- Understanding Private Health Insurance in Australia

- Key Features of Private Health Insurance Plans

- Factors Influencing Plan Choice: Best Private Health Insurance Plans In Australia

- Top Private Health Insurance Providers

- Choosing the Right Plan

- Frequently Asked Questions

- Conclusive Thoughts

- Essential Questionnaire

Best private health insurance plans in Australia are essential for navigating the complex healthcare system. With a wide range of options available, finding the right plan can be daunting. This comprehensive guide delves into the intricacies of private health insurance, providing valuable insights to help you make informed decisions.

Understanding the different types of coverage, benefits, and factors influencing plan choice is crucial. From hospital cover to extras, we explore the key features of private health insurance plans, highlighting the importance of considering individual needs and circumstances.

Understanding Private Health Insurance in Australia

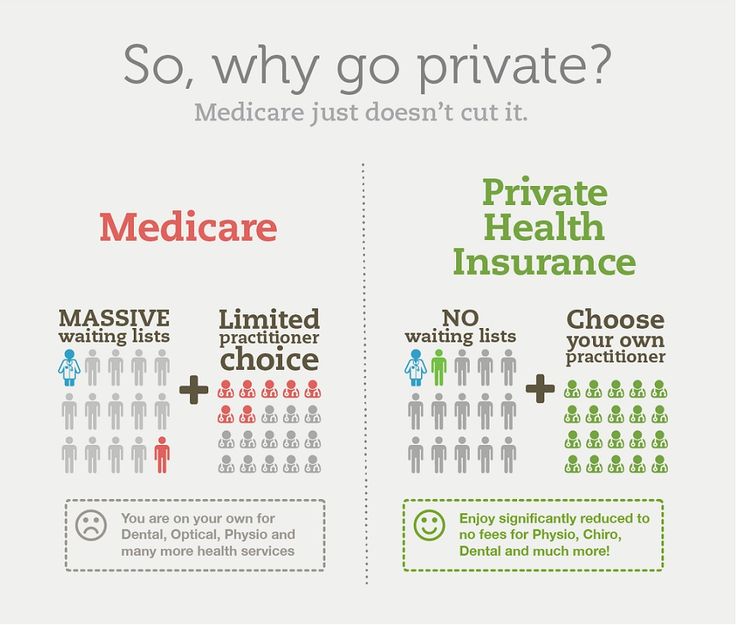

Private health insurance is a vital component of the Australian healthcare system, offering individuals and families access to a wider range of medical services and benefits beyond those provided by Medicare, the public healthcare system. It provides supplementary coverage for medical expenses, allowing individuals to choose their preferred doctors and hospitals, potentially reducing waiting times for elective procedures.

Types of Private Health Insurance

Private health insurance plans in Australia are categorized into different types, each offering a specific range of coverage and benefits. These categories help individuals choose a plan that aligns with their individual needs and budget.

- Hospital Cover: This type of coverage provides financial assistance for hospital stays, including surgery, accommodation, and other related medical expenses. Hospital cover is further divided into levels, with higher levels offering greater coverage for private hospitals and a wider range of procedures.

- Extras Cover: Extras cover provides financial assistance for a range of medical expenses not covered by Medicare, including dental, optical, physiotherapy, and alternative therapies. Extras cover plans can be customized to suit individual needs and preferences, with different levels of coverage available.

- Combined Hospital and Extras Cover: This is the most comprehensive type of private health insurance, combining hospital cover with extras cover. This option provides a complete package of benefits, offering coverage for a wide range of medical expenses.

Benefits of Private Health Insurance

Private health insurance offers numerous benefits, making it an attractive option for many Australians. These benefits include:

- Access to Private Hospitals: Private health insurance allows individuals to choose to receive treatment in private hospitals, often with shorter waiting times for elective procedures and access to a wider range of specialists and services.

- Choice of Doctor: Private health insurance provides the freedom to choose your preferred doctor, offering greater flexibility and control over your healthcare.

- Faster Access to Treatment: Private health insurance can reduce waiting times for elective procedures, allowing individuals to receive treatment sooner and potentially avoid further health complications.

- Financial Protection: Private health insurance can help protect you from significant medical expenses, reducing the financial burden associated with unexpected illnesses or injuries.

- Tax Benefits: Individuals with private health insurance may be eligible for tax rebates, further reducing the cost of coverage.

