Major insurance companies in Australia play a crucial role in the financial well-being of individuals and businesses. The Australian insurance market is a dynamic and competitive landscape, with a wide range of players offering diverse products and services. From life and health insurance to property and motor vehicle coverage, these companies cater to the evolving needs of a diverse population.

This comprehensive guide delves into the key players in the Australian insurance market, exploring their offerings, financial performance, and customer experiences. We examine the competitive landscape, regulatory environment, and future trends shaping the industry. Join us as we navigate the world of insurance in Australia and gain insights into the companies that shape it.

Market Overview

The Australian insurance market is a significant contributor to the nation’s financial services sector. It is characterized by its robust regulatory framework, strong consumer protection measures, and a diverse range of products and services. The market is experiencing steady growth, driven by factors such as increasing affluence, rising awareness of insurance benefits, and a growing demand for protection against various risks.

Competitive Landscape

The Australian insurance market is highly competitive, with a mix of domestic and international players vying for market share. Domestic insurers, such as Suncorp, IAG, and QBE, have a long history in the market and a strong understanding of local consumer needs. International players, including Allianz, AIG, and Zurich, are also present, leveraging their global expertise and resources to compete in the Australian market. This competitive landscape fosters innovation, product development, and price competitiveness, ultimately benefiting consumers.

Regulatory Environment

The Australian Prudential Regulation Authority (APRA) plays a crucial role in regulating the insurance industry, ensuring the financial soundness and stability of insurers. APRA sets prudential standards, monitors insurers’ financial performance, and promotes consumer protection. The Australian Securities and Investments Commission (ASIC) regulates the sale and distribution of insurance products, ensuring fair and transparent practices. The regulatory environment is designed to protect consumers, maintain market integrity, and promote financial stability.

Major Insurance Companies

The Australian insurance industry is a significant sector, offering a wide range of products and services to individuals and businesses. It is dominated by a handful of major players, which collectively account for a substantial portion of the market share.

Major Insurance Companies in Australia

This section identifies and provides an overview of the top 10 major insurance companies in Australia, based on market share, revenue, or other relevant metrics.

| Company Name | Type of Insurance Offered | Key Products/Services | Market Share |

|---|---|---|---|

| Suncorp Group | General Insurance, Life Insurance | Home, Car, Travel, Business, Life, Health | 15.4% |

| IAG | General Insurance, Life Insurance | Home, Car, Travel, Business, Life, Health | 14.8% |

| QBE Insurance Group | General Insurance, Life Insurance | Home, Car, Travel, Business, Life, Health | 10.2% |

| AIA Australia | Life Insurance | Life, Health, Savings, Investment | 7.5% |

| AMP Limited | Life Insurance, Superannuation | Life, Health, Savings, Investment, Superannuation | 6.8% |

| Medibank Private | Health Insurance | Hospital, Extras, Travel | 5.9% |

| nib Holdings | Health Insurance | Hospital, Extras, Travel | 4.7% |

| TAL | Life Insurance | Life, Health, Disability | 3.8% |

| HCF | Health Insurance | Hospital, Extras, Travel | 3.5% |

| NRMA Insurance | General Insurance | Home, Car, Travel, Business | 3.2% |

Suncorp Group is one of the largest insurance companies in Australia, with a long history dating back to the 19th century. It offers a comprehensive range of insurance products and services, including home, car, travel, business, life, and health insurance. Suncorp is known for its strong brand recognition, extensive distribution network, and innovative product offerings.

IAG is another major player in the Australian insurance market, with a diversified portfolio of insurance businesses. It operates under a number of well-known brands, including NRMA Insurance, CGU Insurance, and SGIC. IAG is recognized for its strong financial performance, customer-centric approach, and commitment to innovation.

QBE Insurance Group is a global insurance company with a significant presence in Australia. It offers a wide range of insurance products and services, including general insurance, life insurance, and reinsurance. QBE is known for its expertise in risk management, underwriting, and claims handling.

AIA Australia is a leading life insurance company in Australia, offering a range of products and services to individuals and families. It is known for its strong financial position, innovative product offerings, and commitment to customer service.

