- Understanding Rental Car Insurance in Australia

- Factors Affecting Rental Car Insurance Costs: Rental Car Insurance In Australia

- Choosing the Right Rental Car Insurance

- Common Exclusions and Limitations

- Additional Insurance Options

- Making a Claim

- Tips for Safe and Responsible Driving

- Final Summary

- FAQ

Rental car insurance in Australia is a vital aspect of any road trip or vacation. It protects you from financial losses in case of accidents, theft, or damage to the rental vehicle. Understanding the different types of insurance available, the factors affecting costs, and how to choose the right coverage is crucial for a safe and stress-free experience.

This guide will delve into the intricacies of rental car insurance in Australia, providing you with comprehensive information on the various options, their benefits and drawbacks, and essential tips for making informed decisions. Whether you’re a seasoned traveler or a first-time renter, this guide will equip you with the knowledge needed to navigate the complexities of rental car insurance.

Understanding Rental Car Insurance in Australia

Renting a car in Australia can be a convenient way to explore the country, but it’s essential to understand the different types of insurance available and how they protect you. This guide provides a comprehensive overview of rental car insurance options in Australia, helping you make an informed decision.

Types of Rental Car Insurance

Rental car insurance in Australia typically comes in several forms, each offering different levels of coverage. Understanding the different types of insurance available is crucial for choosing the right option for your needs.

- Basic Insurance: Included in the rental price, this insurance covers damage to the vehicle in case of an accident, but it often comes with high deductibles and limited coverage.

- Collision Damage Waiver (CDW): This insurance covers damage to the rental car, reducing the deductible you would otherwise pay.

- Theft Protection (TP): This insurance protects you against financial loss if the rental car is stolen.

- Personal Accident Insurance (PAI): This insurance covers medical expenses for you and your passengers in case of an accident.

- Third Party Liability (TPL): This insurance covers damage or injury to third parties (other people or property) in case of an accident.

- Excess Reduction: This insurance lowers the deductible you would pay in case of an accident.

- Comprehensive Insurance: This insurance provides comprehensive coverage for damage to the rental car, including theft, vandalism, and natural disasters.

Coverage Breakdown

Each type of rental car insurance provides specific coverage, and it’s essential to understand the details of each policy before renting a car.

- Basic Insurance: This insurance typically covers damage to the rental car in case of an accident but often comes with high deductibles and limited coverage. It may not cover damage caused by certain events, such as theft, vandalism, or natural disasters.

- Collision Damage Waiver (CDW): This insurance reduces the deductible you would otherwise pay for damage to the rental car. It’s often offered as an optional extra and can significantly reduce your out-of-pocket expenses in case of an accident.

- Theft Protection (TP): This insurance protects you against financial loss if the rental car is stolen. It may cover the cost of replacing the vehicle or compensate you for the value of the stolen car.

- Personal Accident Insurance (PAI): This insurance covers medical expenses for you and your passengers in case of an accident. It may also provide coverage for death or disability resulting from an accident.

- Third Party Liability (TPL): This insurance covers damage or injury to third parties (other people or property) in case of an accident. It’s usually mandatory in Australia, and the minimum amount of coverage varies by state.

- Excess Reduction: This insurance lowers the deductible you would pay in case of an accident. It’s often offered as an optional extra and can significantly reduce your out-of-pocket expenses.

- Comprehensive Insurance: This insurance provides comprehensive coverage for damage to the rental car, including theft, vandalism, and natural disasters. It’s often the most expensive option but provides the most comprehensive protection.

Benefits and Drawbacks of Rental Car Insurance

Each type of rental car insurance has its benefits and drawbacks, and it’s important to weigh these factors before making a decision.

- Basic Insurance: This insurance is typically the cheapest option but offers the least coverage. It’s suitable for drivers who are confident in their driving abilities and are willing to accept the risk of high deductibles.

- Collision Damage Waiver (CDW): This insurance offers significant protection against damage to the rental car, reducing your financial liability in case of an accident. However, it’s often an optional extra and can add to the overall cost of renting a car.

- Theft Protection (TP): This insurance provides peace of mind by protecting you against financial loss in case of theft. However, it’s often an optional extra and may not be necessary if you have comprehensive insurance coverage.

- Personal Accident Insurance (PAI): This insurance provides essential coverage for medical expenses in case of an accident. However, it’s often an optional extra and may be unnecessary if you have existing health insurance coverage.

- Third Party Liability (TPL): This insurance is mandatory in Australia and provides essential protection against financial liability to third parties in case of an accident. However, it’s important to ensure that your coverage is sufficient to meet your needs.

