General insurance in Australia sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This guide delves into the multifaceted world of general insurance, exploring its key features, benefits, and considerations for individuals and businesses alike.

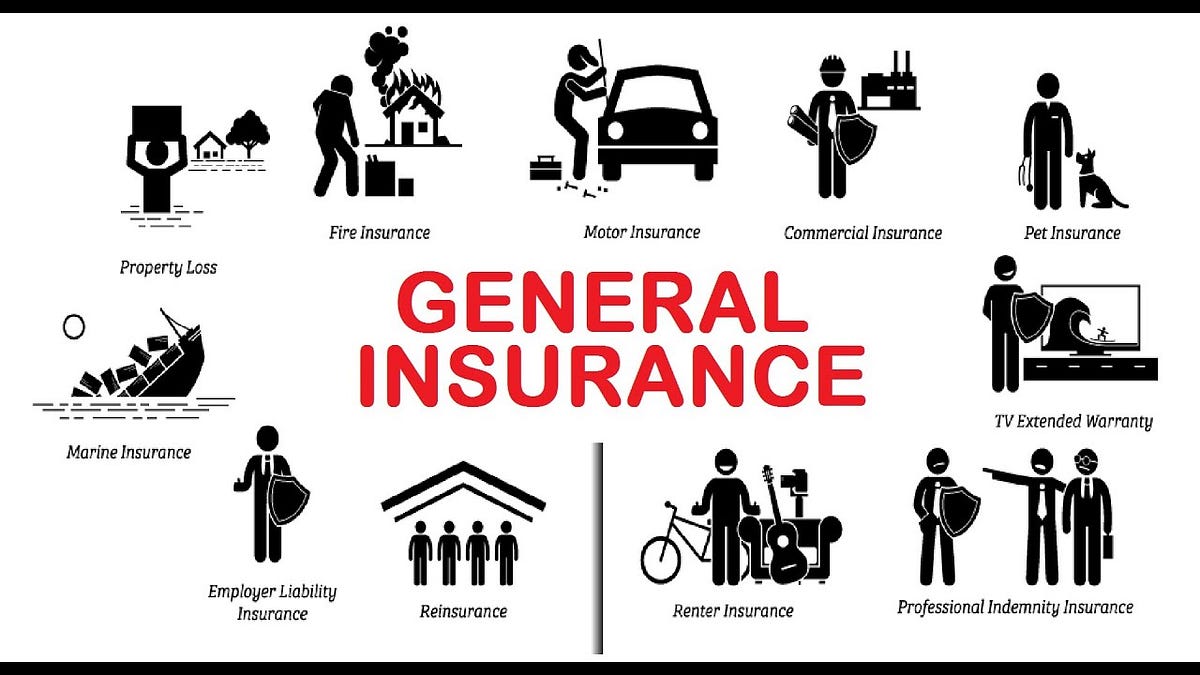

General insurance in Australia encompasses a wide range of policies designed to protect individuals and businesses against financial losses arising from unforeseen events. From safeguarding your home and car to securing your health and travels, general insurance provides a crucial safety net in a world of uncertainties. This comprehensive guide will explore the diverse types of general insurance available, the factors influencing premium calculations, and the process of making a claim, ultimately empowering you to make informed decisions about your insurance needs.

Key Features of Australian General Insurance

General insurance in Australia provides financial protection against various risks that individuals and businesses face. It covers a wide range of potential losses, offering peace of mind and financial stability in unexpected situations.

Coverage Provided by General Insurance Policies

General insurance policies typically cover a range of potential losses, offering financial protection against unexpected events. The specific coverage offered varies depending on the type of policy and the insurer.

- Property Insurance: This covers damage to or loss of property, such as homes, buildings, and contents, due to events like fire, theft, natural disasters, or vandalism. It can also include liability coverage for injuries or damage caused to others on your property.

