Compare car insurance in victoria australia – Compare Car Insurance in Victoria, Australia: navigating the complexities of car insurance in the state can be overwhelming. With various options, factors to consider, and providers to choose from, finding the best car insurance for your needs requires careful planning and research. This guide will help you understand the intricacies of car insurance in Victoria, providing insights into different types of coverage, key factors influencing premiums, and strategies for finding the most suitable and affordable policy.

From understanding mandatory requirements and exploring coverage options to comparing quotes and maximizing savings, this guide aims to empower you with the knowledge and tools to make informed decisions about your car insurance in Victoria. Whether you’re a new driver, seasoned motorist, or simply looking for a better deal, this comprehensive resource will equip you with the necessary information to navigate the car insurance landscape in Victoria confidently.

Understanding Car Insurance in Victoria

Car insurance is an essential part of owning a vehicle in Victoria, providing financial protection in case of accidents, theft, or other incidents. Understanding the different types of car insurance available and the factors that influence premiums can help you make informed decisions about your coverage.

Types of Car Insurance in Victoria

Victoria offers various types of car insurance to cater to different needs and budgets. The most common types are:

- Comprehensive Car Insurance: This provides the most comprehensive coverage, protecting you against damage to your own vehicle, regardless of who is at fault. It also covers theft, fire, and other perils.

- Third-Party Property Damage: This type of insurance covers damage to other people’s property in case of an accident, but it doesn’t cover damage to your own vehicle.

- Third-Party Fire and Theft: This insurance covers theft and fire damage to your vehicle, but it doesn’t cover damage to your own vehicle or other people’s property in case of an accident.

Mandatory Car Insurance Requirements in Victoria

In Victoria, it is mandatory for all vehicle owners to have at least third-party property damage insurance. This means you must have insurance that covers damage to other people’s property in case of an accident. Failing to have this insurance can result in significant fines and penalties.

Factors Influencing Car Insurance Premiums

Several factors influence car insurance premiums in Victoria, including:

- Vehicle Type: The make, model, and age of your vehicle can significantly affect your premium. Luxury or high-performance cars generally have higher premiums than older, less expensive vehicles.

- Age: Younger drivers are generally considered higher risk and therefore pay higher premiums. As drivers gain experience and age, their premiums tend to decrease.

- Driving History: Your driving history, including any accidents or traffic violations, can significantly impact your premium. Drivers with a clean driving record typically receive lower premiums.

