- Types of Life Insurance in Australia

- Key Features and Benefits of Life Insurance

- Finding the Right Life Insurance Policy

- Understanding Life Insurance Premiums and Costs

- Common Exclusions and Limitations

- Claims Process and Payment: Compare Life Insurance In Australia

- Choosing the Right Insurer

- Concluding Remarks

- Frequently Asked Questions

Compare life insurance in Australia, a crucial step in securing your loved ones’ financial future. Navigating the diverse landscape of policies can be daunting, but understanding the options available and their implications is paramount. From term life to whole life insurance, each policy caters to specific needs and circumstances, offering a range of benefits and coverage levels.

This guide delves into the intricacies of life insurance in Australia, providing a comprehensive overview of the different types, key factors to consider, and essential features. It also examines the claims process, cost considerations, and how to choose the right insurer for your individual requirements.

Types of Life Insurance in Australia

Life insurance is a crucial aspect of financial planning, providing financial security to your loved ones in the event of your untimely demise. In Australia, various types of life insurance are available, each catering to specific needs and circumstances. Understanding these options is vital for making informed decisions that align with your individual financial goals and risk tolerance.

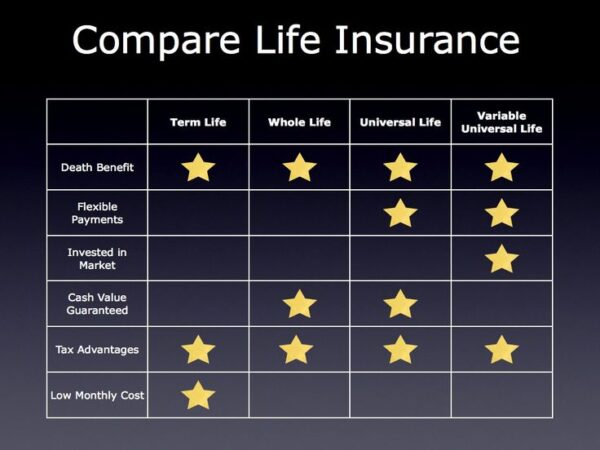

Term Life Insurance

Term life insurance is a type of life insurance that provides coverage for a specific period, typically ranging from 10 to 30 years. It is designed to offer financial protection during a crucial period, such as while raising a family or paying off a mortgage.

- Key Features: Term life insurance policies are generally more affordable than other types of life insurance due to their limited coverage period. They typically offer a death benefit payout only if the insured person passes away during the policy term.

- Benefits: Term life insurance provides a cost-effective way to ensure your loved ones are financially secure in the event of your death during the policy term. It offers peace of mind knowing that your family will have the financial resources to cover essential expenses such as mortgage payments, funeral costs, and living expenses.

- Suitability: Term life insurance is a suitable option for individuals with specific financial needs, such as young families, those with a mortgage, or individuals with a temporary financial obligation.

- Real-life Example: A young couple with a new mortgage and a young child might opt for a 30-year term life insurance policy to ensure that their family would be able to maintain their lifestyle and pay off the mortgage in the event of the breadwinner’s death.

Whole Life Insurance

Whole life insurance provides lifelong coverage, meaning that it remains in effect for as long as you live. It combines a death benefit with a savings component, allowing you to build cash value over time.

- Key Features: Whole life insurance premiums are typically higher than term life insurance premiums due to the lifelong coverage. The policy accumulates cash value, which can be accessed through loans or withdrawals.

- Benefits: Whole life insurance provides lifelong financial protection for your loved ones and offers a savings component that can be used for various purposes. It can serve as a form of investment, providing a guaranteed return on your premiums.

- Suitability: Whole life insurance is suitable for individuals seeking lifelong coverage and a savings component. It can be a good option for those who want to leave a legacy for their heirs or secure their retirement income.

- Real-life Example: A successful entrepreneur with a substantial net worth might choose whole life insurance to provide a financial safety net for their family and ensure a legacy for their children.

Other Variations of Life Insurance

- Group Life Insurance: This type of insurance is typically offered through employers or associations. It provides coverage for members of a group, often at a lower cost than individual policies.

- Permanent Life Insurance: This is a broader category that includes whole life insurance and universal life insurance. These policies offer lifelong coverage and a savings component.

