- Understanding Australian Health Insurance

- Factors Influencing Health Insurance Costs

- Finding the Cheapest Health Insurance Options: The Cheapest Health Insurance In Australia

- Budget-Friendly Health Insurance Choices

- Essential Considerations for Choosing Health Insurance

- Tips for Saving Money on Health Insurance

- Resources and Tools for Finding Affordable Health Insurance

- Conclusion

- Popular Questions

The cheapest health insurance in Australia can be a challenge to find, but it’s essential to have the right coverage for your needs. Understanding the basics of private health insurance in Australia is crucial. Different types of policies are available, each offering unique benefits and drawbacks. The cost of health insurance in Australia is influenced by factors such as age, health status, and location, but government subsidies and rebates can help lower premiums.

Navigating the complex world of health insurance can be overwhelming, but this guide will provide a step-by-step process to help you find the most affordable options. We’ll explore strategies for comparing quotes, negotiating with insurers, and considering the reputation of the insurer.

Understanding Australian Health Insurance

Navigating the world of health insurance in Australia can feel like a maze, especially when you’re looking for the most affordable options. But understanding the basics can make your search much easier.

Private health insurance in Australia is a voluntary system designed to complement the public Medicare system. While Medicare provides essential healthcare services, private health insurance offers additional benefits like access to private hospitals, shorter waiting times for procedures, and coverage for services not covered by Medicare, such as dental and optical.

Types of Health Insurance Policies

Private health insurance policies in Australia come in various forms, each with its own features and costs.

The main types of policies are:

- Hospital Cover: This covers your costs for hospital stays, including accommodation, surgery, and other related expenses.

- Extras Cover: This covers a range of services not covered by Medicare, such as dental, optical, physiotherapy, and alternative therapies.

- Combined Cover: This policy combines both hospital and extras cover, providing comprehensive health insurance.

Benefits of Private Health Insurance

Private health insurance can offer significant benefits, particularly if you’re seeking faster access to healthcare services or need coverage for services not covered by Medicare.

- Shorter Waiting Times: Private health insurance can often provide access to private hospitals, which generally have shorter waiting times for elective surgeries and procedures compared to public hospitals.

- Choice of Hospital and Doctor: You can choose the hospital and doctor you prefer when you have private health insurance.

- Coverage for Non-Medicare Services: Private health insurance can cover services not covered by Medicare, such as dental, optical, and alternative therapies.

- Tax Benefits: You may be eligible for tax rebates on your private health insurance premiums.

Drawbacks of Private Health Insurance

While private health insurance offers benefits, it also comes with drawbacks that you should consider.

- Cost: Private health insurance premiums can be expensive, especially if you opt for comprehensive coverage.

- Waiting Periods: Some policies have waiting periods before certain benefits become available.

- Exclusions and Limitations: Policies may have exclusions and limitations on the services they cover.

Factors Influencing Health Insurance Costs

The cost of health insurance in Australia is influenced by several factors, which are designed to ensure a fair and sustainable system. These factors reflect the individual’s risk profile and the overall cost of providing healthcare.

Age

Age is a significant factor influencing health insurance premiums. As individuals age, their risk of requiring medical treatment generally increases. This is reflected in higher premiums for older individuals. For example, a 65-year-old individual may pay significantly more than a 25-year-old for the same level of cover. This is because older individuals are statistically more likely to require hospital care, treatments, and medications.

Health Status

Individuals with pre-existing medical conditions may face higher premiums. This is because they are considered a higher risk to insurers, as they are more likely to require healthcare services. For example, a person with a history of heart disease may pay more for health insurance than a person with no pre-existing conditions. However, it’s important to note that individuals with pre-existing conditions are still eligible for health insurance and can access coverage.

Location, The cheapest health insurance in australia

Location also plays a role in health insurance premiums. The cost of healthcare can vary significantly depending on the location. For example, individuals living in major cities may pay higher premiums than those living in rural areas. This is due to factors such as higher costs of living, higher demand for healthcare services, and the availability of specialists.