- Excess Reduction: This insurance can significantly reduce your out-of-pocket expenses in case of an accident. However, it’s often an optional extra and may not be necessary if you have a high deductible.

- Comprehensive Insurance: This insurance provides the most comprehensive protection against damage to the rental car. However, it’s often the most expensive option and may not be necessary if you have existing insurance coverage.

Factors Affecting Rental Car Insurance Costs: Rental Car Insurance In Australia

Rental car insurance costs can vary significantly depending on several factors. Understanding these factors can help you make informed decisions and potentially save money on your rental car insurance.

Age and Driving History

Your age and driving history are key factors that influence your rental car insurance premiums. Generally, younger drivers and those with poor driving records are considered higher risks, leading to higher insurance costs.

- Age: Insurance companies often charge higher premiums for drivers under 25, as they are statistically more likely to be involved in accidents. This is because younger drivers have less experience and may be more prone to risky driving behavior.

- Driving History: A history of accidents, traffic violations, or DUI convictions can significantly increase your insurance costs. Insurance companies view these events as indicators of risky driving behavior and may consider you a higher risk.

Vehicle Type

The type of vehicle you rent also impacts the cost of insurance. Luxury cars, SUVs, and high-performance vehicles are generally more expensive to insure due to their higher repair costs and potential for more severe accidents.

- Luxury Cars: Due to their higher value and complex repair requirements, luxury cars often have higher insurance premiums.

- SUVs and Vans: SUVs and vans are often considered riskier to drive due to their size and weight, potentially leading to higher insurance costs.

- High-Performance Vehicles: Sports cars and other high-performance vehicles are often associated with more aggressive driving styles, which can increase insurance premiums.

Rental Car Company

Rental car companies in Australia often have different insurance policies and pricing structures. It’s important to compare quotes from multiple companies to find the best value for your needs.

- Insurance Policies: Some rental car companies may offer more comprehensive insurance coverage, while others may have more limited policies.

- Pricing Structures: Rental car companies may have different pricing models for their insurance, such as daily rates, flat fees, or bundled packages.

Choosing the Right Rental Car Insurance

Choosing the right rental car insurance is crucial to ensure you are adequately covered in case of an accident or other unforeseen events. It’s important to understand your needs and weigh the various options available before making a decision.

Understanding Your Needs

Rental car insurance is designed to protect you financially in case of damage to the rental car or if you’re involved in an accident. It’s important to consider your individual needs when choosing a policy, including the type of coverage you require, the duration of your rental, and your budget.

- Duration of Rental: If you are renting a car for a short period, basic insurance might be sufficient. However, for longer rentals, you may want to consider more comprehensive coverage.

- Type of Trip: If you are planning a road trip or driving in unfamiliar areas, it might be wise to opt for extra coverage, such as collision damage waiver (CDW) and theft protection.

- Budget: Rental car insurance can add significantly to the overall cost of your rental. It’s important to compare different options and find a policy that fits your budget.

