How much for car insurance in Australia sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The cost of car insurance in Australia can vary greatly depending on a number of factors, including your driving history, the type of car you drive, and where you live. Understanding these factors and the different types of coverage available can help you find the best insurance deal for your needs.

This comprehensive guide will explore the key elements influencing car insurance premiums, demystifying the different coverage options available and equipping you with the knowledge to make informed decisions about your insurance. We will delve into the intricacies of finding the most affordable car insurance, navigating the claims process, and maximizing potential savings through discounts and rebates.

Factors Influencing Car Insurance Costs

Car insurance premiums in Australia are determined by a range of factors that insurers carefully consider to assess the risk associated with each policyholder. These factors are designed to ensure that premiums accurately reflect the likelihood of an insured event and the potential cost of claims.

Driving History

Your driving history plays a significant role in determining your car insurance premiums. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or other offenses can lead to higher premiums. This is because insurers view individuals with a history of driving incidents as higher risk and are more likely to file claims.

- No Claims Bonus (NCB): This is a discount offered by insurers for each year you drive without making a claim. The longer your NCB, the greater the discount. For example, a driver with a 5-year NCB may receive a significant discount compared to a driver with a 1-year NCB.

- Driving Offences: Speeding tickets, driving under the influence, and other traffic violations can increase your premiums significantly. Insurers may consider these offences as indicators of risky driving behavior.

- Accidents: Any accidents you have been involved in, regardless of fault, will be considered by insurers. Accidents increase your risk profile and can lead to higher premiums.

Car Age and Model

The age and model of your car have a substantial impact on your insurance premiums. Newer cars generally cost more to repair or replace, making them more expensive to insure. Additionally, certain car models are known to be more prone to accidents or theft, leading to higher premiums.

- New Cars: Newer cars are typically more expensive to insure due to their higher repair costs and the potential for greater financial losses in case of an accident.

- Older Cars: Older cars, while generally less expensive to insure, can still be subject to higher premiums if they have a history of mechanical problems or are considered “high-risk” models.

- Performance Cars: High-performance cars, sports cars, and modified vehicles are often associated with higher risk due to their potential for higher speeds and more severe accidents. As a result, they typically have higher insurance premiums.

