How much is home insurance in Australia? The answer depends on a multitude of factors, from the size and type of your home to its location and the level of coverage you choose. Understanding these factors is crucial for securing the right insurance at a price that fits your budget.

Navigating the world of home insurance can feel overwhelming, but it doesn’t have to be. This guide breaks down the essential aspects of home insurance in Australia, from determining your insurance needs to comparing quotes and finding the best policy for your unique situation.

Factors Influencing Home Insurance Costs

The cost of home insurance in Australia can vary significantly depending on a number of factors. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money on your premiums.

Key Factors Influencing Home Insurance Premiums

Several key factors influence the cost of home insurance premiums in Australia. These factors are related to the risk associated with insuring your property.

| Factor | Description | Impact on Premium | Example |

|---|---|---|---|

| Building Type | The type of construction materials used in your home, such as brick, timber, or concrete, can affect the risk of damage. | Homes with more fire-resistant materials generally have lower premiums. | A brick home is typically considered more fire-resistant than a timber home, so the insurance premium may be lower. |

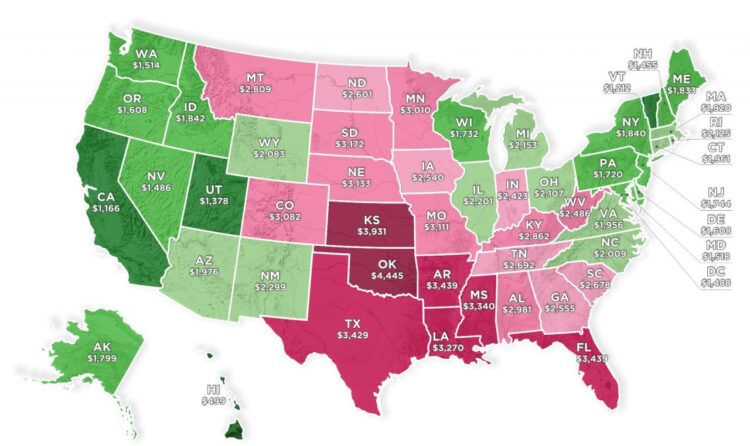

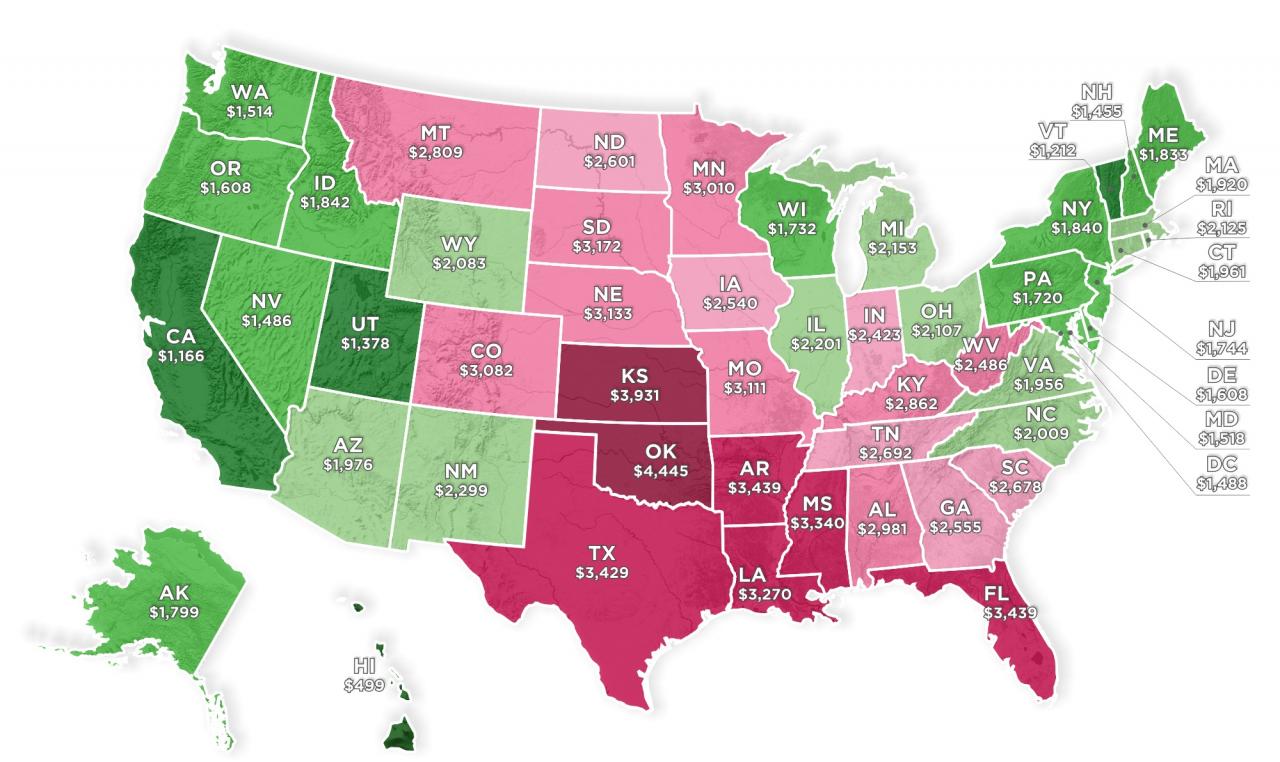

| Location | Your home’s location, including its proximity to fire hazards, flood zones, or areas with high crime rates, can influence the risk of damage. | Homes in high-risk areas may have higher premiums. | A home located in a bushfire-prone area may have a higher insurance premium than a home in a more urban location. |

| Coverage Options | The level of coverage you choose, including the amount of insurance you select and the types of risks covered, can affect your premium. | Higher levels of coverage generally lead to higher premiums. | Choosing comprehensive coverage that includes protection against natural disasters will likely result in a higher premium than basic coverage. |

| Security Features | Security features like alarms, security cameras, and strong doors can reduce the risk of theft and vandalism. | Homes with good security features may have lower premiums. | Installing a security system with a monitored alarm can lead to a discount on your insurance premium. |

| Claim History | Your past claims history, including the number and type of claims you have made, can impact your premium. | Frequent or large claims can lead to higher premiums. | If you have made several claims in the past, your insurer may consider you a higher risk and charge a higher premium. |

| Age of the Property | Older homes may be more prone to wear and tear, which can increase the risk of damage. | Older homes may have higher premiums. | A home that is over 50 years old may have a higher insurance premium than a newer home. |

