- Factors Affecting Health Insurance Costs in South Carolina

- Types of Health Insurance Plans in South Carolina: How Much Is Health Insurance In Sc Per Month

- Average Health Insurance Costs in South Carolina

- Affordable Health Insurance Options in South Carolina

- Key Considerations for Choosing Health Insurance in South Carolina

- Conclusive Thoughts

- Q&A

How much is health insurance in SC per month? This is a common question for South Carolinians, as healthcare costs can vary significantly depending on a variety of factors. From your age and health status to your location and the type of coverage you need, several elements contribute to the final price tag. Understanding these factors is key to finding the right plan for you and your family, ensuring you get the coverage you need at a price that fits your budget.

This guide explores the complexities of health insurance costs in South Carolina, providing insights into average premiums, available plan types, and resources for finding affordable options. We’ll also discuss important considerations for choosing the right plan, helping you make an informed decision about your healthcare.

Factors Affecting Health Insurance Costs in South Carolina

The cost of health insurance in South Carolina is influenced by various factors, making it crucial to understand these elements when seeking coverage. This knowledge empowers individuals and families to make informed decisions about their health insurance needs.

Age, How much is health insurance in sc per month

Age plays a significant role in determining health insurance premiums. Younger individuals generally have lower premiums because they tend to be healthier and require less medical care. Conversely, older individuals typically have higher premiums due to their increased likelihood of needing medical services. This reflects the statistical correlation between age and healthcare utilization.

Health Status

Individuals with pre-existing health conditions, such as diabetes, heart disease, or cancer, often face higher premiums. Insurers consider these conditions when assessing risk, as they are more likely to require expensive medical treatments. However, the Affordable Care Act (ACA) has introduced regulations to prevent insurers from denying coverage or charging higher premiums solely based on pre-existing conditions.

Location

The cost of health insurance can vary significantly depending on the geographic location within South Carolina. Rural areas tend to have lower premiums than urban areas, as healthcare costs and provider networks may be less extensive. Additionally, the density of healthcare providers and the prevalence of certain health conditions can impact insurance costs in specific regions.

Coverage Type

The type of health insurance coverage chosen also significantly impacts premiums. For instance, comprehensive plans that cover a wide range of medical services, including hospitalization, surgery, and prescription drugs, generally have higher premiums than basic plans with limited coverage. Individuals need to carefully consider their healthcare needs and budget when selecting a coverage type.

South Carolina’s Health Insurance Market

South Carolina’s health insurance market is characterized by a competitive landscape, with multiple insurers offering a variety of plans. This competition can influence premium rates, as insurers strive to attract customers with competitive pricing. However, the state’s market dynamics can also impact the availability and affordability of certain coverage options, particularly in rural areas.

Examples of Cost Variations

The factors mentioned above can lead to substantial differences in health insurance costs between individuals and families. For instance, a young and healthy individual living in a rural area may qualify for a relatively low-cost basic plan. In contrast, an older individual with pre-existing conditions living in a major urban area may require a comprehensive plan with a significantly higher premium.

Types of Health Insurance Plans in South Carolina: How Much Is Health Insurance In Sc Per Month

South Carolina offers a variety of health insurance plans to meet different needs and budgets. Understanding the different plan types and their associated benefits can help you choose the best option for your individual circumstances.

Individual Health Insurance Plans

Individual health insurance plans are purchased directly by individuals, independent of an employer. They offer flexibility and control over coverage choices but often come with higher premiums compared to employer-sponsored plans.

- Coverage Options: Individual plans typically offer a range of coverage options, including comprehensive plans that cover hospitalization, surgery, doctor visits, and preventive care, as well as more limited plans that focus on specific needs, like dental or vision care.

- Benefits: Individual plans provide flexibility in choosing coverage options and providers. They allow individuals to select plans that best meet their specific health needs and budget.

- Pros: Flexibility in coverage choices, control over provider selection, and the ability to choose a plan that fits your individual needs.

- Cons: Higher premiums compared to employer-sponsored plans, limited options in some areas, and potentially higher out-of-pocket costs.

Family Health Insurance Plans

Family health insurance plans cover multiple individuals, typically spouses and dependents, under a single policy. These plans provide comprehensive coverage for the entire family but can be more expensive than individual plans.

- Coverage Options: Family plans usually offer comprehensive coverage, including hospitalization, surgery, doctor visits, and preventive care, with varying levels of coverage for each family member based on age and health status.

- Benefits: Comprehensive coverage for the entire family, potential for lower premiums per individual compared to separate individual plans, and the convenience of a single policy for multiple family members.

