- Introduction to Public Liability Insurance in Australia

- Importance of Public Liability Insurance for Businesses

- Key Coverage Areas of Public Liability Insurance

- Factors Influencing Public Liability Insurance Premiums

- Claim Process and Procedures

- Choosing the Right Public Liability Insurance Policy

- Resources and Further Information

- Final Wrap-Up

- Popular Questions: Public Liability Insurance In Australia

Public liability insurance in Australia is a crucial safety net for businesses, providing financial protection against claims arising from injuries or property damage caused by their activities. This type of insurance is essential for safeguarding your business from potential legal and financial repercussions, ensuring peace of mind and stability.

Navigating the complexities of Australian law and understanding your potential liabilities can be daunting. Public liability insurance acts as a shield, covering legal expenses, compensation payments, and other costs associated with third-party claims. It’s a vital component of responsible business practices, ensuring you’re adequately prepared to handle unforeseen events.

Introduction to Public Liability Insurance in Australia

Public liability insurance is a crucial aspect of risk management for individuals and businesses in Australia. It provides financial protection against claims arising from injuries or damage caused to third parties. This type of insurance safeguards you from potential legal and financial consequences associated with accidents or incidents that occur on your property or during your activities.

This guide delves into the essential aspects of public liability insurance in Australia, including its core concepts, key features, and the relevant legal framework.

Key Elements and Features

Public liability insurance offers comprehensive protection against various risks. Key elements and features include:

- Coverage for Third-Party Injuries and Damages: This insurance covers bodily injury, property damage, and other losses caused to third parties due to your negligence or actions. This protection extends to situations like slips, trips, falls, and other incidents on your premises or during your activities.

- Legal Defence Costs: Public liability insurance covers legal expenses associated with defending claims, including court fees, lawyer fees, and expert witness costs. This crucial feature ensures that you have access to legal representation and support in case of a claim.

- Compensation Limits: Each policy has a specific sum insured, which represents the maximum amount the insurer will pay for a single claim or in total for all claims within a policy period. It’s essential to choose a policy with adequate coverage limits to protect your financial interests.

- Exclusions and Limitations: Public liability policies typically have exclusions and limitations. It’s important to review the policy document carefully to understand the specific situations that are not covered or have restricted coverage. For example, certain activities or industries may have higher risks and may be excluded or have limited coverage.

Australian Legal Framework

Australia’s legal framework related to public liability is based on the principles of negligence. The law holds individuals and entities responsible for taking reasonable care to avoid causing harm to others. This framework governs the circumstances under which a claim for damages can be made against a person or entity.

- Negligence: To establish negligence, a plaintiff must prove that the defendant owed them a duty of care, breached that duty, and the breach caused the plaintiff’s injuries or damages. This principle underpins the legal basis for public liability claims in Australia.

- Statutory Requirements: In some industries, there are specific statutory requirements that may influence public liability insurance needs. For example, construction companies may face stricter regulations regarding safety and liability. Understanding these requirements is crucial for obtaining appropriate insurance coverage.

- Common Law: The common law plays a significant role in shaping the interpretation and application of public liability principles. Court decisions and precedents set guidelines for determining liability in specific situations. Staying informed about relevant case law can be beneficial for understanding the legal landscape.

Importance of Public Liability Insurance for Businesses

Operating a business in Australia comes with inherent risks, and these risks can extend beyond the business itself, potentially impacting individuals or property. Public liability insurance acts as a crucial safety net, shielding businesses from the financial burden of these risks.

Understanding the Risks and Liabilities, Public liability insurance in australia

Businesses in Australia face a multitude of potential risks that could lead to significant financial losses. These risks can arise from various sources, including:

- Customer Injuries: A customer tripping over a loose floorboard or slipping on a wet surface could lead to a claim for medical expenses and lost wages.

- Property Damage: A fire or explosion on business premises could damage nearby property, leading to costly repairs or replacements.

- Employee Accidents: A worker injured while performing their duties could file a claim for compensation, potentially impacting the business’s finances.