Government Subsidies and Rebates

The Australian government provides subsidies and rebates to help individuals afford health insurance. These subsidies are means-tested, meaning they are based on the individual’s income and family circumstances. The government’s role is to ensure that health insurance remains affordable for Australians, particularly for lower-income earners and families. The government’s contributions can significantly reduce the cost of health insurance, making it more accessible to a wider population.

Finding the Cheapest Health Insurance Options: The Cheapest Health Insurance In Australia

Now that you understand the basics of Australian health insurance, let’s delve into the practicalities of finding the most affordable options. This section will guide you through comparing quotes, negotiating premiums, and making informed decisions about your coverage.

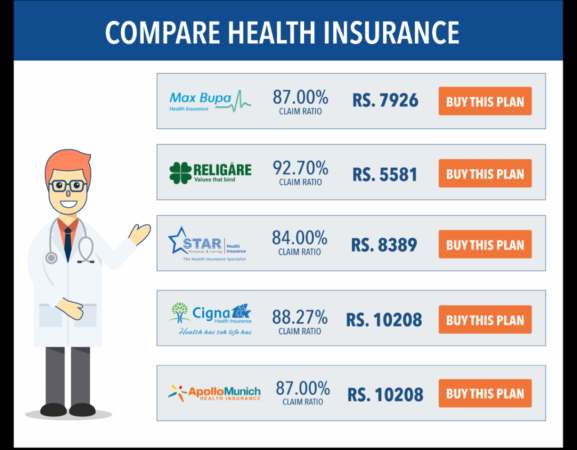

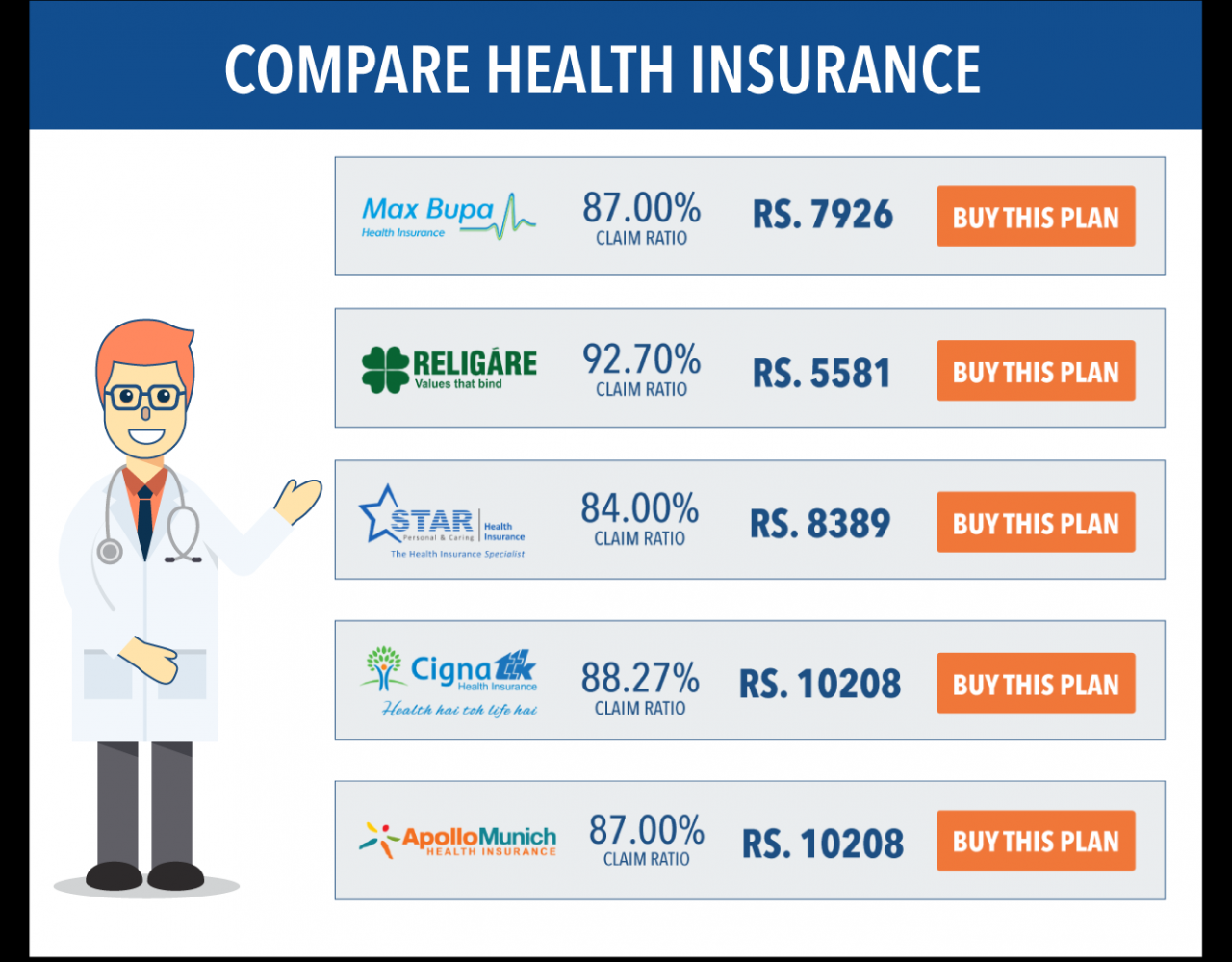

Comparing Health Insurance Quotes

Comparing quotes from different insurers is crucial to finding the cheapest health insurance. Here’s a step-by-step guide to help you navigate this process:

- Identify Your Needs: Before starting your search, assess your health needs and lifestyle. Consider factors like your age, health status, and whether you require specific coverage for pre-existing conditions or hospital stays.

- Utilize Online Comparison Websites: Websites like Compare the Market, iSelect, and Canstar offer a convenient way to compare quotes from multiple insurers simultaneously. These platforms allow you to enter your details and preferences, and they will generate a list of tailored options.

- Contact Insurers Directly: After using comparison websites, consider contacting insurers directly to discuss specific coverage details and ask any questions you might have. This personalized approach can provide valuable insights and help you make an informed decision.

- Review Policy Documents Carefully: Once you’ve narrowed down your options, carefully review the policy documents provided by each insurer. Pay attention to the inclusions, exclusions, and any potential limitations in coverage.