- Pros: Comprehensive coverage for all family members, potential for lower premiums per individual, and the convenience of a single policy.

- Cons: Higher overall premiums compared to individual plans, potential for higher out-of-pocket costs, and limited flexibility in choosing coverage options for individual family members.

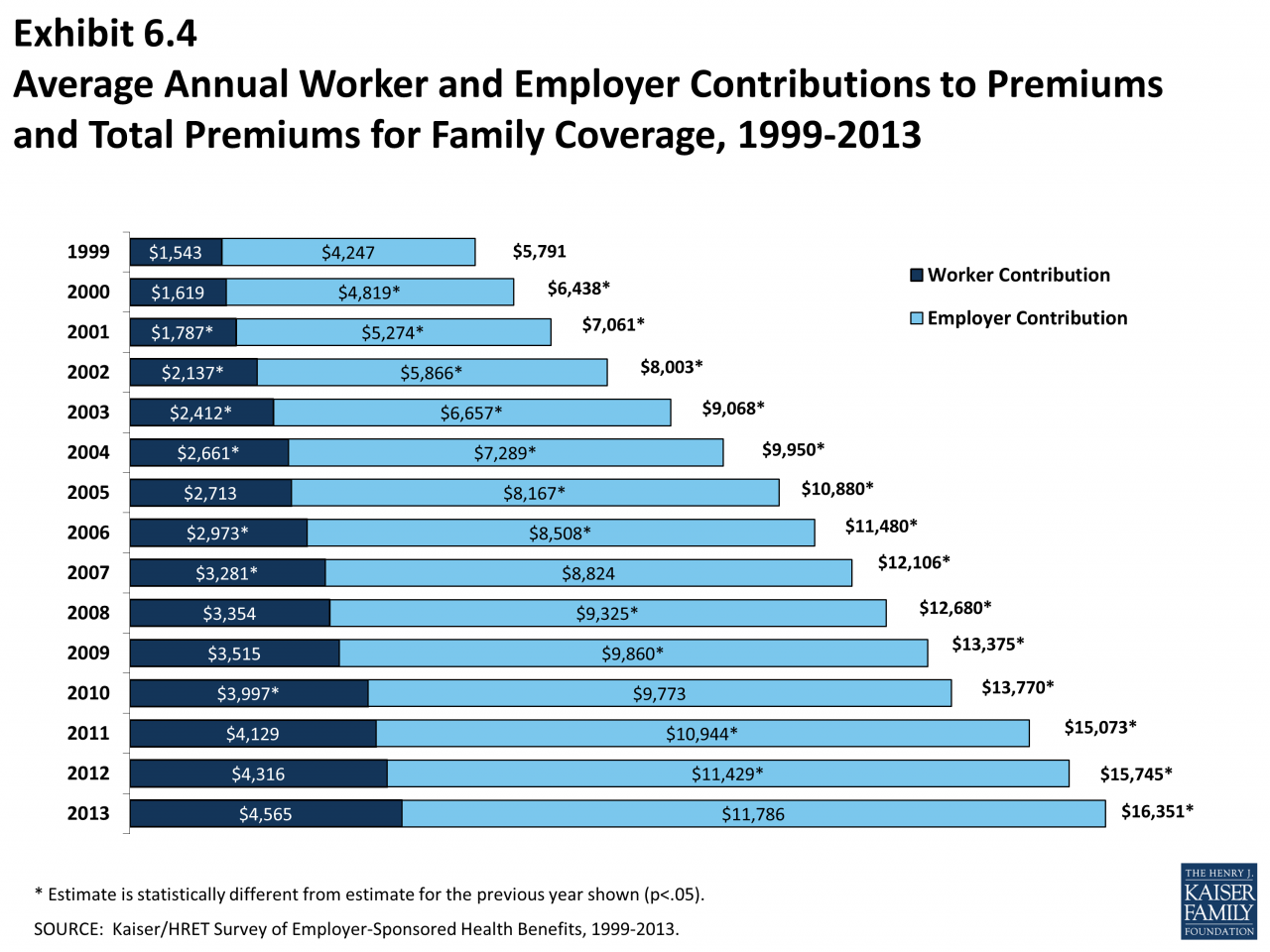

Employer-Sponsored Health Insurance Plans

Employer-sponsored health insurance plans are offered by employers to their employees and their families. These plans often provide more affordable coverage options than individual plans, with lower premiums and potentially lower out-of-pocket costs.

- Coverage Options: Employer-sponsored plans typically offer a range of coverage options, including HMOs, PPOs, and POS plans, with varying levels of coverage and cost-sharing arrangements.