AMP Limited is a diversified financial services company with a significant presence in the Australian life insurance market. It offers a range of products and services, including life insurance, health insurance, savings, investment, and superannuation. AMP is known for its long history, strong brand recognition, and commitment to customer satisfaction.

Medibank Private is the largest private health insurer in Australia, offering a range of hospital and extras cover. It is known for its strong financial position, comprehensive product offerings, and commitment to customer service.

nib Holdings is another major private health insurer in Australia, offering a range of hospital and extras cover. It is known for its innovative product offerings, strong customer service, and commitment to community engagement.

TAL is a leading life insurance company in Australia, offering a range of life, health, and disability insurance products. It is known for its strong financial position, innovative product offerings, and commitment to customer service.

HCF is a not-for-profit health insurer in Australia, offering a range of hospital and extras cover. It is known for its commitment to community engagement, affordable premiums, and comprehensive product offerings.

NRMA Insurance is a well-known general insurance brand in Australia, offering a range of home, car, travel, and business insurance products. It is known for its strong brand recognition, customer-centric approach, and commitment to innovation.

Product Offerings

Australian insurance companies offer a wide range of products to cater to the diverse needs of individuals and businesses. These products can be broadly categorized into four main types: life insurance, health insurance, property insurance, and motor vehicle insurance. Each product category comes with unique features, benefits, and target audiences.

Life Insurance

Life insurance provides financial protection to beneficiaries in the event of the policyholder’s death. It helps cover expenses such as funeral costs, outstanding debts, and ongoing living expenses for dependents.

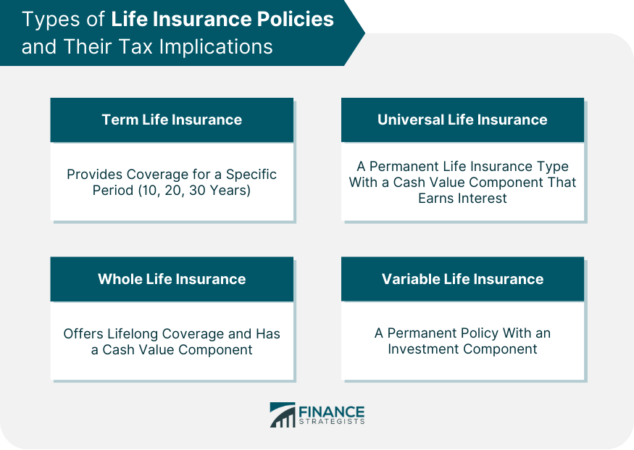

- Term Life Insurance: Provides coverage for a specific period, typically 10 to 30 years. It is generally more affordable than permanent life insurance but does not build cash value.

- Permanent Life Insurance: Offers lifelong coverage and includes a cash value component that grows over time. It is more expensive than term life insurance but provides both death benefit and savings features.

- Whole Life Insurance: A type of permanent life insurance that provides coverage for the entire life of the policyholder. It offers a guaranteed death benefit and a fixed premium.

- Universal Life Insurance: A flexible type of permanent life insurance that allows policyholders to adjust their premiums and death benefit based on their needs. It offers a cash value component that grows based on the investment performance of the policy.

Major Australian insurance companies such as AMP, AIA, and TAL offer various life insurance products with varying features and premiums. Policyholders can choose the type of life insurance that best suits their individual needs and financial circumstances.

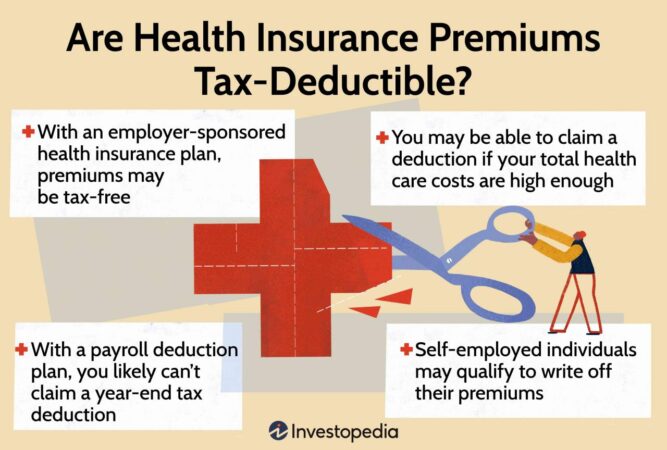

Health Insurance

Health insurance provides coverage for medical expenses, including hospital stays, surgeries, and outpatient treatments. It offers Australians access to private healthcare services and can help reduce out-of-pocket expenses.

