Compare home insurances in Australia, and you’ll discover a world of options, each tailored to different needs and budgets. From protecting your brick and mortar to safeguarding your belongings, home insurance provides crucial financial security in case of unexpected events. Understanding the intricacies of these policies is essential, as it empowers you to make informed decisions that best suit your circumstances.

Navigating the Australian home insurance landscape can be daunting, with numerous providers offering a wide array of coverage options. This guide aims to demystify the process, offering insights into key factors to consider, essential features to compare, and tips for securing the best value. By understanding the fundamentals of home insurance and comparing different providers and policies, you can make an informed choice that provides peace of mind and financial protection.

Understanding Home Insurance in Australia

Home insurance is an essential safety net for Australian homeowners, offering financial protection against various risks that could threaten their property and belongings. This guide will explore the fundamentals of home insurance in Australia, encompassing its purpose, types, key influencing factors, and common exclusions.

Purpose of Home Insurance

Home insurance provides financial compensation to policyholders for losses incurred due to covered events, such as fire, theft, storm damage, or natural disasters. It helps alleviate the financial burden of repairing or rebuilding a damaged home, replacing lost belongings, and covering associated expenses.

Types of Home Insurance

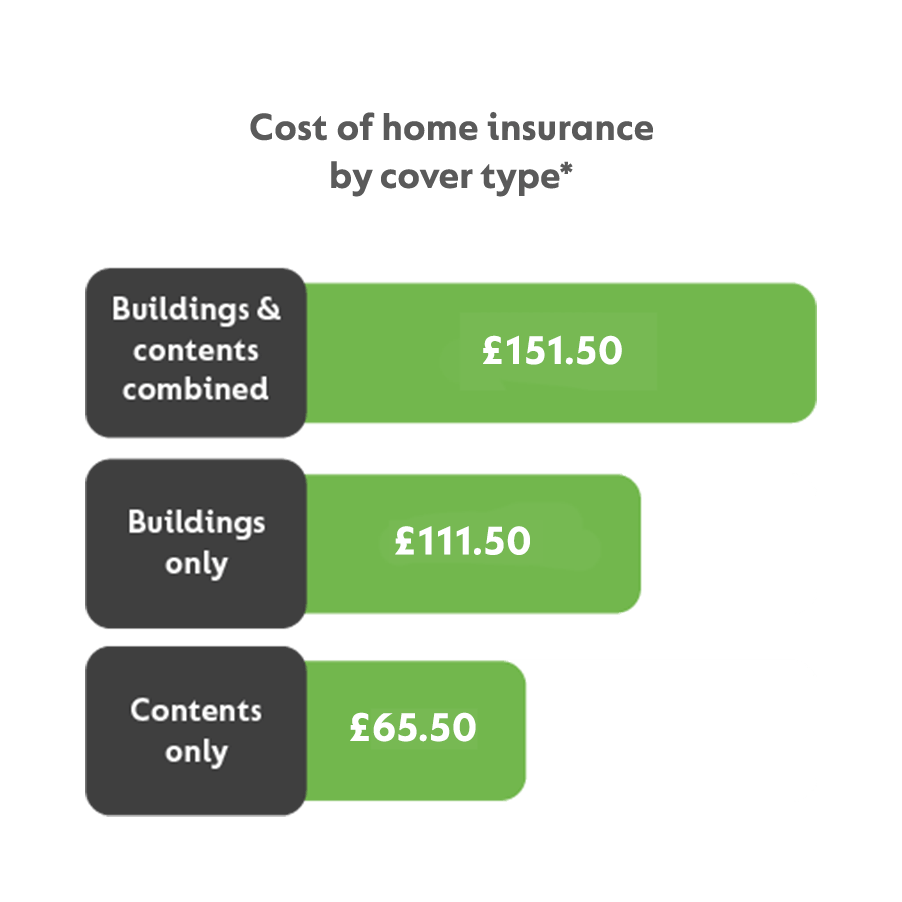

There are several types of home insurance policies available in Australia, each designed to meet specific needs:

- Building Insurance: This covers the structure of your home, including walls, roof, and fixtures, against damage caused by insured events.

