List of general insurance companies in australia – Navigating the world of general insurance in Australia can feel like a daunting task. With so many companies vying for your business, finding the right insurer can be overwhelming. This list provides a comprehensive overview of the top general insurance companies in Australia, offering insights into their offerings, market focus, and key considerations for choosing the right provider.

General insurance, a vital aspect of financial planning in Australia, encompasses a wide range of policies designed to protect individuals and businesses against various risks. From safeguarding your home and car to ensuring your health and travel plans, these policies provide financial security in the face of unexpected events. The Australian general insurance market is a dynamic landscape, characterized by fierce competition and a focus on innovation. As technology continues to shape the industry, insurers are embracing digital solutions and personalized products to cater to the evolving needs of their customers. Understanding the intricacies of the Australian general insurance market is essential for making informed decisions about your financial well-being.

Overview of General Insurance in Australia

General insurance is a crucial part of the Australian financial landscape, providing protection against a wide range of risks. It involves the transfer of risk from individuals and businesses to insurance companies, who pool premiums and pay out claims when insured events occur. This system ensures financial stability and peace of mind in the face of unexpected events.

Regulatory Landscape of General Insurance in Australia

The Australian general insurance market is tightly regulated to protect consumers and ensure fair practices. Several key governing bodies play crucial roles in this regulatory framework.

- Australian Prudential Regulation Authority (APRA): APRA is responsible for the prudential supervision of general insurers, ensuring their financial stability and solvency. It sets capital adequacy requirements and monitors insurers’ risk management practices.

- Australian Securities and Investments Commission (ASIC): ASIC regulates the conduct of insurers in relation to financial products and services, including general insurance. It ensures that insurers comply with consumer protection laws and act ethically.

- Australian Competition and Consumer Commission (ACCC): The ACCC enforces competition laws in the general insurance market, preventing anti-competitive practices and ensuring fair pricing. It also investigates consumer complaints and promotes fair trading.

Types of General Insurance Products in Australia

The general insurance market in Australia offers a diverse range of products designed to protect individuals and businesses against various risks. Some of the most common types of general insurance include:

- Home Insurance: This covers your home and its contents against damage caused by events like fire, theft, and natural disasters. It provides financial protection and helps you rebuild or repair your home after an insured event.

- Car Insurance: This protects you against financial losses arising from accidents involving your car, including damage to your vehicle, injuries to yourself or others, and legal liabilities. There are different types of car insurance, such as comprehensive, third-party property damage, and third-party fire and theft.

- Health Insurance: This provides coverage for medical expenses not covered by Medicare, such as private hospital stays, dental care, and physiotherapy. It offers greater choice and flexibility in accessing healthcare services.

- Travel Insurance: This covers you against unexpected events while you are traveling, such as medical emergencies, flight delays, lost luggage, and travel cancellation. It provides financial protection and peace of mind during your trip.

- Business Insurance: This protects businesses against a wide range of risks, including property damage, liability claims, and business interruption. It ensures the continuity of operations and protects the financial well-being of the business.

Major General Insurance Companies in Australia

Australia’s general insurance market is a diverse landscape, with numerous companies vying for a share of the market. While smaller niche players cater to specific needs, the major players dominate the market, providing a wide range of products and services to individuals and businesses alike.

Top 10 General Insurance Companies in Australia

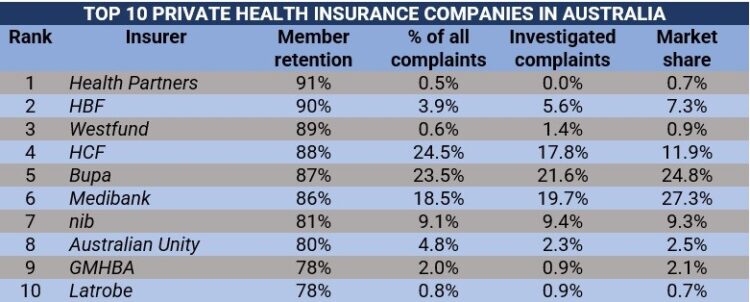

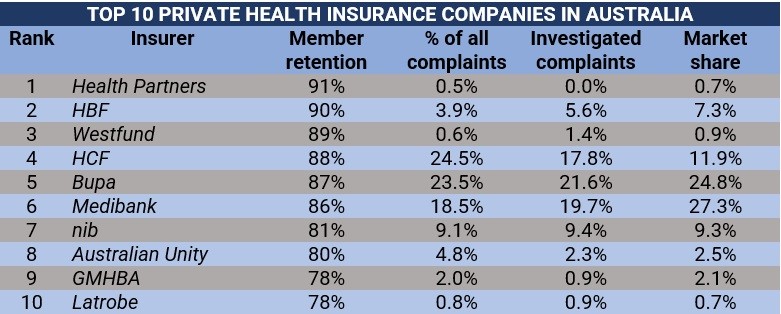

This table highlights the top 10 general insurance companies in Australia, based on market share or premium volume. These companies are known for their comprehensive offerings, robust financial standing, and extensive reach across the country.

