Are life insurance payouts taxable in Australia? This question is a crucial one for many Australians, as life insurance can play a vital role in financial planning and providing for loved ones. Understanding the tax implications of life insurance payouts is essential for ensuring that beneficiaries receive the full intended benefits.

In Australia, the taxability of life insurance payouts depends on several factors, including the type of policy, the purpose of the payout, and the circumstances surrounding the payout. While some life insurance payouts are tax-free, others may be subject to income tax. This guide aims to provide a comprehensive overview of the Australian tax laws regarding life insurance payouts, helping individuals navigate the complexities of this important financial topic.

Life Insurance in Australia

Life insurance is a vital financial safety net for many Australians. It provides financial protection for loved ones in the event of your death, helping them cope with the financial burden and ensuring their future security. Understanding the different types of life insurance policies and their benefits can empower you to make informed decisions about your financial well-being.

Types of Life Insurance Policies in Australia

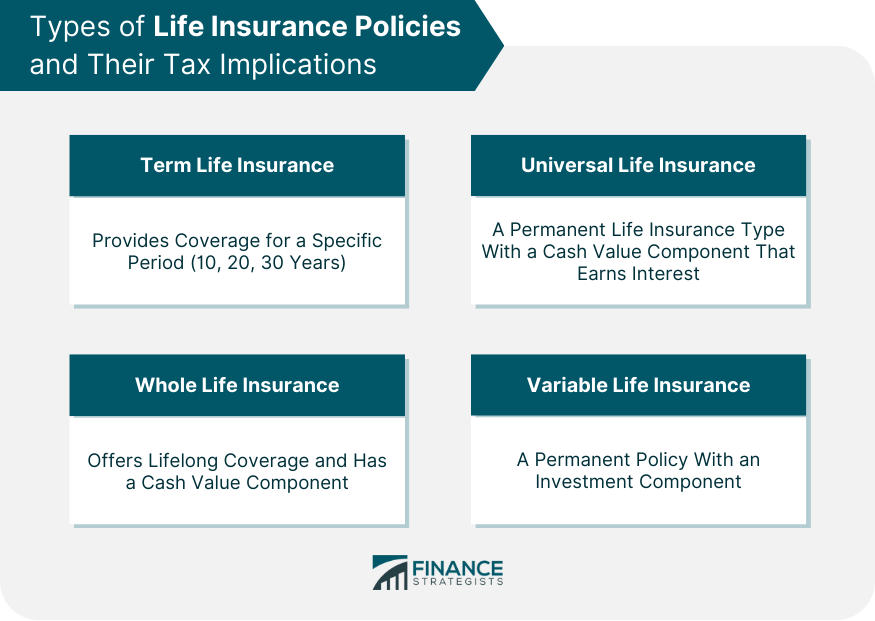

Life insurance policies in Australia are broadly categorized into two main types:

- Term Life Insurance: This type of insurance provides coverage for a specific period, typically 10, 20, or 30 years. It offers a fixed sum payout if you pass away within the policy term. Term life insurance is generally more affordable than permanent life insurance, making it a popular choice for individuals with a limited budget or specific coverage needs.

- Permanent Life Insurance: This type of insurance provides lifelong coverage, offering a guaranteed death benefit. Permanent life insurance policies often include a savings component, allowing you to build cash value over time. While permanent life insurance is typically more expensive than term life insurance, it provides long-term financial security and flexibility.

Purpose and Benefits of Life Insurance

Life insurance serves several critical purposes, offering financial protection and peace of mind:

- Debt Repayment: In the event of your death, life insurance payouts can be used to repay outstanding debts, such as mortgages, loans, or credit card balances, relieving your loved ones of financial burdens.

- Income Replacement: Life insurance can provide a source of income for your family, helping to replace the lost income due to your death. This ensures their financial stability and enables them to maintain their standard of living.

- Funeral Expenses: Life insurance payouts can cover the costs associated with your funeral and memorial services, easing the financial strain on your family during a difficult time.

- Education Expenses: Life insurance can provide financial support for your children’s education, ensuring they have access to quality education even in your absence.

