Cheapest car insurance in Australia is a common search term, as drivers seek to minimize their costs while still maintaining adequate coverage. Finding the most affordable insurance policy involves understanding the factors that influence premiums, comparing different options, and implementing strategies to reduce costs. This guide provides a comprehensive overview of the car insurance landscape in Australia, empowering you to make informed decisions and secure the best value for your money.

Navigating the world of car insurance can be daunting, with a myriad of providers, policies, and terms to consider. However, by understanding the key components of car insurance, comparing different options, and implementing effective strategies, you can find a policy that meets your needs without breaking the bank. This guide will equip you with the knowledge and tools to make informed decisions, enabling you to secure the cheapest car insurance in Australia.

Understanding Car Insurance Costs in Australia

Car insurance is a crucial aspect of owning a vehicle in Australia, offering financial protection in case of accidents, theft, or damage. However, navigating the complex world of car insurance and understanding the factors that influence premiums can be challenging. This guide provides a comprehensive overview of the key elements that determine your car insurance costs, helping you make informed decisions and potentially save money.

Factors Influencing Car Insurance Premiums

Several factors contribute to the calculation of your car insurance premium. Understanding these factors can help you identify potential areas for cost savings.

- Your Driving History: Your driving record plays a significant role in determining your insurance premium. A clean driving history with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents or offenses can lead to higher premiums.

- Your Age and Gender: Insurance companies often consider age and gender when calculating premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. Gender also plays a role, with some insurance companies charging slightly higher premiums for young male drivers.

- Your Vehicle: The type and value of your vehicle are major factors in determining your insurance premium. High-performance vehicles or luxury cars tend to have higher insurance costs due to their higher repair expenses and increased risk of theft.