| Rank | Company | Logo | Core Offerings | Market Focus |

|---|---|---|---|---|

| 1 | Suncorp Group | [Insert Suncorp Group Logo] | Home, car, business, travel, and life insurance | Broad market reach, focusing on both personal and commercial insurance |

| 2 | IAG | [Insert IAG Logo] | Home, car, business, and travel insurance | Strong presence in both personal and commercial lines, with a focus on innovation and customer service |

| 3 | QBE Insurance Group | [Insert QBE Insurance Group Logo] | Home, car, business, and specialty insurance | Known for its global reach and expertise in specialty insurance lines, including construction and energy |

| 4 | AIA Australia | [Insert AIA Australia Logo] | Life, health, and investment insurance | Primarily focused on life and health insurance, with a strong presence in the financial services sector |

| 5 | Allianz Australia | [Insert Allianz Australia Logo] | Home, car, business, and travel insurance | Offers a wide range of insurance products, with a focus on digital innovation and customer experience |

| 6 | Youi | [Insert Youi Logo] | Home and car insurance | Specializes in home and car insurance, known for its competitive pricing and online-focused approach |

| 7 | RAC Insurance | [Insert RAC Insurance Logo] | Home, car, and business insurance | Primarily focused on Western Australia, offering a range of insurance products to individuals and businesses |

| 8 | NRMA Insurance | [Insert NRMA Insurance Logo] | Home, car, and business insurance | Known for its strong presence in New South Wales and its focus on providing value-added services to its members |

| 9 | GIO | [Insert GIO Logo] | Home, car, and business insurance | Offers a wide range of insurance products, with a focus on providing competitive pricing and flexible options |

| 10 | AAMI | [Insert AAMI Logo] | Home, car, and travel insurance | Known for its strong brand recognition and focus on providing affordable and comprehensive insurance solutions |

Key Considerations for Choosing a General Insurance Company

Choosing the right general insurance company is crucial, as it can significantly impact your financial well-being in the event of an unexpected incident. This decision requires careful consideration of several factors, including your individual needs, budget, and risk profile.

Pricing Models and Coverage Options

Different insurance companies employ various pricing models and offer a range of coverage options, making it essential to compare and contrast these offerings to find the best fit for your circumstances.

Pricing Models

- Premium-Based Pricing: This is the most common pricing model, where premiums are calculated based on factors like age, location, driving history (for motor insurance), and the value of the insured asset. Companies use actuarial data and risk assessment models to determine premiums, reflecting the likelihood of claims and the potential cost of payouts.

- Usage-Based Pricing: This model, often used for motor insurance, utilizes telematics devices or smartphone apps to track driving habits and adjust premiums based on factors like mileage, driving speed, and braking behavior. This allows for more personalized pricing, rewarding safer and less frequent drivers with lower premiums.

- Value-Based Pricing: Some insurers offer discounts for customers who demonstrate responsible behavior, such as installing security systems or taking preventive measures. This model incentivizes risk mitigation and can lead to lower premiums over time.

Coverage Options

- Comprehensive Coverage: This provides the most extensive protection, covering a wide range of risks, including accidental damage, theft, fire, and natural disasters. While comprehensive coverage offers peace of mind, it typically comes with higher premiums.

- Third-Party Property Damage (TPPD): This coverage is mandatory for motor vehicles in Australia and protects you from financial liability if you damage another person’s property in an accident. It does not cover your own vehicle’s damage.

- Third-Party Fire and Theft (TPFT): This coverage extends TPPD to include protection against fire and theft of your vehicle. It does not cover accidental damage.

- Excess: This refers to the amount you pay out of pocket before your insurance policy kicks in. Choosing a higher excess can often result in lower premiums.

Customer Service and Claims Process

- Customer Service Responsiveness: It’s crucial to choose an insurer with a reputation for prompt and helpful customer service. Look for companies with 24/7 support, clear communication channels, and readily available information on their policies and procedures.

- Claims Handling Efficiency: The claims process should be straightforward and efficient, with minimal paperwork and delays. Check the insurer’s track record for claim settlement times and customer satisfaction in handling claims.

- Transparency and Communication: A reputable insurer will provide clear and concise information about their policies, coverage options, and claims process. They should be transparent about their pricing structure and any exclusions or limitations.

Role of Insurance Brokers

Insurance brokers act as intermediaries between you and insurance companies. They can help you compare policies from multiple insurers, identify the best coverage options for your specific needs, and negotiate premiums.

- Expertise and Knowledge: Brokers have extensive knowledge of the insurance market and can provide expert advice on different policy options, coverage levels, and pricing models.

- Time-Saving: Brokers can save you time and effort by handling the research and comparison process on your behalf, allowing you to focus on other matters.

- Negotiation Skills: Brokers can leverage their relationships with insurers to negotiate better premiums and coverage terms on your behalf.

Emerging Trends in General Insurance

The Australian general insurance market is undergoing a significant transformation, driven by rapid technological advancements and evolving customer expectations. Digitalization is reshaping the industry landscape, with insurers adopting new technologies to enhance efficiency, personalize customer experiences, and optimize risk management.

