How much car insurance cost in Australia is a question many drivers ask. The cost of car insurance in Australia can vary significantly depending on a number of factors, including the type of vehicle you drive, your age, driving history, location, and the level of coverage you choose. Understanding these factors can help you make informed decisions about your car insurance and potentially save money.

This guide explores the key elements that influence car insurance costs in Australia, providing insights into how different factors contribute to the overall price. It also covers the various types of car insurance coverage available, offering a comprehensive understanding of their benefits, limitations, and associated costs. Furthermore, we delve into practical tips for obtaining accurate quotes, comparing insurance providers, and exploring strategies to reduce your premiums.

Factors Influencing Car Insurance Costs in Australia

Car insurance premiums in Australia are influenced by a variety of factors, each contributing to the overall cost. Understanding these factors can help you make informed decisions when choosing your car insurance policy.

Vehicle Type, How much car insurance cost in australia

The type of vehicle you drive significantly impacts your insurance premiums. This is because different vehicle types pose varying risks to insurers. For example, luxury cars or high-performance vehicles are more expensive to repair and replace, leading to higher premiums. Conversely, older, smaller cars typically have lower insurance costs.

- Vehicle Age: Newer cars generally have more safety features and are less prone to breakdowns, resulting in lower premiums. Older cars, on the other hand, may have higher premiums due to potential maintenance costs and increased risk of accidents.

- Vehicle Value: The market value of your vehicle plays a crucial role in determining your insurance premium. Expensive cars, such as luxury or high-performance models, have higher replacement costs, leading to higher insurance premiums. In contrast, less expensive cars will have lower premiums.

- Vehicle Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are considered safer and therefore attract lower insurance premiums. These features help reduce the likelihood of accidents and injuries, resulting in lower claims for insurers.

Age and Driving History

Your age and driving history are significant factors considered by insurers. Younger drivers, especially those with limited driving experience, are statistically more likely to be involved in accidents. This increased risk translates to higher insurance premiums. Conversely, older drivers with a clean driving record generally benefit from lower premiums.

- Driving History: A clean driving record with no accidents or traffic violations is a major factor in obtaining lower insurance premiums. Insurers view drivers with a history of accidents or offenses as higher risk, leading to higher premiums. However, drivers with a long history of safe driving may qualify for discounts.

- Age: Younger drivers, especially those under 25, are generally considered higher risk due to their inexperience and potential for recklessness. This translates to higher insurance premiums. As drivers age and gain experience, their premiums tend to decrease. However, drivers over 70 may also face higher premiums due to potential health concerns.