- Financial Security: Life insurance provides a financial safety net for your loved ones, offering them peace of mind and stability in the event of your death.

Situations Where Life Insurance Payouts are Necessary

Life insurance payouts are essential in various situations, providing financial support and stability:

- Single-Parent Families: In single-parent households, life insurance can provide vital financial support for the surviving parent and children, ensuring their financial security and well-being.

- Dual-Income Families: If both partners contribute to the family income, life insurance can help replace the lost income and maintain the family’s financial stability in the event of one partner’s death.

- Families with Young Children: Life insurance can provide financial security for young children, covering their expenses and ensuring their future well-being in the event of their parents’ death.

- Individuals with Debts: Life insurance payouts can be used to repay outstanding debts, relieving your loved ones of financial burdens and ensuring their financial stability.

- Business Owners: Life insurance can provide financial protection for business owners, ensuring the continuation of their business and protecting their families’ financial interests.

Taxation of Life Insurance Payouts

Life insurance payouts are generally not taxable in Australia. This means that the money you receive from a life insurance policy after the death of the insured person is not subject to income tax. However, there are specific circumstances where life insurance payouts may be subject to tax.

Taxable Life Insurance Payouts

Life insurance payouts may be taxable in certain circumstances. The most common situation is when the policy is held within a superannuation fund.

- Life insurance payouts received from a superannuation fund are generally taxed as a lump sum payment. The tax rate applied depends on the age of the recipient and the amount of the payout.

- Life insurance payouts received from a life insurance policy taken out for business purposes are also generally taxable. The tax rate will depend on the structure of the business and the type of policy.

Another circumstance where life insurance payouts may be taxable is when the policy is held within a trust.

- Life insurance payouts received from a trust may be subject to tax depending on the terms of the trust deed and the beneficiary’s tax status.

It is important to note that the tax treatment of life insurance payouts can be complex. If you are unsure about the tax implications of a particular life insurance policy, it is recommended that you seek advice from a qualified tax advisor.

Taxable Scenarios

While life insurance payouts are generally considered tax-free, there are specific scenarios where they can be considered taxable income. These situations involve circumstances where the payout is deemed to be derived from a source that is subject to income tax.

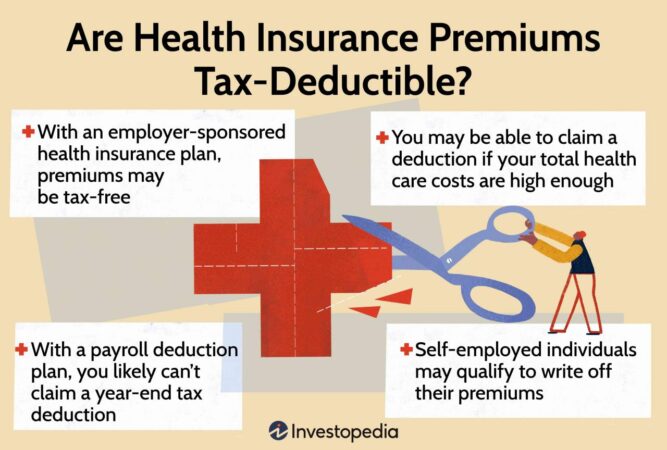

Life Insurance Premiums Paid by an Employer

If an employer pays for your life insurance premiums, the payout you receive may be considered taxable income. This is because the premiums are treated as a fringe benefit to you. In this situation, the taxable amount is usually the difference between the total payout and the premiums you have paid.

The rationale for taxing these payouts is that they are seen as a form of income derived from the employer. The premiums are a form of compensation for your services and are treated as part of your overall income.

Income Protection Insurance Payouts

Income protection insurance payouts are generally considered taxable income because they are designed to replace lost income. This is because the payouts are intended to compensate for the loss of earnings, and this compensation is treated as taxable income.

The amount of income protection insurance payouts that are taxable is usually determined by the specific policy terms and the relevant tax laws.

Lump-Sum Death Benefits Received by a Business

Life insurance payouts received by a business as a lump-sum death benefit may be considered taxable income. This is because the payout is seen as a form of income derived from the business. This situation usually arises when the deceased individual was a key employee or shareholder of the business, and the payout is intended to compensate for the loss of their contribution.

