Are insurance payouts taxable in Australia? This question is crucial for anyone who has received or may receive an insurance payout, as it directly impacts their financial obligations. Understanding the tax implications of insurance payouts is essential for ensuring compliance with Australian tax laws and making informed financial decisions.

The taxability of insurance payouts in Australia depends on various factors, including the type of insurance, the circumstances surrounding the payout, and the specific provisions of the Australian Taxation Office (ATO). This article will delve into the intricacies of insurance payout taxation, providing a comprehensive overview of the relevant rules, exceptions, and reporting requirements.

Types of Insurance Payouts in Australia

Insurance payouts in Australia can vary depending on the type of insurance policy you hold. Here’s a breakdown of some common types and their associated payouts.

Life Insurance

Life insurance payouts are typically received by beneficiaries upon the death of the insured person. The amount received depends on the type of policy and the sum assured. Life insurance policies can be categorized into two main types:

- Term Life Insurance: This type of policy provides coverage for a specific period, usually 10, 20, or 30 years. If the insured person dies within the term, the beneficiary receives a lump sum payment. If the insured person survives the term, no payout is made.

- Whole Life Insurance: This type of policy provides coverage for the entire lifetime of the insured person. The beneficiary receives a lump sum payment upon the insured person’s death, regardless of when it occurs. Whole life insurance policies also accumulate cash value over time, which can be accessed by the policyholder during their lifetime.

Examples of common life insurance payouts:

- A lump sum payment of $500,000 to a beneficiary upon the death of the insured person.

- A monthly income payment of $5,000 to a beneficiary for a period of 10 years, following the death of the insured person.

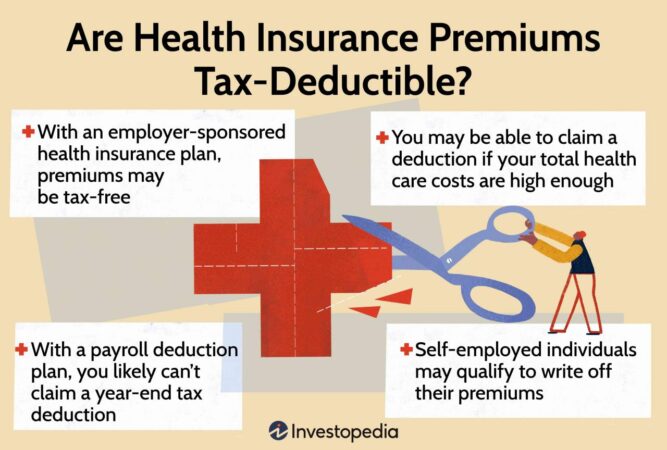

Health Insurance

Health insurance payouts are received by the policyholder to cover medical expenses, including hospital stays, surgeries, and consultations. The specific payouts vary depending on the level of cover chosen and the nature of the medical expense.

Examples of common health insurance payouts:

- Reimbursement for hospital expenses, such as room charges, nursing fees, and operating theatre costs.

- Payment for ambulance services, including transport to and from hospitals.

- Partial or full coverage for medical consultations, such as visits to GPs, specialists, and physiotherapists.

Income Protection Insurance

Income protection insurance payouts are received by the policyholder to replace lost income due to illness or disability. The amount received is usually a percentage of the policyholder’s pre-disability income, and the payout period can range from a few months to several years.

Examples of common income protection insurance payouts:

- A monthly payment of $3,000 to a policyholder who is unable to work due to a back injury.

- A lump sum payment of $10,000 to a policyholder who is diagnosed with a terminal illness.

Taxability of Insurance Payouts

In Australia, the taxability of insurance payouts depends on the type of insurance and the purpose for which the payout is received. Generally, insurance payouts are considered tax-free if they are received to compensate for a loss or damage. However, there are some exceptions to this rule, and some payouts may be subject to tax.

Tax Implications of Different Types of Insurance Payouts

The tax implications of insurance payouts vary depending on the type of insurance policy. Here are some common types of insurance payouts and their tax implications:

- Health insurance payouts: Payouts from health insurance policies are generally tax-free. This includes payments for medical expenses, hospital stays, and other health-related costs.