- Accidental Death and Dismemberment (AD&D) Insurance: This type of insurance provides a lump-sum benefit if the insured person dies or is severely injured in an accident.

- Trauma Insurance: This insurance provides a lump-sum benefit if the insured person is diagnosed with a serious illness or suffers a major injury.

Key Features and Benefits of Life Insurance

Life insurance offers a crucial safety net for your loved ones, ensuring their financial security in the event of your untimely demise. It provides a lump sum payment, known as a death benefit, which can be used to cover various expenses, such as mortgage repayments, funeral costs, living expenses, and outstanding debts.

Death Benefit

The death benefit is the core feature of life insurance. It’s a predetermined sum of money that your beneficiaries receive upon your death. This financial support can alleviate the financial burden on your family, allowing them to maintain their standard of living and achieve their financial goals without facing undue hardship. The amount of the death benefit is determined by factors such as your age, health, and the type of policy you choose.

Terminal Illness Cover

In addition to death benefit, many life insurance policies offer terminal illness cover. This benefit allows you to access a portion of your death benefit while you are still alive if you are diagnosed with a terminal illness. This provides you with financial support during your final months or years, enabling you to focus on your well-being and make arrangements for your family.

Other Optional Inclusions

Life insurance policies often include various optional inclusions that can enhance the overall benefits and provide additional protection. These can include:

- Total and Permanent Disability (TPD) Cover: This benefit provides financial support if you become permanently disabled and unable to work.

- Trauma Cover: This cover provides a lump sum payment if you are diagnosed with a serious medical condition, such as a heart attack, stroke, or cancer.

- Income Protection: This cover provides a regular income stream if you are unable to work due to illness or injury.

Life insurance plays a vital role in providing financial security for dependents in case of death. By providing a lump sum payment, it can help to cover essential expenses, such as mortgage repayments, funeral costs, and living expenses. This financial support can alleviate the stress and uncertainty that families often face during difficult times.

Finding the Right Life Insurance Policy

Finding the right life insurance policy in Australia is essential to protect your loved ones financially in the event of your unexpected passing. With numerous insurers and policy options available, navigating this process can feel overwhelming. However, by following a structured approach and understanding your needs, you can find a policy that provides the right coverage at a competitive price.