The Impact of Digitalization and Technology, List of general insurance companies in australia

Digitalization is revolutionizing the general insurance industry in Australia, impacting every aspect of the value chain, from product development and distribution to claims processing and customer service. The adoption of digital technologies is enabling insurers to:

- Improve operational efficiency: Automation and data analytics streamline processes, reducing manual effort and improving accuracy. For example, insurers are using AI-powered chatbots to handle routine inquiries, freeing up human agents to focus on complex issues.

- Enhance customer experience: Digital platforms provide customers with convenient access to information, policy management tools, and claims services, anytime and anywhere. Insurers are also leveraging data analytics to personalize products and services based on individual customer needs.

- Optimize risk management: Data analytics and machine learning algorithms enable insurers to better assess risks, develop more accurate pricing models, and identify potential fraud. For example, telematics data from connected vehicles can help insurers assess driving behavior and offer personalized premiums.

Adoption of Telematics, Artificial Intelligence, and Data Analytics

The adoption of telematics, artificial intelligence (AI), and data analytics is accelerating the transformation of the general insurance industry in Australia.

Telematics

Telematics is the use of technology to collect and analyze data from vehicles, providing insights into driving behavior and risk assessment. This technology is increasingly being adopted by insurers to offer usage-based insurance (UBI) programs.

- Usage-based insurance (UBI): Insurers are using telematics data to personalize premiums based on individual driving behavior. Drivers with safer driving habits can benefit from lower premiums, while those with riskier driving patterns may face higher premiums.

- Improved risk assessment: Telematics data provides insurers with a more comprehensive understanding of driving behavior, allowing them to assess risks more accurately and develop more effective pricing models.

- Enhanced customer engagement: Telematics devices can provide drivers with feedback on their driving behavior, encouraging them to adopt safer driving practices and reduce accidents.

Artificial Intelligence (AI)

AI is being used in various aspects of the general insurance industry, including:

- Claims processing: AI-powered algorithms can automate claims processing, reducing manual effort and improving efficiency. For example, AI can be used to assess the severity of claims based on images and data, providing faster and more accurate assessments.

- Fraud detection: AI algorithms can identify patterns and anomalies in claims data, helping insurers detect and prevent fraudulent activity.

- Customer service: AI-powered chatbots and virtual assistants can handle routine customer inquiries, providing instant responses and improving customer satisfaction.

Data Analytics

Data analytics is essential for insurers to gain insights into customer behavior, market trends, and risk factors. By analyzing vast amounts of data, insurers can:

- Develop personalized products: Data analytics enables insurers to tailor products and services to individual customer needs and preferences, offering more relevant and competitive offerings.

- Improve pricing accuracy: Data-driven insights allow insurers to develop more accurate pricing models, ensuring that premiums reflect the true risk profile of each customer.

- Enhance risk management: Data analytics helps insurers identify emerging risks and trends, allowing them to proactively manage their portfolio and minimize potential losses.

Future Trends in General Insurance

The Australian general insurance market is expected to continue evolving, driven by technological advancements and changing customer expectations. Key trends to watch include:

- Personalized products: Insurers are increasingly focusing on developing personalized products and services that cater to the unique needs and preferences of individual customers. This trend is driven by the growing demand for customized solutions and the availability of data analytics to personalize offerings.

- Growth of niche insurance markets: The general insurance market is becoming increasingly fragmented, with the emergence of niche markets catering to specific customer segments. For example, there is growing demand for insurance products tailored to the needs of specific industries, such as technology or healthcare.

- Increased use of digital channels: Insurers are continuing to invest in digital channels to provide customers with convenient access to information, products, and services. This trend is driven by the increasing adoption of smartphones and the growing preference for online interactions.

- Greater focus on customer experience: Insurers are recognizing the importance of providing exceptional customer experiences to retain customers and drive loyalty. This trend is driven by the increasing competition in the market and the growing expectations of customers for personalized and seamless interactions.

Final Thoughts

Choosing the right general insurance company is a crucial decision that requires careful consideration. By understanding the factors discussed above, individuals and businesses can make informed choices that align with their specific needs and financial circumstances. Whether you are seeking comprehensive coverage for your home, reliable protection for your vehicle, or peace of mind for your travels, this list serves as a valuable resource for navigating the Australian general insurance landscape. Remember to compare quotes, read policy terms carefully, and seek guidance from insurance brokers to ensure you are making the best choice for your unique needs. With the right insurance in place, you can face the future with confidence, knowing you have the protection you need to navigate life’s uncertainties.

Quick FAQs: List Of General Insurance Companies In Australia

What are the main types of general insurance offered in Australia?

General insurance in Australia covers a wide range of risks, including home, car, health, travel, and business insurance. Each type provides specific coverage tailored to the unique needs of individuals and businesses.

How can I find the best general insurance deal for me?

The best way to find a great deal is to compare quotes from multiple insurers. Consider factors like coverage, pricing, customer service, and claims history when making your decision.

What are some of the latest trends in general insurance in Australia?

The Australian general insurance market is embracing digital solutions, personalized products, and innovative technologies like telematics and artificial intelligence to enhance customer experiences and improve efficiency.