pocket costs for medical care.

- Provides greater peace of mind in case of unexpected medical needs.

* Cons:

*

- Higher monthly premiums.

- May not be cost-effective if you rarely use healthcare services.

Deductibles and Out-of-Pocket Costs: What Is A Good Deductible Health Insurance

Your deductible is the amount you pay out-of-pocket before your health insurance plan starts covering your healthcare costs. It’s an important factor in determining your overall healthcare expenses. Understanding how deductibles work and how they relate to your out-of-pocket costs can help you make informed decisions about your health insurance plan.

Deductibles and Out-of-Pocket Costs

The deductible is the amount you pay for healthcare services before your health insurance plan starts paying. The higher the deductible, the lower your monthly premium, but you’ll pay more out-of-pocket before your insurance kicks in.

For example, if you have a $1,000 deductible and you receive $2,000 in medical services, you would pay the first $1,000 yourself and your insurance would cover the remaining $1,000.

Out-of-Pocket Maximums

In addition to deductibles, most health insurance plans have an out-of-pocket maximum, which is the most you’ll have to pay for covered healthcare services in a year. Once you reach your out-of-pocket maximum, your insurance plan will cover 100% of your eligible healthcare costs for the rest of the year.

For example, if your out-of-pocket maximum is $5,000 and you have already paid $4,000 in deductibles and copayments, your insurance will cover 100% of your healthcare costs for the rest of the year, even if your medical bills exceed $5,000.

Comparing Deductible Levels

Here’s a table that compares the potential costs associated with different deductible levels:

| Deductible Level | Monthly Premium | Out-of-Pocket Costs Before Insurance Kicks In | Out-of-Pocket Maximum |

|—|—|—|—|

| $500 | $200 | $500 | $2,500 |

| $1,000 | $150 | $1,000 | $3,000 |

| $2,000 | $100 | $2,000 | $4,000 |

Implications of Exceeding Out-of-Pocket Maximums

Once you reach your out-of-pocket maximum, your insurance plan will cover 100% of your eligible healthcare costs for the rest of the year. However, it’s important to note that this does not include all healthcare costs. For example, you may still be responsible for paying for services that are not covered by your insurance plan, such as cosmetic surgery or over-the-counter medications.

It’s also important to note that exceeding your out-of-pocket maximum does not reset your deductible for the next year. You will still have to pay your deductible again at the beginning of the new year.

Deductibles and Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are specifically designed to work in conjunction with high-deductible health insurance plans. By combining these two, you can potentially save money on healthcare costs and build a tax-advantaged fund for future medical expenses.

Benefits of Using HSAs with High Deductible Plans, What is a good deductible health insurance

HSAs offer several advantages when paired with high-deductible plans.

- Triple Tax Advantage: Contributions to HSAs are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free.

- Lower Premiums: High-deductible plans often have lower monthly premiums compared to plans with lower deductibles, allowing you to potentially save money on your insurance costs.

- Control Over Healthcare Spending: HSAs give you more control over your healthcare spending, allowing you to save for future medical expenses and manage your healthcare budget more effectively.

- Potential for Investment Growth: HSA funds can be invested, potentially allowing your savings to grow over time.

- Rollover Benefits: Unused HSA funds roll over year after year, allowing you to accumulate a substantial healthcare savings balance.

Setting Up and Utilizing an HSA

Setting up and using an HSA is a straightforward process.

- Eligibility: You must be enrolled in a high-deductible health insurance plan to be eligible for an HSA.

- Choose an HSA Provider: Several banks and financial institutions offer HSA accounts. Research different providers to compare fees, investment options, and other features.

- Open an Account: Once you’ve chosen a provider, open an HSA account. You’ll need to provide your personal information and your high-deductible health plan details.

- Make Contributions: Contribute to your HSA regularly, either through payroll deductions or direct deposits. The annual contribution limit varies depending on your coverage status.

- Use for Qualified Medical Expenses: You can withdraw money from your HSA tax-free to pay for eligible medical expenses, such as doctor’s visits, prescriptions, and hospital stays.

- Keep Records: Maintain records of all your medical expenses and HSA transactions to ensure you can prove the legitimacy of your withdrawals.

