How much does insurance cost in Australia? This question weighs on the minds of many Australians, as the cost of living continues to rise. Navigating the complexities of insurance in Australia can be daunting, with numerous factors influencing premiums. From your age and location to your driving history and the specific type of insurance you need, understanding these variables is crucial to securing the best possible coverage at a reasonable price.

This guide aims to demystify the world of Australian insurance costs, providing insights into the key factors that shape premiums, a comprehensive overview of different insurance types, and practical tips to help you save money. We’ll also delve into the role of government regulations and emerging trends that are shaping the future of insurance in Australia.

Factors Influencing Insurance Costs

Insurance premiums in Australia are calculated based on a complex interplay of factors, ensuring that individuals pay a price that reflects their risk profile.

Age

Age is a significant factor influencing insurance costs. Younger drivers are statistically more likely to be involved in accidents due to factors like inexperience and risk-taking behavior. As drivers age, their experience increases, and their risk profile generally improves, leading to lower premiums.

Location

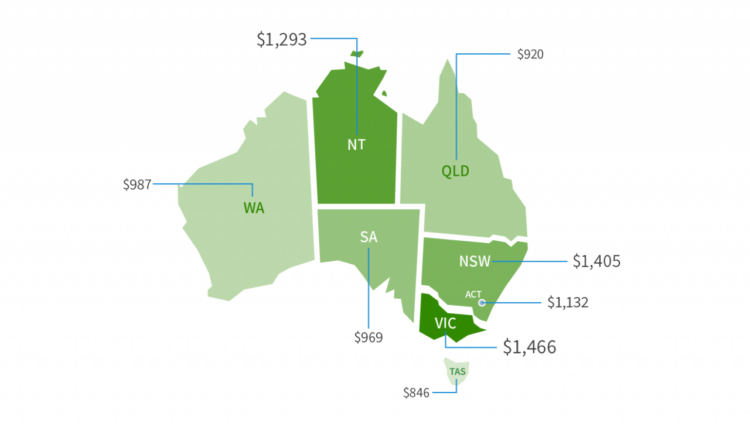

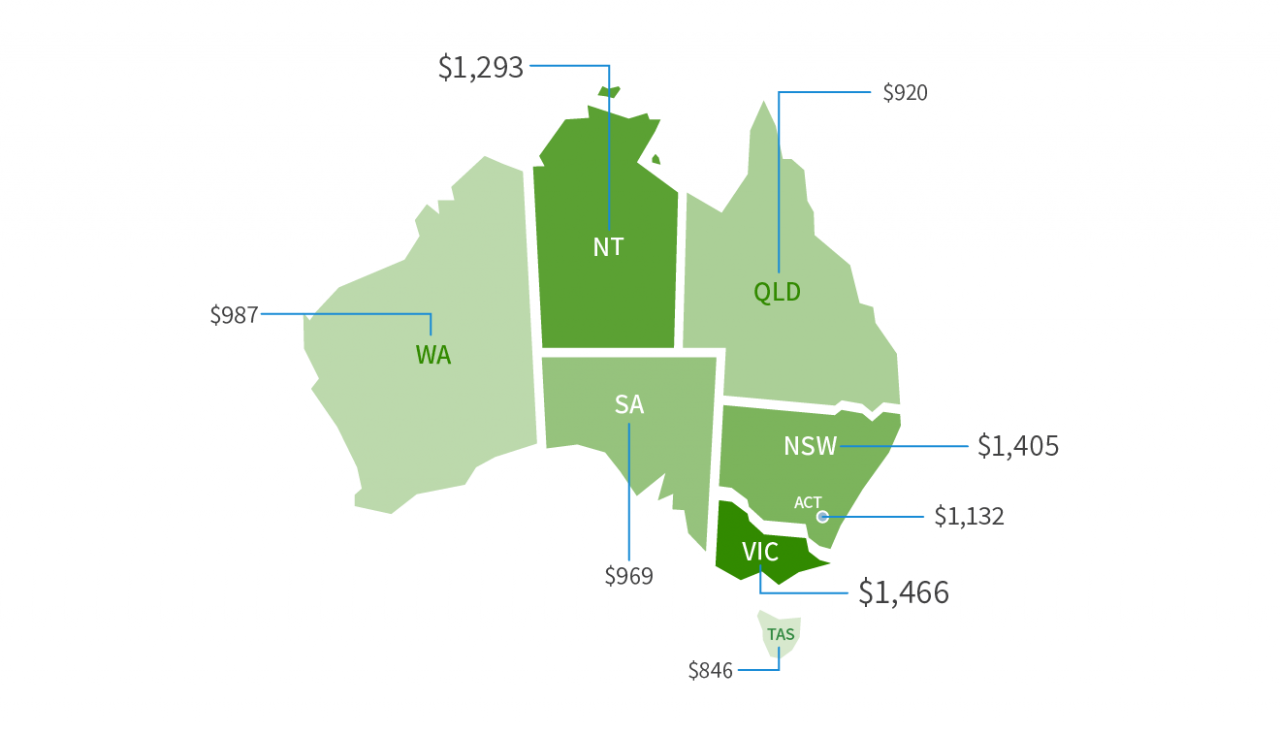

The location where you live can also influence insurance premiums. Areas with higher crime rates, traffic congestion, or a higher incidence of accidents may result in higher premiums. Insurance companies assess the risk associated with different locations and adjust premiums accordingly.

Driving History

Your driving history plays a crucial role in determining insurance costs. A clean driving record with no accidents or traffic violations can lead to lower premiums. Conversely, individuals with a history of accidents, speeding tickets, or other offenses may face higher premiums as they are considered a higher risk.

Individual Risk Profiles

Beyond age, location, and driving history, several other factors contribute to your individual risk profile, influencing your insurance costs. These factors can include:

- Type of vehicle: The make, model, and age of your vehicle can influence premiums. High-performance cars or luxury vehicles are often associated with higher risk and, therefore, higher premiums.

