- Introduction to International Health Insurance in Australia

- Types of International Health Insurance Policies

- Benefits of International Health Insurance

- Factors to Consider When Choosing International Health Insurance

- Providers of International Health Insurance in Australia

- Claims and Reimbursement Process

- Tips for Managing International Health Insurance

- Conclusion

- Conclusion

- FAQ Resource

International health insurance in Australia provides a safety net for individuals and families seeking comprehensive healthcare coverage, both domestically and abroad. The Australian healthcare system, while robust, relies heavily on Medicare, a universal public health insurance program. However, Medicare doesn’t cover all medical expenses, leaving many Australians seeking supplementary private insurance. This is where international health insurance steps in, offering a wide range of coverage options tailored to individual needs and financial situations.

International health insurance in Australia can be a valuable asset for expats, travelers, and even permanent residents seeking peace of mind. It provides access to quality healthcare services, potentially reducing out-of-pocket expenses and ensuring timely medical attention. This comprehensive guide will explore the intricacies of international health insurance, from policy types and benefits to choosing the right provider and managing your coverage effectively.

Introduction to International Health Insurance in Australia

International health insurance in Australia is a vital safety net for expats, travellers, and even Australian citizens seeking comprehensive healthcare coverage beyond the public system. It provides peace of mind and financial protection in case of unexpected medical emergencies or chronic conditions, especially when travelling abroad or residing in Australia on a temporary visa.

The Australian Healthcare System

Australia has a universal healthcare system known as Medicare, which provides essential medical services to Australian citizens and permanent residents. However, Medicare does not cover all medical expenses, including:

- Certain medical treatments, such as cosmetic surgery

- Private hospital accommodation

- Some medications and therapies

- Medical expenses incurred while travelling overseas

Therefore, international health insurance becomes crucial for individuals who require coverage beyond the scope of Medicare.

Significance of International Health Insurance in Australia

International health insurance offers several benefits to individuals and families living in Australia:

- Comprehensive Coverage: It provides coverage for a wide range of medical expenses, including hospitalisation, surgery, medical consultations, and prescription medications.

- Global Coverage: International health insurance plans typically provide coverage worldwide, ensuring peace of mind while travelling or living abroad.

- Financial Protection: It protects individuals and families from the potentially high costs of medical emergencies, especially when travelling overseas.

- Access to Private Healthcare: International health insurance plans often allow access to private hospitals and specialists, providing shorter waiting times and more personalized care.

- Peace of Mind: Knowing that you have comprehensive medical coverage can reduce stress and anxiety, allowing you to focus on your health and well-being.

Types of International Health Insurance Policies

International health insurance in Australia offers various policy types to cater to diverse needs and circumstances. Choosing the right policy depends on factors such as your travel plans, health conditions, and budget.

Policy Types and Coverage Options

International health insurance policies are broadly categorized into three main types: comprehensive plans, travel insurance, and specialized policies for specific medical conditions. Here’s a table summarizing the key features of each type:

| Policy Type | Coverage | Benefits | Cost Factors |

|---|---|---|---|

| Comprehensive Plans | Wide-ranging coverage for medical expenses, including hospitalization, surgery, and outpatient care, both in Australia and overseas. |

|

|

| Travel Insurance | Primarily focused on covering medical expenses incurred while traveling abroad. |

|

|

| Specialized Policies for Specific Medical Conditions | Designed to cover specific health conditions, such as chronic illnesses or pre-existing conditions, providing tailored coverage and benefits. |

|

|

Benefits of International Health Insurance

International health insurance offers significant advantages for individuals living or traveling in Australia. It provides peace of mind and financial security, ensuring access to quality healthcare services both within and outside Australia. This comprehensive coverage can be particularly beneficial in various situations, safeguarding individuals from unexpected medical expenses and potential financial strain.

Access to Quality Healthcare Services

International health insurance provides access to a wide range of healthcare services, both within and outside Australia. This includes coverage for:

- Hospitalization: This covers the costs associated with inpatient care, including room and board, surgical procedures, and medical supplies.

- Outpatient care: This includes coverage for consultations with doctors, specialists, and other healthcare professionals, as well as diagnostic tests and treatments.

- Emergency medical evacuation: This covers the cost of transporting an insured individual to a medical facility in their home country or another suitable location in case of a medical emergency.

- Repatriation: This covers the cost of transporting an insured individual’s remains back to their home country in case of death.

