Can you get private health insurance? The answer is often yes, but the process and availability can vary depending on your individual circumstances. Private health insurance, unlike public options, provides additional coverage and flexibility, but it also comes with its own set of considerations. From understanding the different plan types to navigating the cost and eligibility factors, this guide will help you explore the world of private health insurance.

Navigating the healthcare system can be overwhelming, and understanding your options is crucial. Private health insurance offers an alternative to public healthcare, providing a range of benefits and coverage options. This guide delves into the intricacies of private health insurance, covering everything from eligibility and costs to advantages and disadvantages.

Understanding Private Health Insurance

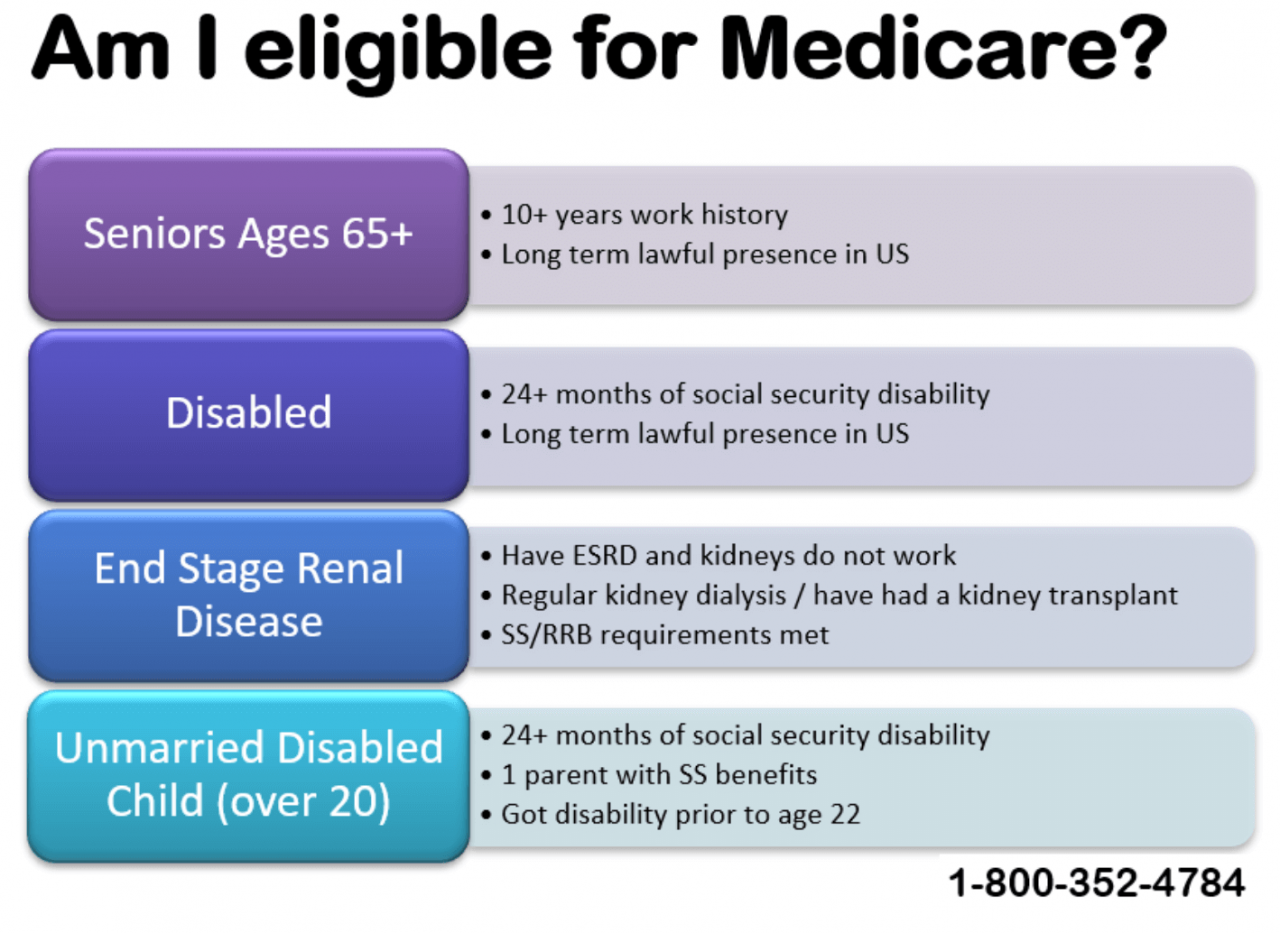

Private health insurance is a type of insurance that helps individuals and families pay for healthcare costs. It differs from public health insurance, such as Medicare and Medicaid, which are government-funded programs. Private health insurance is purchased from private companies and offers coverage for various medical expenses, including doctor’s visits, hospital stays, and prescription drugs.