- Hospital Cover: Covers the cost of hospital stays, including accommodation, medical care, and surgical procedures. It can be purchased as a standalone policy or as part of a comprehensive health insurance policy.

- Extras Cover: Covers the cost of non-hospital medical services, such as dental care, physiotherapy, and optical services. It can be purchased as a standalone policy or as part of a comprehensive health insurance policy.

- Comprehensive Health Insurance: Combines hospital and extras cover, providing comprehensive coverage for a wide range of medical expenses.

Major Australian health insurers such as Medibank, Bupa, and NIB offer a variety of health insurance policies with different levels of coverage and premiums. Policyholders can choose a policy that aligns with their individual health needs and budget.

Property Insurance, Major insurance companies in australia

Property insurance protects homeowners and businesses against financial losses caused by damage or destruction to their property. It provides coverage for various risks, including fire, theft, natural disasters, and vandalism.

- Home Insurance: Covers the structure of a home, its contents, and liability for accidents that occur on the property.

- Landlord Insurance: Covers the structure of a rental property and provides liability protection for landlords.

- Contents Insurance: Covers personal belongings inside a home or business, including furniture, electronics, and clothing.

- Business Insurance: Covers a variety of risks associated with a business, including property damage, liability, and business interruption.

Major Australian insurance companies such as Suncorp, Allianz, and QBE offer a range of property insurance products with different levels of coverage and premiums. Policyholders can select a policy that meets their specific property needs and risk profile.

Motor Vehicle Insurance

Motor vehicle insurance provides financial protection against losses arising from accidents involving a vehicle. It covers damage to the insured vehicle, injuries to the driver and passengers, and liability for damages caused to other vehicles or property.

- Third Party Property Damage: Covers damage caused to other vehicles or property in an accident, but does not cover damage to the insured vehicle or injuries to the driver or passengers.

- Third Party Fire and Theft: Covers damage to the insured vehicle caused by fire or theft, as well as third-party property damage.

- Comprehensive Car Insurance: Provides the most comprehensive coverage, including damage to the insured vehicle, injuries to the driver and passengers, and third-party property damage.

Major Australian insurance companies such as RACV, NRMA, and AAMI offer a variety of motor vehicle insurance products with different levels of coverage and premiums. Policyholders can choose a policy that balances their budget with their need for protection.

Financial Performance

The Australian insurance industry has demonstrated resilience and growth in recent years, with major players showcasing strong financial performance. This section delves into the recent financial performance of these companies, examining key metrics such as revenue, profitability, and market capitalization. It also explores the factors influencing their financial performance and identifies key trends impacting the industry.

Revenue and Profitability

Revenue generation and profitability are crucial indicators of an insurance company’s financial health. The Australian insurance market has witnessed consistent revenue growth, driven by factors such as population growth, rising affluence, and increased awareness of insurance products.

- Major insurance companies have reported substantial revenue increases in recent years. For instance, [Company Name] recorded a [percentage] revenue growth in [year], while [Company Name] reported a [percentage] increase in the same period.

- Profitability, measured by metrics like net profit margin and return on equity, has also been positive for many insurers. This can be attributed to factors such as disciplined underwriting practices, efficient operations, and a favorable regulatory environment.

Market Capitalization

Market capitalization reflects the total value of a company’s outstanding shares in the market. It is a key indicator of investor confidence and the company’s overall financial standing.

- The market capitalization of major Australian insurance companies has generally been on an upward trend. [Company Name] has seen a significant increase in its market capitalization over the past [number] years, reflecting investor confidence in its long-term growth prospects.

- Factors such as strong financial performance, favorable market conditions, and strategic acquisitions have contributed to the increase in market capitalization for several insurance companies.

