Average car insurance cost in Australia can vary significantly depending on a multitude of factors. From the type of vehicle you drive to your driving history, location, and coverage choices, understanding these influences is crucial for finding the best insurance deal.

This guide delves into the key aspects of car insurance in Australia, providing insights into average premiums, comparison tips, and a comprehensive understanding of coverage options. Whether you’re a seasoned driver or a new car owner, this information will equip you with the knowledge to make informed decisions and potentially save money on your car insurance.

Factors Influencing Car Insurance Costs

Your car insurance premium is calculated based on various factors, making it crucial to understand these elements to find the best deal. Factors influencing your car insurance costs in Australia include the type of vehicle you drive, your age, driving history, location, and the coverage options you choose.

Vehicle Type

The type of vehicle you drive is a significant factor in determining your car insurance premium. High-performance cars, luxury vehicles, and expensive models are generally more expensive to insure than standard vehicles. This is because these cars are more likely to be involved in accidents, and repairs or replacements are more costly. For instance, insuring a sports car like a Porsche or a luxury sedan like a Mercedes-Benz will likely cost more than insuring a Toyota Corolla or a Honda Civic.

Age, Average car insurance cost in australia

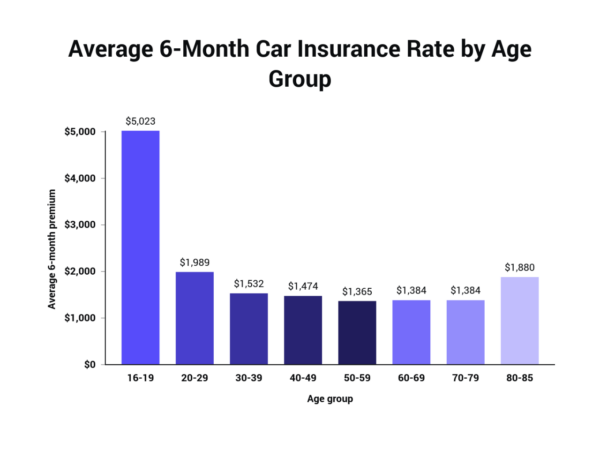

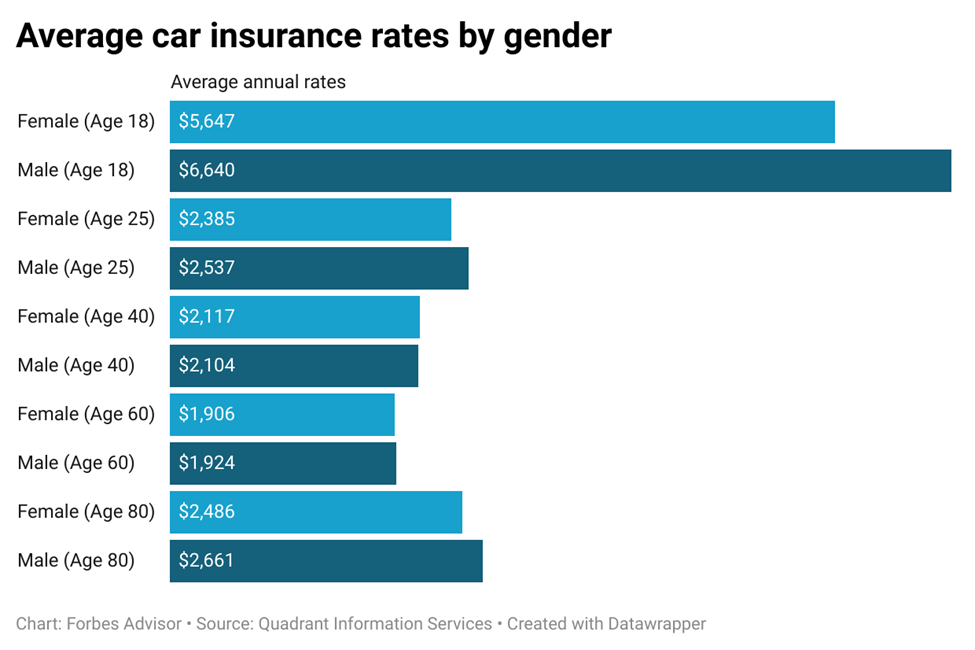

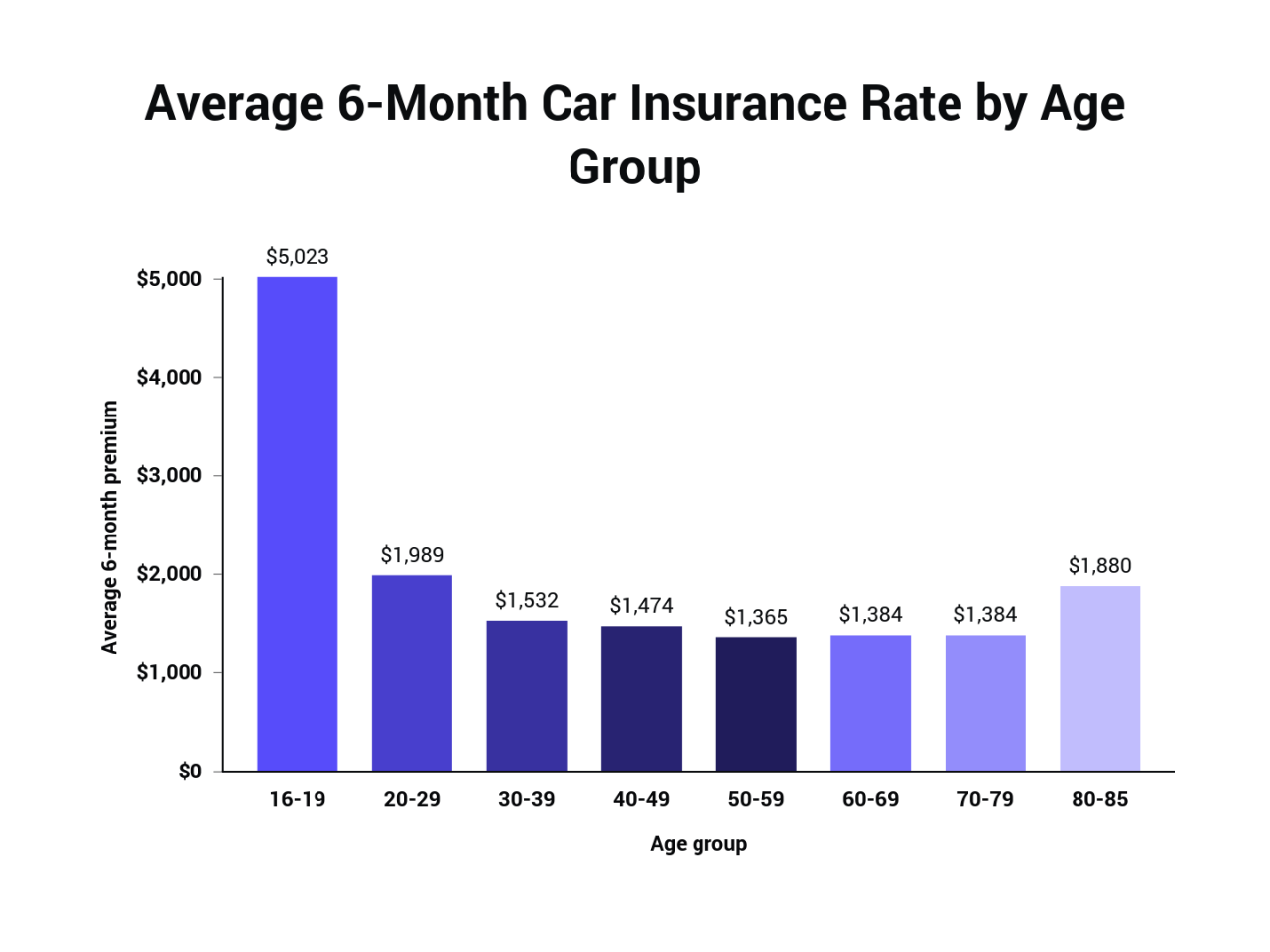

Your age also plays a role in determining your car insurance premium. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. Insurance companies consider this higher risk and charge higher premiums to younger drivers. Conversely, older drivers, generally considered more experienced and cautious, may enjoy lower premiums.

Driving History

Your driving history is a crucial factor in calculating your car insurance premium. A clean driving record with no accidents or traffic violations will generally lead to lower premiums. However, if you have a history of accidents or traffic violations, insurance companies may view you as a higher risk and charge higher premiums.

Location

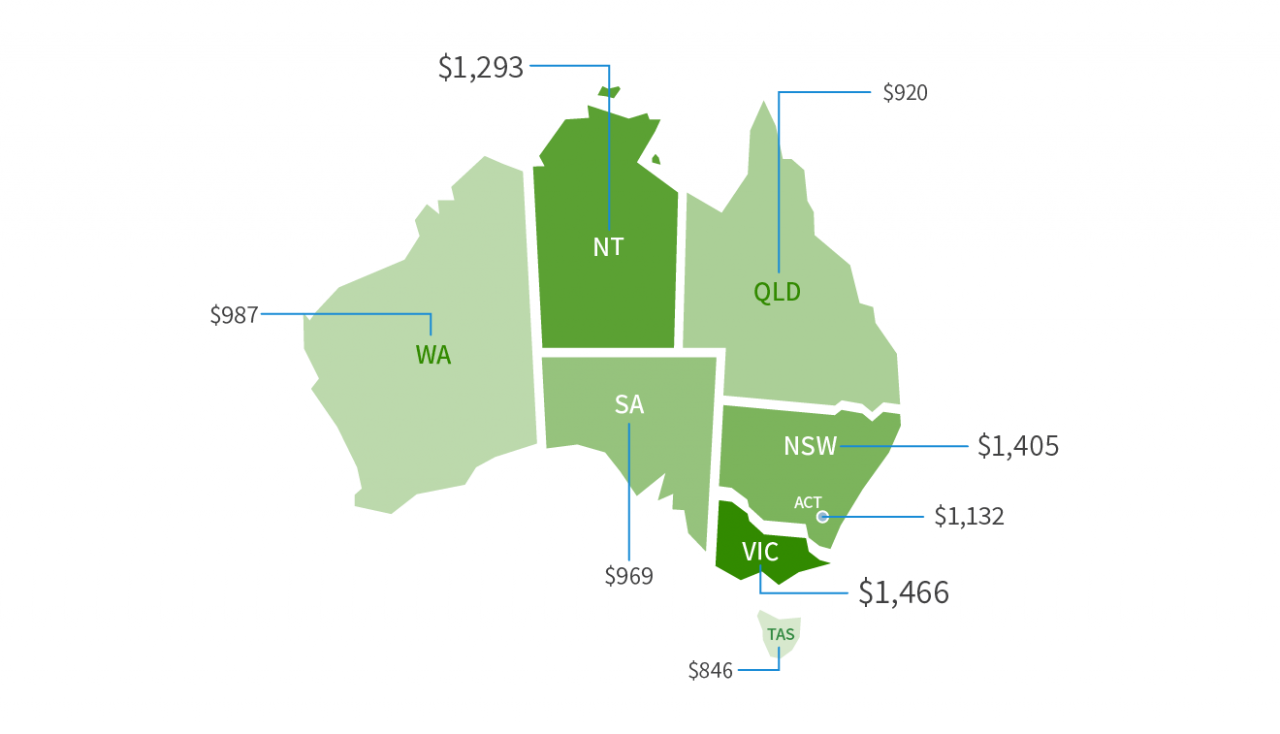

Your location can also affect your car insurance premium. Areas with higher crime rates or more traffic congestion tend to have higher insurance premiums. This is because insurance companies consider these areas to have a higher risk of accidents and theft. For example, premiums in metropolitan areas may be higher than in rural areas.

