Benefits of private health insurance in Australia offer a compelling alternative to the public healthcare system, providing access to a wider range of healthcare options, shorter waiting times, and financial protection against unexpected medical expenses. This comprehensive coverage encompasses hospital care, specialist consultations, and a variety of extra benefits, such as dental, optical, and physiotherapy.

Navigating the Australian healthcare landscape can be complex, and understanding the benefits of private health insurance is crucial for making informed decisions about your health and well-being. This guide explores the key advantages of private health insurance, providing insights into its potential impact on your access to healthcare, financial security, and overall health outcomes.

Access to Healthcare

In Australia, healthcare is provided through a dual system consisting of a publicly funded system, Medicare, and a private health insurance system. While Medicare provides essential healthcare services, private health insurance offers additional benefits and choices. This section explores the differences in access to healthcare services between the two systems.

Access to Specialized Medical Treatments and Procedures

Private health insurance provides access to a wider range of medical treatments and procedures, including those not covered by Medicare. This includes specialized medical treatments such as:

- Cosmetic surgery: This includes procedures like breast augmentation, liposuction, and rhinoplasty, which are not covered by Medicare.

- Dental care: Private health insurance can cover a significant portion of dental expenses, including routine checkups, fillings, and more complex procedures like crowns and implants.

- Physiotherapy and rehabilitation: Private health insurance often covers physiotherapy and rehabilitation services, which can be beneficial for recovering from injuries or managing chronic conditions.

- Mental health services: Private health insurance can provide access to psychologists, psychiatrists, and other mental health professionals, offering additional support beyond what is available through Medicare.

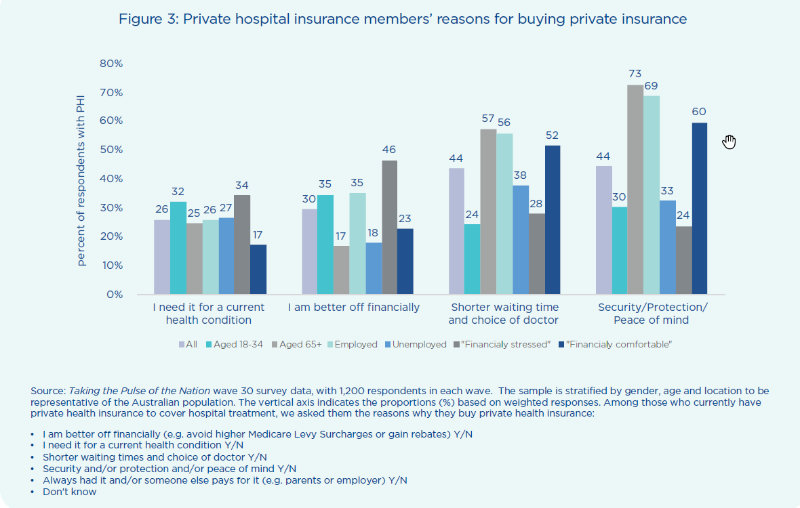

Shorter Waiting Times for Elective Surgeries and Consultations with Specialists

Private health insurance can significantly reduce waiting times for elective surgeries and consultations with specialists. This is because private hospitals have more resources and capacity to handle patients with private health insurance, leading to faster access to treatment.

“Private health insurance can be a valuable investment for individuals who want faster access to healthcare services, particularly for elective surgeries and consultations with specialists.”

For example, a patient with private health insurance may be able to schedule an elective surgery within a few weeks, while a patient relying solely on Medicare might face a wait of several months or even years.

Choice of Healthcare Providers

Private health insurance in Australia offers a significant advantage in terms of choice when it comes to healthcare providers. With private health insurance, you have the freedom to choose from a wider range of hospitals, doctors, and specialists, allowing you to access the best possible care tailored to your specific needs.

