Largest insurers in Australia play a crucial role in the financial well-being of individuals and businesses. They provide essential protection against risks, ranging from health and life to property and liability. This industry is constantly evolving, shaped by technological advancements, changing consumer needs, and evolving regulatory landscapes.

Understanding the key players in the Australian insurance market, their offerings, and their financial performance is essential for both consumers seeking coverage and investors seeking opportunities. This analysis delves into the world of Australia’s largest insurers, providing insights into their strategies, strengths, and the future of the industry.

Market Overview

The Australian insurance market is a dynamic and complex landscape, shaped by a confluence of factors including economic conditions, regulatory changes, and evolving consumer preferences. The industry is characterized by a high level of competition, with a significant number of both domestic and international players vying for market share.

Key Trends

Several key trends are shaping the Australian insurance market, influencing the strategies and operations of major players.

- Digital Transformation: The insurance industry is undergoing a rapid digital transformation, driven by the increasing adoption of technology by consumers and businesses. Insurers are investing heavily in digital channels, such as online platforms and mobile apps, to improve customer experience, streamline processes, and enhance efficiency.

- Data Analytics: Data analytics is playing a critical role in insurance, enabling insurers to gain deeper insights into customer behavior, risk assessment, and pricing strategies. This trend is leading to the development of more personalized and data-driven insurance products and services.

- Regulatory Landscape: The Australian insurance industry is subject to a complex regulatory environment, with ongoing changes and updates. Key regulatory developments include the introduction of the Financial Services Royal Commission, which has resulted in increased scrutiny of insurance practices and consumer protection measures.

- Climate Change: Climate change is a growing concern for the insurance industry, as it increases the frequency and severity of extreme weather events, such as bushfires, floods, and cyclones. This trend is leading to higher insurance premiums and a greater focus on risk mitigation strategies.

Competitive Landscape

The Australian insurance market is highly competitive, with a diverse range of players operating across different segments. The major players in the market include:

- Suncorp Group: One of Australia’s largest insurance companies, offering a wide range of products including home, motor, business, and travel insurance.

- IAG: Another major insurance player, with a portfolio of brands including NRMA, CGU, and SGIO.

- QBE Insurance Group: A global insurance company with a strong presence in Australia, specializing in commercial insurance.

- Allianz Australia: A subsidiary of Allianz SE, offering a comprehensive range of insurance products and services.

- AIA Australia: A leading provider of life insurance, health insurance, and savings products.

These major players are competing for market share across various segments, including:

- Home and Contents Insurance: This segment is highly competitive, with numerous players offering a wide range of products and coverage options.

- Motor Vehicle Insurance: This segment is characterized by price competition, with insurers offering various discounts and incentives to attract customers.

- Business Insurance: This segment is more complex, with insurers specializing in specific types of businesses and risks.

- Life Insurance: This segment is dominated by a few major players, with a focus on providing financial protection for individuals and families.

Top Insurers in Australia

The Australian insurance market is highly competitive, with a diverse range of insurers vying for market share. This section will provide an overview of the largest insurers in Australia, based on their market share or premium volume.

