Biggest life insurance companies in Australia play a vital role in providing financial security to families in the event of an unexpected loss. With a diverse range of policies and providers available, understanding the landscape and finding the right coverage can feel overwhelming. This guide aims to demystify the process, offering insights into the top players, policy types, and key considerations for choosing the best life insurance for your needs.

Navigating the world of life insurance can seem daunting, but with careful planning and research, you can secure the peace of mind knowing your loved ones are financially protected in the future. This guide provides a comprehensive overview of the biggest life insurance companies in Australia, their offerings, and essential factors to consider when making your choice.

Top Life Insurance Companies in Australia

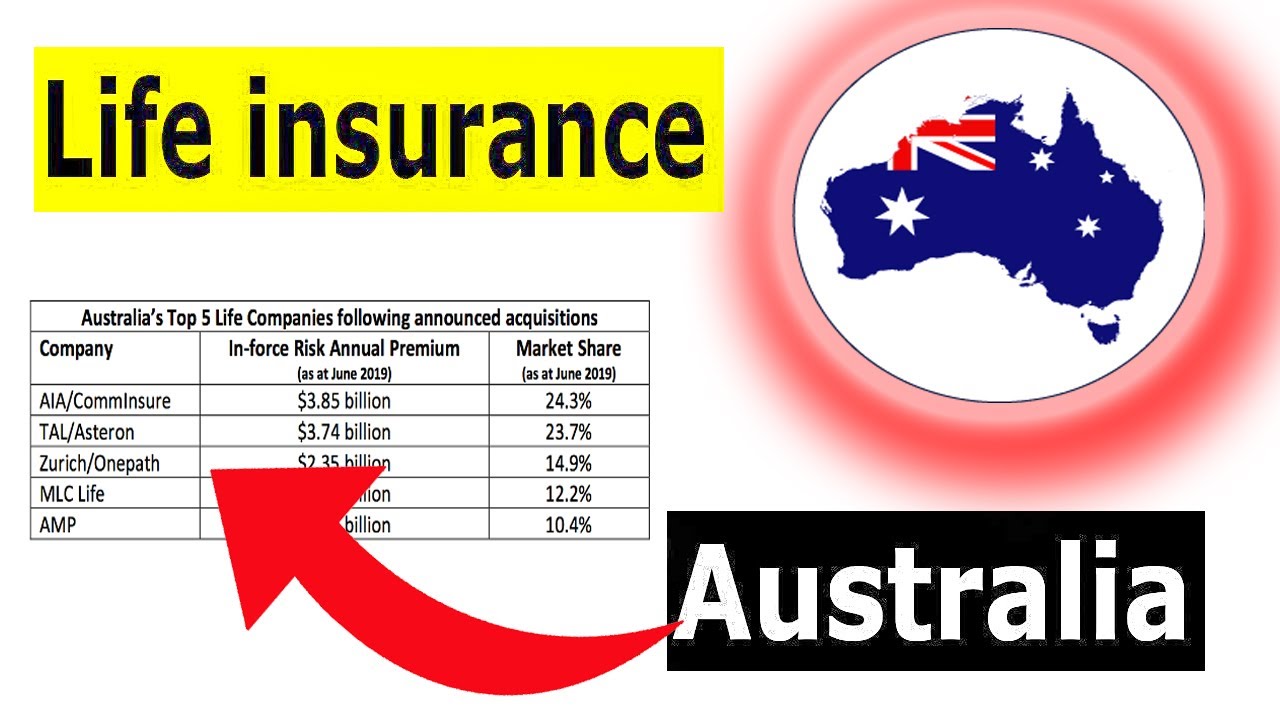

Life insurance is an essential part of financial planning in Australia, providing financial security for loved ones in the event of death or critical illness. The Australian life insurance market is highly competitive, with numerous companies vying for customers. This article will delve into the top 5 life insurance companies in Australia, examining their market share, products, and services, and the factors that contribute to their success.

Top 5 Life Insurance Companies in Australia

The ranking of the top life insurance companies in Australia is based on various factors, including market share, premium income, and customer satisfaction. These factors are often intertwined and influence each other.

