Australian insurance companies in the Philippines have steadily gained traction, carving a significant niche in the country’s insurance market. This presence is driven by a confluence of factors, including the Philippines’ robust economic growth, a burgeoning middle class, and a growing awareness of the importance of insurance.

The arrival of Australian insurance companies in the Philippines has been marked by a strategic approach, focusing on offering a diverse range of insurance products tailored to the unique needs of Filipino consumers. These products cover areas such as life insurance, health insurance, and property insurance, catering to a wide spectrum of individuals and businesses.

Introduction to Australian Insurance Companies in the Philippines

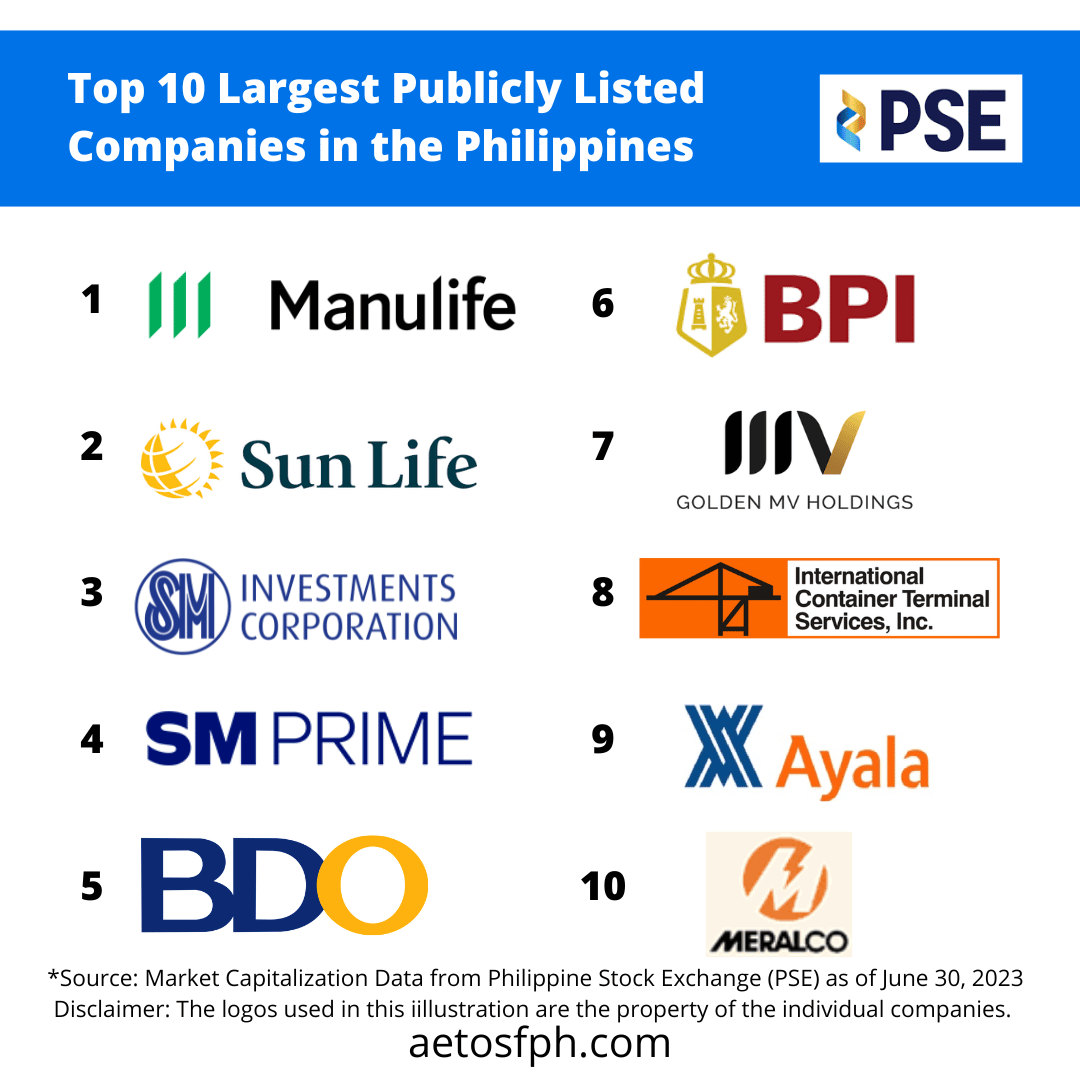

The Philippine insurance market is a vibrant and growing sector, characterized by a diverse range of insurance products and services catering to a wide customer base. Australian insurance companies have established a significant presence in the Philippines, contributing to the market’s dynamism and innovation.

The presence of Australian insurance companies in the Philippines reflects a long-standing relationship between the two countries. Australian insurance companies have been operating in the Philippines for decades, driven by the country’s economic growth and the increasing demand for insurance products and services.

