Insurance companies in Australia list sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the complex world of insurance in Australia can be daunting, but understanding the landscape and the major players is essential for securing the right protection. This guide delves into the diverse range of insurance companies operating within Australia, providing insights into their offerings, key factors to consider when choosing an insurer, and practical tips for finding the best coverage.

Australia’s insurance market is a vibrant and competitive landscape, offering a wide range of insurance products to meet the diverse needs of individuals and businesses. From home and car insurance to health and life insurance, the options are vast and often complex. Understanding the key types of insurance, the factors to consider when choosing a provider, and the emerging trends in the industry is crucial for making informed decisions.

Introduction

The Australian insurance landscape is vast and diverse, encompassing a wide range of insurance products and services. Insurance companies play a crucial role in providing financial protection to individuals and businesses against unforeseen risks, contributing significantly to the stability and resilience of the Australian economy.

Insurance companies in Australia operate within a highly regulated environment, ensuring consumer protection and promoting fair and transparent practices. The Australian Prudential Regulation Authority (APRA) oversees the financial soundness of insurance companies, while the Australian Securities and Investments Commission (ASIC) regulates their conduct and product offerings.

Types of Insurance

Insurance companies in Australia offer a comprehensive range of insurance products to cater to diverse needs. These include:

- General Insurance: This category encompasses insurance products that protect against various risks, including property damage, liability claims, and personal accidents. Examples include home insurance, car insurance, business insurance, and travel insurance.

- Life Insurance: This type of insurance provides financial protection to beneficiaries in the event of the policyholder’s death. It can include term life insurance, whole life insurance, and endowment policies.

- Health Insurance: Health insurance policies cover medical expenses, including hospital stays, surgery, and other healthcare services. There are various types of health insurance plans available, offering different levels of coverage.

- Superannuation: Superannuation is a retirement savings scheme that allows individuals to accumulate funds for their retirement. Many superannuation funds offer insurance products, such as death and disability cover.

Major Insurance Companies in Australia

The Australian insurance market is a vibrant and competitive landscape, with a wide range of companies offering various insurance products and services. Understanding the key players and their offerings is crucial for individuals and businesses seeking the right insurance solutions.

Top Insurance Companies in Australia

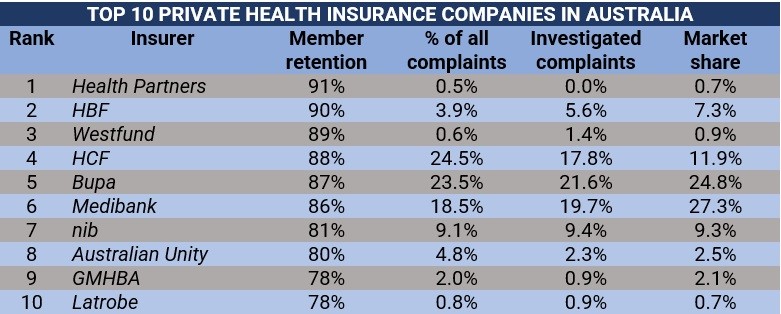

Here is a list of the top 10 insurance companies in Australia, based on market share or revenue, as of 2023. This list provides a snapshot of the major players in the Australian insurance industry.

| Company Name | Website URL | Primary Types of Insurance Offered | Key Services and Offerings |

|---|---|---|---|

| Suncorp Group | https://www.suncorp.com.au/ | General insurance, life insurance, banking | Offers a comprehensive range of insurance products, including home, car, travel, and business insurance. Also provides banking services. |

| IAG | https://www.iag.com.au/ | General insurance, life insurance | Operates several well-known insurance brands, including NRMA Insurance, CGU, and SGIO. Offers a broad range of general and life insurance products. |

| QBE Insurance Group | https://www.qbe.com/ | General insurance, reinsurance | A global insurance provider with a strong presence in Australia. Specializes in general insurance, including commercial and personal lines. |

| AIA Australia | https://www.aia.com.au/ | Life insurance, health insurance | Offers a variety of life insurance products, including term life, whole of life, and investment-linked insurance. Also provides health insurance. |

| Medibank Private | https://www.medibank.com.au/ | Health insurance | One of Australia’s largest health insurers, offering a wide range of health insurance plans and services. |