- AMP is a leading financial services provider in Australia, offering a wide range of products, including life insurance. Founded in 1849, AMP has a long history of providing financial services to Australians. The company has a strong brand reputation and a wide distribution network, which contributes to its market dominance.

- AIA Australia is a subsidiary of AIA Group, one of the largest life insurance companies in the world. AIA Australia offers a comprehensive range of life insurance products, including term life, whole life, and critical illness cover. The company has a strong focus on innovation and technology, which has helped it to attract a growing customer base.

- TAL is a leading life insurance provider in Australia, offering a range of products, including term life, whole life, and income protection. TAL has a strong focus on customer service and has been recognized for its commitment to providing excellent customer experiences.

- OnePath is a leading provider of life insurance, superannuation, and other financial products in Australia. OnePath is a subsidiary of the Australian Unity Group, a mutual organization that has been providing financial services to Australians for over 100 years.

- Suncorp Life is a subsidiary of Suncorp Group, a major Australian financial services company. Suncorp Life offers a range of life insurance products, including term life, whole life, and critical illness cover. The company has a strong focus on innovation and technology, which has helped it to attract a growing customer base.

Types of Life Insurance Offered

Life insurance in Australia comes in various forms, each designed to meet specific needs and financial goals. Understanding the differences between these policies is crucial for making an informed decision. This section explores the key types of life insurance available, outlining their features, benefits, and suitability for different individuals and families.

Term Life Insurance

Term life insurance is a straightforward and affordable option that provides coverage for a specified period, typically ranging from 10 to 30 years. This type of policy is designed to protect your loved ones financially in the event of your death during the policy term.

- Key Features:

- Fixed Premium: You pay a fixed premium for the duration of the policy term.

- Death Benefit: A lump sum payment is paid to your beneficiaries upon your death within the policy term.

- No Cash Value: Term life insurance does not accumulate cash value, meaning there is no investment component.

- Benefits:

- Affordability: Term life insurance is generally the most affordable type of life insurance due to its temporary nature.

- Targeted Coverage: It provides specific coverage for a defined period, making it ideal for situations where temporary protection is needed, such as during a mortgage or while raising young children.

- Simplicity: Term life insurance is relatively simple to understand and purchase.

- Suitability:

- Young Families: Term life insurance can provide financial security for young families during a period when dependents rely on the primary income earner.

- Mortgage Holders: It can cover the outstanding mortgage balance in case of the borrower’s death, ensuring the family can remain in their home.

- Temporary Needs: Individuals with temporary financial obligations, such as a student loan or business debt, may find term life insurance suitable.

Whole Life Insurance

Whole life insurance offers lifelong coverage, providing financial protection for your entire life. It combines a death benefit with a savings component, allowing you to build cash value over time.

- Key Features:

- Lifetime Coverage: Whole life insurance provides coverage for as long as you live, regardless of your age or health.

- Cash Value Accumulation: A portion of your premium contributes to a cash value account, which grows over time.

- Fixed Premium: The premium remains fixed for the life of the policy.

- Benefits:

- Long-Term Financial Security: Whole life insurance provides lifelong coverage and a savings component, ensuring financial stability for your family even after your death.

- Cash Value Benefits: The cash value can be borrowed against or withdrawn for various financial needs.

- Tax Advantages: The cash value grows tax-deferred, meaning you don’t pay taxes on the growth until you withdraw it.

- Suitability:

- Individuals Seeking Lifetime Coverage: Whole life insurance is ideal for those who want to ensure their family’s financial security for the rest of their lives.

- Estate Planning: It can be used as a tool for estate planning, helping to minimize estate taxes.

- Long-Term Savings: The cash value component provides a long-term savings option.

Universal Life Insurance

Universal life insurance combines a death benefit with a flexible premium and investment component, giving you greater control over your policy.

- Key Features:

- Flexible Premiums: You can adjust your premium payments based on your financial circumstances.

- Cash Value Accumulation: Your premium payments contribute to a cash value account that you can invest in various options, such as mutual funds.

- Death Benefit Flexibility: You can adjust the death benefit to meet your changing needs.

- Benefits:

- Flexibility: Universal life insurance offers greater flexibility in premium payments and investment choices.

- Potential for Growth: The cash value can grow significantly if invested wisely.

