Do I need health insurance to travel to Europe? This is a question that many travelers ask themselves, and the answer isn’t always straightforward. While European healthcare systems are generally robust, they can differ significantly from country to country. Additionally, non-EU citizens may not have access to the same level of care as residents. Travel insurance can provide peace of mind and financial protection in case of unexpected medical emergencies or unforeseen circumstances.

This article will delve into the intricacies of European healthcare systems, explore the benefits of travel insurance, and provide a comprehensive guide to help you make an informed decision about whether or not you need health insurance for your European adventure.

Understanding European Healthcare Systems

Europe boasts a diverse range of healthcare systems, each with its own unique characteristics and approaches. While some systems are primarily funded through taxes, others rely on a combination of public and private insurance. Understanding these differences is crucial for travelers to navigate healthcare access and costs effectively.

National Healthcare Systems

European countries have implemented various healthcare models, each with its own structure and funding mechanisms. Some countries, such as the UK, have a universal healthcare system funded through taxes, providing free access to essential services. Others, like Germany, operate a social insurance model where contributions are made by both employers and employees to fund healthcare services. In contrast, countries like France have a mixed system that combines public and private insurance options.

- Universal Healthcare Systems: Countries like the UK, Ireland, and Denmark operate universal healthcare systems funded through taxes. These systems provide comprehensive coverage for essential medical services, including primary care, hospitalization, and emergency care, regardless of income or employment status.

- Social Insurance Systems: Countries like Germany, Austria, and the Netherlands have social insurance systems where both employers and employees contribute to a fund that finances healthcare services. Individuals typically choose a health insurance provider from a selection of non-profit options. This model often provides comprehensive coverage for a wide range of medical services.

- Mixed Systems: Countries like France, Spain, and Italy have mixed systems that combine elements of universal and social insurance models. They often provide a basic level of healthcare coverage through a public system, while individuals can also purchase private insurance for additional benefits or faster access to care.

Commonalities and Variations in Coverage, Do i need health insurance to travel to europe

While European healthcare systems differ in their funding mechanisms, they generally share some commonalities in coverage. Most systems offer essential medical services, including primary care, hospitalization, and emergency care. However, variations exist in the specific services covered and the level of access provided.

- Essential Medical Services: All European healthcare systems provide coverage for essential medical services such as primary care, hospitalization, and emergency care. This typically includes doctor visits, diagnostic tests, and basic medications.

- Specialty Care: Access to specialty care, such as consultations with specialists or advanced treatments, may vary depending on the specific system. Some systems may require referrals from primary care physicians, while others allow direct access to specialists.

- Dental and Vision Care: Coverage for dental and vision care can vary significantly. Some systems offer limited or no coverage for these services, while others provide more comprehensive coverage.

- Prescription Medications: The cost of prescription medications can vary depending on the system and the specific medication. Some systems offer subsidized or free medication for certain conditions, while others require individuals to pay a portion of the cost.

Medical Emergencies

Travelers should be aware of the common medical emergencies that might require immediate healthcare access in Europe. These emergencies can include:

- Heart Attack: A sudden blockage of blood flow to the heart muscle, requiring immediate medical attention.

- Stroke: A sudden interruption of blood flow to the brain, leading to brain damage.

- Severe Allergic Reactions: Anaphylaxis, a life-threatening allergic reaction, can cause breathing difficulties and require immediate treatment.

- Severe Infections: Bacterial or viral infections, such as sepsis, can become life-threatening if left untreated.

- Accidents: Traffic accidents, falls, and other injuries can lead to serious medical emergencies.

