- Cost and Coverage Considerations

- Benefits and Protection

- Access to Healthcare Services

- Financial Stability and Peace of Mind

- Employer-Sponsored Health Insurance

- Individual Health Insurance Market

- Uninsured Population

- Future of Health Insurance

- Last Recap: Is Having Health Insurance Worth It

- Detailed FAQs

Is having health insurance worth it? The answer, like most things in life, is complex and depends on individual circumstances. It’s a question that weighs heavily on many minds, as navigating the healthcare system can feel like a maze of costs and coverage options. But the reality is that health insurance plays a vital role in ensuring access to quality care and protecting individuals from financial ruin in the face of unexpected medical emergencies.

From understanding the different types of health insurance plans to navigating the intricacies of premiums, deductibles, and copayments, this exploration aims to shed light on the various aspects of health insurance and its impact on our lives. We’ll delve into the benefits and protections offered, the access to healthcare services it provides, and its influence on overall health and well-being. Ultimately, this journey will equip you with the knowledge to make informed decisions about your health insurance needs and find the best path to financial stability and peace of mind.

Cost and Coverage Considerations

Understanding the cost and coverage aspects of health insurance is crucial to making an informed decision. It involves analyzing different plan types, premium structures, and potential out-of-pocket expenses. This information helps individuals determine if health insurance is financially viable and aligns with their healthcare needs.

Types of Health Insurance Plans

Different health insurance plans cater to varying needs and budgets. Each plan type comes with its own cost structure and network of healthcare providers.

- Health Maintenance Organization (HMO): HMOs typically offer lower premiums but restrict coverage to a specific network of providers. You need to choose a primary care physician (PCP) within the network, who acts as a gatekeeper for referrals to specialists.

- Preferred Provider Organization (PPO): PPOs offer more flexibility than HMOs, allowing you to see providers outside the network, though at a higher cost. You do not need a PCP referral for specialists.

- Exclusive Provider Organization (EPO): EPOs are similar to HMOs, requiring you to stay within a network for coverage. However, unlike HMOs, EPOs do not offer out-of-network coverage, even in emergencies.

Cost Breakdown

Health insurance costs are often broken down into premiums, deductibles, copayments, and coinsurance.

- Premiums: These are monthly payments you make to maintain your health insurance coverage.

- Deductibles: This is the amount you pay out-of-pocket before your insurance starts covering healthcare costs. For example, a $1,000 deductible means you pay the first $1,000 in medical expenses yourself before your insurance kicks in.

- Copayments: These are fixed amounts you pay for specific services, such as doctor visits or prescriptions.

- Coinsurance: This is a percentage of the cost you pay after meeting your deductible. For example, 80/20 coinsurance means your insurance covers 80% of the cost, and you pay the remaining 20%.

Cost Comparison

The average annual cost of health insurance varies depending on factors like age, location, and plan type. However, it is essential to consider the potential cost of medical expenses without coverage.

For example, a single, unexpected hospitalization could easily cost tens of thousands of dollars, putting a significant strain on your finances.

Factors Influencing Premiums

Several factors influence health insurance premiums:

- Age: Older individuals generally have higher premiums due to increased healthcare needs.

- Location: Premiums can vary depending on the cost of living and healthcare expenses in your area.

- Health Status: Individuals with pre-existing conditions may face higher premiums.

- Coverage Level: Higher coverage levels, such as comprehensive plans with low deductibles, typically have higher premiums.