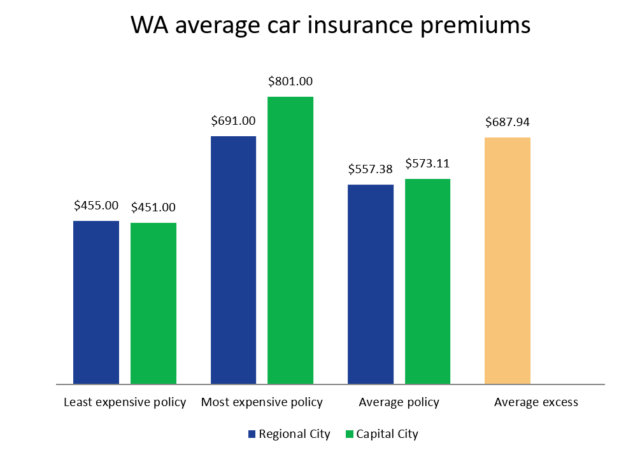

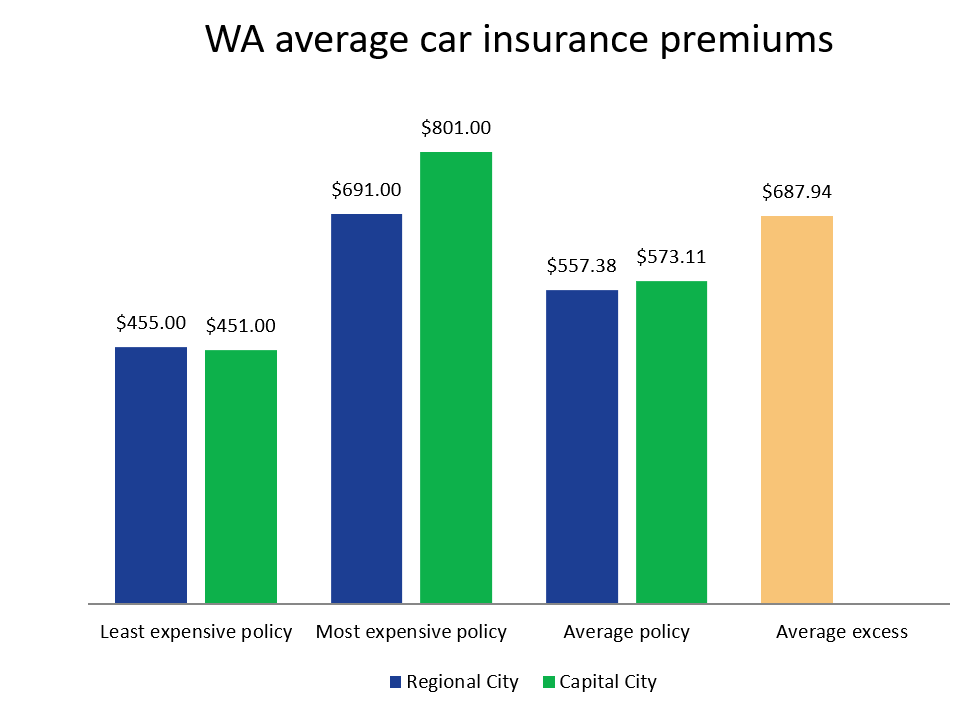

Location and Postcode

The location where you live and your postcode can also influence your car insurance premiums. This is because insurers consider the risk of accidents and theft in different areas. Areas with higher crime rates or more traffic congestion may have higher insurance premiums.

- Urban Areas: Urban areas with high population density and heavy traffic tend to have higher insurance premiums due to the increased risk of accidents and theft.

- Rural Areas: Rural areas with lower population density and less traffic may have lower insurance premiums as the risk of accidents and theft is generally lower.

Types of Car Insurance Coverage

In Australia, car insurance policies offer different levels of coverage, each with its own benefits and limitations. Choosing the right coverage depends on your individual needs, driving habits, and budget. Here’s a breakdown of the main types of car insurance available:

Types of Car Insurance Coverage in Australia

The types of car insurance available in Australia can be categorized as follows:

- Comprehensive Car Insurance: This is the most comprehensive type of car insurance, providing coverage for a wide range of incidents, including accidents, theft, fire, and natural disasters. It also covers damage to your own car, regardless of who is at fault.

- Third-Party Property Damage (TPPD): This type of insurance covers damage to other people’s property in an accident that you cause. It does not cover damage to your own vehicle.

- Third-Party Fire and Theft (TPFT): This coverage provides protection against damage to your vehicle caused by fire or theft. It does not cover damage caused by accidents.

- Third-Party Only (TPO): This is the most basic type of car insurance, providing coverage for damage to other people’s property and injuries to other people in an accident that you cause. It does not cover damage to your own vehicle.

Benefits and Limitations of Different Car Insurance Coverage

The following table summarizes the key benefits and limitations of each type of car insurance:

| Coverage Type | Key Benefits | Limitations |

|---|---|---|

| Comprehensive Car Insurance |

|

|

| Third-Party Property Damage (TPPD) |

|

|

| Third-Party Fire and Theft (TPFT) |

|

|

| Third-Party Only (TPO) |

|

|

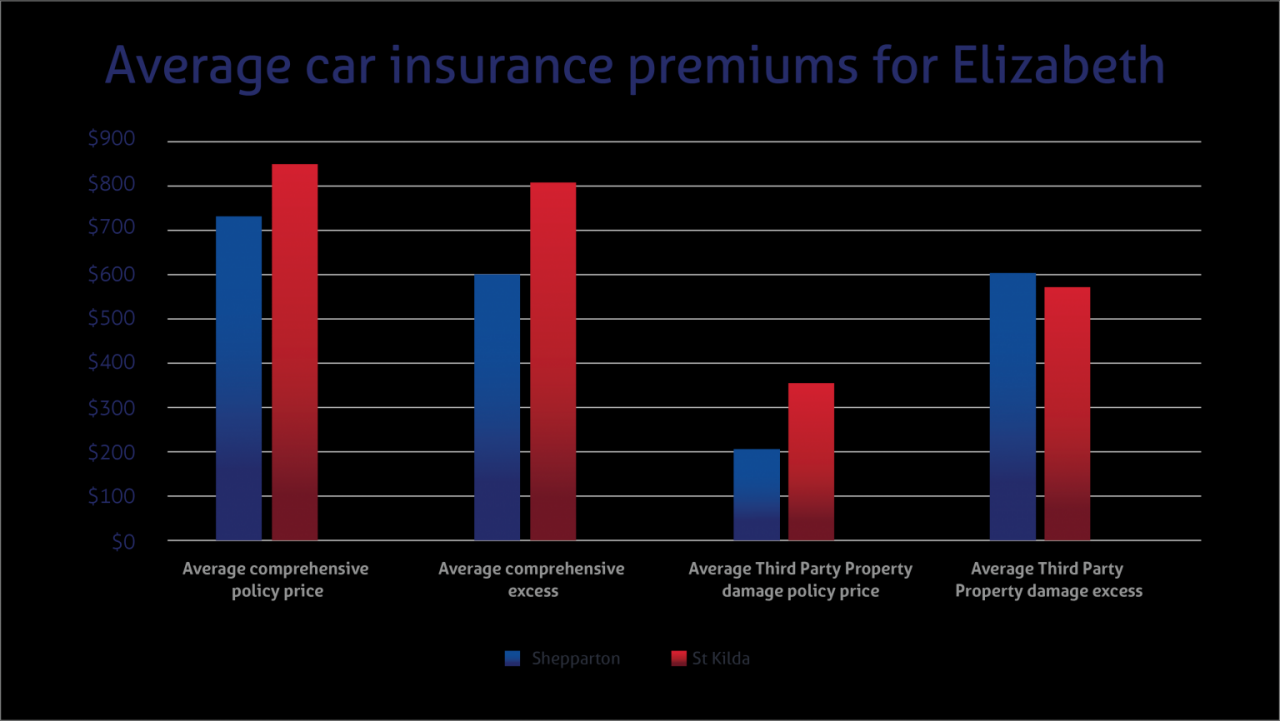

Comparing Comprehensive and Third-Party Insurance

Comprehensive car insurance is generally more expensive than third-party insurance because it offers greater coverage. However, the higher cost is justified by the comprehensive protection it provides.

Comprehensive insurance is the most suitable option for drivers who want complete peace of mind and financial protection against various risks, including accidents, theft, and natural disasters.

Third-party insurance is a more affordable option for drivers who are comfortable with the risk of not being covered for damage to their own vehicle. However, it’s important to consider the potential financial burden if you are involved in an accident that damages your own car.

The Importance of Understanding Coverage Options

Choosing the right car insurance policy is crucial. It’s important to understand the different coverage options available and choose the one that best suits your needs and budget. Carefully consider the following factors:

- Your driving habits and experience.

- The age and value of your vehicle.

- Your financial situation and risk tolerance.

- Your individual needs and priorities.

By understanding the different types of car insurance and their benefits and limitations, you can make an informed decision and choose a policy that provides the right level of protection for you.

Finding the Best Car Insurance Deal

Securing the most affordable car insurance in Australia requires a strategic approach. It’s not simply about picking the first quote you see; it’s about understanding your needs, comparing options, and negotiating for the best possible deal.

Comparing Quotes from Different Insurers

To find the best car insurance deal, you need to compare quotes from different insurers. This involves gathering quotes from various insurers and then comparing them side-by-side.

- Use online comparison websites: Websites like Compare the Market, iSelect, and Canstar allow you to enter your details once and receive quotes from multiple insurers. This saves you time and effort compared to contacting each insurer individually.

- Contact insurers directly: While comparison websites are convenient, you can also contact insurers directly to get quotes. This can be beneficial if you have specific needs or want to discuss your coverage options in detail.

- Consider different types of insurance: When comparing quotes, consider different types of car insurance, such as comprehensive, third-party property damage, and third-party fire and theft. Each type of insurance offers different levels of coverage, so choose the one that best suits your needs and budget.

- Compare premiums and excesses: Pay attention to the premiums and excesses offered by each insurer. Premiums are the regular payments you make for your insurance, while excesses are the amounts you pay out of pocket before your insurance covers the rest.

- Look for discounts: Many insurers offer discounts for safe drivers, good driving records, and other factors. Make sure you ask about any available discounts to lower your premium.

Using a Broker to Find Insurance

Insurance brokers can be valuable resources when searching for car insurance. They work on your behalf to find the best deal from a range of insurers.