- Usage: The frequency and purpose of your driving can also impact your premiums. Individuals who drive long distances daily or use their vehicles for business purposes may face higher premiums.

- Claims history: Your claims history, even if you were not at fault, can affect your premiums. Insurance companies track claims data to assess risk and adjust premiums accordingly.

- Occupation: Certain occupations may be associated with higher risk, such as those involving frequent travel or driving in hazardous conditions.

- Credit score: In some cases, your credit score may be used to assess your risk profile. Individuals with lower credit scores may face higher premiums as they are considered a higher risk.

Types of Insurance in Australia

Australia offers a diverse range of insurance options to cater to various needs and protect individuals and businesses against unforeseen events. These insurance policies provide financial security and peace of mind, helping individuals and businesses mitigate potential risks.

Health Insurance

Private health insurance in Australia provides coverage for medical expenses not covered by Medicare, the government-funded universal healthcare system. It offers benefits like access to private hospitals, shorter waiting times for elective surgery, and coverage for a broader range of medical services.

The cost of health insurance varies depending on factors such as age, location, level of cover, and pre-existing medical conditions. For example, a young and healthy individual in a low-cost area may pay less for basic cover compared to an older person with pre-existing conditions seeking comprehensive cover in a metropolitan area.

Here’s a table comparing the average costs of different health insurance types across different age groups:

| Age Group | Basic Cover (Monthly) | Comprehensive Cover (Monthly) |

|—|—|—|

| 18-29 | $100-$200 | $250-$400 |

| 30-44 | $150-$300 | $350-$550 |

| 45-64 | $200-$400 | $450-$700 |

| 65+ | $250-$500 | $550-$850 |

It’s important to note that these are just average figures, and actual costs may vary depending on individual circumstances.

Car Insurance, How much does insurance cost in australia

Car insurance in Australia is mandatory, covering third-party liability and providing financial protection against damage to other vehicles or property in an accident. Optional coverages, such as comprehensive insurance, can also be purchased to protect your own vehicle from damage or theft.

