- Understanding Australian Private Health Insurance

- Comparing Private Health Insurance Providers

- Key Considerations for Choosing Private Health Insurance

- Government Subsidies and Rebates

- Tips for Saving Money on Private Health Insurance

- Last Recap: Compare Private Health Insurance In Australia

- Top FAQs

Compare private health insurance in Australia, and discover the best options for your needs. Navigating the world of private health insurance can feel like a maze, with numerous providers offering a wide array of plans and coverage options. Understanding the different types of policies, comparing providers, and considering government subsidies are crucial steps in making an informed decision.

This comprehensive guide will help you understand the Australian private health insurance landscape, from choosing the right policy to finding ways to save money on your premiums. Whether you’re looking for hospital cover, extras coverage, or a combination of both, this guide will provide you with the information you need to make the best choice for your individual circumstances.

Understanding Australian Private Health Insurance

Navigating the world of private health insurance in Australia can be a bit overwhelming, especially with the different types of policies and options available. This guide will break down the essentials of private health insurance in Australia, helping you understand the different types of policies, their key features, and the factors that influence their cost.

Types of Private Health Insurance Policies

Private health insurance in Australia is designed to cover various healthcare costs, and it’s typically categorized into three main types: hospital, extras, and combined.

- Hospital cover: This policy primarily covers the costs associated with hospital treatment, including accommodation, surgery, and other medical procedures. It’s important to note that hospital cover doesn’t cover all hospital-related expenses, such as out-of-pocket costs for non-covered procedures or services.

- Extras cover: This policy complements hospital cover by providing coverage for a range of healthcare services outside of hospital stays, such as dental, optical, physiotherapy, and other allied health services. The specific benefits and coverage vary depending on the policy chosen.

- Combined cover: This policy combines the features of both hospital and extras cover, offering comprehensive coverage for both hospital stays and a range of other healthcare services. It provides a broader scope of coverage and can be a cost-effective option for those seeking comprehensive health insurance.

Key Features and Benefits of Private Health Insurance Policies

Private health insurance policies come with various features and benefits that can vary depending on the chosen policy. Here’s a breakdown of the key aspects:

- Coverage: The coverage of a private health insurance policy Artikels the specific healthcare services and treatments covered by the policy. This includes the types of hospitals, procedures, and services covered. It’s crucial to understand the specific coverage details to ensure the policy aligns with your healthcare needs.

- Exclusions: Private health insurance policies typically have exclusions, which are specific services or treatments not covered by the policy. These exclusions can include pre-existing conditions, cosmetic surgery, and certain experimental treatments. It’s important to review the exclusions carefully to avoid surprises later.

- Waiting periods: Waiting periods are a common feature of private health insurance policies, particularly for hospital cover. They specify the period you must wait before accessing certain benefits, such as surgery or specific treatments. These waiting periods can vary depending on the policy and the specific benefit. For instance, there may be a waiting period for elective surgery, but not for emergency surgery.

Factors Influencing the Cost of Private Health Insurance Premiums, Compare private health insurance in australia

The cost of private health insurance premiums is influenced by several factors, including:

- Age: Premiums generally increase with age, as older individuals are statistically more likely to require healthcare services.

- Health status: Individuals with pre-existing health conditions may face higher premiums due to the increased risk of needing healthcare services.

- Policy coverage: The level of coverage chosen significantly impacts the premium cost. A policy with comprehensive coverage, including both hospital and extras, will generally be more expensive than a policy with limited coverage.

- Location: Premiums can vary depending on the location, as healthcare costs can differ across different regions.

Comparing Private Health Insurance Providers

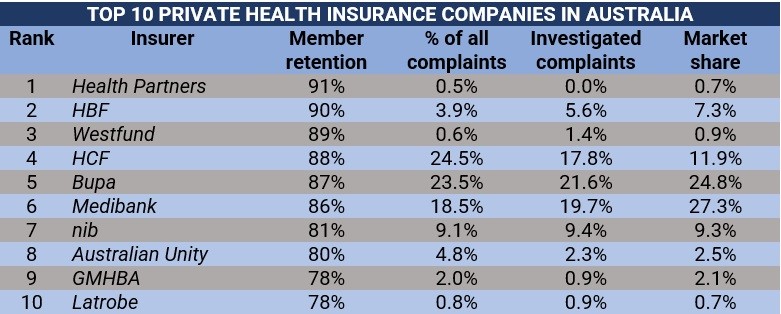

Choosing the right private health insurance provider can be overwhelming, with numerous options available. This section will guide you through the process of comparing the top providers in Australia, helping you make an informed decision based on your individual needs and budget.