- Expertise and knowledge: Brokers have extensive knowledge of the insurance market and can help you understand different policies and their features. They can also advise you on the best options for your specific needs.

- Access to multiple insurers: Brokers have access to a wide range of insurers, allowing them to compare quotes from different providers. This can save you time and effort, as you don’t have to contact each insurer individually.

- Negotiation skills: Brokers can negotiate with insurers on your behalf, potentially securing better premiums and coverage. They can also help you understand the fine print and ensure you’re getting a fair deal.

- Claims assistance: In the event of an accident, brokers can assist you with the claims process. They can provide guidance and support to ensure you receive the compensation you deserve.

Reading Policy Terms and Conditions Carefully

Once you’ve chosen an insurer and policy, it’s crucial to read the terms and conditions carefully. This document Artikels the details of your coverage, including what is covered, what is not covered, and any exclusions or limitations.

- Understand your coverage: Carefully review the policy to ensure you understand what is covered and what is not. Pay attention to the limits of your coverage, such as the maximum amount your insurer will pay for a claim.

- Identify exclusions: Pay attention to any exclusions or limitations in the policy. These are situations where your insurance will not cover you. For example, your insurance may not cover you if you drive while intoxicated or under the influence of drugs.

- Understand the claims process: The policy should Artikel the process for making a claim. This includes the steps you need to take, the documentation required, and the timeframes involved.

- Ask questions: If you have any questions about the policy, don’t hesitate to ask your insurer or broker for clarification. It’s better to be safe than sorry and ensure you fully understand the terms of your insurance.

Common Car Insurance Claims

In Australia, car insurance claims are common occurrences. While no one wants to be involved in an accident, understanding the common types of claims and the claims process can help you navigate the situation effectively.

Types of Common Claims, How much for car insurance in australia

- Third-Party Property Damage: This is the most common type of claim, involving damage to another person’s vehicle or property caused by your vehicle.

- Third-Party Injury: This type of claim covers injuries to another person caused by your vehicle.

- Own Damage: This covers damage to your own vehicle, regardless of who is at fault.

- Fire and Theft: This covers damage or loss of your vehicle due to fire or theft.

- Windscreen Damage: This covers damage to your vehicle’s windscreen, often due to hail or debris.

- Natural Disaster: This covers damage to your vehicle caused by natural disasters like floods, storms, or earthquakes.

The Claims Process

When you need to make a claim, the process typically involves the following steps:

- Report the Incident: Immediately contact your insurer and report the accident or incident.

- Gather Information: Collect all relevant information, including details of the other parties involved, witnesses, police reports, and photos of the damage.

- Submit a Claim: Complete and submit a claim form to your insurer, providing all necessary documentation.

- Assessment and Investigation: Your insurer will assess the claim and may investigate the incident to determine the cause and liability.

- Claim Approval and Payment: If your claim is approved, your insurer will process the payment for repairs, medical expenses, or other covered losses.

Common Claim Scenarios

Here are some examples of common claim scenarios:

- Collision with Another Vehicle: A collision with another vehicle at an intersection, resulting in damage to both vehicles.

- Hitting a Stationary Object: A collision with a parked car, a fence, or a lamp post.

- Vehicle Theft: Your vehicle is stolen from your driveway or a parking lot.

- Damage from Hail: Your vehicle is damaged by hail, resulting in dents and scratches.

- Damage from Flooding: Your vehicle is submerged in floodwater, causing significant damage.

Importance of Adequate Coverage

Having adequate insurance coverage is crucial for protecting yourself financially in the event of an accident or claim. If you are underinsured, you may have to pay out-of-pocket for repairs, medical expenses, or other costs.

For example, if you have only the minimum third-party property damage insurance and are involved in an accident that causes significant damage to the other vehicle, you may be liable for a large sum of money.

Tips for Minimizing the Risk of Accidents and Claims

While accidents can happen, there are steps you can take to minimize the risk of being involved in an accident and making a claim:

- Drive Safely: Always obey traffic laws, maintain a safe distance from other vehicles, and avoid distractions while driving.

- Maintain Your Vehicle: Regularly service your vehicle, check tire pressure, and ensure all lights are working properly.

- Park Safely: Park in well-lit and secure areas to reduce the risk of theft.

