Biggest insurance company in australia – Australia’s biggest insurance company holds a prominent position within the country’s robust financial landscape. This company plays a vital role in providing financial security and peace of mind to millions of Australians. Exploring the factors that have contributed to its dominance and the key services it offers provides valuable insights into the insurance industry in Australia.

The Australian insurance market is characterized by its size, growth trends, and regulatory landscape. Several key players operate within this sector, each with its own unique strengths and market share. Understanding the competitive landscape and the strategies employed by these companies is crucial for both consumers and investors.

Market Overview: Biggest Insurance Company In Australia

The Australian insurance market is a significant contributor to the country’s financial landscape, characterized by a robust regulatory framework and a diverse range of players. This section provides insights into the market’s size, growth trends, key drivers, and the regulatory landscape.

Market Size and Growth Trends

The Australian insurance market is experiencing steady growth, driven by factors such as rising affluence, increasing awareness of insurance products, and the evolving regulatory environment.

- The total gross written premium (GWP) in the Australian insurance market reached $144.7 billion in 2022, representing a 4.6% increase from the previous year, according to the Insurance Council of Australia (ICA). This growth reflects the increasing demand for insurance products across various segments.

- The market is expected to continue its growth trajectory in the coming years, with projections indicating a GWP of over $170 billion by 2025. This growth is anticipated to be fueled by factors such as rising property values, increased awareness of cyber risks, and the growing popularity of digital insurance solutions.

Key Drivers of Growth

Several factors are driving the growth of the Australian insurance sector, including:

- Rising Affluence: As disposable incomes increase, Australians are more likely to invest in insurance products to protect their assets and financial well-being. This trend is particularly evident in the segments of life insurance, health insurance, and general insurance.

- Increased Awareness: Growing awareness of the importance of insurance and its role in mitigating financial risks is another significant driver. This awareness is fueled by various initiatives, including government campaigns, media coverage, and the increasing availability of information online.

- Evolving Regulatory Landscape: The Australian government’s commitment to promoting financial stability and consumer protection has led to a more stringent regulatory environment. This includes the introduction of new regulations, such as the Financial Sector Reform Act (2014) and the Insurance Contracts Act (1984), which have contributed to increased consumer confidence and trust in the insurance sector.

- Technological Advancements: The rapid adoption of technology is transforming the insurance industry. Insurers are leveraging digital platforms, data analytics, and artificial intelligence (AI) to improve customer experiences, enhance operational efficiency, and develop innovative products.

- Emerging Risks: The emergence of new risks, such as cyberattacks, climate change, and pandemics, has increased the demand for insurance solutions to mitigate these potential threats. Insurers are adapting their product offerings and services to address these evolving risks.

Regulatory Landscape

The Australian insurance market is subject to a robust regulatory framework overseen by the Australian Prudential Regulation Authority (APRA). APRA’s role is to ensure the stability and integrity of the financial system, including the insurance sector.

- APRA sets prudential standards for insurers, including capital adequacy requirements, risk management practices, and corporate governance. These standards aim to protect policyholders and ensure the financial soundness of insurers.

- The Australian Securities and Investments Commission (ASIC) is responsible for regulating financial markets and products, including insurance. ASIC enforces consumer protection laws and ensures that insurers comply with disclosure requirements and act ethically.

- The Insurance Council of Australia (ICA) is a representative body for the insurance industry. The ICA promotes best practices, provides industry insights, and advocates for policy changes that benefit the sector and its stakeholders.

Key Industry Players

The Australian insurance market is dominated by a few major players, including:

- Suncorp Group: A leading provider of general insurance, life insurance, and banking services. Suncorp operates under various brands, including Suncorp, AAMI, GIO, and Bingle.

- QBE Insurance Group: A global insurance company with a strong presence in Australia. QBE offers a wide range of insurance products, including general insurance, specialty insurance, and reinsurance.

- IAG: One of Australia’s largest insurance companies, offering a comprehensive range of products, including general insurance, life insurance, and health insurance. IAG operates under various brands, including NRMA, CGU, and SGIC.

- Medibank Private: A leading provider of private health insurance in Australia, offering a range of health insurance plans and services.

- AMP: A financial services company that provides life insurance, investment products, and superannuation services.