| nib Health Funds | https://www.nib.com.au/ | Health insurance | Provides health insurance products with a focus on value and flexibility. Offers a range of plans and services to meet individual needs. |

| HCF | https://www.hcf.com.au/ | Health insurance | A not-for-profit health insurer, offering a wide range of health insurance plans and services. |

| RACQ Insurance | https://www.racq.com.au/ | General insurance, roadside assistance | A Queensland-based insurance provider offering car, home, and business insurance, as well as roadside assistance services. |

| Allianz Australia | https://www.allianz.com.au/ | General insurance, life insurance, asset management | A global insurance company with a strong presence in Australia. Offers a comprehensive range of insurance products and services. |

| Youi | https://www.youi.com.au/ | General insurance | A direct insurer offering car, home, and contents insurance. Known for its competitive pricing and online services. |

Types of Insurance Offered

Australian insurance companies offer a wide range of insurance products to protect individuals and businesses from various risks. These products provide financial security and peace of mind, ensuring that policyholders can manage unexpected events without facing significant financial hardship.

Home and Contents Insurance, Insurance companies in australia list

Home and contents insurance is essential for homeowners and renters, protecting them against financial losses caused by damage to their property or belongings.

- Key features and benefits: This insurance provides financial compensation for damage or loss to the insured’s home and its contents due to various perils, including fire, theft, natural disasters, and vandalism. It also covers additional expenses incurred during recovery, such as temporary accommodation and relocation costs.

- Common coverage options: Home and contents insurance policies offer various coverage options, including building insurance, contents insurance, and combined building and contents insurance. Building insurance covers the structure of the home, while contents insurance protects personal belongings. Combined policies offer comprehensive coverage for both the building and its contents.

- Examples of situations where this insurance is essential: Home and contents insurance is crucial in situations like fire, theft, storms, floods, and earthquakes. It provides financial support to rebuild or repair the damaged property and replace lost or damaged belongings.

Motor Vehicle Insurance

Motor vehicle insurance is a legal requirement in Australia, protecting vehicle owners and drivers from financial losses arising from accidents or other incidents.

- Key features and benefits: Motor vehicle insurance covers the costs of repairs or replacement of the insured vehicle, medical expenses for the insured and other parties involved in an accident, and legal costs associated with accidents. It also provides third-party liability coverage, protecting the insured from claims made by other parties for damages caused by the insured vehicle.

- Common coverage options: Motor vehicle insurance policies come in different types, including comprehensive insurance, third-party property damage insurance, and third-party fire and theft insurance. Comprehensive insurance offers the most extensive coverage, while third-party insurance provides limited protection for third-party claims.

- Examples of situations where this insurance is essential: Motor vehicle insurance is essential for any vehicle owner or driver, as accidents can happen unexpectedly. It provides financial protection in cases of collisions, rollovers, fire, theft, and vandalism.

Health Insurance

Health insurance provides financial assistance for medical expenses, allowing individuals to access private healthcare services and receive faster treatment.

- Key features and benefits: Health insurance covers the costs of private hospital stays, surgical procedures, specialist consultations, and other medical expenses. It also provides access to private health insurance benefits, such as shorter waiting times for treatment and access to a wider range of healthcare providers.

- Common coverage options: Health insurance policies offer different levels of coverage, from basic hospital cover to comprehensive cover that includes extras like dental, optical, and physiotherapy. Policyholders can choose a level of cover that suits their individual needs and budget.

- Examples of situations where this insurance is essential: Health insurance is essential for individuals who want to access private healthcare services, receive faster treatment, and avoid long waiting lists for public hospitals. It is also beneficial for those who need specialized medical care or have pre-existing conditions.

Life Insurance

Life insurance provides financial protection for dependents in the event of the insured’s death, ensuring their financial security and well-being.

- Key features and benefits: Life insurance pays a lump sum benefit to the insured’s beneficiaries upon their death. This benefit can be used to cover funeral expenses, mortgage repayments, living expenses, or other financial obligations.

- Common coverage options: Life insurance policies come in different types, including term life insurance, whole life insurance, and endowment life insurance. Term life insurance provides coverage for a specific period, while whole life insurance provides lifetime coverage. Endowment life insurance combines life insurance with an investment component.

