Finding the best and cheap car insurance in Australia can be a daunting task, with numerous providers offering a wide range of policies and coverage options. Navigating this complex landscape requires a thorough understanding of the different types of insurance, key factors influencing premiums, and strategies for securing the most affordable coverage. This guide aims to provide you with the essential information to make informed decisions about your car insurance, ensuring you get the protection you need without breaking the bank.

The Australian car insurance market offers various types of coverage, each catering to different needs and budgets. Comprehensive insurance provides the most extensive protection, covering damage to your vehicle, as well as liability for injuries to others and property damage. Third-party property damage insurance covers only damage to other vehicles or property, while third-party fire and theft insurance provides protection against these specific risks. The type of insurance you choose will depend on your individual circumstances and risk tolerance.

Understanding Australian Car Insurance

Navigating the world of car insurance in Australia can be overwhelming, especially with the numerous options available. This guide will shed light on the different types of car insurance, the key factors influencing premiums, and common inclusions and exclusions in policies.

Types of Car Insurance in Australia

Car insurance in Australia offers varying levels of coverage, each tailored to different needs and risk tolerances. Here’s a breakdown of the most common types:

- Comprehensive Car Insurance: This provides the most extensive coverage, protecting your car against a wide range of incidents, including accidents, theft, fire, and natural disasters. It also covers damage to your vehicle caused by other drivers, regardless of fault.

- Third Party Property Damage: This type of insurance covers damage you cause to another person’s vehicle or property in an accident, but it doesn’t cover damage to your own car.

- Third Party Fire and Theft: This policy offers protection against damage caused by fire or theft, but not accidents. It covers damage to other people’s vehicles or property, but not your own.

- Third Party Only: This is the most basic level of insurance, offering minimal coverage. It covers damage you cause to other people’s vehicles or property, but not your own.

Factors Influencing Car Insurance Premiums

Several factors determine the cost of your car insurance premium. Understanding these factors can help you make informed decisions and potentially lower your premiums:

- Age and Driving History: Younger drivers and those with a history of accidents or traffic violations tend to pay higher premiums due to their higher risk profile.

- Car Model and Value: Expensive and high-performance vehicles are generally more expensive to insure due to their higher repair costs and greater risk of theft.

- Location: Insurance premiums can vary depending on the location where you live and park your car. Areas with higher crime rates or more frequent accidents may have higher premiums.

- Driving Habits: Your driving habits, such as the number of kilometers you drive annually, can impact your premium. Drivers who commute long distances or drive frequently may face higher premiums.

- Claims History: A history of insurance claims can increase your premiums. Insurance companies assess your risk based on past claims, and a higher risk profile typically translates to higher premiums.

- No-Claim Bonus: If you haven’t made any claims on your car insurance policy for a certain period, you may be eligible for a no-claim bonus. This discount can significantly reduce your premium.

Common Inclusions and Exclusions in Car Insurance Policies

Understanding the inclusions and exclusions in your car insurance policy is crucial to avoid surprises when making a claim. Here’s a general overview:

- Inclusions:

- Third Party Liability: This covers damage you cause to other people’s vehicles or property.

- Own Damage: This covers damage to your vehicle, depending on the type of insurance policy you have.

- Fire and Theft: Most policies include coverage for damage caused by fire or theft.

- Natural Disasters: Coverage for damage caused by natural disasters like floods, storms, and earthquakes may be included in comprehensive policies.

- Towing and Recovery: In case of an accident or breakdown, your insurance may cover towing and recovery expenses.

- Emergency Accommodation: If your car is damaged and you’re unable to drive, your insurance may cover emergency accommodation expenses.

- Hire Car: If your car is damaged and you need a temporary replacement, your insurance may cover the cost of a hire car.

- Exclusions:

- Wear and Tear: Damage caused by normal wear and tear on your vehicle is generally not covered.

- Mechanical Breakdown: Most policies don’t cover damage caused by mechanical breakdowns.

- Driving Under the Influence: Damage caused while driving under the influence of alcohol or drugs is typically excluded.

- Driving Without a License: Damage caused while driving without a valid license is generally not covered.

- War or Terrorism: Damage caused by war or terrorism is usually excluded.

Finding the Best Car Insurance

Finding the right car insurance in Australia can be a bit of a maze. With so many providers and policies, it’s easy to get lost in the details. But don’t worry, we’re here to help you navigate the process and find the best coverage at a price that fits your budget.