The rationale for taxing these payouts is that they are seen as a form of business income, and therefore subject to the usual income tax rules.

Tax-Free Scenarios: Are Life Insurance Payouts Taxable In Australia

Life insurance payouts are generally tax-free in Australia, but there are specific conditions that need to be met. Understanding these conditions is crucial to ensure that you receive the full benefit of your policy without incurring any unexpected tax liabilities.

Types of Policies with Tax-Free Payouts

Life insurance policies designed to provide a death benefit are typically tax-free, regardless of the policy type. This includes:

- Term life insurance: This provides coverage for a specific period, usually 10 to 30 years. If the insured dies within that period, the beneficiary receives the death benefit.

- Whole life insurance: This provides coverage for the insured’s entire lifetime, with premiums paid until death. The death benefit is paid to the beneficiary upon the insured’s death.

- Endowment life insurance: This combines life insurance with a savings component. If the insured dies before the policy matures, the beneficiary receives the death benefit. If the insured survives until the policy matures, they receive the accumulated savings.

Criteria for Tax-Free Payouts

There are several criteria that must be met for a life insurance payout to be tax-free in Australia. These include:

- The policy must be a genuine life insurance policy: This means the policy must be primarily designed to provide a death benefit, and not for investment or other purposes.

- The payout must be a death benefit: This means the payout must be paid as a result of the insured’s death, and not for any other reason, such as surrender or maturity.

- The payout must be received by a beneficiary: This means the payout must be paid to a designated individual or entity, not to the insured’s estate.

- The policy must be held for life insurance purposes: This means the policy must not be used for any other purpose, such as investment or tax avoidance.

Important Note: If a life insurance policy is used for purposes other than providing a death benefit, the payout may be subject to tax. For example, if a policy is used as a savings vehicle or to provide a tax-free lump sum at maturity, the payout may be taxed as income.

Tax Implications for Beneficiaries

Receiving a life insurance payout can be a significant financial benefit for beneficiaries, but it’s crucial to understand the tax implications associated with these payments. Depending on the circumstances, life insurance payouts may be subject to tax in Australia.

Tax Implications of Life Insurance Payouts

Beneficiaries generally receive life insurance payouts tax-free. This is because the proceeds are considered a capital payment, not income. However, there are certain scenarios where tax may be payable on the payout.

- Life Insurance Premiums Paid by an Employer: If the premiums for the life insurance policy were paid by the deceased’s employer, the beneficiary may be required to pay tax on the portion of the payout that exceeds the employer’s contributions. This is because the employer’s contributions are considered a fringe benefit to the deceased employee, and the beneficiary is considered to have received a taxable benefit upon receiving the payout.

- Life Insurance Premiums Used as Tax Deductions: If the deceased individual used life insurance premiums as a tax deduction, the beneficiary may be required to pay tax on the payout. This is because the premiums were deducted from the deceased’s taxable income, and the payout is considered a recovery of the deducted amount.

- Life Insurance Policies Held as Investments: If the life insurance policy was held as an investment, the beneficiary may be required to pay tax on any capital gains made from the policy. This is because the policy is considered an asset, and any increase in value is subject to capital gains tax.

Minimizing Tax Liabilities

Beneficiaries can take steps to minimize their tax liabilities on life insurance payouts. Here are some strategies:

- Seek Professional Advice: It’s always best to consult with a qualified financial advisor or tax professional to understand the specific tax implications of your situation. They can help you navigate the complexities of life insurance payouts and develop a tax planning strategy that minimizes your liabilities.

- Understand the Terms of the Policy: Carefully review the terms of the life insurance policy to understand the tax implications of the payout. This will help you identify any potential tax liabilities and take steps to minimize them.

- Consider Tax-Free Life Insurance Policies: Some life insurance policies are designed to provide tax-free payouts to beneficiaries. These policies can be a good option for individuals who want to ensure their loved ones receive the full benefit of their insurance coverage without having to pay taxes.

