How much is life insurance in Australia? This question often arises when individuals start considering the importance of financial security for their loved ones. Life insurance acts as a safety net, providing financial support in the event of an unexpected passing, ensuring that your family can navigate life’s challenges without the added burden of financial strain. Understanding the different types of life insurance, the factors that influence premiums, and the process of obtaining quotes are crucial steps in making informed decisions.

Life insurance premiums in Australia are influenced by various factors, including your age, health, lifestyle, and the coverage amount you choose. A comprehensive understanding of these factors allows you to make informed decisions and find the right policy to meet your specific needs and budget.

Understanding Life Insurance in Australia

Life insurance is a crucial part of financial planning in Australia, offering protection for your loved ones in the event of your unexpected passing. Understanding the different types of life insurance and the factors influencing premiums is essential for making informed decisions.

Types of Life Insurance in Australia

There are various types of life insurance available in Australia, each catering to different needs and circumstances. Here’s a breakdown of some common options:

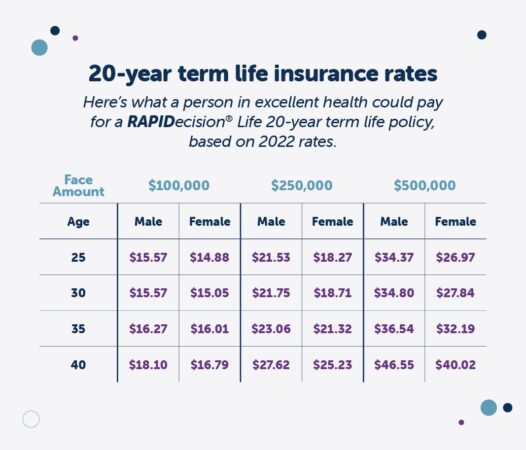

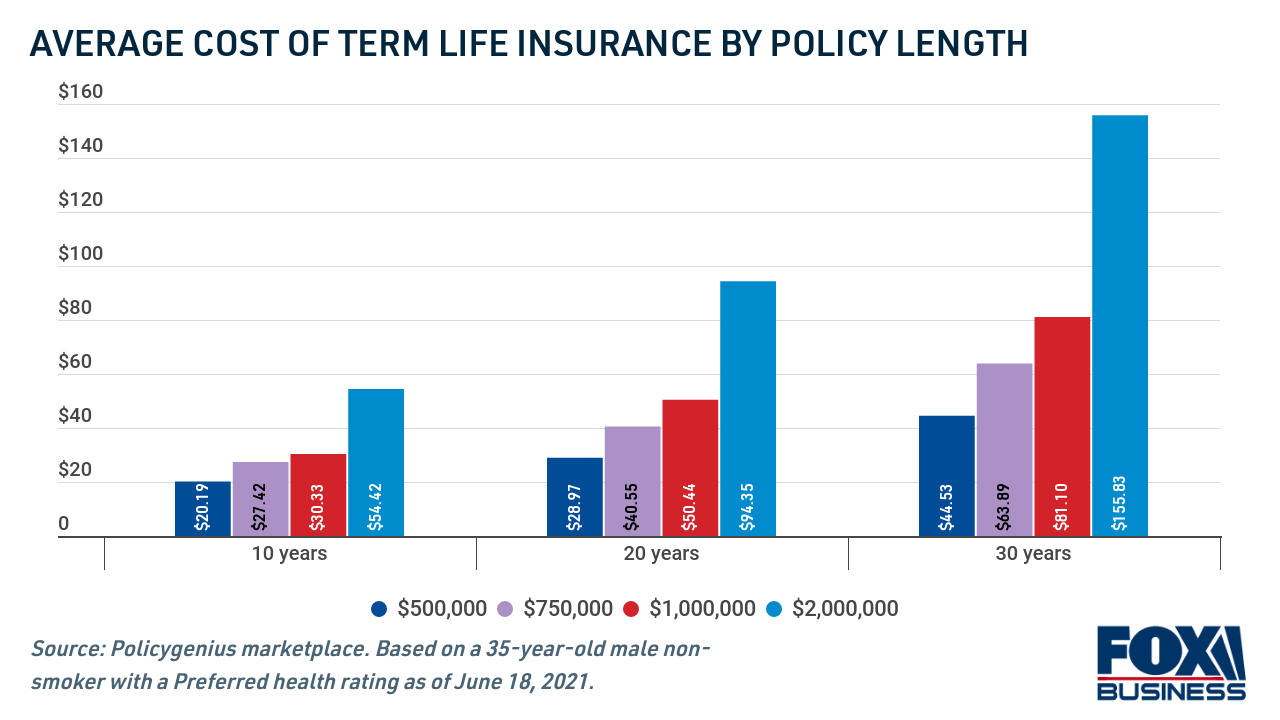

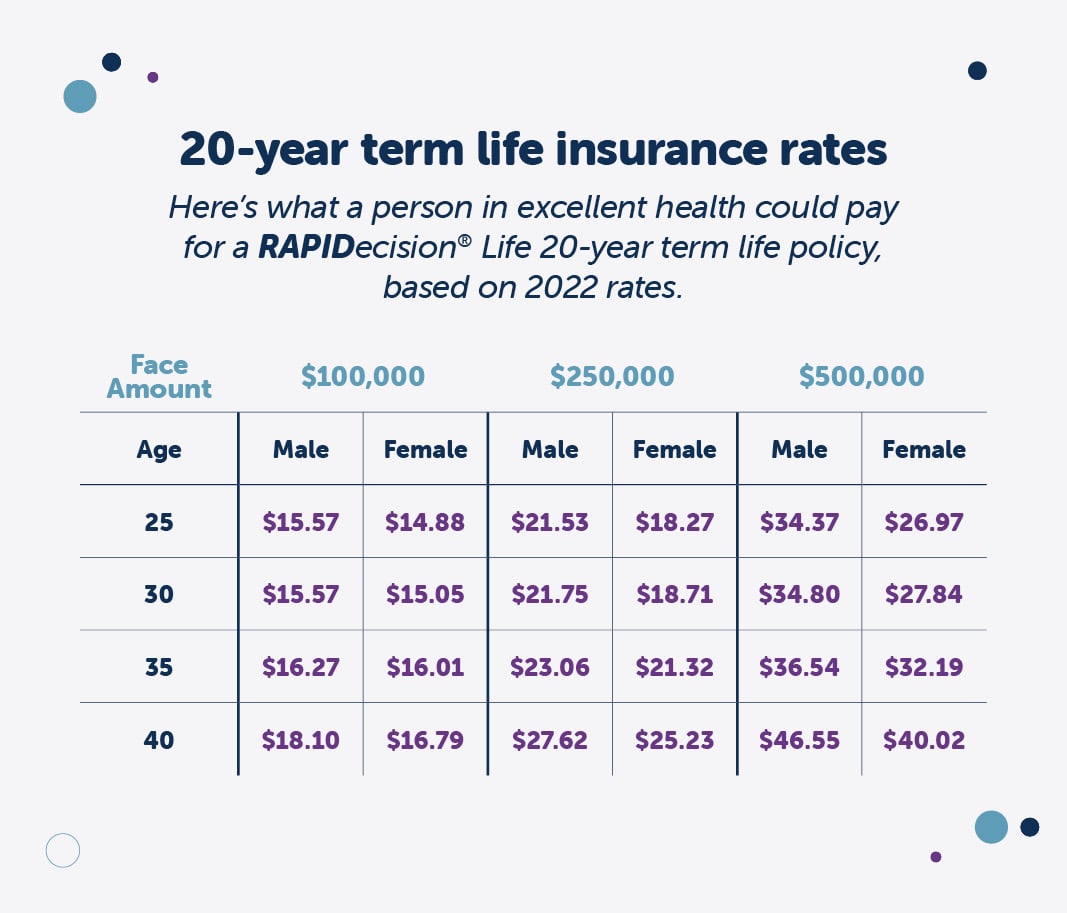

- Term Life Insurance: This provides coverage for a specific period, typically 10, 20, or 30 years. It’s a cost-effective option for individuals with a short-term need for life insurance, such as covering a mortgage or supporting young children. Premiums are generally lower than whole life insurance.

- Whole Life Insurance: This provides lifelong coverage, meaning it remains in effect as long as you pay the premiums. Premiums are generally higher than term life insurance but can build cash value over time, which you can borrow against or withdraw.