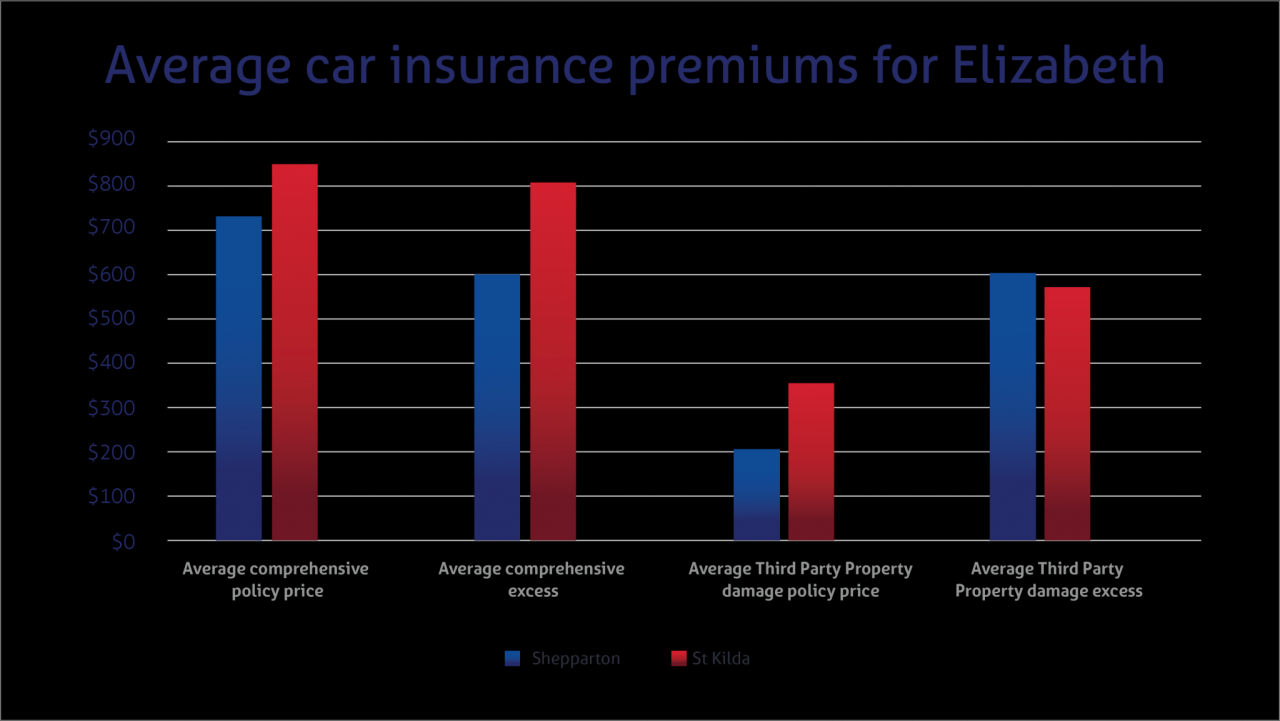

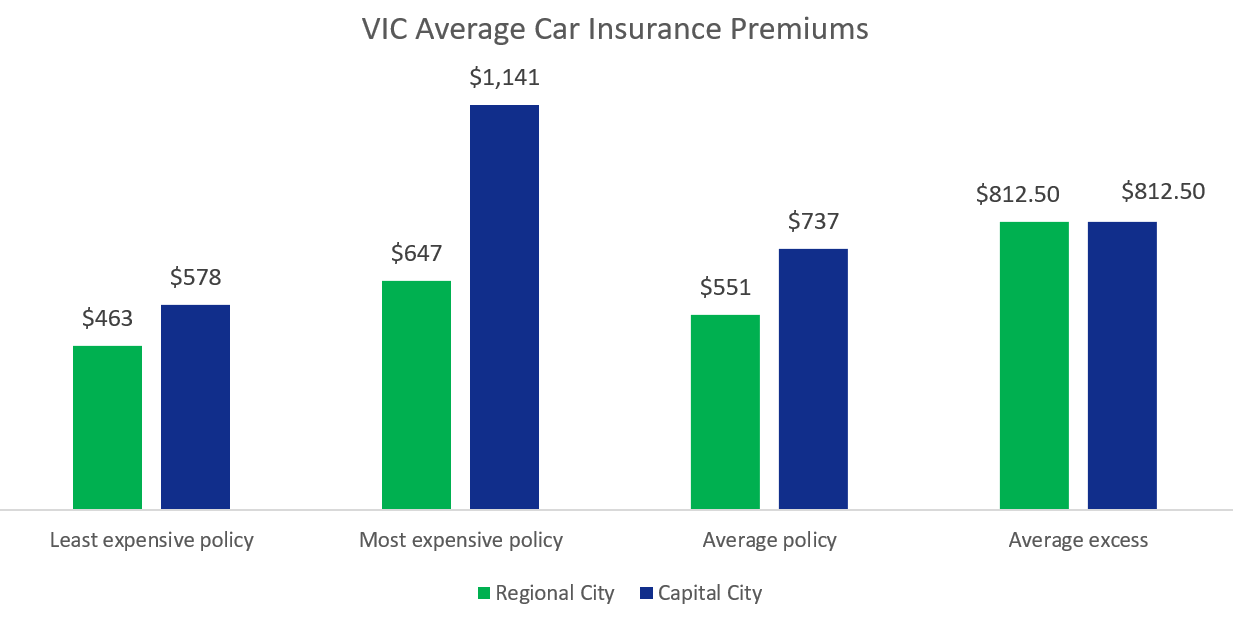

- Location: Where you live can also influence your premium. Areas with higher rates of accidents or theft may have higher premiums.

