- Understanding Australian Health Insurance

- Factors Influencing Health Insurance Costs

- Finding the Cheapest Health Insurance Options

- Key Considerations for Choosing Health Insurance

- Tips for Saving on Health Insurance Premiums

- Navigating the Health Insurance Market

- Final Thoughts

- Detailed FAQs: Cheapest Health Insurance In Australia

Cheapest health insurance in Australia is a common search term, and for good reason. Navigating the Australian healthcare system can be complex, with a blend of public and private options. Understanding the various types of health insurance available, the factors that influence costs, and the strategies for finding the most affordable plans is crucial for securing adequate coverage without breaking the bank.

This guide delves into the Australian health insurance landscape, providing a comprehensive overview of the system, its key components, and the factors that determine costs. We’ll explore the role of Medicare, the government-funded healthcare system, and discuss the different types of private health insurance available. You’ll also find valuable tips for finding the cheapest options, understanding your coverage needs, and making informed decisions about your health insurance.

Understanding Australian Health Insurance

Navigating the Australian healthcare system can seem complex, especially when it comes to health insurance. This guide will demystify the intricacies of health insurance in Australia, providing you with the information you need to make informed decisions about your health coverage.

Types of Health Insurance in Australia

There are two main types of health insurance available in Australia:

- Public health insurance: This is provided by the government through the Medicare system, which is universal and funded through taxes. Medicare covers essential healthcare services such as doctor’s visits, hospital stays, and some medications.

- Private health insurance: This is purchased from private health insurance companies and provides coverage for a wider range of services, including private hospital care, dental, and optical.

The Australian Healthcare System

The Australian healthcare system is a hybrid model that combines public and private insurance.

- Medicare: The cornerstone of the system, Medicare is a universal public health insurance scheme funded by taxes. It provides essential healthcare services to all Australian citizens and permanent residents.

- Private Health Insurance: While Medicare covers essential services, private health insurance offers additional coverage for a broader range of services, such as private hospital care, dental, and optical.

The Role of the Government in Healthcare

The Australian government plays a significant role in healthcare through Medicare.

- Medicare: Medicare is a universal public health insurance scheme that provides essential healthcare services to all Australian citizens and permanent residents. It is funded through taxes and is a key component of the Australian healthcare system.

- Government Subsidies: The government provides subsidies to private health insurance companies, making private health insurance more affordable for Australians. These subsidies are designed to encourage people to take out private health insurance and reduce the burden on the public healthcare system.

- Regulation: The government also regulates the private health insurance industry, setting standards for coverage and ensuring fair pricing practices.

Factors Influencing Health Insurance Costs

Health insurance premiums are determined by a variety of factors, including your age, location, health status, and the level of cover you choose. Understanding these factors can help you make informed decisions about your health insurance needs and budget.

Pricing Structures of Different Health Insurance Providers

Health insurance providers in Australia typically use a combination of factors to determine their premiums. These factors can vary between providers, and it’s important to compare quotes from multiple providers to find the best value for your needs.

Most providers use a combination of factors, such as age, location, health status, and level of cover, to determine their premiums.

- Age: Generally, younger people pay lower premiums than older people, as they are statistically less likely to require medical care. This is due to the higher likelihood of older individuals requiring more frequent and complex medical treatments.

- Location: Premiums can vary depending on your location, as the cost of medical services and the prevalence of certain health conditions can differ between regions. For example, areas with higher population density may have higher premiums due to greater demand for medical services.

- Health Status: Your health status can also influence your premiums. If you have pre-existing medical conditions, you may be charged higher premiums as you are statistically more likely to require medical care. This is based on the principle that individuals with pre-existing conditions are more likely to utilize healthcare services.

- Level of Cover: The level of cover you choose also affects your premiums. Higher levels of cover, such as hospital and extras cover, generally come with higher premiums. This is due to the greater financial protection and broader range of services included in these plans.

Finding the Cheapest Health Insurance Options

Finding the most affordable health insurance plan in Australia can be a challenging task, but with a structured approach and a bit of research, you can significantly reduce your premiums. This section will provide a comprehensive guide to help you find the cheapest health insurance options available.

Step-by-Step Guide to Finding the Cheapest Health Insurance Plans

The process of finding the most affordable health insurance plan involves several steps, each contributing to your overall savings.

- Assess Your Needs: Begin by determining your health insurance needs. Consider your age, health status, and the types of medical services you anticipate needing. If you’re young and healthy, you may opt for a basic hospital cover. However, if you have pre-existing conditions or require frequent medical care, a more comprehensive plan might be more suitable.