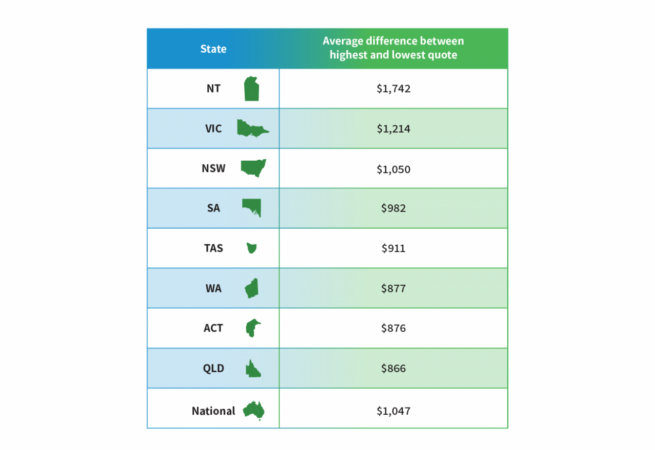

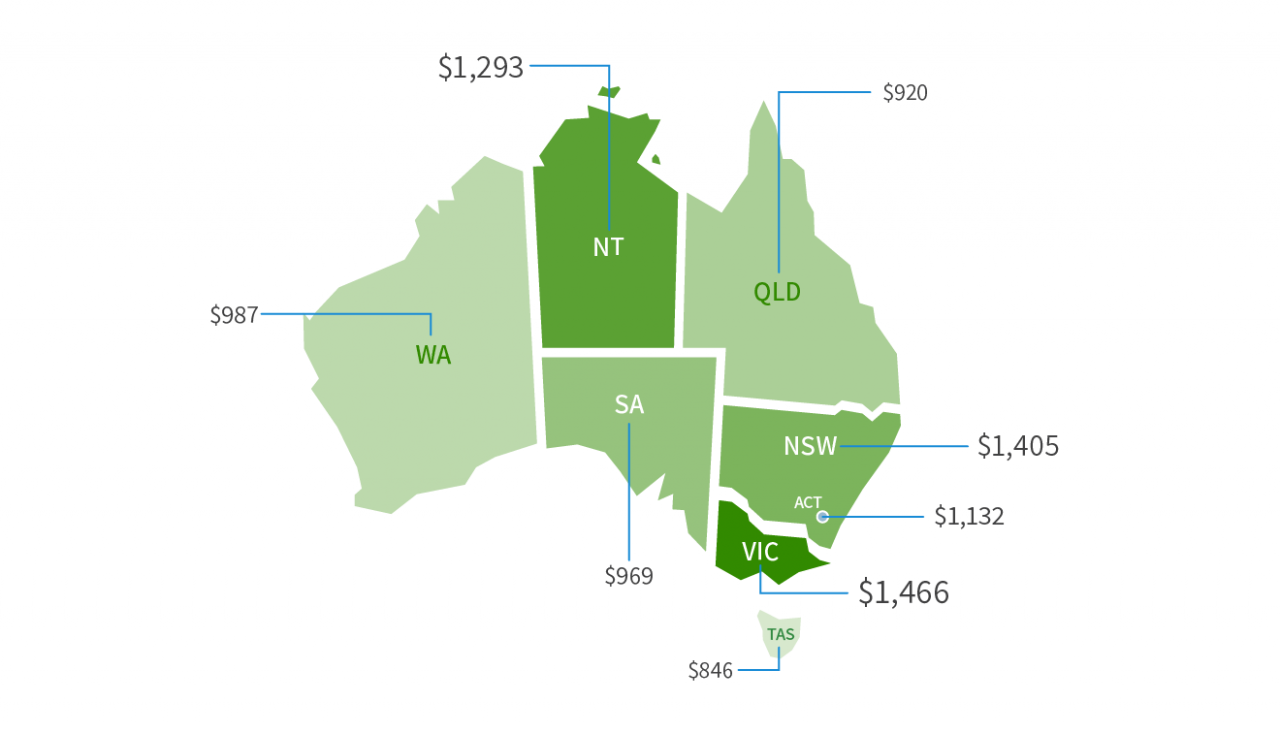

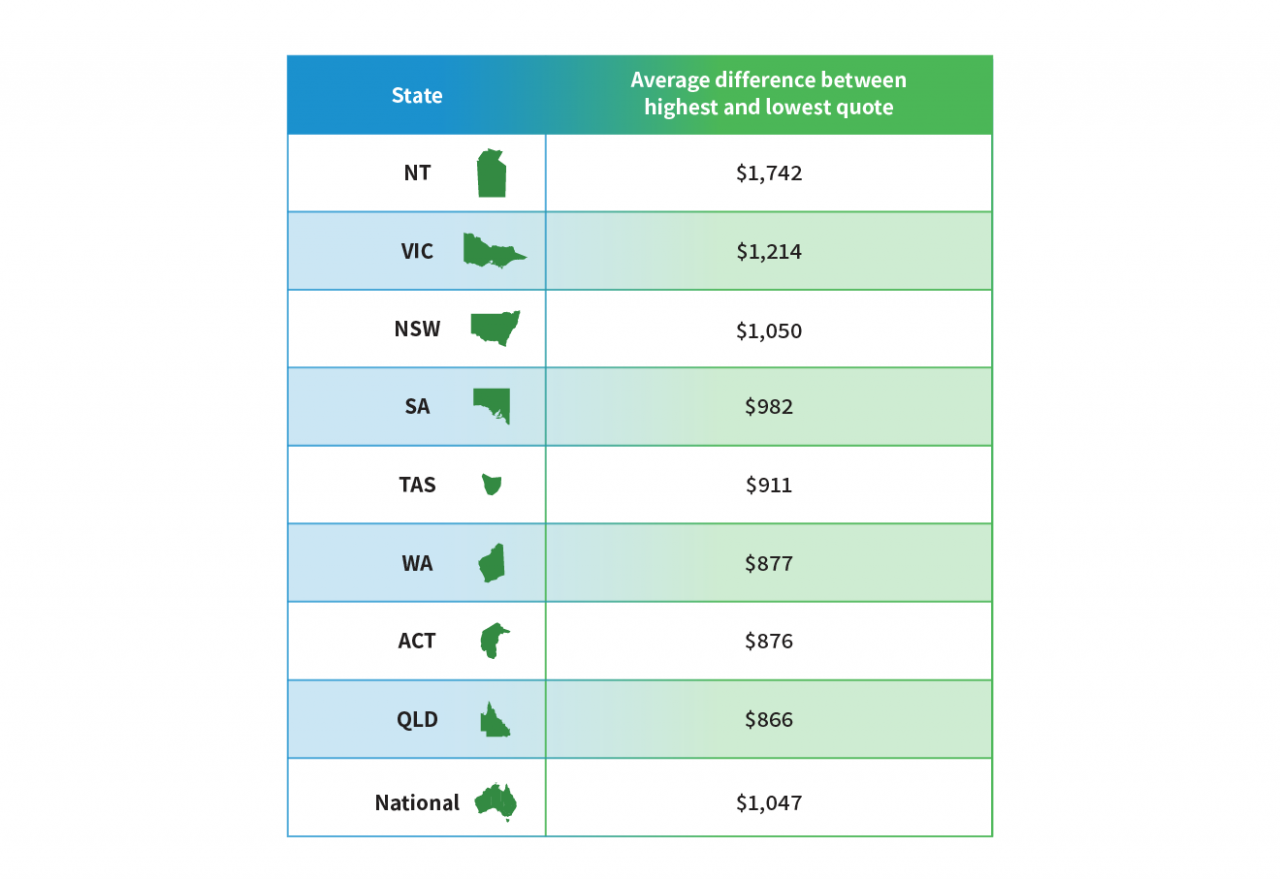

- Your Location: The location where you reside can impact your car insurance premium. Areas with high traffic density, crime rates, or a history of accidents often have higher insurance premiums.

- Your Coverage Options: The level of coverage you choose for your car insurance also affects the premium. Comprehensive coverage, which protects against damage from various causes like theft, vandalism, or natural disasters, typically costs more than third-party property damage or third-party fire and theft coverage.

- Your Excess: The excess is the amount you pay out of pocket before your insurance kicks in. A higher excess generally results in lower premiums, as you are taking on more financial responsibility.

- Your Claims History: If you have filed previous claims, it can influence your current insurance premium. Insurance companies may view you as a higher risk if you have a history of making claims.

Key Components of Car Insurance Costs

Car insurance premiums are made up of several key components, each contributing to the overall cost.

- Administrative Costs: These costs cover the expenses incurred by insurance companies for managing their operations, such as salaries, rent, and marketing.

- Claims Costs: This is the largest component of insurance premiums and covers the cost of repairs, replacements, and compensation for accidents and other covered events.

- Profit Margin: Insurance companies aim to make a profit from their operations. This profit margin is factored into the premiums to ensure the company’s financial sustainability.

Impact of Driving Habits and Vehicle Types on Insurance Rates

Driving habits and vehicle types have a direct impact on insurance premiums.

- Driving Habits: Drivers with a history of speeding violations, reckless driving, or driving under the influence of alcohol or drugs are considered higher risk and often face higher insurance premiums.

- Vehicle Types: As mentioned earlier, the type of vehicle you drive significantly influences your insurance premium. Sports cars, luxury cars, and high-performance vehicles are typically more expensive to insure due to their higher repair costs and increased risk of theft.