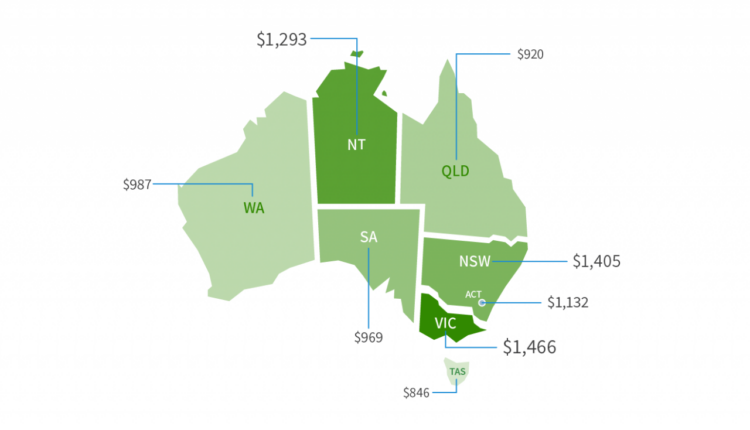

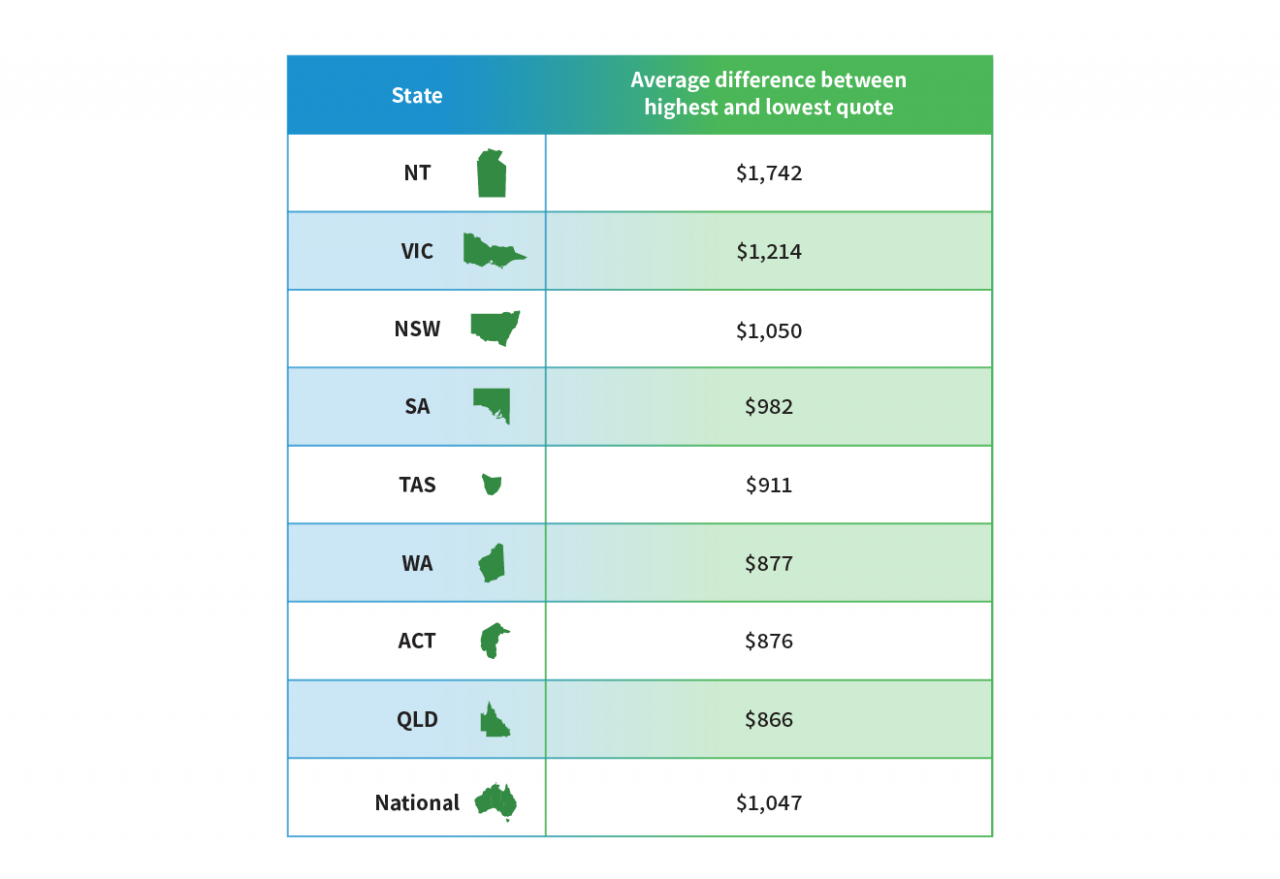

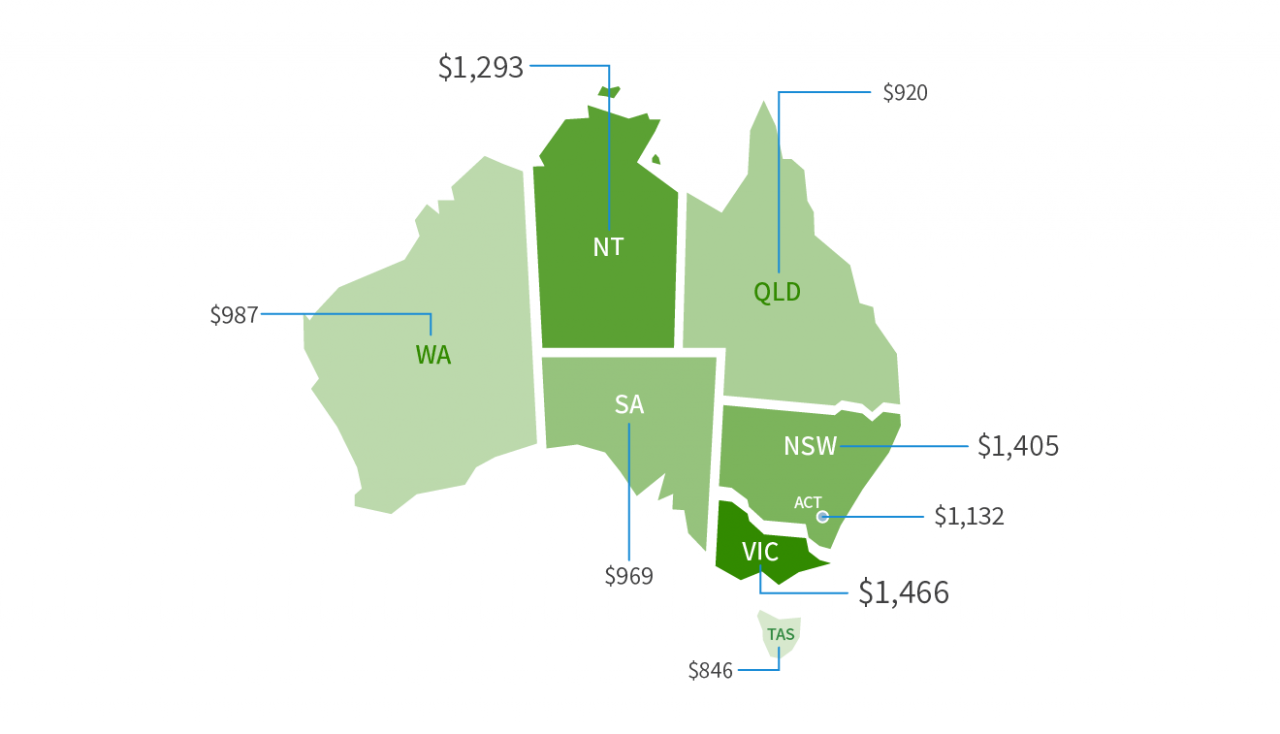

Location

The location where you live can influence your car insurance premiums. Areas with high crime rates, congested traffic, or a high frequency of accidents tend to have higher insurance premiums. This is because insurers face a higher risk of claims in these locations.

- Traffic Density: Areas with heavy traffic increase the likelihood of accidents, leading to higher insurance premiums. This is because congested traffic conditions can lead to more frequent fender benders and other collisions.

- Crime Rates: Areas with high crime rates are associated with an increased risk of car theft and vandalism, leading to higher insurance premiums. Insurers factor in these risks when calculating premiums, as they may have to cover the cost of stolen or damaged vehicles.

- Weather Conditions: Regions with extreme weather conditions, such as heavy rain, snow, or hail, can increase the risk of accidents and damage to vehicles. Insurers may adjust premiums to reflect these risks.

Coverage Options

The type and amount of coverage you choose also affect your car insurance premiums. Comprehensive coverage, which protects you against a wider range of risks, including theft, vandalism, and natural disasters, is generally more expensive than basic liability coverage.

- Excess: The excess is the amount you pay out of pocket in the event of a claim. A higher excess generally leads to lower premiums, as you are taking on more of the financial risk. However, it’s important to choose an excess you can comfortably afford.

- Optional Extras: Some insurers offer optional extras, such as roadside assistance, windscreen cover, and new-for-old replacement, which can increase your premium. It’s important to weigh the benefits of these extras against the additional cost.

Getting Quotes and Comparing Car Insurance

Obtaining accurate car insurance quotes is crucial for finding the best deal. Comparing quotes from multiple providers is essential to ensure you’re getting the most competitive price and coverage. This section will guide you through the process of obtaining and comparing car insurance quotes in Australia.

Obtaining Accurate Quotes