Factors to Consider When Comparing Car Insurance

Finding the right car insurance in Victoria involves more than just getting the lowest price. You need to consider various factors to ensure you have the right coverage for your needs and budget. This means carefully evaluating your options and comparing different policies to find the best fit for your individual circumstances.

Coverage Options

It’s important to understand the different types of coverage available and choose the options that best protect you and your vehicle.

- Third-party property damage: This covers damage you cause to another person’s property, but not your own vehicle. It’s the minimum required insurance in Victoria.

- Third-party fire and theft: This covers damage to another person’s property and also protects your vehicle against fire and theft.

- Comprehensive car insurance: This covers damage to your vehicle, including fire, theft, and accidents, as well as damage caused by other events like hailstorms or floods. It also provides third-party property damage and third-party fire and theft coverage.

Premium Costs

Car insurance premiums can vary significantly based on several factors. Here’s a breakdown of what can influence the cost:

- Your vehicle: The make, model, age, and value of your vehicle affect the premium. Higher-value vehicles often have higher premiums.

- Your driving history: Your driving record, including accidents and traffic violations, plays a significant role in determining your premium. A clean driving record can lead to lower premiums.

- Your location: The area where you live can influence your premium. Areas with higher accident rates may have higher premiums.

- Your age and gender: Generally, younger and male drivers tend to have higher premiums due to higher risk factors.

- Your occupation: Some occupations may be associated with higher risk of accidents, potentially leading to higher premiums.

Discounts

Many insurers offer discounts to lower your premium. Here are some common discounts:

- No claims bonus: This is a discount you receive for not making any claims on your insurance policy. The longer you go without a claim, the larger the discount you may receive.

- Safe driving discounts: Some insurers offer discounts for completing a defensive driving course or for using a telematics device that tracks your driving habits.

- Multi-policy discounts: You can often get a discount if you bundle your car insurance with other insurance policies, like home or contents insurance, from the same insurer.

- Other discounts: Some insurers offer discounts for being a member of certain organizations or for having certain safety features installed in your vehicle.

Customer Service

It’s important to consider the level of customer service provided by the insurer. You’ll want to choose an insurer that is responsive, helpful, and easy to deal with.

- Accessibility: Make sure the insurer has convenient ways to contact them, such as phone, email, or online chat.

- Response time: Check how quickly the insurer responds to inquiries and resolves issues.

- Claims process: Find out how straightforward and efficient the claims process is.

Common Car Insurance Add-ons in Victoria

- Excess reduction: This reduces the amount you have to pay out of pocket if you make a claim.

- New for old: This covers the cost of replacing your vehicle with a new one, even if it’s older, if it’s written off in an accident.

- Windscreen cover: This covers the cost of repairing or replacing your windscreen if it’s damaged.

- Towing and roadside assistance: This covers the cost of towing your vehicle if it breaks down or is involved in an accident.

- Hire car: This covers the cost of hiring a car if your vehicle is damaged and cannot be driven.

Finding the Best Car Insurance for Your Needs

Getting the right car insurance in Victoria can feel like a daunting task. With so many providers and policies available, it’s easy to feel overwhelmed. However, with a bit of research and careful comparison, you can find a policy that offers the best value for your money.

Comparing Car Insurance Quotes

It’s crucial to compare quotes from multiple car insurance providers in Victoria. This allows you to see a wide range of options and find the best deal for your needs.

Here’s a breakdown of key areas to consider when comparing car insurance quotes:

- Coverage: This is the most important factor to consider. Ensure you understand the different types of coverage offered by each provider and choose the one that best suits your needs. For example, you might need comprehensive coverage if you have a new car, while third-party property damage insurance might be sufficient if you have an older car.

- Excess: This is the amount you’ll have to pay out of pocket in the event of a claim. A higher excess generally leads to lower premiums. Consider your risk tolerance and budget when deciding on your excess.

