How many insurance companies in australia – How many insurance companies are in Australia sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Australia boasts a robust and diverse insurance industry, catering to the needs of its citizens and businesses. From life and health to property and casualty insurance, the market is home to a multitude of companies, each offering unique products and services. This exploration delves into the heart of this industry, uncovering its size, key players, and the forces shaping its future.

The Australian insurance market is a complex and dynamic ecosystem, influenced by factors such as economic conditions, regulatory frameworks, and technological advancements. Understanding the key players, their market share, and the challenges they face is essential for anyone seeking to navigate this intricate landscape.

The Australian Insurance Landscape

The Australian insurance industry is a significant contributor to the country’s economy, providing financial protection to individuals and businesses against a wide range of risks. The industry is diverse, encompassing various sectors, and operates within a robust regulatory framework designed to ensure its stability and consumer protection.

Key Sectors of the Australian Insurance Industry

The Australian insurance industry can be broadly categorized into several key sectors:

- General Insurance: This sector covers a wide range of risks, including property, liability, motor vehicle, and travel insurance. General insurers offer protection against financial losses arising from events such as fire, theft, accidents, and natural disasters.

- Life Insurance: This sector provides financial protection to individuals and their families in the event of death or critical illness. Life insurance policies can offer lump-sum payments, income replacement, or other benefits to help beneficiaries cope with financial hardship.

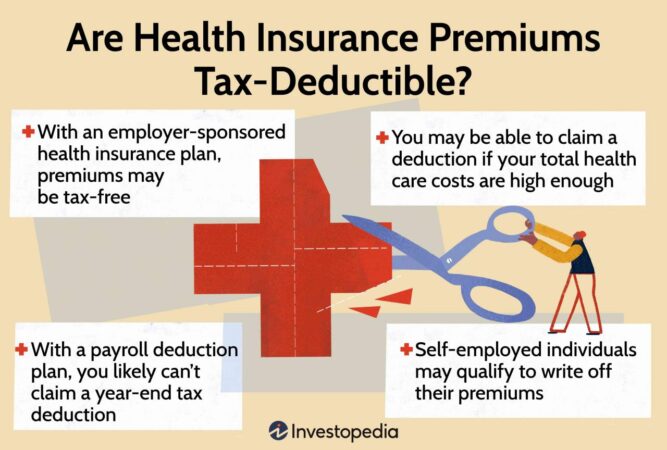

- Health Insurance: This sector offers coverage for medical expenses, including hospital stays, surgery, and other healthcare services. Health insurance policies can be private or public, with the latter being provided by the Australian government.

- Workers’ Compensation Insurance: This sector provides financial protection to employees who suffer injuries or illnesses arising from their work. Workers’ compensation insurers are responsible for paying medical expenses, lost wages, and other benefits to injured workers.

Regulatory Framework for Insurance in Australia

The Australian insurance industry is subject to a comprehensive regulatory framework designed to protect consumers and ensure the stability of the industry. This framework is overseen by the Australian Prudential Regulation Authority (APRA), which is responsible for:

- Setting prudential standards for insurers, including capital adequacy requirements and risk management practices.

- Monitoring the financial health of insurers and taking action to address any concerns.

- Promoting competition and innovation in the insurance industry.

- Ensuring that insurers comply with consumer protection laws.

Role of the Australian Prudential Regulation Authority (APRA), How many insurance companies in australia

APRA plays a crucial role in overseeing the Australian insurance industry, ensuring its stability and protecting consumers. APRA’s key responsibilities include:

- Setting Prudential Standards: APRA sets prudential standards for insurers, including capital adequacy requirements and risk management practices. These standards aim to ensure that insurers have sufficient financial resources to meet their obligations to policyholders.

- Monitoring Insurer Financial Health: APRA monitors the financial health of insurers, assessing their capital adequacy, risk management practices, and overall financial performance. This monitoring helps to identify any potential problems early on and take appropriate action to mitigate risks.

- Promoting Competition and Innovation: APRA promotes competition and innovation in the insurance industry by encouraging the development of new products and services. This helps to ensure that consumers have access to a wide range of insurance options at competitive prices.

- Ensuring Compliance with Consumer Protection Laws: APRA ensures that insurers comply with consumer protection laws, including those relating to fair dealing, disclosure, and complaints handling. This helps to protect consumers from unfair or misleading practices by insurers.