International health insurance can be especially valuable for individuals who are:

- Traveling frequently: This type of insurance provides peace of mind while exploring different countries, knowing that they have access to quality healthcare services if needed.

- Living in Australia on a temporary visa: This insurance ensures that individuals have access to healthcare services while they are in the country, regardless of their visa status.

- Relocating to Australia permanently: International health insurance can bridge the gap between existing health insurance and the Australian healthcare system, providing coverage during the transition period.

Factors to Consider When Choosing International Health Insurance

Choosing the right international health insurance policy is essential for peace of mind while traveling or living abroad. It’s a decision that requires careful consideration, as the right policy can provide financial protection in case of unexpected medical emergencies.

Coverage Limits

Coverage limits determine the maximum amount your insurer will pay for specific medical expenses. These limits can vary depending on the policy and the type of medical care required. Understanding these limits is crucial to ensure your policy will cover the potential costs of your healthcare needs.

- Hospitalization: Policies often have limits on the number of days covered for hospitalization. Make sure the limit is sufficient for your potential needs.

- Surgery: Policies may have limits on the total cost of surgery. Consider the potential cost of complex procedures.

- Medical Expenses: Some policies have limits on the total amount they will pay for all medical expenses combined. Evaluate whether this limit is sufficient for your potential needs.

Pre-Existing Conditions

Pre-existing conditions are medical conditions you had before purchasing the policy. International health insurance policies may have limitations or exclusions for pre-existing conditions. It’s essential to understand these limitations to ensure your policy will cover your existing medical needs.

- Exclusions: Some policies may completely exclude coverage for pre-existing conditions. Be sure to check the policy details.

- Waiting Periods: Other policies may have waiting periods before covering pre-existing conditions. This means you may have to wait a certain amount of time before you can claim for these conditions.

- Additional Premiums: Some policies may require you to pay higher premiums if you have pre-existing conditions. Compare the premiums and coverage offered by different insurers.

Exclusions

Exclusions are specific medical conditions or treatments that are not covered by the policy. Understanding these exclusions is crucial to ensure your policy meets your needs.

- Routine Checkups: Most international health insurance policies do not cover routine checkups. You may need to pay for these out of pocket.

- Dental Care: Dental care is often excluded or limited. Check the policy details to understand the extent of dental coverage.

- Pre-existing Conditions: As mentioned earlier, pre-existing conditions may be excluded or have limitations. Review the policy carefully.

- War and Terrorism: Policies typically exclude coverage for medical expenses incurred due to war or terrorism.

Premium Costs

Premium costs are the monthly or annual fees you pay for your international health insurance policy. These costs can vary significantly depending on several factors.

- Coverage Level: Higher coverage levels typically result in higher premiums. Consider the level of coverage that best suits your needs and budget.

- Age: Older individuals typically pay higher premiums than younger individuals. This is because older individuals are statistically more likely to require medical care.

- Health Status: Individuals with pre-existing conditions may pay higher premiums. Insurers may assess your health status and adjust your premiums accordingly.

- Location: The cost of medical care varies across different countries. Policies for locations with higher healthcare costs may have higher premiums.

Factors to Consider When Choosing International Health Insurance

| Factor | Importance | Considerations | Tips for Evaluation |

|---|---|---|---|

| Coverage Limits | High | Maximum amount covered for specific medical expenses, such as hospitalization, surgery, and medical expenses. | Ensure the limits are sufficient for your potential healthcare needs. Compare limits across different policies. |

| Pre-existing Conditions | High | Coverage limitations or exclusions for medical conditions you had before purchasing the policy. | Understand waiting periods, exclusions, and potential additional premiums for pre-existing conditions. |

| Exclusions | High | Specific medical conditions or treatments that are not covered by the policy. | Review the policy carefully to understand all exclusions, such as routine checkups, dental care, pre-existing conditions, and war/terrorism. |

| Premium Costs | High | Monthly or annual fees you pay for your international health insurance policy. | Compare premiums from different insurers, considering coverage levels, age, health status, and location. |

Providers of International Health Insurance in Australia

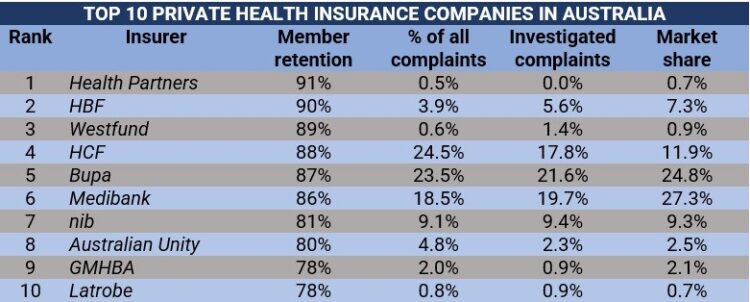

Choosing the right international health insurance provider is crucial for ensuring adequate coverage and peace of mind while traveling abroad. Several reputable providers offer various plans catering to different needs and budgets.