| Maintenance and Upkeep | Regular maintenance and upkeep can help reduce the risk of damage and lower insurance premiums. | Well-maintained homes may have lower premiums. | Having a recent building inspection and keeping your roof in good condition can help you secure a lower premium. |

Types of Home Insurance Coverage

Choosing the right home insurance policy can be overwhelming, given the various options available. Understanding the different types of coverage is crucial to securing the right protection for your property and belongings.

Home Insurance Coverage Types

| Coverage Type | Description | Key Benefits | Typical Exclusions |

|---|---|---|---|

| Building Insurance | Covers the physical structure of your home, including the walls, roof, foundations, and fixtures. |

|

|

| Contents Insurance | Covers your personal belongings inside your home, such as furniture, appliances, clothing, and valuables. |

|

|

| Combined Policies | Offers comprehensive coverage that includes both building and contents insurance in a single policy. |

|

|

Obtaining Quotes and Comparing Policies: How Much Is Home Insurance In Australia

Obtaining quotes and comparing policies is a crucial step in finding the right home insurance for your needs. By getting quotes from multiple providers and carefully analyzing their offerings, you can ensure you’re getting the best value for your money.

Comparing Quotes from Different Providers

It’s highly recommended to obtain quotes from at least three different insurance providers. This allows you to compare their coverage, premiums, and features side-by-side.

Here’s a step-by-step guide to obtaining quotes:

- Gather your information: Before you start, gather all the necessary information about your home, including its address, age, building materials, square footage, and any renovations or upgrades. This will help you provide accurate details to the insurance providers.

- Use online quote tools: Many insurance providers offer online quote tools that allow you to quickly and easily get a preliminary estimate of your premium. These tools typically ask for basic information about your home and your desired coverage.

- Contact insurance providers directly: If you prefer a more personalized approach, you can contact insurance providers directly by phone or email. This allows you to speak with a representative who can answer your questions and provide a more tailored quote.

- Compare quotes: Once you have received quotes from multiple providers, compare their premiums, coverage, and features. Pay close attention to the deductible, excess, and any exclusions.

- Read the policy documents carefully: Before making a decision, take the time to read the policy documents carefully. This will help you understand the full scope of coverage and any limitations.