- Examples of situations where this insurance is essential: Life insurance is essential for individuals with dependents, such as spouses, children, or elderly parents. It provides financial security for their loved ones in the event of their untimely death.

Travel Insurance

Travel insurance protects travelers from unexpected events that may occur during their trip, providing financial assistance for medical expenses, trip cancellation, and other travel-related emergencies.

- Key features and benefits: Travel insurance covers medical expenses incurred while traveling, including emergency medical evacuation. It also provides financial protection for trip cancellations, delays, lost baggage, and other travel-related inconveniences.

- Common coverage options: Travel insurance policies offer various coverage options, including basic cover, comprehensive cover, and specialized cover for specific activities like skiing or scuba diving. Policyholders can choose a level of cover that suits their travel needs and budget.

- Examples of situations where this insurance is essential: Travel insurance is essential for all travelers, as unforeseen events can happen anywhere. It provides financial protection for medical emergencies, flight delays, lost luggage, and other travel-related issues.

Factors to Consider When Choosing an Insurance Company

Choosing the right insurance company is a crucial decision, as it can significantly impact your financial well-being and peace of mind. It’s essential to consider various factors to ensure you select a company that aligns with your needs and provides the best possible coverage.

Reputation and Financial Stability

A company’s reputation and financial stability are crucial indicators of its reliability and ability to fulfill its obligations.

- Research the company’s history: Look for evidence of past claims handling practices, customer satisfaction ratings, and any regulatory actions taken against them.

- Check their financial ratings: Reputable agencies like Standard & Poor’s or Moody’s provide financial ratings that assess a company’s financial health. A strong financial rating indicates the company is financially sound and likely to be able to pay claims.

- Consider the company’s size and scope: Larger companies may have more resources to handle claims, but smaller companies might offer more personalized service.

Coverage Options and Limitations

Insurance policies come with various coverage options and limitations, so it’s essential to understand what’s included and excluded.

- Compare coverage options: Different companies offer varying levels of coverage, deductibles, and exclusions. Carefully review the policy documents to ensure the coverage meets your specific needs.

- Understand exclusions: Be aware of what is not covered by the policy, such as specific types of events, conditions, or items.

- Consider add-ons: Some companies offer optional add-ons that can enhance coverage, but they come with additional costs. Weigh the benefits and costs before deciding.

Premium Pricing and Affordability

Insurance premiums are the costs associated with coverage, and finding affordable options is crucial.

- Compare quotes from multiple companies: Don’t settle for the first quote you receive. Compare quotes from several companies to get the best possible price.

- Consider factors that influence premiums: Premiums are based on various factors, such as your age, location, driving history, and the type of coverage you need.

- Look for discounts: Many companies offer discounts for various factors, such as safe driving records, bundling policies, or being a loyal customer.

Customer Service and Claims Handling Processes

A company’s customer service and claims handling processes are crucial when you need to file a claim.

- Read customer reviews and testimonials: See what other customers have to say about the company’s customer service and claims handling processes.

- Check the company’s claims handling procedures: Understand the process for filing a claim, the documentation required, and the expected timeframes for processing and payment.

- Contact the company directly: Ask questions about their customer service and claims handling processes to get a better understanding of how they operate.

Online Presence and Digital Tools

In today’s digital age, having a strong online presence and user-friendly digital tools is essential for insurance companies.

- Assess the company’s website: Look for a well-designed website with clear information about their products, services, and contact details.

- Check for online tools: Some companies offer online tools for managing policies, filing claims, or accessing account information. These tools can be convenient and time-saving.

- Evaluate the company’s social media presence: A company’s social media presence can provide insights into their customer engagement, communication style, and responsiveness.

Tips for Finding the Right Insurance

Finding the right insurance policy can feel like a daunting task, but with a little effort and the right approach, you can ensure you have the coverage you need at a price that fits your budget.

Comparing Quotes and Conducting Thorough Research

Comparing quotes from multiple insurance companies is crucial to finding the best value for your money.

- Utilize online comparison websites, which allow you to input your details and receive quotes from various providers simultaneously.

- Contact insurance companies directly and request personalized quotes.