- Motor Vehicle Insurance: This covers damage to your vehicle, injuries to yourself or others, and liability for accidents. It can include comprehensive cover (for all types of damage), third-party property damage (for damage to other vehicles or property), or third-party personal injury (for injuries to others).

- Public Liability Insurance: This covers you against claims for injury or damage caused to others by your negligence or actions. It is essential for businesses and individuals who interact with the public.

- Workers Compensation Insurance: This covers employees for injuries or illnesses sustained at work. It includes medical expenses, lost wages, and rehabilitation costs.

- Travel Insurance: This provides financial protection for unexpected events while traveling, such as medical expenses, lost luggage, flight delays, and cancellations.

Common Exclusions and Limitations

While general insurance policies provide comprehensive coverage, they often have exclusions and limitations. These are specific circumstances or events that are not covered by the policy.

- Exclusions: Common exclusions include pre-existing conditions, intentional acts, wear and tear, and certain types of natural disasters (e.g., earthquakes in some areas).

- Limitations: Policies may have limitations on the amount of coverage, the duration of coverage, or the specific events covered. For example, there may be a maximum payout for a particular claim, or a waiting period before certain benefits become available.

Premiums and Factors Influencing Premium Calculations

The premium you pay for your general insurance policy is the price you pay for the coverage provided. It is calculated based on various factors that assess the risk associated with insuring you.

- Type of Coverage: The type of insurance you choose will significantly influence your premium. For example, comprehensive motor vehicle insurance will be more expensive than third-party property damage only.

- Value of the Asset: The value of the asset being insured is a key factor. For example, a higher-value home will have a higher premium than a lower-value home.

- Location: The location of the insured property or asset can impact the premium. For example, homes in high-risk areas for natural disasters may have higher premiums.

- Your Personal Circumstances: Factors such as your age, driving history, claims history, and occupation can also influence your premium.

- Insurer’s Risk Assessment: Each insurer uses its own risk assessment models to calculate premiums. These models consider various factors to determine the likelihood of claims and the potential cost of those claims.

The premium you pay for general insurance is based on a careful assessment of the risk associated with insuring you. It is important to understand the factors that influence your premium and to compare quotes from different insurers to ensure you are getting the best value for your money.

Choosing the Right General Insurance

Finding the right general insurance policy can feel like a daunting task. With so many providers and options available, it’s crucial to make an informed decision that aligns with your specific needs and circumstances.

Comparing Insurance Providers and Policies

Comparing different insurance providers and policies is essential to finding the best value for your money. Here are some key factors to consider:

- Coverage: Carefully review the policy documents to understand the extent of coverage offered, including the types of events covered, the limits of liability, and any exclusions or limitations.

- Premiums: Compare the annual or monthly premiums charged by different providers, keeping in mind that lower premiums may come with less comprehensive coverage.

- Excess: The excess is the amount you pay out of pocket before the insurance company covers the remaining costs. A higher excess may lead to lower premiums.

- Claims Process: Research how easy it is to file a claim and how quickly the provider typically processes claims.

- Customer Service: Read reviews and ratings from other customers to get an idea of the provider’s customer service responsiveness and helpfulness.

Understanding Your Individual Needs and Risks

Before comparing insurance providers, it’s crucial to understand your specific needs and risks. Consider the following:

- Your Assets: Identify the assets you need to protect, such as your home, car, belongings, or business.

- Your Lifestyle: Your lifestyle can influence your insurance needs. For example, if you frequently travel or engage in high-risk activities, you may require more comprehensive coverage.

- Your Financial Situation: Assess your financial capacity to cover potential expenses in the event of a claim.

Seeking Advice from Financial Advisors or Insurance Brokers

Seeking advice from financial advisors or insurance brokers can be beneficial when choosing general insurance. They can provide:

- Personalized Recommendations: Based on your individual needs and circumstances, they can suggest suitable insurance providers and policies.

- Expert Guidance: They can help you understand complex insurance terminology and policies.