- Compare Quotes from Multiple Providers: Once you have a clear understanding of your needs, compare quotes from multiple health insurance providers. Don’t hesitate to contact different insurers directly to obtain personalized quotes. This allows you to assess various plans and compare premiums based on your specific requirements.

- Utilize Online Comparison Websites: Numerous online comparison websites streamline the process of comparing health insurance quotes. These websites aggregate quotes from multiple insurers, enabling you to compare different plans side-by-side. This saves you time and effort, making the comparison process efficient.

- Consider Extras Cover: Extras cover provides reimbursement for a range of services, including dental, physiotherapy, and optical. While extras cover can add to your premiums, it can offer significant savings on out-of-pocket expenses. Carefully consider your healthcare needs and budget when deciding whether to include extras cover.

- Negotiate with Your Insurer: Don’t be afraid to negotiate with your insurer, especially if you have a good claims history or have been with the insurer for an extended period. You might be able to secure a lower premium or additional benefits through negotiation.

- Explore Discounts and Incentives: Many health insurance providers offer discounts and incentives to attract customers. These can include discounts for paying your premiums annually, group discounts for family members, or rewards programs for healthy habits.

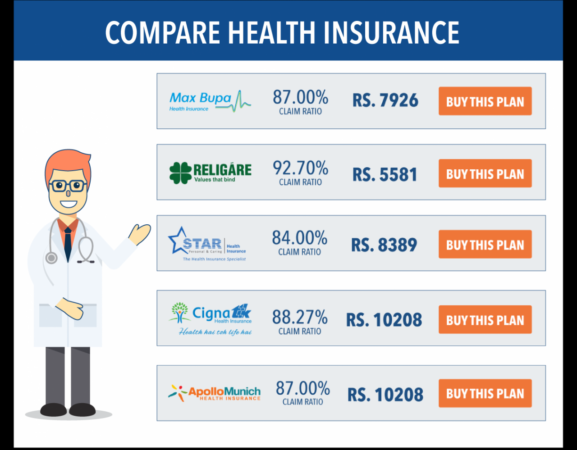

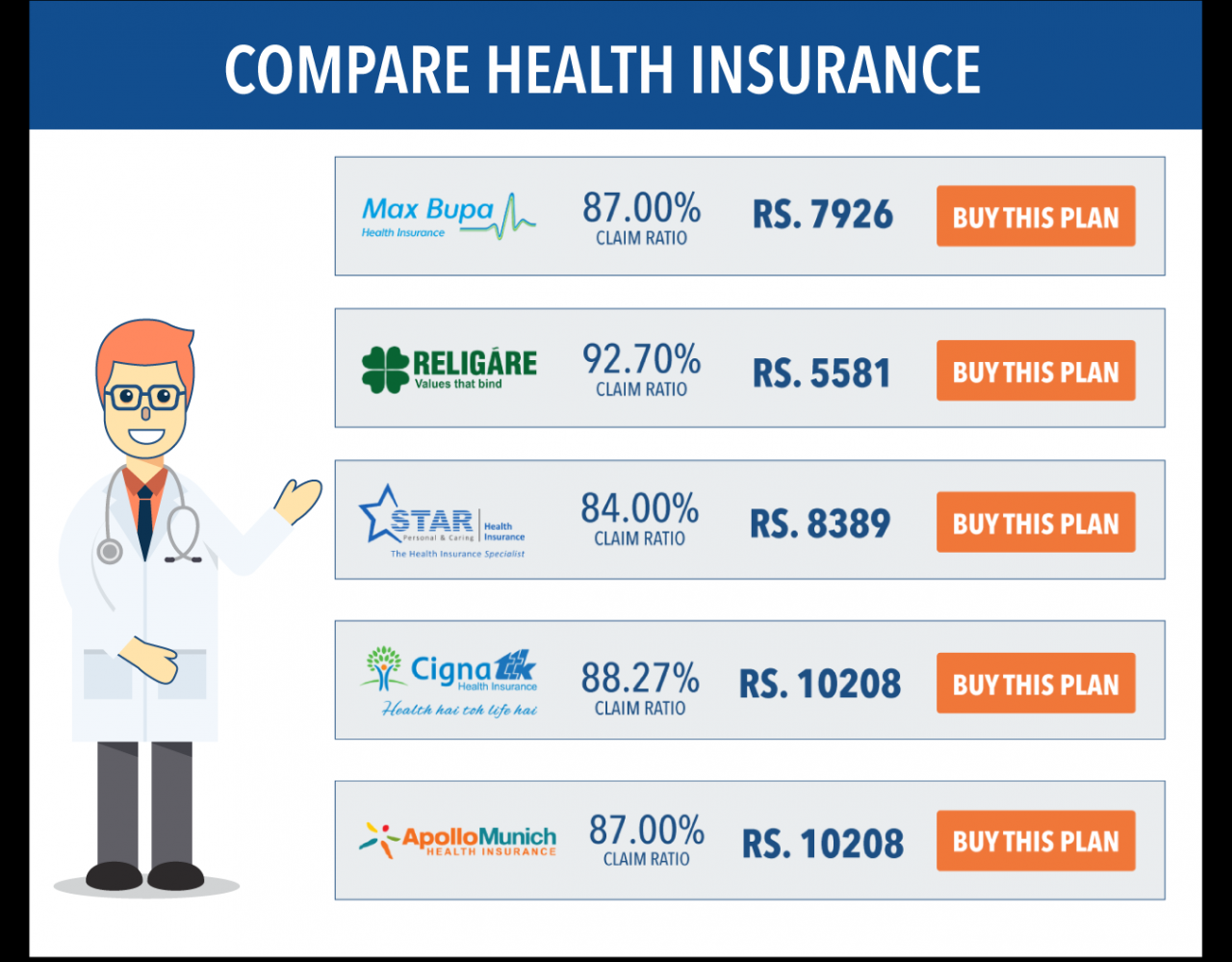

Comparing the Cheapest Health Insurance Providers in Australia

While premium costs can fluctuate depending on individual circumstances, some insurers consistently offer competitive pricing. The following table provides a general comparison of the cheapest health insurance providers in Australia:

| Insurer | Average Annual Premium (Hospital Cover) | Average Annual Premium (Extras Cover) |

|---|---|---|

| Medibank | $1,200 | $500 |

| Bupa | $1,150 | $450 |

| HCF | $1,050 | $400 |

| NIB | $1,100 | $420 |

Note: These figures are estimates and can vary based on factors such as age, location, and the chosen plan.

Reputable Online Comparison Websites for Health Insurance

Online comparison websites play a crucial role in finding the most affordable health insurance options. They provide a platform to compare quotes from multiple insurers simultaneously, saving you time and effort. Here is a list of reputable online comparison websites for health insurance in Australia:

- Compare the Market: This website compares quotes from a wide range of health insurance providers, offering a comprehensive overview of available options.

- Canstar: Canstar is another reputable comparison website that provides detailed information on health insurance plans, including ratings and reviews.