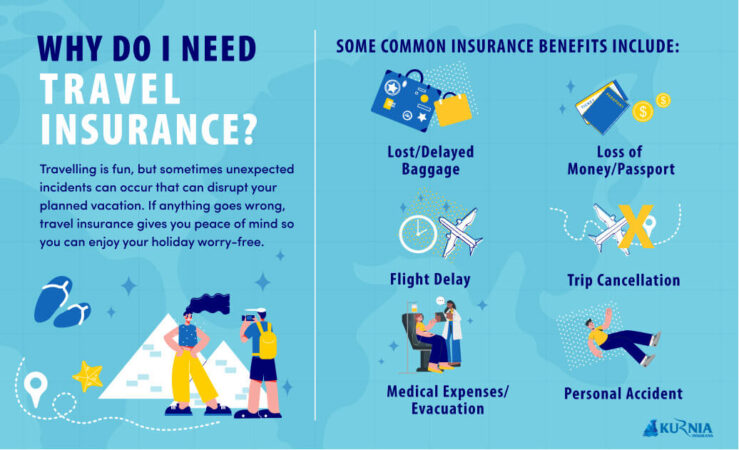

Travel Insurance

While European healthcare systems are generally efficient and affordable for residents, travelers from outside the EU might find themselves facing unexpected medical costs. This is where travel insurance comes into play, offering crucial financial protection during your trip.

Types of Travel Insurance

Travel insurance policies can be tailored to your specific needs and budget. Understanding the different types available can help you choose the right coverage for your trip.

- Single Trip Insurance: Ideal for short-term vacations, this type provides coverage for a specific trip duration.

- Annual Multi-Trip Insurance: This option offers comprehensive coverage for multiple trips within a year, making it suitable for frequent travelers.

- Backpacker Insurance: Specifically designed for adventurous travelers, this type often includes additional coverage for activities like hiking, skiing, and diving.

- Family Travel Insurance: Tailored for families, this policy typically includes coverage for children and offers family-specific benefits like lost luggage reimbursement.

Coverage Offered by Travel Insurance

Travel insurance policies can provide a wide range of coverage, including:

- Medical Expenses: This covers costs related to medical treatment, hospitalization, and emergency medical evacuation.

- Emergency Medical Evacuation: This covers the cost of transporting you back home in case of a serious medical emergency.

- Lost or Stolen Luggage: This provides compensation for lost or stolen belongings during your trip.

- Trip Cancellation or Interruption: This covers expenses incurred if you have to cancel or interrupt your trip due to unforeseen circumstances, such as illness or natural disasters.

- Personal Liability: This protects you from legal expenses if you are involved in an accident that causes damage or injury to others.

Benefits of Purchasing Travel Insurance

Travel insurance offers numerous benefits, particularly for travelers from outside the EU:

- Financial Protection: It provides financial security in case of unexpected medical expenses or other travel-related emergencies.

- Peace of Mind: Knowing you have insurance coverage can reduce stress and allow you to focus on enjoying your trip.

- Access to Medical Care: In some cases, your insurance provider can help you access medical care, even in remote areas.

- Legal Assistance: Some policies include legal assistance, which can be invaluable in case of legal issues while traveling.

Travel Insurance vs. Existing Health Insurance

While your existing health insurance might offer some coverage abroad, it’s crucial to understand the limitations:

- Limited Coverage: Most health insurance plans offer limited coverage for medical expenses incurred outside your home country.

- Exclusion of Certain Expenses: Some policies might exclude specific expenses like emergency medical evacuation or lost luggage.

- Complex Claims Processes: Filing claims with your existing health insurance provider while abroad can be time-consuming and complicated.

“Purchasing travel insurance can provide comprehensive coverage and simplify the claims process, offering valuable peace of mind during your European adventure.”

EU Regulations and Reciprocal Healthcare: Do I Need Health Insurance To Travel To Europe

The European Union (EU) has established a system of reciprocal healthcare, allowing citizens of member states to access necessary medical treatment while traveling within the EU. This system is based on the principle of solidarity, ensuring that citizens have access to healthcare regardless of their location within the EU.

European Health Insurance Card (EHIC)

The European Health Insurance Card (EHIC) is a free card issued to citizens of EU member states, as well as citizens of Iceland, Liechtenstein, Norway, and Switzerland. The EHIC is a proof of entitlement to state-provided healthcare in the country of residence. It allows citizens to access necessary medical treatment during temporary stays in other participating countries.