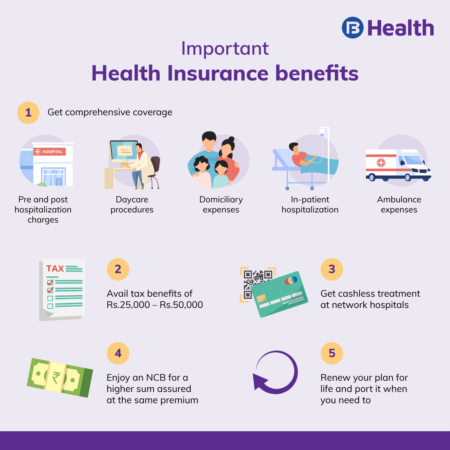

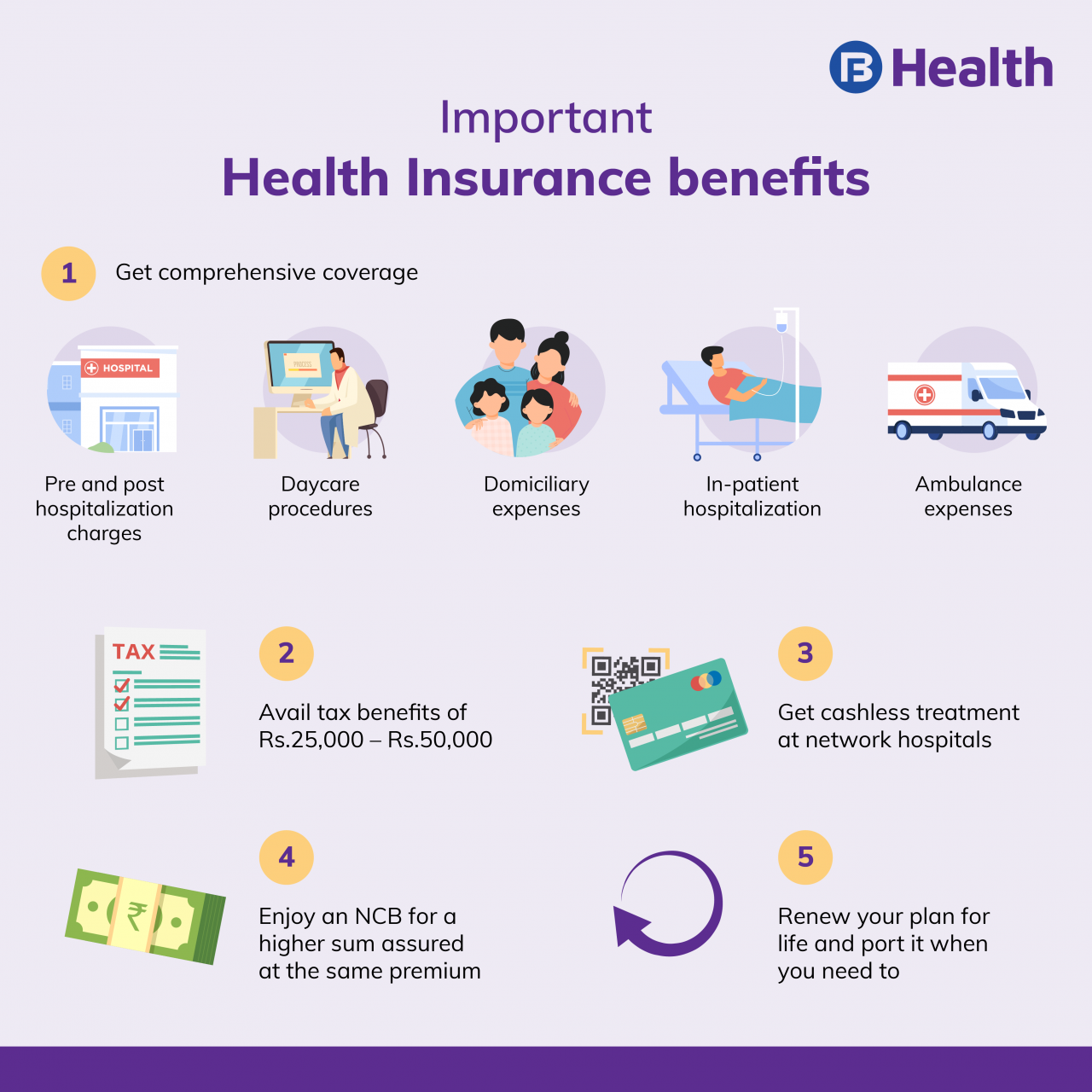

Benefits and Protection

Health insurance provides much more than just financial coverage for medical expenses. It offers a safety net, peace of mind, and the ability to access essential healthcare services without the fear of crippling debt.