- Be Aware of Your Surroundings: Pay attention to your surroundings, anticipate potential hazards, and be prepared to react quickly.

Car Insurance Discounts and Rebates

In Australia, car insurance companies offer various discounts and rebates to reduce premiums. These incentives can significantly lower your insurance costs, making it essential to explore all available options. Understanding the eligibility criteria and potential savings associated with these discounts can help you secure the best possible deal.

Types of Car Insurance Discounts and Rebates

Discounts and rebates are offered to encourage safe driving practices, reward loyalty, and attract new customers. Here’s a breakdown of common car insurance discounts and rebates in Australia:

| Discount Type | Eligibility Requirements | Potential Savings |

|---|---|---|

| No Claims Bonus (NCB) | Having no claims on your insurance policy for a specified period, typically one or more years. | Up to 50% off your premium. |

| Safe Driver Discount | Maintaining a clean driving record, free from traffic violations and accidents. | Varies depending on the insurer and your driving history. |

| Multi-Policy Discount | Holding multiple insurance policies with the same insurer, such as home, contents, or health insurance. | Up to 10% off your premium. |

| Loyalty Discount | Renewing your car insurance policy with the same insurer for consecutive years. | Varies depending on the insurer and the duration of your loyalty. |

| Garaging Discount | Parking your vehicle in a secure location, such as a garage or carport. | Varies depending on the insurer and the level of security. |

| Vehicle Safety Features Discount | Having safety features installed in your car, such as anti-theft devices, airbags, or anti-lock brakes. | Varies depending on the insurer and the specific safety features. |

| Occupation Discount | Working in certain professions that are considered low-risk, such as teachers or healthcare professionals. | Varies depending on the insurer and your occupation. |

| Pay-in-Full Discount | Paying your car insurance premium in full upfront. | Varies depending on the insurer. |

| Direct Debit Discount | Setting up automatic payments for your car insurance premium. | Varies depending on the insurer. |

Exploring All Available Discounts and Rebates

It is essential to actively inquire about all available discounts and rebates when obtaining a car insurance quote. Don’t hesitate to ask your insurer about specific discounts that may apply to your situation. Some insurers may not automatically offer all discounts, so it’s crucial to be proactive in seeking out these potential savings.

Maximizing Potential Savings

To maximize your potential savings through discounts and rebates, consider these tips:

* Maintain a clean driving record: This is the most significant factor influencing your car insurance premium. Avoid traffic violations and accidents to qualify for safe driver discounts.

* Compare quotes from multiple insurers: Different insurers offer varying discounts and rebates. Compare quotes to find the best deal.

* Bundle your insurance policies: Combining your car insurance with other policies, such as home or contents insurance, can lead to substantial savings through multi-policy discounts.

* Consider your parking options: Parking your car in a secure location, such as a garage, can qualify you for a garaging discount.

* Invest in vehicle safety features: Installing safety features like anti-theft devices or airbags can lower your premium.

* Ask about specific discounts: Inquire about any occupation-based discounts or other specialized rebates that may apply to your circumstances.

* Renew your policy on time: Don’t let your policy lapse, as this can negatively impact your NCB and future discounts.

* Pay your premium in full: Opting for upfront payment can result in a discount.

* Set up automatic payments: This can qualify you for a direct debit discount.

By understanding the various discounts and rebates available and actively seeking these opportunities, you can significantly reduce your car insurance costs.

Conclusion: How Much For Car Insurance In Australia

By understanding the factors that affect car insurance costs, the different coverage options available, and the strategies for finding the best deal, you can navigate the world of car insurance with confidence. Remember to compare quotes from multiple insurers, explore available discounts and rebates, and carefully review the terms and conditions of your policy. Armed with this knowledge, you can ensure that you have the right insurance coverage to protect yourself and your vehicle on the road.

FAQ Resource

How do I compare car insurance quotes?

You can compare car insurance quotes online by using a comparison website or by contacting insurance companies directly. Provide your details, including your driving history, car details, and desired coverage, and receive quotes from multiple insurers.

What are the most common car insurance claims in Australia?

Common car insurance claims in Australia include accidents, theft, fire, and natural disasters.

How can I get a discount on my car insurance?

You can often get a discount on your car insurance by driving safely, having a clean driving record, installing safety features in your car, and bundling your insurance policies.