- Consider the Insurer’s Reputation: Research the insurer’s reputation for claims handling and customer service. Look for independent reviews and ratings from reputable sources.

Negotiating Health Insurance Premiums

While finding the cheapest option is important, it’s also worth exploring ways to negotiate lower premiums. Here are some tips to consider:

- Bundle Policies: If you have other insurance policies with the same insurer, inquire about potential discounts for bundling your health insurance with other products, such as home or car insurance.

- Ask About Discounts: Many insurers offer discounts for various factors, such as being a member of a specific organization or having a healthy lifestyle. Don’t hesitate to ask about available discounts.

- Shop Around Regularly: It’s a good idea to compare quotes and consider switching insurers every year or two, as premiums can fluctuate. This proactive approach can help you secure the best deals.

- Negotiate With Your Current Insurer: If you’re happy with your current insurer but want to lower your premium, consider contacting them to discuss potential negotiation options. Be prepared to explain your reasons for seeking a lower premium and present evidence of competitive offers.

Considering Coverage and Insurer Reputation

While cost is a significant factor, it’s essential to consider the coverage provided and the insurer’s reputation. Here’s why:

- Coverage: The cheapest policy might not necessarily be the best if it doesn’t meet your specific needs. Carefully evaluate the coverage offered, ensuring it includes the essential services you might require. Consider factors like hospital coverage, extras benefits, and any limitations or exclusions.

- Reputation: An insurer’s reputation is crucial, particularly when it comes to claims handling and customer service. Research the insurer’s track record, read reviews, and look for independent ratings to ensure they are reliable and responsive to customer needs.

Budget-Friendly Health Insurance Choices

Finding affordable health insurance in Australia can be a challenge, but it’s not impossible. Several options are available for those seeking budget-friendly coverage. This section will explore some strategies and policies that can help you save on your premiums without compromising on essential healthcare needs.