Protection from Financial Ruin

Unexpected medical emergencies or chronic illnesses can have devastating financial consequences. Without health insurance, individuals and families may face overwhelming medical bills that could lead to bankruptcy. Health insurance acts as a shield against these risks, helping to protect individuals from financial ruin.

- Hospitalization and Surgery: Health insurance covers the costs associated with hospitalization, including room and board, nursing care, and medical supplies. It also covers surgical procedures, ensuring access to necessary medical interventions.

- Prescription Drugs: Health insurance plans typically cover prescription medications, allowing individuals to access essential drugs without paying exorbitant prices.

- Preventive Care: Many health insurance plans cover preventive care services, such as annual checkups, screenings, and vaccinations. These services help detect health issues early, potentially preventing more serious and costly problems in the future.

Protection for Individuals with Pre-existing Conditions

Before the Affordable Care Act (ACA), individuals with pre-existing conditions often faced difficulty obtaining health insurance or were charged exorbitant premiums. The ACA prohibited insurance companies from denying coverage or charging higher premiums based on pre-existing conditions. This ensures that individuals with pre-existing conditions have access to affordable and comprehensive health insurance.

“The Affordable Care Act has been a game-changer for millions of Americans with pre-existing conditions. It has given them access to affordable health insurance, which was previously unavailable or unaffordable.” – Dr. David Blumenthal, President of the Commonwealth Fund.

Real-Life Examples

Health insurance has helped countless individuals and families navigate medical challenges and avoid financial hardship. For example, a single mother with a chronic illness was able to manage her medical costs and maintain her financial stability thanks to her health insurance. The insurance plan covered her medications, doctor’s visits, and hospital stays, allowing her to focus on her health and well-being without worrying about overwhelming medical bills.

Access to Healthcare Services

Health insurance plays a crucial role in facilitating access to a comprehensive network of healthcare providers, ensuring timely access to essential medical treatments and procedures. It acts as a bridge between individuals and the healthcare system, enabling them to receive the care they need when they need it.

Impact of Health Insurance on Access to Healthcare Services

Health insurance empowers individuals to access a wide range of healthcare services, including routine checkups, preventive screenings, specialized treatments, and emergency care. It grants them access to a network of doctors, hospitals, and specialists who are contracted with their insurance plan. This network ensures that insured individuals can find qualified healthcare providers within their geographical area.

- Reduced Financial Barriers: Health insurance significantly reduces financial barriers to healthcare access. By covering a portion or all of the medical expenses, it eliminates the need for individuals to pay out-of-pocket for every medical service, making healthcare more affordable and accessible.

- Timely Access to Necessary Treatments: Health insurance facilitates timely access to essential medical treatments and procedures. Without insurance, individuals may face delays in receiving care due to financial constraints or the need to navigate complex billing processes. Health insurance streamlines these processes, enabling quicker access to necessary medical care.

- Access to Specialized Care: Health insurance provides access to specialized care, including consultations with specialists, advanced diagnostic tests, and complex surgical procedures. It eliminates the need for individuals to search for specialists out of pocket, ensuring they receive the necessary specialized care from qualified professionals.

Accessibility of Healthcare Services for Insured vs. Uninsured Individuals

The accessibility of healthcare services for insured individuals is significantly higher compared to those without coverage. Individuals without health insurance often face numerous challenges in accessing healthcare, including:

- Limited Provider Networks: Uninsured individuals often have limited access to healthcare providers, as many providers do not accept patients without insurance. This can lead to longer wait times for appointments and difficulty finding a provider who meets their specific needs.

- Financial Barriers: The lack of health insurance means individuals are responsible for paying the full cost of medical services out-of-pocket. This can be a significant financial burden, especially for unexpected medical emergencies, leading to delayed or forgone care.