- Negotiation Support: They may be able to negotiate better premiums or coverage on your behalf.

Making a Claim

Making a claim under your general insurance policy is a process you hope you’ll never have to go through, but it’s important to understand how it works in case you need to.

When you make a claim, you’re essentially asking your insurer to pay for the costs associated with a covered event, such as a fire, theft, or accident. The process involves several steps, and it’s crucial to provide accurate information and documentation to ensure your claim is processed smoothly.

Submitting a Claim

Submitting a claim typically involves contacting your insurer by phone, email, or through their online portal. You’ll need to provide details about the event, including the date, time, and location, as well as any relevant information about the damage or loss. Your insurer will then guide you through the next steps.

Providing Documentation

To support your claim, you’ll need to provide documentation that verifies the event and the extent of the damage or loss. This may include:

- Police report (in case of theft or vandalism)

- Photos or videos of the damage

- Receipts for any repairs or replacements

- Proof of ownership of the damaged property

The specific documents required will depend on the type of claim and the insurer’s policy.

Claim Assessment

Once you’ve submitted your claim and provided the necessary documentation, your insurer will assess the validity of your claim and determine the amount of compensation you’re eligible for. This process may involve an inspection of the damaged property or a review of your policy documents.

Claim Outcomes

There are several possible outcomes to your claim:

- Acceptance: Your claim is accepted, and your insurer agrees to pay for the costs associated with the event. The amount of compensation you receive will depend on the terms of your policy and the extent of the damage or loss.

- Rejection: Your claim is rejected, which means your insurer will not pay for the costs associated with the event. This could happen if the event is not covered by your policy, if you didn’t provide sufficient documentation, or if your claim is deemed fraudulent.

- Partial Payment: Your claim is partially accepted, and your insurer agrees to pay for some of the costs associated with the event. This could happen if the damage or loss is only partially covered by your policy or if there are other factors that affect the amount of compensation you’re eligible for.

It’s important to understand the terms of your policy and the potential outcomes of a claim before you make one. If you have any questions or concerns, don’t hesitate to contact your insurer.

Impact of General Insurance on Australian Society

General insurance plays a crucial role in the Australian society by providing financial protection against various risks, fostering economic stability, and promoting social well-being. It acts as a safety net for individuals and businesses, helping them manage unforeseen events and recover from losses.

Role of General Insurance in Risk Management

General insurance helps individuals and businesses manage risk by providing financial compensation in case of unexpected events. This allows them to mitigate potential financial losses and focus on recovery and rebuilding. For example, home insurance protects homeowners from financial losses due to fire, theft, or natural disasters. This financial security enables them to rebuild their homes and lives without facing significant financial hardship. Similarly, car insurance provides financial protection in case of accidents, covering repair costs, medical expenses, and legal liabilities. This enables drivers to focus on their well-being and recover from the incident without facing substantial financial burdens.

Current Trends and Future Developments

The Australian general insurance market is constantly evolving, driven by technological advancements, changing customer expectations, and evolving regulatory landscapes. Understanding these trends and anticipating future developments is crucial for insurers to remain competitive and meet the evolving needs of their customers.

Digitalization and Data Analytics

Digitalization is transforming the Australian general insurance industry. Insurers are increasingly leveraging technology to streamline processes, enhance customer experiences, and gain valuable insights from data.

- Online Platforms and Mobile Apps: Many insurers now offer online platforms and mobile apps for policy purchase, claims reporting, and customer service interactions. This provides convenience and accessibility for customers.

- Data Analytics and Predictive Modeling: Insurers are using data analytics to understand customer behavior, identify risk factors, and develop personalized pricing models. This allows for more accurate risk assessments and efficient resource allocation.

- Artificial Intelligence (AI): AI is being integrated into various aspects of insurance, including fraud detection, claims processing, and customer support. AI-powered chatbots can handle routine inquiries, while machine learning algorithms can analyze vast amounts of data to identify patterns and improve decision-making.