- Premium: This is the cost of your car insurance policy. Compare premiums from different providers and factor in the coverage, excess, and other features offered.

- Discounts: Many car insurance providers offer discounts for various factors, such as good driving history, safe driving courses, or installing security features in your car. Inquire about these discounts and see if you qualify.

- Customer Service: A good car insurance provider should offer excellent customer service. Read online reviews or talk to friends and family to get an idea of the customer service offered by different providers.

Reputable Car Insurance Providers in Victoria

Here are some of the reputable car insurance providers in Victoria, along with their strengths and weaknesses:

- AAMI: AAMI is a well-known provider offering a range of car insurance products. Strengths include competitive pricing and good customer service. A potential weakness is their limited coverage options in some cases.

- RACV: RACV is a leading provider in Victoria, known for its strong focus on road safety and member benefits. They offer comprehensive coverage options and competitive pricing, but their premiums might be higher than some other providers.

- NRMA: NRMA is a popular choice for car insurance in Victoria, offering a wide range of products and competitive pricing. They are known for their strong customer service and claims handling process. One potential drawback is their limited online features.

- GIO: GIO is a reputable provider known for its flexibility and personalized insurance solutions. They offer a range of coverage options and competitive pricing. However, their claims process might be more complex than some other providers.

- Suncorp: Suncorp is a major insurance provider in Victoria, offering a range of products and services. They are known for their strong financial stability and good customer service. However, their premiums might be higher than some other providers.

Tips for Saving Money on Car Insurance: Compare Car Insurance In Victoria Australia

Getting the best car insurance deal in Victoria doesn’t have to be a complicated process. By understanding your options and implementing smart strategies, you can significantly reduce your premiums and ensure you’re getting the coverage you need without breaking the bank.

Safe Driving Practices

Safe driving practices are crucial for lowering your car insurance premiums in Victoria. Insurance companies recognize that drivers with a clean record and a history of responsible driving are less likely to file claims.

- Maintain a Safe Driving Record: Avoid speeding, driving under the influence of alcohol or drugs, and other traffic violations. A clean driving record can earn you significant discounts on your premiums.

- Complete Defensive Driving Courses: Many insurance companies offer discounts for drivers who complete defensive driving courses. These courses teach you safe driving techniques and can help you avoid accidents.

- Regularly Service Your Vehicle: Keeping your car in good working condition is essential for safety and can also impact your insurance premiums. Regular servicing ensures your car is reliable and less likely to break down, reducing the risk of accidents.

Choosing a Higher Excess

The excess is the amount you agree to pay out of pocket if you make a claim. By choosing a higher excess, you can generally lower your premiums.

- Assess Your Risk Tolerance: Consider how likely you are to make a claim. If you’re a cautious driver with a good driving record, a higher excess might be a suitable option.

- Understand the Impact of a Higher Excess: Remember that if you do make a claim, you’ll have to pay a larger amount out of pocket. Carefully weigh the potential savings against the financial burden of a higher excess.

- Review Your Excess Regularly: As your financial situation changes, you might need to re-evaluate your excess. If your risk tolerance or financial capacity changes, you can adjust your excess accordingly.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as home or contents insurance, can often lead to significant discounts.

- Contact Your Current Insurer: Check if your current insurer offers discounts for bundling multiple policies. They might have attractive deals for customers who combine their insurance needs.

- Compare Bundled Policies: Shop around and compare quotes from different insurers to find the best bundled package for your needs. Consider the coverage and discounts offered by each insurer.

- Ensure Comprehensive Coverage: While bundling can save you money, ensure you’re not sacrificing coverage for the sake of lower premiums. Make sure the bundled policies provide sufficient protection for your assets.

Discounts Available in Victoria

Several discounts are available to car insurance buyers in Victoria, potentially reducing your premiums.

- No-Claims Discount: This discount is awarded to drivers who have not made a claim within a specified period. The longer you go without making a claim, the larger your discount may be.

- Multi-Car Discount: If you insure multiple vehicles with the same insurer, you may be eligible for a multi-car discount. This discount is often applied to all vehicles on the policy.