Comparing Car Insurance Providers

When comparing car insurance providers, it’s crucial to consider not only price but also the coverage offered and the quality of customer service. Here are some of the top providers in Australia, known for their competitive pricing and comprehensive coverage:

- AAMI: AAMI is a well-established insurer known for its competitive prices and comprehensive coverage options. They offer a range of discounts, including no-claim bonuses and multi-policy discounts.

- NRMA: NRMA is another popular choice, particularly for those living in New South Wales. They provide excellent customer service and a wide range of insurance products, including car, home, and travel insurance.

- RACQ: RACQ is a Queensland-based insurer with a strong reputation for its comprehensive coverage and competitive rates. They offer a variety of insurance products, including car, home, and contents insurance.

- GIO: GIO is a reputable insurer known for its straightforward and transparent policies. They offer a wide range of coverage options and discounts, making it a popular choice for many Australians.

Key Features to Consider

When choosing car insurance, there are several key features to consider that can significantly impact the cost and coverage of your policy:

- Excess Fees: Excess fees are the amount you pay out of pocket in the event of a claim. The higher the excess, the lower your premium will be. It’s important to choose an excess you can comfortably afford.

- No-Claim Bonuses: No-claim bonuses are discounts offered for not making a claim on your insurance policy. These bonuses can be substantial, so it’s worth maintaining a clean driving record to maximize your savings.

- Roadside Assistance: Roadside assistance provides support in case of a breakdown or accident, including towing, jump starts, and tire changes. This can be a valuable addition to your policy, especially for long drives or if you live in a remote area.

Obtaining and Comparing Quotes, Best and cheap car insurance in australia

Getting quotes from different insurers is essential to find the best deal. Here’s a guide to help you:

- Gather Your Information: Before you start getting quotes, have your car details ready, including the make, model, year, and registration number. You’ll also need your driver’s license information and any relevant claims history.

- Use Comparison Websites: Comparison websites like Compare the Market, iSelect, and Canstar can help you compare quotes from multiple insurers in one place. This can save you time and effort.

- Contact Insurers Directly: You can also contact insurers directly to get a quote. This allows you to discuss your specific needs and ask questions about their policies.

- Compare Quotes Carefully: Once you have received quotes from different insurers, compare them carefully, considering the coverage offered, excess fees, no-claim bonuses, and any other relevant features. Don’t just focus on the cheapest option; ensure you understand the coverage you’re getting.

Tips for Saving Money on Car Insurance

Finding the best car insurance deal isn’t just about getting the lowest price; it’s about securing comprehensive coverage that aligns with your needs while minimizing your out-of-pocket expenses. By implementing smart strategies and leveraging available discounts, you can significantly reduce your insurance premiums.

Qualifying for Discounts

Insurance companies offer various discounts to reward safe driving habits and responsible vehicle ownership. By taking advantage of these discounts, you can significantly reduce your premium costs.

- Safe Driving Courses: Completing a defensive driving course demonstrates your commitment to safe driving and can lead to discounts of up to 10%. These courses teach valuable driving techniques and help you avoid accidents.

- Anti-theft Devices: Installing anti-theft devices like alarms, immobilizers, or GPS tracking systems reduces the risk of theft and can earn you a discount of 5-15%. These devices deter theft and make it easier to recover your vehicle if it’s stolen.

- Multiple Policy Discounts: Bundling your car insurance with other policies, such as home or contents insurance, can result in substantial savings. Insurers often offer discounts of 10-20% for multiple policies.

- Loyalty Discounts: Staying with the same insurer for an extended period can qualify you for loyalty discounts. These discounts reward long-term customers and can range from 5% to 15% depending on your insurer.

- Good Driving Record: Maintaining a clean driving record with no accidents or violations is a significant factor in obtaining lower premiums. A spotless record demonstrates your responsible driving habits and can lead to significant savings.

Reducing Your Risk of Accidents

The primary goal of car insurance is to protect you financially in case of an accident. However, reducing your risk of accidents can also have a positive impact on your insurance premiums.

- Defensive Driving: Practicing defensive driving techniques, such as maintaining a safe following distance, scanning for potential hazards, and avoiding distractions, can significantly reduce your chances of getting into an accident.

- Vehicle Maintenance: Regular vehicle maintenance, including oil changes, tire rotations, and brake inspections, ensures your car is in optimal condition and reduces the risk of breakdowns or accidents caused by mechanical failures.

- Avoiding Distractions: Distracted driving is a major cause of accidents. Avoid using your phone, eating, or engaging in other activities while driving to maintain focus on the road.