Car insurance premiums are calculated based on factors such as the vehicle’s age, make, and model, the driver’s age, driving history, and location. For example, a new, high-performance car driven by a young driver in a high-risk area will typically have a higher premium than an older, basic car driven by an experienced driver in a low-risk area.

Home Insurance

Home insurance protects homeowners against financial losses resulting from damage or destruction to their property due to various events, including fire, theft, storms, and natural disasters. It also provides liability coverage for accidents that occur on the property.

The cost of home insurance depends on factors such as the value of the property, its location, and the level of cover. For instance, a large, expensive house in a coastal area with a high risk of natural disasters will generally have a higher premium than a smaller, less valuable house in an inland area with a lower risk profile.

Life Insurance

Life insurance provides financial protection to beneficiaries in the event of the policyholder’s death. It can be used to cover funeral expenses, outstanding debts, or provide financial support for dependents.

Life insurance premiums are calculated based on factors such as the policyholder’s age, health, and the amount of coverage. For example, a younger and healthier individual will typically pay lower premiums than an older person with pre-existing health conditions.

Income Protection Insurance

Income protection insurance provides financial support if you are unable to work due to illness or injury. It pays a regular income replacement to help cover your living expenses while you are unable to earn.

Income protection premiums are calculated based on factors such as your age, occupation, income, and health. For example, a high-income earner in a physically demanding job will typically pay higher premiums than a lower-income earner in a less demanding job.

Travel Insurance

Travel insurance provides financial protection against unforeseen events while traveling overseas. It can cover medical expenses, trip cancellation, lost luggage, and other travel-related emergencies.

Travel insurance premiums are calculated based on factors such as your destination, the length of your trip, and the level of cover. For example, a trip to a high-risk destination with a comprehensive level of cover will typically have a higher premium than a trip to a low-risk destination with basic cover.

Insurance Providers and Their Pricing

Navigating the Australian insurance market can be overwhelming, with numerous providers offering a diverse range of policies and pricing models. Understanding the key players and their pricing strategies is crucial for securing the best insurance coverage at a competitive price.

Major Insurance Providers in Australia

This section delves into the prominent insurance providers in Australia, outlining their core features and pricing strategies.

- AAMI: Known for its comprehensive insurance offerings, AAMI provides car, home, travel, and health insurance. They are recognized for their competitive pricing, particularly for young drivers, and offer discounts for bundling multiple policies. AAMI’s pricing model often focuses on risk assessment, considering factors like driving history and vehicle type.

- RACQ: Predominantly operating in Queensland, RACQ is a prominent provider of car, home, and travel insurance. They are known for their strong community focus and offer discounts for members, emphasizing loyalty programs. RACQ’s pricing strategy often prioritizes customer satisfaction, offering competitive rates and flexible payment options.

- Suncorp: A leading insurer in Australia, Suncorp offers a wide range of insurance products, including car, home, business, and travel insurance. They are recognized for their innovative digital services and personalized insurance solutions. Suncorp’s pricing model typically incorporates a blend of risk assessment and customer segmentation, catering to different needs and budgets.

- NRMA: Primarily operating in New South Wales and the ACT, NRMA provides car, home, and travel insurance. They are known for their commitment to road safety and offer discounts for safe driving practices. NRMA’s pricing strategy often focuses on risk mitigation, incentivizing safe driving behaviors through discounted premiums.

- GIO: A subsidiary of Suncorp, GIO offers a range of insurance products, including car, home, and business insurance. They are known for their straightforward and transparent pricing models. GIO’s pricing strategy often emphasizes simplicity and clarity, providing upfront quotes and easy-to-understand policies.

Pricing Models of Insurance Companies

Insurance companies employ various pricing models to determine premiums, balancing risk assessment, competition, and profitability. Here are some common pricing strategies:

- Risk-Based Pricing: This model relies on assessing the risk associated with each individual or policyholder. Factors like driving history, age, location, and vehicle type influence premiums. Higher-risk individuals generally pay higher premiums.

