Cheapest medical insurance in Australia can be a tricky quest, navigating a complex system with various providers, plans, and costs. But finding the best deal doesn’t have to be a headache. This guide will equip you with the knowledge and tools to confidently explore your options, understand the factors that influence pricing, and ultimately secure the most affordable medical insurance for your needs.

In Australia, healthcare is a blend of public and private systems. Medicare, the government-funded universal healthcare system, provides essential medical services. However, for more comprehensive coverage, including private hospitals and faster access to specialists, private health insurance is often sought. The decision to choose private insurance or rely solely on Medicare depends on individual circumstances and preferences. This guide will explore the nuances of both options, helping you make an informed choice.

Understanding Australian Medical Insurance

Navigating the world of healthcare in Australia can be a bit complex, especially when it comes to understanding the different types of medical insurance available. This guide will provide you with a comprehensive overview of Australian medical insurance, covering the essential aspects of both public and private options, including their coverage, costs, and benefits.

Medicare

Medicare is Australia’s universal healthcare system, funded by taxes. It provides essential healthcare services to all Australian citizens and permanent residents.

- Coverage: Medicare covers a wide range of services, including consultations with doctors, hospital stays, and some essential medications. However, it does not cover all medical expenses, such as dental care, physiotherapy, and some specialist services.

- Cost: Medicare is free at the point of service. However, there are some out-of-pocket expenses, such as co-payments for certain services and a gap between what Medicare covers and the actual cost of the service.

- Benefits: Medicare provides access to essential healthcare services, ensuring everyone has access to basic medical care regardless of their income. It also helps to control healthcare costs by negotiating bulk-billing agreements with doctors.

Private Health Insurance

Private health insurance provides supplementary coverage for medical expenses not covered by Medicare.

- Coverage: Private health insurance offers a wide range of coverage options, including hospital, extras, and ambulance cover. Hospital cover helps with the cost of private hospital stays, while extras cover services like dental, physiotherapy, and optical care. Ambulance cover provides financial assistance for ambulance services.

- Cost: Premiums for private health insurance vary depending on the level of coverage, age, and health status. The higher the level of coverage, the higher the premium.

- Benefits: Private health insurance provides access to private hospitals, shorter waiting times for elective surgery, and coverage for services not covered by Medicare. It also offers the option to choose your own doctor and hospital.

Private Health Insurance vs. Medicare

Choosing between relying solely on Medicare or opting for private health insurance is a personal decision based on individual circumstances and needs. Here’s a comparison of the pros and cons of each option:

| Medicare | Private Health Insurance | |

|---|---|---|

| Pros | Free at the point of service | Access to private hospitals |

| Covers essential healthcare services | Shorter waiting times for elective surgery | |

| Provides access to bulk-billing doctors | Coverage for services not covered by Medicare | |

| Protects against catastrophic medical expenses | Choice of doctor and hospital | |

| Cons | Limited coverage for some services | Higher premiums |

| Potential for long waiting times for elective surgery | Out-of-pocket expenses for some services | |