Basic Coverage Policies

Choosing a basic coverage policy is one of the most effective ways to reduce your health insurance premiums. These policies offer a more limited range of benefits compared to comprehensive plans, focusing on essential healthcare needs. Here are some key features of basic coverage policies:

- Lower Premiums: By opting for a basic plan, you can significantly reduce your monthly or annual premiums, making health insurance more accessible.

- Essential Benefits: Basic plans typically cover essential services like hospital admissions, surgeries, and some outpatient treatments. This ensures access to crucial healthcare when needed.

- Exclusions: These policies often have specific exclusions, such as certain elective surgeries or alternative therapies. It’s crucial to carefully review the policy documents to understand what’s covered and what’s not.

Policies with Specific Exclusions

Another strategy for reducing premiums is choosing a policy with specific exclusions. These policies often offer lower premiums by excluding certain benefits or services that you may not frequently use. For example, you might choose a policy that excludes dental or optical coverage if you have separate insurance for these services.

Comparison of Budget-Friendly Plans

To effectively compare budget-friendly plans, consider the following:

- Premium Costs: Compare the monthly or annual premiums of different plans to find the most affordable option.

- Coverage Benefits: Carefully review the coverage benefits offered by each plan to ensure it meets your essential healthcare needs.

- Exclusions: Understand the specific exclusions of each policy to ensure you are not compromising on crucial services.

- Excesses: Compare the excesses associated with each plan, as higher excesses can lead to lower premiums but also increase out-of-pocket expenses.

Tips for Finding Affordable Health Insurance

Here are some practical tips for finding the cheapest health insurance in Australia:

- Compare Prices Online: Utilize online comparison websites to quickly compare premiums and coverage benefits from different insurers.

- Consider Family Discounts: Many insurers offer discounts for families or couples, which can significantly reduce premiums.

- Look for Bundled Packages: Some insurers offer bundled packages that combine health insurance with other services like home or car insurance, often providing discounts.

- Review Your Coverage Regularly: As your health needs and circumstances change, review your coverage and consider adjusting your plan to ensure it remains affordable and meets your current requirements.

Essential Considerations for Choosing Health Insurance

Choosing the right health insurance policy is a crucial decision that requires careful consideration of your individual needs and circumstances. It’s not just about finding the cheapest option; it’s about ensuring you have adequate coverage for potential health risks while staying within your budget.

Assessing Individual Health Needs and Risks

Understanding your health needs and risks is the foundation of choosing the right health insurance policy. This involves evaluating your current health status, family history, lifestyle factors, and potential future health needs.

For example, if you have a family history of heart disease, you might prioritize a policy that covers cardiovascular procedures. Similarly, if you are an active individual, you might want a policy that includes coverage for sports injuries.

Impact of Pre-existing Conditions on Coverage and Costs

Pre-existing conditions, which are health issues you had before obtaining health insurance, can significantly impact your coverage and costs. Insurance providers may have limitations or exclusions for pre-existing conditions, which can lead to higher premiums or denial of coverage.

For example, if you have diabetes, you might face higher premiums or have limited coverage for diabetes-related treatments.

Provider Network and Accessibility of Services

A crucial factor in choosing health insurance is the provider network and accessibility of services. Ensure the policy covers healthcare providers you trust and that the services you need are readily available within the network.

It’s essential to check the provider network and ensure your preferred doctors, hospitals, and specialists are included. You should also consider the geographical coverage of the policy and the accessibility of services in your area.

Tips for Saving Money on Health Insurance

Finding the cheapest health insurance is just the first step. You can further reduce your premiums by implementing smart strategies and taking advantage of available options. Here are some tips to help you save money on your health insurance:

Negotiate Your Premium

Don’t be afraid to negotiate with your insurer. Contact them and discuss your options. You may be able to lower your premium by:

- Increasing your excess: This is the amount you pay out of pocket before your insurance kicks in. Increasing your excess can lead to lower premiums.