- Contents Insurance: This protects your personal belongings, such as furniture, electronics, and clothing, against damage or loss due to covered perils.

- Combined Building and Contents Insurance: This comprehensive policy offers coverage for both the structure and contents of your home, providing a single, all-encompassing solution.

- Landlord Insurance: Designed for landlords, this policy covers the building and its contents, including fixtures and fittings, against damage or loss due to insured events.

Factors Influencing Home Insurance Premiums

Several factors determine the cost of your home insurance premiums:

- Property Value: The higher the value of your home and its contents, the higher your premium will be.

- Location: Premiums are influenced by the risk of damage or loss in your area, considering factors like crime rates, natural disaster susceptibility, and proximity to fire hazards.

- Building Materials: Homes constructed with fire-resistant materials, such as brick or concrete, generally attract lower premiums compared to those built with more flammable materials like timber.

- Security Features: Installing security measures like alarms, security cameras, and reinforced doors can reduce your premium, as they indicate a lower risk of theft or burglary.

- Claims History: Your past claims history plays a significant role in determining your premium. Frequent claims may result in higher premiums, reflecting a higher risk profile.

- Policy Excess: The excess is the amount you pay out of pocket before your insurance covers the remaining costs. A higher excess usually translates to a lower premium.

- Cover Options: The level of coverage you choose, including the types of events and perils covered, directly impacts your premium. More comprehensive policies typically come with higher premiums.

Common Exclusions and Limitations

It’s crucial to understand the limitations and exclusions of your home insurance policy:

- Wear and Tear: Most policies do not cover damage caused by normal wear and tear, such as fading paint or cracked tiles.

- Negligence: If damage is caused by your own negligence, such as leaving a window open during a storm, your claim may be denied.

- Pre-existing Conditions: Damage resulting from pre-existing conditions, like structural defects or leaks that were present before the policy was purchased, may not be covered.

- Specific Events: Some policies may exclude coverage for certain events, such as earthquakes, volcanic eruptions, or acts of war.

Key Factors to Consider When Comparing Home Insurances

Choosing the right home insurance policy can be a daunting task, as there are many factors to consider. Understanding the different types of policies available, their features, and the specific needs of your home and lifestyle is crucial in making an informed decision.

Types of Home Insurance Policies

Home insurance policies in Australia typically fall into three main categories: building insurance, contents insurance, and combined policies.

- Building insurance covers the structure of your home, including the walls, roof, and fixtures. This type of insurance is essential for protecting your investment in your property and ensuring you have the funds to rebuild or repair it in case of damage.

- Contents insurance covers the personal belongings inside your home, such as furniture, appliances, electronics, and clothing. It provides financial protection against loss or damage to your possessions due to events like fire, theft, or natural disasters.

- Combined policies offer comprehensive coverage for both the building and contents of your home. These policies provide a convenient and cost-effective option for homeowners who want to protect both their property and belongings with a single insurance plan.

Key Features to Consider, Compare home insurances in australia

When comparing home insurance policies, several key features are essential to consider:

- Coverage Limits: The maximum amount the insurer will pay for a claim, which can vary significantly between policies. It’s important to choose a policy with coverage limits that are sufficient to cover the full cost of rebuilding or replacing your home and belongings.

- Deductibles: The amount you pay out of pocket before your insurer starts covering the claim. A higher deductible typically results in lower premiums, while a lower deductible leads to higher premiums. Carefully consider your risk tolerance and financial situation when choosing a deductible.

- Premium Costs: The monthly or annual cost of your insurance policy. Premiums can vary depending on factors like the value of your home, the level of coverage, your location, and your personal risk profile. Comparing quotes from different insurers is crucial to finding the best value for your money.

Understanding Your Needs and Circumstances

Choosing the right home insurance policy requires a thorough understanding of your individual needs and circumstances. Factors to consider include:

- Value of your home and belongings: Ensure the coverage limits of your policy are sufficient to cover the full cost of rebuilding or replacing your home and possessions.