| Limited choice of doctor and hospital |

Factors Influencing Cost: Cheapest Medical Insurance In Australia

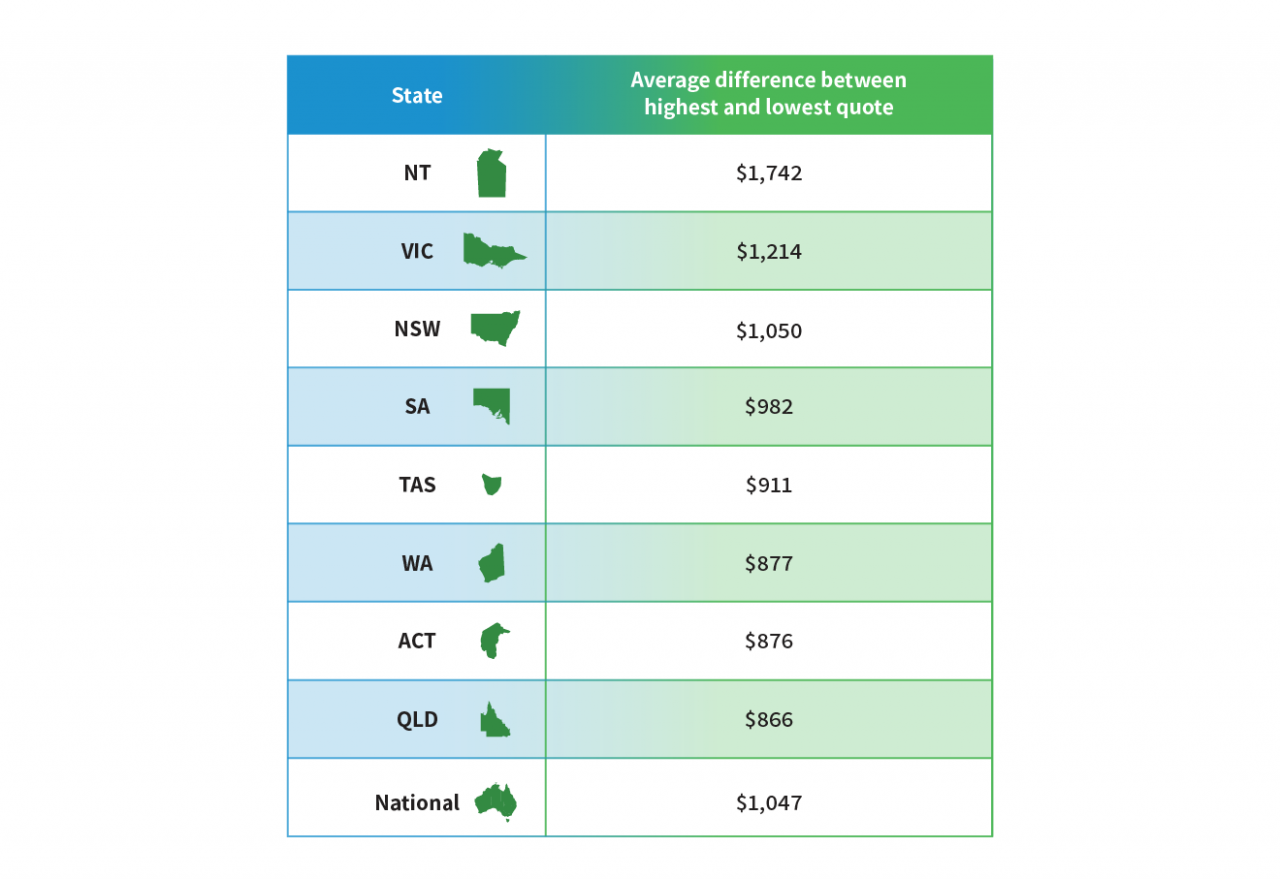

The cost of medical insurance in Australia is influenced by a variety of factors, including your age, health status, location, and the level of coverage you choose. Understanding these factors can help you make informed decisions when comparing insurance policies and finding the best value for your needs.

Age

Age is a significant factor in determining your insurance premium. As you get older, your risk of needing medical care increases, leading to higher premiums. Younger individuals generally enjoy lower premiums due to their lower risk profile.

Health Status

Your health status plays a crucial role in pricing. Individuals with pre-existing conditions or a history of health issues may face higher premiums. Insurance companies assess your medical history and current health to determine your risk level.

Location

The cost of medical insurance can vary depending on your location. Urban areas with higher concentrations of medical facilities and specialists often have higher premiums compared to rural areas.

Level of Coverage

The level of coverage you choose also impacts your premium. Comprehensive policies with broader coverage and higher benefits generally come with higher premiums. Basic policies with limited coverage typically have lower premiums.

Pre-existing Conditions

Pre-existing conditions can significantly influence your insurance premiums. If you have a pre-existing condition, insurance companies may charge higher premiums to cover the increased risk of potential claims. Some insurers may exclude coverage for certain pre-existing conditions or impose waiting periods before covering them.

Pricing Structures of Different Providers

Insurance providers often have different pricing structures and offer unique features or discounts.

- Some insurers may offer discounts for healthy lifestyle choices, such as non-smoking or regular exercise.

- Others may provide discounts for families or multiple policyholders.

- Some insurers may have tiered pricing based on your age and health status.

- It’s essential to compare quotes from different providers to find the best deal that suits your needs and budget.

Finding the Cheapest Options

Finding the most affordable medical insurance in Australia involves a strategic approach to research and comparison. This section will guide you through the process of obtaining quotes, comparing plans, and ultimately securing the best value for your health coverage needs.

