Don’t have health insurance? You’re not alone. Millions of Americans face the daunting reality of navigating the healthcare system without the safety net of insurance. This can lead to a cascade of financial, emotional, and even health-related challenges. From overwhelming medical bills to limited access to essential care, the lack of insurance can create a significant burden, impacting individuals and families alike.

This article delves into the complex world of healthcare access for those without insurance, exploring the financial, emotional, and societal consequences. We’ll examine the challenges individuals face in accessing essential medical services, discuss the potential impact on health outcomes, and highlight available government programs and resources. We’ll also explore the Affordable Care Act and its impact on expanding coverage, as well as the role of advocacy organizations in advocating for policy solutions.

The Impact of Lacking Health Insurance

The absence of health insurance can have far-reaching consequences, significantly impacting individuals and families both financially and emotionally. The lack of coverage can lead to overwhelming medical bills, crippling debt, and mental health challenges.

Financial Consequences of Medical Bills

Without health insurance, individuals are fully responsible for covering their medical expenses. This can result in substantial financial burdens, leading to significant debt and even bankruptcy. The cost of medical care, especially for serious illnesses or accidents, can be astronomical.

A recent study by the Kaiser Family Foundation found that 1 in 5 adults in the United States had problems paying medical bills in the past year.

Real-Life Situations of Medical Debt

Numerous real-life examples illustrate the devastating impact of medical debt on individuals and families. For instance, a single mother in Texas faced over $50,000 in medical bills after her child was diagnosed with a rare disease. Unable to afford the treatment, she was forced to sell her home and declare bankruptcy.

In another case, a young couple in California incurred over $100,000 in medical expenses after a car accident. They were forced to take out loans, sell their assets, and even rely on charity to cover the bills.

The Emotional Toll of Medical Debt

The financial strain of medical debt can take a significant toll on mental health. The constant worry and stress associated with mounting bills can lead to anxiety, depression, and even suicidal thoughts.

A study published in the Journal of Health Economics found that individuals with medical debt are more likely to report symptoms of depression, anxiety, and sleep disturbances.

Access to Healthcare Services

The lack of health insurance poses significant challenges for individuals seeking essential healthcare services. Without insurance, individuals often face financial barriers, limited access to specialists, and delayed or forgone care, ultimately impacting their overall health and well-being.

Financial Barriers

Individuals without health insurance often face substantial financial burdens when seeking healthcare. The cost of medical services, including doctor visits, diagnostic tests, and treatments, can be prohibitively expensive. This financial strain can lead to delayed or forgone care, as individuals may choose to avoid seeking medical attention due to the high cost.

“A 2020 study by the Kaiser Family Foundation found that uninsured Americans are more likely to delay or forgo needed medical care due to cost concerns. For example, 38% of uninsured adults reported delaying or not getting needed medical care in the past year, compared to 16% of insured adults.”

Limited Access to Specialists

Many specialists, such as cardiologists, oncologists, and surgeons, may not accept uninsured patients. This limited access can be particularly problematic for individuals with complex medical conditions that require specialized care.

Cost Comparison

The cost of healthcare services varies significantly with and without insurance.

| Service | Cost with Insurance | Cost without Insurance |

|---|---|---|

| Doctor’s Visit | $20 – $100 | $150 – $300 |

| Diagnostic Test (e.g., Blood Work) | $50 – $200 | $200 – $500 |

| Surgery (e.g., Appendectomy) | $5,000 – $20,000 | $20,000 – $50,000 |

Health Outcomes and Preventive Care

The lack of health insurance can significantly impact individuals’ health outcomes, leading to a higher risk of developing chronic conditions and experiencing poorer overall health. This is largely due to the limited access to preventive care that individuals without insurance often face.

Impact of Limited Access to Preventive Care, Don’t have health insurance

Preventive care plays a crucial role in maintaining good health by detecting potential health issues early on and addressing them before they escalate into serious problems. However, individuals without health insurance often face significant barriers to accessing these essential services.

- Financial constraints: The cost of preventive care, such as screenings, vaccinations, and check-ups, can be prohibitive for individuals without insurance, leading them to delay or forgo these services altogether.