Tax Advantages of HSAs

HSAs offer significant tax benefits that can help you save money on healthcare costs.

- Tax-Deductible Contributions: Contributions to an HSA are tax-deductible, meaning you can reduce your taxable income by the amount you contribute.

- Tax-Free Growth: Earnings on HSA funds grow tax-free, allowing your savings to accumulate more quickly.

- Tax-Free Withdrawals: Withdrawals for qualified medical expenses are tax-free, making it a more advantageous way to pay for healthcare compared to traditional health insurance plans.

“An HSA is a powerful tool for saving for healthcare expenses. By combining a high-deductible health plan with an HSA, you can potentially lower your insurance premiums, save money on healthcare costs, and build a tax-advantaged fund for future medical expenses.”

Choosing the Right Deductible

Choosing the right deductible for your health insurance plan is crucial. It directly affects your out-of-pocket costs, influencing your monthly premiums and how much you pay for medical services. Understanding your health needs, financial situation, and risk tolerance is key to making an informed decision.

Deductible Selection Checklist

A checklist can help you assess your individual needs and preferences when choosing a deductible.

- Your Health Status: Consider your current health and anticipated healthcare needs in the coming year. Are you generally healthy, or do you have pre-existing conditions that require regular medical attention?

- Expected Healthcare Costs: Estimate your potential healthcare expenses for the year. This includes routine checkups, prescription medications, and any anticipated medical procedures.

- Financial Situation: Assess your ability to pay a higher deductible if necessary. Consider your emergency fund and overall financial stability.

- Risk Tolerance: Determine your comfort level with paying a higher deductible in exchange for lower premiums. Are you willing to take on more financial risk to save on monthly costs, or do you prefer a lower deductible for peace of mind?

- Health Savings Account (HSA): If you have an HSA, consider the potential for tax-advantaged savings to offset deductible costs.

Deductible Selection Decision-Making Process

A flowchart can help visualize the decision-making process for choosing a deductible.

- Assess your health status and anticipated healthcare needs.

- Estimate your potential healthcare expenses for the year.

- Evaluate your financial situation and ability to pay a higher deductible.

- Consider your risk tolerance.

- Determine if you have an HSA and its potential impact.

- Compare different health insurance plans with varying deductibles.

- Choose the plan that best aligns with your needs and budget.

Comparing Health Insurance Plans with Different Deductibles

Comparing health insurance plans with varying deductibles is essential to finding the best fit.

- Obtain quotes from multiple insurance providers.

- Compare the monthly premiums for each plan.

- Analyze the deductible amounts and out-of-pocket maximums.

- Consider the coverage benefits, such as prescription drug coverage and preventive care.

- Review the provider network and access to healthcare professionals.

It’s crucial to remember that a lower deductible generally means higher monthly premiums, while a higher deductible often translates to lower monthly costs.

| Plan | Monthly Premium | Deductible | Out-of-Pocket Maximum |

|---|---|---|---|

| Plan A | $200 | $1,000 | $5,000 |

| Plan B | $300 | $2,500 | $6,000 |

| Plan C | $400 | $5,000 | $7,000 |

Ultimate Conclusion

Choosing the right deductible for your health insurance is a crucial decision. It’s a balancing act between saving on premiums and managing out-of-pocket costs. By carefully considering your health, finances, and risk tolerance, you can make an informed choice that best suits your needs. Remember, there’s no one-size-fits-all answer, and what works for one person may not work for another. Ultimately, the key is to understand your options and make a decision that provides you with the financial security and peace of mind you deserve.

Quick FAQs

How does a deductible work in real-life?

Imagine you have a $1,000 deductible and need surgery that costs $5,000. You’ll pay the first $1,000 out-of-pocket, and your insurance will cover the remaining $4,000.

Can I use an HSA with a high deductible plan?

Yes, HSAs are specifically designed for use with high-deductible health plans. You can use HSA funds to pay for qualified medical expenses, including deductibles.

What happens if I exceed my out-of-pocket maximum?

Once you reach your out-of-pocket maximum, your insurance will cover 100% of your remaining medical expenses for the rest of the year.

Is a high deductible always better?

Not necessarily. While a high deductible can lower your premiums, it may not be the best option if you have a high risk of needing expensive medical care.