- Factors Influencing House Insurance Costs in Australia

- Types of House Insurance Policies in Australia

- Obtaining House Insurance Quotes in Australia

- Key Considerations for Choosing House Insurance: How Much Does House Insurance Cost In Australia

- Tips for Reducing House Insurance Costs in Australia

- Closure

- Essential Questionnaire

How much does house insurance cost in Australia? This is a question on the minds of many homeowners, as the cost of insurance can vary significantly depending on a range of factors. From location and property type to building materials and security features, there are numerous variables that influence premiums. Understanding these factors is crucial for securing adequate coverage at a reasonable price.

In Australia, house insurance policies are designed to protect homeowners against financial losses arising from unexpected events like fire, theft, or natural disasters. These policies can provide coverage for both the building itself and its contents, offering peace of mind in the event of unforeseen circumstances. However, navigating the complexities of house insurance can be daunting, with a wide range of policy options, coverage levels, and insurer offerings available.

Factors Influencing House Insurance Costs in Australia

House insurance premiums in Australia are influenced by a variety of factors, each playing a significant role in determining the final cost. Understanding these factors can help homeowners make informed decisions and potentially reduce their insurance premiums.

Location

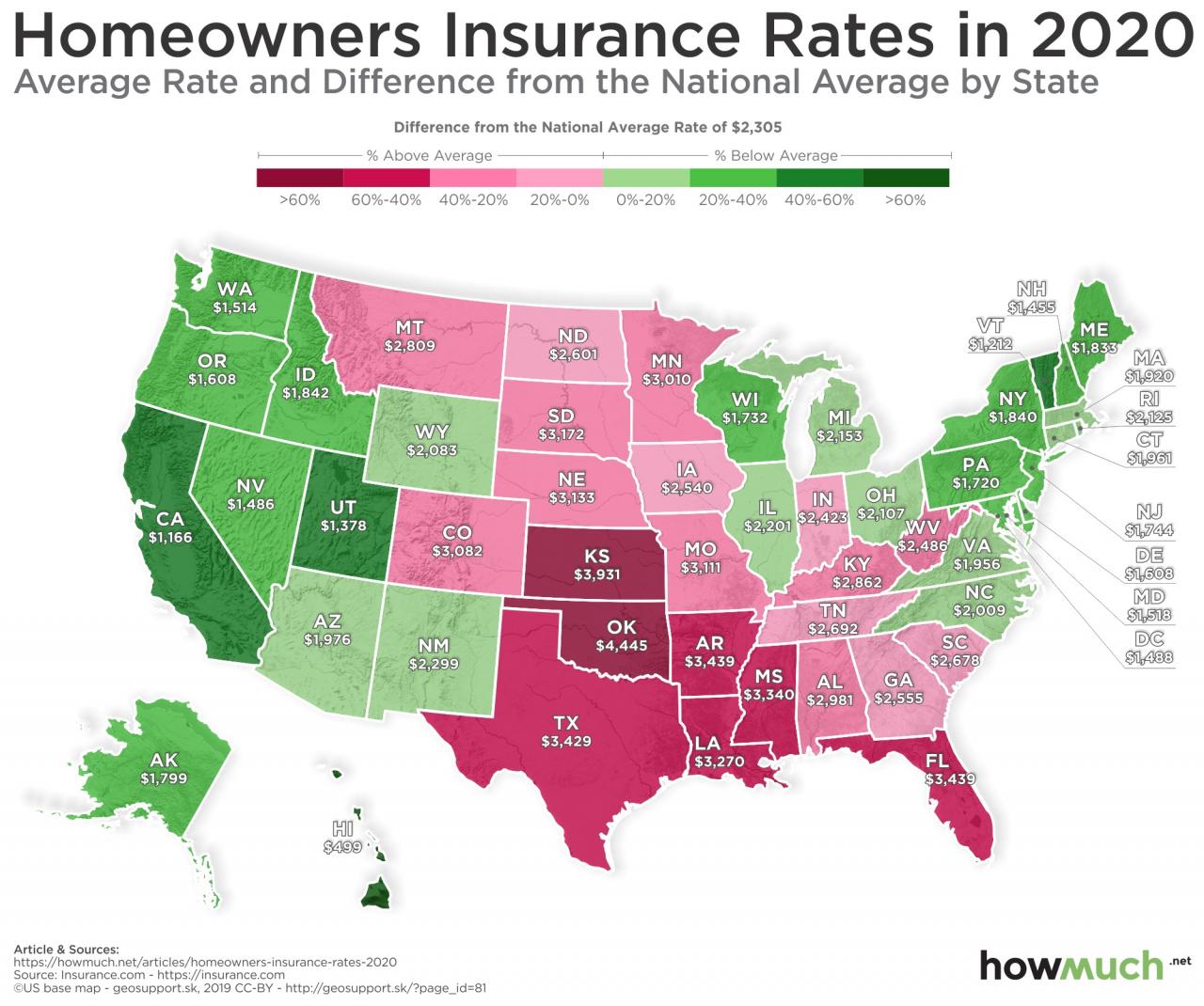

The location of your property significantly impacts your insurance premiums. Areas prone to natural disasters, such as bushfires, floods, or earthquakes, will generally have higher premiums. For instance, properties located in coastal areas may face higher premiums due to the risk of cyclones and storm surges. Similarly, properties situated in areas with a high risk of bushfires will have higher premiums due to the potential for fire damage. Insurance companies assess the risk of each location based on historical data and their own risk models.

Property Type, How much does house insurance cost in australia

The type of property you own also plays a role in determining your insurance premiums. Detached houses typically have lower premiums compared to townhouses or units. This is because detached houses are generally considered less susceptible to damage from neighboring properties. The age of the property also influences premiums. Older properties may have higher premiums due to potential maintenance issues or outdated building codes.

Building Materials

The materials used to construct your home can also affect your insurance premiums. Homes built with fire-resistant materials, such as brick or concrete, may have lower premiums compared to homes built with timber. This is because fire-resistant materials are less likely to be damaged in a fire. Similarly, properties with modern building materials that meet current building codes may have lower premiums compared to properties with older building materials that may not meet current standards.

Security Features

Security features installed in your home can help reduce your insurance premiums. Features such as alarms, security cameras, and motion sensors can deter burglars and reduce the risk of theft. Insurance companies may offer discounts to homeowners who have installed these security features.

Contents Coverage

The amount of coverage you choose for your belongings can also impact your premiums. Higher coverage amounts will generally result in higher premiums. It’s important to consider the value of your possessions and choose coverage that adequately protects them.

