Compare health insurance policies in Australia, a complex landscape of choices, can feel overwhelming. Understanding the intricacies of the system, from Medicare’s role to the various private insurance options, is crucial for making informed decisions. This guide aims to simplify the process, offering insights into factors to consider, key coverage areas, and strategies for finding the right policy for your individual needs.

Navigating the Australian health insurance system requires careful consideration of factors like your budget, health status, and desired coverage levels. From hospital and medical benefits to ancillary services, each policy offers a unique blend of features and costs. This guide explores the key considerations, helping you make an informed choice that aligns with your individual needs and circumstances.

Understanding Australian Health Insurance

Navigating the Australian healthcare system can be complex, with a combination of public and private options available. Understanding the different types of health insurance policies and how they interact with the public system is crucial for making informed decisions about your healthcare coverage.

Types of Health Insurance Policies

There are two main types of health insurance policies in Australia: hospital cover and extras cover.

- Hospital cover: This policy covers the costs of hospital treatment, including surgery, accommodation, and other related expenses. It is important to note that hospital cover does not cover all medical expenses, such as doctor’s fees or ambulance services.

- Extras cover: This policy covers a range of medical expenses not covered by Medicare or hospital cover, such as dental, optical, physiotherapy, and alternative therapies. Extras cover policies vary in the services they offer and the level of coverage they provide.

Key Features and Benefits

Health insurance policies in Australia offer a range of features and benefits, depending on the type of policy and the level of coverage chosen.

- Hospital cover: Key features of hospital cover include coverage for various medical procedures, such as surgery, childbirth, and cancer treatment. Benefits may include private hospital accommodation, access to specialist doctors, and shorter waiting times for treatment.

- Extras cover: Extras cover policies typically offer benefits such as discounts on dental care, optical services, physiotherapy, and other health-related expenses. The level of coverage and the specific services covered vary between policies.

Australian Health Insurance System

The Australian health insurance system is a combination of public and private healthcare.

- Medicare: This is the public health insurance system in Australia, providing universal access to essential healthcare services. Medicare covers a wide range of services, including doctor’s visits, hospital stays, and some prescription medications. However, Medicare does not cover all medical expenses, such as dental care, optical services, and some specialist consultations.

- Private Health Insurance: Private health insurance provides additional coverage for medical expenses not covered by Medicare. Private health insurance can be purchased in addition to Medicare, offering a range of benefits, including private hospital accommodation, access to specialist doctors, and coverage for a wider range of medical services.

Factors to Consider When Comparing Policies

Choosing the right health insurance policy is a significant decision that requires careful consideration. Many factors need to be weighed to ensure you select a policy that meets your specific needs and budget.

Coverage

Coverage refers to the types of medical services and treatments your health insurance policy will cover. Understanding the scope of coverage is crucial to ensure your policy adequately protects you against potential medical expenses.

- Hospital Cover: This covers expenses related to inpatient hospital treatment, including accommodation, surgery, and other medical services. It’s often categorized into levels, with higher levels providing broader coverage.

- Extras Cover: This covers a wide range of health services not typically covered by Medicare, such as dental, physiotherapy, optical, and chiropractor services. Extras cover is often customizable, allowing you to choose the services that are most relevant to your needs.

- Ambulance Cover: This covers the cost of ambulance transport in case of an emergency. It’s important to consider your location and frequency of potential ambulance usage when deciding whether ambulance cover is necessary.

- Psychiatric Cover: This covers mental health services, including consultations with psychiatrists and psychologists. Mental health is a growing concern, and having adequate coverage can be vital for those seeking support.

Premiums

Premiums are the regular payments you make to your health insurance provider. They are influenced by various factors, including your age, location, health status, and chosen level of coverage.

Premiums can vary significantly between insurers and policies, so comparing quotes from different providers is essential to find the most affordable option.

Waiting Periods

Waiting periods are the timeframes you must wait before certain benefits become available under your policy. These periods typically apply to specific treatments or services, such as dental or optical procedures.

- Pre-existing Conditions: Some policies may have longer waiting periods for pre-existing conditions, meaning conditions you had before taking out the policy.

- Specific Treatments: Waiting periods may apply to specific treatments, such as hip replacements or knee reconstructions.

Extras

Extras are additional benefits offered by health insurance providers beyond the core coverage. These can include things like discounts on gym memberships, health and wellness programs, or access to telehealth services.

It’s important to consider the value of these extras and whether they align with your needs and lifestyle.