- Limited access to providers: Many healthcare providers may not accept uninsured patients or may have limited capacity to accommodate them, making it challenging for individuals without insurance to find a provider who can meet their needs.

- Lack of awareness: Some individuals may not be aware of the importance of preventive care or the resources available to them, leading to a lack of engagement in these services.

Health Risks Associated with Delayed or Forgone Medical Treatment

When individuals lack health insurance, they may delay or forgo necessary medical treatment due to financial concerns. This can have serious consequences for their health, leading to:

- Progression of diseases: Delaying treatment can allow health conditions to progress, potentially leading to more serious complications and higher healthcare costs in the long run.

- Increased risk of hospitalization: Individuals without insurance may be more likely to seek medical attention only when their condition has become severe, requiring hospitalization and potentially leading to longer recovery times.

- Higher mortality rates: Studies have shown that individuals without health insurance have higher mortality rates compared to those with insurance, indicating the significant impact of lack of access to healthcare on overall health outcomes.

Socioeconomic Implications

The lack of health insurance has a profound impact on an individual’s socioeconomic status, creating a vicious cycle of poverty and health disparities. The absence of insurance can lead to financial hardship, limit employment opportunities, and contribute to a lower quality of life.

Impact on Employment Opportunities and Job Security

The availability of health insurance is a crucial factor for many employers when hiring new employees. Employers often prefer to hire individuals with health insurance because it reduces their own healthcare costs and administrative burdens. Individuals without health insurance may face discrimination in the job market, as they are perceived as a higher risk to employers. Additionally, individuals without health insurance may be more likely to experience job insecurity due to their vulnerability to health-related expenses. A sudden illness or injury can lead to lost wages and potential job loss, further exacerbating their financial difficulties.

The Cycle of Poverty and Health Disparities

The lack of health insurance can create a vicious cycle of poverty and health disparities. Individuals without health insurance are more likely to delay or forgo necessary medical care due to the high cost. This can lead to preventable health problems, chronic illnesses, and ultimately, a decline in overall health and well-being. These health issues can further limit employment opportunities, reduce earning potential, and perpetuate a cycle of poverty. Individuals in poverty often lack access to healthy food options, safe housing, and other essential resources that contribute to good health. This can lead to a higher prevalence of chronic diseases, such as diabetes, heart disease, and obesity, which can further exacerbate their financial burden.

Government Programs and Resources: Don’t Have Health Insurance

The lack of health insurance can be a significant burden, but there are government programs and resources designed to help individuals without coverage. Understanding these options is crucial for navigating the healthcare system and accessing necessary medical care.

Government Programs and Eligibility

Several government programs offer health insurance or financial assistance for medical expenses. The most prominent program is Medicaid, a joint federal and state program providing health coverage to low-income individuals and families. The eligibility criteria for Medicaid vary by state, but generally include factors like income, household size, and disability status. Another significant program is the Children’s Health Insurance Program (CHIP), which provides health insurance to children in families who earn too much to qualify for Medicaid but cannot afford private health insurance.

Here is a table comparing some of the most common government programs:

| Program | Eligibility Criteria | Benefits |

|---|---|---|

| Medicaid | Low income, household size, disability status, citizenship or legal residency | Comprehensive health coverage, including doctor visits, hospital stays, prescription drugs, and preventive care |

| CHIP | Children in families with income above Medicaid limits but below CHIP income limits | Comprehensive health coverage for children, including doctor visits, hospital stays, prescription drugs, and preventive care |

| Medicare | Individuals aged 65 or older, people with certain disabilities, and people with end-stage renal disease | Hospital insurance, medical insurance, and prescription drug coverage |

| Affordable Care Act (ACA) Marketplace | Individuals and families who do not have health insurance through their employer or other sources | Tax credits to help afford health insurance premiums, subsidies to help pay for out-of-pocket costs |

Application Process for Government-Funded Health Insurance

The application process for government-funded health insurance can vary depending on the program and state. However, a general flow chart outlining the process is provided below:

Step 1: Determine Eligibility:

* Visit the official website of the program (Medicaid, CHIP, ACA Marketplace) or contact your state’s health insurance marketplace.

* Provide information about your income, household size, and other relevant factors.

* Use online eligibility tools or speak with a representative to determine your eligibility.