Historical Context of Australian Insurance Companies in the Philippines

Australian insurance companies entered the Philippine market primarily through acquisitions and joint ventures with local insurance companies. These partnerships facilitated market access and enabled Australian companies to leverage local expertise and market knowledge.

The entry of Australian insurance companies into the Philippines was further driven by the country’s economic liberalization policies in the 1990s, which encouraged foreign investment and competition in the insurance sector. This led to a significant increase in the number of foreign insurance companies operating in the Philippines, including Australian players.

Australian insurance companies have brought a wealth of experience and expertise to the Philippine market, contributing to the development of innovative insurance products and services.

Key Players and Their Services

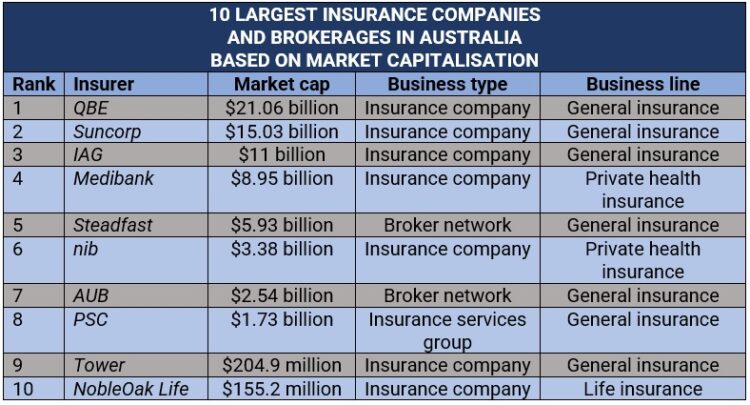

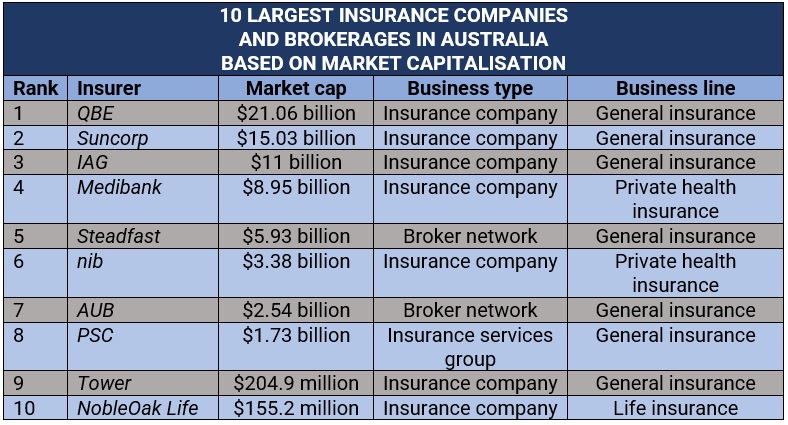

The Australian insurance industry has a strong presence in the Philippines, with several major players offering a wide range of products and services. These companies are known for their financial stability, global reach, and commitment to customer satisfaction.

Major Australian Insurance Companies in the Philippines

Australian insurance companies have established a strong foothold in the Philippine market, offering a diverse range of products and services to meet the needs of individuals and businesses. Here are some of the key players:

| Company Name | Services Offered | Key Features |

|---|---|---|

| AIA Philippines | Life insurance, health insurance, savings and investment products | Strong financial backing, extensive network of agents, innovative products and services |

| Sun Life Philippines | Life insurance, health insurance, retirement planning, savings and investment products | Long history in the Philippines, wide range of products and services, strong customer service reputation |

| Manulife Philippines | Life insurance, health insurance, savings and investment products, retirement planning | Global financial strength, comprehensive product offerings, focus on customer experience |

| AXA Philippines | Life insurance, health insurance, savings and investment products, general insurance | Global insurance leader, innovative product offerings, strong financial stability |

| Allianz PNB Life | Life insurance, health insurance, savings and investment products, retirement planning | Joint venture between Allianz and PNB, strong financial backing, focus on customer needs |

Regulatory Landscape and Market Dynamics

The Philippine insurance industry operates within a robust regulatory framework designed to protect policyholders and ensure the financial stability of insurers. The Insurance Commission (IC), an independent regulatory body, oversees the industry, setting standards and enforcing compliance. This regulatory landscape, coupled with market dynamics, influences the growth and development of Australian insurance companies in the Philippines.

Regulatory Framework

The regulatory framework governing insurance companies in the Philippines is comprehensive, encompassing various laws, rules, and regulations. The Insurance Code of the Philippines (IC), enacted in 1978, serves as the primary legislation governing the insurance industry. This code defines the legal framework for insurance companies, outlining their operations, licensing requirements, and financial reporting obligations.