Comparing Quotes from Different Providers

Obtaining quotes from various insurance providers is crucial for finding the cheapest options. This involves a systematic approach to ensure you receive accurate and comprehensive information.

- Identify Your Needs: Before contacting insurance providers, clearly define your medical insurance requirements. This includes factors like your age, health status, desired level of coverage, and any specific medical conditions you may have.

- Utilize Online Comparison Websites: Several reputable websites allow you to compare quotes from multiple insurance providers simultaneously. These platforms streamline the process and provide a comprehensive overview of available plans.

- Contact Insurance Providers Directly: After using comparison websites, consider contacting insurance providers directly to discuss specific plans and obtain personalized quotes. This allows you to ask questions and clarify any details.

- Compare Quotes Carefully: Once you have collected quotes from various providers, meticulously compare them based on factors such as premiums, coverage, benefits, and exclusions. This ensures you choose a plan that aligns with your budget and health needs.

Key Features and Pricing of Popular Plans

The following table provides a simplified comparison of key features and pricing for several popular and affordable medical insurance plans in Australia. It’s important to note that specific premiums and coverage may vary depending on individual circumstances.

| Plan Name | Provider | Monthly Premium (approx.) | Hospital Cover | Extras Cover | Key Features |

|---|---|---|---|---|---|

| Essential Plus | Medibank | $150 | Yes (basic) | Yes (limited) | Covers essential hospital services, limited extras like dental and optical. |

| Gold Value | Bupa | $200 | Yes (comprehensive) | Yes (extensive) | Includes comprehensive hospital cover, extensive extras including physiotherapy and chiropractic. |

| Silver Choice | HCF | $180 | Yes (intermediate) | Yes (moderate) | Offers intermediate hospital cover, moderate extras like dental and optical. |

Reputable Online Comparison Websites

Several reputable online comparison websites can assist you in finding the cheapest medical insurance options. These platforms provide a comprehensive overview of available plans from various insurance providers, allowing you to compare quotes and make informed decisions.

- Compare the Market: This website allows you to compare quotes from multiple insurance providers across various categories, including medical insurance. It provides a user-friendly interface and detailed plan information.

- iSelect: iSelect is another popular comparison website that offers a wide range of medical insurance plans from leading providers. It provides comprehensive plan details and allows you to filter results based on your specific needs.

- Canstar: Canstar is a trusted source for insurance comparisons, offering a comprehensive range of medical insurance plans. It provides ratings and reviews to help you make informed decisions.

Important Considerations

Choosing the cheapest medical insurance in Australia is crucial, but it’s equally important to understand the finer details of your policy to ensure it meets your specific needs. Don’t just focus on the lowest premium; consider the comprehensive coverage, exclusions, and waiting periods associated with each plan.

Waiting Periods and Exclusions

It’s vital to understand the waiting periods and exclusions associated with different insurance plans. These terms can significantly impact your coverage and the benefits you receive.

- Waiting Periods: These are the periods you must wait after taking out a policy before you can claim for certain conditions or treatments. For example, you might have to wait 12 months before claiming for pre-existing conditions. Understanding these periods is crucial to ensure you’re covered when you need it most.

- Exclusions: These are specific conditions or treatments that are not covered by your policy. It’s important to read the policy document carefully to understand what is and isn’t covered. This can include things like cosmetic surgery, experimental treatments, or pre-existing conditions.

Negotiating Lower Premiums

While finding the cheapest medical insurance is a priority, it’s possible to negotiate lower premiums or secure discounts. Here are some tips:

- Compare Quotes: Don’t settle for the first quote you receive. Use comparison websites or contact multiple insurers directly to compare prices and benefits. This will give you a better understanding of the market and help you find the best value for money.

- Bundle Policies: If you have other insurance policies, such as home or car insurance, consider bundling them with your medical insurance. Many insurers offer discounts for multiple policies.

- Pay Annually: Paying your premiums annually instead of monthly can often lead to a discount. This is because insurers reward customers who pay in full upfront.

- Look for Discounts: Some insurers offer discounts for certain groups, such as seniors, students, or members of specific organizations. Check if you qualify for any discounts.