Coverage Options

The coverage options you choose will also impact your car insurance premium. Comprehensive coverage, which includes protection against theft and damage from natural disasters, will generally cost more than third-party property damage coverage, which only covers damage to other vehicles. Similarly, higher excess amounts will lead to lower premiums, while lower excess amounts will lead to higher premiums.

Average Car Insurance Premiums in Australia

Understanding the average car insurance costs in Australia is crucial for budget planning and making informed decisions. This section delves into the typical premiums for different vehicle types and coverage levels, providing insights into the financial implications of car insurance in Australia.

Average Car Insurance Premiums by Vehicle Type and Coverage

The average car insurance premium in Australia varies depending on the type of vehicle and the level of coverage chosen. The following table presents an overview of average premiums for different vehicle types and coverage levels, based on data from reputable sources such as the Australian Bureau of Statistics and insurance comparison websites.

| Vehicle Type | Coverage Level | Average Premium | Premium Range |

|---|---|---|---|

| Small Car | Third Party Property Damage | $500 – $700 | $400 – $800 |

| Small Car | Comprehensive | $800 – $1,200 | $700 – $1,500 |

| Medium Car | Third Party Property Damage | $600 – $800 | $500 – $900 |

| Medium Car | Comprehensive | $1,000 – $1,500 | $900 – $1,800 |

| Large Car | Third Party Property Damage | $700 – $900 | $600 – $1,000 |

| Large Car | Comprehensive | $1,200 – $1,800 | $1,100 – $2,000 |

| SUV | Third Party Property Damage | $800 – $1,000 | $700 – $1,100 |

| SUV | Comprehensive | $1,400 – $2,000 | $1,300 – $2,200 |

Car Insurance Comparison and Savings Tips

Finding the right car insurance policy can be a daunting task, especially with so many providers and plans available. However, comparing premiums and understanding your options can lead to significant savings.

Comparing Car Insurance Premiums

Comparing premiums from different insurance providers is essential to ensure you get the best value for your money. You can use online comparison tools, which allow you to enter your details and receive quotes from multiple insurers simultaneously. This allows you to easily see the price differences and features of each policy.

Tips for Finding Affordable Car Insurance

- Shop around: Get quotes from multiple insurers to compare premiums and coverage.

- Consider discounts: Many insurers offer discounts for various factors, such as good driving records, safety features in your car, and being a member of certain organizations.

- Choose the right coverage: Consider your needs and budget when selecting the level of coverage. A higher excess (the amount you pay before your insurance covers the rest) can lower your premium.

- Review your policy regularly: Your insurance needs may change over time. It’s a good idea to review your policy annually to ensure you have the right coverage at the best price.

Using Online Insurance Comparison Tools

Online comparison tools can save you time and effort when searching for car insurance. These tools work by gathering your information, such as your car details, driving history, and desired coverage, and then presenting you with quotes from various insurers.

- Input accurate information: Ensure you provide accurate information to receive accurate quotes.

- Compare features and benefits: Pay attention to the coverage provided by each insurer, including the excess, limits, and exclusions.

- Read the fine print: Before making a decision, carefully review the policy documents to understand the terms and conditions.

Understanding Car Insurance Coverage Options: Average Car Insurance Cost In Australia

Choosing the right car insurance coverage is crucial to ensure you’re adequately protected in case of an accident or other unforeseen events. Australia offers various car insurance options, each with its benefits and limitations. Understanding these options can help you make an informed decision that aligns with your needs and budget.

