What is the definition of deductible in health insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Health insurance deductibles are a fundamental aspect of coverage, representing the amount you must pay out-of-pocket before your insurance plan begins to cover your healthcare expenses. Think of it as a threshold you need to cross before your insurance kicks in. Imagine you have a deductible of $1,000 and you need a medical procedure costing $2,000. You’ll be responsible for the first $1,000, and your insurance will cover the remaining $1,000.

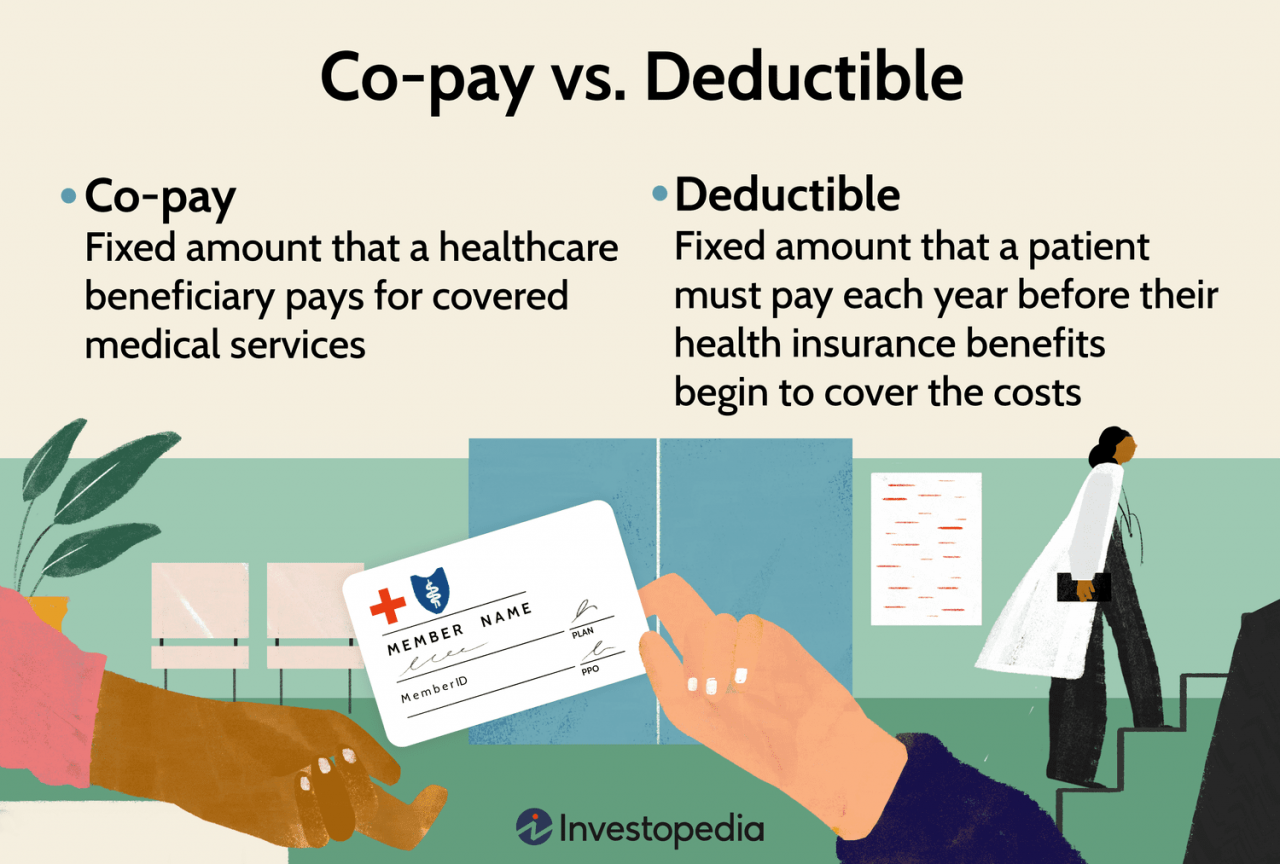

Deductibles play a significant role in how you manage your healthcare costs. They are often coupled with copayments or coinsurance, which are additional amounts you pay for specific services. Understanding the intricacies of deductibles, their impact on your finances, and the different types available is crucial for making informed decisions about your health insurance plan.

Introduction to Deductibles

In the realm of health insurance, understanding the concept of a deductible is crucial. It plays a vital role in how you share the cost of your healthcare with your insurance company. Essentially, a deductible is the amount you pay out-of-pocket before your insurance coverage kicks in.

