- Understanding Australian Health Insurance Landscape

- Key Considerations for Choosing a Provider

- Top Health Insurance Providers in Australia

- Understanding Coverage and Benefits

- Customer Service and Claims Process

- Additional Tips for Choosing a Provider

- Closing Notes: Best Health Insurance Provider In Australia

- Top FAQs

Finding the best health insurance provider in Australia can be a daunting task, given the vast array of options and intricate details involved. Navigating the complex landscape of Australian health insurance requires careful consideration of factors like coverage, premiums, and customer service.

This comprehensive guide aims to equip you with the knowledge and tools to make an informed decision, exploring key considerations for choosing a provider, comparing top contenders, and understanding the intricacies of coverage and benefits. We’ll delve into the essential features to look for, the importance of understanding policy exclusions and limitations, and how to navigate the claims process efficiently.

Understanding Australian Health Insurance Landscape

Navigating the Australian health insurance system can feel overwhelming, with various plans, premiums, and government schemes. Understanding the key aspects of this landscape is crucial for making informed decisions about your health coverage.

Types of Health Insurance Plans

Australian private health insurance plans offer different levels of coverage, catering to individual needs and budgets. These plans are categorized into various levels, each with its own set of benefits and exclusions.

- Hospital Cover: This is the most basic level of health insurance, providing coverage for hospital treatment, including surgeries, accommodation, and medical expenses. It doesn’t cover outpatient services or other medical expenses.

- Ancillary Cover: This type of coverage extends beyond hospital treatment, including benefits for services like dental, optical, physiotherapy, and mental health. It can be purchased as a separate policy or bundled with hospital cover.

- Combined Hospital and Ancillary Cover: This comprehensive option combines both hospital and ancillary cover, offering a wider range of benefits and potential cost savings.

Factors Influencing Health Insurance Premiums

Several factors influence the cost of health insurance premiums in Australia, making it essential to understand these factors when comparing plans and choosing the best fit for your needs.

- Age: Premiums generally increase with age as older individuals tend to have higher healthcare needs.

- Location: Premiums can vary based on your location, reflecting differences in healthcare costs and utilization patterns across different regions.

- Health Status: Pre-existing conditions can affect premiums, with higher premiums potentially charged for individuals with specific health concerns.

- Level of Cover: The level of coverage you choose directly impacts your premium, with comprehensive plans generally costing more than basic options.

- Lifestyle Factors: Lifestyle factors, such as smoking or engaging in risky activities, can influence premium calculations, with higher premiums potentially charged for individuals with higher-risk profiles.

Australian Government’s Role in Health Insurance, Best health insurance provider in australia

The Australian government plays a significant role in the health insurance landscape, aiming to ensure affordable and accessible healthcare for all citizens. The government provides subsidies to private health insurance providers, making premiums more affordable for many individuals. Additionally, the government operates Medicare, a universal healthcare system that provides essential healthcare services free of charge at the point of service.

Key Considerations for Choosing a Provider

Choosing the right health insurance provider in Australia can significantly impact your financial well-being and access to healthcare. It’s crucial to consider various factors beyond just the premium cost to ensure you’re making an informed decision.

Understanding Your Needs

It’s essential to evaluate your individual healthcare requirements before comparing different providers. Consider your current health status, family history, lifestyle, and any potential future health needs. For instance, if you’re prone to certain conditions, you might prioritize providers with comprehensive coverage for those specific areas.

Comparing Providers and Coverage Options

Once you’ve assessed your needs, you can start comparing different providers and their coverage options.

- Premium Costs: Premiums can vary significantly between providers, so it’s important to compare quotes from multiple insurers. Consider factors like your age, location, and chosen level of cover.

- Coverage Levels: Health insurance policies come in different levels of coverage, ranging from basic to comprehensive. Higher levels of cover generally come with higher premiums but offer more extensive benefits.

- Exclusions and Limitations: Carefully review the policy documents to understand any exclusions or limitations on coverage. Some policies may exclude pre-existing conditions, certain treatments, or specific types of hospitals.

- Waiting Periods: Many policies have waiting periods before certain benefits become active. It’s essential to be aware of these waiting periods and factor them into your decision.

- Hospital Networks: Some providers have preferred hospital networks. Check if your preferred hospitals are included in the provider’s network before making a decision.

- Extras Cover: Extras cover offers benefits for non-hospital related healthcare services like dental, physiotherapy, and optical. Compare the extras packages offered by different providers to find the best fit for your needs.