Types of Insurance Companies

The Australian insurance landscape is diverse, with a wide range of insurance companies catering to various needs. These companies can be categorized based on their ownership structure, specialization, and the products they offer. Understanding these categories helps consumers make informed decisions about their insurance needs.

Categorization of Insurance Companies

Insurance companies in Australia can be broadly categorized into the following types:

| Company Name | Type | Key Products Offered |

|---|---|---|

| AIA Australia | Life Insurance Company | Life insurance, health insurance, investment products |

| AMP | Financial Services Company | Life insurance, superannuation, investment products, wealth management |

| AAMI | General Insurance Company | Car insurance, home insurance, contents insurance |

| Allianz | General Insurance Company | Car insurance, home insurance, business insurance, travel insurance |

| Australian Unity | Mutual Insurance Company | Health insurance, life insurance, superannuation |

| BUPA | Health Insurance Company | Private health insurance, dental insurance, vision insurance |

| Cigna | Health Insurance Company | Private health insurance, dental insurance, vision insurance |

| GIO | General Insurance Company | Car insurance, home insurance, contents insurance |

| HBF | Health Insurance Company | Private health insurance, dental insurance, vision insurance |

| Medibank | Health Insurance Company | Private health insurance, travel insurance |

| NRMA Insurance | General Insurance Company | Car insurance, home insurance, contents insurance, travel insurance |

| QBE | General Insurance Company | Business insurance, commercial insurance, specialty insurance |

| Suncorp | General Insurance Company | Car insurance, home insurance, contents insurance, travel insurance |

| Westpac Life | Life Insurance Company | Life insurance, income protection insurance, trauma insurance |

Market Size and Growth: How Many Insurance Companies In Australia

The Australian insurance market is a significant contributor to the country’s financial sector. It plays a vital role in providing financial protection to individuals and businesses against various risks.

The market’s size and growth are influenced by several factors, including economic conditions, regulatory changes, and consumer demand.

Market Size

The Australian insurance market is substantial, with a total gross written premium (GWP) exceeding AUD 150 billion in 2022. This makes it one of the largest insurance markets in the Asia-Pacific region.

Market Growth

The Australian insurance market has consistently grown over the past few years. In 2021, the market recorded a GWP growth rate of around 5%. This growth can be attributed to several factors, including:

- Rising disposable incomes: As the Australian economy continues to grow, disposable incomes are increasing, allowing individuals to allocate more funds towards insurance products.

- Increased awareness of risk: Growing awareness of potential risks, such as natural disasters, cyberattacks, and health issues, has prompted individuals and businesses to seek insurance protection.

- Government initiatives: The Australian government has implemented several initiatives to promote insurance coverage, such as compulsory motor vehicle insurance and health insurance schemes.

- Technological advancements: The adoption of digital technologies, such as online platforms and mobile apps, has made insurance products more accessible and convenient, driving market growth.

Growth Drivers

Several key factors are driving the growth of the Australian insurance market:

- Increasing demand for life insurance: With rising life expectancy and a growing awareness of financial security needs, demand for life insurance products is on the rise.

- Growing popularity of health insurance: The Australian government’s private health insurance rebate scheme has contributed to the increasing popularity of health insurance products.

- Expansion of the general insurance market: The general insurance market, encompassing products such as home, motor vehicle, and travel insurance, is expanding due to factors like increased car ownership and travel activities.

Closing Notes

The Australian insurance industry is a dynamic and evolving sector, shaped by a complex interplay of factors. From the leading players and their market share to the emerging trends and challenges, this exploration has provided a comprehensive overview of this crucial industry. As technology continues to reshape the landscape, the future of insurance in Australia promises to be exciting and full of potential.

Quick FAQs

What are the main types of insurance in Australia?

The main types of insurance in Australia include life insurance, health insurance, general insurance (covering property, motor vehicles, and liability), and workers’ compensation insurance.

Is there a government-run insurance scheme in Australia?

Yes, Australia has a government-run health insurance scheme called Medicare, which provides universal healthcare coverage to all citizens and permanent residents.

What are the key regulations governing the Australian insurance industry?

The Australian Prudential Regulation Authority (APRA) is the primary regulator of the insurance industry in Australia, setting standards and overseeing the financial health of insurance companies.

What are the major challenges facing the Australian insurance industry?

Some of the major challenges include rising claims costs, increasing competition, regulatory changes, and the need to adapt to technological advancements.