Definition of a Deductible, What is the definition of deductible in health insurance

A deductible is a fixed amount that you, as the insured individual, are responsible for paying before your health insurance plan starts covering your medical expenses. It acts as a threshold that needs to be crossed before your insurance company begins to share the costs of your healthcare.

Example of a Deductible

Imagine you have a health insurance plan with a $1,000 deductible. If you incur $500 in medical expenses, you would be responsible for paying the entire $500 out-of-pocket. However, if your medical expenses reach $1,500, you would pay the first $1,000 (your deductible) and your insurance company would cover the remaining $500.

How Deductibles Work

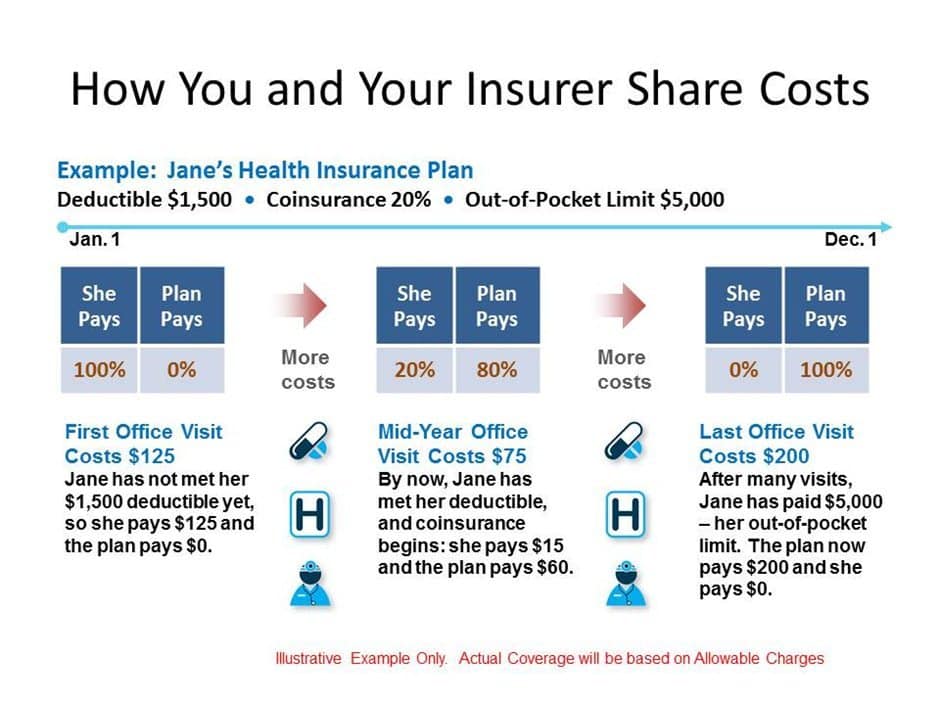

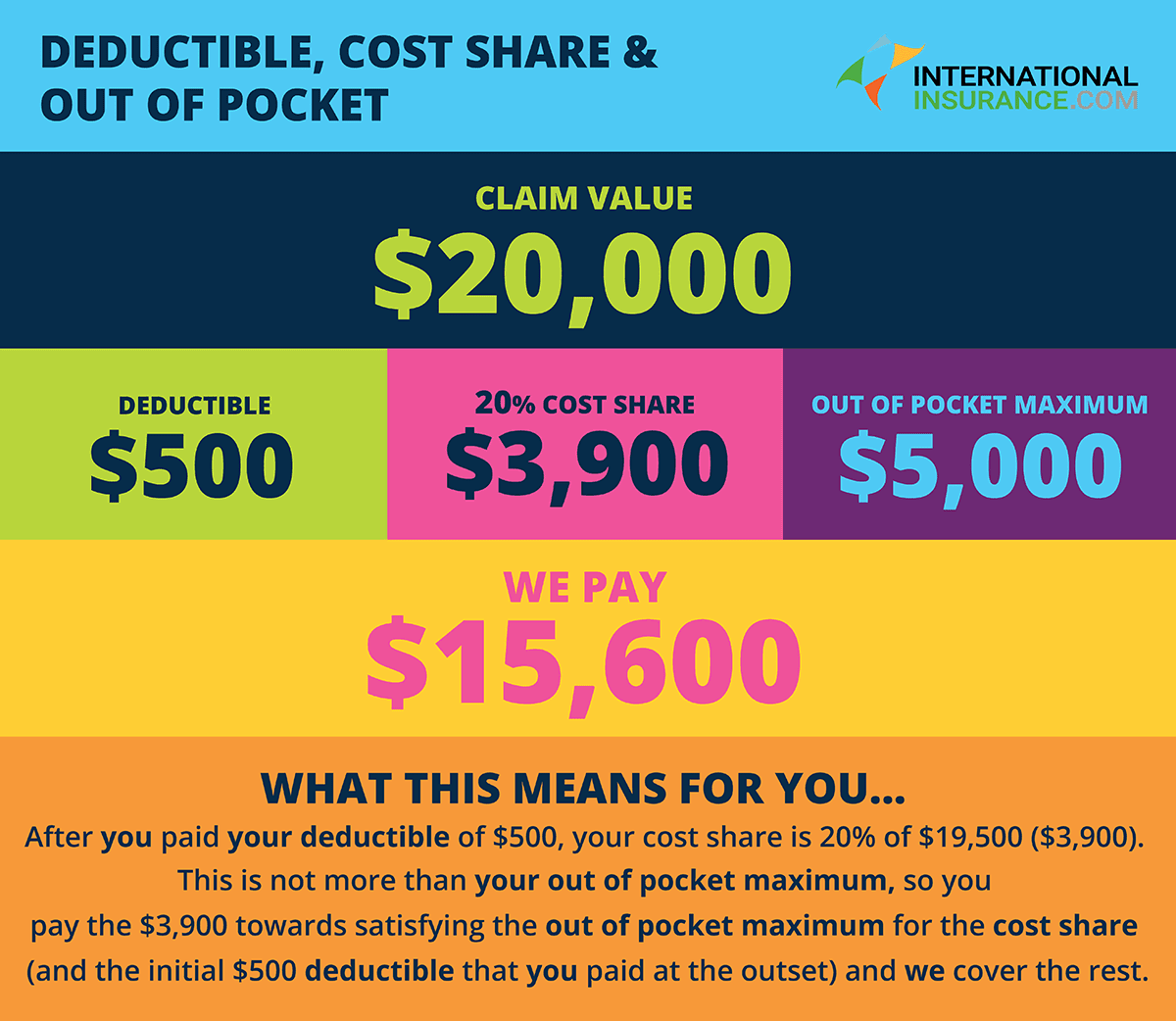

Deductibles are applied to healthcare expenses after you’ve met your deductible for the year. This means that you’ll be responsible for paying the first portion of your healthcare costs up to the deductible amount before your insurance plan begins to cover the remaining costs.

Deductible Calculation and Application

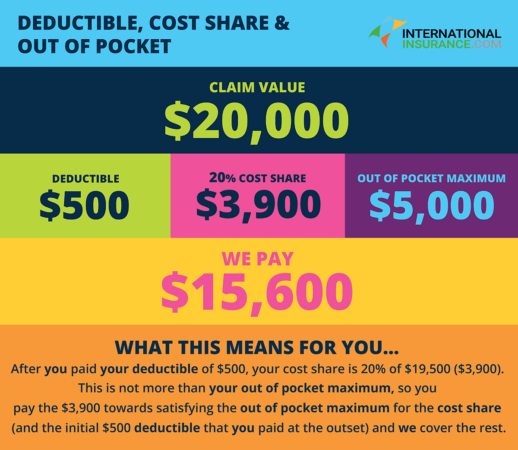

Deductibles are typically calculated on an annual basis, and they can vary depending on your insurance plan. You will need to pay out-of-pocket for all healthcare expenses until you reach your deductible amount. Once you reach your deductible, your insurance plan will start covering the remaining costs, subject to any copayments or coinsurance.