Tax Planning Strategies

Here are some tax planning strategies that beneficiaries can use to minimize their tax liabilities on life insurance payouts:

- Consider a Trust: Establishing a trust can help to reduce tax liabilities on life insurance payouts. This is because the trust is considered a separate legal entity, and the payout is made to the trust, not directly to the beneficiaries. This can help to reduce the overall tax burden on the beneficiaries.

- Use the Payout for Tax-Free Purposes: Beneficiaries can use the life insurance payout for tax-free purposes, such as paying off debts, investing in assets, or funding their children’s education. This can help to minimize the overall tax impact of the payout.

- Spread Out the Payout: If the payout is large, beneficiaries can consider spreading it out over time to minimize their tax liabilities. This can help to reduce the amount of tax payable in any given year.

Seeking Professional Advice

Navigating the complexities of life insurance payouts and their tax implications can be overwhelming. Seeking professional financial advice is crucial to ensure you understand your obligations and maximize your benefits.

Financial advisors can provide valuable guidance in understanding your tax obligations related to life insurance payouts. They possess the expertise to analyze your specific circumstances, identify potential tax implications, and recommend strategies for minimizing your tax burden.

Benefits of Seeking Professional Advice

- Comprehensive Understanding of Tax Laws: Financial advisors are well-versed in the intricacies of Australian tax laws, particularly those related to life insurance payouts. They can provide accurate and up-to-date information on relevant tax rules and regulations.

- Personalized Financial Planning: Financial advisors take a personalized approach to financial planning, considering your individual circumstances, financial goals, and risk tolerance. They can tailor their advice to your specific needs, ensuring that you make informed decisions about your life insurance payout.

- Strategic Tax Minimization: Financial advisors can help you identify opportunities to minimize your tax liability. They may recommend strategies such as claiming deductions, utilizing tax-efficient investment options, or structuring your payout to optimize tax benefits.

- Avoid Costly Mistakes: Making mistakes related to tax obligations can result in penalties and financial losses. Financial advisors can help you avoid these costly errors by providing accurate guidance and ensuring compliance with tax regulations.

Situations Where Professional Advice is Crucial, Are life insurance payouts taxable in australia

- Large Life Insurance Payouts: When receiving a substantial life insurance payout, seeking professional advice is essential to navigate the complex tax implications and make informed decisions about how to manage the funds.

- Complex Estate Planning: If the life insurance payout is part of a complex estate plan, financial advisors can help ensure that the funds are distributed effectively and in accordance with your wishes, minimizing tax implications.

- Investment Decisions: Financial advisors can provide guidance on how to invest your life insurance payout to achieve your financial goals while minimizing tax exposure. They can help you select appropriate investment options and manage your portfolio effectively.

- Tax-Free Scenarios: Even in situations where the life insurance payout is tax-free, financial advisors can provide valuable insights into how to manage the funds effectively and maximize your financial well-being.

Closing Summary

Navigating the tax implications of life insurance payouts in Australia can be a complex endeavor. It is crucial to understand the specific tax laws and regulations that apply to your situation. Seeking professional financial advice from a qualified tax advisor can provide invaluable guidance and ensure that you maximize your benefits while minimizing potential tax liabilities. Remember, proper planning and understanding of the tax implications are essential for making informed decisions about life insurance and ensuring that your beneficiaries receive the full intended benefits.

FAQ Summary

How do I know if my life insurance payout is taxable?

The taxability of your life insurance payout depends on several factors, including the type of policy, the purpose of the payout, and the circumstances surrounding the payout. It’s best to consult with a financial advisor or tax professional to determine the tax implications for your specific situation.

What are some common situations where life insurance payouts are tax-free?

Life insurance payouts are generally tax-free when they are received as a result of the death of the insured individual. This includes payouts from policies designed to provide death benefits, such as term life insurance and whole life insurance.

What are some common situations where life insurance payouts are taxable?

Life insurance payouts may be taxable if they are received as a result of a disability or illness, or if the premiums were paid by an employer. In these cases, the payouts may be considered taxable income.

How can I minimize my tax liability on life insurance payouts?

There are several strategies you can use to minimize your tax liability on life insurance payouts, such as structuring your policy to ensure tax-free benefits, making tax-deductible contributions, and seeking professional advice from a qualified financial advisor.