Key Coverage Areas

When comparing health insurance policies, understanding the key coverage areas is essential. These areas typically include hospital, medical, and ancillary services. Each policy offers varying levels of coverage within these areas, impacting your out-of-pocket expenses and overall benefits.

Hospital Coverage

Hospital coverage encompasses the costs associated with inpatient care, including accommodation, surgery, and other medical procedures performed in a hospital setting. The level of hospital coverage varies significantly between policies, impacting your out-of-pocket expenses for these services.

Here are some key aspects of hospital coverage:

- Waiting periods: Most policies have waiting periods before you can claim for certain procedures, especially for pre-existing conditions. These waiting periods can range from 12 months to 24 months, depending on the policy and the specific procedure.

- Excesses: This is the amount you pay upfront before your health insurance kicks in. Excesses can vary depending on the policy and the type of hospital care required. Some policies offer options to reduce your excess by paying a higher premium.

- Benefit limits: Some policies have limits on the amount they will cover for certain procedures. For example, there may be a limit on the number of days you can stay in the hospital or the total amount they will cover for a specific surgical procedure.

- Public hospital coverage: Most policies cover the costs associated with public hospital care, including basic services and procedures. However, policies may offer different levels of coverage for private hospital care, which can significantly impact your out-of-pocket expenses.

Medical Coverage

Medical coverage includes expenses related to outpatient care, such as consultations with doctors, specialists, and allied health professionals, as well as diagnostic tests and other medical treatments. This coverage can vary depending on the policy, with some policies offering broader coverage than others.

- Waiting periods: Similar to hospital coverage, some policies have waiting periods before you can claim for certain medical services, particularly for pre-existing conditions.

- Excesses: Policies may have excesses for medical services, meaning you pay a certain amount upfront before your health insurance covers the remaining costs.

- Benefit limits: Similar to hospital coverage, there may be limits on the amount your policy will cover for certain medical services, such as the number of consultations with a particular specialist or the total amount covered for diagnostic tests.

- Coverage for specific services: Policies may vary in their coverage for specific medical services, such as physiotherapy, psychology, or dental care. Some policies may have limitations or exclusions for these services, while others may offer comprehensive coverage.

Ancillary Coverage

Ancillary coverage includes services that are not directly related to hospital or medical care but are considered essential for maintaining good health. These services can include dental, optical, physiotherapy, and other allied health services.

- Waiting periods: Ancillary services often have waiting periods before you can claim for them. These waiting periods can vary depending on the policy and the specific service.

- Excesses: Many policies have excesses for ancillary services, meaning you pay a certain amount upfront before your health insurance covers the remaining costs.

- Benefit limits: Policies may have limits on the amount they will cover for certain ancillary services, such as the number of dental checkups or the total amount covered for physiotherapy.

- Coverage for specific services: Policies may vary in their coverage for specific ancillary services, such as dental, optical, or physiotherapy. Some policies may offer limited coverage for these services, while others may provide comprehensive coverage.

Comparing Coverage Levels and Costs

The following table compares the coverage levels and associated costs for different health insurance policies:

| Policy | Hospital Coverage | Medical Coverage | Ancillary Coverage | Monthly Premium |

|---|---|---|---|---|

| Policy A | Comprehensive coverage, including private hospital care | Broad coverage, including consultations, diagnostic tests, and allied health services | Limited coverage for dental, optical, and physiotherapy | $200 |

| Policy B | Basic coverage, limited to public hospital care | Limited coverage, excluding some specialist consultations and diagnostic tests | No coverage for ancillary services | $100 |

| Policy C | Comprehensive coverage, including private hospital care | Broad coverage, including consultations, diagnostic tests, and allied health services | Comprehensive coverage for dental, optical, and physiotherapy | $300 |

This table is a simplified example, and the actual coverage and costs of health insurance policies can vary significantly. It is important to carefully compare policies from different insurers and consider your individual needs and circumstances when choosing a policy.

Cost and Value for Money

Choosing the right health insurance policy involves a careful consideration of costs and value for money. While comprehensive coverage is important, it’s crucial to find a balance between affordability and the level of benefits you need.

Factors Influencing Premium Costs

Premium costs for health insurance in Australia are influenced by a range of factors, including:

- Age: As you age, your risk of requiring medical treatment generally increases, leading to higher premiums.

- Location: Premiums can vary based on your location due to differences in healthcare costs and the availability of medical providers.

- Health Status: If you have pre-existing health conditions, you may face higher premiums, as insurers assess the potential risk associated with your health history.

- Lifestyle and Habits: Factors like smoking, alcohol consumption, and lack of exercise can influence premium costs, as these habits are linked to higher healthcare utilization.