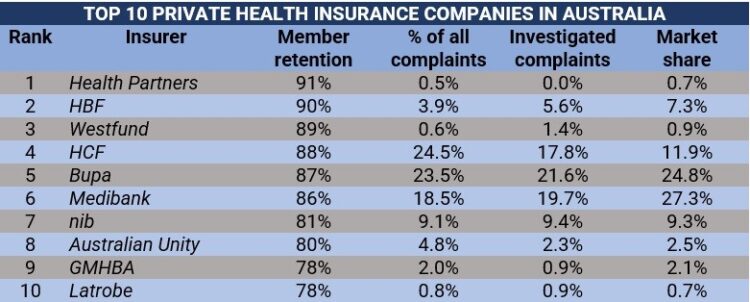

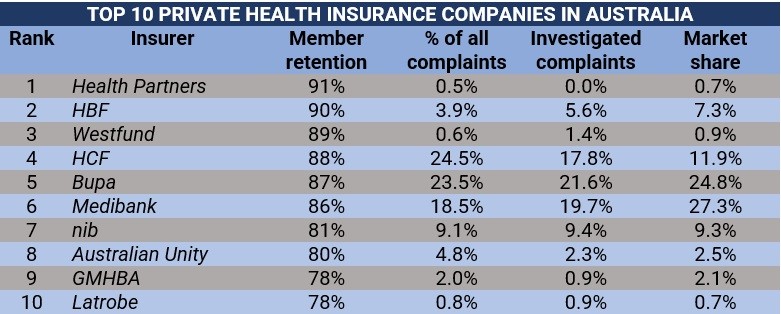

Comparison of Services Offered by Different Private Health Insurance Providers

Private health insurance providers offer a diverse range of services, with varying levels of coverage and benefits. This means you can select a plan that best aligns with your individual healthcare requirements and budget.

- Hospital Coverage: Some providers offer comprehensive coverage for all hospital services, including private rooms, elective surgeries, and complex procedures. Others may offer limited coverage or require a co-payment for certain services.

- Extras Coverage: This category covers a wide range of healthcare services outside of hospital care, such as dental, optical, physiotherapy, and mental health services. The level of coverage and the specific services included vary greatly between providers.

- Ambulance Coverage: Most private health insurance policies include ambulance coverage, but the level of coverage and the specific benefits may differ. Some policies cover only emergency ambulance services, while others may cover all ambulance services.

It’s essential to carefully compare the different policies and services offered by various providers to find the plan that best meets your individual needs and budget.

Hospital Coverage: Benefits Of Private Health Insurance In Australia

Private health insurance can provide valuable coverage for hospital stays, offering a range of benefits and potentially significant cost savings compared to relying solely on public healthcare. Understanding the different levels of hospital cover available is crucial for making an informed decision about your insurance needs.

Types of Hospital Cover

Private health insurance offers various levels of hospital cover, each providing different benefits and associated costs. Here’s a breakdown of common types:

- Private Hospital Rooms: This option allows you to choose a private room during your hospital stay, offering greater privacy and comfort.

- Private Hospital Beds: This type of cover grants you access to a private bed within a shared ward, providing more space and potentially reduced noise levels compared to a standard public ward.

- Other Benefits: Depending on your chosen level of cover, you might also receive benefits such as access to private hospitals, choice of surgeon, faster access to treatment, and coverage for specific procedures like joint replacements or cosmetic surgery.

Cost Savings with Private Hospital Coverage

While private health insurance comes with premiums, it can offer substantial cost savings compared to out-of-pocket expenses for hospital care under the public system. For instance, private health insurance can cover the full cost of a hospital stay, including accommodation, surgery, and other related expenses, while public hospitals may charge a gap fee for certain procedures or services.

Comparing Hospital Cover Levels

The table below provides a comparison of different hospital cover levels, highlighting the associated costs and benefits:

| Level of Cover | Cost (Estimated Annual Premium) | Benefits |

|---|---|---|

| Basic | $1,000 – $1,500 | Limited coverage, typically for public hospitals, basic procedures, and shared wards. |

| Mid-Level | $1,500 – $2,500 | Broader coverage, including access to private hospitals, choice of surgeon for some procedures, and private beds in shared wards. |

| Top-Level | $2,500+ | Comprehensive coverage, encompassing all private hospitals, full choice of surgeon, private rooms, and a wide range of procedures. |

Extra Benefits

Private health insurance in Australia goes beyond just covering hospital and medical expenses. It often includes a range of extra benefits that can significantly enhance your overall health and well-being. These benefits can cover essential services like dental, optical, and physiotherapy, potentially saving you money and providing convenient access to care.

Extra Benefits Overview

Private health insurance policies often offer a range of extra benefits beyond standard hospital and medical coverage. These benefits can include dental, optical, and physiotherapy, as well as other services depending on your chosen policy. These benefits can significantly impact your overall health and well-being, providing convenient access to care and potentially saving you money.

| Benefit | Description | Conditions |

|---|---|---|

| Dental | Covers a range of dental procedures, including check-ups, cleanings, fillings, and extractions. | Policy-specific limits and waiting periods may apply. |

| Optical | Covers the cost of eye exams, glasses, and contact lenses. | Policy-specific limits and waiting periods may apply. |

| Physiotherapy | Covers physiotherapy treatments for various conditions, including injuries and chronic pain. | Policy-specific limits and waiting periods may apply. |

| Other Benefits | May include coverage for services like chiropractor, podiatry, and psychology. | Policy-specific limits and waiting periods may apply. |

Cost Savings and Convenience

The extra benefits offered by private health insurance can provide significant cost savings and convenience. For example, dental coverage can help you avoid the high costs associated with unexpected dental emergencies. Optical coverage can ensure you have access to regular eye exams and affordable glasses or contact lenses. Physiotherapy coverage can help you manage injuries and chronic pain without incurring significant out-of-pocket expenses.