Factors to Consider When Choosing a Private Health Insurance Plan

Choosing the right private health insurance plan is crucial to ensure you receive the coverage you need at a price you can afford. Several factors should be considered when making this decision:

- Your Health Needs: Consider your current health status, any pre-existing conditions, and your likelihood of requiring hospital treatment or other medical services.

- Your Budget: Private health insurance premiums vary depending on the level of cover and your age, so it is important to choose a plan that fits your budget.

- Your Lifestyle: Consider your lifestyle and any specific medical needs, such as dental, optical, or physiotherapy.

- Your Location: The availability of private hospitals and specialists in your area can influence your choice of plan.

- The Insurer’s Reputation: Research different insurers and their reputations for customer service, claims processing, and financial stability.

Key Features of Private Health Insurance Plans

Private health insurance in Australia is designed to provide individuals and families with access to a wider range of healthcare services, including hospital care, specialist consultations, and other medical treatments. It offers a valuable safety net for individuals and families, providing peace of mind and financial protection.

Hospital Cover

Hospital cover is a crucial component of private health insurance, providing financial assistance for a range of hospital services. It is divided into various levels of cover, each offering different benefits and coverage for specific procedures and treatments.

The five levels of hospital cover available in Australia are:

- Basic: Offers the most basic level of hospital cover, usually including a limited range of procedures and treatments. It may not cover all procedures or treatments, and waiting periods may apply.

- Bronze: Offers a more comprehensive level of hospital cover, including a wider range of procedures and treatments. It may have shorter waiting periods than basic cover.

- Silver: Offers a more extensive level of hospital cover, including a broad range of procedures and treatments. It may have shorter waiting periods and cover a wider range of conditions.

- Gold: Offers the most comprehensive level of hospital cover, including a wide range of procedures and treatments, with minimal waiting periods.

- Top: Offers the highest level of hospital cover, covering all procedures and treatments, with no waiting periods.

The level of hospital cover chosen will depend on individual needs, budget, and health status.

Extras Cover

Extras cover provides financial assistance for a range of medical expenses not covered by Medicare, such as dental, optical, physiotherapy, and other allied health services. It can help individuals and families manage the cost of these essential healthcare services.

Note: Extras cover is optional and can be purchased separately from hospital cover.

There are a wide range of extras cover options available, with different levels of coverage and benefits. Some common extras cover options include:

- Dental: Covers a range of dental treatments, including check-ups, cleaning, fillings, and more complex procedures.

- Optical: Covers eye examinations, glasses, and contact lenses.

- Physiotherapy: Covers physiotherapy treatments, including massage, exercise therapy, and rehabilitation.

- Chiropractic: Covers chiropractic treatments, including spinal adjustments and other therapies.

- Psychology: Covers psychological assessments and therapy sessions.

The specific extras cover options and benefits available will vary depending on the insurer and the chosen policy.

Waiting Periods

Waiting periods are a common feature of private health insurance plans. They are the period of time you must wait before you can access certain benefits or services. Waiting periods vary depending on the type of cover, the insurer, and the specific benefits you are seeking.

- Hospital Cover: Waiting periods for hospital cover typically apply to specific procedures or treatments, such as elective surgery or joint replacements.

- Extras Cover: Waiting periods for extras cover typically apply to specific services, such as dental or optical treatments.

Waiting periods are designed to help insurers manage risk and ensure that policyholders are not claiming for pre-existing conditions. It is important to understand the waiting periods associated with your policy before you make a claim.

Factors Influencing Plan Choice: Best Private Health Insurance Plans In Australia

Choosing the right private health insurance plan in Australia can be a complex process, as various factors come into play. It’s crucial to consider your individual needs, budget, and lifestyle to find the best fit.

Premium and Benefit Comparison

Different private health insurance plans offer varying premiums and benefits. The premium is the monthly cost you pay for your insurance, while the benefits are the services and treatments covered by your policy. It’s essential to compare premiums and benefits across different plans to find the best value for your money.

- Hospital Cover: This covers the costs of hospital stays, including surgery, medical care, and accommodation. The level of hospital cover you choose will determine the types of hospitals and wards you can access. Higher levels of cover, such as “gold” or “platinum,” offer greater flexibility and access to private hospitals.

- Extras Cover: This covers the costs of services and treatments not covered by hospital cover, such as dental, optical, physiotherapy, and chiropractor visits. The level of extras cover you choose will determine the amount you can claim back on these services. Higher levels of cover offer greater coverage and lower out-of-pocket expenses.