International Health Insurance Providers in Australia

Here is a comparison of some major international health insurance providers in Australia:

| Provider | Key Features | Strengths | Weaknesses |

|---|---|---|---|

| Bupa Global | Comprehensive coverage, worldwide medical evacuation, 24/7 support, various plan options | Wide network of healthcare providers, strong reputation, excellent customer service | Premiums can be higher compared to some competitors |

| Allianz Global Assistance | Wide range of plans, competitive pricing, 24/7 assistance, travel insurance options | Affordable premiums, user-friendly website, good value for money | Coverage may be limited for certain medical conditions |

| Cigna Global | Global coverage, access to a network of hospitals and doctors, 24/7 assistance | Strong international network, high-quality healthcare providers | Premiums can be high, limited plan options |

| AIA International | Comprehensive coverage, medical evacuation, 24/7 support, online claims management | Competitive pricing, strong financial stability, digital-focused services | Limited network of providers in some regions |

| Medibank Global | Worldwide coverage, medical evacuation, 24/7 assistance, flexible plan options | Strong reputation in Australia, user-friendly website, comprehensive coverage | Premiums can be high, limited coverage for certain medical conditions |

Claims and Reimbursement Process

Understanding the claims and reimbursement process is crucial when considering international health insurance. This process involves submitting documentation to your insurer for covered medical expenses and receiving reimbursement.

The claims process typically involves the following steps:

Documentation Required, International health insurance in australia

You’ll need to provide supporting documentation to your insurer to support your claim. This may include:

- A claim form, which can be obtained from your insurer’s website or by contacting them directly.

- Original medical bills and receipts for the treatment or services received.

- A detailed medical report from your doctor or healthcare provider outlining the diagnosis, treatment plan, and expenses incurred.

- Proof of identity, such as a passport or driver’s license.

- In some cases, you may also need to provide pre-authorization from your insurer before receiving certain treatments.

Timelines Involved

The time it takes to process a claim can vary depending on the insurer and the complexity of the claim. However, you can generally expect to receive a response from your insurer within a few weeks of submitting your claim.

Methods of Reimbursement

The method of reimbursement will vary depending on your insurer and your policy. Common methods include:

- Direct billing: Your insurer will pay the medical provider directly for covered expenses. This is often the most convenient option for the policyholder.

- Reimbursement: You will pay for the medical expenses upfront and then submit a claim to your insurer for reimbursement.

- Cashless claims: You can present your insurance card to the medical provider, and the insurer will pay for the expenses directly.

Step-by-Step Guide to Filing a Claim

Here’s a step-by-step guide to filing a claim with your international health insurance provider:

- Contact your insurer: Once you have received medical treatment, contact your insurer to inform them about your claim. You can do this by phone, email, or through their website.

- Gather required documentation: Collect all necessary documents, such as medical bills, receipts, and a medical report, to support your claim.

- Submit your claim: Complete the claim form provided by your insurer and submit it along with all supporting documentation.

- Track your claim: You can usually track the status of your claim online or by contacting your insurer.

- Receive reimbursement: Once your claim has been approved, you will receive reimbursement from your insurer through the chosen method, such as direct billing, reimbursement, or cashless claims.

Tips for Managing International Health Insurance

Managing international health insurance effectively is crucial to maximizing its benefits and ensuring you have peace of mind when traveling abroad. By understanding your policy, planning ahead, and taking proactive steps, you can make the most of your coverage and minimize potential financial burdens.

Understanding Your Policy

The first step in managing your international health insurance is to thoroughly understand your policy. This includes knowing the specific coverage you have, the limitations, and the exclusions. Carefully review your policy documents and ask your insurer any questions you may have.

- Coverage Limits and Exclusions: Familiarize yourself with the maximum coverage limits for different services, such as hospitalization, surgery, and medical emergencies. Pay attention to any specific exclusions, such as pre-existing conditions or certain types of treatments.