Comparing Insurance Options

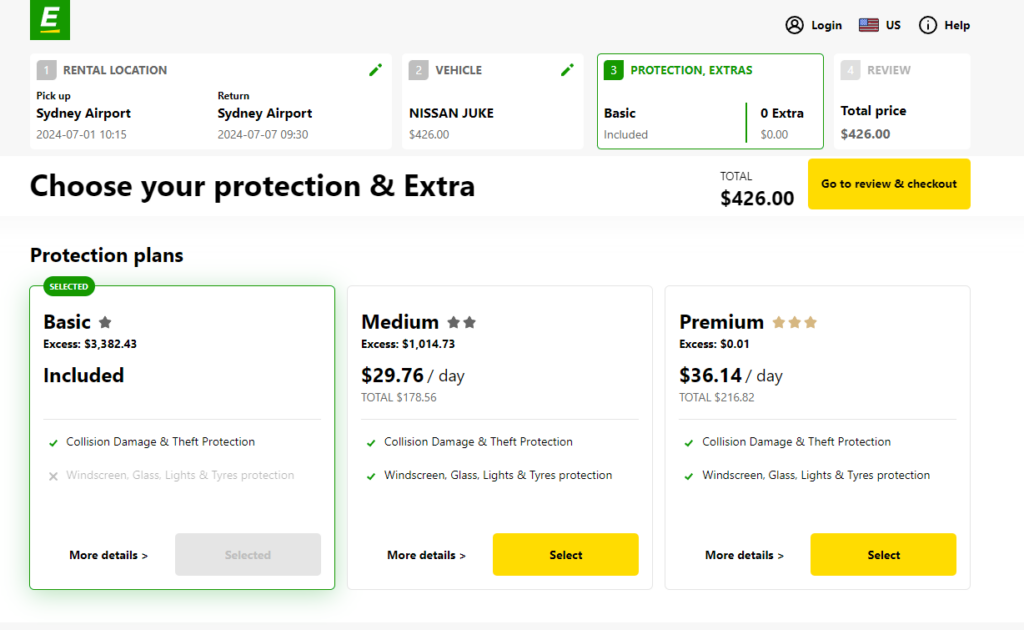

Rental car companies offer a range of insurance options, each with its own coverage and cost. It’s important to compare different options to find the best value for your needs. Here’s a table comparing some common insurance options:

| Insurance Option | Coverage | Cost |

|---|---|---|

| Basic Insurance | Liability coverage, typically required by law | Included in the rental price |

| Collision Damage Waiver (CDW) | Covers damage to the rental car, excluding deductible | Varies, typically around $10-$20 per day |

| Theft Protection | Covers theft of the rental car | Varies, typically around $5-$10 per day |

| Personal Accident Insurance (PAI) | Covers medical expenses and death benefits for the driver and passengers | Varies, typically around $5-$10 per day |

| Personal Effects Coverage (PEC) | Covers damage or theft of personal belongings in the rental car | Varies, typically around $5-$10 per day |

Negotiating Better Rates

While rental car insurance is essential, you can often negotiate better rates by following these tips:

- Shop Around: Compare prices from different rental car companies before booking. Some companies offer better deals than others.

- Consider Existing Coverage: Check if your existing car insurance policy covers rental car damage or theft. This can help you save money on rental car insurance.

- Ask for Discounts: Many rental car companies offer discounts for AAA members, frequent renters, or those who book online. Be sure to inquire about any available discounts.

- Decline Unnecessary Coverage: Don’t feel pressured to purchase additional coverage you don’t need. If you already have comprehensive car insurance, you might not need CDW or theft protection.

Common Exclusions and Limitations

Rental car insurance policies, like any insurance, have limitations and exclusions. Understanding these aspects is crucial to avoid unexpected costs and ensure you have the right coverage for your needs. This section will Artikel common exclusions and limitations, providing examples to illustrate potential scenarios where insurance claims may be denied.

Driving Under the Influence

Driving under the influence of alcohol or drugs is a common exclusion in rental car insurance policies. This is because driving under the influence significantly increases the risk of accidents and damages.

If you are found to be driving under the influence, your insurance claim may be denied, and you may be held personally liable for any damages or injuries caused.

Unauthorized Drivers

Rental car insurance policies typically cover only authorized drivers. If someone other than the named driver on the rental agreement is driving the vehicle, the insurance may not cover damages or losses.

For example, if you let a friend drive the rental car without informing the rental company, and they cause an accident, the insurance may not cover the damages.

Unpermitted Use

Rental car insurance policies usually restrict the use of the vehicle. This means the car cannot be used for specific purposes, such as:

- Commercial use: Using the car for business purposes, such as deliveries or transporting goods, may be prohibited.

- Off-road driving: Driving the car on unpaved roads or off-road terrain is typically not allowed.

- Racing or competitive events: Participating in any racing or competitive events is usually excluded.

If you use the rental car for a purpose not permitted by the rental agreement, your insurance claim may be denied.

Pre-existing Damage

If the rental car already has damage before you rent it, the insurance may not cover repairs for that damage.

It is important to inspect the rental car thoroughly before driving off and report any existing damage to the rental company.

Wear and Tear, Rental car insurance in australia

Rental car insurance policies typically do not cover normal wear and tear on the vehicle. This includes things like:

- Flat tires

- Scratches and dents

- Oil changes

You will be responsible for any repairs or replacements related to normal wear and tear.

Failure to Comply with Rental Agreement

Failure to comply with the terms of the rental agreement, such as exceeding the mileage limit or returning the car late, may result in the insurance not covering damages or losses.

It is crucial to read and understand the rental agreement thoroughly before signing it.

Acts of God

Rental car insurance policies may not cover damages caused by natural disasters, such as floods, earthquakes, or tornadoes.

If your rental car is damaged by an act of God, you may need to seek coverage from a separate insurance policy or contact the rental company directly.

Additional Insurance Options

Beyond the basic rental car insurance that’s usually included in your rental agreement, there are various additional insurance options available to provide you with extra protection and peace of mind. These options are designed to cover specific risks or situations that may not be fully addressed by the basic coverage. While these add-ons can be beneficial, it’s essential to carefully consider your needs and budget before deciding whether to purchase them.