Personal Circumstances

Your personal circumstances can also influence your insurance premiums. For example, homeowners with a history of claims may have higher premiums. Similarly, homeowners with a good credit score may qualify for lower premiums.

Types of House Insurance Policies in Australia

In Australia, there are various types of house insurance policies available, each offering different levels of coverage to suit diverse needs and circumstances. Choosing the right policy depends on factors such as the type of property, its value, and the specific risks you want to cover.

Building Insurance

Building insurance provides financial protection against damage to the physical structure of your home, including the walls, roof, floors, and fixtures. It covers a range of perils such as fire, storms, floods, and earthquakes. This type of insurance is essential for homeowners, as it helps to rebuild or repair your home in the event of a covered disaster.

Contents Insurance

Contents insurance protects your personal belongings inside your home from damage or loss due to covered events. This includes furniture, appliances, electronics, clothing, and other valuable items. While building insurance covers the structure of your home, contents insurance covers the things inside it.

Combined Policies

Combined policies offer comprehensive coverage by merging building insurance and contents insurance into one policy. This approach simplifies the insurance process, providing a single policy that protects both your home and your belongings. Combined policies often offer discounts compared to purchasing separate building and contents insurance.

Obtaining House Insurance Quotes in Australia

Getting quotes for house insurance in Australia is relatively straightforward. You can obtain quotes online, over the phone, or in person at an insurance broker’s office.

Comparing Quotes from Multiple Insurers

Comparing quotes from multiple insurers is essential to ensure you are getting the best value for your money. Different insurers offer varying premiums and coverage options, so it’s crucial to shop around and compare quotes before making a decision.

Factors to Consider When Comparing Quotes

When comparing quotes, it’s important to consider the following factors:

| Factor | Description |

|---|---|

| Premium Cost | The annual cost of the insurance policy. |

| Coverage Details | The specific events and situations covered by the policy. |

| Excess | The amount you pay out of pocket for each claim. |

| Insurer Reputation | The insurer’s track record for handling claims and customer service. |

| Discounts | Any discounts offered by the insurer, such as for security features or being a long-term customer. |

Key Considerations for Choosing House Insurance: How Much Does House Insurance Cost In Australia

Choosing the right house insurance policy is crucial to protect your financial well-being in the event of unforeseen circumstances like fire, theft, or natural disasters. It’s not just about finding the cheapest option, but rather a policy that offers adequate coverage at a reasonable price while also aligning with your specific needs.

Understanding Your Insurance Needs and Coverage Requirements

Before you start comparing quotes, it’s important to have a clear understanding of your insurance needs and coverage requirements. This involves considering factors like the value of your property, the level of risk you’re willing to take, and the types of events you want to be covered for. For example, if you live in an area prone to bushfires, you might want to consider a policy that offers additional coverage for fire damage.