For example, let’s say your deductible is $1,000, and you incur a $2,000 medical bill. You will be responsible for paying the first $1,000 of the bill, and your insurance will cover the remaining $1,000.

Relationship with Copayments and Coinsurance

Deductibles are often combined with copayments and coinsurance.

* Copayments are fixed amounts you pay for specific healthcare services, such as doctor’s visits or prescriptions.

* Coinsurance is a percentage of the cost of healthcare services that you pay after you’ve met your deductible.

For example, let’s say your insurance plan has a $1,000 deductible, a $20 copayment for doctor’s visits, and a 20% coinsurance for hospital stays. If you have a $500 doctor’s visit, you will pay $20 (copayment) and your insurance will cover the remaining $480. If you have a $5,000 hospital stay after meeting your deductible, you will pay $1,000 (20% coinsurance) and your insurance will cover the remaining $4,000.

Individual and Family Deductibles

Deductibles can be applied individually or to a family.

* Individual deductibles apply to each individual covered under the insurance plan.

* Family deductibles apply to the entire family, meaning that once the total amount of medical expenses for the family reaches the deductible, the insurance will begin covering the remaining costs for all family members.

For example, if a family has a $5,000 family deductible and the family incurs $4,000 in medical expenses for one member and $1,500 for another, the family will have met the deductible, and the insurance will cover the remaining costs for all family members.