Identifying the Biggest Insurance Company

The Australian insurance market is a significant industry, with several major players competing for market share. To understand the landscape, it’s crucial to identify the largest companies and analyze their performance.

Top 5 Largest Insurance Companies in Australia

The top 5 largest insurance companies in Australia are determined based on their market capitalization or revenue.

- QBE Insurance Group: QBE is a global insurer with a significant presence in Australia. It offers a wide range of insurance products, including general insurance, life insurance, and health insurance.

- Suncorp Group: Suncorp is another major player in the Australian insurance market. It provides a comprehensive suite of insurance products, including home, car, and business insurance.

- Insurance Australia Group (IAG): IAG is a leading provider of general insurance in Australia. It operates several well-known brands, including NRMA, CGU, and SGIC.

- AMP Limited: AMP is a diversified financial services company with a strong presence in the life insurance market. It offers a range of life insurance products, including term life, whole of life, and investment-linked insurance.

- Medibank Private: Medibank is a leading provider of private health insurance in Australia. It offers a range of health insurance products, including hospital cover, extras cover, and travel insurance.

Market Share and Product Offerings

The top 5 insurance companies in Australia hold a significant market share, with each offering a diverse range of products to cater to various customer needs.

- QBE Insurance Group: QBE is known for its global reach and diverse product offerings, including general insurance, life insurance, and health insurance.

- Suncorp Group: Suncorp is a prominent provider of home, car, and business insurance, with a focus on providing comprehensive coverage for individuals and businesses.

- Insurance Australia Group (IAG): IAG dominates the general insurance market through its multiple brands, offering a wide array of insurance products for various customer segments.

- AMP Limited: AMP specializes in life insurance, providing a range of products that cater to different financial needs and risk profiles.

- Medibank Private: Medibank is a leader in the private health insurance market, offering comprehensive health insurance plans that cover hospital expenses, medical treatments, and other healthcare services.

Financial Performance and Profitability

The financial performance of leading insurance companies is crucial to understanding their market position and competitive advantage.

- QBE Insurance Group: QBE has demonstrated consistent profitability over the years, driven by its global operations and diversified product portfolio.

- Suncorp Group: Suncorp has experienced steady growth in recent years, benefiting from its strong presence in the Australian market and its focus on customer satisfaction.

- Insurance Australia Group (IAG): IAG has a solid financial track record, with a history of profitability and a strong balance sheet.

- AMP Limited: AMP has faced challenges in recent years, with its profitability impacted by regulatory changes and market volatility.

- Medibank Private: Medibank has a strong financial performance, driven by its dominant position in the private health insurance market.

Key Products and Services

Australia’s largest insurance companies offer a wide range of insurance products to cater to the diverse needs of individuals and businesses. These products are designed to provide financial protection against various risks and uncertainties, ensuring peace of mind and financial stability in the face of unforeseen events.

General Insurance

General insurance products provide coverage for a wide range of risks, including property damage, liability claims, and personal accidents. These products are essential for individuals and businesses alike, providing financial protection against unexpected events.

- Home Insurance: This product provides coverage for damage to your home and its contents, including theft, fire, and natural disasters. It is essential for homeowners to protect their most valuable asset.

- Contents Insurance: This product provides coverage for your personal belongings, such as furniture, electronics, and clothing, against theft, fire, and other perils. It is particularly important for renters who do not have coverage for their belongings through their landlord’s insurance.

- Motor Vehicle Insurance: This product provides coverage for damage to your vehicle and liability for accidents involving other vehicles or property. It is a legal requirement in Australia to have at least third-party property damage insurance.

- Business Insurance: This product provides coverage for a variety of risks faced by businesses, including property damage, liability claims, and business interruption. It is essential for businesses to protect their assets and operations from unforeseen events.

- Travel Insurance: This product provides coverage for medical expenses, lost luggage, and other travel-related risks while you are traveling overseas. It is essential for anyone traveling abroad, particularly to destinations with high medical costs or where medical facilities may be limited.

Life Insurance, Biggest insurance company in australia

Life insurance products provide financial protection for your loved ones in the event of your death. These products can help ensure that your family is financially secure and can cover expenses such as mortgage payments, funeral costs, and living expenses.