The EHIC does not replace travel insurance. It is a supplementary card that helps cover the costs of essential healthcare services, such as emergency treatment, during a temporary stay. It does not cover all healthcare costs, and it is essential to have travel insurance to cover other expenses, such as repatriation, medical evacuation, and lost luggage.

EHIC Limitations and Applicability to Non-EU Citizens

The EHIC is only valid for citizens of participating countries and is not applicable to non-EU citizens. Non-EU citizens must have private travel insurance that covers medical expenses. The EHIC is also limited in its coverage. It does not cover:

* Non-essential healthcare services: The EHIC covers only necessary medical treatment, such as emergency treatment, and does not cover non-essential services, such as cosmetic surgery or routine checkups.

* Private healthcare facilities: The EHIC is valid for state-provided healthcare services only and does not cover private healthcare facilities.

* Long-term stays: The EHIC is designed for temporary stays and is not valid for long-term stays, such as those exceeding three months.

* All medical costs: The EHIC covers a portion of medical costs, and patients may be required to pay a portion of the costs upfront, which can be reimbursed later.

Accessing Healthcare Under the EHIC

| Requirement | Procedure |

|---|---|

| EU Citizenship | Hold a valid EHIC card. |

| Temporary Stay | The stay should be temporary, typically less than three months. |

| Necessary Medical Treatment | The medical treatment should be necessary and not elective. |

| State-provided Healthcare | The EHIC is valid for state-provided healthcare facilities only. |

| Payment of Co-payments | Patients may be required to pay a portion of the costs upfront. |

Specific Situations and Recommendations

While relying on the European healthcare system can be a viable option for many travelers, there are certain situations where travel insurance becomes a crucial safety net. Understanding these scenarios and the benefits of travel insurance can help you make an informed decision about your coverage needs.

Scenarios Where Travel Insurance is Highly Recommended

Travel insurance offers valuable protection beyond basic medical coverage. Here are some specific scenarios where it’s highly recommended:

- Pre-existing Medical Conditions: If you have a pre-existing medical condition, travel insurance is essential. It can cover medical expenses related to your condition while traveling, ensuring you receive the necessary treatment without financial burden.

- High-Risk Activities: Engaging in activities like skiing, scuba diving, or extreme sports carries inherent risks. Travel insurance can provide coverage for medical expenses, emergency evacuation, and even cancellation costs in case of an accident or injury.

- Emergency Medical Evacuation: In the event of a serious medical emergency, travel insurance can cover the cost of medical evacuation back to your home country, ensuring you receive the best possible care.

- Lost or Stolen Belongings: Travel insurance can help reimburse you for lost or stolen luggage, personal belongings, and even travel documents, providing peace of mind in case of unexpected incidents.

- Trip Cancellation or Interruption: If you need to cancel or interrupt your trip due to unforeseen circumstances, travel insurance can help recover some of your non-refundable expenses, such as flights and accommodations.

Decision-Making Flowchart for Travel Insurance

The decision of whether to purchase travel insurance or rely on existing coverage involves considering several factors. Here’s a flowchart illustrating the process:

[Flowchart Illustration: Start with “Do you have any pre-existing medical conditions?” If yes, proceed to “Do you plan to engage in high-risk activities?” If yes, proceed to “Purchase travel insurance.” If no, proceed to “Do you have sufficient existing coverage?” If yes, proceed to “Consider relying on existing coverage.” If no, proceed to “Purchase travel insurance.” If you answered “no” to the first question, proceed to “Do you plan to engage in high-risk activities?” If yes, proceed to “Purchase travel insurance.” If no, proceed to “Consider relying on existing coverage.” End with “Evaluate your risk tolerance and budget.” ]

Steps Involved in Obtaining Travel Insurance

Obtaining travel insurance is a straightforward process. Here are the steps involved:

- Determine Your Coverage Needs: Identify the specific risks and situations you want to be covered for, such as medical expenses, emergency evacuation, lost luggage, or trip cancellation.

