What is a deductible for health insurance example – What is a health insurance deductible example? Understanding deductibles is crucial when navigating the world of health insurance. It’s a common question many people ask, and the answer can have a significant impact on your out-of-pocket expenses. In essence, a deductible is the amount you pay for covered healthcare services before your health insurance plan starts paying its share. This means that you’ll need to pay the deductible amount upfront, whether it’s for a doctor’s visit, prescription medication, or a more serious medical procedure.

Imagine a scenario where you have a health insurance plan with a $1,000 deductible. If you need a medical procedure that costs $5,000, you would be responsible for paying the first $1,000. After you’ve met your deductible, your health insurance plan would start covering the remaining costs, based on your plan’s co-pay or co-insurance provisions. Understanding how deductibles work can help you make informed decisions about your health insurance coverage and ensure you’re prepared for the financial implications of healthcare expenses.

What is a Deductible?

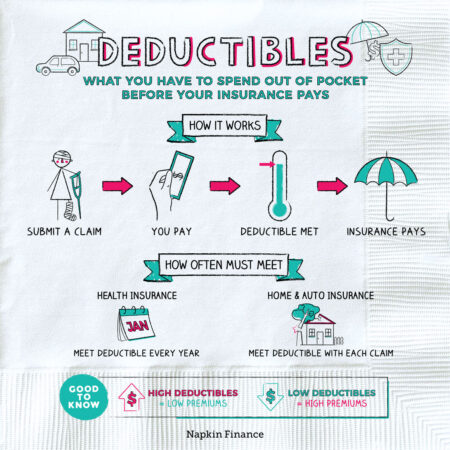

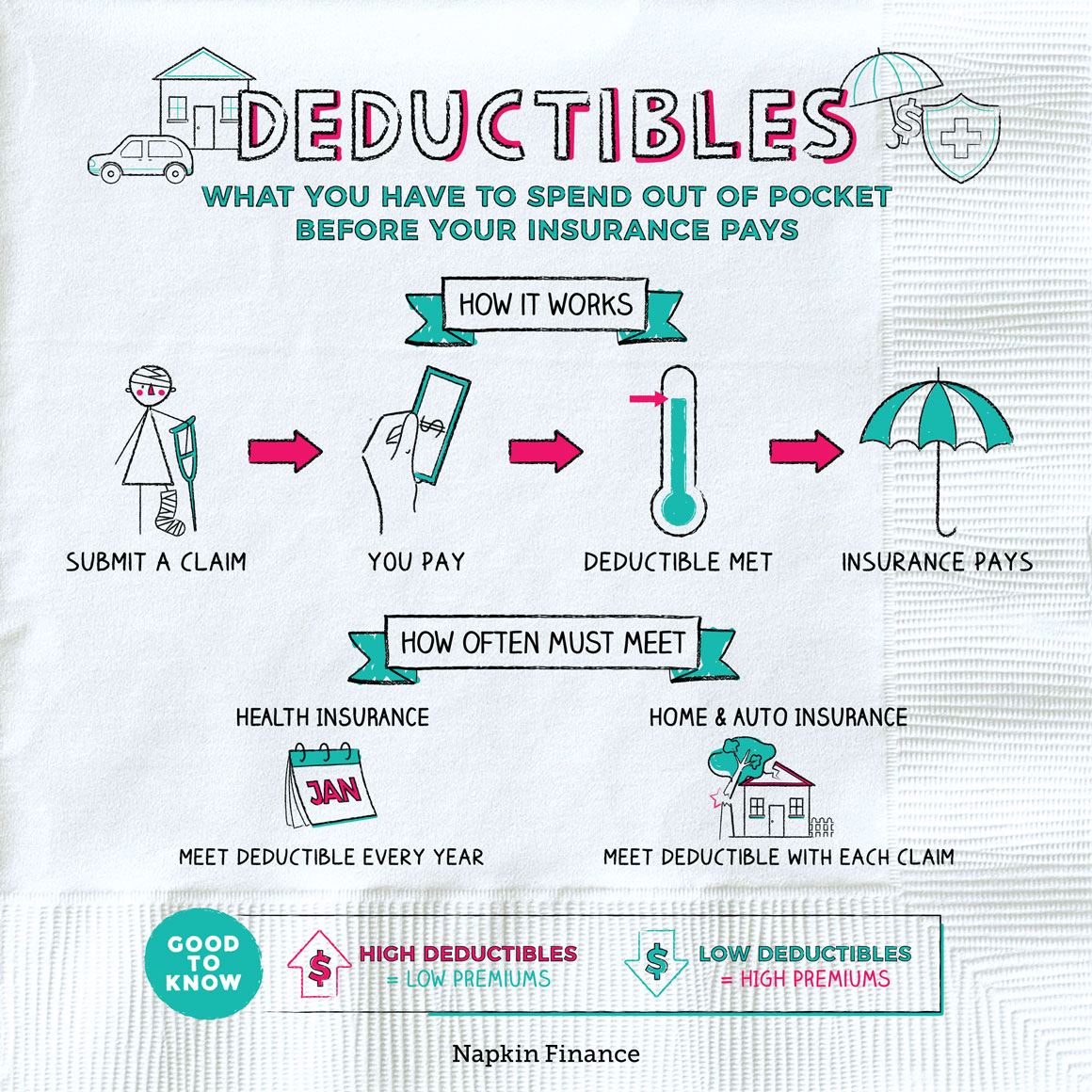

A deductible is a fixed amount of money that you, as an insured individual, are required to pay out-of-pocket before your health insurance plan starts covering your medical expenses. It’s like a threshold you need to cross before your insurance kicks in.

Purpose of a Deductible

Deductibles play a crucial role in managing health insurance costs. They help keep premiums lower for everyone by encouraging insured individuals to be more mindful of their healthcare spending.

Deductibles and Out-of-Pocket Expenses

The amount of your deductible directly impacts your out-of-pocket expenses. A higher deductible generally means lower monthly premiums, but you’ll have to pay more upfront before your insurance covers your medical bills. Conversely, a lower deductible might mean higher premiums but less out-of-pocket expenses when you need healthcare.

Deductible Example Scenario

Imagine you have a health insurance policy with a $2,000 deductible. This means you need to pay the first $2,000 of your healthcare costs before your insurance coverage kicks in.

Scenario

Let’s say you need to undergo a surgical procedure that costs $5,000. Here’s how the deductible would work:

* You pay the deductible: You would first pay the $2,000 deductible out-of-pocket.

* Insurance covers the rest: Your insurance company would then cover the remaining $3,000 of the procedure’s cost.

In this scenario, you would pay $2,000 out-of-pocket, and your insurance would cover the remaining $3,000.