Key Financial Trends

The Australian insurance industry is experiencing several key financial trends that are shaping the future of the sector.

- Growing Demand for Digital Solutions: Customers are increasingly demanding digital insurance solutions, such as online quotes, policy management, and claims processing. This trend has led to significant investments in technology by insurance companies to enhance customer experience and streamline operations.

- Increased Competition: The insurance market is becoming increasingly competitive, with the emergence of new players and the expansion of existing ones. This competition is driving innovation and forcing companies to offer more competitive pricing and products.

- Focus on Sustainability: Environmental, social, and governance (ESG) factors are gaining importance in the insurance industry. Companies are increasingly focusing on sustainable practices and incorporating ESG considerations into their investment and underwriting decisions.

Factors Influencing Financial Performance

Several factors influence the financial performance of insurance companies in Australia.

- Economic Conditions: The overall economic climate significantly impacts the insurance industry. During periods of economic growth, insurance demand tends to increase, while recessions can lead to lower premiums and higher claims.

- Regulatory Environment: The regulatory landscape plays a crucial role in shaping the industry. Changes in regulations, such as those related to pricing transparency or product design, can have a direct impact on insurance companies’ financial performance.

- Natural Disasters: Australia is prone to natural disasters, such as bushfires and floods. These events can result in significant claims payouts, impacting insurers’ profitability.

- Competition: The competitive landscape within the insurance industry is a key driver of financial performance. Companies need to differentiate themselves through pricing, product offerings, and customer service to remain competitive.

- Technology: Technological advancements are transforming the insurance industry. Companies that invest in technology to enhance customer experience, streamline operations, and improve risk assessment are likely to perform better financially.

Customer Experience: Major Insurance Companies In Australia

In the highly competitive Australian insurance market, customer experience is a critical differentiator for major insurance companies. This section explores the customer experience offered by these companies, including their service channels, customer satisfaction levels, and brand reputation. It also examines best practices and innovative approaches to customer service in the industry and discusses the challenges and opportunities for improving customer experience.

Service Channels

The service channels offered by Australian insurance companies have evolved significantly in recent years. Customers now have access to a wide range of options, including:

- Websites: Most major insurers have comprehensive websites that allow customers to obtain quotes, manage policies, file claims, and access other services online.

- Mobile Apps: Many insurers have developed mobile apps that provide customers with convenient access to their policies, claims information, and other services on their smartphones.

- Call Centers: Traditional call centers remain an important service channel for many customers, particularly for complex inquiries or claims.

- Social Media: Some insurers utilize social media platforms to provide customer support, respond to inquiries, and engage with customers.

- Broker Networks: A significant portion of insurance sales are facilitated through broker networks, which provide personalized advice and support to customers.

Customer Satisfaction Levels

Customer satisfaction levels in the Australian insurance industry are generally high. According to the Australian Financial Complaints Authority (AFCA), the insurance sector has a lower rate of complaints compared to other financial services industries. However, there are significant variations in customer satisfaction levels among different insurance companies.

- Customer satisfaction surveys: Organizations such as Roy Morgan and Canstar conduct regular surveys to assess customer satisfaction with insurance companies.

- Independent reviews: Websites like ProductReview.com.au and Trustpilot provide platforms for customers to share their experiences and rate insurance companies.

- Social media sentiment: Analyzing social media conversations can provide insights into customer sentiment and identify areas where companies can improve their customer experience.

Brand Reputation

Brand reputation is crucial for insurance companies as it influences customer trust and loyalty. A strong brand reputation is built on factors such as:

- Financial stability: Customers are more likely to trust insurance companies that have a strong financial track record.

- Transparency: Companies that are transparent about their policies, pricing, and claims processes build trust with customers.

- Customer service excellence: Providing excellent customer service is essential for building a positive brand reputation.

- Community engagement: Insurance companies that are actively involved in their communities can enhance their brand reputation.

Best Practices and Innovative Approaches

Australian insurance companies are increasingly adopting best practices and innovative approaches to improve customer experience. Some notable examples include:

- Personalization: Using data analytics to personalize customer communications and provide tailored product recommendations.