It’s essential to provide accurate information to insurers when requesting quotes. This ensures you receive quotes that reflect your specific needs and circumstances.

- Be Honest and Detailed: Provide accurate information about your vehicle, driving history, and any other relevant details. This includes your car’s make, model, year, and modifications, as well as your driving history, including any accidents or traffic violations.

- Specify Your Needs: Clearly communicate your coverage requirements. Do you need comprehensive or third-party property damage (TPPD) insurance? Are you looking for additional features like roadside assistance or excess reduction? The more specific you are, the more accurate the quotes you receive.

- Compare Quotes Online: Many insurers offer online quote tools. This allows you to quickly compare quotes from multiple providers without leaving your home. You can also use comparison websites that aggregate quotes from various insurers, making the process even easier.

- Contact Insurers Directly: Don’t hesitate to contact insurers directly if you have any questions or need clarification. They can provide personalized advice and ensure you understand the terms and conditions of their policies.

Comparing Quotes

Once you have a few quotes, it’s time to compare them carefully. Consider the following factors when evaluating each quote:

- Premium: The premium is the amount you pay for your insurance. It’s important to compare premiums from different insurers to find the most affordable option.

- Coverage: Ensure that the coverage offered by each insurer meets your needs. Consider factors like the amount of excess you’re willing to pay, the level of comprehensive coverage, and any additional benefits included.

- Key Features: Some insurers offer additional features, such as roadside assistance, new-for-old replacement, or discounts for safe driving. These features can add value to your policy and make it more appealing.

- Customer Service: Read online reviews or ask for recommendations from friends and family to get an idea of each insurer’s customer service reputation.

- Claims Process: Inquire about the insurer’s claims process and how they handle claims. A straightforward and efficient claims process is essential, especially if you need to make a claim in the future.