- Benefits: Lower premiums compared to individual plans, potentially lower out-of-pocket costs, and access to a wider network of providers.

- Pros: Lower premiums, potentially lower out-of-pocket costs, and access to a wider network of providers.

- Cons: Limited flexibility in choosing coverage options, potential for higher deductibles and co-pays, and reliance on the employer for plan administration.

Government-Sponsored Health Insurance Plans

Government-sponsored health insurance plans, such as Medicare and Medicaid, are available to individuals who meet specific eligibility criteria. These plans provide affordable healthcare options for eligible individuals and families.

- Coverage Options: Medicare provides health insurance for individuals aged 65 and older, as well as certain younger individuals with disabilities. Medicaid provides health insurance for low-income individuals and families. Both programs offer a range of coverage options, including hospitalization, doctor visits, and prescription drugs.

- Benefits: Affordable healthcare options for eligible individuals and families, comprehensive coverage for a wide range of healthcare needs, and access to a broad network of providers.

- Pros: Affordable premiums, comprehensive coverage, and access to a wide network of providers.

- Cons: Eligibility requirements, potential for limited provider choice, and potential for longer wait times for appointments.

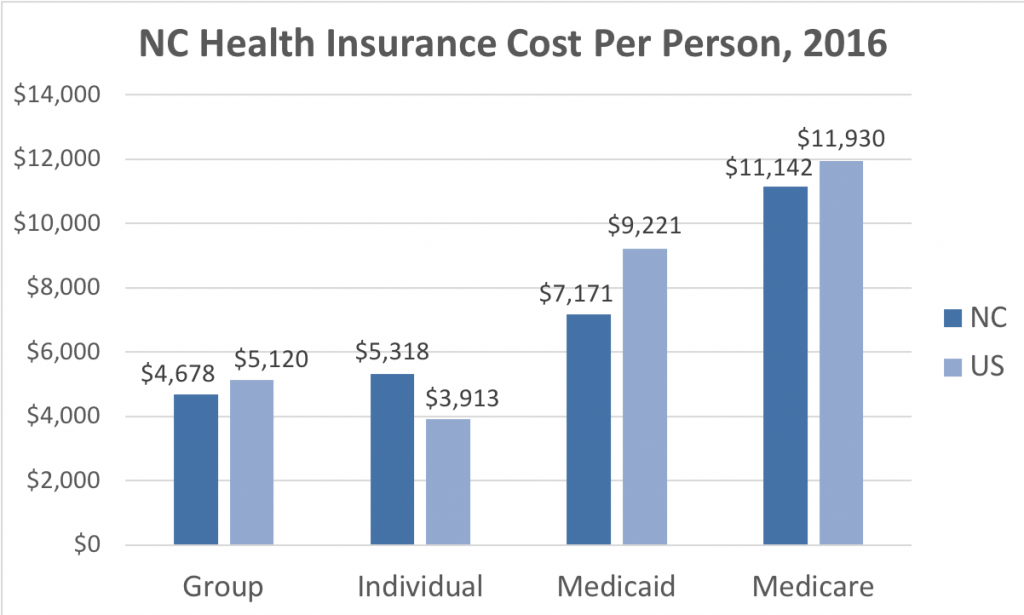

Average Health Insurance Costs in South Carolina

The cost of health insurance in South Carolina can vary widely depending on several factors, including age, location, health status, and the type of plan chosen. To give you a better understanding of the average costs, let’s examine some typical monthly premiums for different health insurance plans in South Carolina.