The Impact of Deductibles

Deductibles are an integral part of health insurance plans, and understanding their impact is crucial for policyholders. They directly affect the financial responsibility of individuals when seeking healthcare services.

The Financial Implications of Deductibles

Deductibles significantly impact the out-of-pocket expenses individuals face when accessing healthcare. Policyholders are responsible for paying the deductible amount before their insurance coverage kicks in. This means that individuals with high deductibles may face substantial upfront costs for medical services. For instance, if a policyholder has a $5,000 deductible and incurs $7,000 in medical expenses, they would be responsible for paying the first $5,000 before the insurance coverage takes effect.

Types of Deductibles

Deductibles in health insurance can be structured in various ways, affecting how you pay for healthcare services. Understanding the different types of deductibles is crucial for making informed decisions about your health insurance plan.

Annual Deductibles

An annual deductible is the most common type. It’s the amount you need to pay out-of-pocket for covered healthcare services before your health insurance starts paying its share. This deductible is calculated on a yearly basis and resets at the start of each new policy year.

For example, if you have an annual deductible of $1,000, you’ll need to pay the first $1,000 of your healthcare expenses before your insurance kicks in.

Per-Service Deductibles

Unlike annual deductibles, per-service deductibles apply to each individual healthcare service you receive. This means you’ll have to pay a separate deductible for each doctor’s visit, prescription, or hospital stay.

For instance, you might have a $50 deductible for each doctor’s visit and a $200 deductible for each hospital stay.

In-Network/Out-of-Network Deductibles

Many health insurance plans have separate deductibles for in-network and out-of-network providers. In-network providers are those who have a contract with your insurance company, while out-of-network providers do not.

You might have a $1,000 deductible for in-network care and a $2,000 deductible for out-of-network care. This means you’ll need to pay more out-of-pocket if you choose to see an out-of-network provider.

Choosing the Right Deductible: What Is The Definition Of Deductible In Health Insurance

Selecting the right deductible for your health insurance plan is a crucial decision that can significantly impact your out-of-pocket costs. The deductible, as you now know, is the amount you pay before your insurance coverage kicks in. It’s a trade-off: a higher deductible generally means lower monthly premiums, but you’ll have to pay more out-of-pocket before your insurance covers costs. Conversely, a lower deductible means higher premiums but lower out-of-pocket expenses.

Factors to Consider

To determine the best deductible for you, consider these factors:

- Health History: If you have a history of frequent or expensive medical needs, a lower deductible might be beneficial. This way, you’ll have less to pay out-of-pocket for your healthcare.

- Expected Healthcare Costs: If you anticipate needing significant medical care in the coming year, a lower deductible may be more financially prudent. However, if you are generally healthy and expect minimal medical expenses, a higher deductible could save you money on premiums.

- Risk Tolerance: Consider your financial comfort level. Are you comfortable with the possibility of paying a larger sum upfront if you need medical care? If so, a higher deductible might be a good option. However, if you prefer lower out-of-pocket expenses, a lower deductible might be more suitable.

- Financial Situation: Evaluate your overall financial situation. If you have a stable income and emergency savings, a higher deductible may be manageable. If you are on a tighter budget, a lower deductible might provide greater financial security.

Decision-Making Process

A simple flowchart can help you visualize the decision-making process:

- Assess your health history and expected healthcare needs.

- Evaluate your financial situation and risk tolerance.

- Compare premiums for different deductible options.

- Choose the deductible that best aligns with your needs and financial circumstances.

It’s also helpful to consult with a financial advisor or insurance broker to get personalized guidance.

Final Conclusion

In conclusion, deductibles are a key component of health insurance that influences both your out-of-pocket costs and your healthcare utilization. Choosing the right deductible involves careful consideration of your health history, expected healthcare expenses, and risk tolerance. By understanding how deductibles work and their various types, you can make informed decisions to optimize your health insurance coverage and manage your healthcare finances effectively.

FAQ Summary

How do deductibles affect my healthcare utilization?

Higher deductibles may discourage individuals from seeking routine or preventive care due to the upfront cost. However, some people may be more proactive about managing their health to avoid reaching their deductible threshold.

What are the benefits of a high deductible plan?

High deductible plans often have lower monthly premiums, making them more affordable. They can also be paired with a Health Savings Account (HSA), allowing you to save pre-tax money for healthcare expenses.

What are the disadvantages of a low deductible plan?

Low deductible plans typically have higher monthly premiums. While they offer more immediate coverage, they may not be as cost-effective if you rarely use healthcare services.

Can I use my HSA to pay for my deductible?

Yes, you can use your HSA funds to pay for your deductible, as well as other eligible healthcare expenses.