- Difficulty Navigating the Healthcare System: Without insurance, individuals may struggle to navigate the complex healthcare system, including understanding billing procedures, finding affordable care, and negotiating payment plans. This can create significant obstacles to accessing necessary medical care.

Financial Stability and Peace of Mind

Health insurance offers much more than just access to healthcare; it provides a crucial layer of financial security and peace of mind, protecting individuals from the potentially devastating financial consequences of unexpected medical events. The financial burden of unforeseen medical expenses can be overwhelming, leading to debt, bankruptcy, and even financial ruin. Health insurance acts as a safety net, ensuring that individuals can access necessary medical care without fear of crippling financial repercussions.

Financial Protection from Unexpected Medical Expenses

Health insurance plays a vital role in shielding individuals from the financial burdens associated with unexpected medical bills. It acts as a financial buffer, mitigating the risk of catastrophic medical expenses. Here’s how it works:

- Coverage for Medical Costs: Health insurance policies cover a wide range of medical expenses, including hospital stays, surgeries, medications, and doctor’s visits. This coverage helps individuals manage the costs of treatment and prevent them from accumulating substantial debt.

- Reduced Out-of-Pocket Expenses: Health insurance policies typically have deductibles and copayments, which are amounts individuals pay out of pocket before insurance coverage kicks in. However, these out-of-pocket expenses are significantly lower than the total cost of medical services, providing financial relief.

- Protection from Bankruptcy: Without health insurance, a single medical emergency can lead to substantial debt, potentially pushing individuals into bankruptcy. Health insurance acts as a financial safety net, preventing such catastrophic financial outcomes.

Financial Stability and Peace of Mind

Health insurance contributes significantly to financial stability, allowing individuals to focus on their health and recovery without worrying about the financial implications of their medical needs.

- Predictable Healthcare Costs: Health insurance policies provide predictable healthcare costs through fixed monthly premiums, allowing individuals to budget for their healthcare expenses and avoid unexpected financial shocks.

- Reduced Financial Stress: Knowing that their healthcare costs are covered by insurance, individuals can experience reduced financial stress and anxiety, allowing them to focus on their well-being and recovery.

- Financial Security: Health insurance provides a sense of financial security, knowing that they are protected from the potentially crippling financial consequences of unforeseen medical events. This peace of mind allows individuals to plan for their future and pursue their goals without fear of financial ruin.

Employer-Sponsored Health Insurance

Employer-sponsored health insurance is a common way for individuals to obtain health coverage in the United States. It’s a system where employers offer health insurance plans to their employees as a benefit. This type of insurance often comes with significant advantages, making it a popular choice for many individuals.

Benefits of Employer-Sponsored Health Insurance

Employer-sponsored health insurance plans typically offer several benefits to employees.

- Group Rates: Employers negotiate group rates with insurance companies, which often result in lower premiums compared to individual plans. The larger the employer’s group, the better the negotiating power, leading to more favorable rates.

- Tax Advantages: Employer contributions to health insurance premiums are often tax-deductible for both the employer and the employee. This can lead to significant tax savings for individuals.

- Employer Contributions: Many employers contribute a portion of the premium cost, making health insurance more affordable for employees. This can significantly reduce the out-of-pocket expenses for individuals.

Understanding Coverage Provided by Employer-Sponsored Plans

It’s crucial to understand the coverage provided by employer-sponsored plans. This involves examining factors such as:

- Deductibles: The amount you must pay out-of-pocket before your insurance starts covering medical expenses.

- Co-pays: Fixed amounts you pay for specific services, such as doctor’s visits or prescriptions.

- Co-insurance: A percentage of the medical expenses you share with your insurer after the deductible is met.

- Network: The list of doctors, hospitals, and other healthcare providers covered by your plan. It’s important to choose a plan with a network that includes providers you trust and use frequently.

- Prescription Drug Coverage: Understanding the coverage for prescription drugs is essential, including formularies (lists of covered medications) and co-pays.