- Life insurance payouts: Life insurance payouts are generally tax-free if they are received as a result of the death of the insured person. However, if the payout is received as a result of a critical illness, it may be subject to tax.

- Income protection insurance payouts: Payouts from income protection insurance policies are generally taxable as they are considered a replacement for lost income. However, there may be some exceptions depending on the specific policy terms and conditions.

- General insurance payouts: Payouts from general insurance policies, such as home, car, or business insurance, are generally tax-free if they are received to compensate for a loss or damage. However, if the payout is received for a profit-making activity, it may be subject to tax.

- Investment insurance payouts: Payouts from investment insurance policies are generally taxable as they are considered investment income. However, there may be some exceptions depending on the specific policy terms and conditions.

Examples of Taxable and Non-Taxable Insurance Payouts

Here are some examples of scenarios where insurance payouts are taxable and where they are not:

Taxable Insurance Payouts

- Income protection insurance payout: If you receive a payout from an income protection policy because you are unable to work due to illness or injury, this payout will be considered taxable income. This is because the payout is replacing your lost income.

- Investment insurance payout: If you receive a payout from an investment insurance policy that has grown in value over time, this payout will be considered taxable income. This is because the payout represents investment income.

- General insurance payout for a profit-making activity: If you receive a payout from a general insurance policy to cover a loss or damage to your business, this payout may be considered taxable income. This is because the payout is related to your business income.

Non-Taxable Insurance Payouts

- Life insurance payout: If you receive a payout from a life insurance policy as a result of the death of the insured person, this payout will be tax-free. This is because the payout is intended to provide financial support to the beneficiaries.

- Health insurance payout: If you receive a payout from a health insurance policy to cover medical expenses, this payout will be tax-free. This is because the payout is intended to help you pay for health-related costs.

- General insurance payout for a personal loss: If you receive a payout from a general insurance policy to cover a loss or damage to your personal property, this payout will be tax-free. This is because the payout is intended to help you replace or repair your damaged property.

Exceptions to Taxability: Are Insurance Payouts Taxable In Australia

While most insurance payouts are generally considered taxable income in Australia, there are certain exceptions where these payouts are not subject to tax. These exceptions are designed to protect individuals from financial hardship and ensure that insurance payments intended for specific purposes are not taxed.

Life Insurance Proceeds, Are insurance payouts taxable in australia

Life insurance payouts are generally exempt from income tax in Australia, regardless of the reason for the payout. This exemption applies to payments received by beneficiaries upon the death of the insured person. The life insurance proceeds are considered a capital gain and not taxable income.

Life insurance payouts are generally exempt from income tax in Australia.

Health Insurance Payments

Health insurance payouts received for medical expenses are generally tax-free. This exemption applies to payments from private health insurance policies that cover medical costs, such as hospital bills, surgery fees, and ambulance charges. These payments are considered reimbursements for out-of-pocket medical expenses and are not considered taxable income.

Health insurance payouts for medical expenses are generally tax-free.

Income Protection Insurance Payments

Income protection insurance payouts are generally tax-free if they are received to replace lost income due to illness or disability. These payments are intended to compensate for lost wages and are not considered taxable income. However, if the payments exceed the insured person’s pre-disability income, the excess amount may be subject to tax.

Income protection insurance payouts are generally tax-free.

Workers’ Compensation Payments

Workers’ compensation payments received for injuries or illnesses sustained at work are generally tax-free. These payments are considered compensation for lost wages and medical expenses and are not considered taxable income.

Workers’ compensation payments are generally tax-free.

Taxation of Lump Sum Payments

Lump sum insurance payouts, such as death benefits or payouts for total and permanent disability, can be subject to tax in Australia. The tax treatment of these payments depends on various factors, including the type of insurance policy, the reason for the payout, and the individual’s financial circumstances.

Tax Implications of Different Types of Lump Sum Payments

The taxability of lump sum insurance payouts depends on the type of insurance policy and the reason for the payout.