Comprehensive Car Insurance

Comprehensive car insurance provides the most comprehensive protection, covering damage to your vehicle, regardless of who is at fault, as well as third-party liability. This type of insurance typically covers:

- Damage to your car from accidents, fire, theft, vandalism, natural disasters, and other events.

- Third-party liability for damage to other vehicles or property.

- Medical expenses for you and your passengers in case of an accident.

- Loss of use coverage, which compensates you for the cost of renting a car while yours is being repaired.

Comprehensive car insurance is generally recommended for newer or high-value vehicles, as it provides the most comprehensive protection against a wide range of risks.

Third-Party Property Damage Insurance

This type of insurance covers damage to other vehicles or property that you are responsible for, but not damage to your own car. It is a more affordable option than comprehensive insurance, but it offers less protection.

- Covers damage to other vehicles or property you cause in an accident.

- Does not cover damage to your own car.

- May not cover medical expenses.

Third-party property damage insurance is suitable for older vehicles or those with a lower value, as it provides basic protection against third-party liability.

Third-Party Fire and Theft Insurance

This type of insurance covers damage to your car from fire and theft, but not from accidents. It offers less protection than comprehensive insurance but more than third-party property damage insurance.

- Covers damage to your car from fire and theft.

- Does not cover damage from accidents.

- May not cover medical expenses.

Third-party fire and theft insurance is a good option for those who want basic protection against fire and theft but do not need comprehensive coverage for accidents.

Car Insurance Claims and Processes

Making a car insurance claim in Australia can be a stressful experience, but understanding the process and knowing what to expect can make it smoother.

Making a Claim

When you need to make a claim, it’s important to contact your insurer as soon as possible after the incident. Most insurers have a 24/7 claims hotline for immediate assistance. You’ll need to provide details of the incident, including the date, time, location, and any other relevant information. Your insurer will then guide you through the next steps.

Required Documentation and Information

To process your claim, your insurer will require certain documentation and information. This usually includes:

- Your policy details

- Details of the incident, including a police report if applicable

- Details of any other parties involved

- Photos or videos of the damage

- Estimates for repairs or replacement costs

- Proof of ownership of the vehicle

- Your driver’s license

It’s best to gather all the necessary documents and information before contacting your insurer. This will help expedite the claims process.

Common Reasons for Claim Denials

While insurers aim to assist policyholders, there are instances where claims may be denied. Common reasons for claim denials include:

- Failure to disclose relevant information during policy application: If you didn’t disclose any pre-existing conditions or driving violations, your claim might be denied. It’s crucial to be transparent with your insurer during the application process.

- Driving under the influence of alcohol or drugs: Driving under the influence is illegal and can result in claim denial.

- Driving without a valid license: Driving without a valid license can lead to claim rejection.

- Using the vehicle for an unauthorized purpose: If you use your vehicle for a purpose not covered by your policy, your claim might be denied.

- Making a fraudulent claim: Attempting to deceive your insurer by making false claims will result in claim denial and potentially legal consequences.

To avoid claim denials, it’s crucial to be honest with your insurer and follow the terms and conditions of your policy.

Ending Remarks

Navigating the world of car insurance in Australia can seem daunting, but with the right information and a proactive approach, finding affordable and suitable coverage is achievable. By understanding the factors that influence premiums, utilizing comparison tools, and carefully selecting your coverage options, you can secure the protection you need while minimizing your insurance costs.

Detailed FAQs

What is the cheapest car insurance in Australia?

There is no single “cheapest” car insurance provider as prices vary widely based on individual factors. The best way to find the most affordable option is to compare quotes from multiple insurers.

How often should I review my car insurance?

It’s recommended to review your car insurance policy at least annually, or even more frequently if your circumstances change, such as a change in your driving record, vehicle, or address.

What are the penalties for driving without car insurance in Australia?

Driving without car insurance in Australia is illegal and can result in hefty fines, suspension of your license, and even the impoundment of your vehicle.