- Understanding ITINs and Health Insurance Eligibility

- Health Insurance Options for ITIN Holders: Can Someone With Itin Get Health Insurance

- Finding Affordable Health Insurance with an ITIN

- Navigating the Healthcare System with an ITIN

- Financial Considerations for ITIN Holders

- Conclusive Thoughts

- Clarifying Questions

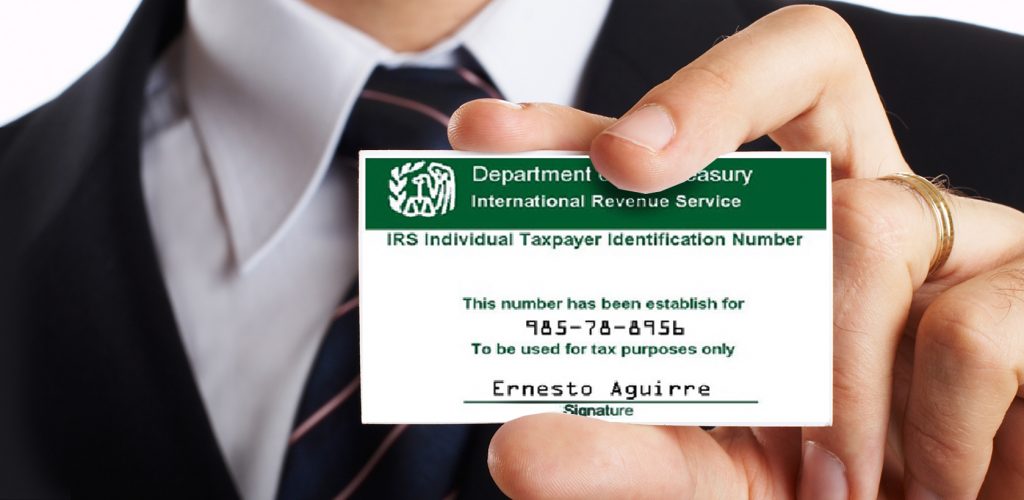

Can someone with ITIN get health insurance? This question often arises for individuals who have an Individual Taxpayer Identification Number (ITIN) instead of a Social Security Number (SSN). ITINs are issued by the Internal Revenue Service (IRS) to non-U.S. citizens and residents who need a taxpayer identification number for tax purposes. While an ITIN doesn’t grant automatic access to all the benefits of an SSN, there are still options for obtaining health insurance.

This article explores the ins and outs of health insurance for ITIN holders, covering topics such as eligibility criteria, available insurance options, enrollment procedures, and navigating the healthcare system. We’ll also delve into the financial considerations and available resources for ITIN holders seeking health insurance coverage.

Understanding ITINs and Health Insurance Eligibility

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS) to individuals who are not eligible for a Social Security Number (SSN). This includes foreign nationals, nonresident aliens, and certain U.S. citizens. Understanding the purpose of an ITIN and its differences from an SSN is crucial for navigating the U.S. healthcare system, particularly when it comes to health insurance.

ITINs and Their Purpose

An ITIN is primarily used for tax purposes. It allows individuals who are not eligible for an SSN to file federal income tax returns and claim any applicable tax benefits. An ITIN does not grant an individual any immigration status or make them eligible for government benefits, such as Social Security or Medicare.

Eligibility Criteria for Obtaining an ITIN

To obtain an ITIN, individuals must meet specific eligibility criteria. Generally, an individual needs to demonstrate a valid tax filing requirement, such as:

- A U.S. tax treaty obligation.

- A need to claim a refund of U.S. taxes.

- A need to file a U.S. tax return to claim certain tax credits or deductions.

Health Insurance Eligibility for ITIN Holders

While ITIN holders can file federal income tax returns, they are generally not eligible for government-sponsored health insurance programs like Medicare or Medicaid. This is because these programs require U.S. citizenship or lawful permanent resident status.

However, ITIN holders can still obtain health insurance through the Affordable Care Act (ACA) marketplace, known as Health Insurance Marketplaces, or through private insurance providers. When applying for health insurance through the ACA marketplace, ITIN holders are required to provide certain documentation, such as:

- A valid ITIN.

- Proof of residency in the U.S.

- Income documentation.

ITIN holders can also purchase private health insurance directly from insurance companies, but they may face higher premiums due to their immigration status.

Health Insurance Options for ITIN Holders: Can Someone With Itin Get Health Insurance

While ITIN holders are not eligible for most government-funded health insurance programs, they can still access private health insurance plans. These plans offer varying levels of coverage and cost, making it crucial to understand the different options available.

Types of Health Insurance for ITIN Holders

ITIN holders have access to various health insurance plans, each with its own benefits and limitations. Here’s a breakdown of the most common options:

- Individual Health Insurance: This type of plan is purchased directly from an insurance company and covers the individual. It offers flexibility in choosing coverage and plans, but premiums can be higher compared to group plans.