- Professional Negligence: A mistake or oversight by a professional service provider could result in a claim for financial losses incurred by the client.

- Product Liability: A defective product causing harm to a consumer could lead to a product liability claim, potentially involving significant legal fees and compensation.

Public Liability Insurance as a Financial Safeguard

Public liability insurance acts as a vital financial safeguard for businesses, protecting them from the financial consequences of these risks. It covers the legal and financial costs associated with third-party claims, including:

- Legal Defense Costs: If a claim is made against the business, public liability insurance covers the legal fees associated with defending the claim.

- Compensation Payments: In the event of a successful claim, the insurance policy will cover the compensation payments awarded to the injured party, including medical expenses, lost wages, and pain and suffering.

- Property Damage Costs: If the business is responsible for property damage, public liability insurance covers the costs of repairs or replacements.

Real-World Examples of Public Liability Insurance in Action

The importance of public liability insurance is evident in numerous real-world scenarios. Consider these examples:

- A café owner in Melbourne was sued by a customer who slipped on a wet floor. Public liability insurance covered the legal costs and the compensation paid to the customer, preventing the café owner from facing significant financial hardship.

- A construction company in Sydney was held liable for damage caused to a nearby building during a demolition project. Public liability insurance covered the repair costs, saving the company from a potentially crippling financial loss.

- A doctor in Brisbane was sued by a patient for medical negligence. Public liability insurance covered the legal costs and the compensation paid to the patient, protecting the doctor from a potentially devastating financial blow.

Key Coverage Areas of Public Liability Insurance

Public liability insurance provides financial protection to businesses and individuals against claims arising from injuries or damages caused to third parties. The coverage extends to various situations where negligence or accidents occur, safeguarding the insured from significant financial burdens.

Types of Coverage

Public liability insurance policies generally include a range of coverage areas to address different scenarios. These coverages aim to provide comprehensive protection against potential risks associated with business operations and personal activities.

- Bodily Injury: This coverage protects the insured against claims arising from injuries sustained by third parties due to the insured’s negligence. It includes medical expenses, lost wages, and pain and suffering.

- Property Damage: This coverage protects the insured against claims arising from damage to third-party property caused by the insured’s negligence. It covers repairs or replacement costs.

- Legal Defense Costs: This coverage provides financial support for legal defense expenses incurred in defending against claims. It covers legal fees, court costs, and expert witness fees.

- Product Liability: This coverage protects manufacturers and suppliers against claims arising from defective products that cause injury or damage to third parties.

- Public Liability: This coverage protects the insured against claims arising from injuries or damages caused to third parties while on the insured’s premises or as a result of the insured’s activities.

Limits and Exclusions

It’s crucial to understand the limits and exclusions associated with public liability insurance policies. Limits refer to the maximum amount the insurer will pay for a claim, while exclusions are specific events or situations not covered by the policy.

- Policy Limits: Each coverage area has a specific limit, often expressed as a dollar amount. The limit represents the maximum amount the insurer will pay for a single claim or series of claims related to a specific event.

- Exclusions: Common exclusions in public liability insurance policies include:

- Intentional acts: The policy generally does not cover claims arising from intentional acts of the insured or their employees.

- Criminal activity: Claims resulting from criminal activity by the insured or their employees are usually excluded.

- Environmental damage: Policies often exclude coverage for environmental damage caused by the insured’s activities.

- Professional negligence: Professional liability insurance is typically separate from public liability insurance and covers negligence in professional services.

Examples of Coverage Scenarios

To illustrate how public liability insurance applies in different situations, consider these examples:

- Bodily Injury: A customer slips and falls on a wet floor in a retail store, sustaining a broken leg. The store’s public liability insurance covers the customer’s medical expenses, lost wages, and pain and suffering.

- Property Damage: A contractor accidentally damages a customer’s fence while working on a landscaping project. The contractor’s public liability insurance covers the cost of repairing or replacing the fence.

- Legal Defense Costs: A business owner is sued by a customer who alleges they were injured on the premises. The business owner’s public liability insurance covers the legal fees and court costs associated with defending the lawsuit.