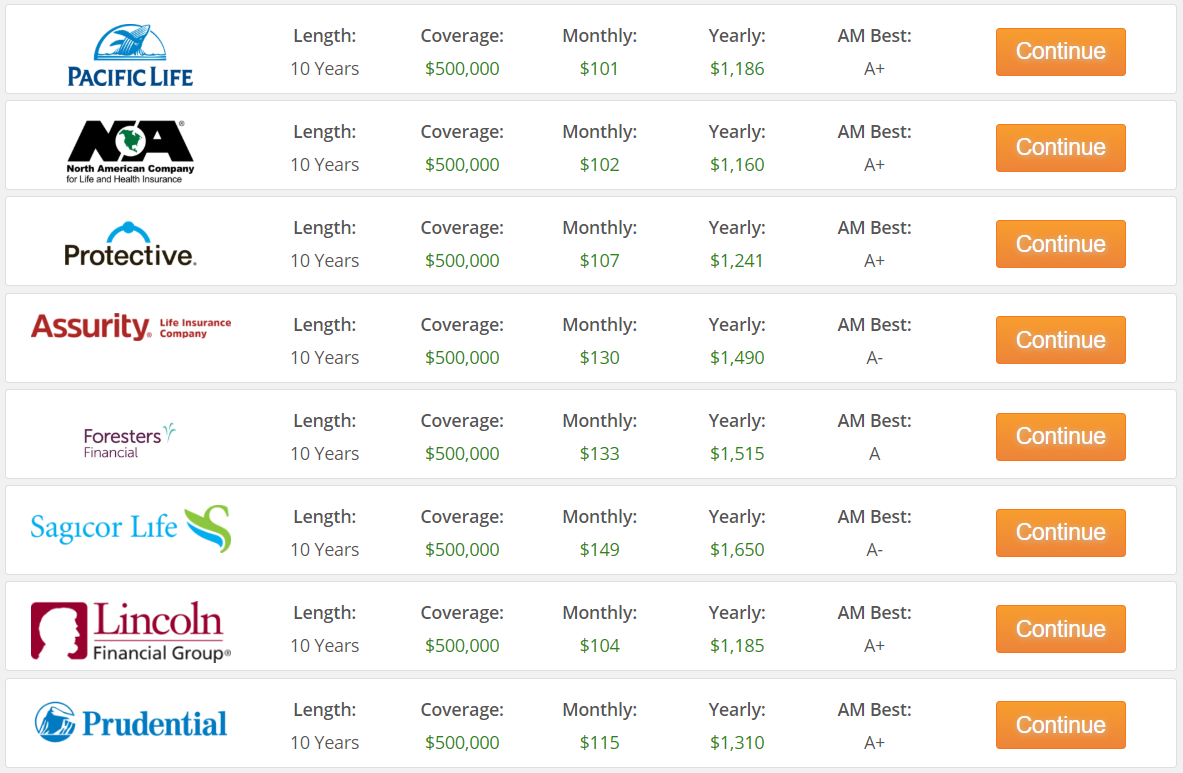

Comparing Quotes and Policies

Before committing to any policy, it is crucial to compare quotes from different insurers. This allows you to assess the various options and find the most suitable coverage for your specific circumstances. Consider using online comparison websites or contacting insurance brokers to obtain quotes from multiple providers. When comparing quotes, pay close attention to the following factors:

- Sum insured: This is the amount of money your beneficiaries will receive upon your death. Determine the appropriate sum based on your financial obligations and the needs of your dependents.

- Premiums: This is the regular payment you make for your policy. Compare premiums across different insurers and ensure they fit within your budget.

- Coverage period: This refers to the duration of your policy. Choose a coverage period that aligns with your long-term financial goals and needs.

- Exclusions and limitations: Carefully review the policy documents to understand any exclusions or limitations on coverage. This includes specific conditions or activities that may not be covered.

- Claim process: Research the claims process of each insurer and ensure it is transparent and efficient. This includes understanding the documentation required and the timeframe for processing claims.

Negotiating Premiums

While life insurance premiums are typically fixed, there are some ways to negotiate a better price. Consider the following tips:

- Shop around: As mentioned earlier, comparing quotes from multiple insurers is essential to secure the best possible premium. Leverage the competition to your advantage.

- Bundle policies: If you have other insurance policies, such as health insurance or home insurance, inquire about discounts for bundling your life insurance policy with these. Many insurers offer discounts for multiple policyholders.

- Consider a higher excess: A higher excess means you pay more out of pocket if you make a claim, but it can result in lower premiums. Assess your risk tolerance and financial capacity before opting for a higher excess.

- Pay premiums annually: Paying your premiums annually instead of monthly can often lead to lower premiums. This is because insurers offer discounts for upfront payments.