Types of Additional Insurance

Additional insurance options can be broadly categorized into three main types:

- Collision Damage Waiver (CDW): This coverage protects you from financial responsibility for damage to the rental vehicle, often with a deductible. CDW is typically included in the basic rental price, but some rental companies offer additional options like “zero deductible” CDW, which eliminates the deductible entirely.

- Theft Protection: This coverage protects you against financial liability for the theft of the rental vehicle. It’s usually included in the basic rental price, but additional options may offer broader coverage or eliminate the deductible.

- Personal Accident Insurance (PAI): This insurance covers medical expenses and other related costs for the renter and passengers in case of an accident. PAI is often offered as an add-on to the basic rental price and may provide coverage for medical expenses, lost wages, and other related costs.

Benefits and Drawbacks of Additional Insurance

Each additional insurance option has its own benefits and drawbacks, and it’s important to weigh these carefully before making a decision.

- Benefits:

- Increased Coverage: Additional insurance options provide more comprehensive coverage than the basic rental insurance, potentially covering a wider range of risks and situations.

- Peace of Mind: Knowing that you’re protected against potential financial losses due to accidents, theft, or other incidents can provide a sense of peace of mind during your rental period.

- Reduced Financial Risk: Additional insurance options can significantly reduce your financial risk in case of an incident, protecting you from hefty repair costs, legal fees, or other expenses.

- Drawbacks:

- Additional Cost: Purchasing additional insurance options will increase the overall cost of your rental.

- Overlapping Coverage: Your existing personal auto insurance policy may already cover some of the risks covered by additional rental car insurance, leading to potential overlap and unnecessary expenditure.

- Complexity: The terms and conditions of additional insurance options can be complex, and it’s essential to read and understand them carefully before making a decision.

Cost and Coverage Comparison

The cost and coverage of additional insurance options vary significantly depending on the rental company, the type of vehicle, the length of the rental period, and the specific coverage offered.

- CDW: The cost of CDW can range from a few dollars per day to over $20 per day, depending on the factors mentioned above. It’s essential to compare the coverage offered by different rental companies and choose the option that best suits your needs and budget.

- Theft Protection: The cost of theft protection can vary, but it’s often included in the basic rental price. If you’re renting a high-value vehicle, it’s essential to check if the basic coverage is sufficient or if you need additional protection.

- PAI: The cost of PAI can range from a few dollars per day to over $10 per day. It’s important to compare the coverage offered by different rental companies and consider your existing health insurance coverage before deciding whether to purchase PAI.

Important Considerations

- Your Existing Insurance Coverage: Review your personal auto insurance policy to determine if it provides any coverage for rental vehicles. Some policies offer secondary coverage for rental vehicles, meaning they will cover damages or losses after your primary rental insurance has been exhausted.

- Credit Card Benefits: Check if your credit card offers any rental car insurance benefits. Some credit cards provide automatic coverage for collision damage and theft, eliminating the need for additional insurance.

- Rental Company Policies: Carefully review the terms and conditions of the rental agreement, including the details of the basic insurance coverage and any additional insurance options.

- Risk Assessment: Consider your individual risk tolerance and the potential financial impact of an accident or theft. If you’re comfortable assuming a higher level of risk, you may not need to purchase additional insurance.

Making a Claim

Making a claim with your rental car insurance provider is a straightforward process, but it’s essential to understand the steps involved and the necessary documentation. This section Artikels the process, the required information, and some helpful tips for a smooth claims experience.

Filing a Claim

When you need to make a claim, the first step is to contact your insurance provider as soon as possible. This can typically be done via phone, email, or online through their website. During the initial contact, provide them with the following information:

- Your policy details, including your policy number and the dates of your rental

- Details of the incident, including the date, time, and location

- A description of the damage to the rental car

- The names and contact information of any other parties involved

- Any relevant police reports or witness statements

Once you’ve contacted your insurer, they will guide you through the next steps. This may involve providing additional documentation, such as:

- A copy of your driver’s license

- A copy of your rental agreement

- Photographs or video footage of the damage

- Any receipts for repairs or other expenses related to the incident

Claim Processing

After you submit your claim, your insurance provider will review the details and begin the processing. This typically involves:

- Assessing the damage to the rental car

- Investigating the incident

- Determining the extent of your coverage

- Calculating the amount of your claim

The processing time for claims can vary depending on the complexity of the incident and the availability of information. It’s crucial to cooperate with your insurance provider throughout the process and provide any requested information promptly.