- Waiting Periods: These are periods of time you must wait before you can claim certain benefits. Waiting periods can vary depending on the type of benefit and the insurance provider. For example, there may be a waiting period before you can claim for pregnancy-related expenses or for certain types of surgery.

Impact of Age, Health Status, and Lifestyle

Your age, health status, and lifestyle can significantly impact the type of private health insurance plan you choose.

- Age: Premiums generally increase with age, as older people are statistically more likely to require medical treatment. Younger individuals may opt for lower levels of cover with lower premiums, as they may have lower health risks. However, it’s important to consider the possibility of future health needs and the potential for higher premiums later in life.

- Health Status: People with pre-existing medical conditions may need to consider higher levels of cover to ensure they have access to the treatment they need. Some plans may have exclusions or limitations for certain pre-existing conditions. It’s important to carefully review the policy documents to understand any restrictions.

- Lifestyle: Your lifestyle choices can also impact your health insurance needs. For example, if you engage in high-risk activities such as extreme sports, you may need to consider a plan with higher levels of cover or specific inclusions for these activities.

Role of Government Subsidies and Rebates, Best private health insurance plans in australia

The Australian government provides subsidies and rebates to help people afford private health insurance. These subsidies are based on your age, income, and the level of cover you choose.

- Government Rebates: These are tax-free payments that reduce your overall premium costs. The amount of the rebate you receive depends on your age and income. For example, individuals under 30 years old receive a higher rebate than those over 30. The rebate also increases with age.

- Loading: This is an extra premium you may have to pay if you haven’t had private health insurance for a certain period of time. The loading can be significant, particularly for older individuals. It’s important to factor in the potential for loading when comparing plans.

- Medicare Levy Surcharge: This is an extra tax you may have to pay if you don’t have private health insurance and your income exceeds a certain threshold. The surcharge is designed to encourage people to take out private health insurance. However, individuals with certain medical conditions or low incomes may be exempt from the surcharge.

Top Private Health Insurance Providers

Choosing the right private health insurance provider is crucial for ensuring comprehensive coverage and peace of mind. With a diverse range of providers offering various plans and benefits, understanding the top contenders in the Australian market can help you make an informed decision.

Top Private Health Insurance Providers in Australia

Here’s a table showcasing some of the leading private health insurance providers in Australia, along with their key features and customer service ratings:

| Provider | History | Coverage Options | Customer Service Rating |

|---|---|---|---|

| Medibank Private | Founded in 1976, Medibank Private is one of Australia’s largest private health insurance providers, with a strong reputation for comprehensive coverage and customer service. | Offers a wide range of plans, including hospital, extras, and combined options, catering to diverse needs and budgets. | 4.5 out of 5 stars on Canstar Blue, reflecting positive customer feedback on their responsiveness and support. |

| Bupa Australia | Bupa is a global healthcare provider with a strong presence in Australia. They offer a variety of plans, including hospital, extras, and combined options, catering to diverse needs and budgets. | Offers a wide range of plans, including hospital, extras, and combined options, catering to diverse needs and budgets. | 4.2 out of 5 stars on Canstar Blue, highlighting their commitment to customer satisfaction. |

| NIB Health Funds | NIB Health Funds is a leading private health insurance provider in Australia, known for its comprehensive coverage and innovative features. | Offers a wide range of plans, including hospital, extras, and combined options, catering to diverse needs and budgets. | 4.3 out of 5 stars on Canstar Blue, showcasing their strong customer service focus. |

| HCF | HCF is a not-for-profit health fund, established in 1932, with a long history of providing affordable and accessible healthcare to Australians. | Offers a wide range of plans, including hospital, extras, and combined options, catering to diverse needs and budgets. | 4.1 out of 5 stars on Canstar Blue, emphasizing their commitment to providing quality healthcare. |

| Australian Unity | Australian Unity is a mutual organization that has been providing health insurance and other financial services for over 100 years. | Offers a wide range of plans, including hospital, extras, and combined options, catering to diverse needs and budgets. | 4 out of 5 stars on Canstar Blue, showcasing their dedication to customer satisfaction. |

Choosing the Right Plan

Finding the best private health insurance plan for your needs can seem daunting, but it doesn’t have to be. With a strategic approach and a little research, you can navigate the options and secure a policy that provides excellent coverage at a reasonable price. This section Artikels a step-by-step guide to choosing the right plan, offers tips for negotiating premiums and maximizing benefits, and provides resources for comparing plans and obtaining quotes.