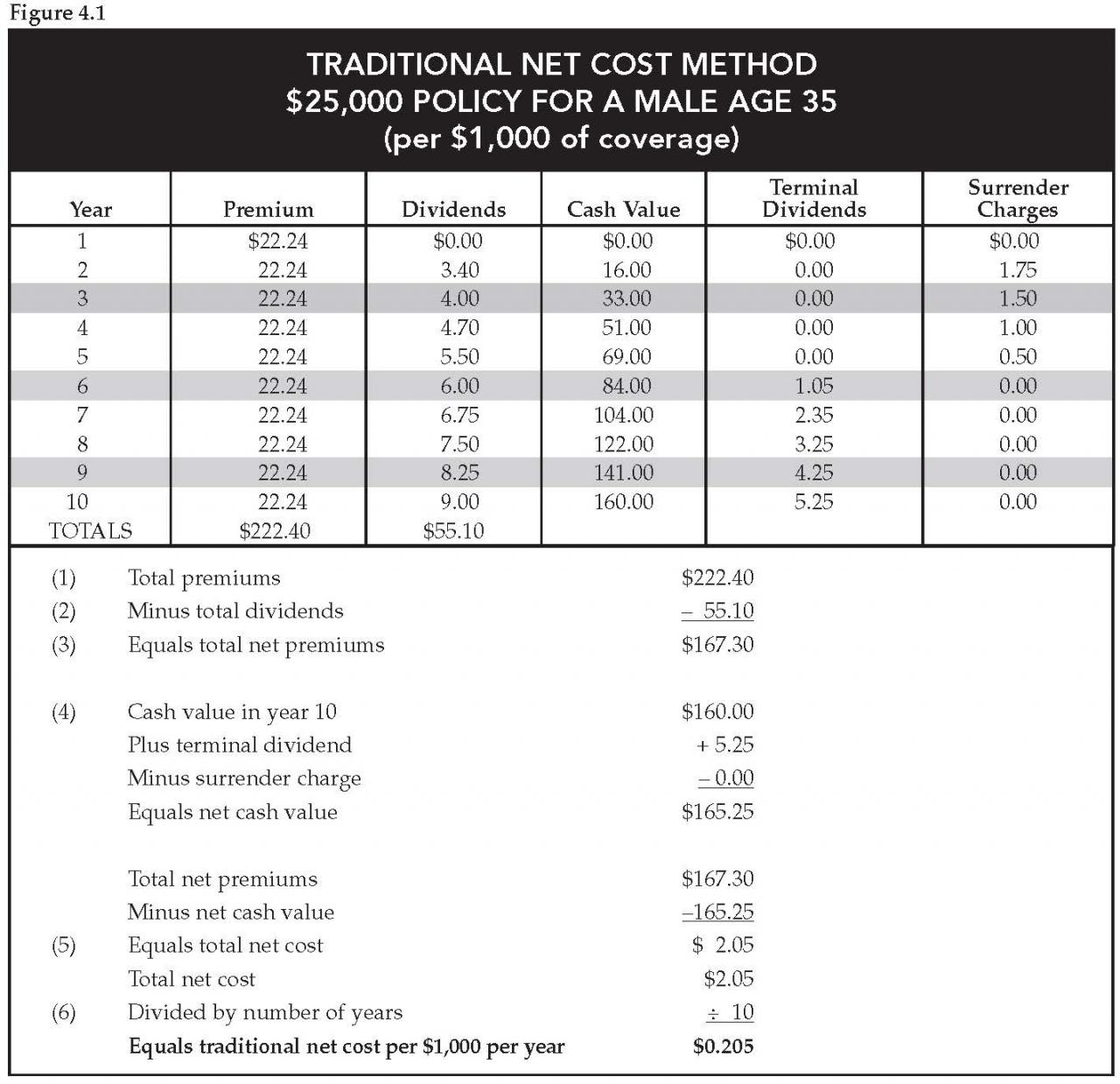

Understanding Life Insurance Premiums and Costs

Life insurance premiums are the monthly, quarterly, or annual payments you make to maintain your policy. These premiums are calculated based on various factors, ensuring that you pay a fair price for the coverage you need.

Factors Influencing Life Insurance Premiums

The cost of your life insurance premiums is influenced by several factors, including:

- Age: As you age, your risk of death increases, which leads to higher premiums. Younger individuals generally pay lower premiums than older individuals.

- Health: Your health status plays a significant role in determining your premiums. Individuals with pre-existing health conditions or a family history of certain illnesses may face higher premiums. Life insurance companies assess your health through medical questionnaires, medical examinations, and sometimes, blood tests.

- Lifestyle: Certain lifestyle choices, such as smoking, excessive alcohol consumption, or engaging in high-risk activities, can increase your premiums. These activities are considered riskier and can increase your chances of an early death.

- Coverage Amount: The amount of coverage you choose will directly impact your premiums. A higher coverage amount will generally result in higher premiums, as the insurance company is assuming a greater financial responsibility in case of your death.

Premium Payment Options

Life insurance premiums can be paid through various methods, providing flexibility to suit your financial situation.

- Monthly Payments: This is the most common payment option, allowing you to spread the cost of your premiums over smaller, regular payments. Monthly payments offer convenience and can help with budget management.

- Quarterly Payments: You can choose to pay your premiums every three months, which can be beneficial if you prefer fewer payments throughout the year. However, it’s important to ensure you have sufficient funds available to cover the larger quarterly payments.

- Annual Payments: By paying your premiums annually, you can often secure a discount on your overall premium cost. This option can be suitable if you have a lump sum available and prefer to pay your premiums less frequently.