- Loyalty Discount: Some insurers offer loyalty discounts to customers who have been with them for a certain period. This discount is a reward for customer loyalty and can help you save money.

- Other Discounts: Other discounts might be available, such as discounts for safe driving features, vehicle security systems, and certain occupations. Check with your insurer to see what discounts you might qualify for.

Resources and Tools for Car Insurance Buyers, Compare car insurance in victoria australia

Several resources and tools are available to help car insurance buyers in Victoria find the best deals.

- Online Comparison Websites: Many websites allow you to compare quotes from different insurers side-by-side. This can save you time and effort when shopping for car insurance.

- Government Resources: The Victorian government website provides information and resources about car insurance, including consumer rights and tips for finding the best deals.

- Independent Financial Advisers: An independent financial adviser can provide personalized advice and help you find the right car insurance policy for your needs.

Understanding Your Policy and Making a Claim

It’s crucial to understand your car insurance policy thoroughly before you need to make a claim. Carefully reading and understanding the terms and conditions of your policy can help you avoid surprises and ensure you’re covered adequately.

The Claims Process in Victoria

Making a car insurance claim in Victoria is a straightforward process. Here’s what you need to do:

- Contact your insurer as soon as possible after an accident, providing them with the necessary details, including the date, time, and location of the accident, and the extent of the damage.

- Provide the required documentation, including your policy details, driver’s license, registration certificate, and police report if applicable.

- Cooperate with your insurer throughout the claims process, providing any additional information or documentation they may require.

- Follow the instructions provided by your insurer regarding the repair or replacement of your vehicle.

Common Reasons for Car Insurance Claims in Victoria

Car insurance claims in Victoria are most frequently filed due to:

- Accidents: These can range from minor fender benders to serious collisions, resulting in damage to vehicles and injuries to occupants.

- Theft: Car theft is a significant issue in Victoria, and insurance claims are often filed to cover the loss of the vehicle.

- Natural disasters: Events like hailstorms, floods, and bushfires can cause significant damage to vehicles, leading to insurance claims.

- Vandalism: Acts of vandalism can result in damage to vehicles, requiring insurance coverage for repairs.

Consequences of Making a Fraudulent Claim

Making a fraudulent car insurance claim in Victoria is a serious offense. If you’re caught, you could face severe consequences, including:

- Criminal charges, including fines and imprisonment.

- Cancellation of your insurance policy, making it difficult to obtain insurance in the future.

- A criminal record, which could affect your employment prospects and other aspects of your life.

Concluding Remarks

Ultimately, finding the best car insurance in Victoria involves a combination of understanding your needs, carefully comparing options, and leveraging available resources. By taking the time to explore different providers, consider coverage options, and utilize online tools, you can secure a car insurance policy that offers the right protection at a price that suits your budget. Remember, knowledge is power, and with the right information, you can make informed choices that safeguard your financial well-being and provide peace of mind on the roads of Victoria.

Essential FAQs

What are the different types of car insurance available in Victoria?

Victoria offers various car insurance types, including comprehensive, third-party property damage, and third-party fire and theft. Comprehensive provides the broadest coverage, while third-party options offer varying levels of protection for damages caused to others.

How do I make a car insurance claim in Victoria?

Contact your insurance provider immediately after an accident. Provide them with details of the incident, including date, time, location, and involved parties. They will guide you through the claims process, which may involve submitting documentation and providing evidence.

What are some common reasons for car insurance claims in Victoria?

Common reasons include accidents, theft, vandalism, and natural disasters. Understanding these potential risks can help you choose the right coverage for your needs.

Can I get discounts on my car insurance in Victoria?

Yes, various discounts are available, including no-claims discounts, multi-car discounts, and loyalty discounts. You can often save money by maintaining a clean driving record, insuring multiple vehicles, and staying with the same insurer.

What resources are available to help me compare car insurance in Victoria?

Online comparison websites, government resources, and insurance brokers can provide valuable information and tools for comparing quotes and finding the best deals.