- Life Insurance: Lump sum payouts from life insurance policies are generally tax-free if the policy was taken out for genuine insurance purposes, such as protecting against financial hardship in the event of death. However, if the policy was taken out primarily for investment purposes, the payout may be subject to capital gains tax.

- Total and Permanent Disability (TPD) Insurance: Lump sum payouts from TPD insurance policies are generally tax-free, as they are intended to compensate for the loss of income due to disability. However, if the payout is used to purchase an annuity, the annuity payments may be subject to tax.

- Trauma Insurance: Lump sum payouts from trauma insurance policies are generally tax-free, as they are intended to cover the financial costs associated with a serious illness or injury.

- Income Protection Insurance: Lump sum payouts from income protection insurance policies are generally taxable as income, as they are intended to replace lost income.

Potential Tax Deductions for Lump Sum Insurance Payouts

In some cases, it may be possible to claim tax deductions for expenses related to lump sum insurance payouts. For example, if you have incurred legal fees in relation to claiming an insurance payout, these fees may be deductible.

Examples of Different Scenarios Involving Lump Sum Payouts and Their Corresponding Tax Implications

- Scenario 1: A person receives a lump sum payout of $1 million from a life insurance policy after the death of their spouse. The payout is tax-free, as it was received from a genuine life insurance policy taken out for insurance purposes.

- Scenario 2: A person receives a lump sum payout of $500,000 from a TPD insurance policy after becoming permanently disabled. The payout is tax-free, as it was received from a TPD insurance policy taken out for insurance purposes.

- Scenario 3: A person receives a lump sum payout of $200,000 from an income protection insurance policy after being unable to work for six months due to an illness. The payout is taxable as income, as it was received from an income protection insurance policy taken out for income replacement purposes.

Taxation of Regular Payments

Regular insurance payments, such as those received from income protection insurance, are generally considered assessable income in Australia. This means that they are subject to income tax. The tax treatment of these payments can vary depending on the type of insurance and the circumstances surrounding the payout.

Taxation of Income Protection Insurance Payouts

Income protection insurance payouts are designed to replace lost income when an individual is unable to work due to illness or injury. These payments are generally taxed as ordinary income. This means they are taxed at the individual’s marginal tax rate.

The Australian Taxation Office (ATO) considers income protection insurance payouts as assessable income because they are a substitute for income that would have been earned had the individual been able to work.

Tax Deductions for Income Protection Insurance Premiums

In some cases, individuals may be able to claim a tax deduction for the premiums they pay for income protection insurance. This is possible if the insurance is taken out for the purpose of generating assessable income. For example, a self-employed individual who takes out income protection insurance to cover their income while they are unable to work may be able to claim a tax deduction for the premiums.

To claim a deduction for income protection insurance premiums, individuals must be able to demonstrate that the insurance is:

- Taken out for the purpose of generating assessable income.

- Necessary for the individual to generate assessable income.

The ATO provides guidance on claiming deductions for income protection insurance premiums on its website.

Examples of How Regular Insurance Payments are Taxed

Here are some examples of how regular insurance payments are taxed in different scenarios:

- Scenario 1: A self-employed individual takes out income protection insurance to cover their income while they are unable to work. They receive a monthly payout of $5,000. This payout is considered assessable income and will be taxed at the individual’s marginal tax rate. The individual may also be able to claim a tax deduction for the premiums they paid for the insurance.

- Scenario 2: An employee takes out income protection insurance through their employer’s group insurance scheme. They receive a monthly payout of $3,000. This payout is also considered assessable income and will be taxed at the individual’s marginal tax rate. However, the employee may not be able to claim a tax deduction for the premiums as they were paid by their employer.

It is important to note that the tax treatment of regular insurance payments can be complex. Individuals should seek professional advice from a qualified tax advisor to ensure they are complying with their tax obligations.

Reporting Insurance Payouts

You are generally required to report any insurance payouts you receive to the Australian Taxation Office (ATO). This is because insurance payouts are considered income and are subject to taxation in Australia.

Reporting Procedures

The ATO provides various methods for reporting insurance payouts. You can choose the method that best suits your circumstances.