- Permanent Life Insurance: This is a broader category that encompasses whole life insurance and other types that offer lifelong coverage, such as universal life insurance and variable life insurance. These policies typically have higher premiums than term life insurance but offer more flexibility and potential for investment growth.

- Total and Permanent Disability (TPD) Insurance: This provides financial protection if you become permanently disabled and unable to work. It pays a lump sum benefit to help cover living expenses, medical costs, and other financial obligations.

- Trauma Insurance: This provides a lump sum benefit if you are diagnosed with a serious illness or injury, such as cancer, heart attack, or stroke. This can help cover medical expenses, lost income, and other costs associated with your illness or injury.

Factors Influencing Life Insurance Premiums

Several factors determine your life insurance premiums, including:

- Age: Younger individuals generally pay lower premiums than older individuals, as they have a lower risk of death. As you age, your premiums tend to increase.

- Health: Your health status significantly influences your premiums. Individuals with pre-existing medical conditions or risky lifestyle habits may face higher premiums. It’s important to be upfront about your health history when applying for life insurance.

- Lifestyle: Your lifestyle choices, such as smoking, excessive alcohol consumption, or engaging in dangerous hobbies, can impact your premiums. Healthy habits generally lead to lower premiums.

- Occupation: Certain occupations, such as those involving high-risk activities, may result in higher premiums. Insurance companies assess the level of risk associated with your profession.

- Cover Amount: The amount of coverage you choose directly affects your premiums. Higher cover amounts generally result in higher premiums.

- Policy Type: Different types of life insurance policies, such as term life, whole life, or permanent life, have varying premium structures. Term life insurance typically has lower premiums than whole life insurance.

Common Life Insurance Scenarios

Life insurance can be tailored to different needs and circumstances. Here are some common scenarios:

- Young Couple with a Mortgage: A young couple with a mortgage may consider term life insurance to cover the outstanding debt in case one of them passes away. This ensures the surviving partner can continue making mortgage payments and maintain financial stability.

- Single Parent with Children: A single parent with young children may need life insurance to provide financial support for their children’s education and living expenses in case of their death. Term life insurance or a permanent life insurance policy with a death benefit could be suitable options.

- Business Owner with Employees: A business owner may need life insurance to protect their business in case of their death. This could include a key person insurance policy to cover the loss of a crucial employee or a business overhead insurance policy to cover ongoing expenses.

- Retired Individual with Dependents: A retired individual with dependents, such as a spouse or children, may need life insurance to provide financial support for their loved ones after their death. A whole life insurance policy or a permanent life insurance policy with a death benefit could be considered.

Factors Affecting Life Insurance Costs

Life insurance premiums are calculated based on various factors that assess the risk of you needing to claim on your policy. These factors are used to determine the likelihood of you passing away during the policy term and the potential payout amount. Here’s a breakdown of the major factors influencing your life insurance premiums:

Age

Your age is a significant factor in determining your life insurance premiums. As you get older, the risk of passing away increases. Therefore, older individuals generally pay higher premiums than younger individuals. This is based on actuarial tables, which track mortality rates over time. For instance, a 30-year-old individual might pay a lower premium than a 50-year-old individual for the same coverage amount.

Health

Your health status is another critical factor in calculating your life insurance premiums. Individuals with pre-existing health conditions or a history of health problems are considered higher risk. This is because they have a greater chance of needing to claim on their policy. As a result, they may be required to pay higher premiums or even be denied coverage altogether.

For example, individuals with conditions like diabetes, heart disease, or cancer might face higher premiums compared to individuals with no pre-existing health conditions. Life insurance companies will often require you to undergo a medical examination, including blood tests and other assessments, to assess your health status.

Lifestyle

Your lifestyle choices can also impact your life insurance premiums. Engaging in risky activities, such as smoking, excessive alcohol consumption, or participating in dangerous sports, can increase your risk of premature death. Life insurance companies may consider these factors when calculating your premiums. For example, a smoker might pay a higher premium than a non-smoker for the same coverage amount.

Coverage Amount

The amount of coverage you choose will also affect your life insurance premiums. The higher the coverage amount, the higher the premium. This is because the insurance company is taking on a greater financial risk by providing a larger payout in the event of your death. For instance, a $1 million life insurance policy will generally have a higher premium than a $500,000 policy.

Occupation

Your occupation can also influence your life insurance premiums. Certain occupations are considered more dangerous than others, and individuals in these professions may face higher premiums. For example, construction workers or firefighters may be required to pay higher premiums than office workers.