Managing Life Insurance Premiums

Managing your life insurance premiums effectively is crucial for ensuring long-term affordability. Here are some strategies to consider:

- Shop Around: Comparing quotes from multiple life insurance companies can help you find the most competitive premiums. Online comparison websites can make this process easier and more efficient.

- Consider a Shorter Policy Term: A shorter policy term, such as 10 or 20 years, can result in lower premiums compared to a lifetime policy. This option may be suitable if you need coverage for a specific period, such as while your children are young.

- Increase Your Deductible: A higher deductible can lower your premiums. This means you’ll pay more out of pocket if you need to claim, but it can significantly reduce your monthly costs.

- Maintain a Healthy Lifestyle: By adopting healthy habits, such as regular exercise, a balanced diet, and avoiding smoking, you can potentially reduce your premiums over time. Life insurance companies may offer discounts for individuals who demonstrate healthy lifestyle choices.

Common Exclusions and Limitations

Life insurance policies in Australia are designed to provide financial protection to your loved ones in the event of your passing. However, they are not a guarantee of coverage for every eventuality. It’s crucial to understand the common exclusions and limitations that might affect your policy and ensure it aligns with your specific needs.

Pre-Existing Conditions

Pre-existing conditions refer to any health issues or illnesses you had before applying for life insurance. These can significantly impact your coverage and even lead to policy rejection or higher premiums.

For example, if you have a history of heart disease, diabetes, or cancer, the insurer may decline your application or offer a policy with limited coverage or higher premiums.

It’s important to be upfront with your insurer about any pre-existing conditions and provide complete medical history. This allows them to assess the risk accurately and determine the appropriate coverage and premium.

Hazardous Hobbies

Engaging in high-risk activities, known as hazardous hobbies, can also affect your life insurance coverage. These activities may include extreme sports like skydiving, rock climbing, or scuba diving.

Insurance companies may exclude coverage for death resulting from these activities or require additional premiums.

It’s essential to disclose all your hobbies and activities, even those you consider recreational, to ensure your policy adequately covers you.

Other Factors

Beyond pre-existing conditions and hazardous hobbies, other factors can influence your life insurance coverage and premiums. These include:

- Age: Older individuals generally face higher premiums due to increased risk of mortality.

- Lifestyle: Factors like smoking, excessive alcohol consumption, and drug use can increase your premiums.

- Occupation: Certain occupations, such as construction workers or firefighters, carry higher risks and may result in higher premiums.

- Family History: A family history of certain diseases can also affect your premiums.

It’s essential to understand the impact of these factors on your policy and ensure you are adequately covered.

Claims Process and Payment: Compare Life Insurance In Australia

Making a claim on your life insurance policy is a crucial step if you need to access the benefits you’ve paid for. The process involves notifying your insurer, providing supporting documentation, and following their instructions. The time it takes to process your claim and receive payment can vary depending on the complexity of the case and the insurer’s procedures.

Documentation Required for Claims

When submitting a claim, you will need to provide specific documents to support your request. These documents help your insurer verify the details of your claim and ensure that you are eligible for benefits.

- Death Certificate: In case of death, a certified copy of the death certificate is essential. This document confirms the death of the insured person and provides vital details like the date and cause of death.

- Policy Documents: You will need to provide your life insurance policy documents. These documents Artikel the terms and conditions of your policy, including the coverage amount, beneficiaries, and any exclusions.

- Medical Records: Depending on the circumstances of the claim, you may need to provide medical records related to the insured person’s health. These records can help support the claim and demonstrate the cause of death or illness.

- Proof of Identity: You will need to provide proof of your identity, such as a driver’s license or passport, to verify that you are the beneficiary or authorized representative.

Claim Submission Process

Submitting a claim typically involves contacting your insurer and providing the required documentation. Most insurers have dedicated claims departments that handle these processes.

- Contacting the Insurer: You can contact your insurer by phone, email, or online through their website. They will provide you with a claim form and instructions on how to submit it.

- Completing the Claim Form: The claim form will require you to provide detailed information about the claim, including the insured person’s details, the date of death or illness, and the beneficiaries.

- Submitting Supporting Documentation: Along with the claim form, you will need to submit the required documentation, such as the death certificate, policy documents, and medical records.