Step 2: Complete the Application:

* If you are eligible, complete the application form online, by phone, or in person.

* Provide accurate and complete information, including your Social Security number, income details, and household composition.

* Submit the application form according to the program’s instructions.

Step 3: Review and Approval:

* The program will review your application and verify your information.

* You may be asked to provide additional documentation, such as proof of income or residency.

* If your application is approved, you will receive a notification and instructions on how to access your benefits.

Step 4: Enrollment and Coverage:

* Enroll in the program and choose a health plan if applicable.

* Your coverage will begin on the effective date specified in your enrollment confirmation.

* You will receive an insurance card and information about your benefits and how to access healthcare services.

Affordable Care Act and Insurance Options

The Affordable Care Act (ACA), also known as Obamacare, has significantly impacted health insurance coverage in the United States. It aimed to expand access to affordable health insurance for millions of Americans who previously lacked coverage.

Impact of the Affordable Care Act

The ACA has expanded health insurance coverage by implementing several key provisions, including:

- The individual mandate, which required most Americans to have health insurance or face a penalty.

- The creation of health insurance marketplaces, where individuals and families can shop for and compare plans.

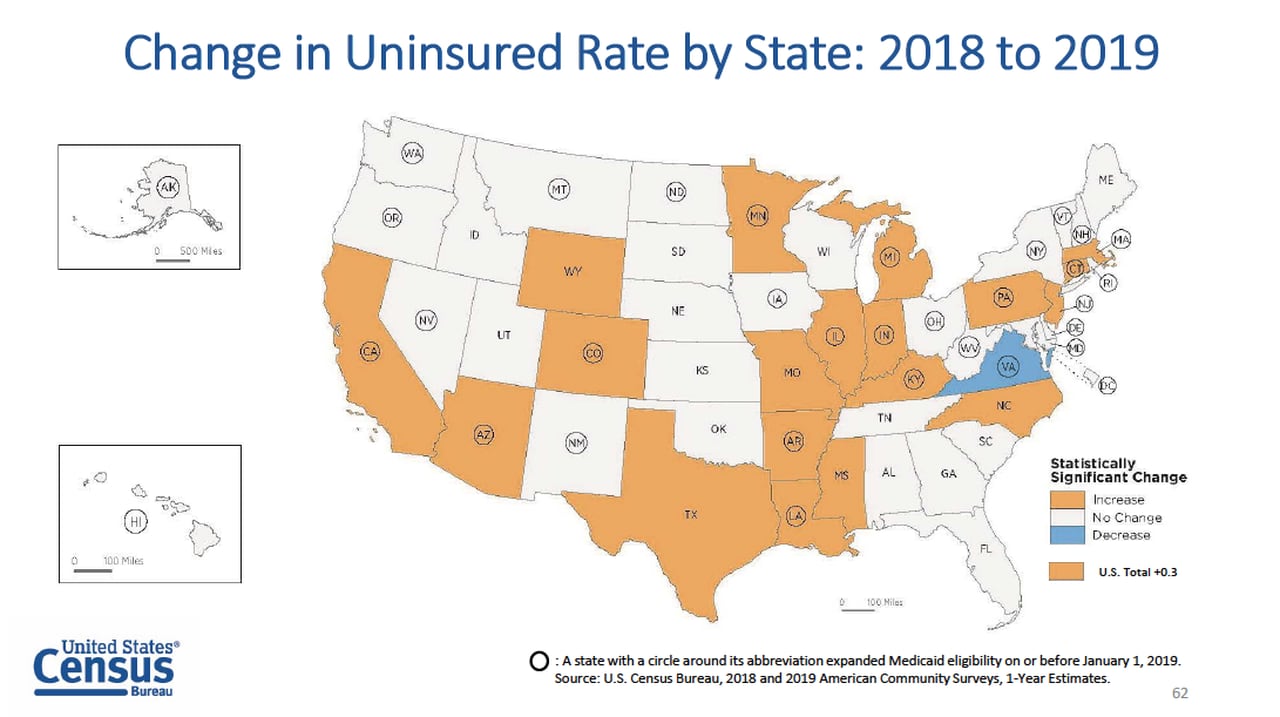

- The expansion of Medicaid eligibility to include more low-income adults.