Family History

Your family history of health conditions can also play a role in determining your life insurance premiums. If you have a family history of certain diseases, such as heart disease or cancer, you may be considered a higher risk and face higher premiums.

Financial Situation

Your financial situation can also impact your life insurance premiums. Life insurance companies may consider your credit score and income level when calculating your premiums. Individuals with good credit scores and higher incomes may be eligible for lower premiums.

Getting Quotes and Comparing Policies

Now that you understand the basics of life insurance in Australia, it’s time to get quotes and compare policies. This process can seem overwhelming, but it’s essential to find the right policy for your needs and budget.

Obtaining Life Insurance Quotes

To get quotes from different providers, you can follow these steps:

- Use online comparison websites: These websites allow you to enter your details and compare quotes from multiple insurers simultaneously. Some popular options include Compare the Market, iSelect, and Canstar.

- Contact insurers directly: You can call or visit the websites of individual life insurance providers to get a quote. This allows you to ask specific questions and get tailored advice.

- Speak to a financial advisor: A financial advisor can help you navigate the process of getting quotes and choosing the right policy. They can also provide personalized advice based on your circumstances.

Comparing Life Insurance Policies

Once you have a few quotes, it’s time to compare policies. Here are the key aspects to consider:

- Coverage: This refers to the amount of money your beneficiaries will receive if you die. It’s important to choose a coverage amount that meets your family’s financial needs.

- Premiums: This is the monthly or annual cost of your policy. It’s essential to find a policy with affordable premiums that fit your budget.

- Benefits: These are the features and options included in your policy, such as additional coverage for specific illnesses or disabilities. Some policies may also offer benefits like funeral expenses or income protection.

- Exclusions: These are the circumstances or events that are not covered by your policy. It’s important to read the policy documents carefully to understand what is and isn’t covered.

Comparing Life Insurance Policies from Major Australian Providers

Here is a table comparing the features and costs of different life insurance policies from major Australian providers:

| Provider | Policy Type | Coverage Amount | Monthly Premium | Benefits | Exclusions |

|---|---|---|---|---|---|

| AIA Australia | Life Cover | $500,000 | $50 | Accidental death benefit, terminal illness benefit | Suicide, pre-existing conditions |

| AMP | Life Cover Plus | $1,000,000 | $100 | Total and permanent disability benefit, income protection | Dangerous hobbies, self-inflicted injuries |

| ASIC | Life Insurance | $250,000 | $25 | Funeral expenses, critical illness cover | War, terrorism |

| Westpac Life | Life Cover Essential | $750,000 | $75 | Accidental death benefit, terminal illness benefit | Suicide, pre-existing conditions |

Note: This table is for illustrative purposes only and the actual premiums and benefits may vary depending on your individual circumstances. It’s always best to get a personalized quote from each insurer to compare policies accurately.

Choosing the Right Life Insurance Policy: How Much Is Life Insurance In Australia

Choosing the right life insurance policy is crucial as it safeguards your loved ones’ financial well-being in your absence. This decision involves a careful assessment of your individual needs, financial situation, and long-term goals. By asking the right questions and considering various factors, you can find a policy that provides the appropriate coverage and peace of mind.

Factors to Consider When Choosing a Life Insurance Policy

Before selecting a life insurance policy, it’s essential to consider your unique circumstances and objectives. The following questions can help you determine the most suitable policy for your needs:

- What are your financial obligations and dependents? Consider your mortgage, loans, and other financial commitments, as well as the number of dependents you have. Your life insurance policy should provide sufficient coverage to meet these obligations and ensure their financial security.

- What is your current financial situation? Assess your income, savings, and other assets. Your financial resources will influence the amount of life insurance you can afford and the type of policy that best suits your needs.

- What are your long-term goals? Consider your aspirations for your family’s future, such as their education or retirement. Life insurance can help achieve these goals by providing financial support to your loved ones after your passing.

- What is your risk tolerance? Your risk tolerance will determine the type of policy you choose. For example, if you are risk-averse, you may prefer a whole life policy that offers guaranteed death benefits, while those with a higher risk tolerance may opt for a term life policy that offers lower premiums but no cash value.