- Location and risk factors: Homes located in areas prone to natural disasters like bushfires, floods, or earthquakes may require higher levels of coverage or specific add-ons.

- Lifestyle and personal belongings: Consider the value of your possessions and whether they are adequately covered by the policy. For example, homeowners with valuable artwork or jewelry may need additional coverage.

- Financial situation: Determine how much you can afford to pay for premiums and deductibles. Consider your risk tolerance and the potential financial impact of a claim.

Comparing Insurance Providers and Policies

With so many home insurance providers and policies available in Australia, comparing them can feel overwhelming. This section will help you navigate this process by providing a clear overview of top providers, popular policies, and key factors to consider when making your decision.

Comparing Top Home Insurance Providers

Understanding the key features, pricing, and customer reviews of top providers is crucial for making an informed decision. Here’s a comparison of some popular home insurance providers in Australia:

| Provider | Key Features | Pricing | Customer Reviews |

|---|---|---|---|

| AAMI | Comprehensive cover, optional add-ons, online quote tool | Competitive pricing, discounts for multiple policies | Generally positive, with some complaints about claims processing |

| BUPA | Focus on health and wellbeing, comprehensive cover, discounts for members | Mid-range pricing, discounts for members | Positive reviews, particularly for customer service and claims handling |

| RAC | Strong focus on road safety, comprehensive cover, discounts for members | Competitive pricing, discounts for members | Generally positive, with some complaints about online platform |

| NRMA | Wide range of cover options, discounts for members, online quote tool | Competitive pricing, discounts for members | Mixed reviews, with some complaints about claims processing |

| Suncorp | Comprehensive cover, optional add-ons, online quote tool | Competitive pricing, discounts for multiple policies | Mixed reviews, with some complaints about customer service |

Comparing Popular Home Insurance Policies

Different policies offer varying levels of coverage and benefits. Here’s a comparison of some popular home insurance policies, highlighting their strengths and weaknesses:

- Building and Contents Cover: This is the most common type of home insurance, providing cover for both the structure of your home and your belongings. It typically includes coverage for damage caused by fire, theft, storm, and other perils.

- Landlord Insurance: Designed specifically for landlords, this policy covers the building and fixtures of a rental property, as well as potential liability claims from tenants.

- Strata Insurance: For owners in apartment buildings, this policy covers the shared areas of the building, such as the lobby, lifts, and common facilities.

- Contents Only Cover: This policy covers your personal belongings, such as furniture, electronics, and clothing, but not the structure of your home. It’s a good option for renters or homeowners with limited building cover.

Choosing the Right Provider and Policy

The best home insurance provider and policy for you will depend on your individual needs and circumstances. Consider these factors:

- Your Budget: Compare premiums from different providers and policies to find the most affordable option that meets your coverage needs.

- Your Coverage Needs: Determine the level of cover you require, considering the value of your home and belongings, your location, and potential risks.

- Customer Service: Research the reputation of different providers for their customer service and claims handling.

- Add-ons: Explore optional add-ons, such as cover for specific items, temporary accommodation, or legal expenses, to tailor your policy to your needs.

Tips for Getting the Best Value

Getting the best value for your home insurance means finding a policy that offers adequate coverage at a price you can afford. This involves understanding your needs, comparing options, and using strategies to lower your premiums.

Negotiating with Insurance Providers

Negotiating with insurance providers can be a powerful way to secure favorable terms. You can try these strategies:

- Bundle your policies: Combining your home, car, or other insurance policies with the same provider can often result in significant discounts.

- Shop around and compare quotes: Don’t settle for the first quote you receive. Get quotes from multiple providers and compare them carefully.

- Ask about discounts: Many insurers offer discounts for various factors, such as security systems, smoke detectors, or loyalty programs.

- Be prepared to negotiate: Once you’ve found a policy you like, don’t be afraid to negotiate the price. You might be able to lower your premium by agreeing to a higher deductible or by making small adjustments to your coverage.