- Finder: Finder offers a user-friendly interface and provides detailed information on various health insurance products, including extras cover.

- iSelect: iSelect is a popular comparison website that offers a range of insurance products, including health insurance.

Key Considerations for Choosing Health Insurance

Choosing the right health insurance policy is crucial, as it significantly impacts your financial well-being and access to healthcare. It’s not just about finding the cheapest option; it’s about finding the best value for your specific needs.

Understanding Your Health Needs and Coverage Requirements

Before diving into the details of different policies, it’s essential to understand your individual health needs and coverage requirements. This involves considering factors such as your age, health history, lifestyle, and family situation. For example, if you have a pre-existing condition, you might need a policy with comprehensive coverage. Similarly, if you are a young and healthy individual, you might be comfortable with a basic policy that covers essential services.

Comparing the Benefits and Limitations of Different Health Insurance Policies

Health insurance policies come in various forms, each with its own set of benefits and limitations. Some common types include:

- Hospital and surgical cover: This is the most basic type of health insurance, covering hospitalization costs and surgical procedures.

- Extras cover: This type of policy covers a range of additional services, such as dental, optical, and physiotherapy.

- Top hospital cover: This provides access to private hospitals and specialist care.

It’s important to compare the benefits and limitations of each policy carefully, considering your specific needs and budget. For instance, if you are concerned about dental costs, you might prioritize a policy with comprehensive dental cover.

Potential Risks and Benefits of Choosing the Cheapest Option, Cheapest health insurance in australia

While choosing the cheapest health insurance policy might seem appealing, it’s essential to weigh the potential risks and benefits.

Risks of Choosing the Cheapest Option

- Limited coverage: The cheapest policies often have limited coverage, which might not be sufficient in case of a major medical event.

- High out-of-pocket expenses: Cheaper policies often have higher out-of-pocket expenses, meaning you will have to pay more for your healthcare services.

- Limited choice of providers: Some cheaper policies restrict your choice of healthcare providers, limiting your access to specialists and hospitals.

Benefits of Choosing the Cheapest Option

- Lower premiums: The most obvious benefit of choosing a cheaper policy is lower premiums, which can save you money in the long run.