- Control: You have more control over your policy’s features and investment options.

- Suitability:

- Individuals with Variable Income: Universal life insurance allows for flexible premium payments, making it suitable for individuals with fluctuating income.

- Experienced Investors: Those with investment experience can potentially maximize the growth of their cash value through strategic investment choices.

- Long-Term Financial Goals: Universal life insurance can be used to achieve long-term financial goals, such as retirement planning or college savings.

Factors to Consider When Choosing a Life Insurance Provider

Choosing the right life insurance provider is a crucial decision that should not be taken lightly. Your choice can have a significant impact on your financial security and the well-being of your loved ones. To ensure you make the best choice, carefully consider several factors, including the financial stability of the insurer, their customer service reputation, the types of life insurance policies they offer, and their pricing structure.

Financial Stability

The financial stability of a life insurance provider is paramount. You want to ensure that your insurer will be able to fulfill their obligations to you and your beneficiaries in the event of your death. A financially sound insurer has a strong track record of paying claims promptly and reliably. To assess an insurer’s financial health, you can consider the following:

- Credit ratings: Reputable credit rating agencies, such as Standard & Poor’s, Moody’s, and AM Best, assign ratings to insurance companies based on their financial strength. Look for insurers with high credit ratings, indicating strong financial stability.

- Capital adequacy: A well-capitalized insurer has enough financial resources to cover potential claims and unexpected events. This can be assessed by examining their capital reserves and solvency ratios.

- Claims-paying history: A consistent track record of paying claims promptly and fairly is a good indicator of an insurer’s financial stability and commitment to their policyholders.

Customer Service

Excellent customer service is essential when dealing with a life insurance provider. You want to be confident that you will receive prompt, helpful, and courteous assistance whenever you need it. To assess a provider’s customer service, consider:

- Customer reviews and ratings: Online review platforms and independent rating agencies can provide valuable insights into a provider’s customer service experience. Look for consistently positive feedback and high ratings.

- Availability of support channels: Choose an insurer that offers multiple channels for contacting them, such as phone, email, and online chat. This ensures easy access to support when needed.

- Response times: A prompt response time to inquiries and claims is a key indicator of excellent customer service. Look for insurers with a history of quick and efficient service.

Product Offerings

The types of life insurance policies offered by a provider should align with your individual needs and circumstances. Different insurers offer various types of policies, including term life insurance, whole life insurance, and universal life insurance.

- Term life insurance: Provides coverage for a specific period, typically 10 to 30 years. It is generally more affordable than permanent life insurance and suitable for individuals seeking temporary coverage, such as during periods of high financial responsibility.

- Whole life insurance: Provides lifetime coverage and accumulates cash value that can be borrowed against or withdrawn. It is more expensive than term life insurance but offers permanent coverage and investment potential.

- Universal life insurance: Offers flexible premiums and death benefit options, allowing you to adjust your coverage and investment strategies over time. It provides lifetime coverage and cash value accumulation but is generally more complex than term life insurance.

Pricing

The cost of life insurance is an important consideration, but it should not be the sole factor driving your decision. While it is essential to find a policy that fits your budget, you should also consider the overall value proposition offered by the insurer. To compare pricing, consider:

- Premiums: Compare premium quotes from different insurers for similar coverage amounts and policy terms. Remember that lower premiums may not always indicate the best value, especially if the policy has limited features or a less reputable insurer.

- Policy features: Assess the features and benefits included in each policy, such as riders, exclusions, and waiting periods. These factors can significantly impact the overall value of a policy.

- Transparency: Look for insurers that provide clear and concise information about their pricing structure, fees, and other charges. Avoid insurers with hidden fees or complex pricing models.

Tips for Getting the Best Life Insurance Policy

Finding the right life insurance policy can be a complex process, but it’s essential to secure your family’s financial future. By following a strategic approach, you can increase your chances of obtaining a suitable and affordable policy that meets your needs.

Compare Quotes from Multiple Providers

Comparing quotes from multiple providers is crucial to finding the best value for your money. Different insurers offer varying premiums and coverage options, so it’s essential to shop around. Online comparison websites can be a helpful tool for streamlining this process.