Types of Private Health Insurance Plans

There are several types of private health insurance plans available, each with its own features and benefits. The most common types include:

- Individual Plans: These plans are purchased by individuals and cover only the policyholder. They are typically more expensive than group plans but offer more flexibility in terms of coverage options.

- Family Plans: These plans cover the policyholder and their dependents, such as spouses and children. They are often more affordable than individual plans due to economies of scale.

- Group Plans: These plans are offered through employers, associations, or other organizations. They are usually the most affordable option because they are negotiated at a group level.

Key Features and Benefits of Private Health Insurance

Private health insurance offers several key features and benefits, which can vary depending on the plan you choose. Some common features include:

- Coverage for Specific Medical Conditions: Many private health insurance plans cover specific medical conditions, such as cancer, heart disease, and diabetes. This can provide peace of mind knowing that you have financial protection if you are diagnosed with a serious illness.

- Hospital Stays: Private health insurance plans typically cover hospital stays, including room and board, surgery, and other related expenses. The level of coverage can vary depending on the plan.

- Outpatient Care: Many plans also cover outpatient care, such as doctor’s visits, diagnostic tests, and physical therapy. This can help you manage your health and avoid unnecessary hospitalizations.

- Prescription Drugs: Some private health insurance plans offer coverage for prescription drugs, which can be a significant expense for individuals with chronic health conditions. However, the coverage may be limited to certain drugs or have a co-pay requirement.

Eligibility and Access to Private Health Insurance

Gaining access to private health insurance involves several factors, including your individual circumstances and the specific insurer’s policies. This section will explore the key aspects of eligibility and the application process.

Factors Influencing Eligibility

Your eligibility for private health insurance is influenced by several factors, including:

- Age: Most insurers have minimum and maximum age limits for coverage. For example, some insurers may not offer coverage to individuals under 18 or over 65.

- Health Status: Your current health condition can significantly impact your eligibility and premiums. Insurers may have specific underwriting guidelines that consider pre-existing conditions and health risks.

- Employment: Your employment status can affect your eligibility and coverage options. Some employers offer group health insurance plans, which may be more affordable than individual plans.

Application Process

Applying for private health insurance typically involves the following steps:

- Contact Insurers: Research different insurers and compare their plans and coverage options.

- Provide Information: You will need to provide personal information, including your name, address, date of birth, and contact details.

- Complete Health Questionnaire: You may be required to complete a health questionnaire that details your medical history and current health status.

- Submit Documentation: Depending on the insurer’s requirements, you may need to provide supporting documentation, such as medical records or proof of employment.

- Underwriting Process: The insurer will review your application and assess your health risks. This process may involve medical examinations or further information requests.

- Waiting Periods: Some coverage may have waiting periods before they become effective. For example, there might be a waiting period for certain procedures or conditions.

Pre-Existing Conditions

Pre-existing conditions are health conditions you had before applying for insurance. These conditions can impact your eligibility and premiums. Insurers may:

- Exclude Coverage: Some insurers may exclude coverage for specific pre-existing conditions.

- Charge Higher Premiums: Insurers may charge higher premiums for individuals with pre-existing conditions, reflecting the higher risk of claims.

- Offer Limited Coverage: Some insurers may offer limited coverage for pre-existing conditions, with specific limitations or exclusions.

Costs and Premiums

The cost of private health insurance premiums can vary significantly depending on several factors. Understanding these factors can help you choose a plan that fits your budget and needs.

Factors Affecting Premium Costs

Several factors contribute to the cost of private health insurance premiums. These factors include:

- Age: Younger individuals generally pay lower premiums than older individuals because they are statistically less likely to require expensive medical care.

- Health Status: Individuals with pre-existing medical conditions may face higher premiums due to the potential for higher healthcare costs.

- Coverage Level: Higher coverage levels, such as comprehensive plans with extensive benefits, typically result in higher premiums.

- Location: Premiums can vary based on the geographic location, reflecting differences in healthcare costs and provider networks.

Typical Premium Costs

The cost of private health insurance premiums can vary widely depending on the plan type and coverage level. Here are some examples of typical premium costs:

- Basic Health Insurance: Basic plans with limited coverage might cost around $200-$300 per month for an individual.

- Comprehensive Health Insurance: Comprehensive plans with extensive coverage, including hospitalization and critical illness, could cost $500-$1000 per month for an individual.