- Driving During Off-Peak Hours: Traffic congestion increases the risk of accidents. Consider driving during off-peak hours to minimize your exposure to heavy traffic.

- Parking in Safe Locations: Park your car in well-lit and secure areas to reduce the risk of theft or damage. Avoid parking in isolated or high-crime areas.

Negotiating with Insurance Providers

Don’t be afraid to negotiate with insurance providers to secure a better deal. Insurance companies are often willing to work with you to find a solution that meets your needs and budget.

- Shop Around: Get quotes from multiple insurers to compare prices and coverage options. This will give you a better understanding of the market and help you negotiate a favorable rate.

- Highlight Your Positive Attributes: Emphasize your safe driving record, good credit score, and any discounts you qualify for. These factors can make you a more attractive customer and increase your bargaining power.

- Be Prepared to Walk Away: Don’t be afraid to walk away if you’re not satisfied with the offer. This shows the insurer that you’re serious about finding the best deal and may prompt them to offer a more competitive rate.

- Consider Increasing Your Deductible: A higher deductible means you’ll pay more out of pocket in case of an accident, but it can significantly lower your premium. This strategy can be beneficial if you’re confident in your driving ability and are willing to take on more financial risk.

Understanding Your Policy: Best And Cheap Car Insurance In Australia

It’s crucial to thoroughly read and understand your car insurance policy. This document Artikels your coverage, limitations, and the procedures for making claims. By familiarizing yourself with its contents, you can ensure you’re adequately protected and know how to navigate the claims process effectively.

Policy Sections

Your car insurance policy is divided into distinct sections, each providing specific information.

- Coverage Details: This section Artikels the types of coverage you have, such as comprehensive, third-party property damage, and third-party personal injury. It specifies the limits of coverage for each type, such as the maximum amount payable for repairs or medical expenses.

- Exclusions: This section lists situations or circumstances not covered by your policy. These can include specific types of damage, events, or actions that are not covered by your policy. For example, damage caused by wear and tear or driving under the influence of alcohol or drugs may be excluded.

- Claims Procedures: This section details the steps you need to take to make a claim. It Artikels the necessary documentation, timelines, and communication channels for reporting an incident and initiating the claims process.

Making a Claim

When you need to make a claim, follow the Artikeld procedures in your policy.

- Report the Incident: Contact your insurer immediately after the incident, providing all relevant details, such as the date, time, location, and circumstances.

- Provide Documentation: Gather necessary documentation, including police reports, witness statements, and photographs of the damage.

- Cooperate with the Insurer: Respond to your insurer’s inquiries promptly and provide all requested information.

- Follow the Claims Process: Your insurer will guide you through the claims process, which may involve inspections, assessments, and negotiations.

It’s important to note that the claims process can vary depending on the insurer and the specific circumstances of your claim.

Additional Considerations

When choosing car insurance, there are a few additional factors to consider beyond just price and coverage. These factors can have a significant impact on your overall experience and the level of protection you receive.

The Role of the Australian Financial Complaints Authority (AFCA)

The Australian Financial Complaints Authority (AFCA) plays a crucial role in resolving disputes between consumers and financial service providers, including insurance companies. If you encounter an issue with your car insurance, such as a claim being denied or a dispute over the amount of compensation, you can contact AFCA for assistance. They provide free and independent dispute resolution services, aiming to resolve issues fairly and efficiently.

The Importance of Maintaining a Good Driving Record

A clean driving record is a significant factor in determining your car insurance premiums. Insurance companies consider your driving history, including any accidents, traffic violations, or points accumulated on your license. Maintaining a good driving record by driving safely and avoiding common driving mistakes can help you secure lower premiums.