Comparing Employer-Sponsored and Individual Health Insurance

While employer-sponsored health insurance offers many benefits, it’s essential to compare it with individual health insurance plans available in the marketplace.

- Flexibility: Individual plans offer more flexibility in choosing coverage options and providers. You can select a plan that best suits your specific needs and preferences.

- Portability: Individual plans are portable, meaning you can keep your coverage even if you change jobs or become self-employed.

- Cost: Individual plans may be more expensive than employer-sponsored plans, especially if you have pre-existing conditions. However, with the availability of subsidies and tax credits, the cost may be comparable for some individuals.

Employer’s Role in Promoting Health and Well-being

Employers play a significant role in promoting health and well-being through their health insurance programs. They can:

- Offer Wellness Programs: Employers can provide programs that encourage healthy lifestyles, such as fitness classes, nutrition counseling, and smoking cessation programs.

- Promote Preventive Care: By covering preventive services like screenings and vaccinations, employers can help employees maintain their health and reduce the risk of chronic diseases.

- Provide Employee Assistance Programs: These programs offer confidential counseling and support for employees dealing with personal or work-related issues.

Individual Health Insurance Market

The individual health insurance market offers a range of options for people who are not covered by employer-sponsored plans. This market provides individuals with the flexibility to choose plans that meet their specific needs and budgets.

Options Available in the Individual Health Insurance Market

The individual health insurance market offers various plan types, including:

- Health Maintenance Organizations (HMOs): HMOs typically require you to choose a primary care physician (PCP) who acts as your main point of contact for healthcare. You need referrals from your PCP to see specialists or access other services. HMOs often have lower premiums but may have limited networks and out-of-network coverage.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility than HMOs. You can see specialists without referrals, and you have access to a wider network of providers. However, PPOs generally have higher premiums than HMOs and may have higher out-of-pocket costs for out-of-network services.

- Point-of-Service (POS) Plans: POS plans combine elements of HMOs and PPOs. They offer a network of providers, but you can also see out-of-network providers for an additional cost. POS plans often have lower premiums than PPOs but may have higher deductibles and copayments.

- High-Deductible Health Plans (HDHPs): HDHPs have lower premiums but higher deductibles than traditional plans. They are often paired with a Health Savings Account (HSA), which allows you to save pre-tax dollars for medical expenses. HDHPs are suitable for individuals who are generally healthy and expect low healthcare costs.

- Catastrophic Plans: Catastrophic plans are available to individuals under 30 or those with a hardship exemption. They have very high deductibles and are designed to cover only catastrophic medical expenses. Catastrophic plans are generally the most affordable option, but they offer limited coverage for routine medical care.

Enrollment in Individual Health Insurance

Individuals can enroll in individual health insurance through various channels, including:

- State and Federal Marketplaces: These marketplaces, often referred to as “exchanges,” offer a variety of plans from different insurance companies. They provide subsidies and tax credits to eligible individuals to help offset the cost of premiums. The Affordable Care Act (ACA) requires individuals to have health insurance or pay a penalty, but this requirement has been suspended for 2023 and 2024.

- Insurance Companies Directly: You can also purchase individual health insurance directly from insurance companies. This option may offer more personalized service but may not provide the same subsidies or tax credits as the marketplaces.

- Insurance Brokers: Brokers can help you navigate the individual health insurance market and find plans that meet your needs. They often work with multiple insurance companies and can provide expert advice.

Factors to Consider When Choosing a Plan

- Coverage: Consider the types of medical services you need, such as doctor visits, hospital stays, prescription drugs, and mental health care. Choose a plan that covers the services you are most likely to use.

- Premiums: Premiums are the monthly payments you make for your health insurance. Compare premiums from different plans and consider your budget when making your decision.

- Deductibles: The deductible is the amount you pay out of pocket before your insurance starts covering your medical expenses. Lower deductibles mean you’ll pay less upfront, but you’ll likely have higher premiums.