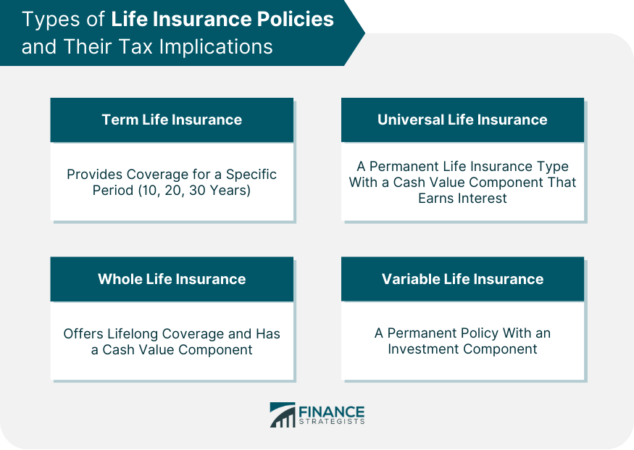

- Term Life Insurance: This product provides coverage for a specific period, typically 10, 20, or 30 years. It is a cost-effective option for individuals who need coverage for a specific period, such as while they have young children or a mortgage.

- Whole Life Insurance: This product provides lifelong coverage and includes a savings component. It is a more expensive option than term life insurance but provides long-term financial security.

- Income Protection Insurance: This product provides a regular income payment if you are unable to work due to illness or injury. It can help ensure that your family has financial security during a difficult time.

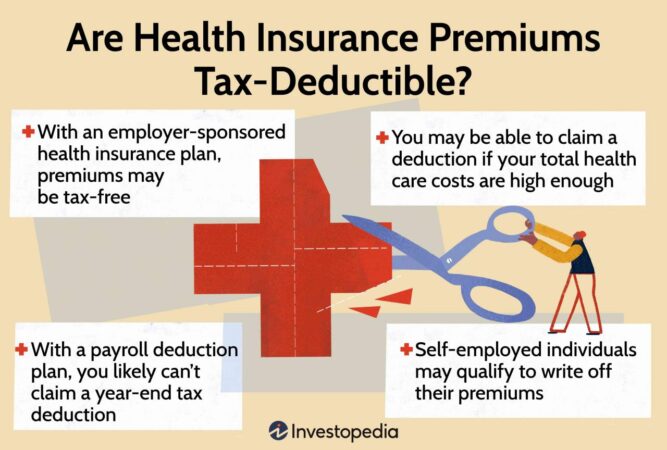

Health Insurance

Health insurance products provide coverage for medical expenses, including hospital stays, surgery, and other medical treatments. These products can help you avoid high out-of-pocket expenses and ensure that you have access to quality healthcare.

- Private Health Insurance: This product provides coverage for a range of medical expenses, including hospital stays, surgery, and some outpatient services. It can help you access private hospitals and specialists, and may also cover some extras, such as dental and physiotherapy.

- Medicare: This is Australia’s universal healthcare system, providing essential healthcare services to all Australians. While it covers basic medical expenses, it does not cover all medical costs, and private health insurance can provide additional coverage.

Customer Experience and Reputation

In the competitive landscape of the Australian insurance market, customer experience and reputation are paramount. Consumers increasingly prioritize companies that offer seamless interactions, personalized solutions, and reliable support. This section delves into the customer experience and reputation of the leading insurance companies in Australia, analyzing customer satisfaction ratings, reviewing strengths and weaknesses in customer service, and comparing their digital and online offerings.

Customer Satisfaction Ratings and Reviews

Customer satisfaction ratings and reviews provide valuable insights into the overall experience provided by insurance companies. Independent organizations, such as Roy Morgan and Canstar, conduct regular surveys and collect customer feedback to assess satisfaction levels across various aspects of the insurance journey, including claims handling, communication, and value for money.

- Roy Morgan: Roy Morgan’s Customer Satisfaction Index (CSI) measures customer satisfaction with various industries, including insurance. The CSI score reflects the overall satisfaction of customers with a particular company, based on their recent experiences. Higher scores indicate greater customer satisfaction.

- Canstar: Canstar is another reputable organization that conducts customer surveys and awards star ratings to insurance companies based on their performance in areas such as customer service, value for money, and claims handling. Canstar’s ratings are widely used by consumers when choosing an insurance provider.

- Online Reviews: Customer reviews posted on websites like Google, Trustpilot, and ProductReview.com.au offer valuable insights into the experiences of individual customers. These reviews often provide detailed accounts of interactions with insurance companies, including both positive and negative experiences.