- Subsidies and tax credits to help individuals and families afford health insurance premiums.

These provisions have led to a significant increase in the number of Americans with health insurance.

Insurance Options Through the Marketplace

The ACA marketplaces offer a variety of health insurance plans, including:

- Bronze plans: These plans have the lowest monthly premiums but also have the highest out-of-pocket costs.

- Silver plans: These plans have a moderate balance between premiums and out-of-pocket costs.

- Gold plans: These plans have higher monthly premiums but lower out-of-pocket costs.

- Platinum plans: These plans have the highest monthly premiums but the lowest out-of-pocket costs.

Each plan offers different levels of coverage, including deductibles, copayments, and coinsurance.

Subsidies and Financial Assistance

The ACA provides subsidies and tax credits to help eligible individuals and families afford health insurance premiums. The amount of financial assistance available depends on the individual’s income and family size. For example, a family of four with an income of $50,000 per year may be eligible for a substantial subsidy to help cover their monthly premiums. The ACA also provides cost-sharing reductions to help lower out-of-pocket costs for eligible individuals.

Advocacy and Policy Solutions

Addressing the issue of health insurance access requires a multi-faceted approach that involves not only policy changes but also robust advocacy efforts.

Role of Advocacy Organizations

Advocacy organizations play a crucial role in advocating for policies that expand health insurance coverage and improve access to healthcare. These organizations work tirelessly to raise awareness about the issue, educate policymakers and the public, and lobby for legislative changes.

- Examples of advocacy organizations include the American Public Health Association (APHA), the Kaiser Family Foundation (KFF), and the Center on Budget and Policy Priorities (CBPP). These organizations conduct research, publish reports, and engage in public outreach to advocate for policies that improve health insurance access.

- Advocacy organizations also play a vital role in supporting individuals and families navigating the complexities of the healthcare system. They provide resources, guidance, and assistance in accessing healthcare services and navigating insurance programs.

Policy Solutions for Expanding Health Insurance Coverage

Policy solutions aimed at expanding health insurance coverage are crucial to ensuring that all Americans have access to affordable and comprehensive healthcare.

- One potential policy solution is to expand eligibility for public health insurance programs like Medicaid and the Children’s Health Insurance Program (CHIP). This would ensure that low-income individuals and families have access to affordable health insurance.

- Another solution is to create a public option for health insurance. This would provide individuals with an alternative to private insurance plans, potentially lowering costs and increasing competition in the market.

- Furthermore, policymakers can explore ways to make private health insurance more affordable. This could include subsidies for premiums, tax credits for individuals purchasing insurance, and regulations to prevent insurance companies from denying coverage based on pre-existing conditions.

Public Awareness Campaigns and Education

Public awareness campaigns and education initiatives are essential for informing individuals about their health insurance options and encouraging them to enroll in coverage.

- These campaigns can utilize various media channels, including television, radio, social media, and community outreach programs, to reach a wide audience. They can provide information about eligibility requirements, enrollment periods, and available benefits.

- Educational efforts can focus on demystifying the complexities of the healthcare system and explaining the importance of having health insurance. They can also provide guidance on navigating insurance plans and accessing healthcare services.

Final Wrap-Up

Ultimately, addressing the issue of healthcare access for those without insurance requires a multifaceted approach. It necessitates increased awareness, expanded access to affordable coverage options, and continued advocacy for policy solutions that prioritize the health and well-being of all Americans. While navigating the system can be challenging, understanding your rights and resources can empower you to make informed decisions and access the care you need.

FAQ Overview

How can I get health insurance if I can’t afford it?

There are various options available, including government programs like Medicaid and CHIP, as well as subsidies offered through the Affordable Care Act marketplace. Explore these options to see if you qualify.

What are the consequences of not having health insurance?

Besides facing significant medical bills, you might experience limited access to preventive care, leading to potential health complications and increased healthcare costs in the long run.

Can I still access emergency medical care without insurance?

Yes, hospitals are legally required to provide emergency medical care regardless of insurance status. However, you may still be responsible for the cost of treatment.

What are some resources available for uninsured individuals?

Many non-profit organizations offer free or low-cost healthcare services, and some community health centers provide care on a sliding scale based on income.