Deductible vs. Co-pay vs. Co-insurance

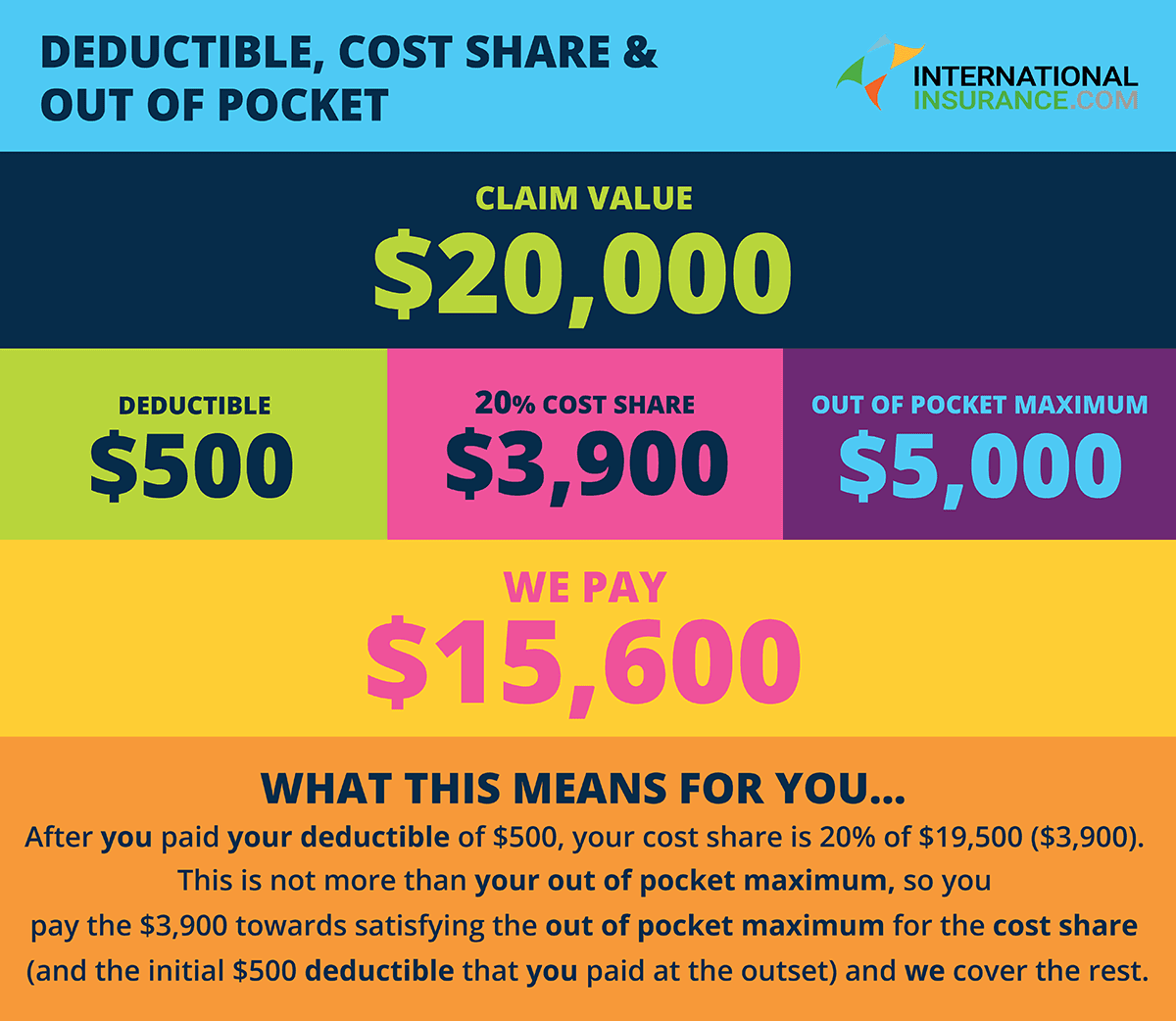

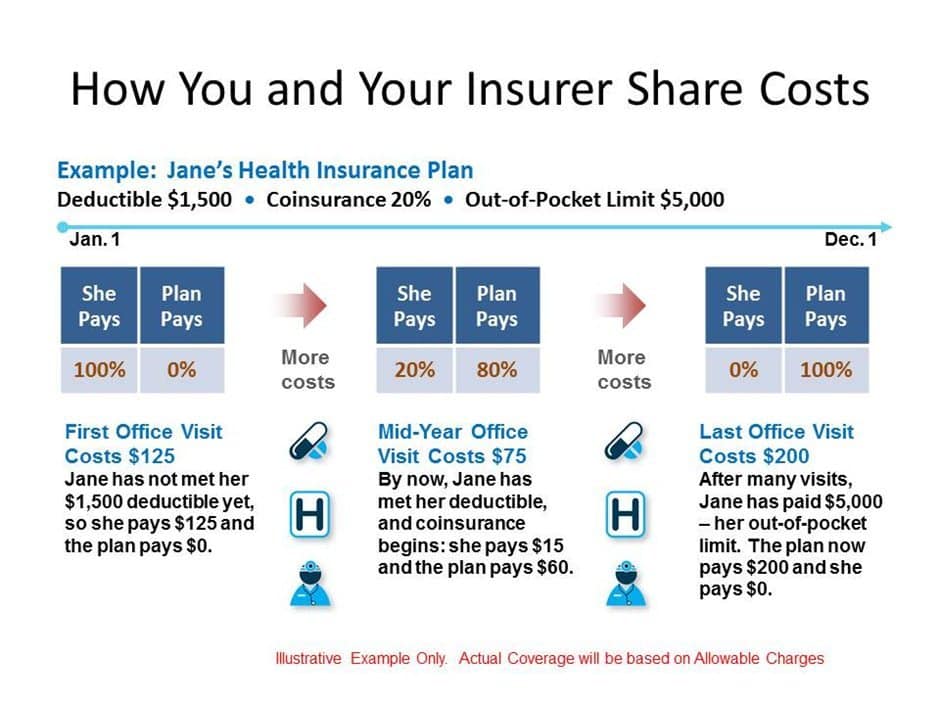

Deductibles, co-pays, and co-insurance are all cost-sharing mechanisms in health insurance plans. They are designed to help spread the cost of healthcare between the insurance company and the insured individual. Understanding the differences between these cost-sharing mechanisms is crucial for making informed decisions about your health insurance plan.

How Each Cost-Sharing Mechanism Works

- Deductible: A deductible is a fixed amount you must pay out-of-pocket for covered healthcare services before your health insurance starts paying. For example, if you have a $1,000 deductible and you incur $2,000 in medical expenses, you would pay the first $1,000 yourself, and your insurance would cover the remaining $1,000.

- Co-pay: A co-pay is a fixed amount you pay for a specific medical service, such as a doctor’s visit or prescription. Co-pays are typically a small, predetermined amount that you pay at the time of service. For example, you might have a $20 co-pay for a doctor’s visit or a $10 co-pay for a prescription.

- Co-insurance: Co-insurance is a percentage of the cost of a covered healthcare service that you pay after you’ve met your deductible. For example, if you have a 20% co-insurance and you incur $1,000 in medical expenses after meeting your deductible, you would pay $200 (20% of $1,000) and your insurance would cover the remaining $800.

Real-World Examples of Cost-Sharing Mechanisms