The IC is enforced by the Insurance Commission (IC), which acts as the industry’s regulator. The IC plays a crucial role in ensuring the financial stability of insurance companies, protecting policyholders, and promoting fair competition. The IC’s powers include:

- Issuing licenses to insurance companies

- Setting minimum capital requirements

- Supervising the financial solvency of insurers

- Regulating insurance products and rates

- Enforcing consumer protection laws

- Investigating and resolving insurance claims disputes

In addition to the IC, other relevant regulations include the following:

- The Securities Regulation Code, which governs the issuance of insurance securities

- The Anti-Money Laundering Act, which requires insurance companies to comply with anti-money laundering regulations

- The Consumer Act of the Philippines, which protects consumer rights in the insurance industry

Competitive Landscape

The Philippine insurance industry is characterized by a high level of competition, with both domestic and foreign insurers vying for market share. The industry is dominated by a few large, established players, but there is also a significant number of smaller, niche insurers. The competitive landscape is influenced by several factors, including:

- Market Size and Growth: The Philippines has a large and growing population, with a rising middle class, which presents significant growth opportunities for the insurance industry. This growing demand for insurance products creates a competitive environment, as insurers strive to attract and retain customers.

- Product Innovation: Insurance companies are constantly innovating and introducing new products to meet the evolving needs of consumers. This includes developing products tailored to specific segments of the population, such as microinsurance for low-income earners or health insurance for seniors.

- Distribution Channels: Insurance companies are leveraging various distribution channels to reach their target markets, including traditional channels like agents and brokers, as well as digital channels like online platforms and mobile apps.

- Pricing Strategies: Insurers employ different pricing strategies to attract customers, including competitive pricing, value-added services, and discounts. The competitive pressure on pricing is intense, particularly in the non-life insurance segment.

- Brand Recognition and Reputation: Strong brand recognition and a positive reputation are crucial for insurance companies to gain customer trust and loyalty. This is particularly important in a market with a high level of competition.

Factors Influencing Growth of Australian Insurance Companies, Australian insurance companies in the philippines

Australian insurance companies have been increasingly active in the Philippine market, attracted by the country’s economic growth and the potential for market expansion. The following factors have influenced the growth of Australian insurance companies in the Philippines:

- Strong Regulatory Environment: The Philippines has a stable and transparent regulatory environment, which provides a conducive framework for foreign investment. The IC’s commitment to promoting a fair and competitive market encourages Australian insurers to enter the market.

- Economic Growth and Development: The Philippine economy has been experiencing steady growth in recent years, driven by factors such as a young and growing population, increasing urbanization, and rising consumer spending. This economic growth translates into increased demand for insurance products, creating opportunities for Australian insurers.

- Market Access and Expansion: Australian insurance companies are leveraging their expertise and experience in developing and managing insurance products to expand their presence in the Philippine market. They are seeking to tap into the country’s large and growing population, particularly the middle class, which is increasingly seeking insurance protection.

- Technological Advancements: Australian insurers are embracing technology to improve their operations and enhance customer service. They are using digital platforms and mobile apps to offer online insurance quotes, streamline claims processing, and provide 24/7 customer support.

- Strategic Partnerships: Australian insurers are forming strategic partnerships with local companies to gain access to the Philippine market and leverage local expertise. These partnerships can help them navigate the regulatory environment, understand local customer needs, and build brand recognition.

Impact and Benefits for Filipino Consumers

The entry of Australian insurance companies into the Philippine market has brought both advantages and disadvantages for Filipino consumers. It has introduced new options, innovative products, and a different approach to insurance, but it also presents challenges in terms of understanding the complexities of these new offerings.

Advantages and Disadvantages of Using Australian Insurance Companies

The arrival of Australian insurance companies in the Philippines has brought about several advantages for Filipino consumers, but it also presents some challenges.

- Greater Choice and Competition: The presence of Australian insurance companies increases competition in the market, giving Filipino consumers a wider range of insurance products and services to choose from. This competition can drive down prices and improve the quality of services offered.

- Innovative Products and Services: Australian insurance companies often bring innovative products and services to the Philippine market. These products can be tailored to the specific needs of Filipino consumers, providing them with more comprehensive coverage and benefits.

- Stronger Financial Stability: Australian insurance companies are generally known for their financial stability and strong regulatory oversight. This can provide Filipino consumers with greater confidence in the security of their insurance policies.

- Potential for Higher Claims Payments: While this is not always guaranteed, some consumers believe that Australian insurance companies might be more likely to pay claims fairly and promptly, compared to some local insurance companies.

- Language and Cultural Differences: Communication barriers can arise due to language and cultural differences. This can make it challenging for Filipino consumers to understand the terms and conditions of insurance policies or to communicate effectively with insurance agents.

- Limited Local Presence: Some Australian insurance companies might have limited physical presence in the Philippines, making it difficult for consumers to access their services or file claims in person.