Ultimately, the decision of whether to choose the cheapest option depends on your individual circumstances and priorities. If you are young and healthy with a limited budget, a cheaper policy might be a suitable option. However, if you have pre-existing conditions or are concerned about potential high medical costs, a more comprehensive policy might be a better choice.

Tips for Saving on Health Insurance Premiums

Lowering your health insurance premiums is achievable with a few strategic approaches. By understanding how premiums are calculated and implementing smart strategies, you can potentially reduce your overall costs.

Group Health Insurance Policies

Group health insurance policies, often offered through employers or professional associations, can offer significant cost savings. These policies leverage the collective bargaining power of a larger group to secure lower premiums. The economies of scale associated with group policies mean that insurance providers can offer more competitive rates.

Maintaining a Healthy Lifestyle

A healthy lifestyle is not only beneficial for your well-being but can also impact your health insurance premiums. By adopting healthy habits, you can reduce your risk of developing chronic conditions, which often lead to higher premiums.

“Individuals with a history of health issues may face higher premiums due to increased risk.”

Reducing Health Risks

Taking proactive steps to reduce health risks can lower your premiums. These steps can include:

- Regular health checkups and screenings

- Quitting smoking and limiting alcohol consumption

- Maintaining a healthy weight through diet and exercise

By taking control of your health, you can potentially reduce your health insurance costs.

Navigating the Health Insurance Market

The Australian health insurance market can be complex, with numerous providers offering a wide array of policies and options. To make informed decisions and find the best fit for your needs, understanding the intricacies of health insurance policies is crucial.

Reading and Understanding Health Insurance Policy Documents

Health insurance policy documents are legally binding contracts that Artikel the terms and conditions of your coverage. Carefully reading and understanding these documents is crucial to avoid surprises and ensure you are adequately protected.

- Policy Summary: This document provides a concise overview of your policy, including the benefits, exclusions, and premiums.

- Product Disclosure Statement (PDS): The PDS is a comprehensive document that details all aspects of your policy, including the coverage, waiting periods, exclusions, and premium calculations.

- Schedule of Benefits: This document Artikels the specific benefits covered under your policy, such as hospital, surgical, and ancillary services.

Common Terms and Conditions Associated with Health Insurance

Understanding common terms and conditions is essential for navigating the health insurance market effectively.

- Waiting Periods: These are periods during which certain benefits are not available, typically for pre-existing conditions.

- Exclusions: These are specific conditions or treatments not covered by your policy.

- Excess: This is a fixed amount you pay towards the cost of certain services before your health insurance covers the remaining amount.

- Premium: This is the regular payment you make to maintain your health insurance coverage.

- Benefit Limits: These are maximum amounts your policy will cover for specific services or treatments.

Seeking Professional Advice from a Health Insurance Broker

Navigating the complex world of health insurance can be overwhelming. Seeking professional advice from a health insurance broker can simplify the process and ensure you make informed decisions.

- Expert Knowledge: Brokers have in-depth knowledge of the health insurance market and can provide unbiased advice tailored to your individual needs.

- Comparison Services: Brokers can compare policies from different providers, helping you identify the most suitable and affordable option.

- Negotiation Skills: Brokers can negotiate with insurers on your behalf to secure better premiums or benefits.

Final Thoughts

Finding the cheapest health insurance in Australia requires a careful balance of affordability and coverage. By understanding the factors that influence costs, comparing plans from different providers, and taking advantage of available resources, you can make informed decisions that align with your budget and healthcare needs. Remember to prioritize your health and ensure that the chosen plan provides adequate coverage for your specific requirements. While seeking the cheapest option is important, don’t compromise on the quality and comprehensiveness of your health insurance.

Detailed FAQs: Cheapest Health Insurance In Australia

What is the difference between Medicare and private health insurance?

Medicare is Australia’s universal healthcare system, providing subsidized access to essential healthcare services. Private health insurance supplements Medicare, offering coverage for a wider range of services, including private hospitals, specialists, and extras like dental and optical care.

How do I know if I need private health insurance?

The need for private health insurance depends on individual circumstances. Consider factors like your health needs, desired level of coverage, and budget. Private health insurance can be beneficial for those seeking faster access to specialists, private hospitals, or coverage for extras not covered by Medicare.

Can I claim private health insurance on my taxes?

Yes, under certain conditions, you may be eligible for a private health insurance rebate on your taxes. The rebate amount depends on your age, income, and the type of health insurance policy you hold.

What are some common health insurance extras?

Health insurance extras can include dental, optical, physiotherapy, chiropractic, and other services. These extras may not be covered by Medicare and can be added to your private health insurance policy for an additional premium.