- Deductible: Imagine you need a surgery that costs $10,000. If you have a $2,000 deductible, you would pay the first $2,000 out-of-pocket, and your insurance would cover the remaining $8,000.

- Co-pay: If you visit your doctor for a routine checkup, you might have a $25 co-pay. This means you would pay $25 at the time of the appointment, and your insurance would cover the rest of the cost.

- Co-insurance: Let’s say you need a hospital stay that costs $5,000 after you’ve met your deductible. If you have a 20% co-insurance, you would pay $1,000 (20% of $5,000), and your insurance would cover the remaining $4,000.

Choosing a Health Plan with a Deductible

When choosing a health plan, the deductible is a crucial factor to consider. It represents the amount you must pay out-of-pocket before your insurance coverage kicks in. Understanding the relationship between deductibles and other plan features is essential for selecting a plan that aligns with your individual needs and budget.

Deductible Amount and Monthly Premium Costs

The deductible amount and your monthly premium are inversely related. Generally, a higher deductible means lower monthly premiums, and vice versa. This is because insurance companies assume less risk when you agree to pay more out-of-pocket. However, it’s important to consider your individual healthcare needs and financial situation.

- If you anticipate needing frequent medical care, a lower deductible might be more beneficial, even with higher monthly premiums. This can help you avoid significant out-of-pocket costs.

- On the other hand, if you are generally healthy and only expect occasional healthcare visits, a higher deductible with lower premiums might be more cost-effective.