- Family Health Insurance: Premiums for family plans, covering multiple individuals, are typically higher than individual plans and can range from $1000-$2000 per month.

Deductibles, Copayments, and Coinsurance

Private health insurance plans often involve deductibles, copayments, and coinsurance, which affect out-of-pocket expenses:

- Deductible: The amount you pay out-of-pocket before your insurance coverage kicks in. For example, a $1000 deductible means you pay the first $1000 of medical expenses yourself.

- Copayment: A fixed amount you pay for specific services, such as doctor visits or prescriptions. Copayments are typically a flat fee, such as $20 for a doctor’s visit.

- Coinsurance: A percentage of the cost of a service you pay after meeting your deductible. For example, 80/20 coinsurance means your insurance covers 80% of the cost, and you pay 20%.

It is important to note that these are just examples, and actual premiums and out-of-pocket costs can vary significantly depending on the specific plan and insurer.

Advantages and Disadvantages of Private Health Insurance

Private health insurance can provide individuals with a range of benefits, but it also comes with certain drawbacks. Understanding these advantages and disadvantages is crucial when deciding whether private health insurance is right for you.

Advantages of Private Health Insurance

Private health insurance offers several advantages that can enhance your healthcare experience.

- Access to Specialized Care: Private health insurance often provides access to a wider network of healthcare providers, including specialists, which may not be readily available through public healthcare systems. This can be particularly beneficial for individuals with complex medical conditions or who require specialized treatments.

- Faster Appointment Scheduling: Private health insurance can facilitate faster appointment scheduling with healthcare providers. This is because private insurance companies often have agreements with healthcare providers that prioritize their insured patients, leading to shorter wait times for appointments and procedures.

- Broader Coverage: Private health insurance plans typically offer broader coverage than public healthcare systems. This can include coverage for a wider range of medical services, treatments, and medications, potentially providing greater peace of mind and financial protection.

- Choice of Providers: Private health insurance often gives individuals greater flexibility in choosing their healthcare providers. This allows patients to select providers based on their preferences, location, and expertise, potentially leading to a more personalized healthcare experience.

Disadvantages of Private Health Insurance

While private health insurance offers several advantages, it also comes with certain drawbacks that individuals should consider.

- Higher Costs: Private health insurance premiums can be significantly higher than public healthcare system contributions. This can be a major financial burden for individuals, especially those with limited income or who need extensive medical care.

- Limitations on Coverage: Private health insurance plans often have limitations on coverage, meaning they may not cover all medical services or treatments. These limitations can vary depending on the plan and insurer, so it’s important to carefully review the policy details before making a decision.

- Pre-existing Condition Exclusions: Some private health insurance plans may exclude coverage for pre-existing conditions, meaning they may not cover treatments or services related to conditions that existed before the policy was purchased. This can be a significant concern for individuals with chronic health issues.

- Administrative Complexity: Navigating private health insurance can be complex, involving paperwork, claims processing, and understanding policy terms. This can be particularly challenging for individuals who are unfamiliar with the healthcare system or who have limited financial literacy.

Choosing the Right Plan

Navigating the world of private health insurance plans can be overwhelming. With so many options available, finding the right plan for your individual needs and circumstances is crucial. This section provides a step-by-step guide to help you make an informed decision.

Comparing Plans, Can you get private health insurance

Before choosing a plan, it’s essential to compare different options from various providers. This allows you to assess the coverage, premiums, and out-of-pocket costs associated with each plan. Here’s a step-by-step approach:

- Identify Your Needs: Determine your specific health needs and priorities. Consider factors such as pre-existing conditions, desired coverage levels, and preferred healthcare providers.

- Research Providers: Explore different private health insurance providers and familiarize yourself with their reputation, coverage options, and customer service. You can consult online resources, compare websites, and seek recommendations from friends or family.

- Compare Plans: Obtain quotes and compare plans from multiple providers. Pay close attention to the coverage details, including benefits, exclusions, and limitations. Analyze the premium costs, deductibles, copayments, and out-of-pocket maximums.

- Consider Additional Features: Some plans may offer additional features, such as wellness programs, telehealth services, or prescription drug discounts. Evaluate these features and determine if they align with your needs and preferences.

- Seek Professional Advice: If you’re unsure about the best plan, consult with a licensed insurance broker or financial advisor. They can provide personalized guidance based on your individual circumstances.