Comparing Private Health Insurance Providers

| Provider Name | Policy Type | Key Features | Benefits | Premium Costs | Customer Reviews |

|---|---|---|---|---|---|

| Medibank | Hospital, Extras, Combined | Wide network of hospitals, comprehensive extras cover, online tools and resources | Hospital cover, dental, optical, physiotherapy, etc. | Varies depending on policy type, age, and location | Generally positive, with strong customer service and benefits |

| Bupa | Hospital, Extras, Combined | Strong focus on preventative health, international cover options, digital health services | Hospital cover, dental, optical, alternative therapies, etc. | Varies depending on policy type, age, and location | Mixed reviews, with some praising their benefits and others citing issues with claims processing |

| NIB | Hospital, Extras, Combined | Competitive premiums, flexible cover options, online claims management | Hospital cover, dental, optical, physiotherapy, etc. | Varies depending on policy type, age, and location | Generally positive, with many praising their affordability and ease of use |

| HCF | Hospital, Extras, Combined | Non-profit organization, community focus, strong benefits package | Hospital cover, dental, optical, physiotherapy, etc. | Varies depending on policy type, age, and location | Positive reviews, known for their commitment to community and value for money |

| Australian Unity | Hospital, Extras, Combined | Focus on health and wellbeing, wellness programs, community initiatives | Hospital cover, dental, optical, alternative therapies, etc. | Varies depending on policy type, age, and location | Positive reviews, praised for their commitment to holistic health and customer service |

This table provides a general overview of some of the top private health insurance providers in Australia. It is essential to note that this is not an exhaustive list, and premiums and benefits can vary significantly depending on individual circumstances. It is recommended to compare multiple providers and policies before making a decision.

Key Considerations for Choosing Private Health Insurance

Choosing the right private health insurance policy is a significant decision that can impact your financial well-being and access to healthcare. It’s crucial to carefully consider your individual needs and circumstances to ensure you select a policy that provides adequate coverage at an affordable price.

Assessing Individual Health Needs and Lifestyle Factors

Understanding your health needs and lifestyle factors is essential for making an informed decision about private health insurance. This involves considering your current health status, any pre-existing conditions, your family history, and your anticipated healthcare needs in the future. For instance, if you have a family history of heart disease, you might prioritize a policy that covers cardiac care. Similarly, if you’re an active individual who participates in sports or enjoys adventurous activities, you might want to consider a policy that offers coverage for sports injuries or overseas travel.

Questions to Consider When Comparing Private Health Insurance Providers

When comparing different private health insurance providers, it’s important to ask yourself a series of questions to determine the best fit for your needs.

- What are the premiums and coverage limits for different policies?

- What types of hospital and medical services are covered?

- What are the waiting periods for different services?

- What are the exclusions and limitations of the policy?

- What are the provider’s claims processing procedures and customer service reputation?

- Does the provider offer any discounts or incentives for healthy lifestyle choices?

- What are the options for increasing or decreasing coverage in the future?

Benefits and Drawbacks of Higher or Lower Coverage

The level of coverage you choose for your private health insurance policy will directly impact your premiums and the range of services you can access. Higher levels of coverage typically offer more comprehensive benefits, such as access to private hospitals, wider choice of specialists, and coverage for a wider range of treatments. However, they also come with higher premiums. Conversely, lower levels of coverage might have lower premiums but offer more limited benefits.

It’s important to weigh the benefits and drawbacks of different coverage levels to determine the best balance for your individual needs and budget.

Government Subsidies and Rebates

The Australian government offers a private health insurance rebate to help offset the cost of premiums. This rebate is a significant financial incentive for individuals to take out private health insurance, making it more affordable for many.

Eligibility Criteria for the Private Health Insurance Rebate

To be eligible for the private health insurance rebate, you must meet certain criteria. The key eligibility criteria include:

- You must be an Australian resident.

- You must be aged 18 years or older.

- You must not be receiving a government pension or allowance.

- You must be covered by a private health insurance policy that meets the government’s minimum standards.

Impact of the Rebate on Private Health Insurance Costs

The private health insurance rebate is calculated as a percentage of your premium, and the amount of the rebate varies depending on your age and income. The rebate can significantly reduce the cost of private health insurance for individuals, making it more accessible.