- Potential for Higher Premiums: Some Australian insurance companies might charge higher premiums than local insurance companies, especially for certain types of insurance policies.

- Lack of Familiarity with the Philippine Market: Some Australian insurance companies might lack a deep understanding of the specific needs and risks of the Philippine market, potentially leading to products and services that are not fully tailored to local conditions.

Role in Promoting Financial Inclusion and Access to Insurance

Australian insurance companies have played a significant role in promoting financial inclusion and access to insurance in the Philippines. They have introduced new products and services that cater to the specific needs of underserved segments of the population, such as microinsurance products for low-income earners and digital insurance platforms that make it easier for people to access insurance services online.

“The entry of Australian insurance companies has brought about greater competition and innovation in the Philippine insurance market. This has resulted in a wider range of products and services, including microinsurance and digital insurance solutions, which have made insurance more accessible to Filipinos.”

Customer Experience and Satisfaction Levels

Customer satisfaction with Australian insurance companies in the Philippines is generally positive, with many consumers praising their customer service, claims processing efficiency, and innovative products. However, some consumers have reported challenges with communication and accessibility, particularly with companies that have limited physical presence in the country.

- Positive Customer Experiences: Many Filipino consumers have reported positive experiences with Australian insurance companies, highlighting their efficient claims processing, responsive customer service, and innovative product offerings.

- Challenges with Communication and Accessibility: Some consumers have expressed challenges with communication and accessibility, particularly with companies that have limited physical presence in the Philippines.

- Importance of Clear Communication and Local Presence: Australian insurance companies need to prioritize clear communication and local presence to ensure that Filipino consumers have a positive and seamless experience.

Future Trends and Prospects: Australian Insurance Companies In The Philippines

The Philippine insurance market is poised for significant growth in the coming years, driven by factors such as rising affluence, increasing awareness of insurance products, and the government’s push for financial inclusion. This presents both opportunities and challenges for Australian insurance companies looking to expand their presence in the country.

Opportunities for Australian Insurance Companies

The increasing demand for insurance products in the Philippines presents significant opportunities for Australian insurance companies. The country’s growing middle class, coupled with rising disposable incomes, is driving demand for a wide range of insurance products, including life insurance, health insurance, and property insurance. Australian insurance companies can leverage their expertise and experience in these areas to cater to the evolving needs of Filipino consumers.

- Strong Reputation: Australian insurance companies have a strong reputation for financial stability and product innovation, which can be leveraged to build trust and confidence among Filipino consumers.

- Technological Advancement: Australian insurance companies are at the forefront of technological advancements in the insurance industry, such as digital insurance platforms and data analytics. These technologies can be used to enhance customer experience and improve efficiency in the Philippine market.

- Specialized Products: Australian insurance companies can offer specialized products that are not readily available in the Philippines, such as travel insurance, pet insurance, and cyber insurance. These products cater to the emerging needs of a growing and more sophisticated consumer base.

Challenges for Australian Insurance Companies

While the Philippine insurance market presents numerous opportunities, Australian insurance companies also face certain challenges.

- Competition: The Philippine insurance market is highly competitive, with a large number of domestic and international players. Australian insurance companies need to differentiate themselves to attract and retain customers.

- Regulatory Environment: The Philippine insurance industry is subject to a complex regulatory environment. Australian insurance companies need to navigate these regulations effectively to ensure compliance and operate smoothly in the market.

- Cultural Differences: Australian insurance companies need to understand the cultural nuances of the Philippine market to tailor their products and services to local preferences.

Long-Term Prospects

The long-term prospects for Australian insurance companies in the Philippines are positive. The country’s economic growth, rising middle class, and increasing insurance penetration are all factors that favor the growth of the insurance industry. Australian insurance companies that can effectively navigate the challenges and leverage the opportunities in the market are well-positioned to achieve success in the long run.

Closing Summary

The impact of Australian insurance companies in the Philippines is undeniable. Their entry has introduced innovative products, enhanced competition, and contributed to greater financial inclusion. As the Philippine insurance market continues to evolve, Australian companies are poised to play an even more prominent role, shaping the future of insurance in the country.

Expert Answers

What are the main advantages of using Australian insurance companies in the Philippines?

Australian insurance companies often bring a reputation for financial stability, strong regulatory oversight, and a focus on customer service. They also offer a wide range of products and services, including innovative solutions tailored to the Philippine market.

Are Australian insurance companies regulated in the Philippines?

Yes, all insurance companies operating in the Philippines, including Australian companies, are regulated by the Insurance Commission (IC) of the Philippines. The IC ensures that these companies meet specific financial and operational standards.

How can I find an Australian insurance company in the Philippines?

You can easily find information about Australian insurance companies operating in the Philippines online. Many of these companies have dedicated websites and local offices where you can inquire about their products and services.