- Consider your specific needs and circumstances when comparing quotes, as policies may vary in coverage, exclusions, and premiums.

It’s also essential to conduct thorough research on each insurance company you are considering.

- Read reviews and ratings from reputable sources to get an idea of the company’s customer service, claims handling process, and financial stability.

- Check the company’s financial strength rating, which indicates its ability to pay claims.

Understanding Policy Terms and Conditions

Before committing to an insurance policy, it’s crucial to understand the terms and conditions thoroughly.

- Pay close attention to the policy’s coverage limits, deductibles, and exclusions.

- Read the fine print carefully to ensure you understand the policy’s scope and limitations.

- Don’t hesitate to ask questions if anything is unclear.

Understanding the policy’s terms and conditions can help you avoid surprises and ensure you have the coverage you need.

Seeking Professional Advice from Insurance Brokers

Insurance brokers can be valuable resources when searching for insurance.

- They can provide impartial advice and help you navigate the complexities of the insurance market.

- They can assess your needs and recommend policies that best suit your situation.

- They can negotiate with insurers on your behalf and help you secure the best possible rates.

Consider consulting with an insurance broker, especially if you have complex insurance needs or require specialized coverage.

Utilizing Online Resources and Comparison Websites

Online resources and comparison websites can be helpful tools in your insurance search.

- These platforms provide access to a wide range of insurance providers and allow you to compare quotes side-by-side.

- They can also offer valuable information on different types of insurance, policy terms, and industry trends.

- Utilize these resources to streamline your research and make informed decisions.

Remember to verify the information provided on these websites and consult with an insurance broker or financial advisor if you have any questions.

Trends in the Australian Insurance Industry

The Australian insurance industry is undergoing a period of significant transformation, driven by technological advancements, evolving customer expectations, and regulatory shifts. These trends are reshaping the way insurance is bought, sold, and delivered, creating both opportunities and challenges for insurers and consumers alike.

Digitalization and Online Insurance Platforms

The rise of digital technology has revolutionized the insurance landscape. Online insurance platforms are becoming increasingly popular, offering consumers greater convenience, transparency, and control over their insurance purchasing experience. These platforms allow customers to compare quotes, purchase policies, and manage their insurance online, eliminating the need for traditional face-to-face interactions.

Use of Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are playing an increasingly important role in the insurance industry. Insurers are leveraging these technologies to automate tasks, improve risk assessment, personalize pricing, and enhance customer service. AI-powered chatbots can provide instant responses to customer queries, while data analytics can help insurers identify patterns and trends in claims data, leading to more efficient risk management.

Growing Focus on Sustainability and Environmental Risks

As the world grapples with climate change and its impacts, the insurance industry is facing growing concerns about environmental risks. Insurers are increasingly factoring in sustainability considerations into their underwriting processes, pricing models, and product offerings. This includes developing new products that cover climate-related risks, such as flood insurance and renewable energy insurance, and incorporating sustainability criteria into their investment strategies.

Impact of Regulatory Changes and Consumer Protection Initiatives

The Australian government has implemented a number of regulatory changes and consumer protection initiatives in recent years, aimed at improving transparency, fairness, and accountability in the insurance sector. These initiatives include the introduction of the Financial Sector Reform (Hayne Royal Commission) Act 2020, which aims to strengthen consumer protection and improve the conduct of financial institutions.

Last Word: Insurance Companies In Australia List

In conclusion, navigating the Australian insurance landscape requires careful consideration of your individual needs, a thorough understanding of the available options, and a commitment to making informed decisions. By researching the key factors, comparing quotes, and utilizing available resources, you can find the insurance company and policy that best meet your requirements. Remember, seeking professional advice from insurance brokers can be invaluable in ensuring you have the right coverage to protect your assets and secure your future.

User Queries

What are the most common types of insurance in Australia?

The most common types of insurance in Australia include home, car, health, life, and travel insurance. Each type provides coverage for specific risks and needs.

How do I compare insurance quotes from different companies?

You can compare insurance quotes online using comparison websites or by contacting insurance companies directly. Be sure to compare the coverage options, premiums, and customer service ratings.

What are the benefits of using an insurance broker?

Insurance brokers can help you find the best coverage options and negotiate better rates. They also provide expert advice and support throughout the insurance process.