Examples of Rebate Application

The rebate is applied to different policy types and premiums. For instance:

- For a 30-year-old individual earning an annual income of $60,000, the rebate on a hospital cover policy with a premium of $1,500 per year might be around $450. This reduces their net premium to $1,050.

- A 55-year-old individual with an annual income of $100,000 might receive a rebate of $600 on a comprehensive policy with a premium of $2,000 per year, resulting in a net premium of $1,400.

The rebate is calculated based on a sliding scale, with higher income earners receiving a lower rebate percentage.

Rebate Calculation and Application

The private health insurance rebate is automatically calculated and applied by your health insurance provider. You don’t need to apply for it separately. The rebate is reflected in your premium invoices and statements.

Tips for Saving Money on Private Health Insurance

Navigating the world of private health insurance in Australia can feel like a maze, especially when trying to find the best value for your money. Luckily, there are several strategies you can use to reduce your premiums and still get the coverage you need. Understanding these options can help you make informed decisions and keep your healthcare costs manageable.

Choosing a Lower Level of Coverage

One of the most direct ways to reduce your premiums is to opt for a lower level of coverage. This means choosing a policy with fewer benefits and a smaller hospital excess. While this may seem like a simple solution, it’s important to carefully consider your individual needs and risk tolerance. For instance, if you’re a young and healthy individual with a low risk of needing extensive medical care, a basic policy might be sufficient. However, if you have pre-existing conditions or a family history of health issues, a higher level of coverage might be more appropriate.

- Basic Hospital Cover: This covers your hospital expenses, including accommodation, surgery, and other medical procedures. It’s typically the most affordable option but offers limited benefits.

- Hospital and Extras Cover: This combines hospital cover with additional benefits, such as dental, optical, and physiotherapy. It provides more comprehensive coverage but comes with a higher premium.

- Top Hospital Cover: This offers the most comprehensive hospital cover, including access to private hospitals and specialists. It’s the most expensive option but provides the greatest peace of mind.

Joining a Family Policy

If you have a family, you might be able to save money by joining a family policy. Most health insurers offer discounts for multiple family members, making it a cost-effective option. This is especially beneficial if you have children, as their premiums are often lower than those for adults. However, it’s essential to ensure that all family members need and will benefit from the coverage offered by the policy.

Taking Advantage of Discounts

Several health insurers offer discounts for various factors, such as:

- Occupation: Some insurers offer discounts to specific professions, such as teachers or nurses, due to their lower risk of needing medical care.

- Lifestyle: Healthy habits like exercising regularly and not smoking can qualify you for discounts from some insurers.

- Loyalty: Being a long-term customer with a particular insurer can sometimes result in discounts.

- Direct Debit: Setting up direct debit payments can often lead to a reduction in premiums.

Comparing Premiums Regularly

The private health insurance market is constantly changing, with insurers adjusting their premiums and benefits. It’s essential to regularly compare premiums from different insurers to ensure you’re getting the best deal. Many comparison websites and tools can help you quickly and easily compare different policies and find the most suitable option for your needs and budget.

Last Recap: Compare Private Health Insurance In Australia

Making the right choice for your private health insurance is a significant decision that impacts your financial well-being and access to healthcare. By carefully considering your individual needs, comparing providers, and taking advantage of government subsidies, you can find a plan that offers the best value and peace of mind. Remember to review your policy regularly and adjust it as your circumstances change. With the right information and guidance, you can navigate the Australian private health insurance system with confidence and make informed choices for your health and financial security.

Top FAQs

What are the waiting periods for private health insurance in Australia?

Waiting periods vary depending on the type of cover and the provider. They can range from a few weeks to several months. For example, there are often waiting periods for specific procedures, such as hip or knee replacements.

Can I claim private health insurance benefits for overseas treatment?

Some private health insurance policies offer limited coverage for overseas treatment, but this is usually subject to specific conditions and limitations. It’s essential to check your policy documents for details on overseas coverage.

How do I cancel my private health insurance policy?

You can usually cancel your policy by providing written notice to your provider. However, there may be cancellation fees or penalties, especially if you cancel before the end of your policy term. It’s important to read your policy documents for specific cancellation terms.

What are the benefits of having private health insurance in Australia?

Private health insurance offers several benefits, including: faster access to medical treatment, a wider choice of healthcare providers, coverage for procedures not covered by Medicare, and potential tax benefits through the government rebate.