Understand Your Needs and Risk Profile

Before you start comparing quotes, take some time to assess your specific needs and risk profile. Consider factors such as your age, health, dependents, and financial obligations. This will help you determine the type of coverage you require and the level of premiums you can afford.

Negotiate Premiums

Don’t be afraid to negotiate premiums with insurers. You may be able to secure a lower rate by demonstrating a healthy lifestyle, good credit history, or by bundling your life insurance with other policies, such as home or car insurance.

Consider Your Coverage Options, Biggest life insurance companies in australia

Life insurance policies come in various forms, each with its own benefits and drawbacks. Some common types include:

- Term Life Insurance: This provides coverage for a specific period, typically 10 to 30 years. It’s generally more affordable than permanent life insurance, but it doesn’t build cash value.

- Permanent Life Insurance: This provides lifetime coverage and includes a cash value component that grows over time. It’s more expensive than term life insurance, but it can be a valuable investment tool.

- Whole Life Insurance: This is a type of permanent life insurance that offers fixed premiums and guaranteed death benefits.

- Universal Life Insurance: This is a type of permanent life insurance that allows for flexible premiums and death benefits.

Review Your Policy Regularly

Once you’ve purchased a life insurance policy, it’s essential to review it regularly to ensure it still meets your needs. Your circumstances may change over time, such as getting married, having children, or experiencing a change in your financial situation. You may need to adjust your coverage or make other changes to your policy.

Choose a Reputable Provider

When selecting a life insurance provider, it’s important to choose a reputable company with a strong financial track record. You can research insurers online or by contacting your state’s insurance department.

Get Professional Advice

If you’re unsure about which type of life insurance policy is right for you, it’s advisable to seek professional advice from a financial advisor or insurance broker. They can help you understand your options and make an informed decision.

Importance of Life Insurance in Australia: Biggest Life Insurance Companies In Australia

Life insurance plays a crucial role in providing financial security and peace of mind for Australians, especially in the face of unexpected events. It acts as a safety net for families, ensuring their financial well-being and stability in the event of the policyholder’s passing.

The Significance of Life Insurance in Australia

In Australia, where life expectancy is high, life insurance is vital for safeguarding families and mitigating the financial impact of unexpected deaths. It serves as a financial buffer, covering essential expenses and allowing loved ones to maintain their lifestyle without undue financial strain.

Real-World Examples and Scenarios

- Imagine a family with a young child and a mortgage. The loss of a primary income earner could leave the family struggling to make mortgage payments, cover living expenses, and provide for the child’s education. Life insurance can help alleviate this financial burden, ensuring the family’s financial stability and security.

- A business owner might rely on life insurance to cover the cost of replacing a key employee or partner. This protects the business from potential financial losses and ensures its continuity in the event of a sudden loss.

Reasons Why Life Insurance Is Essential

- Financial Security for Family: Life insurance provides a lump sum payment to beneficiaries, helping them cover expenses such as mortgage payments, funeral costs, living expenses, and educational costs.

- Debt Repayment: Life insurance can be used to repay outstanding debts, such as mortgages, loans, and credit card balances, relieving financial stress on the family.

- Income Replacement: Life insurance can replace a lost income, ensuring the family’s financial stability and allowing them to maintain their standard of living.

- Peace of Mind: Having life insurance provides peace of mind knowing that your family will be financially protected in the event of your passing.

Last Word

Ultimately, the decision of which life insurance company to choose is a personal one, influenced by individual circumstances, financial goals, and risk tolerance. By understanding the factors Artikeld in this guide, you can make an informed decision and secure the best life insurance policy to meet your unique needs and provide financial security for your family. Remember, taking the time to research and compare options is essential to finding the right coverage for your peace of mind.

Question Bank

What is the difference between term life insurance and whole life insurance?

Term life insurance provides coverage for a specific period, typically 10-30 years, while whole life insurance offers lifetime coverage with a cash value component that accumulates over time.

How much life insurance do I need?

The amount of life insurance you need depends on your individual circumstances, including your income, dependents, outstanding debts, and desired lifestyle for your family.

Can I get life insurance if I have a pre-existing medical condition?

Yes, you can still get life insurance with a pre-existing condition, but you may need to pay higher premiums or be subject to underwriting restrictions.