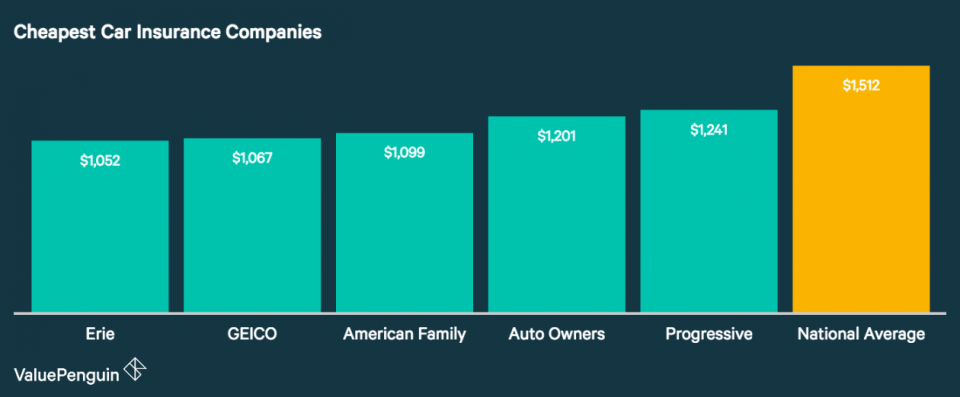

Finding the Cheapest Car Insurance Options

Finding the cheapest car insurance in Australia involves understanding the different types of coverage available and how they can affect your premium. By comparing quotes from multiple insurers and considering factors like your driving history, car type, and location, you can find a policy that suits your needs and budget.

Types of Car Insurance in Australia

Car insurance in Australia comes in three main types: comprehensive, third-party property damage, and third-party fire and theft. Each type offers varying levels of protection and, consequently, different premiums.

- Comprehensive car insurance offers the most extensive coverage, protecting you against damage to your car, regardless of who is at fault. This includes incidents like accidents, theft, fire, and vandalism. It also covers your liability for damage to other vehicles or property.

- Third-party property damage insurance covers damage to other vehicles or property caused by you, but not your own car. This is the minimum level of insurance required by law in Australia.

- Third-party fire and theft insurance provides coverage for damage to your car caused by fire or theft, as well as your liability for damage to other vehicles or property. It does not cover damage caused by accidents.

Factors Affecting Car Insurance Premiums

Several factors influence the cost of your car insurance, including:

- Your driving history: A clean driving record with no accidents or traffic violations will generally result in lower premiums. Insurers consider your past driving behaviour as an indicator of your future risk.

- Your car’s make, model, and age: Newer, more expensive cars tend to have higher premiums due to their replacement cost and potential for higher repair expenses. Similarly, certain car models may be associated with higher accident rates, leading to increased premiums.

- Your location: Areas with higher traffic density and crime rates may have higher insurance premiums due to an increased risk of accidents and theft.

- Your age and occupation: Younger drivers and those in high-risk occupations may face higher premiums. This is because these groups are statistically more likely to be involved in accidents.

- Your annual mileage: Driving more frequently increases your risk of accidents, which can lead to higher premiums.

- Your excess: The excess is the amount you pay upfront in the event of a claim. Choosing a higher excess can reduce your premium, but you will have to pay more out of pocket in case of an accident.

- Coverage limits: These limits determine the maximum amount your insurer will pay for a claim. Higher limits generally mean higher premiums.

- Optional extras: Some insurers offer optional extras like roadside assistance, windscreen cover, and new-for-old replacement, which can add to your premium.

Key Features to Consider When Choosing Car Insurance

When selecting a car insurance policy, consider these key features:

- Excess: Choose an excess you can comfortably afford, balancing the cost savings with the potential out-of-pocket expense in case of a claim.

- Coverage limits: Ensure the limits are sufficient to cover your potential liabilities and the cost of repairs or replacement for your car.

- Optional extras: Decide if the additional features are worthwhile for your needs and budget. Consider the value they provide and the potential cost savings they offer.

Tips for Reducing Car Insurance Premiums: Cheapest Car Insurance In Australia

Saving money on car insurance is a common goal for most Australians. Fortunately, there are various strategies you can implement to lower your premiums. Understanding how insurance companies assess risk and exploring available discounts can significantly impact your overall costs.

The Importance of a Good Driving Record

Maintaining a clean driving record is crucial for securing lower insurance premiums. Insurance companies consider your driving history as a significant indicator of your risk profile. A spotless record demonstrates responsible driving habits, leading to lower premiums. Conversely, traffic violations, accidents, or claims can result in higher premiums, as they indicate a higher likelihood of future incidents.