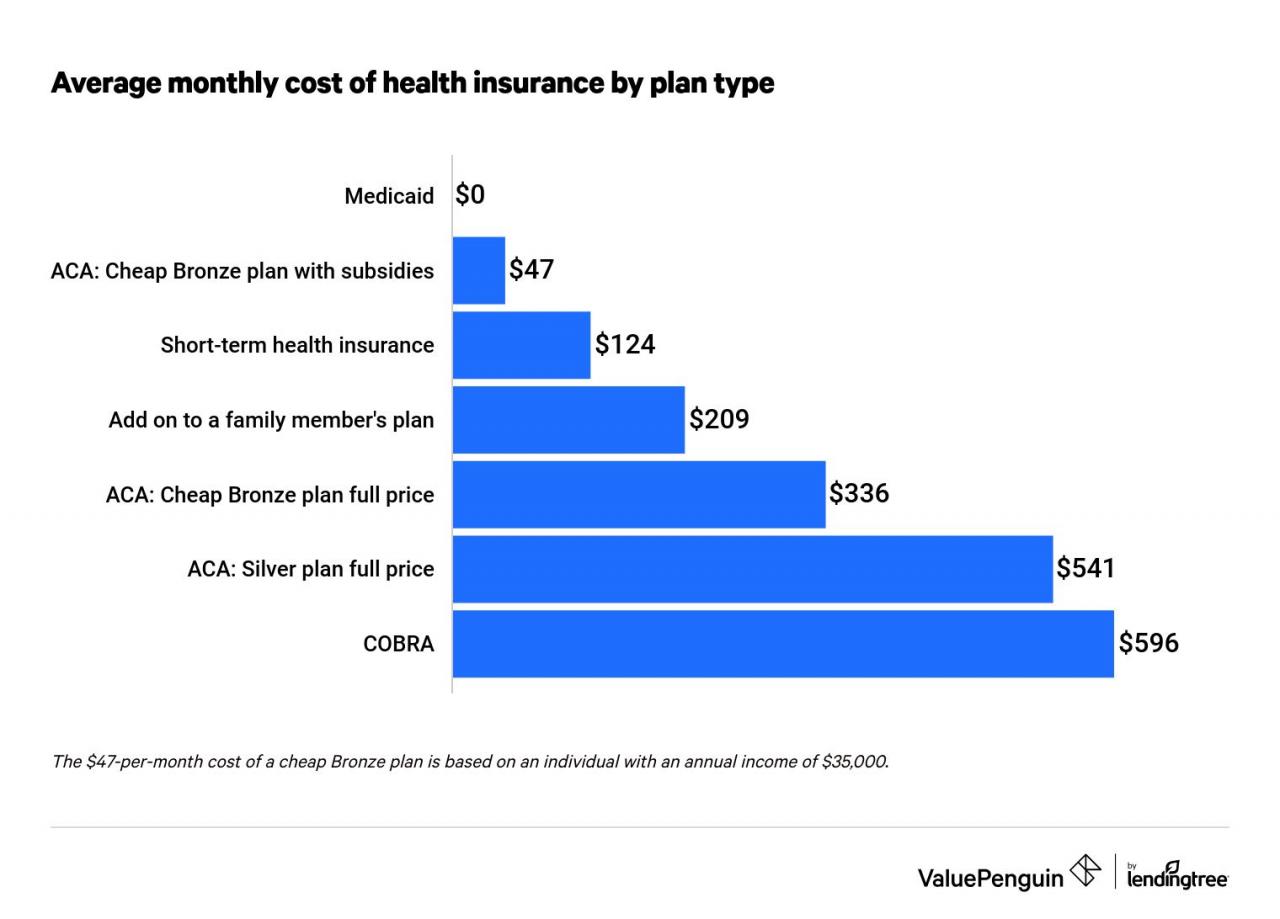

Average Monthly Premiums for Different Health Insurance Plans

| Plan Type | Average Monthly Premium (Individual) | Average Monthly Premium (Family) |

|---|---|---|

| Bronze | $300 – $450 | $700 – $1,000 |

| Silver | $400 – $550 | $900 – $1,200 |

| Gold | $500 – $650 | $1,100 – $1,400 |

| Platinum | $600 – $750 | $1,300 – $1,600 |

It’s important to note that these are just average estimates, and your actual premium may be higher or lower depending on your individual circumstances.

Affordable Health Insurance Options in South Carolina

Finding affordable health insurance in South Carolina can be a challenge, but there are resources available to help.

Affordable Care Act Marketplace

The Affordable Care Act (ACA) Marketplace, also known as HealthCare.gov, offers a platform for individuals and families to compare and enroll in health insurance plans. The ACA Marketplace provides subsidies and tax credits to help eligible individuals and families afford coverage.

Eligibility Requirements

To be eligible for ACA Marketplace subsidies, you must meet the following requirements:

* U.S. citizenship or lawful presence: You must be a U.S. citizen, national, or lawful permanent resident.

* Residency: You must reside in the state of South Carolina.

* Income: Your household income must fall within certain limits, which vary based on family size.

* Not currently covered by employer-sponsored health insurance: You cannot be eligible for affordable health insurance through your employer.

Enrollment Procedures

You can enroll in an ACA Marketplace plan through the following methods:

* Online: Visit HealthCare.gov and create an account to apply for coverage.

* Phone: Call the Marketplace Call Center at 1-800-318-2596 to speak with a representative.

* In person: Visit a certified enrollment assister or agent to receive assistance with enrollment.

Medicaid

Medicaid is a government-funded health insurance program that provides coverage to low-income individuals and families. In South Carolina, Medicaid is administered by the South Carolina Department of Health and Human Services.