For instance, a young driver with a history of accidents might face higher car insurance premiums compared to an older driver with a clean driving record.

- Bundling Discounts: Many insurance companies offer discounts when customers bundle multiple policies, such as car and home insurance. This encourages loyalty and reduces administrative costs for the insurer.

A customer bundling car and home insurance with the same provider might receive a significant discount compared to purchasing separate policies from different companies.

- Loyalty Programs: Some insurers reward long-term customers with loyalty programs, offering discounts or exclusive benefits. This fosters customer retention and encourages long-term relationships.

A customer who has been with an insurer for several years might receive a loyalty discount on their premiums, incentivizing them to stay with the same provider.

Average Car Insurance Premiums in Australia

This table presents average car insurance premiums for different insurance providers, based on a hypothetical profile of a 30-year-old driver with a clean driving record, driving a 2018 Toyota Corolla in Sydney.

| Insurance Provider | Average Annual Premium |

|---|---|

| AAMI | $1,200 |

| RACQ | $1,150 |

| Suncorp | $1,300 |

| NRMA | $1,250 |

| GIO | $1,100 |

Tips for Reducing Insurance Costs

Insurance premiums can be a significant expense, but there are several strategies you can employ to reduce your costs. By taking a proactive approach, you can potentially save a considerable amount of money on your insurance policies.

Comparing Quotes from Multiple Providers

It is crucial to compare quotes from multiple insurance providers before settling on a policy. Different providers have varying pricing structures and may offer discounts or benefits that others do not.

- Using online comparison websites can streamline the process and allow you to quickly compare quotes from multiple insurers.

- Contacting providers directly can give you a more personalized experience and allow you to ask specific questions about their policies.

- Consider factors like customer service, claims handling, and policy features when comparing quotes, not just price.

Impact of Deductibles and Safety Features

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically results in a lower premium, as you are assuming more financial responsibility for smaller claims.

- Increasing your deductible can lead to substantial savings on your premiums, especially for policies like car insurance.

- However, it is important to ensure you can afford the deductible if you need to make a claim.

Investing in safety features for your car, home, or business can also lower your insurance costs.

- Installing security systems, smoke detectors, and other safety features can demonstrate to insurers that you are taking proactive steps to mitigate risks.

- This can lead to discounts on your premiums, reflecting the reduced likelihood of claims.

Government Regulations and Insurance Costs

Government regulations play a crucial role in shaping the insurance landscape in Australia, influencing both the types of insurance available and the costs associated with them. These regulations aim to ensure fairness, transparency, and consumer protection within the insurance market.

Impact of Australian Competition and Consumer Commission (ACCC) Guidelines

The ACCC actively monitors the insurance industry to prevent anti-competitive practices and ensure fair pricing. Its guidelines address various aspects of insurance pricing, including:

- Transparency: Insurers are required to be transparent about their pricing methodologies, including the factors considered in determining premiums.

- Non-discrimination: Insurers cannot discriminate against customers based on factors unrelated to risk, such as gender or postcode.

- Product comparisons: The ACCC encourages insurers to provide clear and concise product comparisons to help consumers make informed choices.

These guidelines have contributed to greater price competition and consumer awareness, potentially leading to lower insurance costs.

Potential Impact of Future Regulatory Changes

The insurance industry is subject to ongoing regulatory scrutiny, and future changes may significantly impact insurance costs.

- Increased scrutiny of pricing models: Regulators may scrutinize pricing models more closely to ensure they are fair and transparent, potentially leading to adjustments in premiums.

- New regulations for specific insurance types: New regulations could be introduced for specific types of insurance, such as health insurance, which could affect premiums and coverage.

- Changes in data privacy laws: Changes in data privacy laws could impact how insurers collect and use data for pricing purposes, potentially influencing premium calculations.

It’s crucial for consumers to stay informed about regulatory developments as they can have a direct impact on their insurance costs.