- Product Liability: A manufacturer’s product malfunctions, causing injury to a consumer. The manufacturer’s product liability insurance covers the costs associated with the injury claim.

- Public Liability: A homeowner hosts a party and a guest trips and falls on the stairs, sustaining a concussion. The homeowner’s public liability insurance covers the guest’s medical expenses and other related costs.

Factors Influencing Public Liability Insurance Premiums

Public liability insurance premiums are not fixed and vary depending on several factors. Understanding these factors can help businesses determine the cost of their insurance and make informed decisions about their risk management strategies.

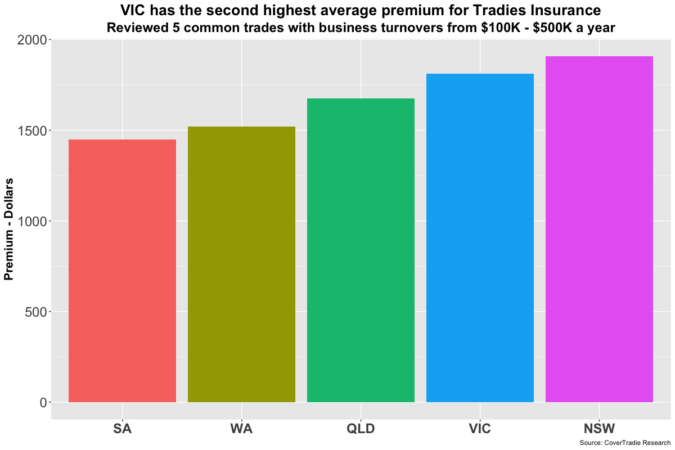

Industry and Business Type

The industry or business type plays a significant role in determining the cost of public liability insurance. Businesses in high-risk industries, such as construction, manufacturing, and hospitality, generally face higher premiums due to the increased likelihood of accidents and injuries. For example, a construction company will likely pay a higher premium than a retail store, as construction work involves inherent risks like falls from heights, heavy machinery, and hazardous materials.

Business Size

The size of a business also impacts public liability insurance premiums. Larger businesses typically have higher premiums because they have a larger workforce, operate in more locations, and handle more transactions. For example, a large corporation with multiple branches and a significant number of employees will pay a higher premium than a small sole proprietorship.

Risk Profile

The risk profile of a business is another key factor that determines premium costs. A business with a high-risk profile, such as one that handles dangerous chemicals or operates in a high-traffic area, will face higher premiums than a business with a low-risk profile.

Past Claims History

A business’s past claims history can significantly impact its public liability insurance premiums. Businesses with a history of frequent claims will typically pay higher premiums because they are considered a higher risk. Conversely, businesses with a clean claims history may qualify for discounts.

Location

The location of a business can also influence its public liability insurance premiums. Businesses located in high-crime areas or areas with high traffic volume may face higher premiums due to the increased risk of accidents and injuries.

Safety Practices

Businesses with strong safety practices and a commitment to risk management can often negotiate lower public liability insurance premiums. Insurers recognize the importance of safety measures and reward businesses that take proactive steps to reduce their risk of liability claims.

Other Factors

Other factors that can influence public liability insurance premiums include:

- The amount of coverage required

- The deductible chosen

- The insurer’s financial stability

- The insurer’s underwriting criteria

Impact of Factors on Premiums

| Factor | Impact on Premiums |

|---|---|

| Industry and Business Type | Higher premiums for high-risk industries |

| Business Size | Higher premiums for larger businesses |

| Risk Profile | Higher premiums for businesses with high-risk profiles |

| Past Claims History | Higher premiums for businesses with frequent claims |

| Location | Higher premiums for businesses in high-risk areas |

| Safety Practices | Lower premiums for businesses with strong safety practices |

| Other Factors | Premiums may vary based on coverage amount, deductible, insurer’s financial stability, and underwriting criteria |

Claim Process and Procedures

Making a public liability insurance claim in Australia involves a series of steps designed to ensure a fair and efficient resolution. Understanding these steps can help you navigate the process smoothly and maximise your chances of a successful outcome.

