Average life insurance policy in Australia, a vital financial tool for many, provides financial security for loved ones in the event of unexpected circumstances. Understanding the different types, costs, and factors influencing premiums is crucial for making informed decisions. This guide will delve into the intricacies of life insurance in Australia, equipping you with the knowledge to navigate this complex landscape.

Life insurance in Australia encompasses various types, each tailored to specific needs and financial situations. Term life insurance, whole life insurance, and other options offer different coverage periods, premiums, and benefits. By comparing these options and understanding their key features, individuals can choose a policy that aligns with their financial goals and personal circumstances.

Understanding Life Insurance in Australia: Average Life Insurance Policy In Australia

Life insurance in Australia provides financial protection to your loved ones in case of your unexpected death or critical illness. Choosing the right life insurance policy can be challenging, given the variety of options available. This guide aims to clarify the different types of life insurance policies in Australia and their key features, empowering you to make an informed decision.

Types of Life Insurance Policies

Life insurance policies in Australia are broadly categorized into two main types: term life insurance and permanent life insurance. These policies differ significantly in their coverage duration, premium structure, and benefits.

- Term life insurance offers coverage for a specific period, typically ranging from 10 to 30 years. It provides a death benefit payout if you pass away during the policy term. Term life insurance premiums are generally lower than permanent life insurance due to the limited coverage period.

- Permanent life insurance provides lifelong coverage, meaning the policy remains in effect as long as you pay the premiums. Unlike term life insurance, permanent life insurance policies build up cash value that you can borrow against or withdraw. These policies usually come with higher premiums compared to term life insurance.

Term Life Insurance

Term life insurance is a cost-effective option for individuals seeking temporary coverage. It is suitable for situations where you need financial protection for a specific period, such as during a mortgage repayment or while raising young children.

- Coverage duration: Term life insurance policies typically offer coverage for a fixed period, ranging from 10 to 30 years. After the policy term expires, you can renew it for another term, subject to the insurer’s approval and health conditions.

- Premium structure: Premiums for term life insurance are generally lower than permanent life insurance due to the limited coverage period. The premiums remain fixed for the policy term, providing predictable financial planning.

- Death benefit: Term life insurance policies pay a death benefit to your beneficiaries if you pass away during the policy term. The death benefit amount is typically a lump sum, which can be used to cover expenses such as funeral costs, mortgage payments, or income replacement.

- No cash value: Term life insurance policies do not accumulate cash value. This means you cannot borrow against or withdraw from the policy, unlike permanent life insurance.

Whole Life Insurance

Whole life insurance provides lifelong coverage and accumulates cash value, offering a combination of financial protection and investment.

- Lifelong coverage: Whole life insurance policies provide coverage for your entire lifetime, as long as you pay the premiums. This ensures that your beneficiaries receive a death benefit regardless of when you pass away.

- Cash value accumulation: A portion of your premium payments is invested in a cash value account that grows over time. This cash value can be borrowed against or withdrawn, providing access to funds for various needs.

- Higher premiums: Whole life insurance policies typically have higher premiums compared to term life insurance due to the lifelong coverage and cash value accumulation features.

- Guaranteed death benefit: Whole life insurance policies typically offer a guaranteed death benefit, ensuring that your beneficiaries receive a predetermined amount regardless of market fluctuations.

Other Life Insurance Options

In addition to term life and whole life insurance, other life insurance options are available in Australia, catering to specific needs and preferences.

- Group life insurance: This type of insurance is offered through employers or organizations, providing coverage to members of a group. Group life insurance policies typically have lower premiums compared to individual policies.

- Accidental death and dismemberment (AD&D) insurance: This type of insurance provides a death benefit or dismemberment benefit if you die or suffer a specific loss of limb or function due to an accident. AD&D insurance is often offered as an add-on to other life insurance policies.

- Critical illness insurance: This type of insurance provides a lump sum payment if you are diagnosed with a critical illness, such as cancer, heart attack, or stroke. It can help cover medical expenses, income replacement, and other financial needs during a difficult time.

- Income protection insurance: This type of insurance provides a regular income stream if you are unable to work due to illness or injury. Income protection insurance can help replace lost wages and maintain your financial stability during a period of disability.

Key Components of an Average Life Insurance Policy

Life insurance policies in Australia come in various forms, each with its own set of features and benefits. Understanding the key components of an average life insurance policy can help you make an informed decision about the right coverage for your needs.

Average Coverage Amount, Average life insurance policy in australia

The average life insurance coverage amount in Australia can vary greatly depending on factors such as age, income, and family circumstances. However, a common benchmark for life insurance coverage is typically around 10 to 15 times an individual’s annual income. This amount is generally considered sufficient to cover outstanding debts, funeral expenses, and provide financial support for dependents in the event of the policyholder’s death.