- Choosing a higher deductible: This is the amount you pay towards your medical expenses before your insurance covers the rest. A higher deductible often results in lower premiums.

- Opting for a lower level of cover: If you are young and healthy, you may not need the most comprehensive level of cover. Consider a lower level of cover to save money.

Bundle Your Policies

Many insurers offer discounts when you bundle your policies, such as home and contents insurance, car insurance, and health insurance. This can save you a significant amount of money.

Take Advantage of Loyalty Programs

Insurers often reward loyal customers with discounts and other benefits. Check if your insurer offers a loyalty program and sign up if you qualify.

Government Subsidies and Rebates

The Australian government offers subsidies and rebates to help people afford health insurance. You may be eligible for these benefits if you meet certain criteria. To determine your eligibility, contact your insurer or visit the Australian Government’s website.

Resources and Tools for Finding Affordable Health Insurance

Navigating the world of health insurance in Australia can feel overwhelming, but with the right tools and resources, finding affordable coverage becomes much easier. Several websites and comparison tools are available to help you compare quotes, understand your options, and find the best fit for your budget.

Health Insurance Comparison Websites

These websites allow you to compare quotes from multiple health insurance providers simultaneously, saving you time and effort. They provide a comprehensive overview of different plans, benefits, and premiums, making it easier to identify the most cost-effective option.

- Compare the Market: This popular comparison website offers a wide range of health insurance providers and allows you to filter your search based on your needs and budget.

- iSelect: iSelect is another reputable comparison platform that provides comprehensive information about different health insurance policies and helps you find the best deal.

- Canstar: Canstar offers detailed reviews and ratings of health insurance providers, allowing you to make an informed decision based on customer satisfaction and performance.

Benefits of Using Health Insurance Comparison Tools

Using health insurance comparison tools offers several advantages, including:

- Saves Time and Effort: Instead of contacting multiple providers individually, comparison tools allow you to gather information from various providers in one place.

- Provides Comprehensive Information: These tools offer detailed information about each plan, including premiums, benefits, and exclusions, helping you make an informed decision.

- Identifies the Best Deals: By comparing quotes from multiple providers, you can easily identify the most affordable options that meet your needs.

Government-Funded Health Insurance Programs

The Australian government provides several health insurance programs to assist individuals and families with accessing healthcare services.

- Medicare: Medicare is Australia’s universal healthcare system, providing essential medical services to all Australian citizens and permanent residents. While it doesn’t cover all healthcare costs, it significantly reduces out-of-pocket expenses for essential medical treatments.

- Private Health Insurance Rebates: The government offers rebates to individuals who choose private health insurance, helping to offset the cost of premiums. The amount of the rebate depends on your age, income, and the level of cover you choose.

Conclusion

Choosing the right health insurance is a crucial decision, and finding the cheapest option shouldn’t come at the expense of adequate coverage. Remember to assess your individual health needs and risks, consider pre-existing conditions, and ensure the provider network and accessibility of services meet your requirements. By utilizing resources and tools for comparing quotes and exploring government-funded programs, you can make an informed choice that aligns with your budget and healthcare needs.

Popular Questions

What are the different types of health insurance policies available in Australia?

Australia offers various health insurance policies, including hospital cover, extras cover, and combined policies that include both. Hospital cover provides coverage for hospital stays, surgeries, and other related expenses. Extras cover provides coverage for a range of services, such as dental, physiotherapy, and optical. Combined policies offer a combination of hospital and extras cover.

How do I know if I need private health insurance?

Whether you need private health insurance depends on your individual circumstances and healthcare needs. If you’re concerned about long wait times for public healthcare services, require specialized treatment, or prefer access to private hospitals and specialists, private health insurance can be beneficial. However, if you’re generally healthy and have a low risk of needing extensive medical care, you may not require private health insurance.

What are the government subsidies and rebates available for health insurance?

The Australian government provides subsidies and rebates to help individuals and families afford private health insurance. These subsidies are based on your age, income, and the type of policy you choose. You can apply for these subsidies through the Australian Taxation Office (ATO).