Plan Comparison Table

The following table provides a simplified comparison of different private health insurance plans, highlighting key features and benefits. It’s important to note that these are general examples, and actual plan details may vary depending on the provider and specific coverage options.

| Plan Type | Coverage | Premiums | Out-of-Pocket Costs | Benefits |

|---|---|---|---|---|

| Basic Plan | Limited coverage for essential services | Lower premiums | Higher deductibles and copayments | Lower monthly costs |

| Comprehensive Plan | Extensive coverage for a wide range of services | Higher premiums | Lower deductibles and copayments | Greater protection against high healthcare expenses |

| High-Deductible Plan | High deductible with lower premiums | Lower premiums | Higher deductibles and out-of-pocket maximums | Suitable for individuals with low healthcare utilization |

| Hospital Indemnity Plan | Fixed cash payments for hospital stays | Lower premiums | Limited coverage for other medical expenses | Provides financial assistance during hospitalization |

Resources and Support

Navigating the world of private health insurance can feel overwhelming, especially with so many options and complexities. However, accessing the right resources and support can make the process much smoother and ensure you make informed decisions.

Reputable Sources for Information

Finding reliable information about private health insurance is crucial. Several resources can provide accurate and up-to-date details:

- Government Websites: Government websites, such as the Department of Health and Human Services (HHS) in the United States or the equivalent agencies in other countries, offer comprehensive information about health insurance, including regulations, consumer rights, and available plans.

- Consumer Protection Agencies: Organizations like the National Association of Insurance Commissioners (NAIC) in the US or similar agencies in other countries are dedicated to protecting consumers’ rights and providing resources on health insurance.

- Insurance Industry Associations: Associations like the America’s Health Insurance Plans (AHIP) in the US or their counterparts in other countries represent insurance companies and can provide information about industry trends and best practices.

- Independent Consumer Groups: Non-profit organizations like the Kaiser Family Foundation (KFF) in the US or similar groups in other countries conduct research and offer unbiased information about health insurance options.

Navigating the Purchase and Management Process

Purchasing and managing private health insurance can be a complex process, but there are ways to simplify it:

- Start with a Needs Assessment: Before exploring options, assess your healthcare needs, including pre-existing conditions, expected medical expenses, and desired coverage levels.

- Compare Plans: Use online comparison tools or consult with an insurance broker to compare different plans based on your needs, budget, and coverage preferences.

- Read the Policy Carefully: Before enrolling, thoroughly read the policy document to understand the coverage details, exclusions, and terms and conditions.

- Ask Questions: Don’t hesitate to ask questions to the insurance company or broker to clarify any uncertainties or seek guidance.

- Keep Records: Maintain accurate records of your policy, premiums paid, claims filed, and other relevant information for easy reference and to ensure smooth claim processing.

Maximizing Value and Smooth Claim Processing

To maximize the value of your private health insurance and ensure smooth claim processing:

- Understand Your Coverage: Familiarize yourself with the specifics of your plan, including covered services, deductibles, co-pays, and out-of-pocket limits.

- Use In-Network Providers: Whenever possible, utilize healthcare providers within your plan’s network to minimize out-of-pocket costs.

- Seek Pre-Authorization: For major procedures or treatments, obtain pre-authorization from your insurer to ensure coverage and avoid unexpected expenses.

- File Claims Promptly: Submit claims promptly after receiving medical services, following the insurer’s instructions and providing all necessary documentation.

- Review Statements Carefully: Regularly review your insurance statements for accuracy and to identify any discrepancies or errors.

Final Conclusion: Can You Get Private Health Insurance

Ultimately, the decision to pursue private health insurance is a personal one, requiring careful consideration of your individual needs and financial situation. By understanding the complexities of private health insurance, you can make an informed choice that best suits your healthcare goals. Remember, seeking advice from insurance professionals and comparing plans from different providers is crucial to ensure you find the best fit for your unique circumstances.

FAQ Compilation

How much does private health insurance cost?

The cost of private health insurance varies widely based on factors such as age, health status, coverage level, and location. You can get quotes from different insurance providers to compare prices.

What are the main differences between public and private health insurance?

Public health insurance is funded by the government and is typically available to all citizens, while private health insurance is purchased from a private company and offers additional coverage options and flexibility. Public health insurance is generally less expensive but may have longer wait times for certain services.

Can I get private health insurance if I have a pre-existing condition?

Yes, you can usually get private health insurance with a pre-existing condition, but it may affect your premium and coverage. Some plans may have exclusions or limitations for pre-existing conditions.

What are the common benefits of private health insurance?

Private health insurance often offers benefits such as faster appointment scheduling, access to specialized care, broader coverage, and greater choice in healthcare providers.