- Copayments and Coinsurance: Copayments are fixed fees you pay for specific services, while coinsurance is a percentage of the cost you pay after meeting your deductible. Consider the copayments and coinsurance for services you are likely to need.

- Network: The network is the group of doctors, hospitals, and other healthcare providers that your insurance plan covers. Choose a plan with a network that includes providers you trust and are convenient for you.

- Prescription Drug Coverage: Consider the formulary, which is the list of prescription drugs covered by your plan. Ensure the plan covers the medications you need.

- Customer Service: Look for an insurance company with a reputation for good customer service. You’ll want to be able to easily reach them if you have questions or need assistance.

Challenges and Complexities of Navigating the Individual Health Insurance Market

Navigating the individual health insurance market can be challenging for several reasons:

- Complexity of Plans: The wide range of plan options and terminology can be confusing for consumers.

- Varying Costs: Premiums, deductibles, and other out-of-pocket costs can vary significantly between plans.

- Open Enrollment Periods: Individuals can only enroll in individual health insurance during specific open enrollment periods, which can make it difficult to change plans or obtain coverage if you have a sudden health event.

- Limited Access to Information: It can be difficult to compare plans and find accurate information about coverage and costs.

Resources and Information for Making Informed Decisions

Several resources are available to help individuals make informed decisions about individual health insurance:

- State and Federal Marketplaces: These marketplaces provide tools and information to help you compare plans and enroll in coverage.

- Insurance Brokers: Brokers can provide expert advice and help you navigate the individual health insurance market.

- Consumer Reports: Consumer Reports offers independent reviews and ratings of health insurance plans.

- Healthcare.gov: The official website for the Affordable Care Act provides information about health insurance options and enrollment.

Uninsured Population

The lack of health insurance coverage in the United States remains a significant issue, impacting millions of Americans and contributing to disparities in access to healthcare. Understanding the scope of the uninsured population, the reasons behind their lack of coverage, and the consequences of being uninsured is crucial for addressing this challenge.

Statistics and Reasons for Lack of Coverage

The number of uninsured Americans fluctuates, but recent data provides insights into the extent of the problem. According to the U.S. Census Bureau’s 2021 American Community Survey, approximately 8.6% of the U.S. population, or about 28.1 million individuals, were uninsured. This represents a slight decrease from the previous year. Several factors contribute to individuals being uninsured, including:

- High Cost of Health Insurance: The cost of health insurance premiums, deductibles, and copayments can be prohibitively expensive for many individuals and families, particularly those with low or moderate incomes.

- Job Loss or Lack of Employer-Sponsored Coverage: Many individuals lose their health insurance coverage when they lose their jobs or work for employers who do not offer health insurance benefits.

- Eligibility Requirements and Navigating the System: Complex eligibility requirements and bureaucratic hurdles associated with public health insurance programs, such as Medicaid, can deter individuals from enrolling or prevent them from successfully navigating the process.

- Immigration Status: Undocumented immigrants are often ineligible for most public health insurance programs, leaving them with limited access to affordable coverage.

Consequences of Being Uninsured

The consequences of being uninsured can be severe, both for individuals and for society as a whole.

- Financial Hardship: Uninsured individuals face significant financial burdens when they need medical care. They may have to pay out-of-pocket for services, which can lead to debt, bankruptcy, and financial instability.

- Delayed or Forgone Care: Without health insurance, individuals may delay or forgo necessary medical care due to the high cost. This can lead to worsening health conditions, chronic diseases, and preventable hospitalizations.

- Health Disparities: The uninsured population is disproportionately composed of minorities, low-income individuals, and those with pre-existing conditions. This lack of coverage contributes to health disparities, as these groups often have poorer health outcomes and limited access to preventive care.

Initiatives to Expand Coverage

Efforts to expand health insurance coverage and reduce the number of uninsured individuals have been ongoing for decades.

- The Affordable Care Act (ACA): The ACA, passed in 2010, has been a major driver of health insurance expansion. It has provided subsidies to help individuals afford coverage, expanded Medicaid eligibility, and created health insurance marketplaces where individuals can compare and purchase plans.