- Policy Type and Level of Cover: The type of policy you choose (hospital, extras, or combined) and the level of coverage you select will directly impact your premium costs. Higher levels of cover generally come with higher premiums.

- Waiting Periods: Policies often have waiting periods for certain treatments or services. These waiting periods can affect your premium costs, as they can impact the insurer’s risk assessment.

- Excess: The excess is the amount you pay out of pocket for each claim. A higher excess can lead to lower premiums, while a lower excess may result in higher premiums.

- Government Rebates: The Australian government provides rebates to help offset the cost of health insurance. The amount of rebate you receive depends on your age, income, and the type of policy you hold.

Comparing Premium Structures and Cost Variations

Different health insurance providers offer various premium structures and cost variations, making it essential to compare policies thoroughly.

- Provider Networks: Some providers may have more extensive networks of hospitals and medical practitioners than others. This can impact the cost of your premiums and the availability of services within your policy.

- Policy Types: Health insurance policies are broadly categorized into hospital, extras, and combined policies. Hospital policies cover the costs of inpatient hospital treatment, while extras policies cover a range of ancillary services like dental, physiotherapy, and optical. Combined policies offer a combination of both hospital and extras cover. The cost of each policy type will vary depending on the level of cover and the specific services included.

- Discounts and Benefits: Some providers offer discounts for families, couples, or individuals with certain occupations. It’s essential to inquire about any available discounts or benefits that could help reduce your premium costs.

Strategies for Maximizing Value for Money

To maximize value for money when choosing a health insurance policy, consider the following strategies:

- Compare Policies Thoroughly: Use comparison websites or contact multiple providers to obtain quotes and compare policy features, premiums, and benefits.

- Assess Your Needs: Consider your individual health needs, lifestyle, and financial situation to determine the level of cover you require. Avoid paying for unnecessary coverage that you are unlikely to use.

- Choose a Policy with a Balanced Approach: Find a policy that provides comprehensive coverage for essential services while offering flexibility and value for money.

- Negotiate with Providers: Don’t hesitate to negotiate with providers to try and secure a lower premium or additional benefits.

- Consider the Long-Term: Think about your future healthcare needs and choose a policy that can provide ongoing value and support over time.

- Explore Government Rebates: Take advantage of government rebates to offset the cost of your premiums. Ensure you are claiming all eligible rebates.

Choosing the Right Policy

With so many options available, navigating the world of health insurance policies can feel overwhelming. This section provides a step-by-step guide to help you make an informed decision that best suits your individual needs and budget.

Comparing Policies

Comparing policies is crucial to finding the best value for your money. This involves evaluating various factors, including coverage, premiums, and exclusions. To make the comparison process more efficient, follow these steps:

- Identify Your Needs: Before you start comparing policies, it’s important to understand your specific healthcare needs. Consider your age, health status, lifestyle, and any pre-existing conditions. This will help you prioritize the features and coverage that are most important to you.

- Use Comparison Websites: Several online comparison websites can help you quickly compare quotes from different insurers. These websites allow you to input your details and preferences, and they will generate a list of policies that match your criteria. This saves you time and effort compared to manually contacting each insurer.

- Read Policy Documents Carefully: Don’t rely solely on comparison websites or sales pitches. Always read the policy documents carefully to understand the specific coverage details, exclusions, and limitations. Pay close attention to the fine print, as it can contain important information that may not be readily apparent.

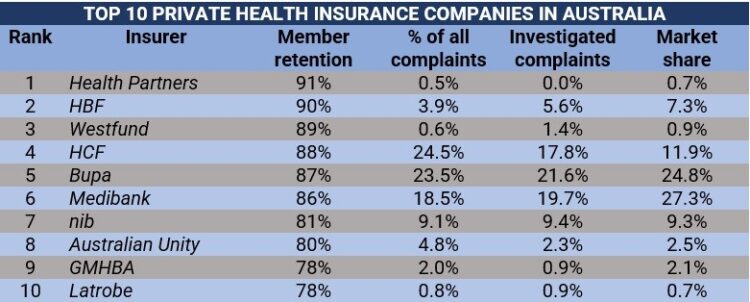

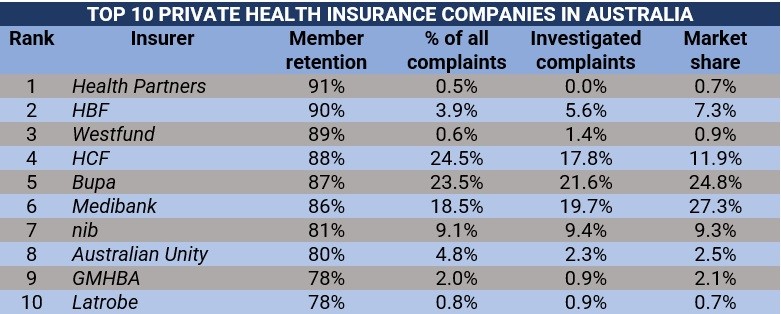

- Consider the Insurer’s Reputation: Research the insurer’s financial stability, customer service, and claims processing procedures. You can find information about an insurer’s reputation on independent websites, consumer reviews, and industry publications.