Future Challenges and Opportunities

The Australian general insurance market faces several challenges and opportunities in the coming years.

- Cybersecurity Threats: As insurers increasingly rely on technology, they become more vulnerable to cyberattacks. Ensuring robust cybersecurity measures is essential to protect customer data and maintain operational continuity.

- Climate Change and Natural Disasters: The increasing frequency and severity of natural disasters pose significant challenges to the insurance industry. Insurers need to adapt their risk assessment models and pricing strategies to account for climate change impacts.

- Regulatory Changes: The regulatory landscape for general insurance is constantly evolving. Insurers need to stay informed about new regulations and adapt their practices accordingly. This includes compliance with data privacy laws and regulations governing the use of AI and other emerging technologies.

- Emerging Technologies: Advancements in technologies such as blockchain, Internet of Things (IoT), and wearable devices present both challenges and opportunities for insurers. These technologies can enable more efficient risk assessment, personalized pricing, and innovative insurance products.

The Evolving Role of Technology in Insurance, General insurance in australia

Technology is playing an increasingly pivotal role in the Australian general insurance industry.

“Technology is not just changing the way we do business, it’s changing the business itself.” – Michael Porter

- Improved Customer Experience: Technology enables insurers to offer personalized services, faster claim processing, and 24/7 accessibility. This enhances customer satisfaction and loyalty.

- Enhanced Risk Management: Data analytics and AI allow insurers to better understand and manage risks, leading to more accurate pricing and improved underwriting decisions.

- Innovation and New Products: Emerging technologies enable insurers to develop innovative products and services that meet the evolving needs of customers. Examples include telematics-based insurance, which uses data from vehicle sensors to provide personalized pricing based on driving behavior.

Wrap-Up: General Insurance In Australia

In conclusion, general insurance plays a pivotal role in Australian society, providing financial protection and peace of mind. Understanding the nuances of general insurance empowers individuals and businesses to navigate the complexities of risk management effectively. As technology continues to shape the industry, embracing digital solutions and data analytics will be crucial for insurance providers to stay competitive and meet the evolving needs of their customers. By staying informed and making informed decisions, Australians can leverage the power of general insurance to safeguard their future and navigate the uncertainties of life with confidence.

FAQ Compilation

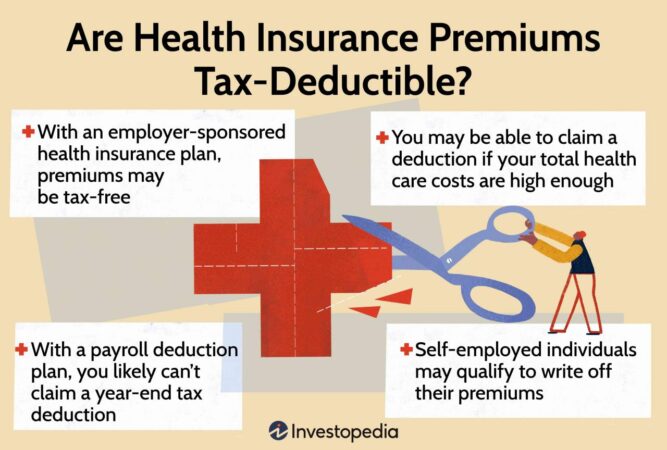

What is the difference between general insurance and life insurance?

General insurance covers risks related to property, possessions, health, and travel, while life insurance provides financial protection to beneficiaries in the event of the policyholder’s death.

How do I choose the right insurance provider?

Consider factors such as coverage, premiums, customer service, claims handling, and financial stability of the provider.

What are the common exclusions in general insurance policies?

Exclusions can vary by policy, but common ones include pre-existing conditions, intentional acts, and acts of war.

What is the role of the Australian Prudential Regulation Authority (APRA)?

APRA regulates the general insurance industry to ensure financial stability and protect consumers’ interests.