- Short-Term Health Insurance: This temporary plan provides coverage for a limited period, typically a few months or a year. It is a cost-effective option for individuals needing short-term coverage but lacks the comprehensive benefits of long-term plans.

- Employer-Sponsored Health Insurance: If employed by a company that offers health insurance, ITIN holders can enroll in the plan, but it’s subject to the employer’s eligibility criteria. Employer-sponsored plans often offer lower premiums and broader coverage compared to individual plans.

Comparing Health Insurance Options

Each health insurance option has unique advantages and disadvantages:

| Option | Benefits | Limitations |

|---|---|---|

| Individual Health Insurance | Flexibility in plan selection, wider range of coverage options | Higher premiums, limited access to government subsidies |

| Short-Term Health Insurance | Lower premiums, temporary coverage for specific needs | Limited coverage, shorter duration, pre-existing conditions may not be covered |

| Employer-Sponsored Health Insurance | Lower premiums, broader coverage, potential for employer contributions | Subject to employer’s eligibility criteria, limited plan choices |

Understanding Coverage

Each health insurance plan offers different coverage levels, including:

- Hospitalization: Covers expenses related to inpatient hospital stays, including room and board, surgery, and medical care.

- Outpatient Care: Covers expenses for medical services received outside a hospital, such as doctor visits, lab tests, and prescription drugs.

- Preventive Care: Covers routine checkups, screenings, and immunizations to promote health and prevent diseases.

- Mental Health Coverage: Covers expenses related to mental health treatment, including therapy, counseling, and medication.

- Dental and Vision Coverage: May be included as part of the health insurance plan or offered as separate policies.

Finding Affordable Health Insurance with an ITIN

Securing affordable health insurance can be challenging for anyone, but it can be even more difficult for individuals with ITINs. While access to health insurance is limited, there are still options available, and with careful planning and research, you can find a plan that fits your budget and needs.

Understanding Your Options

ITIN holders have limited access to government-sponsored health insurance programs like Medicaid and Medicare. However, you can still access private health insurance plans through the Affordable Care Act (ACA) marketplace. These plans are offered by private insurance companies and are available to individuals regardless of immigration status.

Tips for Finding Affordable Health Insurance

- Compare Quotes: Start by comparing quotes from different insurance companies. You can use online tools, insurance brokers, or the ACA marketplace to compare plans and prices.

- Explore Marketplace Plans: The ACA marketplace offers a variety of plans with different levels of coverage and cost-sharing. You can use the marketplace website to compare plans based on your income, location, and health needs.

- Consider Short-Term Plans: Short-term health insurance plans offer temporary coverage and can be a more affordable option for individuals who need coverage for a limited time. However, these plans may have limited benefits and may not cover pre-existing conditions.

- Check for Discounts and Financial Assistance: Many insurance companies offer discounts for things like good health or paying your premiums on time. The ACA marketplace also offers financial assistance to help lower the cost of health insurance premiums.

Key Factors to Consider When Selecting Health Insurance

| Factor | Description |

|---|---|

| Coverage Level | Consider the level of coverage you need based on your health needs and budget. Options include bronze, silver, gold, and platinum plans. |

| Deductible | The amount you must pay out-of-pocket before your insurance starts covering your healthcare costs. |

| Co-pay | A fixed amount you pay for certain services, like doctor’s visits or prescriptions. |

| Co-insurance | A percentage of the cost of healthcare services that you pay after meeting your deductible. |

| Network | The list of doctors, hospitals, and other healthcare providers that your insurance plan covers. |

| Premiums | The monthly cost of your health insurance plan. |

Navigating the Healthcare System with an ITIN

Having an ITIN can make accessing healthcare services a bit more complex, but it’s definitely possible. Understanding your rights and responsibilities, and knowing how to navigate the system effectively, can make the process smoother.

Accessing Healthcare Services with an ITIN

While you may not be eligible for all government-funded programs like Medicaid, you can still access healthcare services.

- Private Health Insurance: ITIN holders can purchase private health insurance plans through the Affordable Care Act (ACA) Marketplace or directly from insurance companies.

- Emergency Care: You have the right to receive emergency medical care regardless of your immigration status.

- Out-of-Pocket Payment: You can pay for healthcare services out-of-pocket, but it’s essential to negotiate prices and payment plans with providers.

- Community Health Centers: These centers often offer sliding-scale fees based on income, making healthcare more accessible to individuals with limited financial resources.

Rights and Responsibilities of ITIN Holders in the Healthcare System

As an ITIN holder, you have certain rights and responsibilities within the healthcare system.

- Right to Confidentiality: Your healthcare information is protected under HIPAA, and providers cannot share it with immigration authorities.

- Right to Quality Care: You have the right to receive quality healthcare services, regardless of your immigration status.

- Responsibility to Provide Accurate Information: You are responsible for providing accurate information to your healthcare providers, including your ITIN and any other relevant details.

- Responsibility to Pay for Services: You are responsible for paying for healthcare services, either through insurance or out-of-pocket.