Top Insurers in Australia by Market Share, Largest insurers in australia

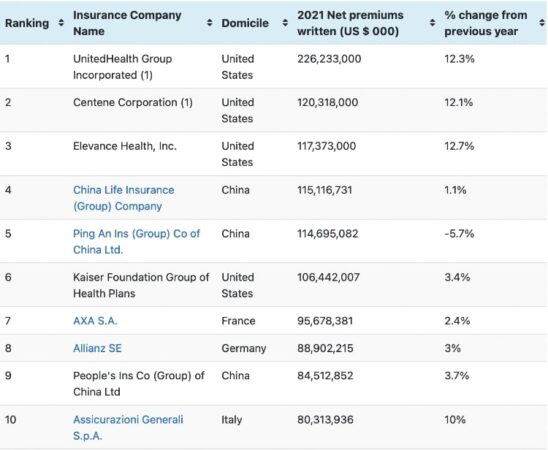

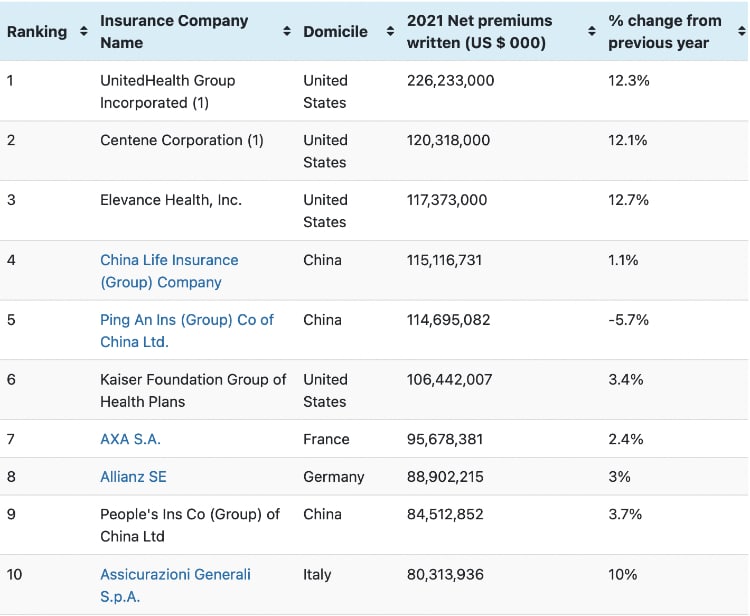

The following table presents a list of the largest insurers in Australia, along with their type of insurance, market share, and key strengths.

| Insurer Name | Type of Insurance | Market Share (%) | Key Strengths |

|---|---|---|---|

| Suncorp Group | General Insurance, Life Insurance | 18.5% | Strong brand recognition, diversified product portfolio, extensive distribution network. |

| IAG | General Insurance, Life Insurance | 17.2% | Strong brand recognition, diversified product portfolio, focus on innovation and technology. |

| AIA Australia | Life Insurance | 10.8% | Strong financial position, focus on customer experience, wide range of life insurance products. |

| AMP | Life Insurance, Superannuation | 9.5% | Strong brand recognition, long history in the Australian market, diversified product portfolio. |

| Medibank Private | Health Insurance | 8.7% | Largest private health insurer in Australia, strong brand recognition, extensive network of hospitals and healthcare providers. |

Key Products and Services

Australia’s largest insurers offer a wide range of insurance products and services to cater to the diverse needs of individuals and businesses. These products are designed to provide financial protection against various risks and uncertainties.

The offerings of different insurers often overlap but can vary in terms of specific features, coverage limits, and pricing. Key differentiators include the insurer’s financial strength, customer service reputation, and innovation in product development.

General Insurance

General insurance products provide protection against financial losses arising from unforeseen events. The most common general insurance products offered by Australian insurers include:

- Home Insurance: This policy covers the insured’s home against various risks such as fire, theft, natural disasters, and accidental damage. Home insurance policies typically include cover for the building, contents, and liability.

- Contents Insurance: This policy provides coverage for the insured’s personal belongings against loss or damage. Contents insurance is often included as part of a comprehensive home insurance policy but can also be purchased separately.

- Motor Vehicle Insurance: This policy protects the insured against financial losses arising from accidents involving their motor vehicle. Motor vehicle insurance typically includes coverage for third-party liability, own damage, and theft.

- Travel Insurance: This policy provides coverage for medical expenses, trip cancellation, and lost baggage while traveling overseas. Travel insurance is particularly important for those traveling to countries with high medical costs or those planning to engage in high-risk activities.

- Business Insurance: This policy protects businesses against financial losses arising from various risks, including property damage, liability claims, and business interruption. Business insurance policies are tailored to the specific needs of each business.

Life Insurance

Life insurance policies provide financial protection to the insured’s beneficiaries in the event of their death. Life insurance policies are typically categorized as:

- Term Life Insurance: This policy provides coverage for a specified period, typically 10 to 30 years. It is a relatively inexpensive option that provides a lump sum payment to beneficiaries if the insured dies during the policy term.

- Whole Life Insurance: This policy provides lifetime coverage and includes a savings component that accumulates over time. Whole life insurance is typically more expensive than term life insurance but offers a guaranteed death benefit and potential for investment growth.

- Permanent Life Insurance: This policy provides lifetime coverage and offers flexibility in terms of premium payments and death benefit options. Permanent life insurance is a more complex product that is typically suited for individuals with specific financial goals.