- Customer Service and Claims Process: Research the provider’s reputation for customer service and the ease of filing claims. You can check online reviews or contact the provider directly to inquire about their claims process.

Understanding Policy Exclusions and Limitations

Understanding the exclusions and limitations of a health insurance policy is crucial to avoid surprises later. Some common exclusions may include:

- Pre-existing Conditions: Some policies may exclude coverage for conditions you had before taking out the policy.

- Experimental Treatments: Policies may not cover experimental treatments or procedures that are not widely accepted by the medical community.

- Cosmetic Procedures: Most policies do not cover cosmetic procedures unless they are medically necessary.

- Specific Hospitals or Doctors: Some policies may limit coverage to specific hospitals or doctors within their network.

Top Health Insurance Providers in Australia

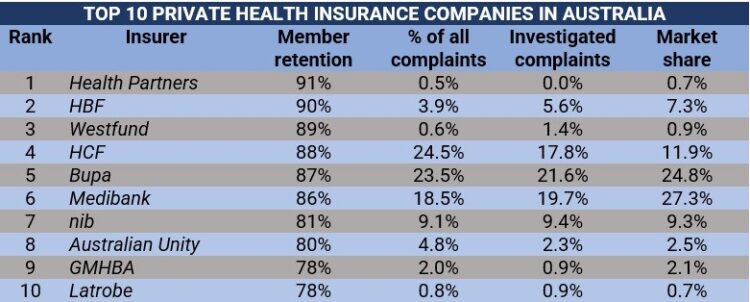

Choosing the right health insurance provider can be overwhelming, with numerous options available. To help you navigate this process, we’ve compiled a comprehensive comparison of the top five providers in Australia, focusing on crucial factors like coverage, premiums, and customer service. This information will empower you to make an informed decision that aligns with your individual needs and budget.

Comparison of Top Health Insurance Providers

| Provider | Coverage | Premiums | Customer Service |

|---|---|---|---|

| Medibank | Comprehensive coverage with various options, including extras. | Competitive premiums with potential discounts for families and groups. | Excellent customer service with 24/7 support and online resources. |

| Bupa | Wide range of coverage options, including international and travel insurance. | Premiums vary depending on coverage and individual needs. | Highly rated customer service with a focus on personalized care. |

| HCF | Offers a comprehensive range of health insurance products with competitive premiums. | Affordable premiums with various discounts available. | Positive customer service with a strong online presence and dedicated support. |

| NIB | Provides comprehensive health insurance with a focus on value for money. | Competitive premiums with a range of options to suit different budgets. | Excellent customer service with online resources and dedicated support. |

| AIA | Offers a variety of health insurance products with a focus on wellness and preventative care. | Premiums vary depending on coverage and individual needs. | Positive customer service with a strong online presence and dedicated support. |

Strengths and Weaknesses of Top Providers

| Provider | Strengths | Weaknesses |

|---|---|---|

| Medibank | Extensive network of hospitals and specialists, strong online platform, competitive premiums. | Limited extras coverage compared to some competitors, potential for higher premiums for certain plans. |

| Bupa | Wide range of coverage options, excellent customer service, strong focus on preventative care. | Premiums can be higher than some competitors, limited coverage for certain treatments. |

| HCF | Affordable premiums, comprehensive coverage, strong online resources. | Limited network of hospitals and specialists in some areas, less emphasis on extras coverage. |

| NIB | Competitive premiums, value-for-money options, strong customer service. | Limited extras coverage compared to some competitors, potential for higher premiums for certain plans. |

| AIA | Focus on wellness and preventative care, comprehensive coverage, strong online presence. | Premiums can be higher than some competitors, limited network of hospitals and specialists in some areas. |

Factors to Consider When Choosing a Provider

The best health insurance provider for you will depend on your individual needs and preferences. Some key factors to consider include:

- Coverage: What level of coverage do you need? Do you require comprehensive cover or are you looking for a more affordable option with limited extras?

- Premiums: What is your budget? Compare premiums from different providers to find the best value for money.

- Customer service: How important is customer service to you? Consider the provider’s reputation for customer satisfaction and their accessibility.

- Network: Does the provider have a strong network of hospitals and specialists in your area? This is crucial for accessing timely and convenient healthcare.

- Extras: What extras coverage do you need? Some providers offer extensive extras coverage, while others focus on core hospital and medical benefits.