Flowchart: Seeking Healthcare with an ITIN

The following flowchart illustrates the general process of seeking healthcare with an ITIN:

| Step | Action |

|---|---|

| 1 | Identify your healthcare needs. |

| 2 | Explore options for accessing healthcare services, such as private health insurance, community health centers, or out-of-pocket payment. |

| 3 | Contact healthcare providers and inquire about their acceptance of ITINs for payment. |

| 4 | Provide your ITIN and other relevant information to the provider. |

| 5 | Receive healthcare services and pay for them accordingly. |

Financial Considerations for ITIN Holders

Obtaining health insurance with an ITIN can come with financial implications. It’s crucial to understand the various costs involved and explore potential financial assistance programs. This information can help you make informed decisions about your health insurance coverage.

Understanding the Costs

The cost of health insurance can vary significantly based on several factors, including your age, location, health status, and the type of plan you choose. Here’s a breakdown of the primary costs associated with health insurance:

- Premiums: These are monthly payments you make to maintain your health insurance coverage. Premiums can vary based on your chosen plan, age, location, and other factors.

- Deductibles: This is the amount you pay out-of-pocket before your insurance starts covering your healthcare costs. Deductibles can range from a few hundred dollars to several thousand dollars depending on your plan.

- Co-pays: These are fixed amounts you pay for specific services, like doctor visits or prescription drugs, after you’ve met your deductible. Co-pays can vary based on the service and your plan.

- Co-insurance: This is a percentage of the cost of healthcare services that you pay after you’ve met your deductible. For example, you might pay 20% of the cost of a hospital stay after your deductible is met.

- Out-of-pocket maximum: This is the maximum amount you’ll have to pay for healthcare costs in a year. Once you reach this limit, your insurance will cover 100% of your remaining healthcare expenses for the rest of the year.

Financial Assistance Programs

Several financial assistance programs are available to help ITIN holders afford health insurance. Here are some key programs:

- The Affordable Care Act (ACA) Marketplace: The ACA Marketplace offers subsidies and tax credits to individuals and families who meet certain income requirements. These subsidies can significantly reduce the cost of health insurance premiums. You can apply for these subsidies through the Marketplace website or by contacting a certified enrollment assister.

- Medicaid: Medicaid is a government-funded health insurance program for low-income individuals and families. Eligibility for Medicaid varies by state, but generally, you must meet certain income and residency requirements. You can apply for Medicaid through your state’s social services agency or online.

- State-Specific Programs: Some states offer additional financial assistance programs specifically for undocumented immigrants. These programs might provide subsidies for health insurance premiums or offer other forms of financial support for healthcare expenses. It’s essential to check with your state’s social services agency or health insurance department to learn about available programs.

Factors Affecting Costs, Can someone with itin get health insurance

Several factors can influence the cost of health insurance for ITIN holders:

- Age: Generally, older individuals tend to have higher health insurance premiums due to increased healthcare needs.

- Location: The cost of health insurance can vary significantly based on your geographic location. Areas with a higher cost of living often have higher premiums.

- Health Status: Individuals with pre-existing medical conditions might face higher premiums or may be denied coverage altogether. The ACA, however, prohibits insurance companies from denying coverage based on pre-existing conditions.

- Plan Choice: The type of health insurance plan you choose will significantly impact your premiums, deductibles, and other costs. For example, plans with lower premiums might have higher deductibles, and vice versa. It’s crucial to carefully consider your needs and budget when selecting a plan.

Conclusive Thoughts

Navigating the healthcare system with an ITIN can be a complex journey, but it’s not impossible. By understanding your options, exploring available resources, and seeking guidance from healthcare professionals, you can secure the health coverage you need. Remember, access to affordable healthcare is crucial for everyone, regardless of their immigration status. This guide aims to empower ITIN holders to make informed decisions about their health insurance and navigate the healthcare system with confidence.

Clarifying Questions

What is the difference between an ITIN and an SSN?

An ITIN is issued by the IRS to individuals who are not eligible for an SSN, while an SSN is issued by the Social Security Administration to U.S. citizens and permanent residents. ITINs are primarily used for tax purposes, while SSNs are used for a wider range of purposes, including accessing government benefits and services.

Can I get health insurance through the Affordable Care Act (ACA) Marketplace with an ITIN?

While you can’t directly enroll in an ACA Marketplace plan with an ITIN, you might be eligible for coverage through other avenues, such as state-based marketplaces or individual health insurance plans.

What if I’m a non-citizen living in the U.S. with an ITIN and I’m pregnant?

Pregnancy is a significant health event, and there are resources available for pregnant individuals, including those with ITINs. You can explore options like Medicaid, which provides health insurance for low-income individuals and families, including pregnant women. You can also look into other state-specific programs that offer prenatal care and support.

Can I use an ITIN to access Medicare?

Medicare is a federal health insurance program primarily for individuals aged 65 and older, as well as certain individuals with disabilities. Generally, Medicare requires an SSN for eligibility. However, some individuals with ITINs may qualify for Medicare under specific circumstances, such as being a lawful permanent resident who has resided in the U.S. for at least five years.