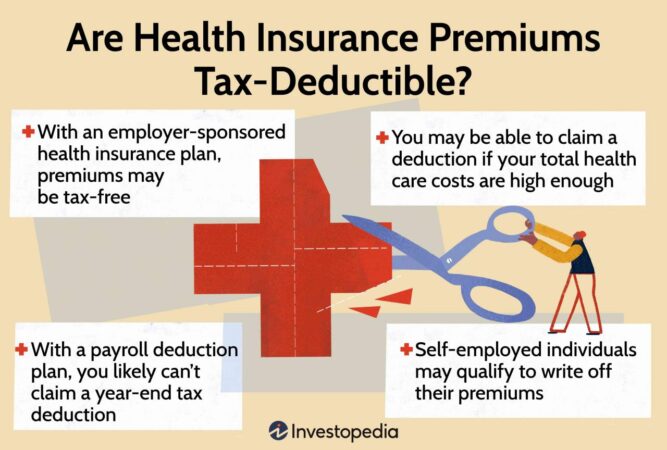

Health Insurance

Health insurance policies provide coverage for medical expenses not covered by the government’s Medicare system. Health insurance policies are typically categorized as:

- Hospital Cover: This policy provides coverage for hospital accommodation, surgical procedures, and other medical expenses incurred in a hospital.

- Ancillary Cover: This policy provides coverage for a range of medical expenses, including dental, optical, and physiotherapy.

- Extras Cover: This policy provides coverage for a wider range of medical expenses, including alternative therapies, chiropractic care, and gym memberships.

Superannuation

Superannuation is a retirement savings scheme that allows individuals to save for their retirement. Superannuation funds are typically managed by financial institutions, including insurance companies.

- Superannuation: This is a mandatory savings scheme in Australia, with employers required to contribute a percentage of their employees’ wages to a superannuation fund. Individuals can also make personal contributions to their superannuation accounts.

Other Services

In addition to insurance products, Australian insurers offer a range of other services, including:

- Financial Advice: Some insurers offer financial advice to help individuals plan for their financial future, including retirement planning, investment strategies, and estate planning.

- Claims Management: Insurers provide assistance with claims processing, including investigating claims, assessing damage, and providing compensation.

- Risk Management: Some insurers offer risk management services to help businesses identify and mitigate potential risks.

Financial Performance and Growth

The Australian insurance industry has consistently demonstrated robust financial performance, with top insurers exhibiting strong revenue growth, profitability, and healthy returns on equity. This success is attributed to a combination of factors, including a favorable regulatory environment, a growing economy, and increasing insurance penetration.

Financial Performance Metrics

Key financial metrics provide insights into the overall performance of Australian insurers.

- Revenue: Australian insurers have experienced steady revenue growth, driven by factors such as population growth, rising disposable incomes, and increased demand for insurance products. The top insurers have successfully expanded their market share and diversified their product offerings, contributing to their revenue growth.

- Profitability: The insurance industry in Australia is characterized by strong profitability. Insurers have maintained healthy profit margins, reflecting efficient operations, effective risk management strategies, and a favorable regulatory landscape.

- Return on Equity (ROE): ROE is a key metric that measures the profitability of a company relative to its shareholders’ equity. Australian insurers have consistently achieved high ROE, indicating their ability to generate strong returns for their investors.

Factors Contributing to Growth and Profitability

Several factors have contributed to the growth and profitability of top insurers in Australia.

- Favorable Regulatory Environment: The Australian government has implemented a stable and supportive regulatory framework for the insurance industry. This has fostered a level playing field for insurers and encouraged innovation and competition.

- Growing Economy: Australia’s robust economic growth has led to increased demand for insurance products. As individuals and businesses experience rising incomes and wealth, they are more likely to invest in insurance protection.

- Rising Insurance Penetration: Insurance penetration refers to the proportion of the population that is insured. Australia has seen a gradual increase in insurance penetration, indicating a growing awareness of the importance of insurance and a willingness to invest in it.

- Technological Advancements: Insurers are leveraging technology to improve efficiency, enhance customer service, and develop innovative products. This has allowed them to operate more effectively and expand their reach to a wider customer base.

- Strategic Acquisitions and Partnerships: Some insurers have pursued strategic acquisitions and partnerships to expand their market presence and enhance their product offerings. These initiatives have contributed to their growth and profitability.