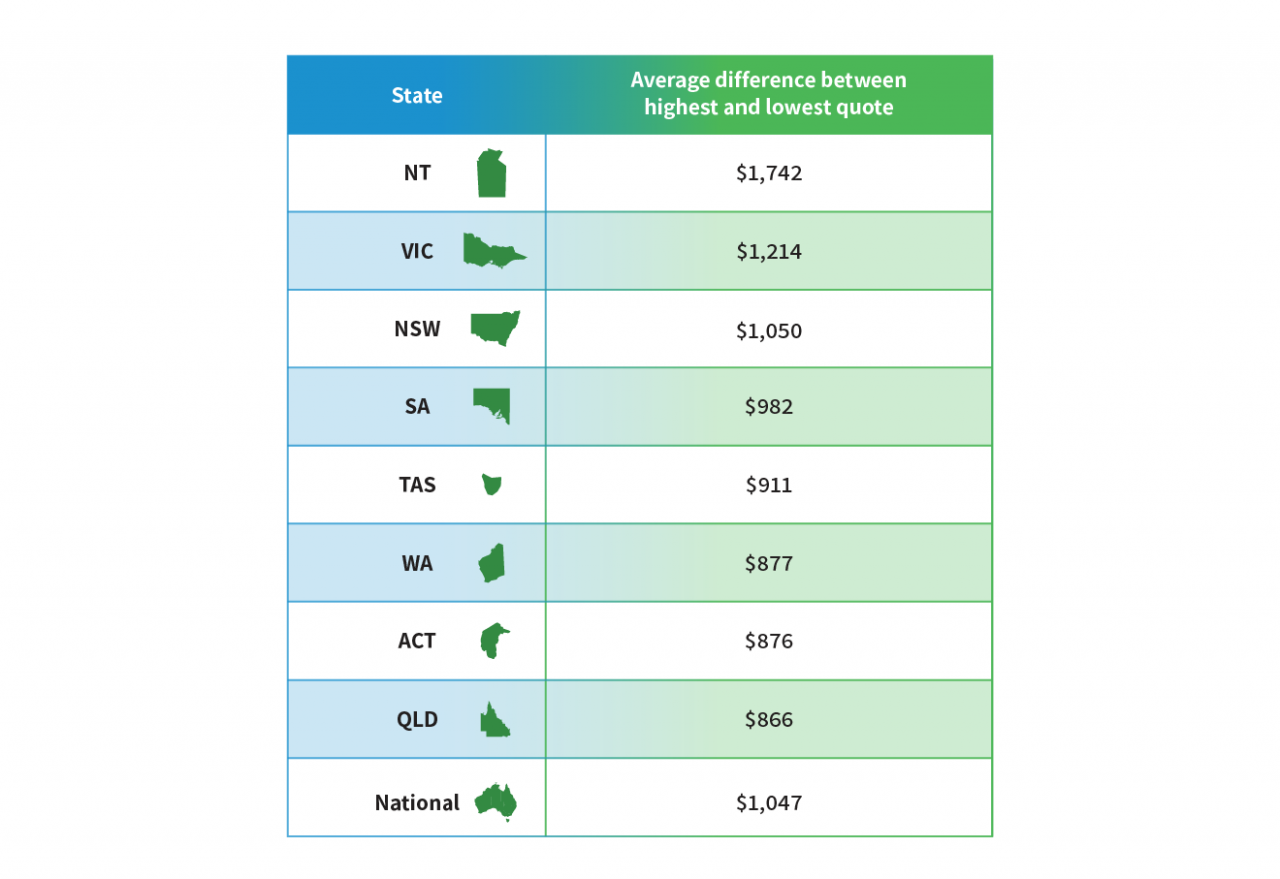

Average Cost of Car Insurance in Different Australian States and Territories

The average cost of car insurance varies significantly across different Australian states and territories, influenced by factors such as population density, traffic conditions, and the prevalence of car theft. Here’s a table outlining the average annual cost of comprehensive car insurance for a 30-year-old driver with a clean driving record, based on a 2022 study:

| State/Territory | Average Annual Cost (AUD) |

|---|---|

| New South Wales | $1,200 |

| Victoria | $1,100 |

| Queensland | $1,000 |

| Western Australia | $1,300 |

| South Australia | $1,050 |

| Tasmania | $1,150 |

| Northern Territory | $1,400 |

| Australian Capital Territory | $1,250 |

Final Wrap-Up

Finding the best and cheap car insurance in Australia involves a combination of careful research, comparison shopping, and proactive steps to minimize your risk. By understanding the various types of insurance available, considering key factors influencing premiums, and implementing cost-saving strategies, you can secure the most affordable coverage that meets your needs. Remember to read your policy carefully, understand its terms and conditions, and seek professional advice if you have any questions or concerns. With the right approach, you can drive with confidence, knowing you have the right protection at the right price.

Detailed FAQs

What are the most common discounts offered by car insurance providers in Australia?

Common discounts include safe driving courses, anti-theft devices, multiple policy discounts, and good driving records.

How do I make a claim with my car insurance provider?

Contact your insurance provider immediately after an accident. They will guide you through the claims process, including providing necessary documentation and arranging repairs or replacement.

What are the common exclusions in Australian car insurance policies?

Common exclusions include damage caused by wear and tear, intentional acts, driving under the influence, and driving without a valid license.