Emerging Trends in Insurance Costs

The Australian insurance landscape is constantly evolving, driven by factors such as technological advancements, changing demographics, and evolving consumer behavior. These trends are influencing insurance costs and how insurers operate, creating a dynamic environment for both insurers and policyholders.

Impact of Technological Advancements

Technological advancements are playing a significant role in shaping the insurance industry, particularly in the area of pricing.

- Telematics: Telematics devices, which track driving behavior, are increasingly used by insurers to assess risk and provide personalized pricing. This technology enables insurers to gather data on factors like speed, braking, and time of day, leading to more accurate risk assessments and potentially lower premiums for safe drivers. For example, a driver who consistently maintains a safe driving record might receive a discount on their car insurance.

- Artificial Intelligence (AI): AI is being employed to automate various aspects of insurance, from underwriting to claims processing. AI algorithms can analyze vast amounts of data to identify patterns and predict future risks, enabling insurers to offer more precise pricing and personalized policies. This can result in more competitive pricing for consumers while also improving the efficiency of the insurance industry.

- Internet of Things (IoT): The growing use of connected devices, such as smart home appliances and wearable fitness trackers, is providing insurers with valuable data about individual risk profiles. This data can be used to develop personalized insurance policies and adjust premiums based on individual behavior and risk factors. For example, a homeowner who installs a smart home security system might receive a discount on their home insurance.

Influence of Changing Demographics

Australia’s aging population and the rise of the “gig economy” are creating new challenges and opportunities for insurers.

- Aging Population: As the population ages, the demand for health insurance and long-term care insurance is increasing. Insurers are adapting their products and services to meet the needs of this growing demographic, potentially leading to changes in pricing for these types of insurance.

- Gig Economy: The rise of the gig economy, where individuals work independently, has created a need for new types of insurance coverage. Insurers are developing products specifically tailored to the needs of gig workers, such as income protection insurance and liability insurance. The pricing of these products will likely be influenced by factors like the type of work, the level of risk, and the individual’s earnings.

Impact of Evolving Consumer Behavior

Consumer behavior is changing, with individuals becoming more informed and demanding more personalized and transparent insurance solutions.

- Demand for Transparency: Consumers are increasingly demanding transparency from insurers, seeking clear and concise information about their policies and pricing. Insurers are responding to this demand by providing more detailed policy documents and online tools that allow customers to compare prices and coverage options.

- Focus on Value: Consumers are also prioritizing value for money, looking for insurance products that offer comprehensive coverage at competitive prices. This is driving insurers to innovate and develop new products and services that meet the evolving needs of their customers. For example, insurers are offering bundled insurance packages that combine multiple types of insurance, providing customers with a more cost-effective solution.

Last Word

As you navigate the Australian insurance landscape, remember that understanding your individual needs and comparing quotes from multiple providers is essential to finding the best value for your money. By staying informed and utilizing the resources available, you can secure the coverage you need without breaking the bank. Ultimately, a proactive approach to insurance can provide peace of mind and financial security in an increasingly uncertain world.

FAQ Explained: How Much Does Insurance Cost In Australia

What are the main factors that influence insurance costs in Australia?

Several factors play a role in determining your insurance premiums, including your age, location, driving history, risk profile, the type of insurance, and the coverage you choose.

How can I find the cheapest insurance in Australia?

The best way to find affordable insurance is to compare quotes from multiple providers. Online comparison websites can streamline this process, allowing you to see different premiums side-by-side. Additionally, consider increasing your deductible, choosing safety features for your car, and maintaining a clean driving record.

Is it better to bundle my insurance policies?

Bundling your insurance policies, such as car, home, and contents insurance, can often lead to discounts. Check with your insurer to see if they offer bundling options and compare their rates with other providers.

What are some emerging trends in the Australian insurance market?

The Australian insurance market is evolving rapidly, with technological advancements, changing demographics, and consumer behavior all influencing pricing. Telematics, which use data from your vehicle to track driving habits, are becoming increasingly common, potentially leading to personalized premiums based on your driving style.