Customer Experience and Innovation

Australia’s insurance industry is increasingly focused on enhancing customer experience and leveraging innovative solutions to meet evolving customer needs. The largest insurers are actively investing in digital transformation and adopting new technologies to improve customer service, simplify processes, and personalize interactions.

Digital Transformation Initiatives

Digital transformation is a key focus for Australia’s largest insurers, enabling them to deliver seamless and personalized customer experiences. They are investing heavily in digital platforms, mobile applications, and online self-service portals to enhance customer convenience and accessibility.

- Online Quoting and Policy Management: Insurers are providing online platforms that allow customers to obtain quotes, purchase policies, and manage their accounts conveniently. This streamlines the insurance buying process and empowers customers to take control of their policies.

- Mobile App Integration: Mobile applications are becoming increasingly popular for managing insurance policies, submitting claims, and accessing customer support. These apps offer a convenient and user-friendly interface for customers to interact with their insurer on the go.

- Artificial Intelligence (AI) and Chatbots: AI-powered chatbots are being deployed to provide instant customer support, answer frequently asked questions, and assist with policy inquiries. This technology enhances efficiency and provides 24/7 availability for customers.

- Data Analytics and Personalization: Insurers are leveraging data analytics to understand customer preferences and personalize their interactions. This allows them to tailor product recommendations, communication, and support services to individual needs.

Innovative Solutions

Australian insurers are embracing innovative solutions to improve customer experience and address emerging needs. These include:

- Telematics and Usage-Based Insurance (UBI): Insurers are using telematics devices to track driving behavior and offer personalized premiums based on individual driving habits. This promotes safer driving and rewards responsible drivers with lower insurance costs.

- Wearable Technology and Health Monitoring: Some insurers are exploring the use of wearable technology to monitor health data and provide personalized health insurance plans based on individual risk profiles. This approach allows for more accurate risk assessment and potentially lower premiums for healthy individuals.

- Blockchain Technology: Blockchain technology is being investigated for its potential to enhance transparency, security, and efficiency in insurance processes, such as claims management and policy administration.

Best Practices in Customer Service and Engagement

The largest insurers in Australia are implementing best practices to deliver exceptional customer service and foster strong customer relationships.

- Proactive Communication: Insurers are adopting proactive communication strategies to keep customers informed about policy updates, claims progress, and relevant information. This builds trust and transparency.

- Personalized Support: Customer service teams are trained to provide personalized support tailored to individual customer needs. This involves understanding customer preferences and offering solutions that address their specific requirements.

- Multi-Channel Support: Insurers are providing multiple channels for customer support, including phone, email, live chat, and social media. This ensures that customers can reach out to their insurer through their preferred communication method.

- Customer Feedback and Improvement: Insurers are actively seeking customer feedback through surveys, online reviews, and social media interactions. This feedback is used to identify areas for improvement and enhance customer experience.

Regulatory Environment

The Australian insurance industry operates within a robust regulatory framework designed to ensure the financial stability and consumer protection. This framework is overseen by the Australian Prudential Regulation Authority (APRA), which plays a crucial role in setting standards, monitoring compliance, and intervening when necessary.

Recent Regulatory Changes and Their Impact

Recent regulatory changes have significantly impacted the insurance industry in Australia. These changes aim to enhance consumer protection, promote competition, and ensure the financial soundness of insurers.

- Increased Transparency and Disclosure: New regulations have been introduced to enhance transparency and disclosure requirements for insurers. This includes providing consumers with clear and concise information about their insurance products, including premiums, coverage, and exclusions. This increased transparency aims to empower consumers to make informed decisions about their insurance needs.

- Strengthened Consumer Protection Measures: The regulatory landscape has seen the introduction of stronger consumer protection measures. This includes stricter rules regarding the sale of insurance products, such as the requirement for insurers to assess a customer’s needs and provide suitable advice. These measures aim to protect consumers from unsuitable or misleading insurance products.

- Focus on Financial Stability: Recent regulatory changes have emphasized the importance of financial stability in the insurance industry. This includes stricter capital adequacy requirements for insurers, designed to ensure they have sufficient financial resources to meet their obligations to policyholders. This focus on financial stability aims to protect consumers and the broader financial system from potential risks associated with insurer insolvencies.

Role of the Australian Prudential Regulation Authority (APRA)

APRA is the primary regulator of the Australian insurance industry. Its role is crucial in ensuring the financial soundness and stability of the industry.