Reputable Insurance Providers in Australia

Several reputable insurance providers operate in Australia, each offering a range of home insurance policies. Here are some of the leading providers:

- AAMI: AAMI offers a wide range of insurance products, including home insurance. They are known for their competitive pricing and comprehensive coverage options. Website: [www.aami.com.au](http://www.aami.com.au)

- Allianz: Allianz is a global insurance company with a strong presence in Australia. They offer a range of home insurance policies with various coverage options. Website: [www.allianz.com.au](http://www.allianz.com.au)

- BUPA: BUPA is primarily known for its health insurance, but they also offer home insurance. They are known for their customer service and personalized approach. Website: [www.bupa.com.au](http://www.bupa.com.au)

- GIO: GIO is a well-established insurance provider in Australia, offering a range of home insurance policies with competitive pricing. Website: [www.gio.com.au](http://www.gio.com.au)

- NRMA Insurance: NRMA Insurance is a popular choice for home insurance in Australia. They offer a wide range of policies and are known for their roadside assistance services. Website: [www.nrma.com.au](http://www.nrma.com.au)

- QBE: QBE is a global insurance company with a strong presence in Australia. They offer a range of home insurance policies with various coverage options. Website: [www.qbe.com.au](http://www.qbe.com.au)

- RACQ: RACQ is a Queensland-based insurance provider that offers a range of home insurance policies. They are known for their competitive pricing and local expertise. Website: [www.racq.com.au](http://www.racq.com.au)

- Suncorp: Suncorp is a major insurance provider in Australia, offering a wide range of home insurance policies with various coverage options. Website: [www.suncorp.com.au](http://www.suncorp.com.au)

Key Features to Consider When Comparing Policies

When comparing home insurance policies, it’s crucial to consider the following key features:

- Coverage: This refers to the types of events covered by the policy. Some policies may cover a wider range of events than others, such as natural disasters, theft, or vandalism.

- Premium: This is the amount you pay for the insurance policy. Premiums can vary depending on factors such as the value of your home, the level of coverage, and your location.

- Deductible: This is the amount you pay out of pocket before the insurance company covers the remaining costs. A higher deductible typically means a lower premium, and vice versa.

- Excess: This is the amount you pay towards each claim. It is similar to a deductible but can apply to specific types of claims.

- Exclusions: These are events or circumstances that are not covered by the policy. It’s important to carefully review the exclusions to ensure you understand what is and is not covered.

- Add-ons: Some policies offer optional add-ons, such as cover for valuables, personal liability, or temporary accommodation. These add-ons can increase your premium but provide additional protection.

- Customer service: Consider the insurance provider’s reputation for customer service and claims handling.

Understanding Policy Differences

Insurance policies can differ significantly in their coverage and features. Here are some key differences to consider:

- Building vs. Contents: Some policies only cover the building itself, while others cover both the building and your personal belongings.

- Natural disaster coverage: Not all policies cover all natural disasters. Some policies may have specific exclusions for events like earthquakes or floods.

- Liability coverage: This covers you if someone is injured on your property or if you cause damage to someone else’s property.

- Policy limits: The maximum amount the insurance company will pay for a claim. It’s essential to ensure the policy limit is sufficient to cover the full value of your home and belongings.

Understanding Policy Terms and Conditions

Before signing on the dotted line, it’s crucial to understand the terms and conditions of your home insurance policy. This document Artikels the details of your coverage, including what’s covered, what’s excluded, and how claims are processed. Taking the time to understand these details can help you make informed decisions and avoid surprises down the road.

Coverage Limits, How much is home insurance in australia

Coverage limits define the maximum amount your insurer will pay for a specific covered event. These limits are often expressed as a dollar amount or a percentage of the insured value of your home. It’s important to ensure that your coverage limits are sufficient to cover the cost of rebuilding or repairing your home and replacing your belongings in the event of a covered loss. For example, if your home is valued at $500,000 and your policy has a coverage limit of $400,000, you would only receive $400,000 in the event of a total loss.

Exclusions

Exclusions are specific events or circumstances that are not covered by your home insurance policy. It’s important to carefully review the exclusions section of your policy to understand what is not covered. Some common exclusions include:

- Natural disasters such as earthquakes and floods, unless you have purchased additional coverage.

- Damage caused by wear and tear or gradual deterioration.

- Damage caused by intentional acts, such as arson or vandalism.

- Losses resulting from business activities conducted at home.

Claims Processes

The claims process Artikels the steps you need to take to file a claim and receive compensation for a covered loss. Understanding this process is essential for ensuring a smooth and timely resolution. Typically, you will need to:

- Report the loss to your insurer as soon as possible.

- Provide detailed information about the loss, including date, time, and circumstances.

- Cooperate with your insurer’s investigation of the claim.

- Provide any necessary documentation, such as receipts or photographs.

Key Sections of a Policy Document

To gain a comprehensive understanding of your home insurance policy, pay close attention to the following sections:

- Definitions: This section explains the meaning of key terms used in the policy, ensuring clear understanding of the scope of coverage.