- Compare Insurance Plans: Research different insurance providers and compare their coverage options, premiums, and terms and conditions.

- Choose a Plan: Select a plan that best meets your needs and budget, ensuring it covers the risks you’re concerned about.

- Provide Personal Information: Fill out the application form with your personal details, travel dates, and destination.

- Pay the Premium: Make the payment for the insurance premium, which can be done online, by phone, or through a travel agent.

- Receive Confirmation: You’ll receive a confirmation email or document with your policy details, including coverage information and contact details.

Financial Implications and Cost Comparisons

The financial implications of traveling to Europe without adequate health insurance can be significant. While European healthcare systems are generally affordable for residents, the costs for non-residents can be substantial, especially for emergency treatment or long-term care.

Cost Comparison Between Travel Insurance and Medical Expenses

Travel insurance offers financial protection against unexpected medical expenses during your trip. The cost of travel insurance varies depending on factors like your age, destination, length of stay, and coverage level. However, it can be a valuable investment, especially considering the potential costs of medical treatment in Europe.

For instance, a basic travel insurance policy for a 10-day trip to Europe might cost around $50, while a comprehensive policy with higher coverage could cost $150 or more.

Without travel insurance, you could face substantial medical expenses, particularly if you require emergency treatment or hospitalization.

Examples of Medical Procedures and Costs in European Countries

Here are some examples of medical procedures and their estimated costs in various European countries:

- Appendicitis surgery: €3,000 – €5,000 in Germany, €2,500 – €4,000 in France, €2,000 – €3,500 in Spain.

- Fracture treatment: €1,500 – €3,000 in Italy, €1,000 – €2,500 in the Netherlands, €800 – €1,800 in Portugal.

- Emergency room visit: €150 – €300 in Austria, €100 – €250 in Belgium, €75 – €150 in Denmark.

These costs can vary depending on the specific hospital, location, and complexity of the procedure.

Financial Risks of Traveling Without Adequate Insurance Coverage

Traveling to Europe without adequate health insurance can expose you to significant financial risks, including:

- High medical expenses: As seen in the examples above, medical costs in Europe can be substantial, especially for complex procedures or long-term care. Without insurance, you could be responsible for paying these costs out of pocket.

- Evacuation costs: If you require medical evacuation back to your home country, the costs can be astronomical. Without insurance, you might have to pay for this expensive transport yourself.

- Lost wages: If you become ill or injured while traveling, you might have to miss work and lose income. Without insurance, you will not receive any compensation for lost wages.

- Financial hardship: The financial burden of unexpected medical expenses can be overwhelming, potentially leading to financial hardship or even bankruptcy.

In conclusion, while European healthcare systems are generally affordable for residents, the costs for non-residents can be significant. Travel insurance can provide financial protection against unexpected medical expenses, mitigating the financial risks associated with traveling to Europe without adequate coverage.

Wrap-Up

Ultimately, the decision of whether or not to purchase travel insurance for your trip to Europe is a personal one. Weighing the potential costs of medical emergencies against the cost of insurance coverage, as well as your individual risk tolerance, can help you make an informed decision. Remember, travel insurance can offer valuable protection and peace of mind, especially in situations where unexpected medical expenses could strain your budget or disrupt your travel plans.

FAQ Explained

How much does travel insurance cost?

The cost of travel insurance varies depending on factors such as your age, destination, length of trip, and the level of coverage you choose. It’s best to get quotes from several providers to compare prices and find the best value for your needs.

What are the common exclusions in travel insurance policies?

Travel insurance policies typically exclude coverage for pre-existing medical conditions, high-risk activities (such as extreme sports), and self-inflicted injuries. It’s crucial to carefully review the policy terms and conditions to understand what is and isn’t covered.

Can I use my existing health insurance in Europe?

While some existing health insurance plans may offer coverage outside your home country, it’s essential to check with your provider to confirm the extent of coverage and any specific requirements for using your insurance in Europe. It’s also important to note that your existing health insurance may not cover all medical expenses, especially in emergency situations.