- Digital Transformation: Investing in digital technologies to streamline processes, improve efficiency, and enhance customer interactions.

- Customer Journey Mapping: Understanding the customer journey and identifying pain points to improve the overall experience.

- Customer Feedback Mechanisms: Actively seeking customer feedback through surveys, reviews, and social media to identify areas for improvement.

- Employee Training and Empowerment: Investing in training programs to equip employees with the skills and knowledge to provide exceptional customer service.

Challenges and Opportunities

Despite the advancements in customer experience, the Australian insurance industry faces several challenges and opportunities:

- Meeting the Expectations of Digital Natives: Younger generations expect seamless digital experiences and personalized interactions.

- Managing Customer Expectations During Claims: The claims process can be stressful for customers, and insurers need to ensure a smooth and transparent experience.

- Staying Ahead of Technological Advancements: The insurance industry is constantly evolving, and companies need to stay ahead of technological advancements to remain competitive.

- Leveraging Data Analytics: Collecting and analyzing data to gain insights into customer needs and preferences is essential for improving customer experience.

- Building Trust and Transparency: Trust and transparency are critical for building strong customer relationships in the insurance industry.

Future Trends

The Australian insurance industry is undergoing a period of significant transformation, driven by technological advancements, evolving customer expectations, and regulatory reforms. These trends are shaping the future of the industry, presenting both opportunities and challenges for major insurance companies.

Technological Advancements

Technological advancements are fundamentally changing the way insurance is bought, sold, and delivered. Artificial intelligence (AI), big data analytics, and blockchain technology are creating new possibilities for insurers to personalize customer experiences, automate processes, and improve risk management.

- AI-powered chatbots are transforming customer service, enabling insurers to provide 24/7 support and personalized recommendations.

- Big data analytics allows insurers to identify and assess risks more effectively, leading to more accurate pricing and risk management strategies.

- Blockchain technology can streamline insurance claims processing and reduce fraud by creating a secure and transparent record of transactions.

Changing Customer Expectations

Customers are increasingly demanding personalized, digital-first experiences, and insurers must adapt to meet these expectations. Consumers are more informed and empowered than ever before, and they expect transparency, convenience, and value from their insurance providers.

- Customers expect seamless digital experiences, including online quotes, policy management, and claims processing.

- They value personalized recommendations and tailored insurance products that meet their specific needs.

- Customers are also demanding greater transparency and accountability from insurers, with a focus on ethical and sustainable practices.

Regulatory Reforms

The Australian government is actively working to improve the insurance industry through regulatory reforms. These reforms aim to increase competition, enhance consumer protection, and promote innovation.

- The government is implementing measures to address issues such as excessive premiums, unfair claims practices, and the use of complex and opaque insurance products.

- Regulatory reforms are also encouraging insurers to adopt new technologies and business models to improve efficiency and customer service.

Final Wrap-Up

As the Australian insurance market continues to evolve, understanding the major players and their offerings is essential. From the established giants to emerging innovators, these companies are constantly adapting to changing customer expectations and technological advancements. By staying informed about the key trends and developments in the industry, individuals and businesses can make informed decisions about their insurance needs and ensure financial security in a complex and dynamic world.

FAQ Summary

What are the main types of insurance offered by major companies in Australia?

Major insurance companies in Australia offer a wide range of insurance products, including life insurance, health insurance, property insurance, motor vehicle insurance, and more. The specific types of insurance offered vary by company, but these are the most common.

How can I compare insurance quotes from different companies?

You can compare insurance quotes online through comparison websites or by contacting insurance companies directly. Be sure to provide accurate information about your needs and circumstances to get accurate quotes.

What are the key factors to consider when choosing an insurance company?

When choosing an insurance company, consider factors such as price, coverage, customer service, claims process, and financial stability. It’s also important to read reviews and compare policies carefully.

What are the latest trends in the Australian insurance industry?

The Australian insurance industry is undergoing significant change, driven by factors such as technological advancements, changing customer expectations, and regulatory reforms. Key trends include the rise of digital insurance, the increasing use of data analytics, and the growing importance of customer experience.