Choosing an Insurer

Once you’ve determined your insurance needs, you can start comparing quotes from different insurers. When choosing an insurer, consider the following factors:

Financial Stability

It’s important to choose an insurer that is financially stable and has a strong track record of paying claims. You can check the insurer’s financial rating with agencies like Standard & Poor’s or Moody’s.

Claims Handling Process

The claims handling process is crucial, as it determines how smoothly and efficiently your claim will be processed in the event of a loss. Look for an insurer with a reputation for prompt and fair claim settlements.

Customer Service

Good customer service is essential, especially during stressful times like when you’re filing a claim. Choose an insurer with a responsive and helpful customer service team.

Selecting a Policy That Offers Adequate Protection at a Reasonable Price

Once you’ve narrowed down your choices, it’s time to compare policies and select one that offers adequate protection at a reasonable price. Consider the following:

Coverage

Ensure the policy covers the risks you’re most concerned about, such as fire, theft, natural disasters, and liability.

Deductible

The deductible is the amount you’ll pay out of pocket before your insurance coverage kicks in. A higher deductible typically results in lower premiums, but you’ll have to pay more if you make a claim.

Premium

The premium is the cost of your insurance policy. Compare premiums from different insurers to find the most affordable option without sacrificing coverage.

Exclusions

Pay close attention to the policy’s exclusions, which are the events or situations that are not covered by the policy.

Add-ons

Some insurers offer add-ons, such as coverage for specific items like jewellery or valuable artwork. Consider whether these add-ons are necessary for your needs.

Tips for Reducing House Insurance Costs in Australia

Lowering your house insurance premiums is achievable with a few strategic steps. By taking proactive measures to minimize risk and understanding your policy options, you can significantly reduce your annual costs.

Implementing Safety Measures

Investing in safety measures can not only enhance your home’s security but also lower your insurance premiums. Insurance companies often reward policyholders who take steps to mitigate potential risks.

- Installing Smoke Alarms: Smoke alarms are crucial for early fire detection, minimizing damage and potential injury. Many insurance companies offer discounts for homes equipped with interconnected smoke alarms that alert you and the fire department in case of a fire.

- Security Systems: Installing a security system, including alarms, motion sensors, and CCTV cameras, can deter burglars and lower your risk of theft. Insurance companies recognize the value of these systems and may offer discounts for their presence.

- Maintaining Your Property: Regular maintenance, including roof inspections, plumbing checks, and electrical repairs, can prevent costly damage and accidents. By keeping your home in good condition, you can reduce the likelihood of claims and potentially lower your insurance premiums.

Increasing Your Excess or Deductible

Your excess, also known as a deductible, is the amount you agree to pay out of pocket in case of a claim. Increasing your excess can result in lower premiums.

Increasing your excess can be a cost-effective way to reduce your insurance premiums, but it’s crucial to ensure you can afford to cover the excess in case of a claim.

- Calculating Your Risk Tolerance: Assess your financial situation and determine the maximum amount you can comfortably afford to pay in case of a claim. If you’re confident you can handle a higher excess, it can lead to significant savings.

- Impact on Premiums: The impact of increasing your excess on your premiums will vary depending on your insurer and the type of policy. Contact your insurer to understand the potential savings associated with different excess amounts.

Closure

Ultimately, the cost of house insurance in Australia is influenced by a multitude of factors, and finding the right policy requires careful consideration of individual needs and circumstances. By understanding the key factors that impact premiums, comparing quotes from multiple insurers, and implementing practical cost-saving measures, homeowners can secure adequate coverage at a price that aligns with their budget. Remember, choosing the right house insurance policy is a crucial step in protecting your most valuable asset.

Essential Questionnaire

What are the main types of house insurance policies available in Australia?

Common types of house insurance policies include building insurance, contents insurance, and combined policies. Building insurance covers the structure of your home, while contents insurance protects your belongings. Combined policies offer comprehensive coverage for both the building and contents.

How often should I review my house insurance policy?

It’s advisable to review your house insurance policy annually to ensure it still meets your needs and provides adequate coverage. Changes in your property, belongings, or risk factors might require adjustments to your policy.

What is an excess or deductible in house insurance?

An excess or deductible is the amount you agree to pay out of pocket for each claim. Choosing a higher excess can generally lower your premiums, but it means you’ll pay more in the event of a claim.

What are some tips for reducing my house insurance premiums?

Consider implementing safety measures like installing smoke alarms, security systems, and fire extinguishers. You can also explore increasing your excess or choosing a higher deductible to potentially lower premiums.