Specific Needs and Preferences

If you are a young and healthy individual with a limited budget, you may prioritize affordability and basic coverage. In this case, HCF or NIB might be good options. However, if you have a family and require comprehensive coverage with extensive extras, Medibank or Bupa might be more suitable. If you are looking for a provider with a strong focus on wellness and preventative care, AIA could be a good choice.

Ultimately, the best health insurance provider for you is the one that best meets your individual needs and budget. By carefully considering your priorities and comparing different providers, you can find the right plan to protect your health and well-being.

Understanding Coverage and Benefits

Choosing the right health insurance policy involves understanding the various benefits and coverage options available. Knowing what’s included and what’s not is crucial to making an informed decision that aligns with your specific needs and budget.

Hospital Cover

Hospital cover is a crucial component of health insurance, providing financial assistance for medical expenses incurred during hospitalization. This cover typically includes:

- Accommodation: This covers the cost of your stay in a public or private hospital room.

- Surgeries: Covers the cost of surgical procedures, including the surgeon’s fees and the use of the operating theatre.

- Medical Devices: This includes the cost of prosthetics, implants, and other medical devices required during your hospital stay.

- Other Services: This may include coverage for physiotherapy, occupational therapy, and other services provided by hospital staff.

The level of hospital cover you choose determines the types of hospitals you can access and the specific procedures covered. Policies often offer different levels of cover, from basic to comprehensive.

Surgical Cover

Surgical cover provides financial assistance for the cost of surgical procedures performed both inside and outside of hospitals. This cover typically includes:

- Surgeon’s Fees: Covers the fees charged by the surgeon performing the procedure.

- Anaesthetist Fees: Covers the fees charged by the anaesthetist administering anaesthesia during the procedure.

- Operating Theatre Fees: Covers the cost of using the operating theatre, including the equipment and staff involved.

- Post-operative Care: May include coverage for some post-operative care, such as physiotherapy or rehabilitation.

Similar to hospital cover, surgical cover is often offered in different levels, each with varying degrees of coverage and benefits.

Ancillary Cover

Ancillary cover encompasses a wide range of benefits that complement hospital and surgical cover. These benefits often include:

- Dental: Provides financial assistance for dental treatments, such as fillings, extractions, and dentures.

- Optical: Covers the cost of eye examinations, glasses, and contact lenses.

- Physiotherapy: Covers the cost of physiotherapy sessions, often limited to a certain number per year.

- Chiropractic: Provides financial assistance for chiropractic treatments, often subject to limitations.

- Psychology: Covers the cost of psychological consultations, often with a specific number of sessions per year.

Ancillary cover is optional and can be tailored to individual needs. It’s important to assess your specific healthcare requirements and choose ancillary benefits that align with your needs and budget.

Customer Service and Claims Process

Navigating the world of health insurance can be a complex experience, especially when you need to make a claim. Having access to excellent customer service and a straightforward claims process can make all the difference in your overall experience. Let’s delve into the importance of customer service and how to effectively navigate the claims process.

Customer Service Excellence in Health Insurance

Customer service plays a crucial role in your health insurance journey. It’s not just about resolving issues but also about building trust and confidence in your provider. When you encounter a problem, a responsive and helpful customer service team can alleviate stress and provide peace of mind.

Here are some examples of excellent customer service in the health insurance industry:

- Prompt Response: Receiving a quick response to your queries, whether through phone, email, or online chat, is essential. Providers with efficient communication channels demonstrate their commitment to customer satisfaction.

- Personalized Support: Health insurance is personal. Providers who understand your individual needs and offer tailored solutions create a more positive experience. This could involve providing personalized advice, explaining complex policies in clear language, or offering additional support based on your specific circumstances.

- Problem Resolution: When you have a claim or need to resolve an issue, a dedicated customer service team should be readily available to assist you. They should actively listen to your concerns, work towards a resolution, and keep you informed throughout the process.

Understanding the Claims Process

Making a claim is a crucial part of the health insurance process. It’s how you access the benefits you’ve paid for. The claims process can vary depending on the provider and the type of claim you’re making. However, understanding the general steps involved can help you navigate the process smoothly.

- Gather Necessary Documentation: This might include medical bills, receipts, or other supporting documents. The specific requirements will be Artikeld by your provider.

- Submit Your Claim: You can usually submit claims online, through a mobile app, or by mail. Ensure you complete all required fields accurately.

- Claim Processing: Your provider will review your claim and process it based on your policy terms. This may involve verifying your coverage and the medical necessity of the services you’re claiming.