Selecting a Deductible that Fits Your Needs

When choosing a deductible, consider the following factors:

- Your health history: If you have pre-existing conditions or anticipate needing frequent medical care, a lower deductible might be more prudent.

- Your budget: Assess your ability to cover the deductible if you need medical services. Consider the potential financial impact of a high deductible.

- Your risk tolerance: Are you comfortable with the possibility of paying a larger amount upfront for medical services? A higher deductible might be suitable if you are risk-tolerant.

- Your overall healthcare costs: Consider your average annual healthcare expenses. If you expect high healthcare costs, a lower deductible might be more advantageous.

It’s important to note that the deductible is only one factor to consider when choosing a health plan. You should also consider other factors like co-pays, co-insurance, and out-of-pocket maximums.

Deductibles and Health Savings Accounts (HSAs): What Is A Deductible For Health Insurance Example

Health Savings Accounts (HSAs) and deductibles are two important concepts in health insurance that are closely intertwined. Understanding their relationship can help you make informed decisions about your health insurance coverage and financial planning.

HSA and Deductible Connection, What is a deductible for health insurance example

HSAs are tax-advantaged savings accounts specifically designed for individuals enrolled in high-deductible health plans (HDHPs). HDHPs generally have higher deductibles than traditional health plans, meaning you pay more out-of-pocket for healthcare expenses before your insurance coverage kicks in. HSAs offer a way to save money pre-tax for these out-of-pocket costs, including your deductible.

Using HSAs to Offset Deductible Costs

Here’s how HSAs can help you offset deductible costs:

* Pre-tax contributions: You can contribute to your HSA with pre-tax dollars, meaning you save on taxes. This reduces your taxable income, potentially leading to tax savings.

* Tax-free withdrawals for qualified medical expenses: You can withdraw funds from your HSA tax-free to pay for qualified medical expenses, including your deductible.

* Potential for growth: Money in your HSA grows tax-free, allowing your savings to accumulate over time.

Maximizing HSA Contributions and Utilization

To maximize the benefits of an HSA, consider these strategies:

* Contribute the maximum amount: The annual contribution limit for HSAs is set by the IRS and changes each year. You can find the current limit on the IRS website. Contributing the maximum amount each year can help you build a substantial fund to cover future healthcare expenses.

* Use your HSA for all eligible medical expenses: Don’t forget to use your HSA for expenses like prescription drugs, doctor visits, and even over-the-counter medications if they are prescribed by a doctor.

* Plan for future medical expenses: Consider using your HSA to save for potential future medical expenses, such as vision or dental care.

* Keep track of your HSA contributions and withdrawals: Keep accurate records of your contributions and withdrawals to ensure you are maximizing the tax benefits and using your funds effectively.

Closing Notes

Navigating the world of health insurance can be complex, but understanding deductibles is a key step in taking control of your healthcare costs. By understanding how deductibles work, you can choose a plan that aligns with your needs and budget. Remember to factor in your expected healthcare utilization, consider the relationship between deductibles and monthly premiums, and explore options like Health Savings Accounts (HSAs) to potentially offset deductible costs. With a clear understanding of deductibles and other cost-sharing mechanisms, you can make informed decisions about your health insurance coverage and ensure you’re prepared for the financial aspects of healthcare.

FAQ Explained

What happens if I don’t meet my deductible?

If you don’t meet your deductible for the year, you’ll be responsible for paying the full cost of any covered healthcare services.

Can I use my HSA to pay my deductible?

Yes, you can use funds from a Health Savings Account (HSA) to pay your deductible, as well as other eligible healthcare expenses.

How does a deductible affect my premium?

Generally, higher deductibles are associated with lower monthly premiums, while lower deductibles usually come with higher premiums.

What are some other things I should consider when choosing a health insurance plan?

Besides the deductible, you should also consider the co-pays, co-insurance, network coverage, and out-of-pocket maximum.