Step-by-Step Guide to Choosing the Right Plan

To ensure you choose the right private health insurance plan, it’s important to follow a systematic approach. This process involves understanding your needs, exploring different options, and making informed decisions.

- Assess Your Healthcare Needs: Begin by identifying your specific healthcare needs and priorities. Consider factors such as your age, health status, family situation, and lifestyle. If you have pre-existing conditions, you’ll need to consider plans that offer comprehensive coverage for those conditions.

- Determine Your Budget: Establishing a clear budget for your health insurance premiums is crucial. Factor in your income, expenses, and financial goals. Remember that premiums can vary significantly based on factors such as your age, location, and chosen level of coverage.

- Research and Compare Plans: Explore different private health insurance providers and compare their plans. Utilize online comparison websites, insurance brokers, or directly contact providers for information and quotes. Focus on understanding the coverage, benefits, exclusions, and premium costs associated with each plan.

- Consider Extras Coverage: Assess whether you require extras coverage, which includes services like dental, optical, physiotherapy, and alternative therapies. Determine if you need this coverage and choose a plan that aligns with your requirements.

- Review the Policy Documents: Before finalizing your decision, carefully review the policy documents. Pay attention to the terms and conditions, coverage details, exclusions, and any waiting periods that might apply.

- Seek Professional Advice: Consider consulting a financial advisor or insurance broker who specializes in private health insurance. They can provide personalized guidance and help you navigate the complexities of choosing the right plan.

Negotiating Premiums and Maximizing Benefits

Once you’ve identified a plan that meets your needs, you can explore ways to negotiate premiums and maximize benefits.

- Consider a Family Policy: If you have a family, opting for a family policy can often be more cost-effective than individual policies.

- Look for Discounts: Inquire about discounts offered by insurers for factors such as being a member of certain organizations or having a healthy lifestyle.

- Negotiate with Your Provider: Contact your insurer to discuss potential premium reductions. They may be willing to negotiate based on your specific circumstances or loyalty.

- Utilize Benefits Wisely: Understand and utilize the benefits offered by your plan. This includes taking advantage of preventative health services, accessing specialist consultations, and using the extras coverage for eligible services.

Resources for Comparing Plans and Obtaining Quotes

Several resources can help you compare plans and obtain quotes.

- Online Comparison Websites: Websites like Compare the Market, iSelect, and Canstar provide a platform for comparing plans from multiple providers.

- Insurance Brokers: Insurance brokers specialize in private health insurance and can assist you in finding the best plan for your needs.

- Direct Contact with Providers: Contact individual insurance providers directly to obtain quotes and discuss specific plan details.

Frequently Asked Questions

This section addresses some of the most common questions regarding private health insurance in Australia.

Eligibility

This section discusses who is eligible for private health insurance in Australia.

- Australian citizens and permanent residents are eligible for private health insurance.

- Temporary visa holders may also be eligible, depending on their visa type and length of stay.

- It’s crucial to check with the individual insurance provider for specific eligibility criteria based on visa status.

Claims Process

This section explains the process of making a claim with private health insurance.

- To file a claim, you’ll typically need to contact your insurance provider and provide details of your medical expenses, including receipts and medical reports.

- Some insurance providers offer online claim submission options, making the process more convenient.

- Claims are usually processed within a specific timeframe, and you’ll receive payment directly from the insurer or reimbursement for out-of-pocket expenses.

Cancellation Policies

This section discusses the cancellation policies of private health insurance in Australia.

- You can generally cancel your private health insurance policy at any time, but you may be subject to cancellation fees or a waiting period before you can re-enroll.

- It’s essential to review the specific cancellation terms and conditions of your policy with your insurer.

- If you’re considering canceling your policy, it’s advisable to contact your insurer to understand the implications and potential consequences.

Conclusive Thoughts

Navigating the world of private health insurance in Australia can be overwhelming, but with careful consideration and planning, you can find the plan that best suits your needs and budget. By understanding the different types of coverage, comparing providers, and utilizing available resources, you can secure the peace of mind that comes with knowing you have adequate health protection.

Essential Questionnaire

How do I know if I need private health insurance?

Private health insurance can be beneficial if you want access to private hospitals, shorter waiting times for elective procedures, or coverage for extras like dental and physiotherapy.

What are the waiting periods for private health insurance?

Waiting periods vary depending on the type of cover and provider. They typically range from 2 to 12 months.

How do I make a claim on my private health insurance?

The claims process varies depending on the provider. Generally, you will need to submit a claim form with supporting documentation.