Insurance for markets stalls in Australia is essential for protecting stall owners from potential risks and financial losses. From public liability to product liability, various insurance policies cater to the unique needs of market stall operators. This guide delves into the different types of insurance available, factors influencing costs, choosing the right policy, making claims, and managing safety and risks.

Understanding the intricacies of market stall insurance is crucial for ensuring peace of mind and protecting your business. By navigating the complexities of different insurance policies, evaluating risk factors, and implementing effective safety measures, market stall owners can operate with confidence and minimize potential liabilities.

Types of Insurance for Market Stalls: Insurance For Markets Stalls In Australia

Running a market stall in Australia comes with its own set of risks. From potential accidents to damage to your goods, it’s crucial to have the right insurance coverage to protect your business and your assets.

Public Liability Insurance, Insurance for markets stalls in australia

Public liability insurance is essential for any market stall owner. It protects you financially if a member of the public is injured or their property is damaged as a result of your stall’s activities. This could include anything from a customer tripping over a loose cable to a faulty product causing an injury. Public liability insurance covers legal costs, compensation payments, and other expenses associated with a claim.

Product Liability Insurance

Product liability insurance is another crucial coverage for market stall owners, especially those selling food or other consumable products. This insurance protects you if a customer becomes ill or suffers an injury due to consuming a product you sold. It covers legal costs, medical expenses, and any compensation payments that may be required.

Other Relevant Coverages

In addition to public liability and product liability insurance, there are other types of insurance that may be beneficial for market stall owners:

- Stock Insurance: This insurance covers your goods against theft, damage, or loss due to fire, flood, or other perils. It’s especially important for stalls selling valuable items or perishable goods.

- Public Transport Insurance: If you use a vehicle to transport your goods to and from the market, you may need public transport insurance. This covers you in case of accidents or damage to your vehicle while transporting your stock.

- Business Interruption Insurance: This insurance covers your lost income if you’re unable to operate your stall due to an insured event, such as a fire or a natural disaster. This can help you cover your ongoing expenses and keep your business afloat during a difficult period.

Conclusive Thoughts

Operating a market stall in Australia comes with its own set of challenges and risks, but with the right insurance coverage and a proactive approach to safety, you can mitigate potential liabilities and enjoy peace of mind. By understanding the various types of insurance available, carefully selecting the right policy, and implementing effective risk management strategies, market stall owners can protect their businesses and thrive in a competitive environment.

FAQ Insights

What are the common types of insurance for market stalls in Australia?

Common types of insurance include public liability, product liability, stock insurance, and personal accident insurance.

How much does insurance for a market stall cost in Australia?

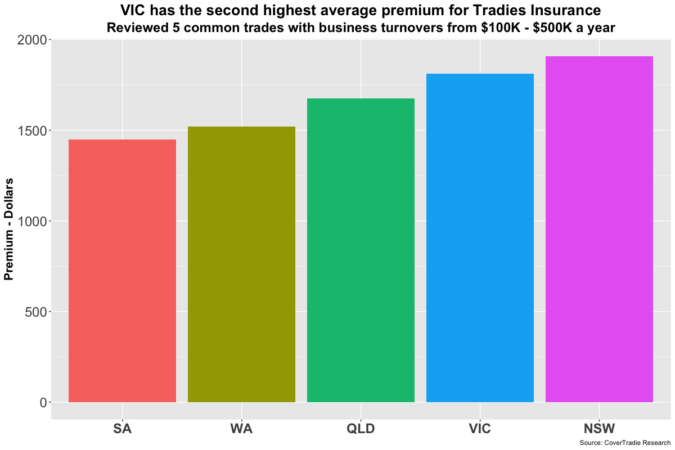

Insurance costs vary depending on factors like stall location, type of goods sold, turnover, and the specific policy chosen.

What are some essential safety measures for market stall owners?

Essential safety measures include fire safety, food safety, proper electrical wiring, and secure storage of goods.

What resources are available for market stall owners in Australia?

Resources include government websites, industry associations, and insurance brokers specializing in market stall insurance.