- Claim Decision: You’ll receive a decision on your claim, which could be approval, partial approval, or denial. If your claim is denied, you’ll receive an explanation outlining the reasons.

- Payment: If your claim is approved, you’ll receive payment for covered expenses, either directly to you or to the provider. The payment method will depend on your provider and the specific claim.

Claims Processing Speed and Customer Support Responsiveness

While there’s no single “best” provider in terms of claims processing speed, some providers are known for their efficiency.

- Medibank: Medibank has been recognized for its generally quick claims processing times, particularly for routine claims. They also offer online claim submission and tracking, which provides transparency throughout the process.

- Bupa: Bupa has a reputation for providing excellent customer support and a streamlined claims process. They offer various options for submitting claims, including online, through their app, or by phone. They also have a dedicated claims team that can answer your questions and guide you through the process.

- NIB: NIB is another provider that’s often praised for its efficient claims processing. They have a user-friendly online platform that allows you to submit claims and track their progress. They also have a dedicated customer support team that’s available to assist you with any queries or concerns.

It’s important to note that claims processing times can vary based on the complexity of the claim and the specific provider.

Additional Tips for Choosing a Provider

Choosing the right health insurance provider can be a complex process, especially given the wide array of options and coverage variations available in Australia. Beyond the essential factors discussed previously, there are several additional tips to consider to ensure you find a plan that perfectly suits your individual needs and budget.

Personal Health Conditions and Lifestyle Factors

It’s crucial to assess your personal health conditions and lifestyle factors when choosing a health insurance provider. This will help you identify the most relevant coverage and benefits for your specific situation.

- Pre-existing conditions: If you have pre-existing conditions, such as diabetes, asthma, or heart disease, it’s essential to find a provider that offers coverage for these conditions. Some providers may have waiting periods or exclusions for pre-existing conditions, so it’s crucial to thoroughly review the policy details.

- Lifestyle factors: Your lifestyle also plays a significant role in determining your health insurance needs. For example, if you are an active individual who engages in high-risk activities, you may require additional coverage for sports injuries or overseas medical expenses. Similarly, if you have a family history of certain health conditions, you may want to consider a plan with broader coverage.

Negotiating Premiums and Coverage

While it’s essential to choose a provider that offers comprehensive coverage, it’s equally important to ensure you’re getting the best possible value for your money. Here are some tips for negotiating premiums and securing favorable coverage:

- Compare quotes from multiple providers: Before settling on a plan, compare quotes from several reputable providers to ensure you’re getting the most competitive rates. Online comparison tools can be helpful in this process.

- Consider a higher excess: A higher excess (the amount you pay out-of-pocket before your insurance kicks in) can often result in lower premiums. This can be a cost-effective option if you are generally healthy and have a good financial buffer.

- Bundle policies: Some providers offer discounts if you bundle multiple policies, such as health insurance and car insurance. This can be a significant saving, especially if you have multiple insurance needs.

- Negotiate with your provider: Don’t be afraid to negotiate with your provider. If you’ve been a loyal customer for a long time or have a good claims history, you may be able to secure a discount or additional benefits.

Closing Notes: Best Health Insurance Provider In Australia

By understanding the Australian health insurance landscape, carefully considering your individual needs and preferences, and comparing different providers, you can confidently choose the best health insurance provider for your unique circumstances. Remember to prioritize your health, explore your options thoroughly, and make informed decisions to secure the coverage you need for peace of mind.

Top FAQs

What are the main types of health insurance plans in Australia?

Australia offers a variety of health insurance plans, including hospital, extras, and combined plans. Hospital plans cover costs associated with inpatient hospital care, while extras plans cover a range of services like dental, physiotherapy, and optical. Combined plans offer a combination of hospital and extras coverage.

How can I compare different health insurance providers?

You can compare providers using online comparison websites, contacting insurers directly, or seeking advice from a financial advisor. When comparing, focus on factors like coverage, premiums, customer service, and claims process.

What is the difference between a public and private health insurance provider?

Public health insurance, provided by Medicare, is a universal system that offers basic healthcare services. Private health insurance, offered by private companies, provides additional coverage beyond Medicare, such as private hospital care and extras benefits.

What are some common exclusions and limitations in health insurance policies?

Common exclusions include pre-existing conditions, cosmetic procedures, and certain treatments. Limitations may apply to the number of visits or treatments covered per year.