Factors Influencing Payment of Benefits

The payment of life insurance benefits is subject to certain conditions and factors. Your insurer will assess your claim based on these factors to determine if you are eligible for the full benefit amount.

- Policy Terms and Conditions: Your insurer will review the terms and conditions of your policy to ensure that the claim meets the eligibility criteria. This includes factors like the coverage amount, the cause of death or illness, and any exclusions or limitations.

- Claim Investigation: The insurer may conduct an investigation to verify the details of your claim. This investigation may involve reviewing medical records, contacting witnesses, or conducting an autopsy.

- Beneficiary Verification: The insurer will verify the identity of the beneficiary and their entitlement to receive the benefits. This ensures that the payment is made to the rightful recipient.

Role of the Insurer and Beneficiary, Compare life insurance in australia

The insurer and the beneficiary play distinct roles in the claims process.

- Insurer’s Role: The insurer is responsible for processing the claim, verifying the information, and making the payment. They have a legal obligation to handle claims fairly and promptly.

- Beneficiary’s Role: The beneficiary is responsible for submitting the claim, providing the required documentation, and cooperating with the insurer’s investigation. They have the right to be informed about the progress of the claim and to receive the benefits as per the policy terms.

Choosing the Right Insurer

Selecting the right life insurance provider is a crucial decision, as it involves entrusting your financial security to a company. It’s not just about finding the cheapest policy; it’s about finding an insurer with a strong track record, a commitment to customer satisfaction, and the financial stability to honor its commitments.

Comparing Insurers

Choosing the right life insurance provider requires careful consideration of various factors. These include:

- Financial Stability: Look for insurers with strong financial ratings from reputable agencies like Standard & Poor’s or Moody’s. A financially sound insurer is more likely to be able to pay out claims when needed.

- Reputation: Research the insurer’s reputation by reading online reviews, checking industry rankings, and looking for any complaints filed with the Australian Financial Complaints Authority (AFCA).

- Customer Service: Consider the insurer’s customer service channels, response times, and overall responsiveness. Look for insurers with a strong track record of resolving customer issues effectively.

- Claim Process: Understand the insurer’s claims process, including the required documentation and the typical timeframes for processing claims. A transparent and efficient claims process is essential for peace of mind.

- Product Features: Compare the features and benefits offered by different insurers, including coverage options, exclusions, and riders. Choose a policy that aligns with your specific needs and circumstances.

- Transparency: Opt for insurers that are transparent in their pricing, policy terms, and claims process. Avoid companies that use complex language or hide important information.

- Innovation: Consider insurers that are innovative in their approach to life insurance, offering digital tools, online platforms, and other features that enhance customer experience.

Researching and Selecting an Insurer

Researching and selecting an insurer with a strong track record and a commitment to customer satisfaction is crucial for ensuring peace of mind.

- Check Financial Ratings: Look for insurers with high financial ratings from reputable agencies like Standard & Poor’s or Moody’s. This indicates financial stability and the ability to pay out claims.

- Read Online Reviews: Explore online review platforms like ProductReview.com.au, Canstar, or Finder to gather insights from real customers about their experiences with different insurers.

- Compare Claims Data: Research insurers’ claims data, which can provide insights into their claim approval rates and average claim processing times.

- Seek Recommendations: Ask friends, family, or financial advisors for recommendations on reputable life insurance providers.

- Contact the Insurer: Contact the insurer directly to ask questions about their policies, claims process, and customer service.

Concluding Remarks

Choosing the right life insurance policy in Australia is a significant decision, one that demands careful consideration and informed research. By understanding the various types of policies, evaluating your individual needs, and comparing quotes from reputable insurers, you can secure a policy that provides peace of mind and financial security for your family in the event of your passing.

Frequently Asked Questions

What are the main types of life insurance in Australia?

The most common types are term life insurance, whole life insurance, and funeral insurance.

How much life insurance do I need?

The amount of life insurance you need depends on your individual circumstances, including your income, dependents, debts, and desired lifestyle for your family.

What factors influence life insurance premiums?

Factors like age, health, lifestyle, and coverage amount all impact your premiums.

How do I make a claim on my life insurance policy?

Contact your insurer to initiate the claims process and provide the necessary documentation.