- Policy Duration and Renewal: Understand the duration of your policy and how to renew it. Ensure you have sufficient coverage for the duration of your trip, especially if you are planning an extended stay.

- Claim Procedures: Familiarize yourself with the claim process, including the necessary documentation and the timeframes involved. Keep all relevant receipts and medical records for easy access.

Minimizing Costs

International health insurance can be expensive, but there are strategies you can implement to minimize costs and maximize value.

- Compare Policies: Before purchasing a policy, compare quotes from different providers to find the most competitive rates and coverage that meets your needs. Consider factors like coverage limits, deductibles, and co-payments.

- Choose the Right Coverage: Evaluate your travel plans and risk tolerance to determine the appropriate level of coverage. If you are traveling for a short period and are relatively healthy, a basic policy may suffice. However, if you have pre-existing conditions or plan an extended trip, you may require a more comprehensive plan.

- Preventative Measures: Maintaining good health and taking preventive measures can help reduce the likelihood of needing medical attention. Stay up-to-date on vaccinations, practice safe travel hygiene, and be aware of potential health risks in your destination.

Resolving Disputes

Despite careful planning, disputes with your insurer can arise. Knowing how to resolve these issues efficiently is essential.

- Communicate Effectively: Maintain clear and concise communication with your insurer. Keep detailed records of all correspondence, including dates, times, and content of conversations.

- Seek Mediation: If you are unable to resolve a dispute directly with your insurer, consider seeking mediation through a neutral third party. Mediation can help facilitate a mutually acceptable solution.

- Understand Your Rights: Be aware of your rights as a policyholder and the regulatory framework governing international health insurance in Australia. You may have the right to appeal a decision or seek external dispute resolution.

Maximizing Benefits

International health insurance offers various benefits that can provide peace of mind and financial protection while traveling. Understanding these benefits and how to access them is crucial.

- Emergency Medical Evacuation: In case of a serious medical emergency, your policy may cover the cost of transporting you back to your home country for treatment. Ensure you know how to access this service and the specific conditions that apply.

- Medical Expenses: Your policy will typically cover a range of medical expenses, including hospitalization, surgery, and medication. Keep all receipts and medical records for reimbursement purposes.

- Repatriation: If you become seriously ill or injured, your policy may cover the cost of transporting your remains back to your home country.

Conclusion

This article has provided a comprehensive overview of international health insurance in Australia, covering key aspects from policy types to benefits, factors to consider, providers, claims process, and tips for effective management. Understanding these aspects is crucial for individuals and families seeking comprehensive healthcare coverage beyond Australia’s borders.

Key Takeaways

- International health insurance offers valuable protection against unexpected medical expenses incurred while traveling or residing abroad.

- Policy types vary based on coverage scope, including travel insurance, expatriate insurance, and global health insurance.

- Benefits include medical expenses, emergency medical evacuation, repatriation, and other essential services.

- Factors to consider when choosing a policy include coverage needs, travel destinations, budget, and provider reputation.

- Claims and reimbursement processes involve specific procedures and documentation requirements.

- Effective management involves understanding policy terms, keeping records, and seeking timely assistance.

Conclusion

Navigating the world of international health insurance in Australia can seem daunting, but with careful planning and research, you can secure the coverage you need to protect your health and well-being. Remember to consider your individual needs, budget, and lifestyle when choosing a policy. By understanding the benefits, factors to consider, and claims process, you can make informed decisions and confidently access quality healthcare when you need it most. With the right international health insurance plan, you can explore all that Australia has to offer with the peace of mind knowing that your health is well-protected.

FAQ Resource

What is the difference between international health insurance and travel insurance?

International health insurance offers comprehensive coverage for a longer duration, often covering both medical and non-medical expenses. Travel insurance typically provides limited coverage for medical emergencies and travel-related incidents during a specific trip.

Do I need international health insurance if I have Medicare?

While Medicare provides basic healthcare coverage, international health insurance can supplement it by covering expenses not covered by Medicare, such as private hospitals, specialist consultations, and overseas medical treatment.

What are some common exclusions in international health insurance policies?

Common exclusions include pre-existing conditions, cosmetic surgery, dental care, and certain types of mental health treatment. It’s essential to review the policy documents carefully to understand the specific exclusions.

How do I make a claim with my international health insurance provider?

Most providers offer online claim forms or a dedicated claims hotline. You will typically need to provide medical bills, receipts, and a completed claim form. The reimbursement process may vary depending on the provider.