- Seek Professional Advice: If you find the comparison process overwhelming, consider seeking advice from a qualified health insurance broker. They can help you understand your options and find a policy that meets your needs and budget.

Evaluating Policy Options

To make an informed decision, ask yourself the following questions when evaluating policy options:

- What is the level of coverage provided? Consider the types of services and treatments covered, including hospital, surgical, and ancillary benefits.

- What are the premiums and out-of-pocket expenses? Compare the monthly premiums, excess fees, and co-payments for different policies.

- Are there any waiting periods or exclusions? Understand the waiting periods for specific services and treatments, and any conditions or treatments that are excluded from coverage.

- What is the insurer’s claims process? Find out how easy it is to submit a claim and how quickly the insurer processes claims.

- Does the insurer offer any discounts or incentives? Some insurers offer discounts for healthy lifestyles, family memberships, or early enrollment.

Negotiating Premiums

While you can’t always negotiate the base premium, there are ways to potentially reduce your overall costs:

- Shop Around: Compare quotes from multiple insurers to find the best deals. Don’t be afraid to negotiate with different insurers to see if they can offer you a lower premium.

- Bundle Policies: If you have other insurance policies, such as home or car insurance, inquire about discounts for bundling multiple policies with the same insurer.

- Consider a Higher Excess: Choosing a higher excess can often result in a lower premium. However, be sure to consider your financial situation and ability to cover the excess in case of a claim.

- Pay Annually: Some insurers offer discounts for paying your premium annually instead of monthly. This can save you money in the long run, but it’s important to ensure you have the financial capacity to make the annual payment.

Understanding Policy Terms and Conditions

It’s crucial to understand the terms and conditions of your policy to avoid surprises and ensure you are covered when you need it. Key things to consider include:

- Excess: The excess is the amount you pay out of pocket before your insurance kicks in. Understand the different excess options available and choose the one that best suits your budget and risk tolerance.

- Co-payments: Co-payments are fixed fees you pay for certain services, such as consultations or medications. Ensure you understand the co-payment structure for your policy and budget accordingly.

- Waiting Periods: Waiting periods apply to certain services and treatments, requiring you to be covered for a specific period before you can claim for them. Be aware of the waiting periods for the services and treatments you are most likely to need.

- Exclusions: Exclusions are specific conditions or treatments that are not covered by your policy. Carefully review the exclusions list to ensure you are not caught off guard if you need treatment for an excluded condition.

Important Considerations

While comparing health insurance policies in Australia, several factors can influence your choices and the overall cost of your premiums. Understanding these factors can help you make informed decisions and secure a policy that best suits your needs and budget.

Impact of Age, Health Status, and Lifestyle

Your age, health status, and lifestyle play a significant role in determining your health insurance premiums. Here’s a breakdown:

- Age: Generally, younger individuals tend to pay lower premiums than older individuals. This is because younger people are statistically less likely to require extensive medical care. As you age, your risk of health issues increases, leading to higher premiums.

- Health Status: Individuals with pre-existing medical conditions may face higher premiums. Health insurers assess your health history to determine your risk profile. Those with chronic illnesses or conditions that require regular treatment may be considered higher risk, resulting in increased costs.

- Lifestyle: Your lifestyle choices, such as smoking, alcohol consumption, and physical activity levels, can also influence your premiums. Unhealthy habits can increase your risk of developing health problems, leading to higher premiums. For instance, smokers often pay higher premiums due to their increased risk of lung and heart diseases.

Pre-Existing Conditions and Waiting Periods

Pre-existing conditions are medical conditions you had before taking out health insurance. Most health insurers have waiting periods for pre-existing conditions, meaning you may need to wait a certain period before coverage for specific treatments or procedures related to those conditions is activated. These waiting periods can range from 12 months to 24 months depending on the insurer and the condition. It’s essential to understand these waiting periods when comparing policies to ensure you are adequately covered for your existing health concerns.