Customer Service Strengths and Weaknesses

Customer service is a critical factor in building and maintaining customer loyalty in the insurance industry. Leading insurance companies invest heavily in their customer service teams to ensure prompt, efficient, and personalized support. However, each company has its strengths and weaknesses in customer service delivery.

- Strengths: Many insurance companies excel in areas such as accessibility, responsiveness, and problem-solving. For example, some companies offer 24/7 customer support via phone, email, or online chat, providing immediate assistance to customers in need. Others have dedicated teams specializing in specific insurance products, enabling them to provide tailored advice and support.

- Weaknesses: While many insurance companies strive to deliver exceptional customer service, some areas may require improvement. These may include long wait times for phone support, inconsistent communication, or difficulties resolving complex claims. Customers may also experience challenges navigating online platforms or accessing information easily.

Digital and Online Experience

The digital landscape has significantly transformed the insurance industry, with customers increasingly expecting convenient and efficient online experiences. Leading insurance companies have invested in digital platforms and online tools to cater to this demand.

- Online Quoting and Policy Management: Most insurance companies offer online quoting tools that allow customers to obtain quotes and purchase policies without the need for phone calls or in-person visits. Online platforms also provide convenient access to policy information, payment history, and claim status.

- Mobile Apps: Many insurance companies have developed mobile apps that offer a range of features, including policy management, claims reporting, and roadside assistance. These apps provide customers with on-the-go access to insurance services and information.

- Digital Customer Support: Leading insurance companies offer various digital channels for customer support, such as online chat, email, and social media. These channels provide customers with convenient and efficient ways to contact customer service representatives and receive assistance.

Future Trends and Outlook

The Australian insurance market is dynamic and constantly evolving, driven by technological advancements, changing consumer expectations, and regulatory shifts. This section explores emerging trends and their impact on the industry, particularly focusing on the future of the biggest insurance companies in Australia.

Technological Advancements Shaping the Industry

Technological advancements are transforming the insurance industry, leading to increased efficiency, improved customer experiences, and new business models.

- Artificial Intelligence (AI): AI is revolutionizing insurance operations, enabling faster and more accurate risk assessment, fraud detection, and claims processing. AI-powered chatbots are also enhancing customer service by providing instant responses and personalized solutions. For example, some insurance companies are using AI to analyze vast amounts of data to identify potential risks and develop personalized pricing models.

- Internet of Things (IoT): The widespread adoption of IoT devices is providing insurance companies with real-time data on policyholders’ behavior and assets. This data can be used to develop innovative insurance products, such as usage-based car insurance, and to offer personalized risk management advice. For instance, insurance companies can use IoT sensors to monitor the condition of insured homes and offer preventive measures to reduce the risk of claims.

- Blockchain Technology: Blockchain technology is transforming the insurance industry by streamlining processes, enhancing security, and increasing transparency. For example, blockchain can be used to create a secure and transparent record of insurance policies and claims, reducing the risk of fraud and disputes. This technology can also facilitate the development of peer-to-peer insurance platforms, where individuals can directly insure each other.

Final Review

The Australian insurance market is a dynamic and evolving sector, influenced by technological advancements, changing consumer preferences, and regulatory changes. As the country’s biggest insurance company continues to adapt and innovate, it will play a crucial role in shaping the future of insurance in Australia. Its success can be attributed to its ability to provide comprehensive insurance solutions, prioritize customer experience, and navigate the complexities of the regulatory environment.

Question Bank

What are the key factors driving the growth of the Australian insurance market?

Factors driving the growth of the Australian insurance market include increasing awareness of risk, rising disposable incomes, and a growing demand for financial protection. The market is also influenced by regulatory changes and technological advancements, such as the adoption of digital insurance platforms.

What are the major insurance products offered by the biggest insurance companies in Australia?

Major insurance products offered by the biggest insurance companies in Australia include general insurance, life insurance, health insurance, and superannuation. These companies offer a wide range of products to cater to the diverse needs of individuals and businesses.

What are the future trends in the Australian insurance market?

Future trends in the Australian insurance market include the increasing adoption of digital technologies, personalized insurance solutions, and the emergence of new insurance products to address emerging risks. The industry is also expected to focus on sustainability and social responsibility.