Hidden Costs and Fees

While the premium is the primary cost, there are often hidden costs and fees associated with medical insurance policies. These can include:

- Excess: This is the amount you have to pay out of pocket before your insurance kicks in. The higher the excess, the lower the premium. But, it’s important to choose an excess you can comfortably afford in case you need to make a claim.

- Loading: This is an additional charge added to your premium if you have a pre-existing condition or a high risk of making a claim. This can significantly increase the cost of your insurance.

- Administrative Fees: Some insurers charge administrative fees for processing claims or making changes to your policy. These fees can add up over time, so it’s important to factor them into your overall costs.

Additional Resources and Support

Navigating the Australian healthcare system can be complex, but there are numerous resources and support organizations available to help you understand your options and make informed decisions. These resources can provide valuable information, guidance, and assistance throughout your journey.

Government Resources

The Australian government provides a wealth of information and resources related to health insurance. Here are some key websites and organizations:

- Department of Health and Aged Care: This website provides comprehensive information on the Australian healthcare system, including Medicare, private health insurance, and other health-related programs. It also offers resources for consumers, including information on choosing a health fund, understanding your policy, and making claims. [https://www.health.gov.au/](https://www.health.gov.au/)

- Medicare: Medicare is Australia’s universal healthcare system, providing access to essential medical services. The Medicare website offers information on eligibility, benefits, and how to access services. It also provides a directory of healthcare providers and information on claiming your health insurance rebates. [https://www.medicare.gov.au/](https://www.medicare.gov.au/)

- Private Health Insurance Ombudsman: The Private Health Insurance Ombudsman (PHIO) is an independent body that helps resolve disputes between consumers and private health insurers. If you have a complaint about your health insurance, you can contact the PHIO for assistance. [https://www.phio.gov.au/](https://www.phio.gov.au/)

Support Organizations

There are several non-profit organizations that provide support and advocacy for consumers in relation to health insurance. These organizations can offer valuable advice, information, and support.

- Consumer Health Forum of Australia: The Consumer Health Forum is a national peak body representing consumers on health issues. It advocates for consumers’ rights and provides information on a wide range of health topics, including private health insurance. [https://www.chf.org.au/](https://www.chf.org.au/)

- Choice: Choice is a consumer advocacy group that provides independent advice and reviews on a wide range of products and services, including private health insurance. It offers comprehensive information on choosing a health fund, comparing policies, and understanding your rights. [https://www.choice.com.au/](https://www.choice.com.au/)

Relevant Articles and Websites, Cheapest medical insurance in australia

There are numerous articles and websites that provide in-depth guidance on navigating the Australian healthcare system and understanding private health insurance. Here are some examples:

- “Understanding Australian Private Health Insurance” by the Department of Health and Aged Care: This article provides a comprehensive overview of private health insurance in Australia, including its benefits, costs, and how to choose a policy. [https://www.health.gov.au/](https://www.health.gov.au/)

- “How to Choose the Right Health Insurance” by Choice: This article provides practical advice on choosing a health fund and policy that meets your individual needs and budget. [https://www.choice.com.au/](https://www.choice.com.au/)

- “Private Health Insurance: A Guide for Consumers” by the Private Health Insurance Ombudsman: This guide provides information on your rights and responsibilities as a private health insurance consumer, as well as tips on resolving disputes. [https://www.phio.gov.au/](https://www.phio.gov.au/)

Closing Summary

Finding the cheapest medical insurance in Australia is a journey of research and comparison. By understanding the factors that impact cost, exploring various provider options, and leveraging online resources, you can find a plan that meets your healthcare needs without breaking the bank. Remember, don’t settle for the first option you find. Take the time to research, compare, and choose a policy that provides the right balance of coverage and affordability for you.

FAQ Corner

What is the difference between Medicare and private health insurance?

Medicare is a government-funded universal healthcare system, providing essential medical services. Private health insurance offers additional coverage, including private hospitals, faster access to specialists, and optional extras like dental and optical care.

How do I know if I need private health insurance?

The need for private health insurance depends on your individual needs and preferences. If you desire faster access to specialists, prefer private hospitals, or require additional coverage beyond what Medicare provides, private insurance may be beneficial.

What are some tips for lowering my medical insurance premiums?

You can often negotiate lower premiums by choosing a higher excess, opting for a lower level of coverage, or bundling your insurance policies with the same provider.