- State-Level Initiatives: Many states have implemented their own programs to expand health insurance coverage, such as expanding Medicaid eligibility beyond federal requirements or creating state-based health insurance marketplaces.

- Community Health Centers: Community health centers provide affordable and accessible healthcare services to underserved populations, including the uninsured. They offer a range of services, including primary care, dental care, and mental health services.

Social and Economic Impact of an Uninsured Population, Is having health insurance worth it

The presence of a large uninsured population has significant social and economic consequences.

- Increased Healthcare Costs: Uninsured individuals are more likely to delay or forgo necessary medical care, which can lead to more expensive emergency room visits and hospitalizations later on. This contributes to rising healthcare costs for everyone.

- Reduced Productivity: The uninsured are more likely to miss work due to illness or injury, leading to reduced productivity and economic losses.

- Strain on Public Health Systems: Uninsured individuals often rely on public hospitals and clinics for their healthcare, placing a strain on these already-overburdened systems.

- Social Inequality: The lack of health insurance contributes to social inequality, as it disproportionately affects low-income individuals and minorities, exacerbating existing health disparities.

Future of Health Insurance

The health insurance landscape is constantly evolving, driven by technological advancements, changing consumer preferences, and a growing emphasis on value-based care. These trends are shaping the future of health insurance, impacting coverage, costs, and the overall healthcare experience.

Impact of Emerging Trends

The convergence of telehealth, value-based care, and personalized medicine is poised to revolutionize the health insurance industry. These trends are interconnected and will likely lead to significant changes in how health insurance is structured, delivered, and consumed.

- Telehealth: The rise of telehealth has made healthcare more accessible and convenient, enabling patients to consult with doctors remotely. Health insurance companies are increasingly incorporating telehealth services into their plans, offering virtual consultations, remote monitoring, and online prescription refills. This trend is expected to continue, with telehealth becoming a standard component of healthcare delivery, potentially leading to lower costs and improved access to care.

- Value-Based Care: Value-based care focuses on delivering high-quality care while managing costs effectively. Health insurance companies are incentivizing providers to deliver better outcomes at lower costs, using measures like pay-for-performance programs and bundled payments. This shift towards value-based care is expected to drive innovation in healthcare delivery, leading to more personalized and proactive care, and potentially lower overall healthcare costs.

- Personalized Medicine: Personalized medicine involves tailoring healthcare treatments to individual patients based on their genetic makeup, lifestyle, and other factors. Health insurance companies are exploring ways to integrate personalized medicine into their plans, offering genetic testing and personalized treatment options. This trend has the potential to improve health outcomes, but it also raises concerns about data privacy and the cost of personalized treatments.

Last Recap: Is Having Health Insurance Worth It

In the end, the decision of whether or not to have health insurance is deeply personal. However, the evidence overwhelmingly suggests that having health insurance is a wise investment in your health and financial well-being. By understanding the various aspects of health insurance and its impact on your life, you can make informed decisions that align with your individual needs and priorities. Remember, prioritizing your health is a crucial step towards a brighter future, and having the right health insurance can be a powerful tool in achieving that goal.

Detailed FAQs

What is the difference between an HMO and a PPO?

An HMO (Health Maintenance Organization) typically has a lower premium but requires you to choose a primary care physician within their network. You need a referral to see specialists. A PPO (Preferred Provider Organization) usually has a higher premium but offers more flexibility in choosing doctors and specialists, often without needing a referral.

Can I get health insurance if I have a pre-existing condition?

Yes, under the Affordable Care Act, insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions. You may have to pay a higher premium, but you are guaranteed coverage.

What is the open enrollment period for health insurance?

The open enrollment period for individual health insurance through the Affordable Care Act Marketplace typically runs from November 1st to January 15th. However, you may be eligible for a special enrollment period if you experience a qualifying life event, such as losing your job or getting married.