- Setting Standards and Guidelines: APRA sets prudential standards and guidelines for insurers, covering areas such as capital adequacy, risk management, and corporate governance. These standards aim to ensure that insurers operate within a sound and responsible framework.

- Monitoring Compliance: APRA monitors the compliance of insurers with its prudential standards and guidelines. This involves regular reporting requirements, on-site inspections, and other supervisory activities. APRA’s monitoring ensures that insurers meet their regulatory obligations and maintain financial stability.

- Intervening When Necessary: APRA has the authority to intervene in the operations of insurers when it deems necessary. This can include imposing sanctions, requiring remedial action, or even placing an insurer under administration or liquidation. APRA’s intervention powers ensure that the financial stability of the insurance industry is maintained.

Future Outlook: Largest Insurers In Australia

The Australian insurance market is expected to continue its growth trajectory in the coming years, driven by factors such as population growth, rising affluence, and increasing awareness of the importance of insurance. However, the industry also faces a number of challenges, including regulatory changes, technological disruption, and the evolving needs of consumers.

Key Challenges and Opportunities

The Australian insurance industry faces several challenges and opportunities.

- Regulatory Changes: The Australian Prudential Regulation Authority (APRA) is constantly reviewing and updating its regulations for the insurance industry. These changes can impact insurers’ operations and profitability. For example, APRA’s new capital adequacy requirements have forced insurers to increase their capital reserves, which can reduce their ability to invest in new products and services. However, these regulations also aim to ensure the financial stability of the industry and protect policyholders.

- Technological Disruption: The insurance industry is being disrupted by new technologies such as artificial intelligence (AI), big data, and blockchain. These technologies are creating new opportunities for insurers to improve their efficiency, develop new products and services, and personalize their customer experiences. For example, AI can be used to automate underwriting processes, while big data can be used to identify and assess risks more effectively. However, insurers need to invest in these technologies and adapt their business models to stay ahead of the curve.

- Evolving Customer Needs: Consumers are becoming more demanding and sophisticated in their expectations of insurance providers. They want personalized products and services, instant access to information, and seamless online experiences. Insurers need to adapt to these changing needs and offer products and services that meet their customers’ expectations. This can involve offering digital-first products, improving customer service channels, and leveraging data to personalize the customer experience.

Emerging Trends and Innovations

Several emerging trends and innovations are shaping the future of the Australian insurance market.

- Insurtech: The emergence of insurtech startups is disrupting the traditional insurance industry. These companies are using technology to develop innovative products and services that are more affordable, accessible, and customer-centric. For example, some insurtech companies offer on-demand insurance products that can be purchased and activated through mobile apps. These companies are challenging traditional insurers to innovate and adapt to the changing needs of consumers.

- Artificial Intelligence (AI): AI is being used to improve efficiency, personalize customer experiences, and develop new products and services. For example, AI can be used to automate underwriting processes, detect fraud, and personalize pricing. This can help insurers reduce costs, improve accuracy, and offer more competitive products.

- Data Analytics: Insurers are increasingly using data analytics to understand their customers better, identify risks, and develop more effective products and services. This involves collecting and analyzing data from a variety of sources, such as customer interactions, claims data, and social media. Data analytics can help insurers to personalize their products and services, improve their pricing, and identify potential risks before they occur.

Last Point

The Australian insurance landscape is dynamic and competitive, with established players continually innovating and new entrants challenging the status quo. By understanding the factors driving growth and the challenges facing the industry, we can gain valuable insights into the future of insurance in Australia. The role of insurers in providing financial security and stability will remain crucial, as they adapt to a changing world and continue to offer essential protection to individuals and businesses alike.

Question & Answer Hub

What are the key regulations governing the Australian insurance industry?

The Australian Prudential Regulation Authority (APRA) is the primary regulator of the insurance industry, setting standards for capital adequacy, solvency, and consumer protection. Other relevant regulations include the Corporations Act and the Insurance Contracts Act.

How do I choose the right insurance policy for my needs?

It’s essential to carefully assess your individual needs and risks before choosing an insurance policy. Consider factors like coverage, premiums, claims processes, and the insurer’s reputation. Comparing quotes from different insurers is also crucial.

What are the main trends impacting the future of the Australian insurance market?

Key trends include digital transformation, increasing demand for personalized products, growing awareness of climate change risks, and the emergence of InsurTech companies offering innovative solutions.