Online Car Insurance Comparison Tools

Online car insurance comparison tools are a valuable resource for Australian drivers looking to find the most affordable insurance policies. These platforms allow you to compare quotes from multiple insurers simultaneously, saving you time and effort in your search for the best deal.

Advantages and Disadvantages of Using Online Comparison Websites, Cheapest car insurance in australia

Online car insurance comparison websites offer a range of benefits, including convenience, efficiency, and access to a wider range of insurers. However, it’s important to be aware of their potential drawbacks.

- Advantages

- Convenience: Comparing quotes from multiple insurers is quick and easy, eliminating the need to contact each insurer individually.

- Efficiency: You can obtain multiple quotes within minutes, saving you valuable time and effort.

- Wider Range of Insurers: Comparison websites typically partner with a broad range of insurers, giving you access to a wider selection of options.

- Transparency: Quotes are presented side-by-side, allowing for easy comparison of coverage and pricing.

- Disadvantages

- Limited Customization: Some comparison websites may not allow you to fully customize your policy to meet your specific needs.

- Potential for Bias: Websites may prioritize insurers that pay them higher commissions, which could influence the order of results.

- Data Accuracy: It’s essential to double-check the information provided on comparison websites, as errors can occur.

- Limited Customer Support: While some comparison websites offer customer support, it may be limited compared to contacting an insurer directly.

Utilizing Comparison Websites Effectively

To maximize the benefits of online car insurance comparison tools, follow these steps:

- Gather Relevant Information: Before starting your search, gather essential information, including your driver’s license details, vehicle registration, and any previous insurance claims.

- Select Multiple Comparison Websites: Utilize at least two or three different comparison websites to broaden your search and ensure you’re comparing quotes from a diverse range of insurers.

- Enter Accurate Information: Provide precise and complete information when entering your details. Inaccuracies can lead to inaccurate quotes.

- Compare Quotes Carefully: Scrutinize each quote, paying close attention to the level of coverage, excess, and any additional fees or conditions.

- Read the Policy Documents: Before making a decision, carefully review the policy documents provided by the insurer to fully understand the terms and conditions.

- Contact the Insurer: If you have any questions or require further clarification, don’t hesitate to contact the insurer directly.

Inputting Relevant Information for Personalized Quotes

To receive personalized quotes, you need to provide accurate information to comparison websites.

- Personal Details: Include your name, address, date of birth, and driver’s license information.

- Vehicle Details: Specify the make, model, year, and registration number of your vehicle.

- Driving History: Provide information about your driving history, including any accidents or convictions.

- Coverage Requirements: Indicate your desired level of coverage, such as third-party property damage, comprehensive, or third-party fire and theft.

- Excess: Choose your preferred excess amount, which is the amount you’ll pay in the event of a claim.

- Other Factors: Consider any additional factors that might influence your premium, such as parking location, vehicle usage, and occupation.

Conclusive Thoughts

Finding the cheapest car insurance in Australia requires a proactive approach. By understanding the factors that influence premiums, comparing different options, and implementing strategies to reduce costs, you can secure a policy that offers adequate coverage without straining your budget. This guide provides a comprehensive framework for navigating the car insurance landscape, empowering you to make informed decisions and achieve significant savings.

FAQ Compilation

What are some common discounts offered by car insurance providers in Australia?

Car insurance providers in Australia often offer discounts for factors such as good driving history, safety features, vehicle modifications, loyalty programs, and multi-policy discounts.

What are some tips for avoiding car insurance claims?

To avoid car insurance claims, it’s important to practice safe driving habits, maintain your vehicle regularly, and be aware of your surroundings. This includes following traffic laws, avoiding distractions, and driving defensively.

How can I make a car insurance claim in Australia?

To make a car insurance claim in Australia, you typically need to contact your insurance provider, provide necessary documentation, and follow their claims process. This may involve reporting the incident, providing details about the damage, and submitting supporting evidence.