Tailoring Life Insurance Choices to Specific Circumstances, How much is life insurance in australia

Life insurance needs vary significantly depending on individual circumstances. Here are some examples of how people can tailor their life insurance choices:

- Young families with children: A young family with children will likely need a substantial amount of life insurance to cover their dependents’ living expenses, education costs, and other financial needs in the event of the primary breadwinner’s death. A term life policy with a high death benefit and a long coverage period would be suitable for this situation.

- Individuals with significant debt: If you have substantial debt, such as a mortgage or student loans, life insurance can help your family repay these obligations after your passing. A term life policy with a coverage amount sufficient to cover your outstanding debts would be a wise choice.

- Self-employed individuals: Self-employed individuals often have no employer-provided life insurance. Therefore, they should consider purchasing a personal life insurance policy to protect their business and family’s financial well-being. A whole life policy with a cash value component can provide both death benefits and savings for retirement.

Additional Considerations

Beyond the cost and features of life insurance, there are several additional factors to consider that can significantly impact your financial well-being and the security of your loved ones. These considerations extend beyond the immediate need for coverage and delve into the broader implications of life insurance within your financial plan.

The Role of Life Insurance in Estate Planning

Life insurance plays a crucial role in estate planning by providing financial resources to cover various expenses, including:

- Debt Repayment: Life insurance proceeds can be used to pay off outstanding debts, such as mortgages, credit card balances, or loans, ensuring that your loved ones are not burdened with these financial obligations.

- Final Expenses: Funeral costs, probate fees, and other expenses related to your passing can be covered by life insurance, alleviating the financial strain on your family during a difficult time.

- Income Replacement: For families who rely on a single income, life insurance can provide a financial safety net to replace lost income, ensuring that your loved ones can maintain their standard of living.

- Business Continuity: Life insurance can be used to protect a business from financial hardship in the event of the death of a key employee or owner, providing funds to cover operational expenses or to buy out the deceased individual’s shares.

By incorporating life insurance into your estate plan, you can provide financial security for your family and ensure that your wishes are carried out according to your plan.

Regular Review and Updates

Life insurance needs are not static and can change over time due to factors such as:

- Changes in Family Structure: The arrival of children, a change in marital status, or the addition of dependents can significantly impact your life insurance needs.

- Financial Goals: As your financial goals evolve, your life insurance coverage may need to be adjusted to meet these changing needs.

- Changes in Income: An increase or decrease in income can affect your ability to afford a certain level of life insurance coverage.

- Interest Rates: Fluctuations in interest rates can impact the value of your life insurance policy over time.

Regularly reviewing and updating your life insurance policy ensures that it remains adequate and relevant to your current circumstances, protecting your loved ones and meeting their financial needs.

Accessing Support and Advice

Navigating the complexities of life insurance can be challenging, and seeking professional guidance can be invaluable.

- Financial Advisors: Financial advisors can provide comprehensive advice on your overall financial plan, including life insurance, helping you determine the right level of coverage and choose a policy that meets your specific needs.

- Insurance Professionals: Insurance brokers and agents can provide expert guidance on specific life insurance policies, helping you compare options, understand policy terms, and choose the best coverage for your situation.

Don’t hesitate to reach out to these professionals for assistance in making informed decisions about your life insurance needs.

Concluding Remarks

Navigating the world of life insurance in Australia can seem daunting, but by understanding the different types, factors influencing costs, and the process of obtaining quotes, you can make informed decisions that provide financial security for your loved ones. Remember to consider your individual needs, financial situation, and long-term goals when choosing a policy, and don’t hesitate to seek advice from a financial advisor or insurance professional for personalized guidance.

Expert Answers

What are the most common types of life insurance in Australia?

The most common types of life insurance in Australia include term life insurance, whole life insurance, and endowment policies. Term life insurance provides coverage for a specific period, while whole life insurance offers lifelong coverage and investment features. Endowment policies combine life insurance with a savings component.

How can I compare different life insurance policies?

When comparing life insurance policies, consider factors such as coverage amount, premiums, benefits, exclusions, and the reputation of the insurer. It’s also helpful to read policy documents carefully and seek professional advice if needed.

What are some tips for getting the best life insurance quote?

To get the best life insurance quote, compare quotes from multiple insurers, be honest about your health and lifestyle, and consider your individual needs and budget. It’s also advisable to use online comparison tools and seek professional advice.