Documentation and Evidence Required for a Successful Claim

It is crucial to provide comprehensive documentation and evidence to support your public liability insurance claim. This documentation serves as proof of the incident, your injuries or damages, and the extent of your losses.

- Police Report: If the incident involved a crime or public safety concern, a police report is essential. It provides an official record of the event and can be crucial for establishing liability.

- Medical Records: For injury claims, medical records are critical. They document the nature and extent of your injuries, treatment received, and any ongoing medical needs. These records can include doctor’s notes, hospital records, and physiotherapy reports.

- Photos and Videos: Visual evidence can be invaluable in supporting your claim. Photos and videos of the incident scene, your injuries, and damaged property can help demonstrate the circumstances and the extent of the losses.

- Witness Statements: Statements from witnesses who saw the incident can provide valuable corroboration of your account. Obtain written statements from anyone who can attest to the events that led to your claim.

- Receipts and Invoices: For property damage or financial losses, receipts and invoices for repairs, replacements, or medical expenses are essential. These documents provide proof of the actual costs incurred.

Role of Insurance Brokers

Insurance brokers play a crucial role in assisting policyholders with the claims process. They act as intermediaries between you and the insurer, providing guidance and support throughout the process.

- Claim Filing: Brokers can assist you in filing your claim correctly and efficiently, ensuring all necessary information is included.

- Communication with Insurer: Brokers can act as your advocate, communicating with the insurer on your behalf and ensuring your interests are represented.

- Negotiation and Settlement: Brokers can help negotiate with the insurer for a fair settlement, taking into account the specifics of your claim and the policy coverage.

- Dispute Resolution: In the event of a dispute, brokers can assist in resolving the issue through mediation or other dispute resolution mechanisms.

Choosing the Right Public Liability Insurance Policy

Selecting the right public liability insurance policy is crucial for businesses in Australia, as it can significantly impact their financial security and ability to operate smoothly. This guide will equip you with the necessary information to make an informed decision about your public liability insurance needs.

Factors to Consider When Choosing a Public Liability Insurance Policy

Choosing the right public liability insurance policy involves considering various factors specific to your business. Here are some key considerations:

- Industry and Business Activities: Different industries have different risks. For example, a construction company faces higher risks than a retail store. Your insurance policy should reflect the specific risks associated with your business activities.

- Location: The location of your business can influence the risk profile. For example, a business operating in a high-traffic area might face a higher risk of claims.

- Number of Employees: The number of employees can impact your risk exposure. Larger businesses with more employees typically have higher insurance premiums.

- Revenue and Assets: The size of your business, as measured by revenue and assets, can influence the level of coverage required. Larger businesses with significant assets may need higher coverage limits.

- Claims History: A history of claims can affect your premium rates. Businesses with a history of claims may be charged higher premiums.

- Policy Limits and Deductibles: Consider the coverage limits and deductibles offered by different policies. Coverage limits determine the maximum amount the insurer will pay for a claim, while deductibles are the amount you pay out-of-pocket before the insurer starts covering the claim.

Comparing Policy Options

The Australian market offers a variety of public liability insurance policies from different insurers. Here’s a breakdown of common policy options:

- Standard Public Liability Insurance: This policy provides basic coverage for bodily injury and property damage caused by your business activities. It’s a good option for businesses with low-risk activities and limited assets.

- Comprehensive Public Liability Insurance: This policy offers broader coverage, including legal defense costs, product liability, and professional indemnity. It’s suitable for businesses with higher risk profiles or significant assets.

- Tailored Public Liability Insurance: Some insurers offer tailored policies designed to meet the specific needs of particular industries. For example, a construction company might need a policy that covers specific risks associated with their industry.