Factors Influencing Policy Cost

Several factors influence the cost of a life insurance policy in Australia. These include:

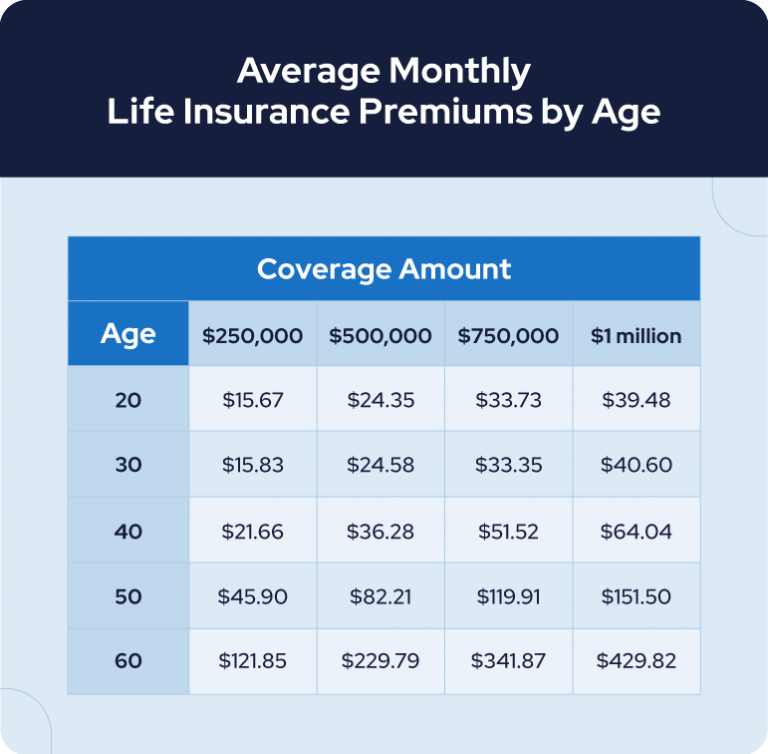

- Age: Younger individuals generally pay lower premiums than older individuals as they have a lower risk of death.

- Health: Individuals with pre-existing medical conditions may face higher premiums due to an increased risk of mortality.

- Lifestyle: Engaging in risky activities, such as smoking or extreme sports, can also increase the cost of a policy.

- Coverage Amount: The higher the coverage amount, the higher the premium.

- Policy Term: The longer the policy term, the higher the premium.

Determining Appropriate Coverage Amount

Determining the appropriate coverage amount is a crucial step in securing the right life insurance policy. Several factors should be considered, including:

- Outstanding Debts: This includes mortgages, loans, and credit card debt.

- Dependents’ Financial Needs: Consider the financial needs of your dependents, such as income replacement, education expenses, and living expenses.

- Funeral Expenses: Funeral costs can be significant and should be factored into your coverage amount.

- Future Financial Goals: If you have any future financial goals, such as retirement savings or investing, these should also be considered when determining coverage.

Factors Influencing Premiums

Life insurance premiums are not fixed; they vary based on several factors that insurers consider to assess the risk associated with insuring you. Understanding these factors can help you make informed decisions about your policy and potentially save money.

Impact of Age, Health, Lifestyle, and Occupation

Your age, health, lifestyle, and occupation are key factors that influence your life insurance premiums.

- Age: Younger individuals generally have lower premiums than older individuals because they are statistically less likely to die prematurely. As you age, the risk of mortality increases, leading to higher premiums.

- Health: Your health history and current health status play a significant role in determining your premium. Individuals with pre-existing conditions or a family history of certain diseases may face higher premiums. Conversely, those with excellent health may qualify for lower premiums.

- Lifestyle: Lifestyle choices such as smoking, excessive alcohol consumption, and risky hobbies can impact your premiums. Insurers may consider these factors as they increase your risk of premature death.

- Occupation: Certain occupations are considered more dangerous than others. For example, construction workers or firefighters may face higher premiums due to the inherent risks associated with their jobs.

Premium Rates Comparison Across Providers

Life insurance premiums can vary significantly between different insurance providers in Australia. It is essential to compare quotes from multiple providers to find the best deal.

- Online Comparison Tools: Several online comparison tools allow you to enter your details and receive quotes from various insurers simultaneously. This can save you time and effort in comparing premiums.

- Financial Advisors: Seeking advice from a financial advisor can be beneficial. They can help you understand your insurance needs and recommend suitable providers based on your circumstances.

- Direct Insurers: Direct insurers often offer competitive premiums as they have lower operational costs compared to traditional insurers. However, it’s essential to research their financial stability and customer service reputation.

Benefits of Adding Riders or Optional Coverages

Adding riders or optional coverages to your life insurance policy can provide additional protection and benefits.

- Total and Permanent Disability (TPD) Cover: This rider provides financial support if you become permanently disabled and unable to work.

- Trauma Cover: This rider offers a lump sum payment if you are diagnosed with a serious illness or suffer a critical injury.

- Income Protection: This rider provides a regular income stream if you are unable to work due to illness or injury.

Choosing the Right Policy

Finding the right life insurance policy can feel overwhelming, but it’s a crucial step in securing your loved ones’ financial future. The best policy for you will depend on your individual needs, circumstances, and budget.