“By choosing a private health insurance policy with extra benefits, you can potentially save money on essential health services and have peace of mind knowing that you have access to quality care when you need it.”

Financial Protection

Private health insurance can provide significant financial protection, particularly in the face of unexpected medical expenses. It acts as a safety net, helping to mitigate the risk of substantial medical bills that could otherwise lead to financial hardship.

Financial Protection from Unexpected Medical Expenses

Private health insurance can help protect individuals and families from the financial burden of unexpected medical expenses. This is particularly crucial in Australia, where healthcare costs can be high.

Private health insurance can cover a wide range of medical expenses, including hospital stays, surgery, and specialist consultations.

For example, imagine a family faces a sudden medical emergency requiring hospitalization and extensive surgery. Without private health insurance, they could be faced with a substantial medical bill that could strain their finances. However, with private health insurance, the costs associated with these services would be significantly reduced or covered entirely, depending on their policy.

Health and Wellbeing

Private health insurance can play a significant role in improving your overall health and wellbeing, going beyond just covering medical expenses. It empowers you to take proactive steps towards maintaining good health and preventing potential issues.

Preventative Care and Early Diagnosis

Preventative care is crucial for maintaining good health and catching potential health problems early, when they are often easier to treat. Private health insurance can provide access to a range of preventative services, including:

- Regular health checks: These check-ups allow healthcare professionals to identify potential health issues early on, when they are often easier to treat. Early detection can significantly improve treatment outcomes and reduce the risk of complications.

- Vaccinations: Private health insurance often covers vaccinations, which are essential for protecting against preventable diseases. Staying up-to-date on vaccinations can safeguard your health and reduce the risk of serious illnesses.

- Screenings: Private health insurance may cover various screenings, such as mammograms, pap smears, and colonoscopies, which can help detect early signs of cancer and other serious conditions.

Promoting Healthy Lifestyle Choices, Benefits of private health insurance in australia

Private health insurance can also promote healthy lifestyle choices by providing access to resources and services that support wellness.

- Gym memberships: Some private health insurance policies offer rebates or discounts on gym memberships, encouraging regular exercise and promoting physical fitness.

- Health and wellness programs: Private health insurance companies often offer programs that provide information and support on healthy eating, stress management, and other aspects of healthy living.

- Access to dieticians and nutritionists: Private health insurance can provide access to dieticians and nutritionists, who can provide personalized advice on healthy eating habits. This can be particularly beneficial for individuals with specific dietary needs or those looking to improve their overall health.

Impact on Mental Health and Wellbeing

Mental health is an integral part of overall wellbeing, and private health insurance can play a vital role in supporting mental health.

- Access to mental health professionals: Private health insurance often covers consultations with psychologists, psychiatrists, and other mental health professionals. This access to mental health care can be crucial for individuals struggling with mental health issues, allowing them to seek support and treatment.

- Reduced financial stress: The financial protection offered by private health insurance can alleviate stress related to medical expenses, which can have a positive impact on mental wellbeing.

- Early intervention: Private health insurance can facilitate early intervention for mental health issues, which is often associated with better treatment outcomes and a faster recovery.

Last Point

Private health insurance in Australia offers a valuable pathway to enhanced healthcare access, personalized choices, and financial security. By providing a wider range of options, shorter waiting times, and comprehensive coverage, it empowers individuals to take control of their health and well-being. Whether you’re seeking specialized medical treatments, faster access to specialists, or financial protection against unexpected medical expenses, private health insurance can play a significant role in your overall health journey.

FAQ Explained

What are the different types of private health insurance available in Australia?

Private health insurance in Australia is categorized into various levels of coverage, from basic hospital cover to comprehensive policies that include extras such as dental, optical, and physiotherapy. The type of cover you choose depends on your individual needs and budget.

How much does private health insurance cost in Australia?

The cost of private health insurance in Australia varies depending on factors such as your age, health, level of cover, and the insurer you choose. It’s essential to compare quotes from different providers to find the best value for your needs.

Can I claim private health insurance benefits for overseas medical expenses?

Some private health insurance policies offer coverage for overseas medical expenses, but the extent of coverage varies. It’s crucial to check the terms and conditions of your policy before traveling internationally.

How do I choose the right private health insurance policy for me?

Choosing the right private health insurance policy involves considering your individual needs, health status, budget, and coverage requirements. It’s recommended to consult with a health insurance broker or compare quotes from different providers before making a decision.