Benefits of Joining a Health Insurance Fund or Using a Comparison Website

Joining a health insurance fund or using a comparison website can provide valuable benefits when comparing policies. Here’s how:

- Health Insurance Funds: Joining a health insurance fund offers advantages like access to exclusive benefits, discounts, and potential lower premiums. Funds often negotiate group rates with insurers, leading to cost savings for their members. They also provide support and advice on choosing the right policy.

- Comparison Websites: Comparison websites simplify the process of comparing health insurance policies from multiple providers. They allow you to input your preferences, including your age, location, and desired coverage, and generate personalized quotes. This saves you time and effort by bringing together information from various insurers in one place.

Additional Resources: Compare Health Insurance Policies In Australia

This section provides a list of reputable resources for further information on health insurance in Australia. You can find helpful information on government websites, consumer protection agencies, and independent health insurance comparison platforms.

Government Websites, Compare health insurance policies in australia

Government websites offer valuable information about health insurance in Australia. They provide official guidelines, policies, and resources to help you understand your options and make informed decisions.

- Australian Government Department of Health: The Department of Health website provides comprehensive information on health insurance, including eligibility criteria, benefits, and costs. You can find details on the Medicare levy surcharge, the Private Health Insurance Act 1973, and other relevant legislation. [Link: https://www.health.gov.au/ ]

- Australian Taxation Office (ATO): The ATO website provides information on the tax implications of health insurance, including the Medicare levy surcharge and the Private Health Insurance Rebate. [Link: https://www.ato.gov.au/ ]

Consumer Protection Agencies

Consumer protection agencies provide information and support to consumers regarding health insurance. They can assist you in understanding your rights and obligations, resolving disputes, and making informed choices.

- Australian Competition and Consumer Commission (ACCC): The ACCC website provides information on consumer rights and responsibilities related to health insurance. They offer resources on making informed choices, understanding your policy, and resolving disputes with insurers. [Link: https://www.accc.gov.au/ ]

- Australian Financial Complaints Authority (AFCA): AFCA is an independent body that resolves disputes between consumers and financial service providers, including health insurers. You can lodge a complaint with AFCA if you are unhappy with your insurer’s actions or decisions. [Link: https://www.afca.org.au/ ]

Independent Health Insurance Comparison Platforms

Independent health insurance comparison platforms provide a convenient way to compare policies from different insurers. They allow you to enter your details and preferences to receive personalized quotes and recommendations.

- Compare the Market: This platform allows you to compare health insurance policies from multiple insurers, including Bupa, Medibank, and HCF. [Link: https://www.comparethemarket.com.au/ ]

- iSelect: iSelect is another popular comparison platform that offers a wide range of health insurance policies. [Link: https://www.iselect.com.au/ ]

- Canstar: Canstar provides independent ratings and reviews of health insurance products, helping you make informed decisions. [Link: https://www.canstar.com.au/ ]

Relevant Articles, Reports, and Guides

For in-depth research on health insurance, you can consult articles, reports, and guides from reputable sources.

- Choice: The consumer advocacy group Choice publishes articles and reports on health insurance, providing insights and recommendations for consumers. [Link: https://www.choice.com.au/ ]

- The Australian Consumers’ Association (ACA): The ACA provides information and advice on health insurance, including tips for choosing the right policy and avoiding common pitfalls. [Link: https://www.aca.org.au/ ]

- The Australian Financial Review (AFR): The AFR publishes articles and reports on the health insurance industry, providing analysis and insights into market trends and consumer behaviour. [Link: https://www.afr.com/ ]

Conclusive Thoughts

Choosing the right health insurance policy in Australia involves weighing your priorities, understanding your needs, and comparing options effectively. By considering factors like coverage, premiums, waiting periods, and extras, you can find a policy that offers the best value for your investment. Armed with knowledge and a clear understanding of the system, you can navigate this complex landscape with confidence, ensuring your health and financial well-being are protected.

Query Resolution

How do I know if I need private health insurance?

Private health insurance provides additional coverage beyond Medicare, including access to private hospitals, shorter waiting times for elective procedures, and coverage for certain services not covered by Medicare.

What is the difference between hospital and extras cover?

Hospital cover provides financial assistance for hospital treatment, while extras cover provides rebates for services like dental, optical, and physiotherapy.

What are waiting periods, and why are they important?

Waiting periods are timeframes before certain benefits become available. They vary depending on the policy and service. Understanding these periods is crucial for planning and budgeting.

How can I find the best health insurance deal?

Use online comparison websites, contact insurance providers directly, and consider factors like your needs, budget, and desired coverage levels. It’s also advisable to seek advice from a financial advisor.