Key Factors to Consider When Comparing Policies

It’s essential to carefully compare different policies before making a decision. Here are some key factors to consider:

- Type of Coverage: Life insurance policies come in various types, each offering different benefits and features. Consider your specific needs and choose the policy that best aligns with them. For example, term life insurance provides coverage for a specific period, while permanent life insurance offers lifelong coverage.

- Coverage Amount: Determine the appropriate amount of coverage you need based on your financial obligations, dependents, and desired level of protection. It’s advisable to calculate your financial needs, considering factors like mortgage, outstanding debts, and living expenses for your family.

- Premiums: Premiums are the regular payments you make for your life insurance policy. Compare the premiums of different policies to find one that fits your budget. Consider factors like age, health, lifestyle, and coverage amount, as these influence premium rates.

- Policy Features: Explore the different features offered by policies, such as riders, exclusions, and waiting periods. Some policies may include additional benefits like accidental death coverage or critical illness cover. Understand the implications of these features before making a decision.

- Financial Strength of the Insurer: It’s important to choose a reputable and financially stable insurance company. Research the insurer’s financial ratings and track record to ensure they can fulfill their obligations in the event of a claim.

- Customer Service: Consider the insurer’s reputation for customer service and responsiveness. Look for companies that offer clear communication, easy claim processing, and helpful support.

Understanding Policy Terms and Conditions

Before signing up for a life insurance policy, it’s crucial to thoroughly understand the terms and conditions. These documents Artikel the details of the policy, including coverage, exclusions, and limitations. Some key aspects to pay attention to include:

- Waiting Period: This is the period after you purchase the policy before coverage becomes fully effective. It’s essential to understand the waiting period to ensure you are adequately protected from the start.

- Exclusions: These are specific situations or events that are not covered by the policy. It’s crucial to be aware of any exclusions to avoid potential issues when claiming benefits.

- Claim Process: Understand the process for filing a claim and the documentation required. It’s also helpful to know the typical time frame for claim processing.

- Policy Renewals: If you choose a term life insurance policy, it will expire after a specific period. Understand the renewal process and potential premium increases when renewing your policy.

The Role of Financial Advisers

Navigating the complex world of life insurance can be daunting, especially with the multitude of options and technical jargon. This is where financial advisers play a crucial role. They act as your guide, helping you understand your insurance needs and choose a policy that aligns with your financial goals and circumstances.

Benefits of Seeking Professional Advice

Seeking professional advice from a financial adviser offers numerous benefits when making life insurance decisions. Here are some key advantages:

- Personalized Guidance: Financial advisers take the time to understand your individual circumstances, including your financial situation, family structure, and risk tolerance. This allows them to tailor their recommendations to your specific needs, ensuring you get the right coverage and features.

- Objective Perspective: They provide an unbiased perspective, helping you avoid emotional decisions or biases that can lead to an unsuitable policy.

- Expert Knowledge: Financial advisers have extensive knowledge of the life insurance market, including different types of policies, providers, and the latest industry trends. They can navigate the complexities of the market and guide you towards the most suitable options.

- Cost Savings: By leveraging their expertise, financial advisers can help you find policies that offer the best value for money. They can negotiate with insurers on your behalf and ensure you are not overpaying for coverage.

- Long-Term Planning: Financial advisers can assist with long-term planning, ensuring your life insurance policy remains relevant and effective as your circumstances change. They can review your policy regularly and recommend adjustments as needed.

Finding a Qualified and Reputable Financial Adviser

Finding a qualified and reputable financial adviser is crucial to ensure you receive the best possible advice. Here are some tips for finding a suitable professional:

- Seek Recommendations: Ask friends, family, or colleagues for recommendations. Word-of-mouth referrals can be a reliable way to find a trusted adviser.

- Check Credentials: Verify the adviser’s qualifications and licenses. Look for certifications like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) to ensure they have the necessary expertise.

- Research Experience: Assess the adviser’s experience in the life insurance industry. Look for professionals with a proven track record and a deep understanding of the market.

- Consider Fees: Understand the adviser’s fee structure before engaging their services. Some advisers charge a flat fee, while others work on a commission basis. Ensure you are comfortable with the fee arrangement.

- Schedule a Consultation: Meet with several potential advisers before making a decision. This allows you to compare their approach, expertise, and communication style to find the best fit for your needs.

Summary

Navigating the world of life insurance can be overwhelming, but armed with the right information, choosing the right policy becomes achievable. By considering factors like age, health, lifestyle, and occupation, individuals can determine the appropriate coverage amount and secure their financial future. Remember to seek professional advice from a qualified financial adviser to ensure your chosen policy meets your specific needs and goals.

Questions and Answers

What is the average life insurance premium in Australia?

The average life insurance premium in Australia varies depending on factors such as age, health, coverage amount, and policy type. It’s recommended to obtain quotes from multiple insurers to compare premiums.

How long does it take to get approved for a life insurance policy?

The approval process for life insurance can take anywhere from a few days to a few weeks, depending on the insurer and the complexity of the application.

What are the common exclusions in life insurance policies?

Common exclusions in life insurance policies may include pre-existing conditions, high-risk activities, and suicide within a specified period.