Eligibility Requirements

To be eligible for Medicaid in South Carolina, you must meet the following requirements:

* Residency: You must reside in South Carolina.

* Income: Your household income must fall below certain limits, which vary based on family size.

* Citizenship or lawful presence: You must be a U.S. citizen, national, or lawful permanent resident.

* Other factors: You may also be eligible based on other factors, such as age, disability, or pregnancy.

Enrollment Procedures

You can apply for Medicaid in South Carolina through the following methods:

* Online: Visit the South Carolina Department of Health and Human Services website and complete an online application.

* Phone: Call the Medicaid Call Center at 1-800-868-0003 to speak with a representative.

* In person: Visit a local Department of Social Services office to complete a paper application.

Tips for Reducing Health Insurance Costs

Here are some tips for reducing your health insurance costs in South Carolina:

* Compare plans: Use the ACA Marketplace or other comparison tools to compare plans and prices.

* Negotiate rates: Contact your insurance company to see if you can negotiate a lower rate.

* Utilize preventive care services: Take advantage of preventive care services, such as annual checkups and screenings, to reduce your risk of developing expensive health conditions.

* Consider a high-deductible health plan: High-deductible health plans (HDHPs) typically have lower monthly premiums, but you’ll pay more out of pocket for medical services.

* Shop around for prescription drugs: Compare prices for prescription drugs at different pharmacies and consider using generic medications when possible.

* Consider a health savings account (HSA): If you have an HDHP, you can open an HSA to save money on healthcare expenses.

Key Considerations for Choosing Health Insurance in South Carolina

Choosing the right health insurance plan is crucial for securing your financial well-being and accessing necessary medical care. Several factors play a significant role in determining the best plan for your individual needs.

Coverage Needs

Understanding your specific health needs and coverage requirements is paramount. Consider your medical history, current health conditions, and potential future healthcare needs. For example, if you have a chronic illness, you might need a plan with comprehensive coverage for prescription drugs and regular doctor visits.

Budget

Your budget is another critical factor. Health insurance premiums vary significantly based on the plan’s coverage and the insurer. Evaluate your monthly budget and determine the maximum amount you can comfortably afford to pay for premiums.

Provider Network

The provider network is a list of doctors, hospitals, and other healthcare providers contracted by your insurance company. Ensure your preferred doctors and hospitals are included in the plan’s network to avoid out-of-network costs.

Prescription Drug Coverage

If you take prescription medications, you need to consider the plan’s prescription drug coverage. Some plans offer formularies, which are lists of approved medications covered at specific costs. Check if your medications are covered and the associated copayments or coinsurance.

Questions to Ask Potential Insurance Providers

To make an informed decision, ask these questions to potential insurance providers:

- What is the monthly premium?

- What is the deductible?

- What is the coinsurance?

- What is the out-of-pocket maximum?

- What is the provider network?

- Are my preferred doctors and hospitals in the network?

- What is the prescription drug coverage?

- Are my medications covered?

- What are the copayments or coinsurance for medications?

- What are the customer service options?

- What is the claims process?

Navigating the Health Insurance Selection Process

Here’s a step-by-step guide to help you navigate the health insurance selection process in South Carolina:

- Assess your needs: Determine your coverage requirements, budget, and preferred healthcare providers.

- Research insurance plans: Compare different plans from various insurers using online tools, insurance brokers, or the South Carolina Department of Insurance website.

- Ask questions: Contact insurance providers directly to clarify coverage details and address any concerns.

- Choose a plan: Select the plan that best aligns with your needs and budget.

- Enroll: Complete the enrollment process with your chosen insurer.

Conclusive Thoughts

Navigating the world of health insurance can feel overwhelming, but with the right information and resources, you can find a plan that meets your needs and budget. Remember to consider your individual circumstances, research different options, and don’t hesitate to seek help from qualified professionals. By understanding the factors that influence health insurance costs in South Carolina and utilizing available resources, you can make confident decisions about your healthcare and secure the peace of mind that comes with knowing you’re protected.

Q&A

What are the most common types of health insurance plans in South Carolina?

The most common types of health insurance plans in South Carolina include individual, family, employer-sponsored, and government-sponsored plans like Medicaid and Medicare.

How can I compare different health insurance plans?

You can compare plans online through the Affordable Care Act Marketplace, contact insurance brokers, or speak with your employer about available plans. Make sure to compare coverage, premiums, and provider networks.

What are some tips for reducing my health insurance costs?

Consider enrolling in a Health Savings Account (HSA), taking advantage of preventive care services, and negotiating rates with your insurance provider.