- Online through myGov: This is the most convenient and efficient way to report your insurance payouts. You can use the ATO’s online services to lodge your tax return and report any income you’ve received, including insurance payouts.

- By mail: You can also report your insurance payouts by mail using the relevant tax forms. The ATO’s website provides detailed instructions on how to complete these forms and the address where you should send them.

- Through a tax agent: If you prefer, you can engage a registered tax agent to lodge your tax return on your behalf. Tax agents are familiar with the reporting requirements and can help ensure that your insurance payouts are reported accurately.

Documentation Required

When reporting your insurance payouts, you need to provide the ATO with specific documentation to support your claims. This documentation typically includes:

- Insurance payout statement: This statement should detail the amount of the payout, the date it was received, and the type of insurance policy that was paid out.

- Policy details: You may need to provide details about your insurance policy, such as the policy number and the name of the insurance company.

- Proof of expenditure: If you are claiming a deduction for any expenses related to the insurance payout, you need to provide supporting documentation, such as receipts or invoices.

Deadlines for Reporting

The deadline for reporting your insurance payouts depends on the type of income you received.

- Taxable income: If the insurance payout is considered taxable income, you need to report it on your tax return by the due date for lodging your tax return. For individuals, this is typically 31 October for the previous financial year.

- Non-taxable income: If the insurance payout is considered non-taxable income, you do not need to report it on your tax return. However, you may still need to keep records of the payout for your own records.

Seeking Professional Advice

While this guide provides a comprehensive overview of the tax implications of insurance payouts in Australia, it is crucial to remember that tax laws are complex and can change frequently. Seeking professional financial advice tailored to your specific circumstances is highly recommended.

Consulting with a qualified tax advisor or financial planner can provide you with personalized guidance and ensure you comply with all relevant tax regulations. These professionals have the expertise to navigate the intricacies of tax law and offer tailored solutions based on your unique financial situation.

Factors to Consider When Choosing a Professional

It’s important to choose a professional who has a strong understanding of Australian tax law and experience in handling insurance payouts. Consider these factors:

- Qualifications and Experience: Look for professionals with relevant qualifications, such as a Certified Practising Accountant (CPA), Chartered Accountant (CA), or a Financial Planner accredited by the Financial Planning Association of Australia (FPA). Ensure they have experience in handling insurance payout matters.

- Reputation and Track Record: Research the professional’s reputation and track record. Check online reviews, testimonials, and professional associations to assess their credibility.

- Communication and Transparency: Choose a professional who communicates clearly, answers your questions thoroughly, and provides transparent advice. They should be willing to explain complex concepts in a way that you understand.

- Fees and Services: Discuss fees upfront and ensure they are transparent and reasonable. Inquire about the services included in their fees and any additional charges that may apply.

By seeking professional advice, you can gain peace of mind knowing that your insurance payout is being handled correctly and that you are maximizing your tax benefits.

Final Thoughts

Navigating the complex world of insurance payout taxation can be challenging, but understanding the fundamental principles and seeking professional guidance when necessary is crucial. By staying informed and taking proactive steps to manage your tax obligations, you can ensure a smoother financial journey and avoid potential penalties. Remember, seeking advice from a qualified tax advisor or financial planner is always recommended, particularly for complex or unique situations.

FAQ Corner

What types of insurance payouts are typically taxable in Australia?

Generally, insurance payouts for things like loss of income, investment returns, or profits are taxable. However, payouts for things like medical expenses, personal injury, or death benefits are usually not taxable.

How do I report insurance payouts to the ATO?

You’ll need to include the details of your insurance payout in your tax return. You may also need to complete specific forms, depending on the type of payout. The ATO website has detailed information on how to report insurance payouts.

Are there any tax deductions available for insurance payouts?

Yes, in some cases, you may be able to claim deductions for expenses related to your insurance payout. For example, if you received a payout for income protection, you may be able to claim a deduction for the premiums you paid.

Can I avoid paying tax on an insurance payout if I use the money for a specific purpose?

In general, the purpose for which you use the money does not affect the taxability of the payout. However, there may be specific exceptions, so it’s important to seek professional advice.