- Coverage: This section Artikels the specific events and circumstances that are covered by the policy, providing a detailed overview of what is protected.

- Exclusions: This section lists the events, circumstances, or items that are not covered by the policy, highlighting potential limitations.

- Conditions: This section Artikels the specific requirements and obligations of both the insured and the insurer, such as reporting requirements and claim procedures.

- Limits of Liability: This section specifies the maximum amount the insurer will pay for a covered event, providing clarity on the financial protection offered.

Tips for Saving on Home Insurance Costs

You’ve already taken steps to understand your home insurance needs and explore different policies. Now, let’s dive into practical strategies for minimizing your premiums and maximizing your savings.

Making Your Home Safer

A safer home translates to lower premiums. Here are some preventative measures you can take:

- Install Security Systems: Alarm systems, motion detectors, and security cameras can deter potential burglars and lower your risk profile. Many insurers offer discounts for installing these systems.

- Strengthen Doors and Windows: Secure your home’s entry points with solid core doors, reinforced frames, and high-quality locks. Consider installing security bars or grills on windows, especially those on the ground floor.

- Improve Lighting: Well-lit areas deter criminals. Install motion-activated lights around your property and ensure adequate lighting in your yard and driveway.

- Landscaping for Security: Trim trees and bushes to improve visibility around your home, making it harder for intruders to hide.

Maintaining Your Home

Regular maintenance reduces the risk of costly repairs and claims, leading to lower premiums:

- Roof Inspections: Schedule regular roof inspections to identify and address any damage early. A well-maintained roof minimizes the risk of leaks and water damage.

- Plumbing Checks: Prevent water damage by having your plumbing system checked regularly. Address any leaks or faulty pipes promptly.

- Electrical System Maintenance: Ensure your electrical system is safe and up-to-date. Have it inspected regularly and address any wiring issues immediately.

Negotiating with Insurers

Don’t hesitate to negotiate with your insurer to secure the best possible rates:

- Shop Around: Get quotes from multiple insurers to compare coverage and premiums. This allows you to identify the best deals and negotiate based on competitive offers.

- Bundle Policies: Consider bundling your home insurance with other policies like car insurance or life insurance. Insurers often offer discounts for multiple policies.

- Increase Deductibles: A higher deductible means you pay more out of pocket in case of a claim, but it can lead to lower premiums. Choose a deductible that aligns with your financial situation and risk tolerance.

- Ask About Discounts: Many insurers offer discounts for various factors, such as home security systems, smoke detectors, fire extinguishers, and being a long-time customer. Inquire about these discounts and see if you qualify.

Comparing Quotes and Identifying Savings

Here’s a checklist for comparing quotes and maximizing savings:

- Focus on Coverage: Don’t solely compare premiums. Ensure the coverage offered by each insurer aligns with your specific needs and the value of your property.

- Consider Excesses: Pay attention to the excess amount (the amount you pay upfront for each claim) and how it varies between insurers.

- Compare Benefits: Look for additional benefits, such as legal cover, emergency accommodation, and contents cover, which can be valuable in the event of a claim.

- Read the Fine Print: Carefully review the policy terms and conditions, including exclusions, limitations, and any specific requirements for making claims.

Pre-Purchase Checklist for Cost-Effective Insurance

Before you purchase a home insurance policy, consider these steps:

- Assess Your Needs: Determine the type of coverage you need based on the value of your home, contents, and personal circumstances.

- Get Multiple Quotes: Obtain quotes from at least three different insurers to compare premiums, coverage, and terms.

- Review Policy Documents: Carefully read the policy documents, including the product disclosure statement, to understand the coverage, exclusions, and conditions.

- Ask Questions: Don’t hesitate to contact insurers with any questions or concerns about the policy or its terms.

Last Point

By understanding the factors that influence home insurance premiums, exploring different coverage options, and utilizing tips for saving money, you can make informed decisions about your home insurance. Remember, protecting your home is an investment, and securing the right insurance policy can provide peace of mind and financial security.

FAQ Corner

What are the most common exclusions in home insurance policies?

Common exclusions include natural disasters like earthquakes and floods, unless you specifically purchase additional coverage. Other exclusions may include wear and tear, intentional damage, and certain types of valuables.

How often should I review my home insurance policy?

It’s a good idea to review your home insurance policy annually, especially if you’ve made significant changes to your home or your financial situation. This ensures your coverage remains adequate and your premiums are competitive.

What are the benefits of bundling home and contents insurance?

Bundling home and contents insurance can often lead to lower premiums and streamlined claims processes. It also simplifies your insurance management and ensures both your home and belongings are covered under a single policy.