Tips for a Smooth Claims Process

- Keep detailed records of the incident, including dates, times, locations, and contact information for any involved parties.

- Take photographs or videos of the damage to the rental car from all angles.

- Obtain witness statements if available.

- Be honest and transparent with your insurance provider about the incident.

- Follow the instructions provided by your insurance provider and respond to any requests for information promptly.

Tips for Safe and Responsible Driving

Driving a rental car in Australia is a great way to explore the country at your own pace. However, it’s important to remember that you’re responsible for the vehicle and its safety. By following some simple tips, you can ensure a safe and enjoyable rental experience.

Driving Safely

Driving safely in Australia is crucial, especially when you’re unfamiliar with the roads. Here are some tips to keep in mind:

- Familiarize yourself with Australian road rules. Australia has its own set of traffic laws and regulations, which may differ from your home country. Take some time to familiarize yourself with these rules before you hit the road. You can find information on the official website of the Australian government.

- Be aware of speed limits. Speed limits in Australia are strictly enforced, and exceeding them can result in fines and penalties. Make sure you are aware of the speed limit for each road you travel on and stick to it.

- Drive defensively. Always be aware of your surroundings and anticipate the actions of other drivers. Be prepared to react quickly to any unexpected situations.

- Avoid driving under the influence of alcohol or drugs. Australia has strict laws against driving under the influence of alcohol or drugs. Even a small amount of alcohol can impair your judgment and reaction time. If you plan on drinking, arrange for a designated driver or take a taxi.

- Take breaks when you’re tired. Driving when you’re tired can be just as dangerous as driving under the influence. If you start to feel drowsy, pull over to a safe spot and take a break. You can also switch drivers if you’re traveling with someone else.

- Be aware of wildlife. Australia is home to a variety of wildlife, and some animals may be active at night. Be particularly careful when driving in rural areas, as animals may cross the road unexpectedly.

Minimizing Risks

While you can’t eliminate all risks when driving, there are steps you can take to minimize them:

- Choose a rental car that’s appropriate for your needs. If you’re planning on driving on unpaved roads or towing a trailer, make sure you choose a vehicle that’s capable of handling these conditions. You can ask the rental company for recommendations based on your specific needs.

- Check the car thoroughly before you drive it. Look for any damage or defects, and report any issues to the rental company immediately. Take pictures of any existing damage for documentation purposes. This will help avoid any disputes when you return the car.

- Keep your valuables out of sight. Don’t leave any valuables in plain view inside the car. If you have to leave something in the car, lock it in the trunk or take it with you.

- Park in well-lit areas. When parking, try to choose a spot that is well-lit and visible. This will help deter thieves and make it easier to find your car.

- Don’t leave the car running unattended. Never leave the car running unattended, even for a short time. This is a common target for car thieves.

Responsible Driving Habits

Adopting responsible driving habits will contribute to a safer and more enjoyable driving experience:

- Obey all traffic laws. This includes speed limits, traffic signals, and road markings. Don’t take unnecessary risks or engage in reckless driving.

- Use your seatbelt. Seatbelts are designed to protect you in case of an accident. Make sure everyone in the car is wearing their seatbelt at all times.

- Avoid distractions. Driving requires your full attention. Avoid distractions like using your phone, eating, or talking to passengers.

- Stay alert. Pay attention to your surroundings and be aware of potential hazards. Avoid driving when you’re tired or under the influence of alcohol or drugs.

- Be courteous to other drivers. Be polite and respectful to other drivers on the road. This includes signaling your intentions, giving way to other vehicles, and avoiding aggressive driving.

Final Summary

Navigating the world of rental car insurance in Australia can seem daunting, but by understanding the different options, factors affecting costs, and how to choose the right coverage, you can ensure a safe and stress-free driving experience. Remember to read the fine print, consider your individual needs, and don’t hesitate to ask questions. With the right insurance, you can explore Australia’s diverse landscapes with peace of mind.

FAQ

What is the difference between liability insurance and collision damage waiver (CDW)?

Liability insurance covers damages to third-party property or injuries to others in an accident, while CDW covers damage to the rental vehicle itself.

Do I need to purchase additional insurance from the rental company?

It depends on your existing insurance policies and the level of coverage you require. Some credit cards offer rental car insurance, and your personal auto insurance may also extend coverage.

What happens if I’m in an accident and don’t have insurance?

You’ll be held responsible for any damages to the rental vehicle, as well as any injuries or property damage to others involved. You could face significant financial penalties and legal repercussions.