Comparison Table

The following table can help you organize and compare quotes from different insurers:

| Insurer Name | Coverage Type | Premium | Key Features |

|---|---|---|---|

| Insurer A | Comprehensive | $1,000 | Roadside assistance, new-for-old replacement |

| Insurer B | TPPD | $800 | Excess reduction, discount for safe driving |

| Insurer C | Comprehensive | $1,200 | No frills, basic coverage |

Saving Money on Car Insurance: How Much Car Insurance Cost In Australia

Car insurance is a necessity for most Australians, but it can be a significant expense. Luckily, there are several strategies you can use to reduce your car insurance costs. By understanding these strategies and implementing them effectively, you can save money on your premiums without compromising on the coverage you need.

Increasing Your Excess

Increasing your excess, which is the amount you pay out of pocket before your insurance covers the rest, can significantly lower your premiums. The higher your excess, the lower your premium will be.

For example, if you increase your excess from $500 to $1000, you might see a 10-15% reduction in your premium. However, it’s crucial to choose an excess amount you can comfortably afford. If you have to claim and can’t cover the excess, you’ll end up paying more in the long run.

Choosing a No-Claims Bonus

A no-claims bonus (NCB) is a discount you receive on your insurance premiums for not making any claims in a specific period. The longer you go without making a claim, the higher your NCB becomes, leading to substantial savings.

Many insurance companies offer NCBs, and the amount of discount varies depending on the insurer and your driving history. Some insurers offer a discount of up to 50% for drivers with a long no-claims history.

Bundling Insurance Policies

Bundling your car insurance with other policies, such as home or contents insurance, can often result in significant discounts. Insurance companies often offer bundled packages at a lower price than purchasing each policy separately.

This strategy is particularly beneficial if you need multiple types of insurance. For example, if you need car insurance, home insurance, and contents insurance, you could potentially save hundreds of dollars per year by bundling these policies together.

Claims and Insurance Processes

Making a car insurance claim can be a stressful experience, but understanding the process and knowing your rights can make it easier. Here’s a breakdown of the key steps involved and what you can expect.

Filing a Claim

Once you’ve been involved in an accident, theft, or experienced damage due to a natural disaster, the first step is to contact your insurance company as soon as possible. They’ll provide you with a claim number and guide you through the next steps.

- Report the Incident: Inform your insurer about the details of the incident, including the date, time, location, and any injuries involved. Be sure to have all relevant information readily available, such as the other driver’s details if applicable.

- Gather Evidence: Take photographs of the damage to your vehicle and the accident scene. If there were witnesses, collect their contact information.

- File the Claim: Complete the necessary claim forms provided by your insurer, ensuring you provide accurate and complete information.

- Provide Documentation: Your insurer may require additional documentation, such as police reports, medical records, or repair estimates.

Types of Claims

There are several common types of claims that car insurance policies cover.

- Accident Claims: These are the most frequent type of claim, covering damage to your vehicle and other property if you’re involved in a collision with another vehicle, object, or pedestrian.

- Theft Claims: If your car is stolen, your insurance will cover the cost of replacing it or the value of the vehicle, depending on your policy.

- Natural Disaster Claims: Your insurance may cover damage to your vehicle caused by events like floods, earthquakes, hailstorms, or bushfires. The extent of coverage depends on your policy and the specific disaster.

Navigating the Claims Process

It’s important to be proactive and organized throughout the claims process.

- Understand Your Policy: Review your policy thoroughly to understand your coverage, exclusions, and any relevant terms and conditions.

- Communicate Clearly: Maintain clear and open communication with your insurance company, providing all necessary information promptly. Ask questions if you’re unsure about anything.

- Be Patient: The claims process can take time, especially for complex situations. Be patient and cooperate with your insurer.

- Seek Independent Advice: If you feel overwhelmed or have concerns about the process, consider seeking advice from a legal professional or an independent insurance broker.

Final Thoughts

Navigating the world of car insurance in Australia can be complex, but by understanding the factors that influence costs, comparing quotes from different insurers, and exploring cost-saving strategies, you can find the best coverage for your needs at a price that fits your budget. Remember to review your insurance policy regularly and adjust it as necessary to ensure you have the right level of protection.

FAQ Section

What are the main factors that affect car insurance premiums in Australia?

The main factors include your vehicle type, age, driving history, location, and the level of coverage you choose. For example, a luxury car will generally cost more to insure than a standard sedan.

How can I get the best car insurance deal?

Compare quotes from multiple insurers, consider increasing your excess, and explore discounts for bundling insurance policies. Remember to read the fine print and understand the terms and conditions of each policy.

What happens if I need to make a claim?

Contact your insurer as soon as possible after an accident or incident. Provide them with all the necessary information, including details of the incident and any witnesses. Your insurer will guide you through the claims process.