Reducing Insurance Premiums

Lowering your home insurance premiums can save you money over the long term. Consider these strategies:

- Increase your deductible: A higher deductible means you’ll pay more out of pocket if you make a claim, but it can significantly reduce your premium.

- Improve your home security: Installing security systems, smoke detectors, and other safety features can lower your premium because they reduce the risk of claims.

- Maintain your home: Regular maintenance and repairs can help prevent damage and claims, which can positively impact your insurance rates.

- Consider a lower level of coverage: If you’re confident in your ability to cover smaller expenses, you might consider reducing your coverage level.

Choosing the Right Policy

Finding the right policy involves considering your individual needs and circumstances.

- Assess your risk: Consider the potential risks to your home, such as its location, age, and construction materials.

- Determine your coverage needs: Consider what you want to be covered for, including the building itself, contents, and any additional features like landscaping or outbuildings.

- Compare coverage options: Look at the different types of coverage offered by insurers, such as building, contents, and liability coverage.

Understanding Claims and Processes: Compare Home Insurances In Australia

Making a claim with your home insurance provider is a crucial step in recovering from a covered event. It involves a series of steps to ensure your claim is processed fairly and efficiently.

Claim Filing Process

Filing a claim typically involves contacting your insurer immediately after the incident. This can be done via phone, online portal, or app. You will need to provide details about the event, including the date, time, location, and nature of the damage. Your insurer may also require you to provide supporting documentation, such as photographs or police reports.

Common Types of Claims

Home insurance claims in Australia cover a range of events, including:

- Fire: This covers damage caused by fire, including smoke and water damage.

- Storm: This covers damage caused by wind, hail, and other severe weather conditions.

- Flood: This covers damage caused by flooding, including rising water levels and sewer backups.

- Theft: This covers the loss or damage of your belongings due to theft or burglary.

- Accidental Damage: This covers damage caused by accidents, such as a broken window or water damage from a burst pipe.

The way these claims are handled can vary between insurers. Some insurers may have specific procedures for different types of claims, while others may have a more standardized process.

Factors Influencing Claim Approval and Settlement

Several factors can influence whether your claim is approved and how much you receive in compensation. These include:

- Policy Coverage: The specific coverage you have purchased will determine what events are covered and what limits apply.

- Deductible: You will typically need to pay a deductible, which is a fixed amount, before your insurer will cover the remaining costs.

- Evidence of Loss: You will need to provide sufficient evidence of the loss, such as photographs, receipts, or police reports.

- Claim History: Your previous claims history can influence your current claim, particularly if you have made multiple claims in a short period.

- Compliance with Policy Terms: Failure to comply with the terms and conditions of your policy can result in claim denial or reduced compensation.

It is essential to understand your policy terms and conditions to ensure you are aware of your coverage and any potential limitations.

Closing Summary

Choosing the right home insurance policy is a significant decision, one that demands careful consideration of your individual needs and circumstances. By understanding the basics, comparing options, and leveraging available resources, you can secure a policy that provides comprehensive coverage and financial protection against unforeseen events. Remember, knowledge is power, and with the right information, you can navigate the Australian home insurance landscape with confidence.

FAQ Overview

How often should I review my home insurance policy?

It’s recommended to review your home insurance policy at least annually, or whenever there are significant changes in your circumstances, such as renovations, additions, or changes in the value of your belongings.

What are the common exclusions in home insurance policies?

Common exclusions include damage caused by wear and tear, gradual deterioration, or acts of war. It’s important to carefully review the policy document to understand the specific exclusions that apply.

Can I claim for damage caused by a natural disaster?

Most home insurance policies cover damage caused by natural disasters, but it’s crucial to check the specific coverage and exclusions related to natural disasters in your policy.

What is a deductible, and how does it affect my claim?

A deductible is the amount you pay out-of-pocket for a claim before your insurance kicks in. A higher deductible generally leads to lower premiums, while a lower deductible results in higher premiums.