Key Considerations for Policy Comparison

When comparing public liability insurance policies, consider these factors:

| Factor | Description |

|---|---|

| Premium Rates | Compare premium rates from different insurers. Look for policies that offer competitive rates without compromising coverage. |

| Coverage Limits | Ensure the policy’s coverage limits are adequate for your business’s potential liability. Higher limits provide greater protection in case of significant claims. |

| Deductibles | Choose a deductible you can comfortably afford. Higher deductibles typically lead to lower premiums, but you’ll need to pay more out-of-pocket in case of a claim. |

| Exclusions | Review the policy’s exclusions carefully. Exclusions specify events or situations not covered by the policy. Ensure the policy covers the risks you need protection from. |

| Customer Service and Claims Process | Consider the insurer’s reputation for customer service and their claims handling process. Choose an insurer with a proven track record of timely and efficient claim resolution. |

Resources and Further Information

This section provides valuable resources to help you gain a deeper understanding of public liability insurance in Australia. It includes links to reputable websites, government resources, and industry associations.

Government Resources and Regulatory Bodies

Government resources and regulatory bodies play a crucial role in providing information and guidance on public liability insurance in Australia. These organizations set standards, enforce regulations, and offer support to businesses and individuals.

- Australian Securities and Investments Commission (ASIC): ASIC is the national regulator for the financial services industry, including insurance. ASIC’s website provides information on consumer rights and responsibilities related to insurance. You can find resources on how to choose an insurance policy, understand your policy terms, and make a claim.

- Australian Prudential Regulation Authority (APRA): APRA regulates the insurance industry in Australia. It sets prudential standards for insurers and monitors their financial stability. APRA’s website provides information on the regulation of the insurance industry, including public liability insurance.

- Australian Competition and Consumer Commission (ACCC): The ACCC enforces consumer law in Australia, including laws relating to insurance. The ACCC’s website provides information on consumer rights and responsibilities when buying insurance, as well as information on how to resolve disputes with insurers.

Industry Associations

Industry associations are valuable resources for information and support on public liability insurance. They represent the interests of insurers and brokers, and they often provide resources and guidance to businesses and individuals.

- Insurance Council of Australia (ICA): The ICA is the peak body for the Australian insurance industry. The ICA’s website provides information on insurance issues, including public liability insurance. It also offers resources for consumers, such as tips on choosing an insurance policy and making a claim.

- Australian Insurance Brokers Association (AIBA): The AIBA represents insurance brokers in Australia. The AIBA’s website provides information on insurance brokerage services, including advice on public liability insurance. It also offers resources for consumers, such as tips on finding an insurance broker and understanding insurance policies.

Reputable Websites and Organizations

Several reputable websites and organizations provide comprehensive information and insights into public liability insurance in Australia. These resources can help you understand the intricacies of this type of insurance and make informed decisions.

- Canstar: Canstar is a leading independent comparison website for financial products, including insurance. Canstar provides ratings and reviews of public liability insurance policies from different insurers, allowing you to compare and choose the best option for your needs.

- Finder: Finder is another popular comparison website that provides information and resources on a wide range of financial products, including insurance. Finder offers tools and resources to help you compare public liability insurance policies from different insurers and find the best deal.

- MoneySmart: MoneySmart is a government-funded website that provides information and resources on a range of financial matters, including insurance. MoneySmart offers guidance on choosing the right insurance policy, understanding your policy terms, and making a claim.

Final Wrap-Up

Investing in public liability insurance in Australia is a wise decision for businesses of all sizes. It provides a crucial layer of protection against financial ruin, allowing you to focus on your core operations with confidence. By understanding the intricacies of this insurance type and choosing a policy tailored to your specific needs, you can effectively manage risks and ensure the long-term sustainability of your business.

Popular Questions: Public Liability Insurance In Australia

What are the common exclusions in public liability insurance policies?

Exclusions vary between policies, but common ones include intentional acts, pre-existing conditions, and claims arising from specific activities like professional negligence. It’s crucial to review the policy details carefully.

How can I find a reputable insurance broker to assist me?

You can seek recommendations from industry associations, business networks, or online directories specializing in insurance brokers. It’s essential to choose a broker with experience in public liability insurance and a strong understanding of your business needs.

What are the benefits of having public liability insurance for a small business?

Small businesses are particularly vulnerable to financial hardship following a liability claim. Public liability insurance protects your assets, covers legal expenses, and provides financial stability in case of an unexpected incident.